3D Rendering Market Size and Regional Insights 2025 to 2034

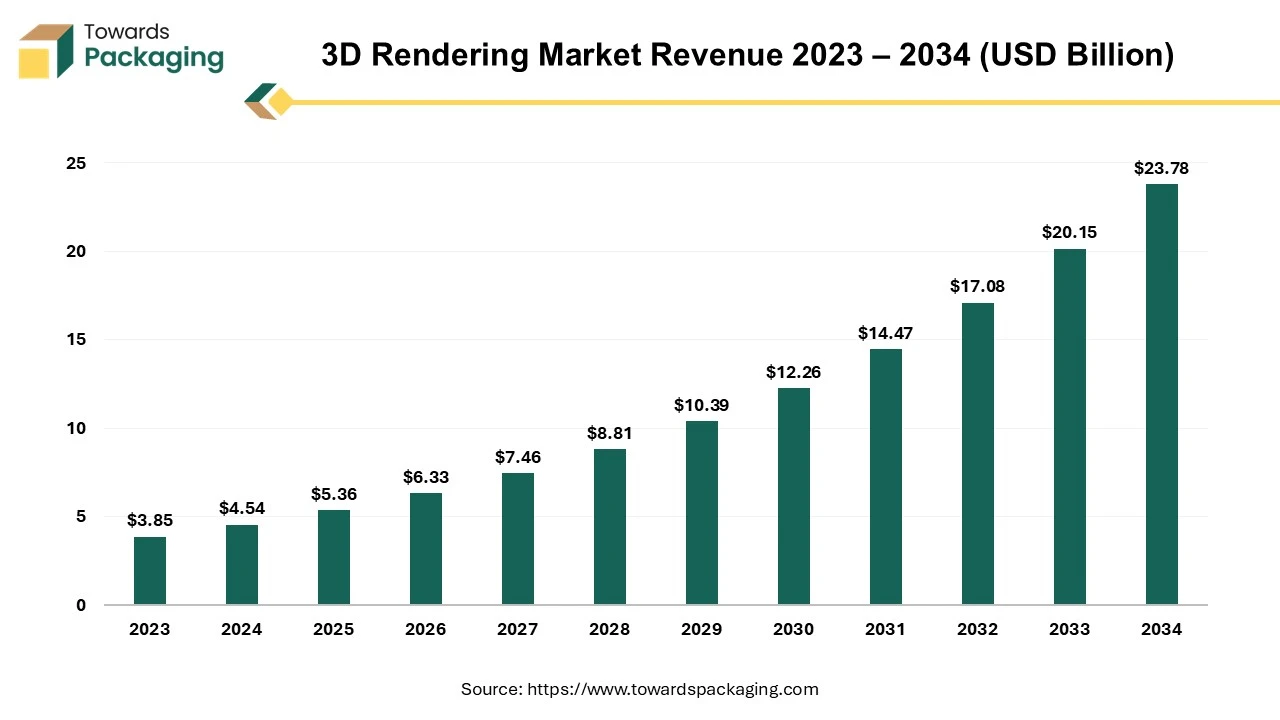

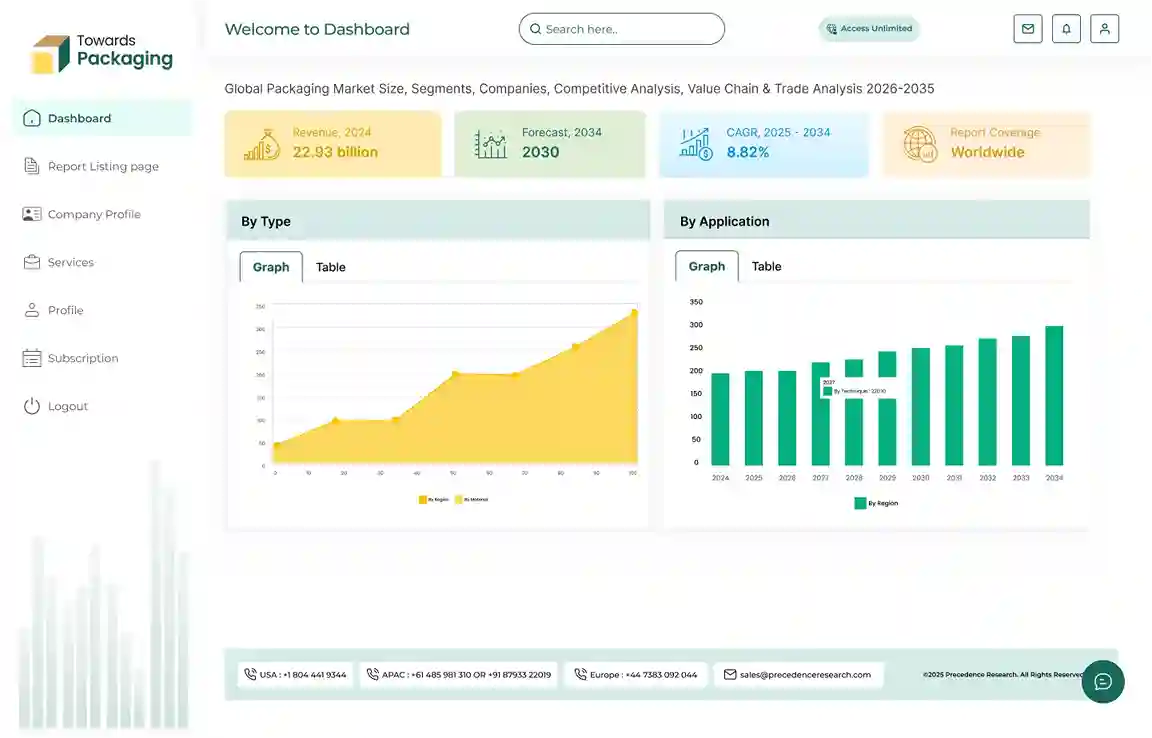

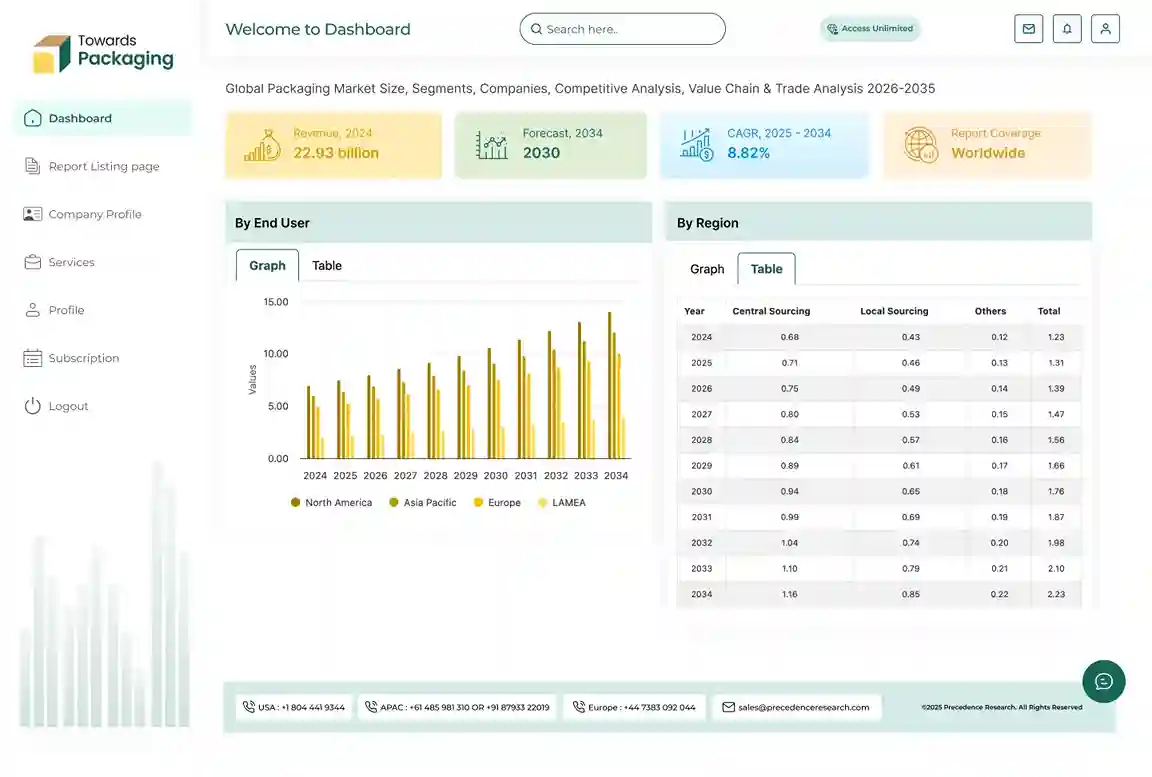

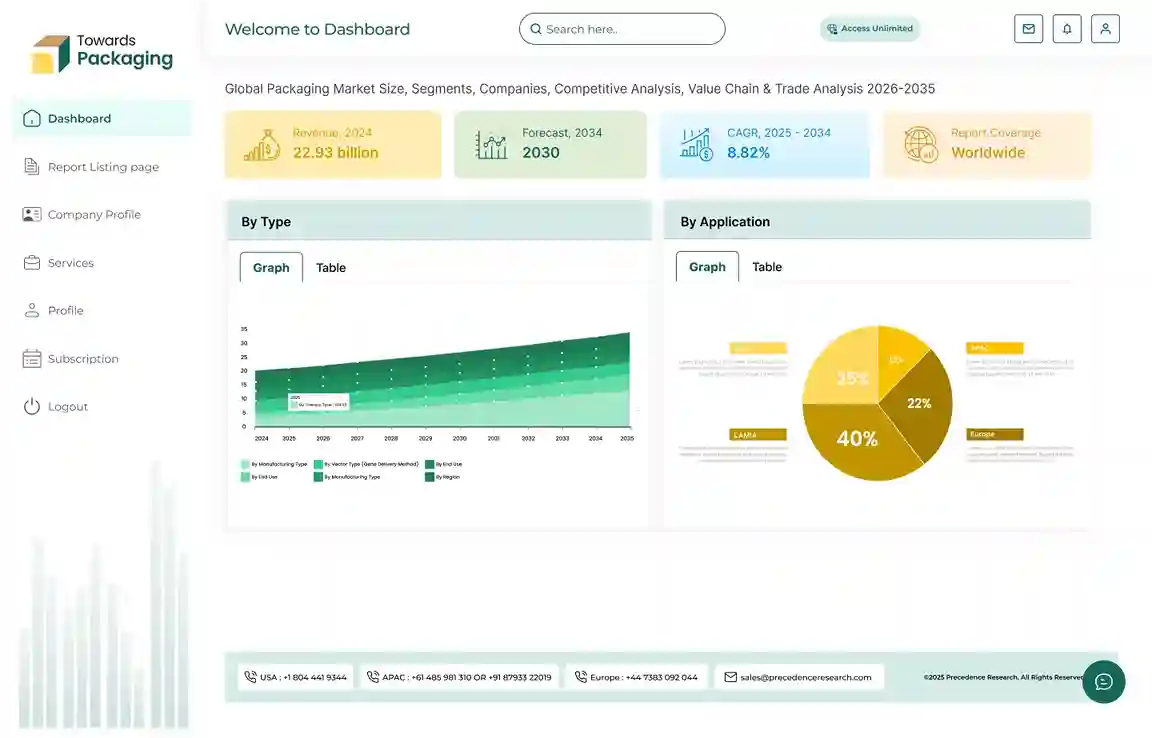

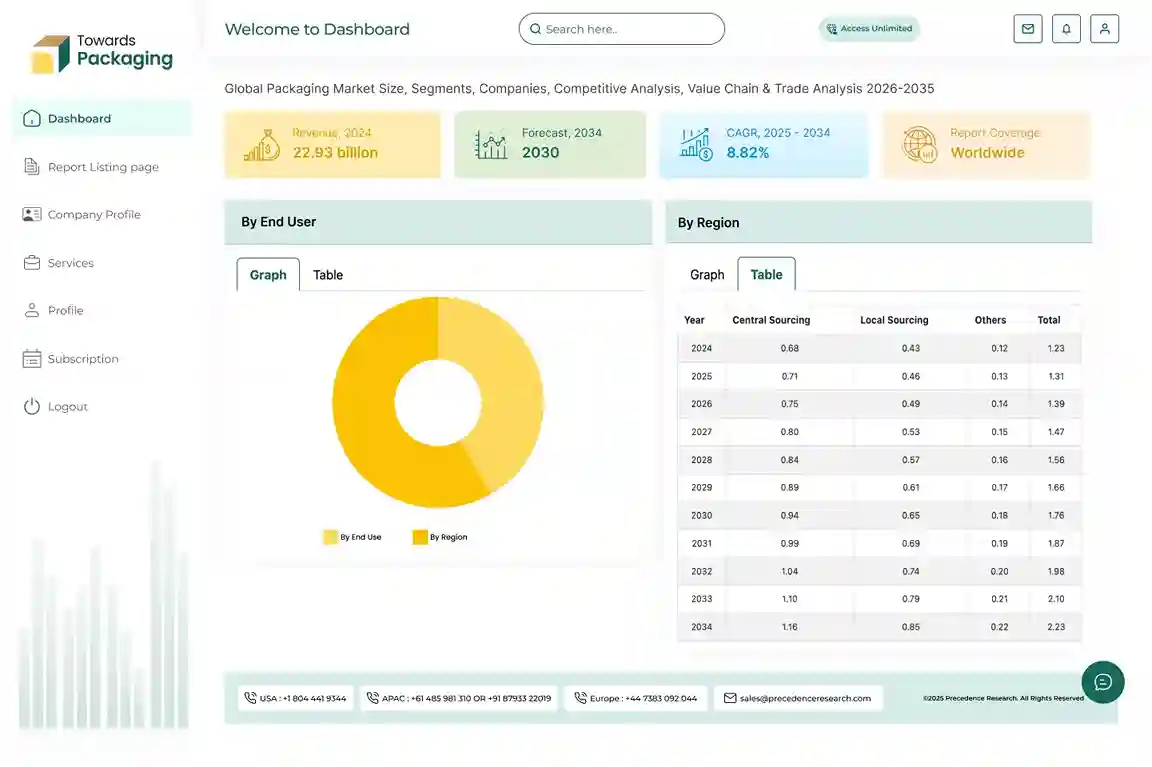

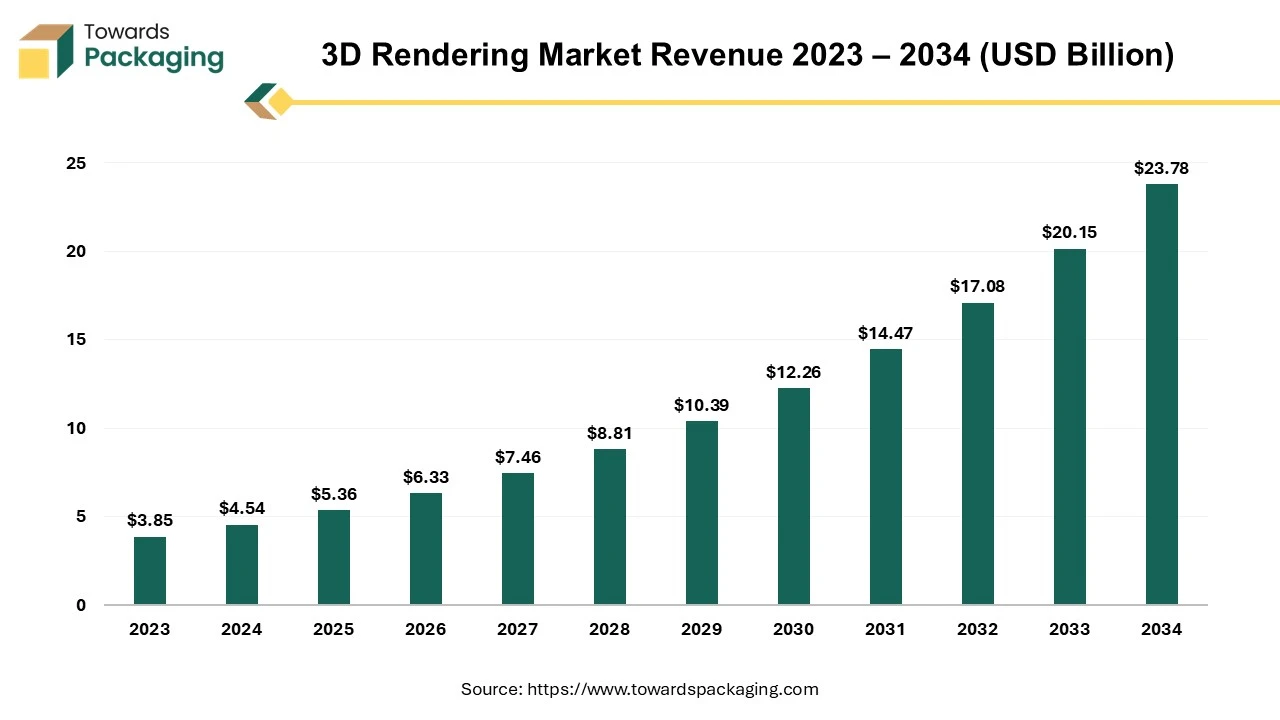

The 3D rendering market is forecasted to expand from USD 6.32 billion in 2026 to USD 28.04 billion by 2035, growing at a CAGR of 18% from 2026 to 2035. This report presents detailed segment data (software vs services, operating systems, applications, end‑use industries), regional insights covering North America, Europe, Asia‑Pacific, Latin America and Middle East & Africa, company profiles and competitive analysis of major players, value chain analysis from raw materials/software to end‑use, trade data including import/export flows, and manufacturers & suppliers information globally.

The rising interest in VR and AR applications necessitates advanced 3D rendering techniques. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop 3D rendering which is estimated to drive the global 3D Rendering market over the forecast period.

