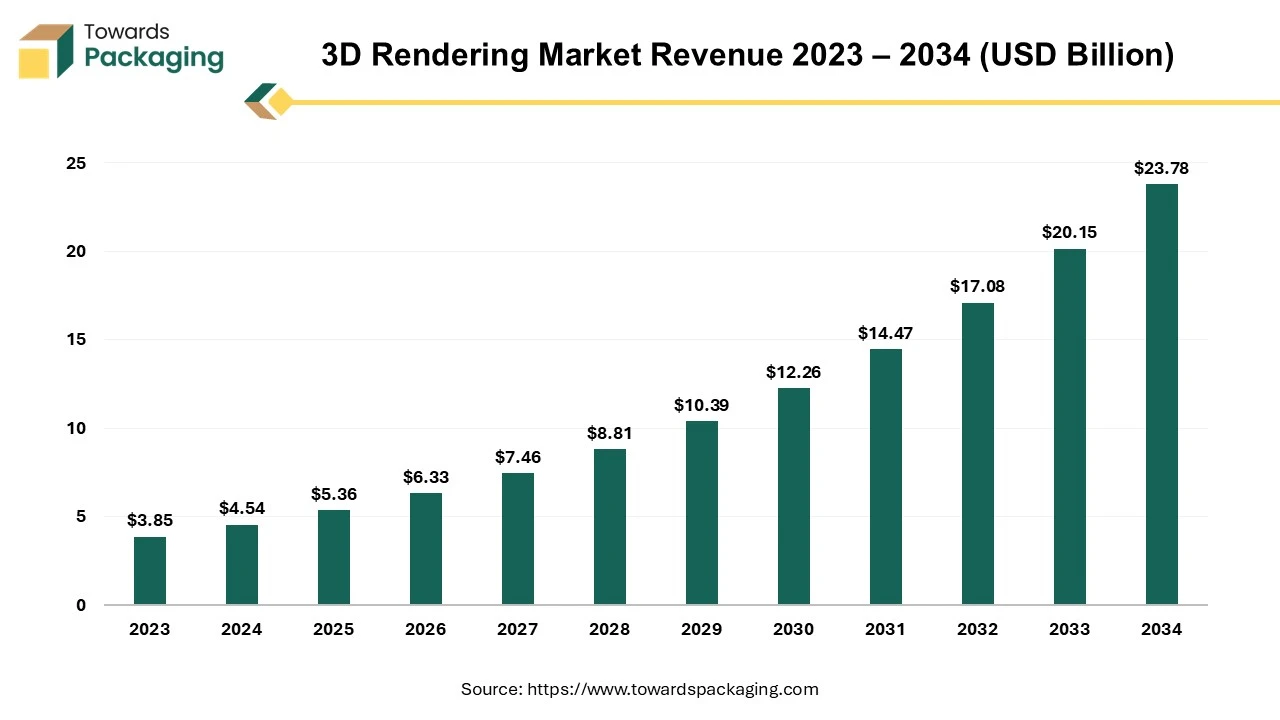

The 3D rendering market is forecasted to expand from USD 6.32 billion in 2026 to USD 28.04 billion by 2035, growing at a CAGR of 18% from 2026 to 2035. This report presents detailed segment data (software vs services, operating systems, applications, end‑use industries), regional insights covering North America, Europe, Asia‑Pacific, Latin America and Middle East & Africa, company profiles and competitive analysis of major players, value chain analysis from raw materials/software to end‑use, trade data including import/export flows, and manufacturers & suppliers information globally.

The rising interest in VR and AR applications necessitates advanced 3D rendering techniques. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop 3D rendering which is estimated to drive the global 3D Rendering market over the forecast period.

The process of using computer graphics to create a two-dimensional image from a three-dimensional model is known as 3D rendering. This technique is widely used in various fields, including animation, architecture, film, video games, and product design. 3D Rendering is done utilizing different techniques ray tracing, global illumination, and rasterization.

