April 2025

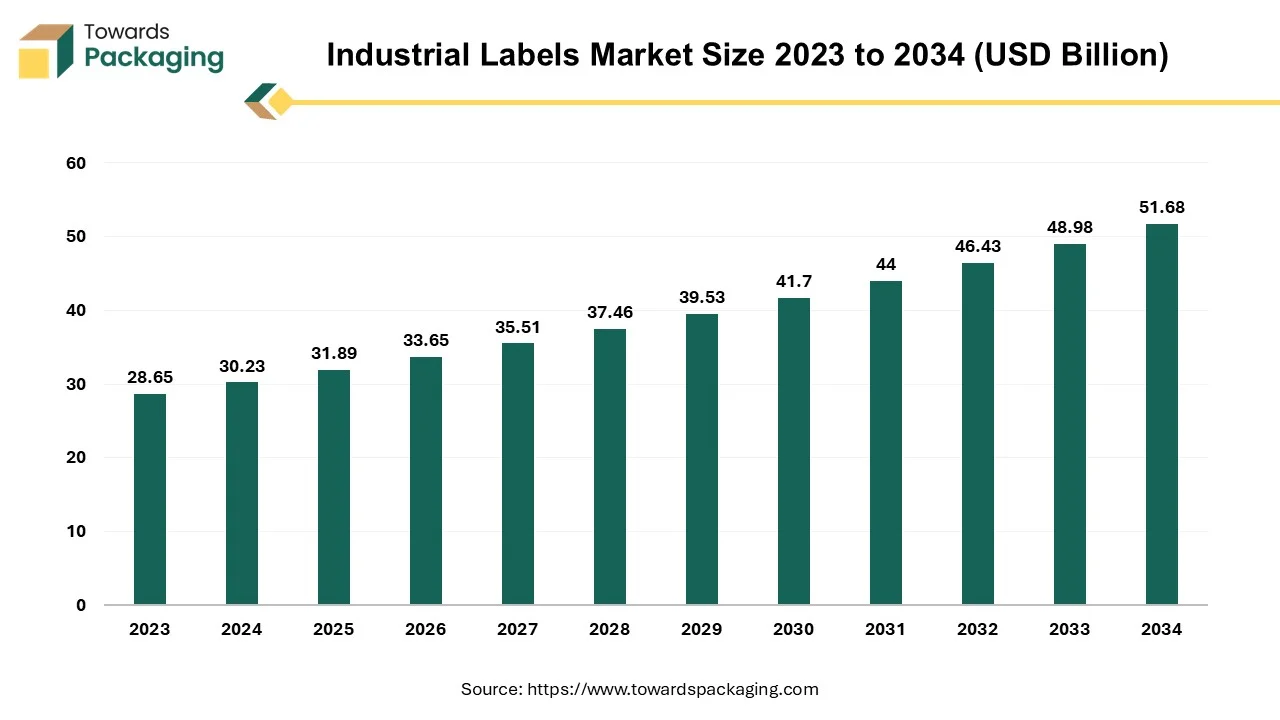

The industrial labels market is set to grow from USD 31.89 billion in 2025 to USD 51.68 billion by 2034, with an expected CAGR of 5.51% over the forecast period from 2025 to 2034.

The industrial labels market is expected to grow at a considerable CAGR during the forecast period. Industrial labels help in asset tracking, product identification processes of all kinds and ensuring that all the safety regulations is followed. Industrial labels are incredibly durable, ultra-solvent and abrasion resistant. They are capable of handling temperatures ranging from -292°F (-180°C) to +730°F (+388°C). They are ideal for use in all applications across the automotive, military, aerospace, and oil and gas industries since they are made to withstand tough industrial conditions.

The increasing production of the consumer durable goods and the growing automotive industry as well as the growing popularity of the online designing tools is anticipated to augment the growth of the market within the estimated timeframe. Furthermore, the emergence of the automated label printing along with the integration with the Internet of Things (IoT) technology is also expected to support the growth of the industrial labels market in the years to come.

The value of labeling in the supply chains and logistics is widely recognized among professionals. Tracking of the components, raw materials and completed goods is necessary for any manufacturing process, storage facility or long-distance transit. When it comes to managing the warehouse operations, effective inventory management is vital. Labeling the containers as well as identifying the labels for the warehouse racks, aisles and the bins can help in keeping the track of all the containers as they proceed through each stage of the procedure by utilization of the warehouse labeling system. In addition to making it easier for the employees to find the products, well-organized systems also produce a trail of logs that make it possible to quickly identify and fix the supply chain errors. As a result, this necessitates the use of labeling solutions in warehousing.