Major Key Insights of the 3D Rendering Market

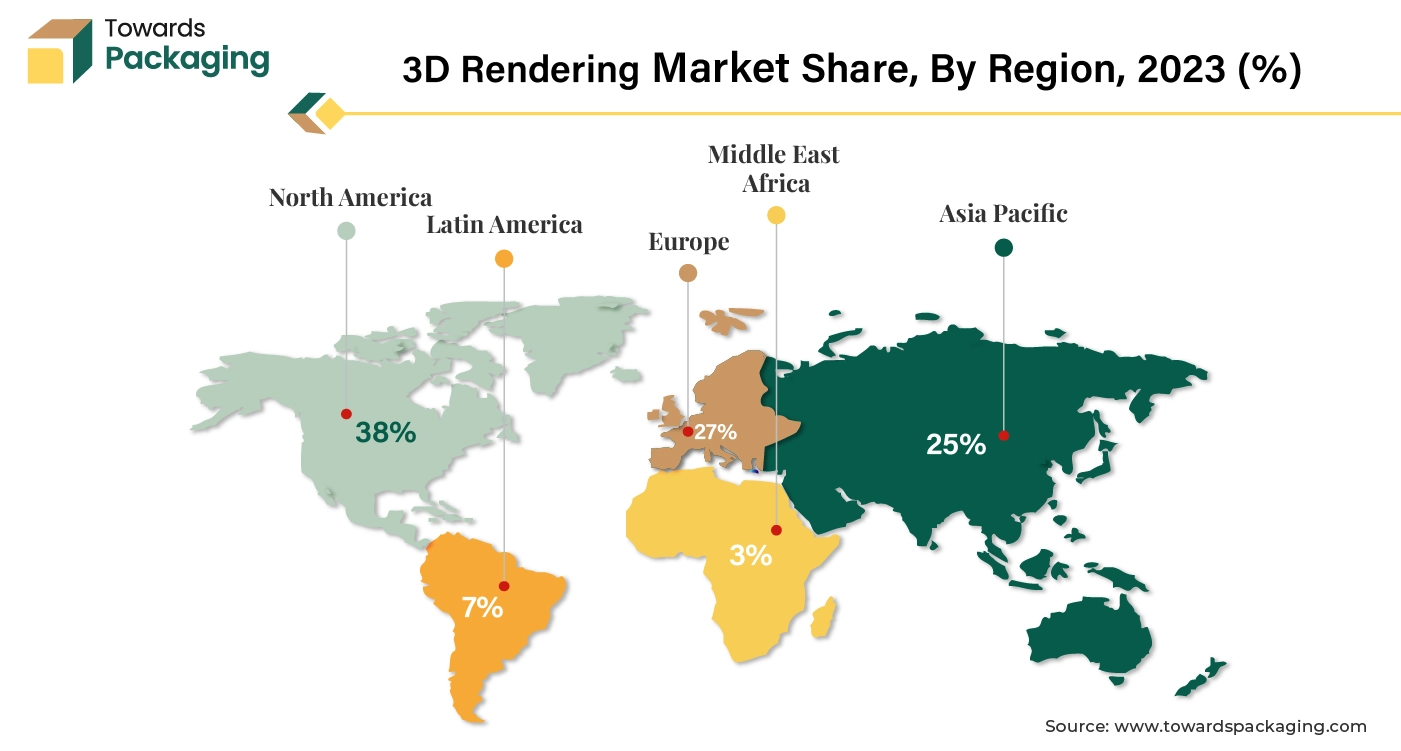

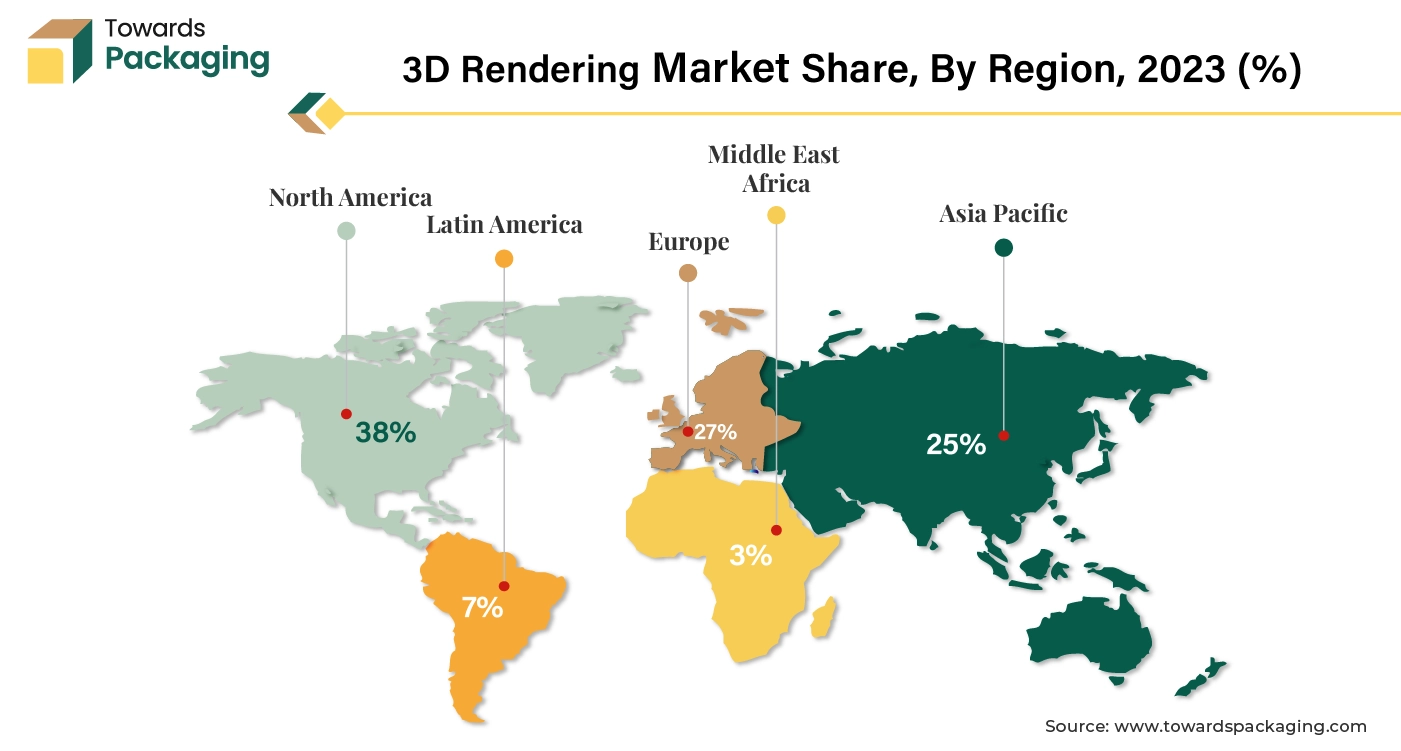

- North America dominated the 3D rendering market in 2023.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By component, the software segment dominated the market with the largest share in 2023.

- By organization size, large enterprises segment is expected to grow at significant rate during the forecast period.

- By operating system, windows segment led the global 3D rendering market.

- By application, visualisation and simulation segment dominated the market globally.

- By end use, the architecture, engineering & construction segment dominated the 3D rendering market in 2023.

3D Rendering Market: Generating Visual Images

The process of using computer graphics to create a two-dimensional image from a three-dimensional model is known as 3D rendering. This technique is widely used in various fields, including animation, architecture, film, video games, and product design. 3D Rendering is done utilizing different techniques ray tracing, global illumination, and rasterization.

3D Rendering is utilized in various sectors such as architecture, product design and entertainment among others. Architects use rendering to visualize buildings and spaces before construction, providing clients with realistic previews. Companies use rendering to showcase products in marketing materials and design reviews, allowing for adjustments before physical production. In films and video games, rendering is essential for creating immersive worlds and characters.

3D rendering is a complex, multi-step process that transforms digital models into visually stunning images. It combines artistry with technology, enabling creators to visualize and communicate ideas in various industries effectively. As technology advances, rendering techniques continue to evolve, pushing the boundaries of realism and creativity in digital media.

7 Key Factors Driving 3D Rendering Market Growth

- The key players operating in the market are focused on geographic expansion and launching their brand in other countries which is expected to drive the growth of the 3D Rendering market in the near future.