3D Rendering is utilized in various sectors such as architecture, product design and entertainment among others. Architects use rendering to visualize buildings and spaces before construction, providing clients with realistic previews. Companies use rendering to showcase products in marketing materials and design reviews, allowing for adjustments before physical production. In films and video games, rendering is essential for creating immersive worlds and characters.

3D rendering is a complex, multi-step process that transforms digital models into visually stunning images. It combines artistry with technology, enabling creators to visualize and communicate ideas in various industries effectively. As technology advances, rendering techniques continue to evolve, pushing the boundaries of realism and creativity in digital media.

AI algorithms can optimize rendering processes, reducing time needed for complex scenes. Techniques like denoising can accelerate the final output by cleaning up noise in real-time. AI-driven upscaling can enhance low-resolution images or models to higher resolutions without significant loss of quality, saving time and resources. AI can analyze user preferences and automatically adjust rendering settings or styles to match specific needs or trends.

AI can automate repetitive tasks such as UV mapping, texture generation, and lighting adjustments, allowing artists to focus on more creative aspects. Machine learning models can generate high-quality textures, realistic materials, and improved lighting effects, elevating the overall realism of renders. AI can assist in procedural content generation, creating complex environments or assets dynamically based on parameters set by artists.

With AI, real-time rendering becomes more feasible, enabling interactive experiences in gaming and virtual reality. AI can analyze completed projects and provide insights or suggestions for improvement, fostering a continuous learning environment. By leveraging these capabilities, the 3D rendering industry can achieve higher quality outputs faster while enhancing creative possibilities.

