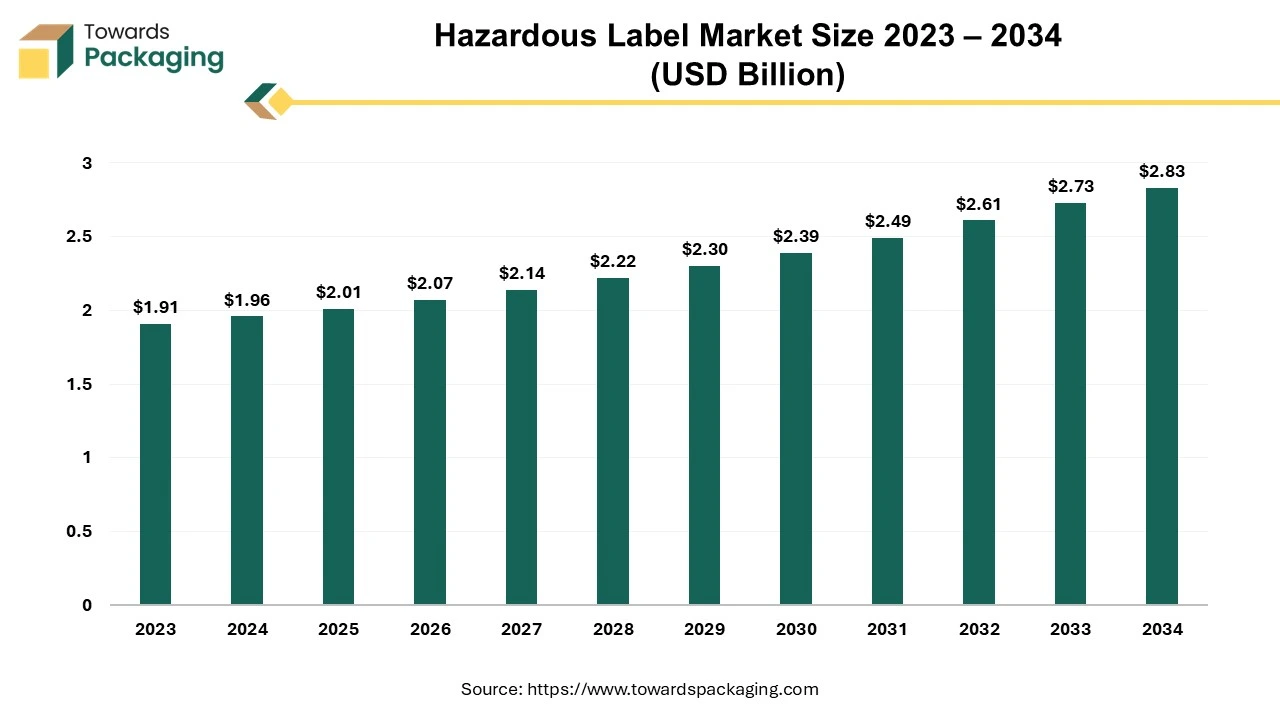

The hazardous label market is projected to reach USD 2.83 billion by 2034, expanding from USD 2.01 billion in 2025, at an annual growth rate of 3.77% during the forecast period from 2025 to 2034.

The industry for hazardous label is set to achieve substantial development in the years to come. Standard hazard identifiers known as "hazard class labels" are created to comply with rules and regulations. There are specific labels for each sort of hazard. In addition to guaranteeing compliant packaging and safe transit during the whole journey, this assists shippers and receivers in identifying the risks involved. Selecting the appropriate labels for the shipments is the responsibility of the shippers.

Inaccurate material labeling can lead to expensive transportation delays, penalties and accidents. Regardless of language, these labels convey information about a chemical's potential risk inside a packaging on a global scale. Labels are required by law to be prominently displayed on the external surface of the package and to remain there during transportation.

The surge in global trade and industrialization along with the growing stringent regulatory frameworks such as those mandated by GHS, OSHA and regional transportation authorities are expected to augment the growth of the hazardous label market during the forecast period. Furthermore, the rising awareness about the workplace safety and environmental impact of the hazardous substances are also anticipated to augment the growth of the market.

