February 2025

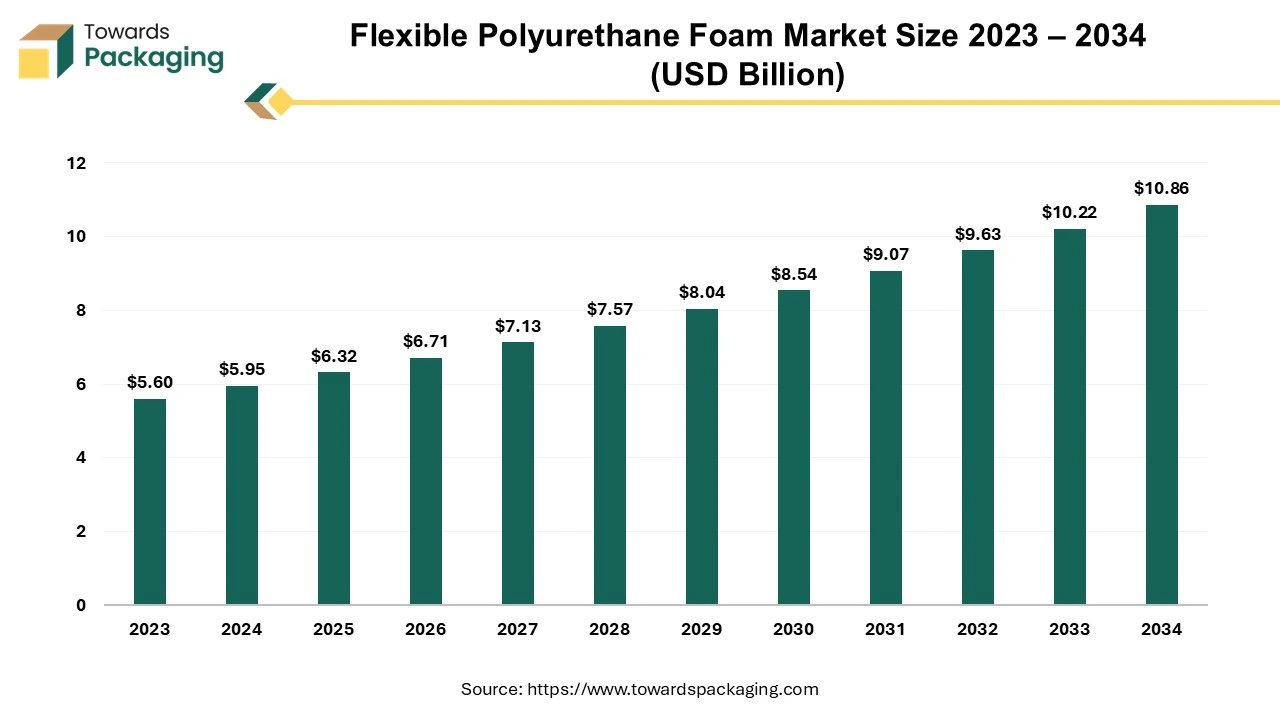

The global flexible polyurethane foam market size reached US$ 5.95 billion in 2024 and is projected to hit around US$ 10.86 billion by 2034, expanding at a CAGR of 6.20% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing flexible polyurethane foam which is estimated to drive the global flexible polyurethane foam market over the forecast period.

Flexible polyurethane foam (FPF) is a lightweight, open-cell type of foam manufactured from polyurethane, a versatile polymer. It is widely used in various applications due to its excellent cushioning, support, and flexibility. The foam is developed by reacting polyols and diisocyanates, which leads to the formation of a cellular structure that can be adjusted to have different densities and properties.

The flexible polyurethane foam (FPF) compress and return to its original shape, making it ideal for cushioning and support. Despite its cushioning properties, FPF is lightweight, which is advantageous for transportation and handling. It has good resilience and retains its shape over time with regular use. The open-cell structure allows air to pass through, providing comfort and ventilation.