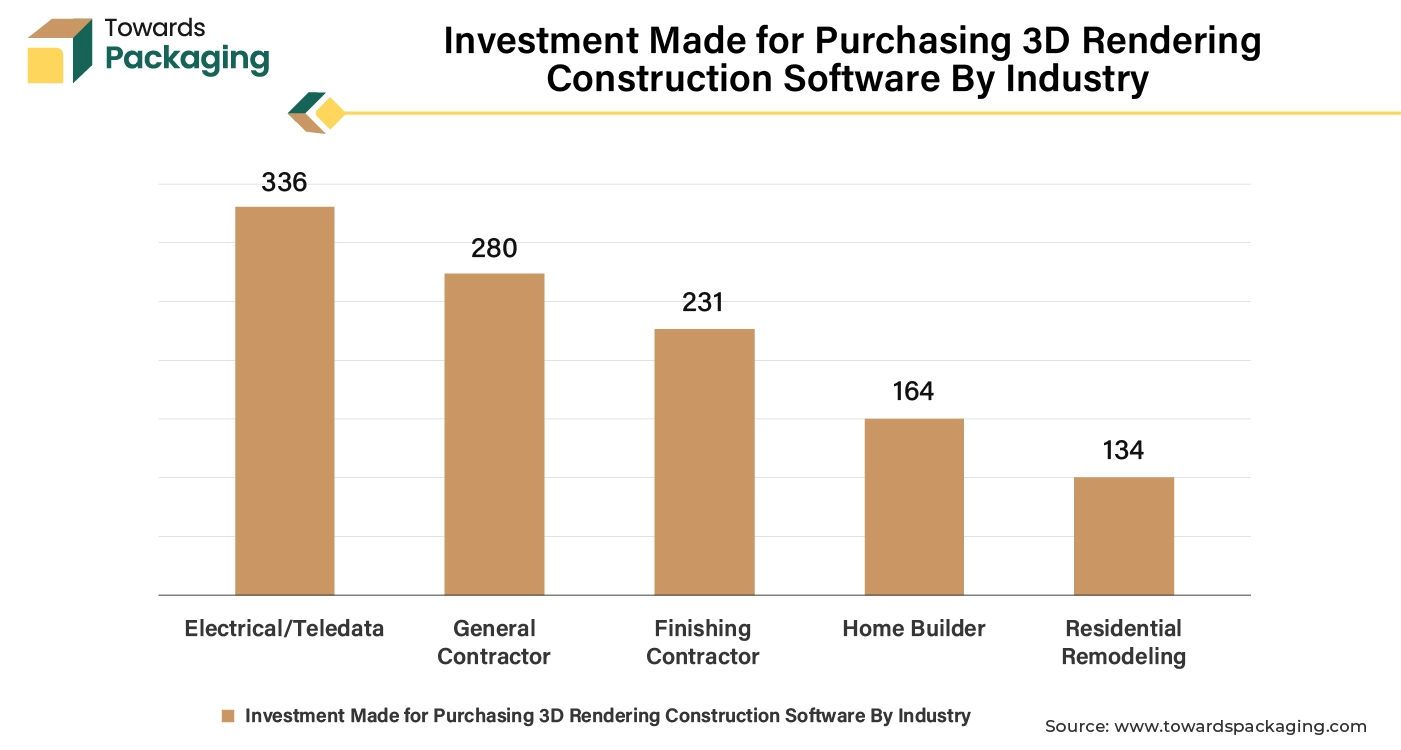

The key players operating in the market are widely making use of 3D rendering software in the real estate and construction sectors, which is estimated to drive the growth of the 3D rendering market over the forecast period. 3D rendering helps stakeholders visualize projects before construction begins, allowing for better understanding and communication of design concepts. High-quality renderings serve as powerful marketing tools, helping to attract clients and investors by showcasing projects in an appealing manner. Renderings allow architects and clients to review and validate design choices, facilitating easier decision-making and revisions. Detailed visualizations can assist in obtaining permits and approvals from regulatory bodies by providing clear representations of the project.

3D renderings are applicable for presentations to stakeholders, helping to convey ideas effectively and generate buy-in. The increasing use of virtual and augmented reality in construction enhances the need for 3D renderings, allowing immersive experiences of the designs. These factors highlight the importance of 3D rendering services in improving communication, efficiency, and success in construction projects.

It is possible to provide an accurate representation of the area, size, and dimensions of your project using 3D house designs. By using house rendering, real estate developers can avoid the costly and time-consuming process of building a model home. Time, money, and effort are all significantly saved as a result of this. Realtors can utilize 3D models to successfully sell their properties to potential purchasers in addition to the other advantages of using this technology. In other words, even before building is completed, 3D models provide a comprehensive understanding of how the property will appear.

Residential sales and launches in India hit a ten-year high in the first half of 2024 due to the use of AI integrated 3D rendering software, with sales surpassing 173,000 units and launches at 1,83,401 units. upper class. There was a 169% year-over-year increase in launches in the premium market utilizing 3D rendering (prices between INR 3-5 crore), and a 116% growth in the luxury segment (prices over US$ 5,98,602.50).

The key players face strong competition from other software available and face major issue of data security which is observed to limit the growth of the 3D rendering market. The initial investment for software, hardware, and skilled personnel can be prohibitive for smaller businesses. Different industries have unique rendering needs, which can complicate standardization and scalability. Economic downturns can lead to reduced budgets for design and rendering projects, impacting demand. High-quality rendering requires significant computational power, which may limit accessibility for some users. Concerns about the security of sensitive data in cloud-based rendering solutions can hinder adoption. Intense competition from established players and emerging technologies can restrict market share and growth potential.

The rise of mobile gaming encourages the development of optimized rendering techniques that can enhance performance on diverse devices. The rise of indie games can lead to increased use of 3D rendering software, as smaller studios seek to create visually appealing content on limited budgets. The key players operating in the market are focused on developing and introducing new indie games and mobile games which requires 3D rendering, which is estimated to create growth opportunity for the 3D rendering market in the near future. Moreover, the rising support of government to develop indie games is rising demand of the 3D rendering for creating indie games.

For instance,

Additionally, Nvidia unveiled a brand-new Nim microservice that lets AI models produce results in the OpenUSD programming language, giving customers the ability to create code to create objects for their 3D environments. A collection of microservices called Nim offers AI-powered technologies to facilitate software development.