- Increasing focus on cost reduction and production efficiency can drive the specialty market growth further.

- Emerging markets and trends for 3D rendering technology it is expected to drive the growth of the global 3D Rendering market over the forecast period.

- Increasing regulatory support is estimated to drive the growth of the market over the forecast period.

- Increasing in adoption of the advanced technology for the production of 2D images using 3D rendering technology is estimated to drive the growth of the global 3D Rendering market in the near future.

- Increasing trend for customized products has driven the demand of 3D rendering software.

- Outsourcing of 3D rendering services fuelling growth of the 3D rendering market.

Market Outlook

- Industry Growth Overview: Growth is driven by the adoption of photorealistic visualizations, VR/AR applications, and digital twins in the design and entertainment industries. Software advancements are improving rendering speed and quality.

- Sustainability Trends: Cloud rendering reduces the need for high-power local workstations, lowering energy consumption. Companies are adopting energy-efficient GPU servers and eco-friendly data centers.

- Startup Ecosystem: Startups introduce AI-powered, real-time rendering solutions and SaaS-based platforms. Small and medium enterprises leverage cloud rendering to access advanced visualization tools without heavy upfront investment.

How Can AI Improve the 3D Rendering Industry?

AI algorithms can optimize rendering processes, reducing time needed for complex scenes. Techniques like denoising can accelerate the final output by cleaning up noise in real-time. AI-driven upscaling can enhance low-resolution images or models to higher resolutions without significant loss of quality, saving time and resources. AI can analyze user preferences and automatically adjust rendering settings or styles to match specific needs or trends.

AI can automate repetitive tasks such as UV mapping, texture generation, and lighting adjustments, allowing artists to focus on more creative aspects. Machine learning models can generate high-quality textures, realistic materials, and improved lighting effects, elevating the overall realism of renders. AI can assist in procedural content generation, creating complex environments or assets dynamically based on parameters set by artists.

With AI, real-time rendering becomes more feasible, enabling interactive experiences in gaming and virtual reality. AI can analyze completed projects and provide insights or suggestions for improvement, fostering a continuous learning environment. By leveraging these capabilities, the 3D rendering industry can achieve higher quality outputs faster while enhancing creative possibilities.

Driver

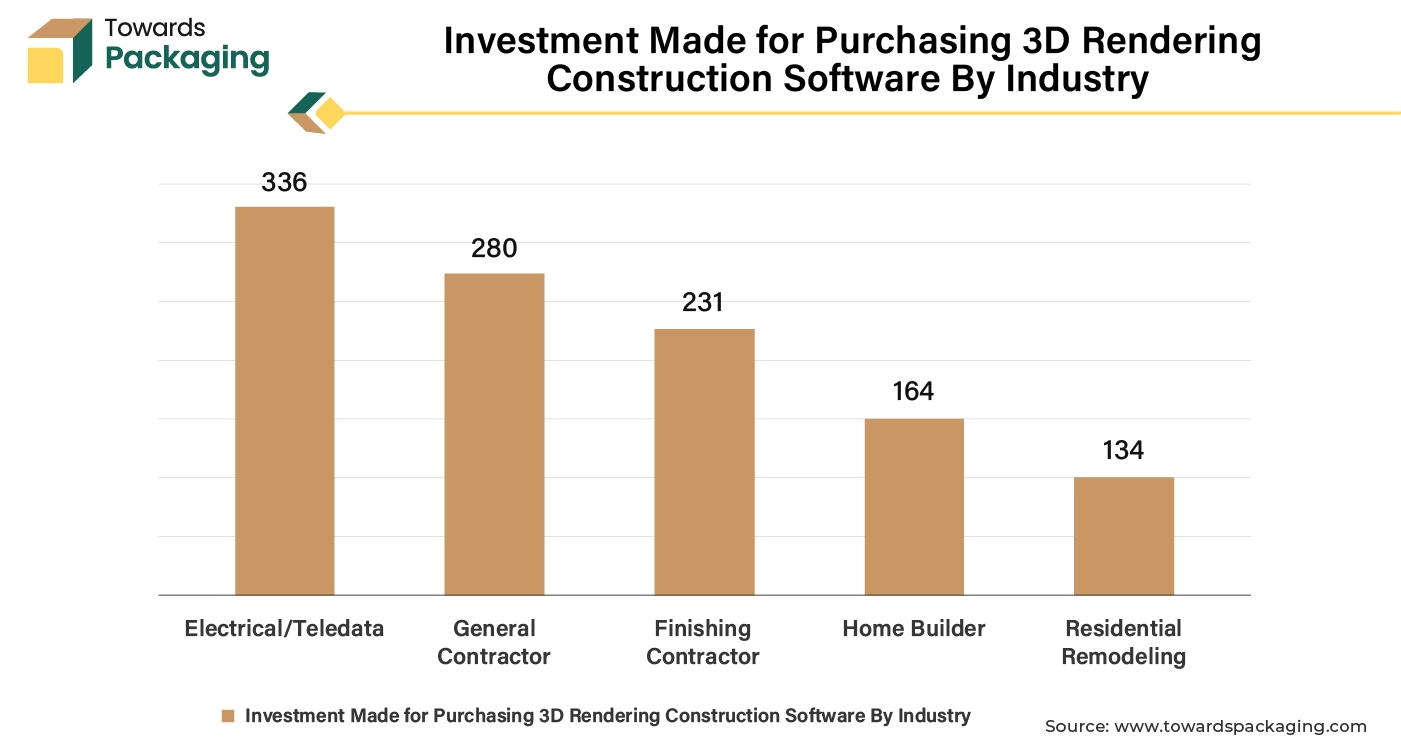

Growing Adoption Rate of 3D Rendering Services in Real Estate and Construction Sector

The key players operating in the market are widely making use of 3D rendering software in the real estate and construction sectors, which is estimated to drive the growth of the 3D rendering market over the forecast period. 3D rendering helps stakeholders visualize projects before construction begins, allowing for better understanding and communication of design concepts. High-quality renderings serve as powerful marketing tools, helping to attract clients and investors by showcasing projects in an appealing manner. Renderings allow architects and clients to review and validate design choices, facilitating easier decision-making and revisions. Detailed visualizations can assist in obtaining permits and approvals from regulatory bodies by providing clear representations of the project.

3D renderings are applicable for presentations to stakeholders, helping to convey ideas effectively and generate buy-in. The increasing use of virtual and augmented reality in construction enhances the need for 3D renderings, allowing immersive experiences of the designs. These factors highlight the importance of 3D rendering services in improving communication, efficiency, and success in construction projects.

