Beverage Closures Market Report, Key Trends, Competitive Landscape, and Regional Forecast Analysis

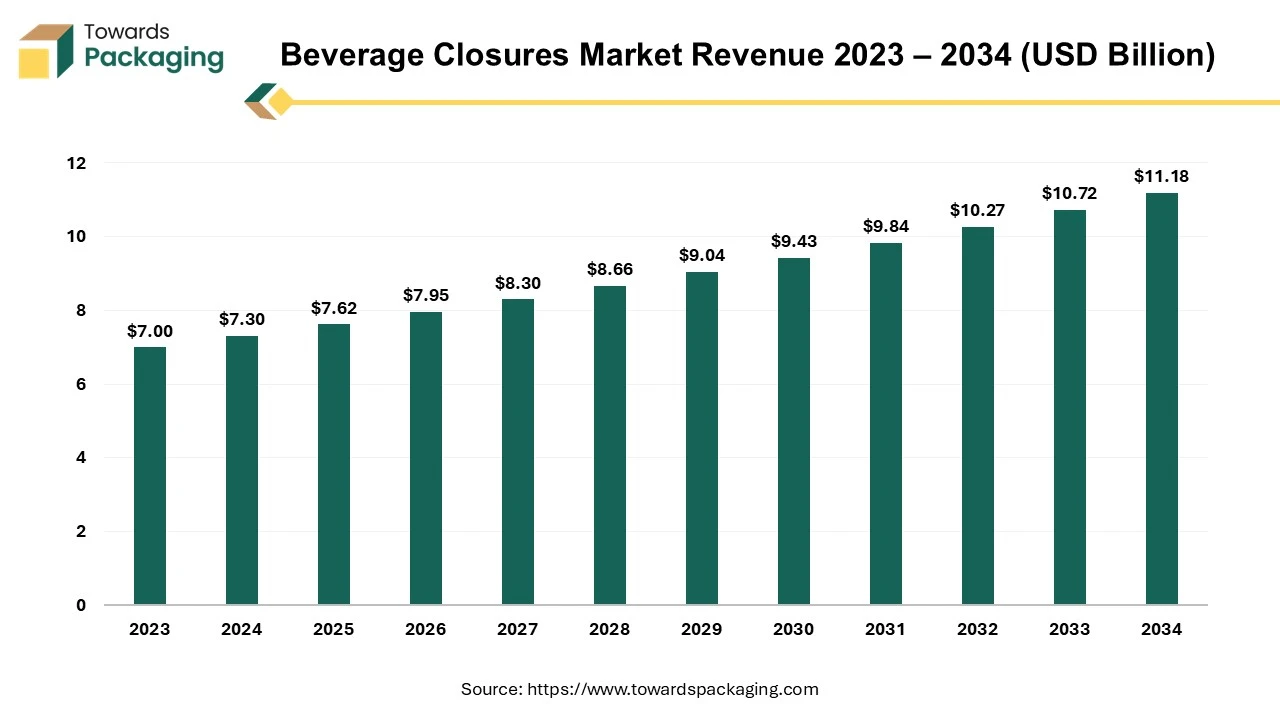

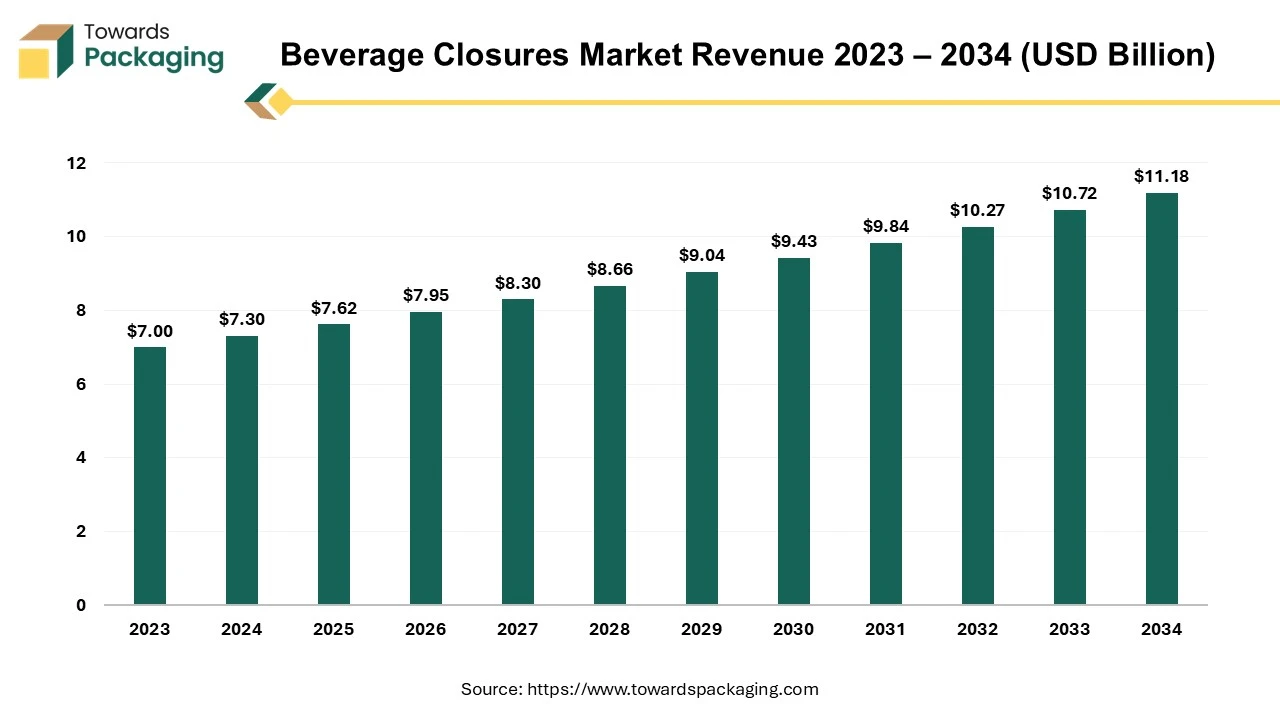

The beverage closures market is forecasted to expand from USD 7.95 billion in 2026 to USD 11.66 billion by 2035, growing at a CAGR of 4.35% from 2026 to 2035. The report provides a comprehensive analysis of market trends, key drivers, restraints, and opportunities, covering segmentation by type (plastic, metal) and application (water, carbonated drinks, juices). It includes regional data for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with Asia Pacific leading the market and North America showing the fastest growth. The study further covers competitive landscape, manufacturer profiles (Berry Global, Bericap, Silgan, Aptar Group, and ALPLA), trade and supply chain analysis, and detailed value chain mapping from raw material sourcing to end-user distribution.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing beverage closures which is estimated to drive the global beverage closures market over the forecast period.

Major Key Insights of the Beverage Closures Market

- Asia Pacific dominated the beverage closures market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By type, the plastic beverage closures segment is expected to grow at significant rate during the forecast period.

- By application, the water segment dominated the beverage closures market in 2024.

Beverage Closures Market Overview

The beverages closures are used to protect the liquid content inside the bottle. Beverage closure refers to the various mechanisms used to seal containers for liquid products, ensuring their safety, freshness, and integrity. These closures play a critical role in the beverage industry, influencing product preservation, consumer convenience, and brand identity. Different types of beverages closures are available namely screw caps, cork closures, crown caps, snap-on caps, flip top closures, and tetra pak seals. Screw caps are easily twisted on and off, providing a secure seal. Common in bottled water, soft drinks, and juices. Cork caps are commonly used for wines and some premium beverages. The cork caps allow for slight gas exchange, which can be beneficial for aging wines.