Additionally, the technological advancements such as RFID and QR code integration to improve traceability and operational efficiency coupled with the trend towards eco-friendly and sustainable label materials as well as the expansion of chemical and logistics sectors are also projected to contribute to the growth of the market in the near future.

The stringent safety regulations across the globe are anticipated to augment the growth of the hazardous label market during the forecast period. Regulatory frameworks such as the Globally Harmonized System of Classification and Labeling of Chemicals (GHS), Occupational Safety and Health Administration (OSHA) standards, and Department of Transportation (DOT) guidelines mandate the utilization of the clear and compliant labels for the hazardous materials. These regulations aim to protect workers, consumers as well as the environment by guaranteeing accurate communication of potential risks that are associated with the hazardous substances. Furthermore, there is an increasing focus on improving these regulations and standards aimed at additional safety. For instance:

These regulatory updates illustrate the global push toward harmonized, detailed and transparent hazard communication standards. They compel businesses to adopt advanced and compliant hazardous labeling solutions, fueling the market growth while guaranteeing safety and regulatory adherence in an increasingly interconnected global economy.

The lack of awareness about regulatory mandates and the importance of proper hazardous labeling are expected to hamper the market growth within the estimated timeframe. Many businesses in the emerging markets, predominantly small and medium-sized enterprises, operate with limited understanding of the global standards or local safety regulations. This most of the times leads to non-compliance, improper labeling practices as well as potential safety risks during the handling, storage and transportation of the hazardous materials.

Also, limited regulatory implementation in some of the countries worsens the problem, as companies may not feel constrained to adopt proper labeling practices without clear penalties or inspections. This not only compromises worker and environmental safety but also restricts the market penetration for compliant labeling options.

Furthermore, frequent regulatory changes also presents challenge for the market. Global frameworks are periodically revised and regional standards often follow them, requiring organizations to adapt quickly to the new rules. For instance, updates in the hazard classification criteria and labeling formats need redesigning of the existing labels, reconfiguring printing processes and retraining the workers.

These adjustments demand time, effort as well as financial investment, mainly for companies that are operating across multiple regions with varying regulatory timelines and requirements. Such frequent changes increase operational complexity. SMEs may face unique obstacles when implementing the GHS since they lack the resources necessary to switch to a new system. However, it is anticipated that the GHS will eventually provide a cost-effective method of communicating hazards.

The rising production across industries such as chemicals, oil & gas, logistics and manufacturing is anticipated to create immense growth opportunities for the market in the years to come. In the oil & gas sector, higher production volumes due to the advancements in the exploration technologies and global energy demand are likely to increase the need for labels that are durable and compliant with the standards. As per the U.S. Energy Information Administration, since 2010, the U.S. crude oil output has soared to all-time highs and in recent months, it has increased even faster.

The efficiency of the new wells has allowed these record peaks to occur in spite of a decline in U.S. drilling activity. In December 2023, the average daily production of the crude oil in the United States was 13.3 million barrels (b/d). U.S. crude oil output has increased by an additional 2% since initially breaking the prior record in August 2023, surpassing the pre-pandemic peak of 0.3 million barrels per day in November 2019.

Similarly, the chemical industry relies on proper labeling to communicate the relevant hazards effectively. According to the American Chemistry Council, in 2024, it is anticipated that chemical output would increase by 3.4% worldwide, with increases in all of the major regions. The economies of the former Soviet Union, Asia/Pacific and Europe will see the biggest improvements. This growth is expected to continue even in 2025 and the volumes are likely to increase by 3.5% globally. As production scales up globally, the hazardous label market stands to benefit significantly, with a growing need for accurate, durable and regulation-compliant solutions across diverse industries.

The plastic segment held largest market share of 61.64% in 2024. This is owing to its durability, versatility and suitability for a wide range of hazardous products. Plastics are highly resistant to chemicals, moisture and extreme environmental conditions, making them ideal for industries that require long-lasting and reliable labels.

These factors makes plastic as an ideal choice of material for label manufacturers and are expected to contribute to the segmental growth of the market. Furthermore, the rising global demand for cost-effective labeling options is also likely to support the growth of the segment in the global market. Additionally, its compatibility with advanced printing technologies such as thermal transfer and inkjet printing is further expected to fuel the segmental growth of the market within the estimated timeframe.

