January 2025

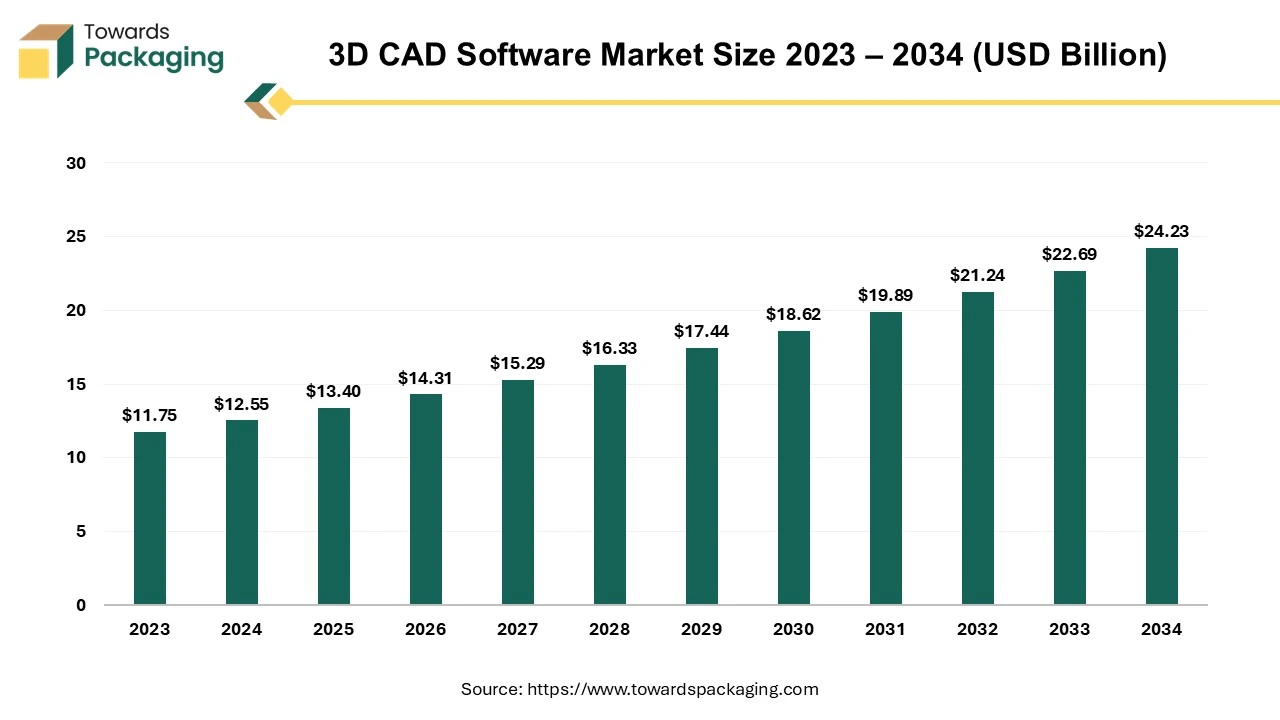

The global 3D CAD software market size reached USD 12.55 billion in 2024 and is projected to hit around USD 24.23 billion by 2034, expanding at a CAGR of 6.8% during the forecast period from 2025 to 2034. The demand for 3D CAD software market is expected to rise with increase in technological advancements will push for growth.

Industries seeking tailored solutions are pushing for CAD systems that can accommodate unique design needs. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop 3D CAD software which is estimated to drive the global 3D CAD software market over the forecast period.

3D CAD software refers to computer-aided design tools that permit users to create, modify, analyze, and optimize three-dimensional models. Unlike traditional 2D CAD, which focuses on flat drawings, 3D CAD enables the representation of objects in three dimensions, providing a more realistic view of designs. By the assistance of 3D CAD software users can develop detailed 3D models of objects or structures.

The software offers tools for rendering models, allowing for realistic images and animations. Many 3D CAD programs include simulation capabilities to test how an engineer will perform under various conditions. Cloud-based options facilitate sharing and collaboration among teams. Industries such as manufacturing, architecture, and engineering widely use 3D CAD software for product design, prototyping, and project planning.

AI can enhance the 3D CAD software industry by automating repetitive tasks, optimizing design processes through generative design algorithms, and improving error detection in models. It can also facilitate better data analysis for informed decision-making, enhance collaboration through smart assistants, and personalize user experiences by learning individual preferences. Additionally, AI-driven simulations can predict performance outcomes, streamlining the development cycle. AI can significantly improve the 3D CAD software market in several ways by automation of design tasks, generating designs, predictive analytics, and assist in training as well as support.