Furthermore, employees can obtain the same warehouse location information that customers receive from the big box store apps by simply incorporating the correct labels into the warehouse inventory management system. This will enable workers to locate the aisle, building and shelving rack that contains the item they're looking for with ease. Labeling warehouses is useful for purposes other than packaging. Labels on floors and racks function exactly like aisle labels at your neighborhood supermarket. Workers can quickly access the product since they can determine exactly where they are.

Also, the push for standardization is closely related to the significance of labeling in the supply chains and logistics. There is no way to create effective terms and conditions for the international retail and shipping if there are dissimilar barcode readers and inconsistent barcode types containing different information. Alternatively, a global standard label type will reduce obstacles and promote higher sales volumes throughout all supply chains and this is anticipated to further augment the demand for industrial labels during the forecast period.

The continuous change in the labeling regulations and standards is expected to hamper the growth of the industrial labels market during the forecast period. Compliance is one of the main issues that organizations have with the global labeling. The huge variations in the labeling for a global supply chain can be challenging to manage and keep up with due to the regularity with which regulations change. Regulatory agencies, industry associations as well as the governing bodies have the authority to introduce and establish the labeling regulations, practices and standards. Organizations must adhere to the most recent labeling compliance standards as standards change in order to prevent the costly violations and barcode problems.

Furthermore, localization, or making labels specific to a particular geographic region and language, is an additional challenge faced by global companies which operate in multiple countries. This challenge also applies to the organizations that want to enter new markets. Goods, ranging from medical devices to food, are frequently sold and transported across borders; as a result, they must adhere to national labeling laws as well as language requirements. Organizations may experience recalls or mistrust of their brand if labels are not properly translated which is likely to reduce the demand for the labels.

One of the most important aspects of keeping an effective supply chain is use of automation in the labeling. Automation technology is evolving continuously that makes it easier to develop safe as well as effective products while also keeping up with the ever-changing standards and the regulations. Furthermore, automation facilitates label compliance, speeds up the production of labels, lowers human error and integrates document and label printing directly.

Automating processes is essential to prevent the product recalls and ensuring the consumer safety across the food and beverage industry, pharmaceutical and medical devices, due to the industry-specific challenges such as lengthy product life cycles and the extensive stock keeping units. Organizations can quickly respond to the changes in the non-compliance by comparing labels for different countries and regions by utilizing artificial intelligence (AI) or machine learning (ML). This technology has become essential for sectors where data as well as the regulations are constantly changing, such as the medical device industry.

Through the prediction of possible issues, the reduction of downtime and the development of the new products, the digital twin concept is also assisting organizations in increasing the productivity. Digital twins are digital representations of processes, people, and objects that are primarily used in the manufacturing and automotive industries. Digital twins promote better business operations, add value, respond to the changes and also help in asset state understanding. Companies will always be aware of what is going on with a particular product since everything that happens to the physical object will essentially appear in the digital model, or twin. Thus, such technological advancements are anticipated to offer growth opportunities for the industrial labeling market in the years to come.

The warning/security labels segment held significant market share of 30.21% in the global industrial labels market. This is attributable to the increasing demand from various industry verticals and growing awareness about the importance of these labels across the globe. To effectively deliver the safety and hazard information, warning labels are essential. They should adhere to the most recent ANSI, UL, OSHA and ISO standards. Maintaining the consistency in the color, design, safety symbol usage as well as the header is essential for the effective conveying of the information. Misleading safety and warning labels have the potential to cause harm or even death in some cases.

Also, strict safety standards and regulations are in place in numerous countries to protect the workers. Safety labels act as the reminder of the necessary safety measures and employers are legally required to provide a safe workplace. Employers may face harsh fines along with the legal repercussions if they violate the safety regulations and this will potentially increase the demand for warning labels.

The food & beverage segment captured considerable market share in 2024. This is owing to the growing need for compliance with the food safety standards along with the increasing consumer awareness and demand for transparency. Food safety is not the sole responsibility of one individual, one regulatory organization, or the food sector. It is a shared duty among consumers, industry, producers and the government. One such legal requirement to guarantee that consumers can understand the food they are consuming is food labeling. Since the label serves as a primary means of communication between the manufacturer and the customer, it must be open, accurate, and clearly state what is included in the package that the customer plans to purchase.

For those who have dietary intolerances or allergies, food labels are very important. If a food allergy sufferer eats something that contains an unreported allergen, they could have major health problems. Cereals containing gluten, milk, crustaceans, fish, eggs, soybeans, peanuts and tree nuts and sulfite have been identified by the FSSAI as eight major allergens that require label disclosure. Also, the food labeling systems are being widely implemented to track the freshness of the products. These smart labels are equipped with the smart sensors that display each item's current temperature and storage compliance.