Beverages Closures protect against external contaminants, oxygen, and moisture, which can spoil the product. For carbonated beverages, closures must maintain pressure to keep the drink fizzy. Easy-to-use closures enhance the consumer experience, allowing for quick access and resealing. Unique closure designs can differentiate products on shelves, contributing to brand identity. Increasing focus on environmentally friendly materials and designs in closures aligns with consumer demand for sustainable packaging. Tamper-evident closures help ensure that the product has not been compromised before purchase. In summary, beverage closures are vital components of packaging that ensure product safety, freshness, and consumer satisfaction. They are continually evolving to meet market demands and consumer preferences.

Driver

Rising Trend for E-commerce Grocery Shopping

The rise of online shopping necessitates durable and efficient closures that can withstand shipping and handling, further boosting demand. As more consumers shop online, there's a rising demand for ready-to-drink beverages that often require effective closures to maintain freshness and quality during delivery. Online grocery sales offer a wider variety of beverages, including niche and craft options that require specialized closures to ensure product integrity. Proper closures are essential for ensuring product safety and quality during transport, which is critical for online sales where products can be handled multiple times. The shift towards eCommerce has highlighted consumer preferences for sustainable packaging. Beverage closures that are recyclable or made from eco-friendly materials are increasingly in demand. As brands seek to differentiate themselves in the crowded eCommerce market, innovative closure designs (like tamper-evident or resealable options) are becoming more popular, driving growth in this sector.