The software segment held a dominant presence in the 3D rendering market in 2023. The software is widely used due to improvements in GPU technology and rendering algorithms enable faster, more realistic rendering, appealing to users across industries. Industries like gaming, film, architecture, and virtual reality are driving demand for high-quality 3D visuals. The software seamlessly integrates with popular design and animation tools enhances usability and workflow efficiency. The rise of subscription models and open-source software has made powerful rendering tools more accessible to a broader audience.

A growing availability of tutorials, courses, and community support facilitates skill development, encouraging more users to adopt 3D rendering tools. Software that allows for user customization and caters to specific industries tends to attract a wider user base. Growing awareness of sustainable practices in design and production encourages the adoption of rendering software that promotes efficient resource use. These factors together create a robust environment for growth in the 3D rendering software market. The key players operating in the market are focused developing and launching 3D rendering software, which is estimated to drive the growth of the segment over the forecast period.

For instance,

The large enterprises segment accounted for a notable share of the 3D rendering market in 2023. Large businesses frequently have complex design, simulation, and visualization requirements that call for sophisticated rendering capabilities due to their size and breadth. These businesses can produce precise, high-quality representations that are crucial for marketing, product development, and architectural planning due to 3D rendering software.

3D rendering provides realistic representations of products, allowing for better design communication and marketing. High-quality visualizations help stakeholders make informed decisions during the design and development process. 3D rendering provides realistic representations of products of large enterprises, allowing for better design communication and marketing.

In addition, rendering software's ability to be integrated with other enterprise systems helps large businesses by facilitating improved departmental communication and streamlined operations. The use of powerful 3D rendering solutions among large organizations is further driven by their enormous investment in technology infrastructure and their pursuit of competitive advantage.

Increasing adoption of the 3D rendering software by the large enterprises is estimated to drive the growth of the segment over the forecast period.

For instance,

The window segment registered its dominance over the global 3D rendering market in 2023. Windows's significant market share in both consumer and professional computer environments is the main factor driving the adoption of 3D rendering applications on the Windows operating system. Windows has a significant share of the desktop market, making it a standard platform for many applications. Many powerful graphics cards and rendering hardware are optimized for Windows, providing better performance for demanding 3D applications.

Windows operating system. Because of its strong support for high-performance hardware configurations and broad compatibility with a variety of 3D rendering end uses, Windows is a popular platform for rendering activities. A wide range of 3D rendering software, including industry-standard tools, are primarily developed for Windows, ensuring robust features and support. Windows facilitates better integration with various software solutions and workflows commonly used in industries like architecture, engineering, and gaming.

The MacOS segment is estimated to grow at fastest rate during the forecast period. The widespread adoption of 3D rendering software on macOS can be attributed to the platform's outstanding user experience and superior visual quality. With strong performance and compatibility for professional-level software, macOS provides a reliable and optimal environment for 3D rendering end users. When rendering duties are integrated with Apple's cutting-edge hardware, including the M1 and M2 CPUs, rendering jobs perform noticeably better.

Additionally, users in graphic design, animation, and visual effects sectors are drawn to macOS because to its aesthetically pleasing interface, ease of use, and compatibility with a particular set of high-end creative and design applications. The acceptance of 3D rendering software on macOS is facilitated by its alignment with the requirements of creative professions.

For instance,

The visualization and simulation segment led the global 3D rendering market. Constant efforts and marketing strategies by many software development companies has led to a growing visualization and simulation segment. Even, updating software versions includes features that minimize the threat associated with final products and enhance user experience, supporting factors for the 3D rendering market. The key players operating in the market are focused on innovating and introducing 3D rendering tools, which is estimated to drive the growth of the segment over the forecast period.

For instance,

The architecture, engineering & construction segment dominated the 3D rendering market globally. Adoption of 3D rendering software in the architecture, engineering & construction sector is fueled by the requirement for precise and in-depth visual representations of intricate projects. By making realistic visualizations and virtual walkthroughs easier, 3D rendering assists stakeholders better grasp design concepts and make defensible judgments. Through improved communication between engineers, architects, clients, and contractors, this technology facilitates more efficient project planning and collaboration.