The manufacturing segment held largest market share of 60.25% in 2024. This is due to the increasing demand across diverse industries such as chemicals, petrochemicals, and oil & gas. In manufacturing operations, hazardous labels help in guaranteeing safety, regulatory compliance and efficient handling of materials. Industries such as chemicals rely on precise labeling for hazardous substances like flammable liquids, toxic chemicals, and corrosive materials, following the frameworks such as GHS and OSHA’s Hazard Communication Standard.

Furthermore, the rapid growth of industrialization mostly in the emerging economies has further fueled the demand for hazardous labels in manufacturing facilities. Additionally, the increasing global focus on the employee health and safety is also expected to contribute to the segmental growth of the market.

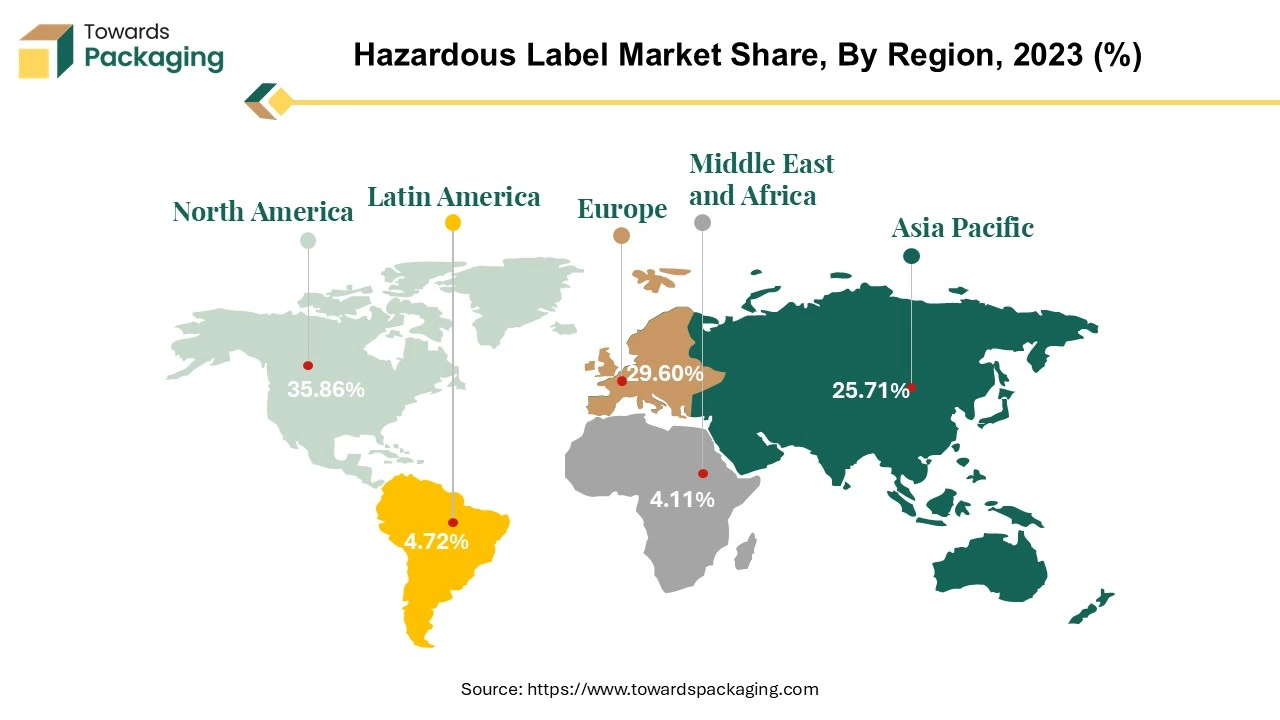

Asia Pacific is likely to grow at fastest CAGR of 5.94% during the forecast period. This is due to the increasing investments across various industrial sectors and growing industrial base in countries like China, India, and Southeast Asia. Also, the surge in the production and consumption of the chemicals is likely to contribute to the regional growth of the market. China dominates the global chemical sales with over 40% market share and leads in innovation with sales of USD 2488.47 billion in 2022, as per the European Chemical Industry Council.

Also, as per the India Brand Equity Foundation, by 2030, the chemical industry in India is expected to reach US$300 billion, and by 2040, it will reach US$1 trillion. By 2025, it is anticipated that the market for the chemicals would increase by 9% annually. Furthermore, the increase in the export activities involving hazardous goods is also expected to contribute to the regional growth of the market.