The rising focus on lightweight and energy-efficient materials for seating, interiors, and insulation is driving demand for flexible polyurethane foam in vehicle manufacturing, especially in electric vehicles (EVs) and autonomous cars. Urbanization and the push for energy-efficient buildings have increased the use of flexible polyurethane foam for insulation and sealing purposes. The foam flexible polyurethane foam remains a key material for mattresses, cushions, and upholstery due to its comfort, durability, and adaptability.

Rising environmental awareness has led to the development of bio-based and recyclable foams. Companies are focusing on circular economy practices, including recycling foam materials and reducing reliance on fossil fuels.

Advancements in foam formulations, such as nano-engineering and additive manufacturing, have improved the performance and design flexibility of flexible polyurethane foam. These developments cater to specific needs like enhanced thermal insulation, soundproofing, and durability.

AI integration can significantly enhance various aspects of the flexible polyurethane foam (FPF) industry, from production efficiency to product innovation and sustainability. The integration of artificial intelligence can analyze historical production data to predict issues like defects or equipment failures, allowing proactive maintenance and minimizing downtime..

AI systems can monitor production parameters (temperature, pressure, chemical ratios) in real-time, ensuring consistent foam quality and minimizing waste. Automated adjustments in reaction times and curing processes based on AI-driven insights can improve efficiency and reduce human error. The AI-powered vision systems can detect inconsistencies, surface defects, or air pockets in foam products faster and more accurately than manual inspection. Machine learning models can help maintain uniform quality across different production batches.