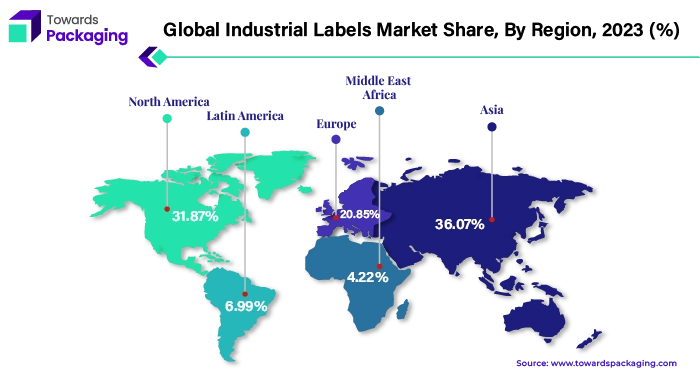

Asia Pacific dominated the market with 36.07% of shares in the global industrial labels market. This is due to the growing e-commerce industry across the region. For instance, according to the data by the India Brand Equity Foundation, by 2030, the Indian e-commerce market is expected to grow significantly and reach a valuation of US$ 300 billion. In e-commerce, label helps the customers in identifying the product and brand. It popularizes the product and brand among the customers thus increasing its demand in the region.

Also, the rapid expansion of the healthcare and pharmaceutical sectors is further expected to drive the demand for the industrial labels in the years to come. The increase in the aging population in the economies such as Japan and China has increased the demand for pharmaceuticals and medical devices, which in turn is anticipated to increase the demand for accurate and compliant labeling in the region.

North America is expected to grow at a considerable CAGR of 5.27% during the forecast period. The increasing stringent regulatory requirements for various industries are projected to contribute to the growth of the market across the region. Furthermore, the early adoption of advanced technologies such as digital printing as well as the integration of smart labels, such as RFID and QR codes, with Internet of Things (IoT) technology is also expected to support the growth of the market in the region.

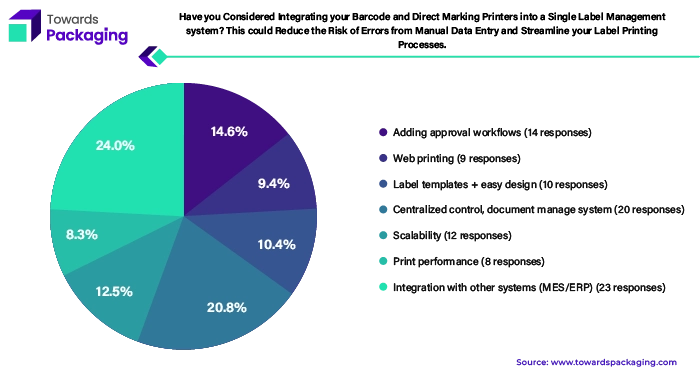

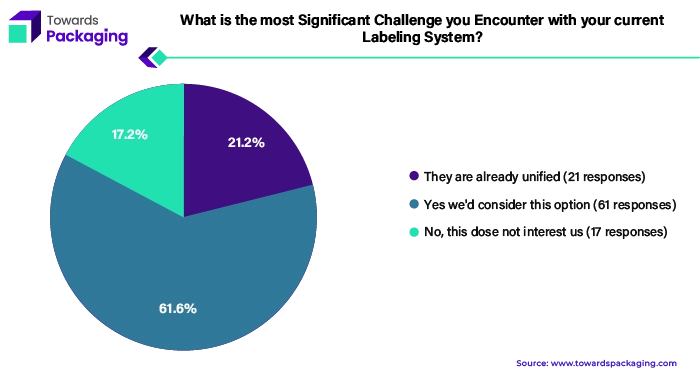

A recent survey by NiceLabel in collaboration with Pharmaceutical Manufacturing reveals the struggles pharmaceutical manufacturers face in ensuring accurate and compliant labeling. The survey, involving a hundred decision makers in pharma and biopharma, highlighted key challenges such as document control, integrating label systems with ERP/MES, web printing, and scalability. These challenges underscore the need for a unified label management system to navigate the complexities of producing labels across multiple products, sites, and markets.

The survey highlighted the critical need for a unified label management platform in the pharmaceutical industry. Key findings include:

By Material

By Type

By Mechanism

By Printing Technology

By End-Use Industry

By Region

April 2025

April 2025

April 2025

April 2025