AI can enhance the 3D CAD software industry by automating repetitive tasks, optimizing design processes through generative design algorithms, and improving error detection in models. It can also facilitate better data analysis for informed decision-making, enhance collaboration through smart assistants, and personalize user experiences by learning individual preferences. Additionally, AI-driven simulations can predict performance outcomes, streamlining the development cycle. AI can significantly improve the 3D CAD software market in several ways by automation of design tasks, generating designs, predictive analytics, and assist in training as well as support.

In June 2024, Ai Build, a company focused on developing web-app that provides personalized AI tools headquartered in U.K., unveiled the introduction of the Aibuild 2.0, the new generation and updated version of its cloud-based, artificial intelligence (AI) powered software. The update incorporates enhanced automation, built-in Al help, and ISO 27001 data security certification into Ai Build's flagship offering, which makes its debut at RAPID + TCT 2024 in Los Angeles on June 25–27.

Additionally, the business has announced a new collaboration with WASP, a maker of large-format 3D printers, to integrate their CAREBRO robotic arm 3D printing tool into Aibuild 2.0 as a digital twin. WASP claims that this integration will provide its ceramic and pellet extruders, among other extrusion systems, new capabilities.

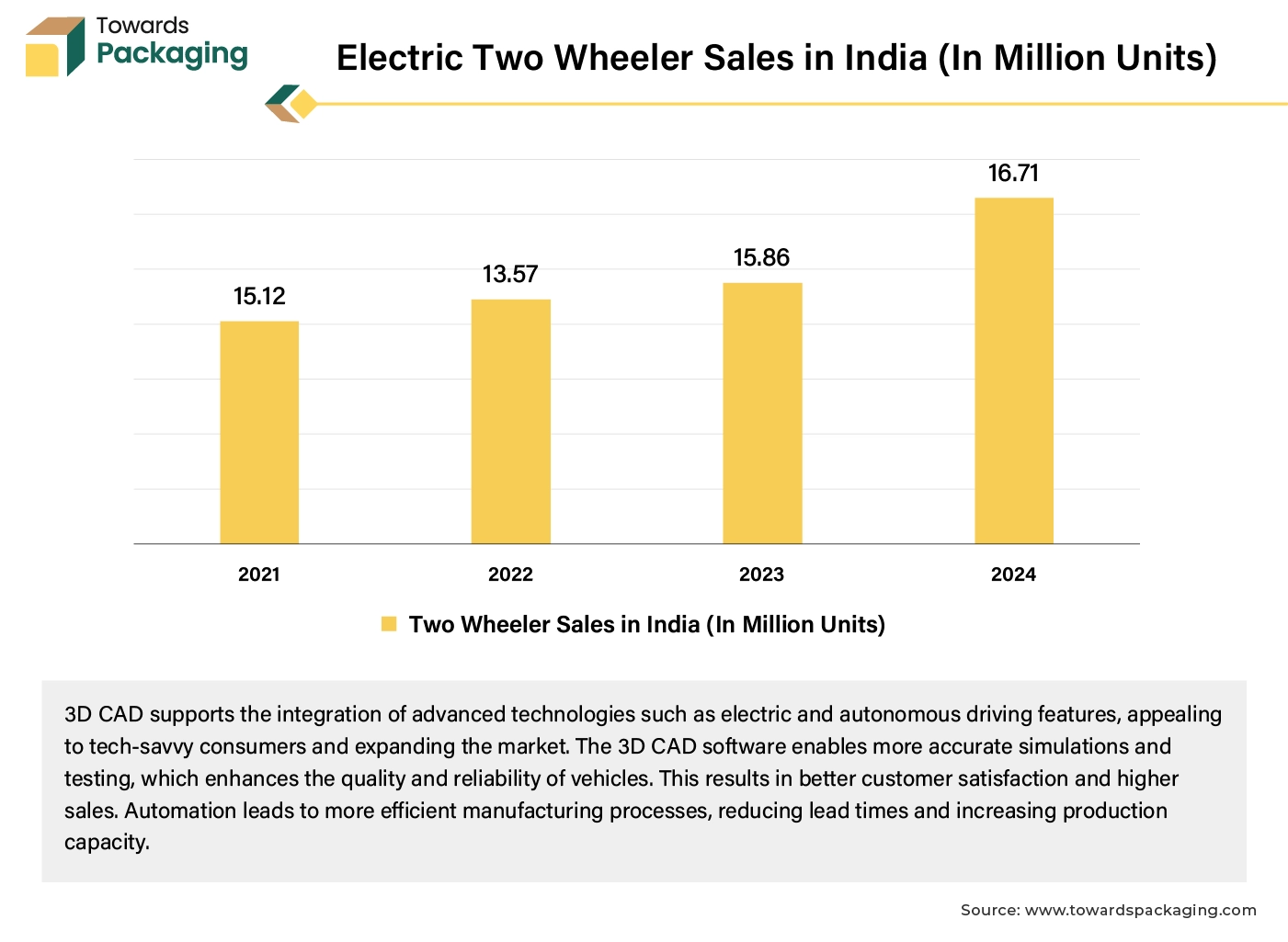

3D CAD software allows for rapid prototyping and design iterations, leading to faster development cycles. This means vehicles can be brought to market more quickly. The software enables more accurate simulations and testing, which enhances the quality and reliability of vehicles. Automation and improved design processes reduce production costs. Savings can be passed on to consumers, making vehicles more competitively priced. This results in better customer satisfaction and higher sales. 3D CAD facilitates greater customization of vehicles, allowing manufacturers to meet specific consumer demands, thus attracting a broader market.

For instance,

The key players operating in the market face challenges in integration of the 3D CAD software and complexity arising during usage which is estimated to create restriction in growth of the 3D CAD software market. The expense of software licenses, training, and hardware can be a barrier for small and medium-sized enterprises. The sophisticated nature of 3D CAD software may require significant training, which can deter potential users. Economic downturns can lead companies to cut budgets for new software investments, slowing market growth.

Difficulties in integrating 3D CAD with existing systems or workflows can hinder adoption, particularly in established organizations. The presence of numerous players in the market can lead to price wars and limit profitability, affecting investment in development. Some industries may not fully understand the benefits of 3D CAD, limiting its adoption in those sectors. Concerns about the security of proprietary designs and intellectual property may deter companies from adopting cloud-based 3D CAD solutions. Addressing these challenges is essential for accelerating growth in the 3D CAD software market.

