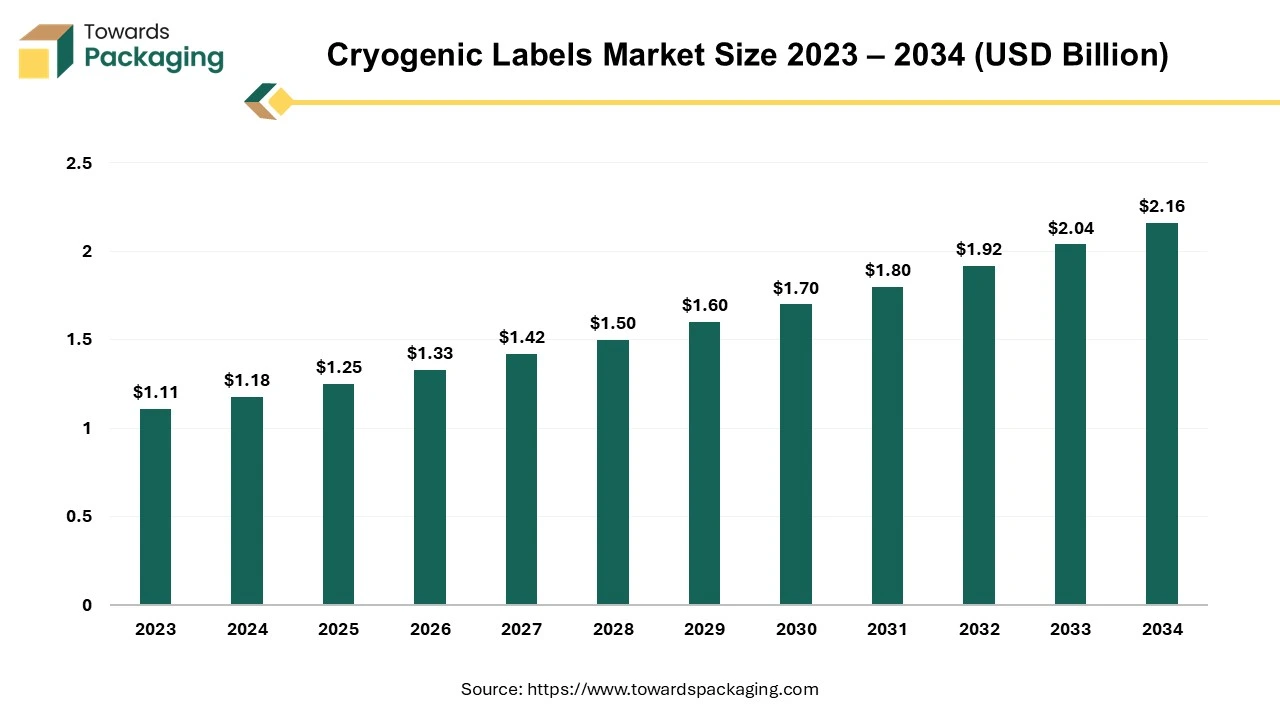

The cryogenic labels market is forecast to grow from USD 1.33 billion in 2026 to USD 2.30 billion by 2035, registering a CAGR of 6.25% during 2026–2035, with detailed analysis covering segment-wise demand, regional performance across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, along with company benchmarking, trade data, and end-to-end value chain mapping.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing cryogenic labels which is estimated to drive the global cryogenic labels market over the forecast period.

Cryogenic labels are specialized labels designed to withstand extremely low temperatures, often as low as -196°C (-321°F), such as those encountered in cryogenic environments like liquid nitrogen storage. These labels are used to identify and track samples, vials, tubes, cryo boxes, or other containers stored in cryogenic conditions without losing adhesion, legibility, or durability. The key characteristics of cryogenic labels are chemical resistance, temperature resistance, compatibility, durability, printable, and writable.

The cryogenic labels can endure exposure to chemicals like ethanol, DMSO, and other solvents commonly used in laboratories. Cryogenic labels resistant to moisture, frost, and chemical exposure, ensuring labels don't degrade or fall off in harsh environments. The cryogenic labels are used for biological research, pharmaceuticals, industrial use and medical labelling.