Moreover, structural modifications, material selections, and spatial interactions may all be shown with 3D rendering software. These features are crucial for improving designs and guaranteeing adherence to legal requirements. The architecture, engineering & construction industry is adopting these tools at a faster rate since being able to offer renderings of superior quality helps attract investors and obtain client approvals. The key players operating in the market are focused on developing and introduction of the 3D rendering software utilized for architects and construction engineering, which is estimated to drive the growth of the segment over the forecast period.

For instance,

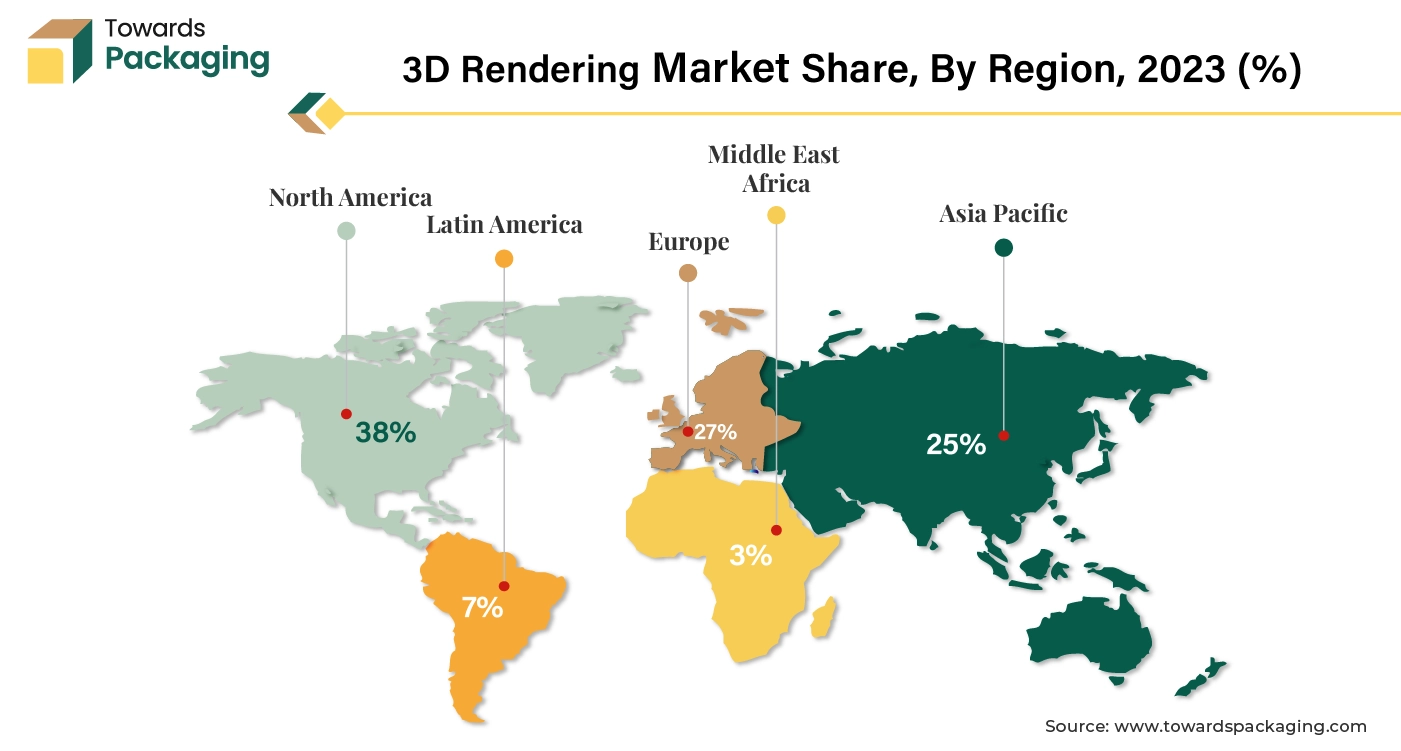

North America region held a significant share of 38% in 3D rendering market in 2023. North America region is home to leading tech companies and startups driving advancements in 3D rendering technologies. Many North American companies engage in international projects, enhancing their reach and influence in the global 3D rendering market. Strong IT infrastructure supports high-performance computing, essential for intensive rendering tasks. The key players operating in the North America market are focused on developing 3D rendering software for architectural visualization and representation which is estimated to drive the growth of the 3D rendering software in the North America region.

