February 2025

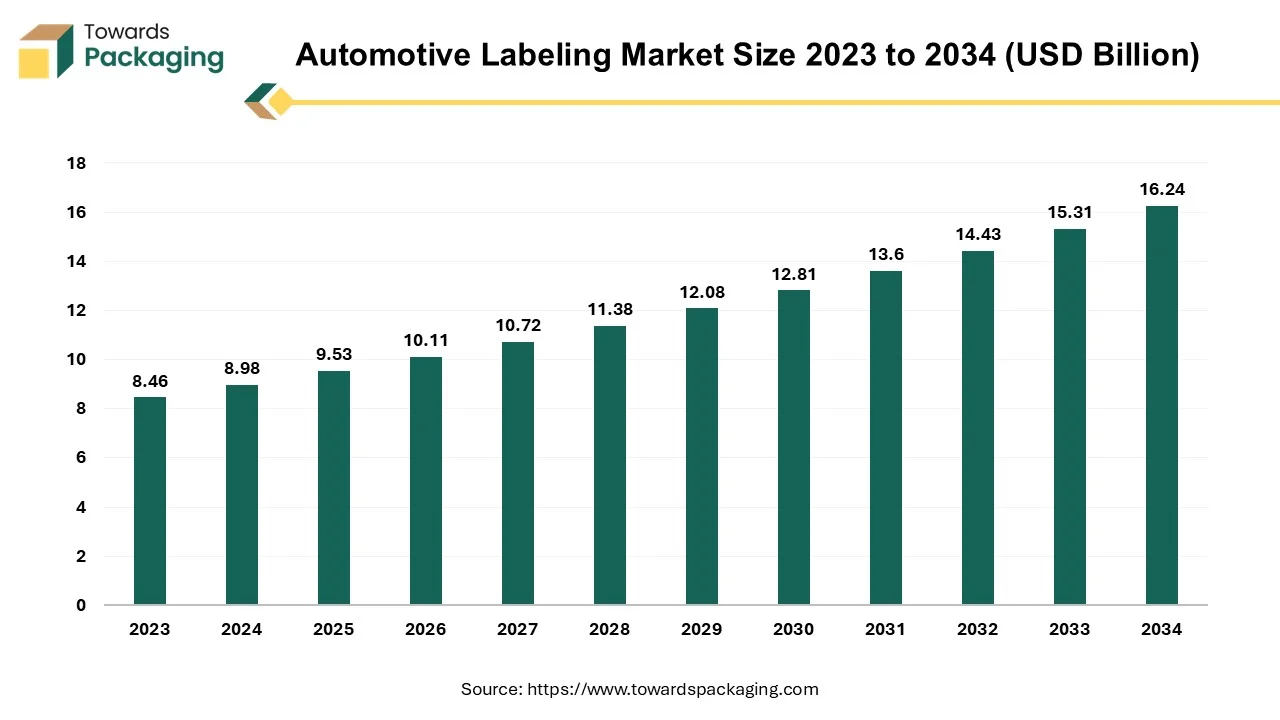

The automotive labeling market is projected to reach USD 16.24 billion by 2034, growing from USD 9.53 billion in 2025, at a CAGR of 6.11% during the forecast period from 2025 to 2034.

The automotive labeling market is anticipated to witness significant growth during the forecast period. The automotive industry uses labels extensively, from markings of the component in the supply chain to the product labels, information labels, or the rating plates. Original equipment manufacturers (OEMs) use the majority of the labels found in automobiles, of which only 10 to 15 percent are visible. Long before a car is assembled, the majority of automobile labels have been identification labels that are employed across the supply chain.

The increasing production and sales of the vehicles coupled with the rising consumer awareness about vehicle safety, maintenance, and quality as well as the growing trend towards personalized consumer experiences is anticipated to augment the growth of the market within the estimated timeframe. The market is further driven by the advancements in the printing technologies and materials science along with the integration with the smart technologies.

The automotive industry depends on printed warnings to give necessary operational, hazard and safety protocol information to the passengers, drivers, and the technicians. Good communication may reduce the liability concerns and save lives. Accurate, high-quality warnings are essential for the preventing the dangerous circumstances and guaranteeing the security of both the employees as well as the passengers.

Safety is enhanced by easily understood and prominently seen warnings and instructions in an automobile as well as in the manufacturing facility, regardless of who is operating the vehicle. With an increasing number of automobiles being composed of different elements and possibly requiring distinct cleaning and environmental conditions, producers provide long-lasting solutions by using the premium adhesives that are resistant to high temperatures and can stick to a variety of surfaces, such as powder-coated, textured, low- or high-energy surfaces.

They are also long-lasting, giving drivers the confidence that the warning will remain functional for the entire life of the car. Additionally, when a safety label, sign or a tag is needed but there isn't enough room, manufacturers are able to create the precise size and shape required, regardless of the dimensions, to guarantee uninterrupted interaction.

Also, manufacturers are introducing modern tracking, identification, and safety labeling systems for automotive sun visors, seat belts, and car carpets, among others. For instance, Avery Dennison Corporation introduced TRANSFER PET125 Label Stock, TRANSFER PET Label Stock, and PET25 MATT WH OPQ Label Stock. These products offer high resistance to temperature cycling, chemicals, and wear and tear, as well as irreversible adhesion to difficult substrates like PVC and textiles using a new heat-activated adhesive, S8073. Instead of printing on finished goods, all three allow printing onto stock labels.

The labeling errors and barcode issues is likely to limit the growth of the market during the forecast period. Labeling mistakes may result in problems for every participant involved in the supply chain and not just the final consumer by giving each one the wrong information. Errors on the labels can also result in the product recalls as well as inaccuracies in the supply chain, which can hinder the organization's plans for further innovation and incur additional costs for the relabeling. The inaccurate data, color problems, a misplaced barcode, low print quality and barcode disruptions are a few examples of the errors.

Recalls have the potential to be exceptionally costly for the large corporations. Recall related expenses can reach millions for the companies. Although there are other factors that can lead to a product recall, it is essential for companies to print and use correct labels in order to prevent these expenses. For organizations that manufacture components, like the manufacturing of the automobiles, these difficulties are exponential. These companies may have first- and second-tier suppliers spread out across the globe. Thus, process standardization can be challenging if an effective labeling solution is not found.

The growing automotive industry in the emerging markets such as China, India and Taiwan is likely to offer a lucrative opportunity for the growth of the automotive labeling market in the near future. This is attributable to the significant economic growth, urbanization and the rising disposable income which is leading to increase in the vehicle ownership and production.

The barcode segment captured a substantial market share of 32.43% in 2024. Several industries have been transformed by barcode labeling and the automotive industry is not an exception. Barcode labels, that provide a number of advantages to improve efficiency, precision and overall performance, have become the backbone of the automotive industry. Keeping track of the inventory can be a challenging task in the extensive system of warehouses and production plants for the automotive industry. But with the help of barcode labeling, this complexity becomes simple and this is expected to support the growth of the segment during the forecast period.

Every component, whether it's an assembled raw material or a completed product that's set to be distributed, is given a special barcode label that contains important data like the serial number, part number, purchase order numbers, specifications along with the manufacturing date. Inventory managers can quickly obtain the detailed information about every item, such as the quantity on hand, its location inside the facility as well as the production status, by scanning these automotive barcode labels. Organizations can streamline its processes and increase the cost-effectiveness by improving the inventory levels, minimizing stock outs and lowering the carrying costs due to this real-time visibility.

The interior segment captured largest market share of 35.58% in 2024. The interior automotive labels may be used for the airbags, seatbelts, seats, flooring carpets and dashboards, among others. Comprehensive information about the features, maintenance and the functioning of the automobile is offered by the interior labels. Labels that provide information like the oil change schedules, tire pressure and the infotainment system instructions, for example, improves the user experience as well as guarantee correct car maintenance. These labels are highly customized to meet the exact specifications and high standards of the automotive industry. They offer vital details to the various target groups and outlive a vehicle's entire life cycle.

The interior label for the car gives a high level of flexibility and can be customized to meet the needs of each individual customer. This is accomplished by utilizing the premium adhesives, customized die-cutting forms and appropriate special materials from top manufacturers. The labels can be directly imprinted with variable amounts based on the site's current data, eliminating the need for label management along with the storage. The majority of manufacturers use advanced die-cutting technologies to ensure the highest level of accuracy as well as dependability for the label application.

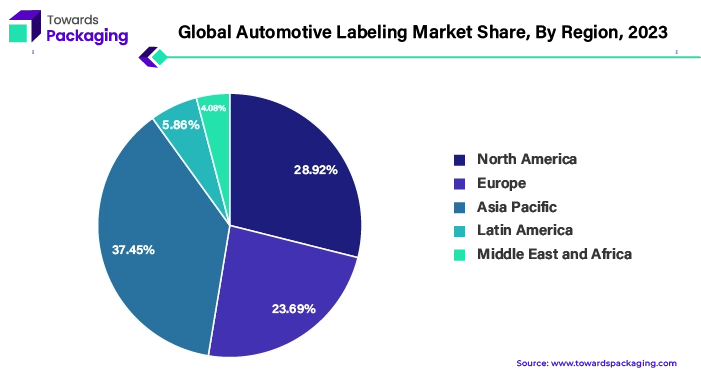

Asia Pacific dominated the market with 37.45% of shares in the global automotive labeling industry. This is due to the growing automotive ownership due to the rapid urbanization along with the growing disposable income of the consumers and the increasing middle class population across the region. Also, the region has presence of countries like China, India, Japan, and South Korea that are major hub for automotive manufacturing this is further expected to drive the demand for labels in the years to come. Furthermore, the region is home to key automakers such as Honda, Suzuki, Toyota, Tata, Nissan, Mazda, Subaru, Daihatsu, and Mitsubishi which is also expected to increase the demand for automotive labeling in the years to come.

North America is expected to grow at a considerable CAGR of 5.50% during the forecast period. The increasing production and sales of vehicles is projected to contribute to the growth of the market across the region. According to the International Energy Agency, there were 1.4 million new electric car registrations in the United States in 2023, indicating a rise of more than 40% as compared to 2022. In just one year, the United States witnessed the registration of half a million new battery-electric vehicles, accounting for 18% of the total sales of the cars (with another 6% coming from the plug-in hybrids).

Also, in 2022, there were 26.3 million registered road motor vehicles in Canada, according to the Statistics Canada. In 2022, the light-duty vehicles made up 91.7% of all registrations; multipurpose vehicles overtook passenger cars as the most popular vehicle type in Canada for the first time. Thus, with the increasing sales of the vehicles the demand for automotive labeling is also likely to increase during the forecast period in the region.

By Identification Technology

By Type

By Application

By Region

February 2025

January 2025

November 2024

November 2024