April 2025

The global IBC tanks market is expected to increase from USD 17.07 billion in 2025 to USD 27.21 billion by 2034, growing at a CAGR of 5.32% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The IBC tanks market is experiencing steady growth within the estimated timeframe. IBC tanks, also known as intermediate bulk containers, are used by many different types of organizations for transporting a variety of commodities. Bulk items, mainly liquids and occasionally dangerous compounds, are frequently transported using these containers. IBC tanks must therefore be manufactured to precisely satisfy the needs of customers. IBCs are extensively utilized in many different sectors and applications due to their dependable design, strength, as well as adaptability. IBCs are utilized in practically every industry, namely the food sector, industrial manufacturing, and environmental protection. The chemicals sector, the food industry, and the pharmaceutical sector are the biggest industries that use IBCs.

The rising demand for efficient and cost-effective bulk packaging solutions across industries such as chemicals, pharmaceuticals, food & beverages and agriculture is expected to augment the growth of the IBC tanks market during the forecast period. Furthermore, the increasing focus on sustainable and reusable packaging along with the rapid industrialization and globalization with the increase in international trade are also anticipated to augment the growth of the market. Additionally, the government regulations and safety standards for the storage and transportation of hazardous materials as well as the expansion of the e-commerce and logistics sectors coupled with the rising automation and smart packaging innovations such as RFID tracking and IoT integration in IBCs is also projected to contribute to the growth of the market in the near future.

| Metric | Details |

| Market Size in 2024 | USD 16.41 Billion |

| Projected Market Size in 2034 | USD 27.21 Billion |

| CAGR (2025 - 2034) | 5.32% |

| Leading Region | North America |

| Market Segmentation | By Product, By Material, By Application and By Region |

| Top Key Players | Mauser Packaging Solutions, SCHÜTZ GmbH & Co. KGaA, Berry Global Group Inc., Snyder Industries, Inc. |

The growing demand across multiple industries such as chemicals, pharmaceuticals, food & beverages and agriculture is anticipated to support the growth of the IBC tanks market during the estimated timeframe. The advantages that polypropylene IBC tanks provide for the production of beer, wine, and cider are being recognized by small breweries. This covers the storage and dispensing of granular materials like grains and yeast. Before being canned or bottled, fresh beer and cider are also kept in food-grade tanks to preserve their flavor and freshness. IBCs are made for the safe storage of drinking water, wines, and other alcoholic drinks as well as for their distillation, fermentation, blending, and handling. Since an IBC has built-in forklift channels that enable safe and cautious movement, it is the perfect solution for transportation needs in wineries and distilleries.

Furthermore, IBCs are frequently utilized in the farming and agricultural sectors to store water for use in crop irrigation or as animal drinking water. Beyond just holding water, they are also useful as a bowser to hold red diesel for tractors and other farm equipment, or they can be used to store as well as transport fertilizer, insecticides and herbicides. Additionally, any kind of material that is extremely sensitive to temperatures, air, and other environmental factors can be transported safely in an IBC without corroding. Furthermore, owing to their strength and longevity, IBCs are perfect for usage on building and construction sites. As industries focus on sustainability, operational efficiency as well as regulatory compliance, the demand for high-capacity bulk packaging IBCs is expected to grow further.

The presence of various substitutes such as bottles, jars, drums, barrels, pails and buckets is likely to hamper the growth of the IBC tanks market during the estimated timeframe. Larger sizes of bottles and jars, from a quart to 2.5 gallons, are available. When the container is larger than one gallon, plastic bottles and jugs with built-in handles, like industrial round jugs or f-style jugs, are the most popular choice since the weight of the product makes it harder to manage. Although there are fewer standard packaging forms available for larger containers, organizations can still customize their products to preserve their brand when they decide to sell them in bulk.

Pail and bucket packing is another popular form of bulk packaging. To comply with shipping rules, pails can be recognized with a UN Rating and come in shapes that are optimal for palletizing. To make it easier for consumers to carry an entire container of goods, many pails are made with handles. Like pails, drums are also utilized for packaging a wide range of bulk goods. Drums come in fiber, steel, and plastic. Hazardous materials can be transported in steel and plastic containers. Powder and other dry goods in bulk are the ideal applications for fiber drums. Drums are not frequently utilized to package consumer goods; instead, they are primarily used for moving large quantities of commodities or ingredients. The availability of multiple bulk packaging options creates a competitive landscape, limiting the IBC market penetration.