It is possible to provide an accurate representation of the area, size, and dimensions of your project using 3D house designs. By using house rendering, real estate developers can avoid the costly and time-consuming process of building a model home. Time, money, and effort are all significantly saved as a result of this. Realtors can utilize 3D models to successfully sell their properties to potential purchasers in addition to the other advantages of using this technology. In other words, even before building is completed, 3D models provide a comprehensive understanding of how the property will appear.

Residential sales and launches in India hit a ten-year high in the first half of 2024 due to the use of AI integrated 3D rendering software, with sales surpassing 173,000 units and launches at 1,83,401 units. upper class. There was a 169% year-over-year increase in launches in the premium market utilizing 3D rendering (prices between INR 3-5 crore), and a 116% growth in the luxury segment (prices over US$ 5,98,602.50).

Restraint

Data Security Concerns

The key players face strong competition from other software available and face major issue of data security which is observed to limit the growth of the 3D rendering market. The initial investment for software, hardware, and skilled personnel can be prohibitive for smaller businesses. Different industries have unique rendering needs, which can complicate standardization and scalability. Economic downturns can lead to reduced budgets for design and rendering projects, impacting demand. High-quality rendering requires significant computational power, which may limit accessibility for some users. Concerns about the security of sensitive data in cloud-based rendering solutions can hinder adoption. Intense competition from established players and emerging technologies can restrict market share and growth potential.

Opportunity

Mobile Gaming Expansion and Indie Games Development

The rise of mobile gaming encourages the development of optimized rendering techniques that can enhance performance on diverse devices. The rise of indie games can lead to increased use of 3D rendering software, as smaller studios seek to create visually appealing content on limited budgets. The key players operating in the market are focused on developing and introducing new indie games and mobile games which requires 3D rendering, which is estimated to create growth opportunity for the 3D rendering market in the near future. Moreover, the rising support of government to develop indie games is rising demand of the 3D rendering for creating indie games.

For instance,

- In April 2024, Japan's Ministry of Economy, Trade and Industry, government organization of Japan announced the introduction of the So-Fu project to support indie game developers.

- In August 2024, Kodansha Ltd., publishing company, uneviled the launch of the Fairy Tail indie game guild project.

- In April 2024, International Olympic Committee (IOC) and nWay, software company, introduced the Olympics Go! Paris 2024, the official mobile game for the Olympic Games Paris 2024.

Nvidia’s Trial on AI Innovations in Rendering

- In July 2024, NVIDIA Corporation, software company, announced the launch new generative AI tools at the annual Siggraph event, premier conference & exhibition on computer graphics & interactive techniques, engineered to supercharge the creation of digital twins and 3D worlds. The chipmaker will be providing new generative AI frameworks that will allow companies to create digital twins of manufacturing facilities or test settings for robots.

Additionally, Nvidia unveiled a brand-new Nim microservice that lets AI models produce results in the OpenUSD programming language, giving customers the ability to create code to create objects for their 3D environments. A collection of microservices called Nim offers AI-powered technologies to facilitate software development.

- In March 2024, NVIDIA Corporation, software company, uneviled the introduction of the NVIDIA Blackwell platform that allows organizations to develop and run real-time generative AI on trillion-parameter large language models at up to 25x less cost and energy usage than its predecessor. Six innovative accelerated computing technologies found in the Blackwell GPU architecture will help NVIDIA take advantage of new business opportunities in data processing, engineering simulation, electronic design automation, computer-aided drug design, quantum computing, and generative Al.

Software Segment Lead 3D Rendering in 2023

The software segment held a dominant presence in the 3D rendering market in 2023. The software is widely used due to improvements in GPU technology and rendering algorithms enable faster, more realistic rendering, appealing to users across industries. Industries like gaming, film, architecture, and virtual reality are driving demand for high-quality 3D visuals. The software seamlessly integrates with popular design and animation tools enhances usability and workflow efficiency. The rise of subscription models and open-source software has made powerful rendering tools more accessible to a broader audience.

A growing availability of tutorials, courses, and community support facilitates skill development, encouraging more users to adopt 3D rendering tools. Software that allows for user customization and caters to specific industries tends to attract a wider user base. Growing awareness of sustainable practices in design and production encourages the adoption of rendering software that promotes efficient resource use. These factors together create a robust environment for growth in the 3D rendering software market. The key players operating in the market are focused developing and launching 3D rendering software, which is estimated to drive the growth of the segment over the forecast period.

For instance,

- In September 2024, Lucid Group, Inc., automaker company, revealed the introduction of the lucid UX 2.4, a major software update for the lucid air. Lucid UX 2.4 provides an enhanced version of DreamDrive Pro, which is lucid’s alternative option for Advanced Driver Assistance System (ADAS), with improvised capabilities, including new Lucid Assistant, a new voice control system; 3D lane visualization; an updated map design for high-quality legibility; and much more.

Large Enterprises to Hold a Notable Share in the Market

The large enterprises segment accounted for a notable share of the 3D rendering market in 2023. Large businesses frequently have complex design, simulation, and visualization requirements that call for sophisticated rendering capabilities due to their size and breadth. These businesses can produce precise, high-quality representations that are crucial for marketing, product development, and architectural planning due to 3D rendering software.

3D rendering provides realistic representations of products, allowing for better design communication and marketing. High-quality visualizations help stakeholders make informed decisions during the design and development process. 3D rendering provides realistic representations of products of large enterprises, allowing for better design communication and marketing.

In addition, rendering software's ability to be integrated with other enterprise systems helps large businesses by facilitating improved departmental communication and streamlined operations. The use of powerful 3D rendering solutions among large organizations is further driven by their enormous investment in technology infrastructure and their pursuit of competitive advantage.

Increasing adoption of the 3D rendering software by the large enterprises is estimated to drive the growth of the segment over the forecast period.

For instance,

- In June 2024, Rady Children’s Hospital, based in San Diego, U.S., reveals that it offers Arc Viewer, a software platform engineered by the hospital's 3D Innovations Lab to educators and hospitals across U.S. The Arc Viewer is a 3D visualization software that utilizes MR and CT images and is sculptured on video games to assists surgeons finer view anatomical structures at free of cost.

Windows Segment to Show Significant Share

The window segment registered its dominance over the global 3D rendering market in 2023. Windows's significant market share in both consumer and professional computer environments is the main factor driving the adoption of 3D rendering applications on the Windows operating system. Windows has a significant share of the desktop market, making it a standard platform for many applications. Many powerful graphics cards and rendering hardware are optimized for Windows, providing better performance for demanding 3D applications.