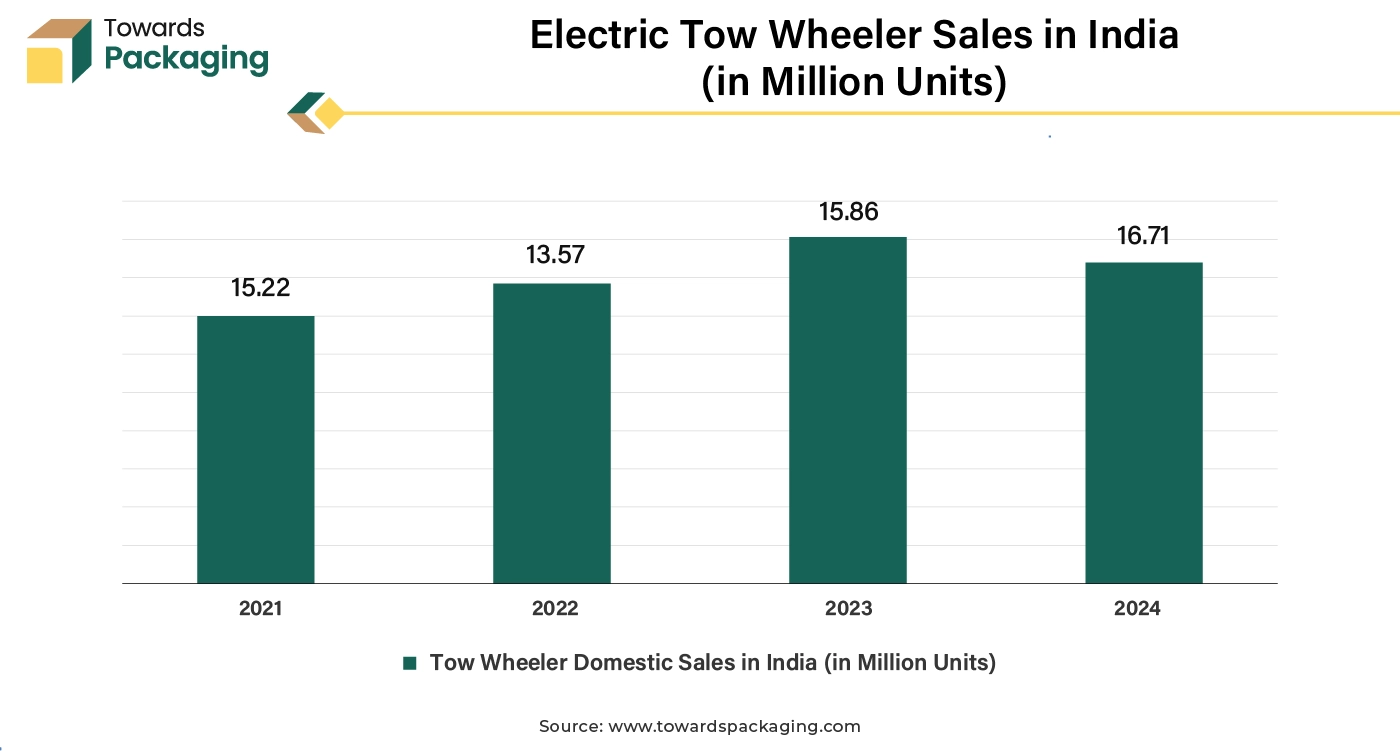

The automotive sector relies on flexible polyurethane foam for seating, insulation, and soundproofing. The shift toward lightweight materials to improve fuel efficiency and electric vehicle development further fuels demand. Increasing launch and sales of the electric vehicle and expanding automotive industry drives the growth of the flexible polyurethane foam market over the forecast period. In electric vehicles (EVs), flexible polyurethane foam is used for thermal insulation to maintain battery efficiency and passenger comfort. Since EVs require lighter materials to offset the battery weight, the adoption of flexible polyurethane foam is rising in electric vehicle production.

According to data published by the Electric Vehicle Association (EVA), Global sales of electric vehicles are expected to reach an astounding US$786.2 billion in 2024.By 2029, this expansion is expected to reach a market size of US$ 1,084.0 billion. Furthermore, it is projected that the market for electric vehicles will reach 18.84 million units sold by 2029. The volume weighted average price of the electric vehicle market is expected to reach US$ 57.5k in 2024, according to market analysis. From a global standpoint, it is clear that China will produce the most income, with an anticipated US$ 376,400 million in 2024.

The key players operating in the market are facing issue from competition from alternative materials and economics conditions, which has been observed to restrict the growth of the flexible polyurethane foam market. The production and disposal of polyurethane foam can release volatile organic compounds (VOCs) and greenhouse gases, leading to stricter environmental regulations. Flexible polyurethane foam is not easily biodegradable, contributing to waste management challenges. Bans or restrictions on certain chemicals, like diisocyanates (a key raw material), can limit production.

Flexible polyurethane foam is derived from petrochemical-based raw materials such as polyols and isocyanates, which are subject to price fluctuations due to changes in crude oil prices. Supply chain disruptions can lead to shortages or increased costs of raw materials. Increased availability of alternative materials, such as memory foams, natural fibers, or recycled plastics, can challenge the demand for traditional polyurethane foam. Customers may prefer eco-friendly or biodegradable alternatives as environmental awareness grows.

Rising consumer and regulatory pressure for sustainability is leading to the development of bio-based polyurethane foams made from renewable sources like soy or castor oil. Advancements in foam recycling technologies can attract environmentally conscious buyers and contribute to a circular economy.

The rapid pace of urbanization in developing countries is driving demand for housing, furniture, and automotive products, which rely on flexible polyurethane foam. Increasing middle-class populations with higher disposable incomes in countries like China, India, and Brazil are boosting demand for high-quality furniture, bedding, and consumer goods.

The automotive segment held a dominant presence in the flexible polyurethane foam market in 2024.

The automotive industry's rising demand for flexible polyurethane foam (FPUF) is driven by its versatile properties and increasing focus on safety, sustainability and comfort. Flexible polyurethane foam is lightweight, helping manufacturers minimize the overall weight of vehicles, which improves fuel efficiency and reduces emissions.

Governments worldwide are enforcing stricter regulations to lower carbon emissions, and lightweight materials like flexible polyurethane foam play a critical role in achieving these goals. Flexible polyurethane foam can be easily molded into various shapes, allowing manufacturers to create customized interiors that improve both functionality and aesthetics. Its versatility supports a wide range of automotive applications, including car roofs, dashboards, door panels, and carpet underlays.