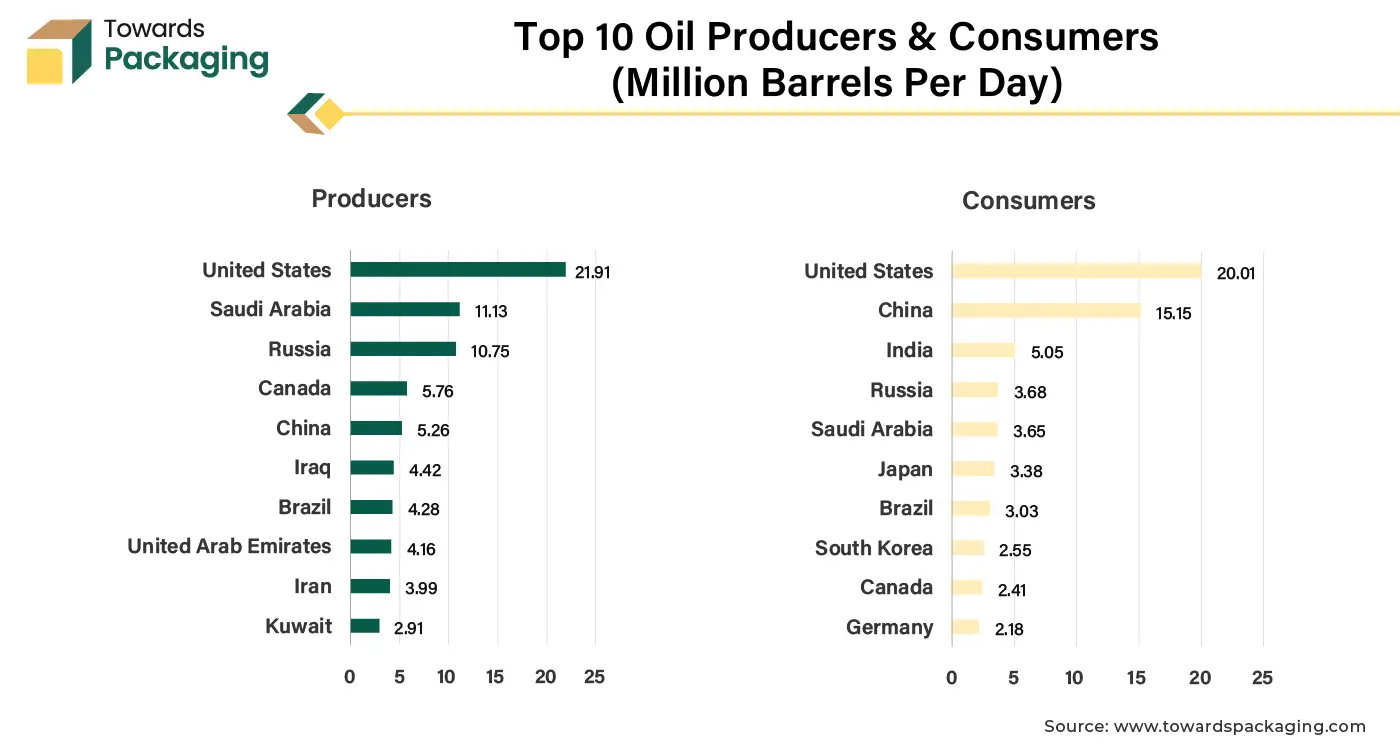

North America held largest market share of 35.86% in 2024. This is owing to the presence of stringent safety regulations along with the growing production of chemicals and oil & gas in the US and Canada. According to the U.S. Energy Information Administration, the United States produces 21.91 million barrels/day of oil which is 22% of the world total and Canada produces 5.76 million barrels/day of oil.

At the same time, the consumption of oil in the United States is 20.01 million barrels/day and Canada’s consumption is 2.41 million barrels/day. Furthermore, the growing focus on improving workplace safety and reducing chemical-related hazards as well as the early adoption of the advanced printing technologies is also expected to contribute to the regional growth of the market in the near future.

By Material

By Printing Technology

By End-Use

By Region

December 2025

December 2025

December 2025

December 2025