- For instance, in March 2024, according to the data published by the National Grocers Association, it is estimated that with Amazon and Flipkart in competition with big firms like Blinkit, Zepto, and Swiggy Instamart, the rapid commerce sector is getting more and more saturated. With intentions to use BB Now to produce US$1 billion of its anticipated US$1.5 billion in sales for the fiscal year, BigBasket has increased its emphasis on speedy commerce. In the fiscal year 2023, Zepto's revenue grew by almost 1,000 percent, far more than BigBasket's 5% growth. Additionally, Instamart has a 20–25% market share, while Zepto and BigBasket have market shares of 15-20% and 10-15%, respectively. Furthermore, the operational revenue of the online grocery store increased by just 6% from INR 7,439.7 Cr (US$ 82 Million) in FY23 to INR 7.884.5 Cr (US$ 90 Million) in FY24.

5 Key Factors Driving Beverages Closures Market Growth

- The key players operating in the market are focused on geographic expansion and launching their beverages brand in other countries which is expected to drive the growth of the beverage closures market in the near future.

- Increasing focus on cost reduction and production efficiency can drive the specialty market growth further.

- Emerging markets and trends for beverage closures is expected to drive the growth of the global beverages closures market over the forecast period.

- Increasing regulatory support is estimated to drive the growth of the market over the forecast period.

- Increasing in adoption of the advanced technology for the production of beverage closures is estimated to drive the growth of the global beverage closures market in the near future.

Market Trends

Integration of Smart Packaging

The incorporation of smart technologies, such as QR codes and NFC-enabled closures, is gaining traction for enhanced consumer engagement and product tracking.

Regional Variations

Different regions are experiencing unique trends based on local consumer preferences, regulations, and market maturity, leading to tailored closure solutions.

Sustainability Focus

There is an increasing demand for eco-friendly and recyclable closures as consumers and regulators push for sustainable packaging solutions.

Expansion of Beverage Varieties to Offer Opportunities to the Market

The introduction of new beverage products, including functional beverages, flavoured drinks, and non-alcoholic options, creates a need for diverse closure solutions. As beverage companies expand into new markets, they seek closures that meet local requirements and consumer preferences, driving market growth. Increasing the launch of the new beverages varieties and brands in the market has observed to rise the demand for the beverage closures, and is estimated to create lucrative opportunity for the growth of the global beverage closures market over the forecast period.

- For instance, on October 28, 2024, Hollywood Actor Tom Holland has introduced Bero, his first line of non-alcoholic beers, in partnership with Imaginary Ventures. There are other celebrities, such as Blake Lively, Lewis Hamilton, and Katy Perry, who make investments in the non-alcoholic sector. After experiencing the challenges of quitting alcohol.

Market Challenge

Market Saturation & Substitution by Alternative Packaging

The key players operating in the market are facing issue in meeting the regulatory guidelines and competition from the alternative, which is estimated to restrict the growth of the global beverage closures market in the near future. In mature markets, the beverage closures segment may face saturation, limiting growth opportunities and encouraging price competition. Fluctuations in the prices of materials like plastics, metals, and glass can increase production costs, impacting pricing and profit margins.

Changes in consumer preferences toward minimal packaging or bulk buying can affect the demand for certain types of closures. Stricter regulations regarding packaging waste and recycling can pose challenges for manufacturers, especially if they rely on non-sustainable materials. Innovations in alternative packaging solutions, such as flexible pouches or cartons, can reduce demand for traditional closures. Economic downturns can lead to reduced consumer spending, impacting the overall beverage market and, subsequently, closures.

Regional Insights

Asia’s Rapid Urbanization: Dominance to Sustain

Asia Pacific region dominated the global beverage closures market in 2024. Increasing urban populations in Asia Pacific region lead to higher demand for packaged beverages, driving the need for effective closures. A rising middle class with disposable income is boosting consumption of convenience and premium beverages, necessitating innovative closure solutions. Asia Pacific is a key manufacturing base, offering cost-effective production capabilities for beverage closures. Increasing launch of the new beverages by the key players operating in the Asia Pacific region is estimated to rise demand for the beverage closures, which is estimated to drive the growth of the global beverage closures market in the region.

- For instance, in October 2024, Re.juve, cold-pressed juice company headquartered in Singapore, Southeast Asia, revealed the launch of the Crush Watermelon, an energy drink to fuel the body and boost hydration.

North America’s High Demand for Innovative Packaging to Support Growth

North America region is anticipated to grow at the fastest rate in the beverage closures market during the forecast period. North America, particularly the United States and Canada, has a mature beverage closures market characterized by a high demand for innovative packaging solutions. North America has a well-established beverage industry, including soft drinks, bottled water, and alcoholic beverages, which drives consistent demand for various types of closures. The region is a hub for innovation in packaging technology, with companies investing in advanced closure designs, such as tamper-evident and resealable options, to enhance user experience. The diverse demographics and preferences in North America create opportunities for a wide range of beverage products, necessitating varied closure options.