The steady increase in the global trade and industrialization worldwide attributed to the economic growth and evolving supply chain dynamics is likely to augment the growth of the IBC tanks market in the years to come. According to the World Trade Organization, as the demand for traded commodities recovers, the volume of global trade is predicted to increase by 3.3% in 2025. In the fourth quarter of the year 2023, the merchandise trade volume was still up 19.1% from the average level in 2015 and 6.3% from the pre-pandemic peak in the 3rd quarter of 2019. Also, as per the Observatory of Economic Complexity, the organic chemicals ranked ninth globally in 2023, with an overall trade value of $502 billion, while fertilizers were the 39th most traded product, with a net trade of $103 billion.

Furthermore, the emerging markets in Asia-Pacific, Latin America and Africa are experiencing rapid industrialization, infrastructure development and agricultural production that are further fueling the IBC adoption. For instance, corn production in China has reached a record of 294.9 million tons in 2024 from 288.8 million tons in 2023, up by 8% as compared to2023. Additionally, the growing manufacturing and agricultural exports as well as invests in the efficient supply chains is also likely to increase the need for bulk packaging. With these factors in play, the growing global trade landscape offers immense growth potential for the IBC tanks market, making it an essential component of the modern industrial supply chains.

The rise of artificial intelligence (AI) is expected to reshape the IBC tanks market and drive a new era of efficiency, precision as well as sustainability. No longer just a storage option, IBC tanks are evolving into smart data-driven assets due to the integration of AI automation, predictive analytics and IoT integration. Smart IBCs make traceability and control easy and it is simple to monitor fill levels, temperature and geolocation in real-time. AI-powered automation in IBC manufacturing improving the precision minimizes material wastage and guarantees higher quality control, leading to cost-effective and sustainable production. Machine learning algorithms help manufacturers identify defects in real time, reducing product recalls and improving durability.

The integration of IoT-enabled smart IBCs with AI lets continuous monitoring of liquid levels, pressure, temperature and potential leaks, improving the operational safety and compliance with the stringent industry regulations. Additionally, AI predictive maintenance helps companies to detect the potential failures before they occur. Through analyzing the historical usage data along with the performance patterns, AI systems can suggest proactive maintenance schedules, reducing the downtime as well as the repair costs. AI also supports in sustainability through assisting manufacturers in optimizing the material utilization and developing eco-friendly IBC choices. As digital transformation improves across industries, AI developments are expected to substantially alter the IBC tanks market in the years to come.

The rigid IBCs segment held largest share of 72.64% in the year 2024. The ideal storage choice for bulk hazardous and non-hazardous liquids and powders, rigid IBCs have a capacity of more than 1000 liters. Rigid IBCs provide organizations a safer and more portable storage option due to their rectangular shape and sturdy high-density polyethylene construction. Caged IBCs have a pallet-mounted container that is further protected by a wire cage. These inflexible containers are frequently utilized to hold toxic materials, flammable liquids, caustic materials, as well as other potentially harmful substances. Logistics also benefits from rigid tanks since they improve packing efficiency and make the product more affordable to ship and store. In addition, the utilization of these tanks reduces carbon emissions, which is expected to contribute to the growth of the segment during the forecast period.

The chemical & petroleum segment held largest share of 37.25% in the year 2024. This is due to the increasing global energy demands, industrial expansion along with the advancements in the refining and petrochemical technologies. Furthermore, the expanding petrochemical applications across various sectors as well as the growing demand for plastics, synthetic fibers, fertilizers and pharmaceuticals is also likely to support the growth of the segment in the global market. Additionally, the rising investments in oil exploration and production in the regions like Middle East, the U.S. and Asia coupled with the increasing R&D efforts to develop high-performance eco-friendly chemicals is expected to contribute to the segmental growth of the market during the forecast period.