For instance,

U.S. 3D Rendering Market Trends

The U.S. 3D rendering market is driven by strong demand from the film industry, gaming, real estate marketing, and architecture. Market expansion is being shaped by the widespread use of sophisticated visualization tools for immersive customer experiences and product design. Adoption across industries is being accelerated by ongoing investments in cloud rendering, real-time visualization, and AI-powered rendering platforms. Real-time rendering and virtual production are gaining strong traction in media and entertainment, increasing use of 3D visuals in e-commerce product presentation is further supporting market expansion.

Asia Pacific region is anticipated to grow at the fastest rate of 18.1% in the 3D rendering market during the forecast period. Many countries are experiencing significant industrial growth, leading to increased demand for 3D rendering in sectors like architecture, manufacturing, and gaming. An expanding pool of skilled professionals trained in digital art and computer graphics supports the industry's growth. Improving IT infrastructure and internet connectivity facilitates better access to rendering software and cloud-based solutions. Increased investment in technology and creative industries, along with government initiatives to promote digital innovation, foster a favourable environment.

The Asia Pacific is anticipated to witness incredible growth because of significant investments in technology and infrastructure in the region. Countries like – China, South Korea and Japan are expected to be major contributors as they have a thriving gaming and entertainment industry which needs high quality effects and experiences that are immersive. The rising demand for digital media also contributes to creating a necessity for advanced rendering technologies. These countries are predicted to be major contributors to the growth of the Asia Pacific region in the forecast period.

India 3D Rendering Market Trends:

India’s 3D rendering market is expanding because of the quick expansion of digital content production infrastructure planning, and real estate visualization market penetration is being aided by growing adoption by small design studios and an increase in rendering service outsourcing. The animation and gaming industries increasing demand and the availability of reasonably priced software solutions are bolstering growth even more. Cost-efficient talent and a strong freelance ecosystem are attracting global clients. Government-led infrastructure and smart city projects are boosting demand for visualization services.

Middle East and Africa 3D Rendering Market:

In MEA, the 3D rendering market is supported by extensive building initiatives and the creation of smart cities. Project approvals, urban planning, and architectural planning all make greater use of visualization. More people are using sophisticated 3D rendering tools thanks to government-led infrastructure projects. High-value real estate and mega projects are driving demand for premium visual outputs.

The UAE market benefits from high demand in luxury real estate, hospitality, and urban development projects. 3D rendering is widely used to present high-value properties and future city concepts before construction. Growing adoption of virtual walkthroughs and immersive visualization is driving steady market growth. Developers are using 3D rendering to accelerate project approval and investor decisions.

Europe 3D Rendering Marketet Trends:

Europe’s 3D rendering market is shaped by strong use in manufacturing design, automotive visualization, and architectural services. Companies focus on precision, realism, and sustainability-focused design visualization. Integration of rendering tools with BIM and digital twin platforms is supporting long-term adoption. Strict design standards and regulatory compliance are increasing demand for accurate visual models.

Germany stands out because of its high demand for advanced manufacturing, industrial design, and automotive engineering. Digital showrooms, simulation, and product prototyping all heavily rely on 3D rendering. The nation's emphasis on Industry 4.0 initiatives and engineering accuracy continues to boost market adoption. Automotive OEMs are increasingly using real-time rendering for design validation.

By Component

By Organization Size

By Operating System

By Application

By End-use

By Region

February 2026

January 2026

January 2026

January 2026