Windows operating system. Because of its strong support for high-performance hardware configurations and broad compatibility with a variety of 3D rendering end uses, Windows is a popular platform for rendering activities. A wide range of 3D rendering software, including industry-standard tools, are primarily developed for Windows, ensuring robust features and support. Windows facilitates better integration with various software solutions and workflows commonly used in industries like architecture, engineering, and gaming.

The MacOS segment is estimated to grow at fastest rate during the forecast period. The widespread adoption of 3D rendering software on macOS can be attributed to the platform's outstanding user experience and superior visual quality. With strong performance and compatibility for professional-level software, macOS provides a reliable and optimal environment for 3D rendering end users. When rendering duties are integrated with Apple's cutting-edge hardware, including the M1 and M2 CPUs, rendering jobs perform noticeably better.

Additionally, users in graphic design, animation, and visual effects sectors are drawn to macOS because to its aesthetically pleasing interface, ease of use, and compatibility with a particular set of high-end creative and design applications. The acceptance of 3D rendering software on macOS is facilitated by its alignment with the requirements of creative professions.

For instance,

- In June 2023, Apple, technology company, revealed macOS Sonoma, the next generation of advanced desktop operating system, bringing high quality set of features that elevate the Mac experience. With exceptional new features like Presenter Overlay, which superimposes a presenter on top of the content being shared, and Reactions, which allows for entertaining gesture-triggered video effects with cinematic clarity, video conferencing also becomes more engaging with macOS Sonoma. Safari receives major upgrades that elevate the online experience. Web apps offer quicker access to favourite websites, and profiles maintain surfing separate amongst several topics or projects. With the release of Game Mode, intriguing new games, and a new toolset for game porting that makes it even simpler for developers to create more Mac games, gaming just gets better.

Visualization and Simulation to Show Dominance in Market in 2023

The visualization and simulation segment led the global 3D rendering market. Constant efforts and marketing strategies by many software development companies has led to a growing visualization and simulation segment. Even, updating software versions includes features that minimize the threat associated with final products and enhance user experience, supporting factors for the 3D rendering market. The key players operating in the market are focused on innovating and introducing 3D rendering tools, which is estimated to drive the growth of the segment over the forecast period.

For instance,

- In September 2024, CADVIZ, architectural designer, uneviled the introduction of the new 3D visualization tool made for engineers, 3D modelers and designers. With CADviz, customers do not require any specific skills to render an image by just dragging and dropping a screenshot of their model.

- CADviz comes with two variants: The free version has all the capabilities needed to produce high-quality renderings, making it perfect for novices and casual users alike.

- PRO edition: Optimized for experts, the PRO edition offers infinite renderings and increased resolution.

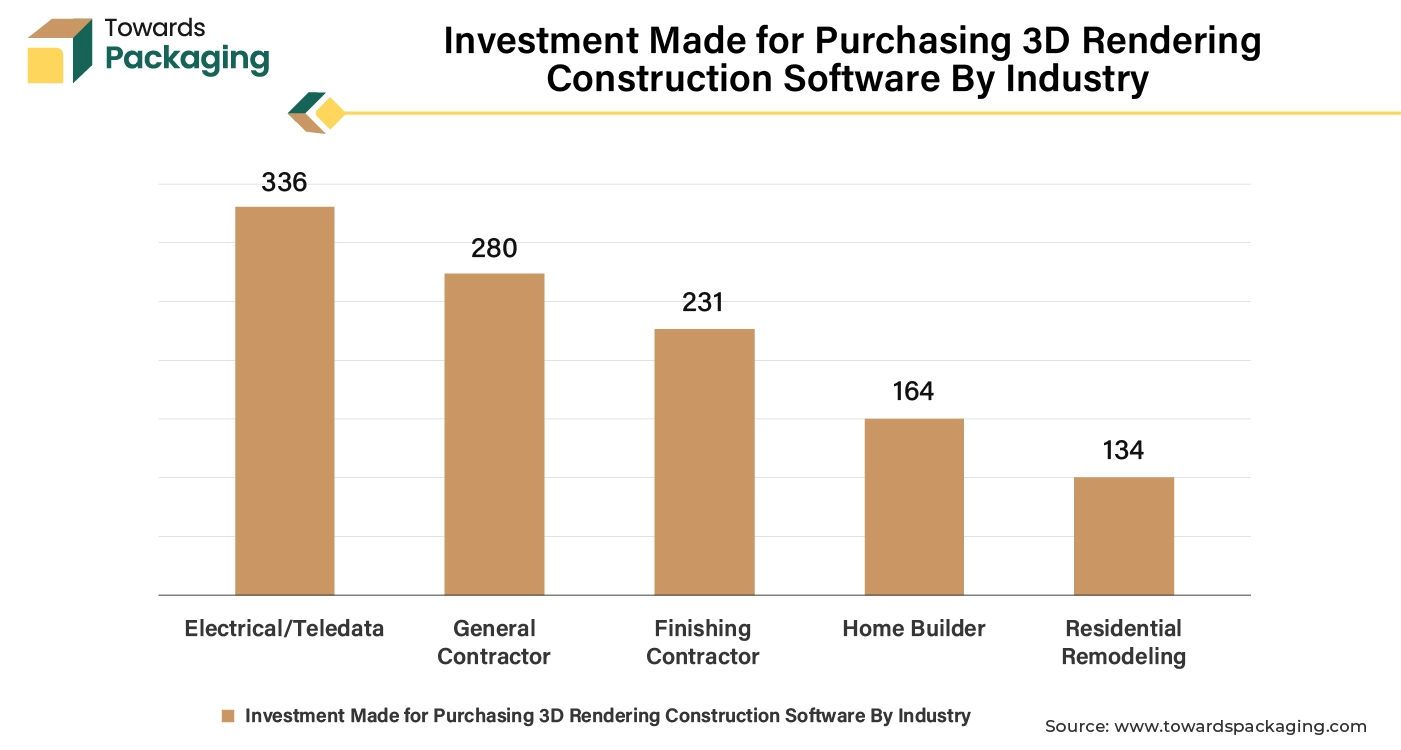

Architecture, Engineering & Construction to Led Market in 2023

The architecture, engineering & construction segment dominated the 3D rendering market globally. Adoption of 3D rendering software in the architecture, engineering & construction sector is fueled by the requirement for precise and in-depth visual representations of intricate projects. By making realistic visualizations and virtual walkthroughs easier, 3D rendering assists stakeholders better grasp design concepts and make defensible judgments. Through improved communication between engineers, architects, clients, and contractors, this technology facilitates more efficient project planning and collaboration.

Moreover, structural modifications, material selections, and spatial interactions may all be shown with 3D rendering software. These features are crucial for improving designs and guaranteeing adherence to legal requirements. The architecture, engineering & construction industry is adopting these tools at a faster rate since being able to offer renderings of superior quality helps attract investors and obtain client approvals. The key players operating in the market are focused on developing and introduction of the 3D rendering software utilized for architects and construction engineering, which is estimated to drive the growth of the segment over the forecast period.