Continuous improvements in software capabilities, such as enhanced modelling, simulation, and visualization tools, are attracting more users. The integration of CAD with technologies like AR, VR, and IoT is enhancing its functionalities and appeal. The shift towards cloud computing allows for better collaboration, accessibility, and scalability, driving adoption among small and medium enterprises. The need for simulations in design processes to predict performance and reduce costs is increasing the reliance on sophisticated CAD tools. Research can identify gaps in user knowledge, leading to better training resources and support systems, which can enhance user retention and attract new users.

The key players operating in the market are focused on adoption of the inorganic growth strategies like collaboration Rising research and development activities for the integration of the 3D CAD software is estimated to create lucrative opportunities for the growth of the 3D CAD software market over the forecast period.

In June 2024, Ai Build, a company focused on developing web-app that provides personalized AI tools headquartered in U.K., uneviled the introduction of the Aibuild 2.0, the new generation and updated version of its cloud-based, artificial intelligence (AI) powered software. The update incorporates enhanced automation, built-in Al help, and ISO 27001 data security certification into Ai Build's flagship offering, which makes its debut at RAPID + TCT 2024 in Los Angeles on June 25–27.

Additionally, the business has announced a new collaboration with WASP, a maker of large-format 3D printers, to integrate their CAREBRO robotic arm 3D printing tool into Aibuild 2.0 as a digital twin. WASP claims that this integration will provide its ceramic and pellet extruders, among other extrusion systems, new capabilities.

The on-premises segment held a dominant presence in the 3D CAD software market in 2023. Many organizations prioritize data security and confidentiality, leading to a preference for on-premises solutions that keep sensitive information within their own networks. On-premises deployments allow companies to tailor the software to their specific needs, offering greater control over features and functionalities. On-premises solutions can provide better performance, particularly for complex modelling tasks, as they leverage local hardware capabilities without relying on internet connectivity. Industries with strict regulatory requirements may favour on-premises solutions to ensure compliance with data protection laws and standards.

Companies with existing legacy systems may find it easier to integrate new 3D CAD software in an on-premises environment. For some organizations, the total cost of ownership may be lower with on-premises deployments, especially when considering long-term usage and licensing.

Businesses can fully control the data and software they use, and they can tailor the program to meet their unique demands. Scalability may be restricted in on-premises deployment. To accommodate their growing user base, businesses might need to make investments in additional servers and infrastructure. Because users are confined to their actual workstations or gadgets, it also has restricted mobility. Significant upkeep, updates, and troubleshooting are necessary, and they can be difficult and time-consuming.

As industries evolve, the demand for sophisticated design and engineering tools will drive investments in robust on-premises solutions. Improvements in hardware and software capabilities can enhance the attractiveness of on-premises solutions, making them more viable for advanced design tasks. These factors collectively influence the decision-making process for organizations considering the future deployment of 3D CAD software.