The key players are focused on developing labels with enhanced durability and adhesive properties that can withstand extreme conditions, such as sub-zero temperatures. Innovations include specialized materials like polyester and nylon, and solutions like multi-layer adhesives to ensure reliability.

Manufacturers are exploring eco-friendly materials and affordable options to meet the increasing demand for sustainable solutions in industrial applications.

The integration of artificial intelligence has the potential to significantly enhance the cryogenic labels industry by enhancing accuracy, efficiency, and adaptability across multiple stages of production and application. The integration AI assists in developing smart label designs and customization of cryogenic labels. The artificial intelligence integration can optimize label designs based on specific client needs, ensuring compatibility with various surfaces and extreme temperature conditions. AI algorithms can analyze data on material performance under cryogenic conditions, helping manufacturers select the most durable and cost-effective materials.

The integration of AI enhances the traceability and inventory management. AI can link cryogenic labels with digital twins for real-time monitoring of labeled items, ensuring proper identification and condition tracking throughout their lifecycle. Integrating AI with labeling systems allows automated sample or product identification, reducing errors and enhancing workflow in labs or storage facilities. Smart labels integrated with AI systems can track the storage conditions of vaccines, ensuring their viability upon delivery. AI can enhance the tracking of biological samples stored in cryogenic conditions, ensuring proper chain-of-custody for research or clinical trials.

The expansion of cryogenic storage solutions in industries like biotechnology, healthcare, and food preservation has significantly increased the need for durable and reliable labels that perform in extreme temperatures. These labels ensure traceability and accurate identification of samples or products.

For instance, in August 2024, according to the data published by the Association of Healthcare Providers - India (AHPI), more than half of the world's demand for different vaccinations, 40% of the US market for generic drugs, and 25% of all medications in the UK are supplied by the Indian pharmaceutical industry. There are over 10,500 manufacturing facilities and 3,000 medicinal businesses in the domestic pharmaceutical industry. In the global pharmaceutical industry, India holds a significant place.