Flexible polyurethane foam is commonly seen in car seats because it absorbs vibration and offers riders more comfort and support. This foam's low weight also aids in lowering a car's total weight, which improves fuel efficiency. Additionally, because flexible PU foam is lightweight and can take on intricate shapes, it is used in automobile interior trim applications such as headliners, door panels, and instrument panels.

The aviation segment is expected to grow at the fastest rate in the flexible polyurethane foam market during the forecast period of 2024 to 2034. The demand for flexible polyurethane foam is increasing in the aviation sector due to its unique properties that align with the industry's priorities of comfort, safety, efficiency, and sustainability. Flexible polyurethane foam is lightweight, making it ideal for reducing the overall weight of aircraft. Lighter materials contribute to improved fuel efficiency and lower operational costs. This aligns with the aviation industry's focus on reducing fuel consumption and carbon emissions.

Flexible polyurethane foam offers excellent cushioning and support, making it a preferred material for aircraft seats, armrests, and headrests. Its sound-absorbing properties help minimize cabin noise, enhancing the passenger experience. Modern flexible polyurethane foam formulations meet stringent fire safety regulations in aviation, ensuring passenger and crew safety.

Flexible polyurethane foam is utilized for thermal insulation in aircraft cabins, assisting to maintain comfortable temperatures at high altitudes. Its acoustic insulation properties minimize engine and external noise, contributing to quieter cabins.

Asia Pacific region held a significant share of the flexible polyurethane foam market in 2024. Countries like India, South Korea, China, and Southeast Asian nations have experienced significant industrial growth, boosting demand for materials like flexible polyurethane foam. The region's economic expansion fuels the growth of industries such as automotive, furniture, bedding, and packaging, which are major consumers of flexible polyurethane foam. Rapid urbanization and infrastructure development have led to increased demand for flexible polyurethane foam in insulation, cushioning, and other applications in residential and commercial construction.

Government initiatives promoting affordable housing and green buildings further drive demand. Asia-Pacific is a leading hub for automotive manufacturing, particularly in China, Japan, South Korea, and India. Flexible Polyurethane Foam is extensively utilized in car seats, headrests, and interiors due to its lightweight, durable, and comfortable properties.

North America region is anticipated to grow at the fastest rate in the flexible polyurethane foam market during the forecast period. Energy efficiency has become a priority in construction, particularly with growing awareness of environmental impact. Flexible polyurethane foam is extensively utilised in both residential and commercial buildings for thermal insulation and soundproofing. Its ability to provide effective insulation and reduce energy consumption has made it a key material in modern construction practices.

There is an increasing demand for comfortable living spaces in North America. Flexible polyurethane foam is extensively utilized in mattresses, upholstery, and furniture and within both residential and commercial properties, contributing to its growth.

New construction techniques and advanced building designs are incorporating more efficient materials. FPUF’s ability to be molded into different shapes and densities makes it adaptable for various construction applications, from insulation to soundproofing. the booming construction industry in North America supports the growth of the flexible polyurethane foam industry by driving demand for energy-efficient, durable, and high-performance building materials that are ideal for insulation, soundproofing, and comfort-related applications.

At PU China 2024 in Shanghai, July 17–19, 2024 Evonik presented its newest additives and a broad range of cutting-edge technology for the polyurethane (PU) sector. Evonik, a prominent industry partner with decades of experience, provides a wide range of additives, including release agents, surfactants, catalysts, curatives, and performance additives. At the event, Evonik introduced its new Low Carbon Footprint (LCF) grades, which are intended to drastically lower the carbon footprint of formulations. Evonik is dedicated to helping its clients and partners better satisfy the changing needs of the market by spearheading the transition to next-generation goods and technologies based on renewable raw resources.

By Application

By Regional

February 2025

February 2025

March 2025

February 2025