The large enterprises segment accounted for a significant share of the market in 2023. 3D CAD software accelerates the design process, allowing for quicker iterations and faster time-to-market for new products being manufactured by the large enterprises. Advanced 3D modelling capabilities facilitate better collaboration among teams, fostering innovation and more effective communication. As products become more complex, 3D CAD tools assists in managing and visualizing intricate designs, minimizing errors and improving accuracy. Improved design processes can lead to significant cost savings by reduction in material waste and minimizing the need for prototypes in large enterprises. 3D CAD software often integrates seamlessly with other enterprise tools, such as PLM (Product Lifecycle Management) and ERP (Enterprise Resource Planning) systems, streamlining workflows.

Large enterprises can customize 3D CAD solutions to meet specific needs and scale them as the organization grows. Many enterprises operate across multiple regions, and 3D CAD software enables consistent design practices and standards across all locations. Adopting cutting-edge technology assist large enterprises maintain a competitive edge in their industries by enhancing product quality and innovation. These factors contribute to the rapid adoption of 3D CAD software among large organizations, aligning with their strategic goals and operational needs.

For instance,

The AEC (Architecture, Engineering, & Construction) segment registered its dominance over the global 3D CAD software market in 2023. The Architecture, Engineering, and Construction (AEC) segment is rapidly adopting 3D CAD software for getting enhanced visualization and increased efficiency. 3D models allow stakeholders to visualize projects more effectively, facilitating better design decisions and communication. Cloud-based 3D CAD tools enable real-time collaboration among architects, engineers, and contractors, reducing misunderstandings and errors. 3D CAD software automates many design tasks, streamlining workflows and significantly reducing project timelines.

For instance,

The healthcare segment is expected to grow at the fastest rate in the 3D CAD software market during the forecast period of 2024 to 2034. 3D CAD allows for the design of patient-specific medical devices and implants, improving fit and functionality. Medical professionals can better visualize anatomical structures through 3D models, aiding in diagnosis, surgical planning, and education. 3D CAD facilitates collaboration among healthcare teams, enabling better communication and planning in complex cases. The software supports quick prototyping of medical equipment and devices, accelerating innovation and reducing time to market. 3D models provide realistic simulations for training healthcare professionals, enhancing skill development without risk to patients.

CAD software assists in ensuring that designs meet regulatory standards, helping streamline the approval process for medical products. By optimizing designs and minimizing material waste, 3D CAD can lower production costs for medical devices. 3D CAD works well with 3D printing and imaging technologies, allowing for cutting-edge applications in personalized medicine and complex surgeries. These factors make 3D CAD software increasingly valuable in the healthcare sector, driving its ongoing adoption. The key players operating in the market are focused on integrating 3D CAD software for developing medical devices as well as manufacturing unit for the same which is estimated to drive the growth of the growth of the segment over the forecast period.