For instance,

- In May 2024, Lumion, software company headquartered in the Netherlands, Europe, uneviled the launch of the real-time 3D-rendering software namely Lumion to develop a virtual, desert-proof glass bunker house informed by the one of the film’s sets demand named Dune films' sets.

North America’s Technology Advancement to support Dominance

North America region held a significant share of 38% in 3D rendering market in 2023. North America region is home to leading tech companies and startups driving advancements in 3D rendering technologies. Many North American companies engage in international projects, enhancing their reach and influence in the global 3D rendering market. Strong IT infrastructure supports high-performance computing, essential for intensive rendering tasks. The key players operating in the North America market are focused on developing 3D rendering software for architectural visualization and representation which is estimated to drive the growth of the 3D rendering software in the North America region.

For instance,

- In January 2024, Poliark, software company headquartered in New York, U.S., revealed the launch of the next-generation AI-based design platform named Kend. Kend is a conversational AI assistant for architects and engineers that uses basic language inputs to produce 3D models from scratch or from 2D sketches. It is built on generative artificial intelligence technology.

U.S. 3D Rendering Market Trends

The U.S. 3D rendering market is driven by strong demand from the film industry, gaming, real estate marketing, and architecture. Market expansion is being shaped by the widespread use of sophisticated visualization tools for immersive customer experiences and product design. Adoption across industries is being accelerated by ongoing investments in cloud rendering, real-time visualization, and AI-powered rendering platforms. Real-time rendering and virtual production are gaining strong traction in media and entertainment, increasing use of 3D visuals in e-commerce product presentation is further supporting market expansion.

Asia’s Rapid Industrialization to Promote Growth

Asia Pacific region is anticipated to grow at the fastest rate of 18.1% in the 3D rendering market during the forecast period. Many countries are experiencing significant industrial growth, leading to increased demand for 3D rendering in sectors like architecture, manufacturing, and gaming. An expanding pool of skilled professionals trained in digital art and computer graphics supports the industry's growth. Improving IT infrastructure and internet connectivity facilitates better access to rendering software and cloud-based solutions. Increased investment in technology and creative industries, along with government initiatives to promote digital innovation, foster a favourable environment.

The Asia Pacific is anticipated to witness incredible growth because of significant investments in technology and infrastructure in the region. Countries like – China, South Korea and Japan are expected to be major contributors as they have a thriving gaming and entertainment industry which needs high quality effects and experiences that are immersive. The rising demand for digital media also contributes to creating a necessity for advanced rendering technologies. These countries are predicted to be major contributors to the growth of the Asia Pacific region in the forecast period.

India 3D Rendering Market Trends:

India’s 3D rendering market is expanding because of the quick expansion of digital content production infrastructure planning, and real estate visualization market penetration is being aided by growing adoption by small design studios and an increase in rendering service outsourcing. The animation and gaming industries increasing demand and the availability of reasonably priced software solutions are bolstering growth even more. Cost-efficient talent and a strong freelance ecosystem are attracting global clients. Government-led infrastructure and smart city projects are boosting demand for visualization services.

Middle East and Africa 3D Rendering Market:

In MEA, the 3D rendering market is supported by extensive building initiatives and the creation of smart cities. Project approvals, urban planning, and architectural planning all make greater use of visualization. More people are using sophisticated 3D rendering tools thanks to government-led infrastructure projects. High-value real estate and mega projects are driving demand for premium visual outputs.

The UAE market benefits from high demand in luxury real estate, hospitality, and urban development projects. 3D rendering is widely used to present high-value properties and future city concepts before construction. Growing adoption of virtual walkthroughs and immersive visualization is driving steady market growth. Developers are using 3D rendering to accelerate project approval and investor decisions.

Europe 3D Rendering Marketet Trends:

Europe’s 3D rendering market is shaped by strong use in manufacturing design, automotive visualization, and architectural services. Companies focus on precision, realism, and sustainability-focused design visualization. Integration of rendering tools with BIM and digital twin platforms is supporting long-term adoption. Strict design standards and regulatory compliance are increasing demand for accurate visual models.

Germany stands out because of its high demand for advanced manufacturing, industrial design, and automotive engineering. Digital showrooms, simulation, and product prototyping all heavily rely on 3D rendering. The nation's emphasis on Industry 4.0 initiatives and engineering accuracy continues to boost market adoption. Automotive OEMs are increasingly using real-time rendering for design validation.

New Advancements in 3D Rendering Industry

- In March 2024, NVIDIA Corporation, software company, revealed the introduction of the Earth Climate Digital Twin for weather forecasting. NVIDIA unveiled its Earth-2 climate digital twin cloud platform, which simulates and visualizes weather and climate on a never-before-seen scale, in an attempt to spur attempts to counteract the US$140 billion in economic losses brought on by extreme weather brought on by climate change.

- In July 2024, Meta Platforms, Inc., technology company, revealed the introduction of the next generation AI text-to-3D generator. A new AI tool from Meta can create or retexture 3D objects in less than a minute. The program combines two of Meta's pre-existing models: TextureGen for texturing and AssetGen for generating 3D objects. When the two are combined, better 3D generation is produced for immersive media.

Value Chain Analysis

- Raw Material Sourcing: High-performance GPUs, CPUs, and server infrastructure are sourced globally. Hardware availability and upgrades influence rendering capacity and efficiency.

- Logistics and Distribution: Cloud-based delivery eliminates traditional logistics challenges, while on-premises solutions require distribution of high-end servers and software licenses.

- Recycling and Waste Management: Recycling of GPUs, CPUs, and electronic hardware is increasingly emphasized to reduce e-waste. Companies are also adopting energy-efficient data center practices.

3D Rendering Market Companies

- Adobe systems Inc

- Autodesk, Inc

- Act3-D B.V

- Blender institute

- Chaos software

- BluEnt CAD

- Corel corporation

- Christie digital systems USA,Inc.

- Dassault systems,Inc.

- Easy render

- Luxion, Inc

- Foundry

- Map systems

- Next limit technologies

3D Rendering Market Segments

By Component

- Software

- On Premises

- Cloud

- Service

By Organization Size

- Large Enterprises

- SMEs

By Operating System

- Windows

- MacOS

- Linux

By Application

- Visualization and Simulation

- Animation

- Product, Design and Modelling

- Others

By End-use

- Architecture, Engineering & Construction

- Automotive

- Gaming

- Healthcare

- Media and Entertainment

- Manufacturing

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (4)