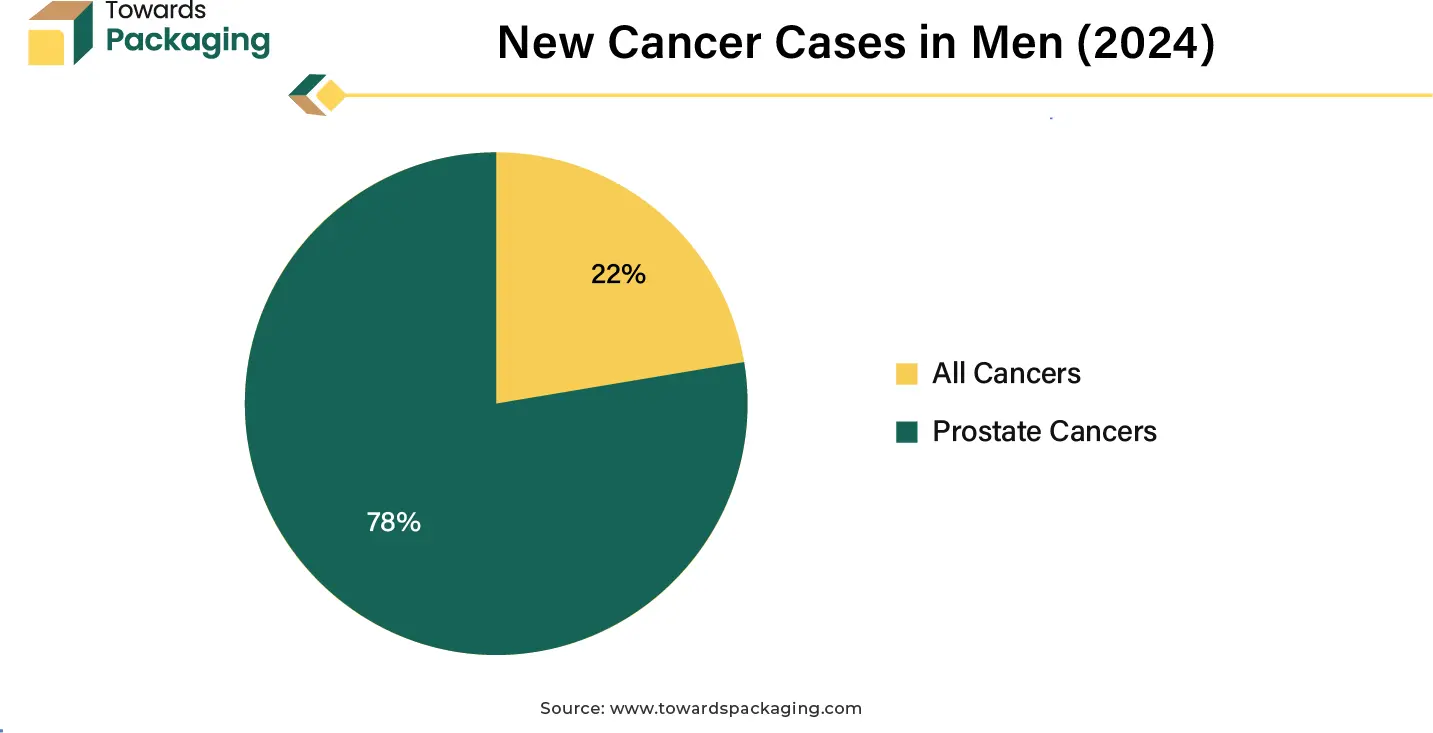

Stored samples are used in studies to understand genetic predispositions and molecular mechanisms of prostate cancer, increasing the demand for robust labeling solutions.

The rise in prostate cancer cases amplifies the demand for cryogenic storage solutions, directly boosting the need for high-performance cryogenic labels. As research, diagnostics, and treatments expand, the industry is likely to experience sustained growth driven by these applications.

The key players operating in the cryogenic labels market face challenges in fulfilling regulatory norms and high investment for developing the compatible material. Strict regulatory requirements, especially in healthcare and pharmaceuticals, can create barriers for manufacturers. Companies need to ensure that their products meet specific standards, increasing the complexity and time-to-market for new products. Labels must be compatible with a variety of surfaces (glass, plastic, metal) and withstand conditions like liquid nitrogen immersion and thawing cycles.

Ensuring universal compatibility is a challenge that can limit market penetration. While there is growing demand for eco-friendly solutions, developing sustainable cryogenic labels without compromising performance remains a challenge. This limits adoption by companies aiming to meet environmental targets.

Rising investments in cryogenics, life sciences, and materials science research are driving demand for specialized labels tailored to emerging applications. This includes smart labels with integrated sensors for temperature and condition monitoring. Due to rise in the rare disease the research and development activities for suitable treatments has increased, which has estimated to drive the growth of the cryogenic labels market.

The World Health Organization estimates that between 5,000 and 8,000 of these rare diseases would affect between 27 million and 36 million people in 2023, or 6% to 8% of Europe's total population. The majority of people suffer from rare diseases that impact less than 1 in 100,000 people. Rare illnesses affect three to four percent of newborns and are 80% genetic in origin.

Both degenerative and proliferative mechanisms can result in rare diseases. Some rare diseases may present with symptoms at birth or in childhood, including cystic fibrosis, patent ductus arteriosus (PDA), spinal muscular atrophy, lysosome storage abnormalities, and familial adenomatous polyposis (FAP). Most rare diseases, such as acute myeloid leukemia and renal cell carcinoma, appear in adulthood.

The permanent segment held a dominant presence in the cryogenic labels market in 2024. Permanent adhesive is widely used for manufacturing cryogenic labels because it offers strong and reliable bonding under extreme conditions, including the low temperatures encountered in cryogenic storage. Permanent adhesives are formulated to withstand ultra-low temperatures (as low as -196°C in liquid nitrogen environments) without losing their bonding strength.