Market Segments

Plastic Beverage Closures Segment to Lead the Market in 2024

The plastic beverage closures segment held a dominant presence in the global beverage closures market in 2024. Plastic closures are much lighter than alternatives like metal or glass, reducing shipping costs and making them easier to handle. The production processes for plastic closures are generally more economical, allowing manufacturers to produce closures at a lower cost. Plastic closures provide excellent sealing properties, ensuring that beverages remain fresh and safe from contamination. Plastic closures can be designed with tamper-evident features, enhancing product safety and consumer confidence. Many plastic types, such as PET, are recyclable, aligning with increasing consumer demand for sustainable packaging solutions. Plastic closures can be effectively used with various types of beverage containers, including bottles and cartons, making them a versatile choice for manufacturers.

- For instance, in August 2024, Origin Materials, chemical and sustainable material manufacturing company, uneviled the introduction of the tethered PET closures. The purpose of the tethered PET cap is to supplement Origin's PET closure, which is said to be the lightest carbonated soft drink (CSD) cap in the world, compatible with the CO1881 neck finish, and the first PET cap made using industrial machinery. According to Origin, any kind of PET plastic, including virgin, recycled, or biobased PET, can be used to make its PET caps.

Water Segment to Show Notable Share in 2024

The water segment accounted for a considerable share of the global beverage closures market in 2024. Increasing health consciousness among consumers has led to a surge in bottled water consumption as a healthier alternative to sugary drinks. Bottled water is perceived as a convenient option for hydration, driving demand for effective closures that ensure freshness and portability. Increased participation in outdoor activities and travel has boosted bottled water sales, leading to higher demand for closures that are easy to use and resealable.

The market has expanded to include flavoured waters, functional waters, and mineral waters, each requiring specialized closures for optimal performance.

- For instance, On March 19, 2024, PepsiCo, beverage brand revealed the introduction of the new sparkling water beverage known as Bubly Burst. The Bubly Burst fruit flavoured water is introduced in six flavours namely Watermelon Lime, Peach Mango and Triple Berry.

Beverage Closures Market Key Players

Latest Announcements by Industry Leaders

- In June 2024, John Bissell, Co-founder and co-CEO of Origin Material company, stated that the company has signed partnership with Bachman Group, active and committed to a sustainable development solutions providing company, who will assist in the end-to-end operation and automation of PET cap mass production lines. Bachman Group is going to assist the Origin Material company in manufacturing billions of caps, from pellet or flake to final closures. Both the companies are dedicated to sustainability and anticipate a productive collaboration. John

Bissell, Co-founder and co-CEO of Origin Material company also announced that "The Bachmann Group, a Swiss conglomerate that has been in business for more than 50 years, has extensive experience in quality control, shipping, and packaging manufacturing, including high-volume, complex goods like coffee capsules that need to be manufactured with extreme precision. Some of the top food, beverage, and healthcare organizations in the world rely on them for cutting-edge technology services.

Furthermore, the Bachmann Group and Origin Material company will run the lines to turn virgin and recycled PET into caps, including tethered caps, employing automation and high-speed machinery in Bachmann's current top-notch European production facilities. Origin's caps are positioned to be the first PET closures to be widely available on a commercial basis.

New Advancements in Beverage Closures Industry

- In April 2024, Blue Ocean Closures, packaging company, signed partnership with Great Earth, Sweden-based nutritional supplement provider to introduce its fibre-based screw cap, noted to be recyclable in paper waste streams.

- In April 2024, SnapSlide, industry-leading solutions providing company, uneviled the introduction of the no-torque caps, estimated to benefit adult consumers with physical disabilities.

- In April 2024, Berry Global, packaging solutions providing company revealed the introduction of the Slimline closures for use in pharmaceutical and personal care applications. These closures feature an active hinge for effortless opening, a comfortable finger recess, and a wide opening angle.

- In October 2024, Domino Printing Sciences (Domino), printing solutions providing company revealed the introduction of a new range of high-speed product handling and printing solutions engineered to reinforce the beverage manufacturers’ get away from labels on bottles for legislative and environmental reasons. Domino Printing Sciences company’s range of Bottle Closure Printing Stations has been engineered to print machine-readable codes and variable data, consisting QR codes, onto HDPE (High Density Polyethylene) bottle caps and closures.

Beverage Closures Market Segments

By Type

- Plastic Beverage Closures

- Metal Beverage Closures

By Application

- Water

- Carbonated Soft Drinks

- Juice

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait