April 2025

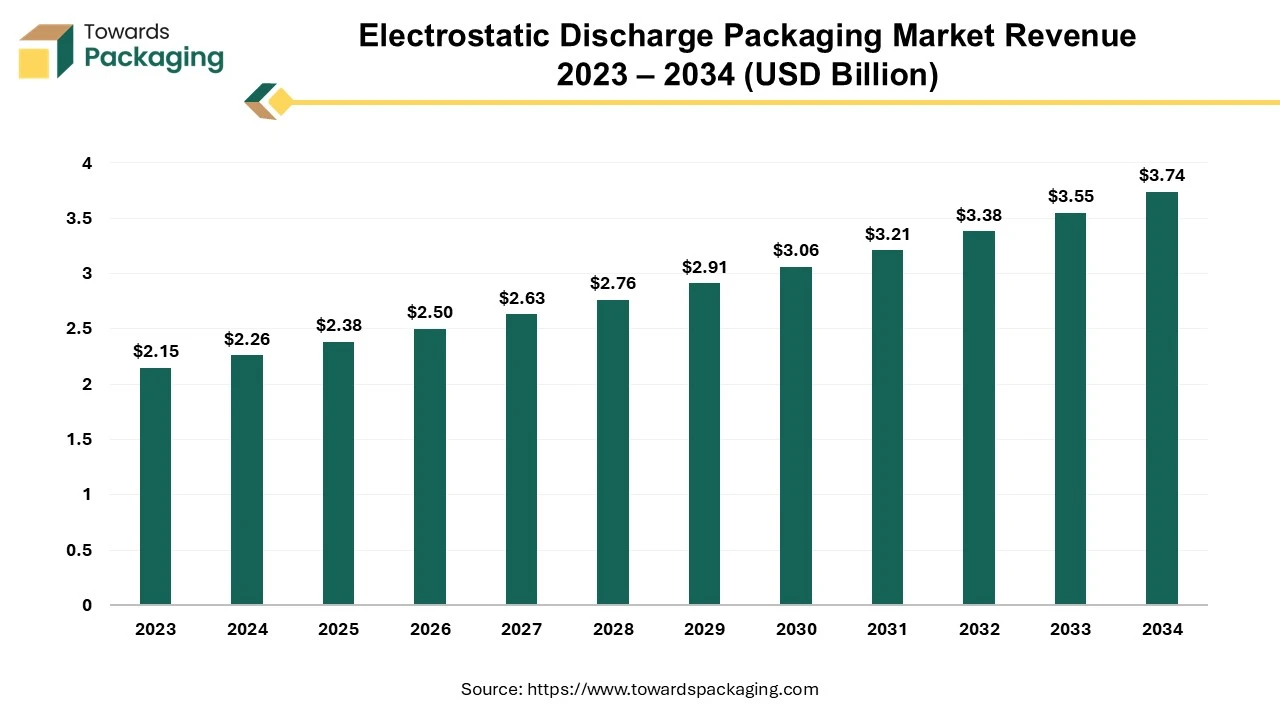

The electrostatic discharge packaging market is predicted to expand from USD 2.38 billion in 2025 to USD 3.74 billion by 2034, growing at a CAGR of 5.15% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing electrostatic discharge packaging which is estimated to drive the global electrostatic discharge packaging market over the forecast period.

Electrostatic Discharge (ESD) is known as the sudden flow of electricity between two objects at different electrical potentials, typically caused by direct contact or close proximity. Electrostatic discharge can be a major concern in industries that handle sensitive electronic components, as it could cause damage to semiconductors, microchips, and other delicate electronics. Even small amounts of static charge could cause permanent failure, malfunctions, or reduced performance of electronic devices. As a result, ESD packaging plays a critical role in protecting these components during their handling, storage, and transportation.

Electrostatic discharge packaging is basically to materials specifically designed to protect electronic components from electrostatic discharge. The electrostatic discharge packaging solutions are manufactured from materials that either dissipate static charges or shield electronic components from electrostatic buildup, ensuring that sensitive components are not exposed to damaging static electricity. There are several types of electrostatic discharge packaging, including bags, trays, boxes, films, and foams, made from various materials that provide varying degrees of protection depending on the sensitivity of the component being stored or transported.

Due to busy lifestyle and rapid automation in the world the demand for the advanced version electronics items as increased. With the proliferation of electronic gadgets, such as wearables, smartphones, consumer electronics, and laptops, the need for packaging solutions that protect against static discharge has surged. Hence, due to rising demand and launch of new electronic devices the electrostatic discharge packaging market growth has observed to be driven.

The trend towards IoT (Internet of Things) devices, smart home technology, and connected systems has created an increased demand for sensitive components. These systems require robust ESD protection, leading to growth in demand for specialized packaging solutions.

With increasing pressure for sustainable practices, there is a growing demand for recyclable and eco-friendly ESD packaging. Manufacturers are investing in biodegradable or recyclable electrostatic discharge packaging materials to meet environmental concerns and reduce waste.

With the rising integration of electronics in automotive systems, including electric vehicles (EVs), autonomous vehicles, and infotainment systems, the demand for electric discharge packaging is also on the rise. Electronic components utilized in vehicles are highly sensitive to electric discharge packaging, especially as the industry shifts towards more advanced automotive electronics. Increasing launch of the new electric vehicles has increased the demand for the electrostatic discharge packaging, which is estimated to create lucrative opportunity for the growth of the electrostatic discharge packaging market over the forecast period.

For instance, in October 2024, Mahindra&Mahindra Ltd., multinational conglomerate company, uneviled the introduction of the two new electric vehicles (EV) models which are going to be launched for commercialization on November 26, 2024. The advanced Qualcomm electronics used in the new cars will improve the user experience by offering a connected car platform. The Mahindra Group is anticipated to reveal plans for EV charging infrastructure in addition to the vehicle launches.

Furthermore, on October 30, 2024, Toyota Motor Co. and Suzuki Motor Corp. said they would work together to develop a new electric SUV that would be available for purchase in international markets. The two OEMs are working together on electric vehicles for the first time. Toyota will receive the new electric car from Suzuki. However, Suzuki, Toyota, and Daihatsu Motor Co. collaborated to build the EV's platform, leveraging each company's unique capabilities and skills. Beginning in the spring of 2025, the model will be constructed at Suzuki Motor Gujarat's production plant in India.

The key players operating in the electrostatic discharge packaging market are facing issues regarding high cost of advanced electrostatic discharge packaging as well as meeting the regulatory norms. The electrostatic discharge packaging materials, especially high-performance options like anti-static bags, conductive foams, and shields, can be more expensive than traditional packaging materials. For smaller businesses or those with tighter budgets, the upfront costs of ESD packaging might be a barrier, especially when alternatives like standard protective packaging are available at a lower price. The numerous and often region-specific standards and regulations related to ESD protection can make compliance challenging for companies, especially smaller firms.

Asia Pacific region dominated the global electrostatic discharge packaging market in 2024. Asia Pacific region, particularly China and India, has a rapidly growing middle class with rising disposable income. As a result, the demand for personal vehicles is increasing. Consumers in these countries are increasingly able to afford cars, leading to higher vehicle sales in both emerging and developed markets within the region. Many countries in APAC, particularly in Southeast Asia (e.g., Thailand, Vietnam, Indonesia), offer lower labor and production costs compared to Western countries. This makes the region an attractive destination for automotive manufacturers looking to reduce expenses and increase profitability. In turn, this supports a competitive automotive sector.

The automotive industry in Asia Pacific region is increasingly adopting advanced technologies such as autonomous driving, connected cars, and smart manufacturing. For example, South Korea and Japan are leading the way in advanced automotive technology, while China is making strides in artificial intelligence (AI) and autonomous vehicle development. These innovations are shaping the future of the automotive sector and making Asia Pacific region a key player in the global electrostatic discharge packaging market.

North America region is anticipated to grow at the fastest rate in the electrostatic discharge packaging market during the forecast period. As eCommerce continues to expand, particularly in sectors like mobile phones, consumer electronics, wearables, computers, and other tech gadgets, there is a growing volume of electronic products being shipped across North America. Electrostatic discharge packaging plays a crucial role in protecting these sensitive components from electrostatic discharge that can damage or destroy electronics during transit, handling, and storage. As more electronics are sold online, the demand for protective electrostatic discharge packaging solutions will rise.

As eCommerce giants like Amazon, Best Buy, and other online retailers continue to expand their logistics and fulfillment capabilities, more sensitive electronic goods are being transported across large distances. These products are handled multiple times by different entities, increasing the risk of ESD exposure. Consequently, the need for electrostatic discharge-safe packaging, such as anti-static bags, conductive foams, and other protective materials, becomes critical for ensuring product integrity throughout the supply chain.

As companies look to comply with these standards, they will need to invest in specialized electrostatic discharge packaging solutions to ensure that products are properly protected from static discharge during shipping and storage. Beyond consumer electronics, niche markets such as medical devices, high-end audio equipment, and industrial electronics are experiencing growth through eCommerce channels. These products often require specialized, high-performance electrostatic discharge packaging due to their sensitivity and the need for precision. As the market for niche electronics grows, the need for tailored electrostatic discharge packaging solutions will increase, providing further opportunities for the electrostatic discharge packaging market to expand in North America.

The bag segment held a dominant presence in the electrostatic discharge packaging market in 2024. Electrostatic discharge packaging bags are specifically designed to dissipate static charges, preventing them from accumulating and discharging onto sensitive electronics. This protection is crucial because even a small static discharge can damage or destroy electronic components like semiconductors, microchips, and circuit boards. Electrostatic discharge packaging bags can be manufactured from various materials that provide both conductive and dissipative properties, ensuring that the electrostatic charge is safely neutralized.

The electrostatic discharge packaging bags are relatively inexpensive compared to other forms of protective packaging like anti-static boxes or custom molded foams. This cost-effectiveness makes them an attractive choice for manufacturers, distributors, and retailers who need to package large volumes of electronic components without significant increases in packaging costs. Their affordability, combined with high effectiveness, makes them a go-to solution for electrostatic protection. The electrostatic discharge packaging bags are lightweight, flexible, and easy to use. Their soft, flexible material allows them to conform to the shape of the component they are protecting, ensuring a snug fit without the need for additional cushioning. This versatility makes them ideal for packaging electronic components of various sizes and shapes, from small semiconductors to larger circuit boards.

The conductive & dissipative polymers segment accounted for a considerable share of the electrostatic discharge packaging market in 2024. Conductive and dissipative polymers are widely used as additives in electrostatic discharge (ESD) packaging due to their unique properties that provide effective protection for sensitive electronic components. These polymers play a crucial role in controlling static electricity and preventing electrostatic discharge (ESD), which can damage electronic parts during manufacturing, handling, storage, and transportation. These materials have the ability to conduct electricity, allowing them to dissipate static charges quickly and safely. They provide a direct path for the static charge to flow to the ground, preventing it from accumulating on sensitive electronics.

Conductive and dissipative polymers are durable and resistant to wear and tear, making them suitable for long-term use in packaging. Unlike some other materials, these polymers do not degrade quickly over time, ensuring that the packaging maintains its electrostatic discharge protection qualities throughout the supply chain—from manufacturing to shipping to storage. This long-lasting performance reduces the need for frequent replacements of packaging, making them cost-effective for businesses.

Conductive and dissipative polymers are widely used in electrostatic discharge packaging due to their efficiency in controlling static charges, flexibility, cost-effectiveness, compatibility with other materials, and ease of manufacturing. These polymers offer a versatile, customizable, and durable solution for protecting sensitive electronic components from electrostatic discharge damage, making them an essential material in the electronics packaging industry. Their growing use is driven by their ability to balance performance with affordability while meeting the diverse needs of various industries.

Electrical & Electronic component segment accounted for a notable share of the market in 2024. Electronics are highly susceptible to damage from electrostatic discharge. Components like microchips, semiconductors, integrated circuits, transistors, and capacitors are particularly vulnerable to electrostatic discharge packaging, even a small electrostatic charge can cause permanent damage, malfunction, or complete failure of these components.

Electrostatic discharge packaging is a standard requirement for most electronic components, making it a non-negotiable aspect of the industry. Components like microprocessors, memory chips, display panels and semiconductors, require specific packaging to meet industry regulations and ensure that products are not damaged before they are integrated into final electronic products. Advancements in electronics (e.g., flexible electronics, wearable tech, and high-speed computing) have resulted in the development of even more sensitive components. As technologies evolve and newer components with higher performance characteristics are introduced, the need for effective electrostatic discharge packaging protection becomes even more critical.

The electrical & electronics segment dominated the electrostatic discharge packaging market globally. As the electronics sector grows, so does the number of electronic components being produced, including semiconductors, microchips, integrated circuits, and printed circuit boards (PCBs). These components are highly sensitive to electrostatic discharge (ESD), which can cause permanent damage or malfunctions. The expansion in electronics manufacturing results in an increased need for electrostatic discharge (ESD)-safe packaging solutions to protect these components during manufacturing, handling, storage, and transportation.

The consumer electronics sector, which includes smartphones, laptops, wearables, gaming consoles, and home appliances, continues to experience robust growth. In parallel, the Internet of Things (IoT) sector is expanding, with more connected devices requiring electronic components that are highly sensitive to electrostatic discharge (ESD). As these industries expand, more electronic devices are being manufactured, transported, and sold all over the world, creating a greater demand for electrostatic discharge packaging solutions to protect the increasing volume of sensitive components from electrostatic damage during transit, assembly, and storage.

By Product Type

By Material & Additive Type

By Application

By End-User Base

By Region

April 2025

April 2025

April 2025

April 2025