This ensures the label remains securely attached. Permanent adhesive is ideal for cryogenic labels due to its ability to maintain a strong, reliable bond under extreme conditions, ensuring durability, legibility, and compliance in critical storage environments.

The polyester segment accounted for a significant share of the market in 2024. Polyester is more widely used than nylon for cryogenic labels due to its superior performance in ultra-low-temperature environments and its cost-effectiveness. Polyester is the most commonly used material for cryogenic labels because it offers a better balance of performance, durability, and cost.

The polyester material is widely used because of its excellent temperature resistance, withstanding extreme cold conditions (as low as -196°C). Superior dimensional stability, ensuring the label does not shrink or warp over time. The polyester material has high resistance to chemicals, abrasion and moisture.

The pharmaceutical & healthcare segment dominated the cryogenic labels market globally. Cryogenic labels are extensively utilized in the pharmaceutical and healthcare sectors because these industries often require the storage and identification of materials under extremely low temperatures. Cryogenic labels are designed to withstand ultra-low temperatures (as low as -196°C in liquid nitrogen storage) without losing adhesion or print quality. This is essential for preserving and identifying samples like biological materials, medications, and vaccines stored in cryogenic environments.

Accurate labeling is crucial in pharmaceuticals and healthcare to ensure compliance with regulatory standards like ISO, GMP, and FDA. Cryogenic labels offer durable, clear, and legible information, enabling reliable traceability of samples, drugs, and clinical trial materials.

The cryogenic labels are widely used for identifying frozen vaccines (e.g., mRNA vaccines requiring storage at ultra-low temperatures). Cryogenic labels are essential in diagnostics and clinical research to label patient samples, ensuring proper tracking and processing. Vital in organ and tissue storage for transplantation, as well as in cryopreservation of stem cells and reproductive materials.

Cryogenic labels are indispensable in the pharmaceutical and healthcare sectors for making sample integrity, compliance, and traceability in environments where standard labels would fail. Their reliability and durability in extreme conditions make them a cornerstone of these industries.

North America region dominated the global cryogenic labels market in 2024. North America, particularly the United States, is home to some of the largest pharmaceutical and biotech companies in the world. These companies require cryogenic labels for the storage and tracking of biological samples, vaccines, and experimental drugs under ultra-low temperatures.

North America has a well-established R&D ecosystem, with significant investments in clinical trials, genetic research, and personalized medicine. Cryogenic labels are essential for managing samples and ensuring traceability in these cutting-edge fields.

North American companies lead in developing innovative cryogenic labeling materials and printing technologies, providing high-quality and customized solutions for diverse needs. Advanced label designs, such as those resistant to liquid nitrogen and harsh chemicals, are more prevalent in this region.

North America’s leadership in the cryogenic labels market stems from its advanced pharmaceutical and healthcare infrastructure, focus on research, and strong market players. These factors, coupled with high regulatory standards and growing demand for biobanking and cryopreservation, solidify its position as the dominant region in the global cryogenic labels market.

Asia Pacific region is anticipated to grow at the fastest rate in the cryogenic labels market during the forecast period. Due to significant investments made by both public and private enterprises, India's pharmaceutical industry has been growing quickly, particularly since the pandemic. The country's pharmaceutical business is now in a favourable position to accept it because to the sector's modernization. Due to its use in the food and beverage sector, the Indian market is expanding as well. Indian businesses operating in these sectors must meet the needs of one billion customers. Because of the enormous volume of customers, businesses must fortify their cold storage facilities, which necessitates the use of cryogenic labels in significant amounts.

One of the top nations in the world for producing specialty chemicals is China. China produces over 40% of the chemicals used in industry worldwide, which are then sold to other nations. Naturally, this export-focused production leads to a high demand for cold storage solutions, which in turn causes a clamor. China's healthcare system is regarded as one of the most advanced globally. Additionally, it makes use of cryogenic labels to store medications, medical equipment, biomaterials, patient specimens, laboratory samples, and biological samples at extremely low temperatures.

By Adhesive Type

By Material Type

By End User

By Region

January 2026

January 2026

January 2026

January 2026