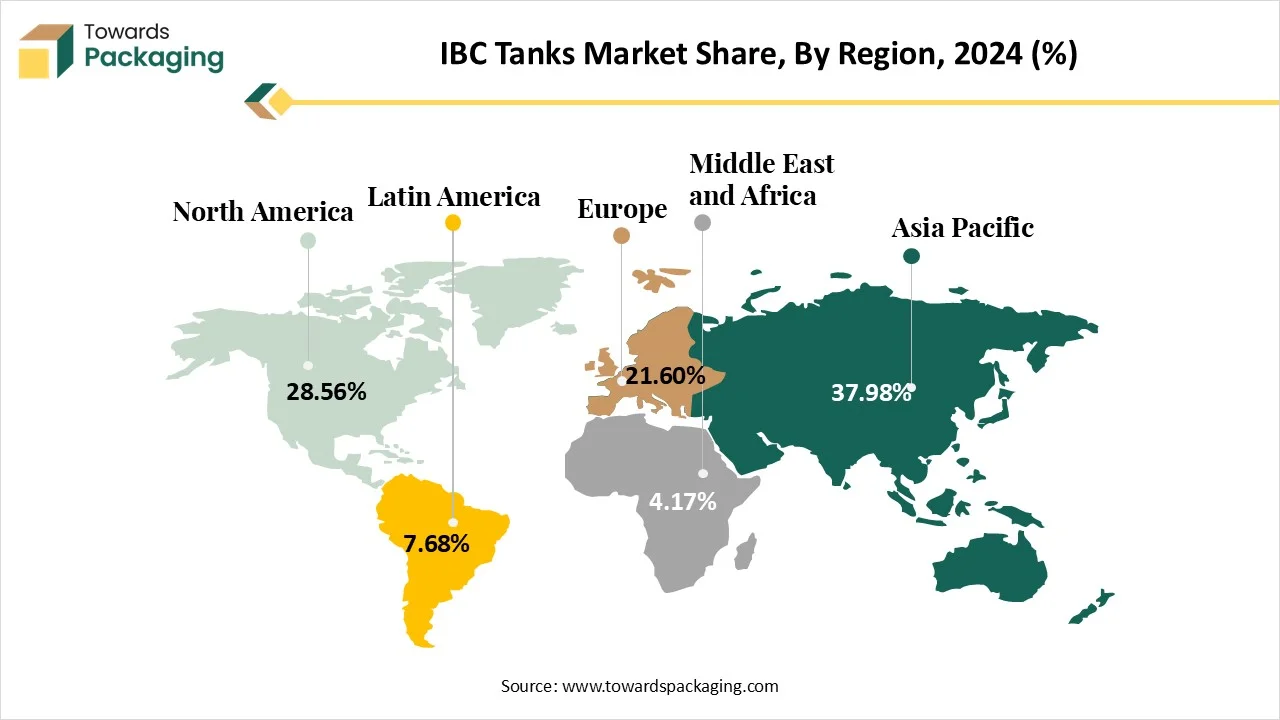

North America held considerable market share of 28.56% in the year 2024. This is due to the well-established chemical and petroleum sector across the region. Also, the ongoing industrial expansion, oil & gas exploration and construction activities are also expected to support the regional growth of the market. For instance, in September 2024, Talos Energy, which has a non-operated share in a block located in the U.S. Gulf of Mexico, the finding of commercial amounts of natural gas and oil. There is a chance that further hydrocarbons will be discovered because the organization is also drilling at another site in the area. Additionally, the presence of the stringent safety and environmental regulations by the U.S. EPA, OSHA, and DOT coupled with the highly developed transportation and logistics sector are also further expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at a considerable CAGR of 7.19% during the forecast period. This is due to the rapid industrialization, growing middle-class population with higher purchasing power in India, China and Southeast Asian countries as well as the economic growth. Additionally, the growing pharmaceutical and biotechnology market along with the rising e-commerce industry, warehousing expansion and third-party logistics (3PL) services are also expected to contribute to the regional growth of the market. According to the National Bureau of Statistics of China, e-commerce transactions totaled USD 6,421.76 billion (46,827.3 billion Yuan) in 2023, a 9.4% increase from the year before. Also, the internet retail sales were USD 2,115.53 billion (15,426.4 billion Yuan), representing an 11.0 percent increase from the year before. Furthermore, the rising urbanization, increasing disposable income, and shifting consumer preferences are likely to contribute to the regional growth of the market.

By Product

By Material

By Application

By Region

April 2025

April 2025

April 2025

April 2025