For instance,

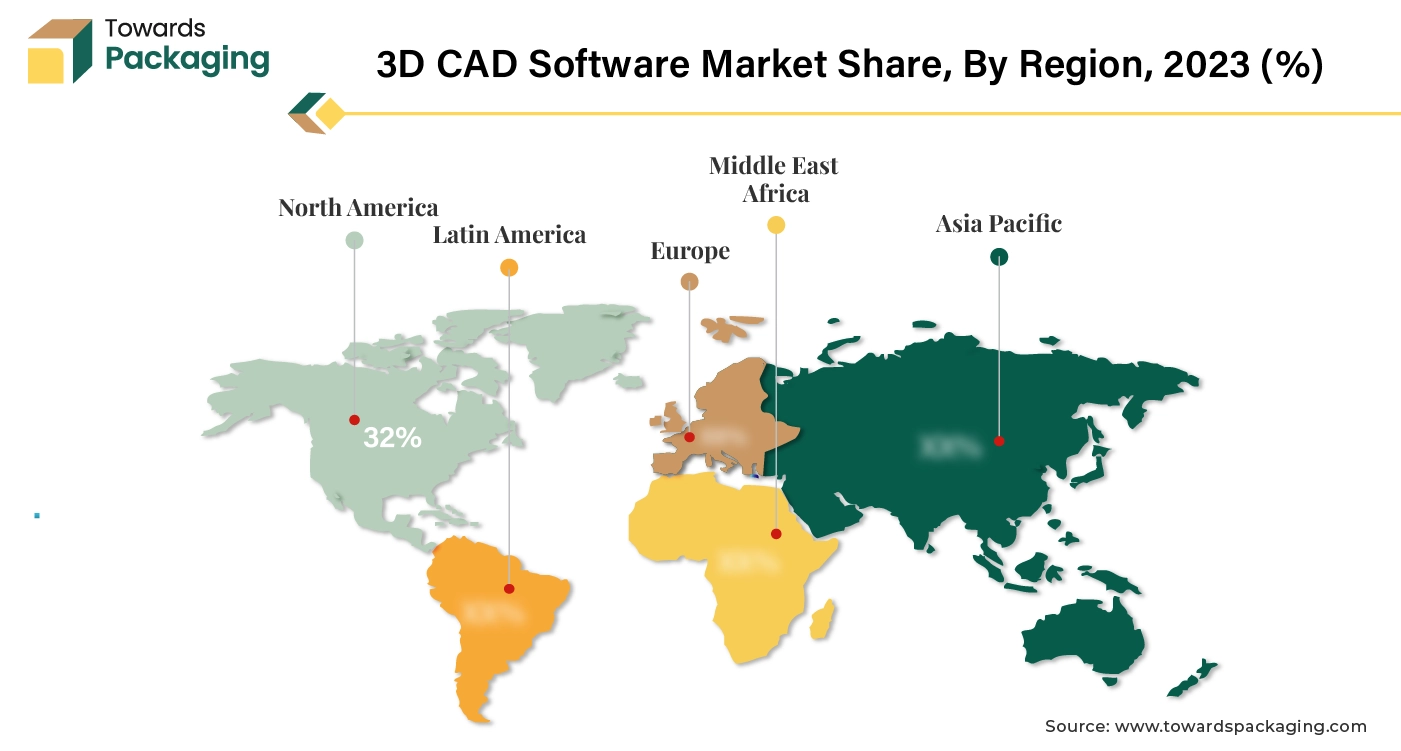

North America region dominated the global 3D CAD software market in 2023. North America, particularly the United States, is a leader in the adoption of 3D CAD software, driven by advancements in technology and a strong manufacturing base. North America region is home to numerous technology companies and research institutions, fostering continuous innovation in CAD tools and features. North America leads in integrating CAD with technologies like AI, IoT, and AR/VR, enhancing functionality and usability.

Industries in North America often set the benchmark for design quality and efficiency, pushing the need for sophisticated CAD tools. Significant investment in infrastructure projects, especially in the construction sector, drives the demand for CAD software to plan and execute these projects efficiently. Major CAD software providers, such as Autodesk, Dassault Systèmes, and PTC, are headquartered in North America, facilitating strong market dynamics and competitive offerings.

North America has seen a rapid shift to cloud-based CAD solutions, which facilitate remote collaboration and reduce IT overhead for companies. The region emphasizes tools that enable real-time collaboration across teams, further boosting the adoption of CAD software. Companies in North America increasingly seek customizable CAD software to meet specific project requirements, driving innovation and development in this space.

The combination of a strong technological foundation, diverse industrial applications, significant investment in innovation, and a skilled workforce makes North America a critical region for the growth of 3D CAD software development. As industries continue to evolve, the demand for sophisticated CAD solutions is likely to expand even further.

For instance,

Asia Pacific region is anticipated to grow at the fastest rate in the 3D CAD software market during the forecast period. The Asia-Pacific region is experiencing rapid growth due to industrialization and increased investment in infrastructure. Countries like China, India, and Vietnam are experiencing significant growth in manufacturing sectors, driving the need for advanced design and engineering tools. Massive investments in infrastructure projects increase demand for architectural and civil engineering applications of CAD software. Many companies are embracing digital technologies, including 3D CAD, to enhance productivity and efficiency in design processes. Improved internet infrastructure supports cloud-based CAD solutions, making them more accessible to a wider range of users.

A growing trend towards personalized products requires flexible design capabilities, pushing industries to adopt 3D CAD solutions. Industries are looking for rapid prototyping capabilities to meet specific market demands quickly. A rising number of small and medium enterprises are adopting CAD tools to remain competitive, further driving 3D CAD software market growth. The growing startup culture in tech hubs is fostering innovation and increasing demand for modern CAD solutions.

Many CAD software providers are offering cost-effective solutions tailored to the needs of the Asian market, making them more accessible to a broader audience. The combination of rapid industrial growth, technological adoption, supportive government policies, and the rising need for customization makes the Asia-Pacific region a hotbed for the growth of the 3D CAD software market. As these trends continue, the demand for advanced CAD solutions is expected to expand significantly.

For instance,

By Deployment

By Enterprise Type

By Application

By Region

January 2025

December 2024

February 2025