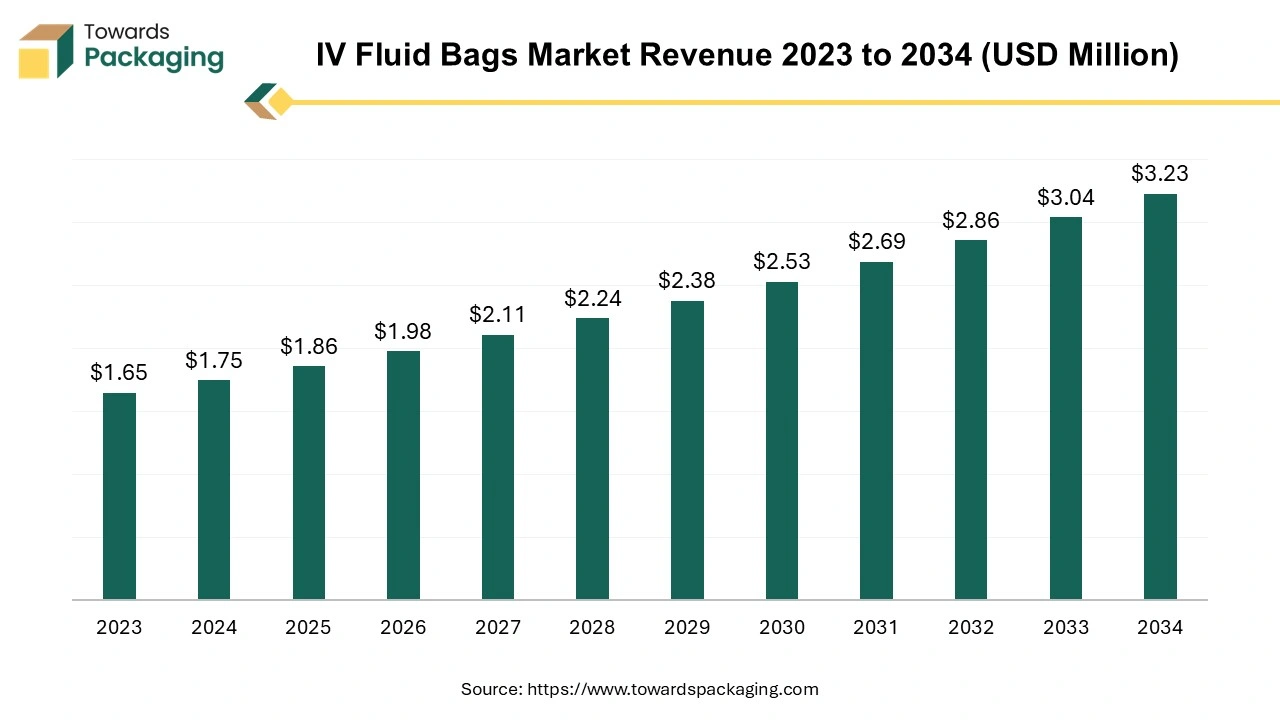

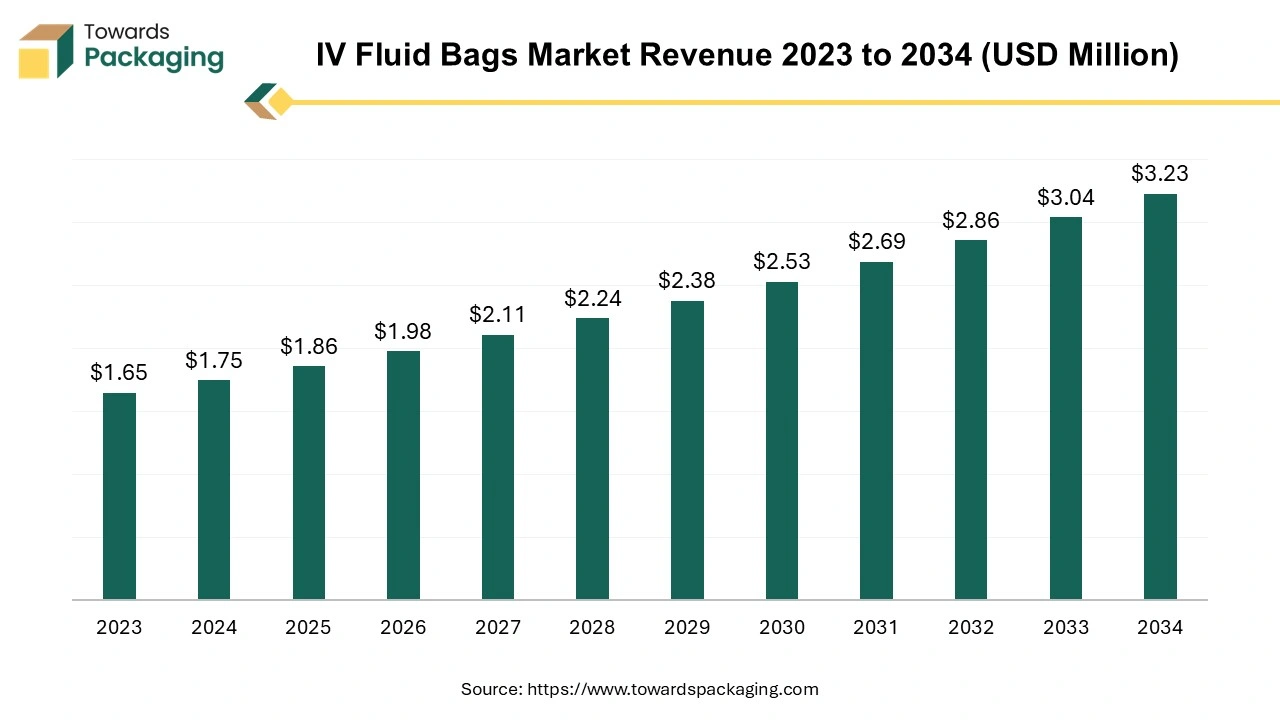

The IV fluid bags market is forecast to grow at a CAGR of 6.3%, from USD 1.86 billion in 2025 to USD 3.23 billion by 2034, over the forecast period from 2025 to 2034.

Key players operating in the market are focusing on business growth strategies, such as acquisitions and mergers, to develop advance technology for manufacturing IV fluid bags, which is expected to boost the market over the studied period.

Major Key Insights of the IV Fluid Bags Market

- North America dominated the market in 2024.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By type, flex plastic intravenous (IV) fluid bags segment led the market in 2024.

- By application, the hospital segment dominated the market in 2024.

IV Fluid Bags: Crucial Medical Supplies

IV (intravenous) fluid bags are essential medical containers. They are used to deliver fluids, medications, and electrolytes directly into a patient's bloodstream. These bags are crucial in various healthcare settings, including hospitals, clinics, and emergency services. Polyvinyl chloride (PVC) or polyethylene is increasingly used to manufacture IV fluid bags. Common solutions packed in IV fluid bags are crystalloids, colloids, and dextrose solutions. IV fluid bags play a vital role in modern medicine, facilitating effective treatment and care across various settings. Their proper use, monitoring, and understanding of the different types and applications are essential for ensuring patient safety and therapeutic effectiveness.

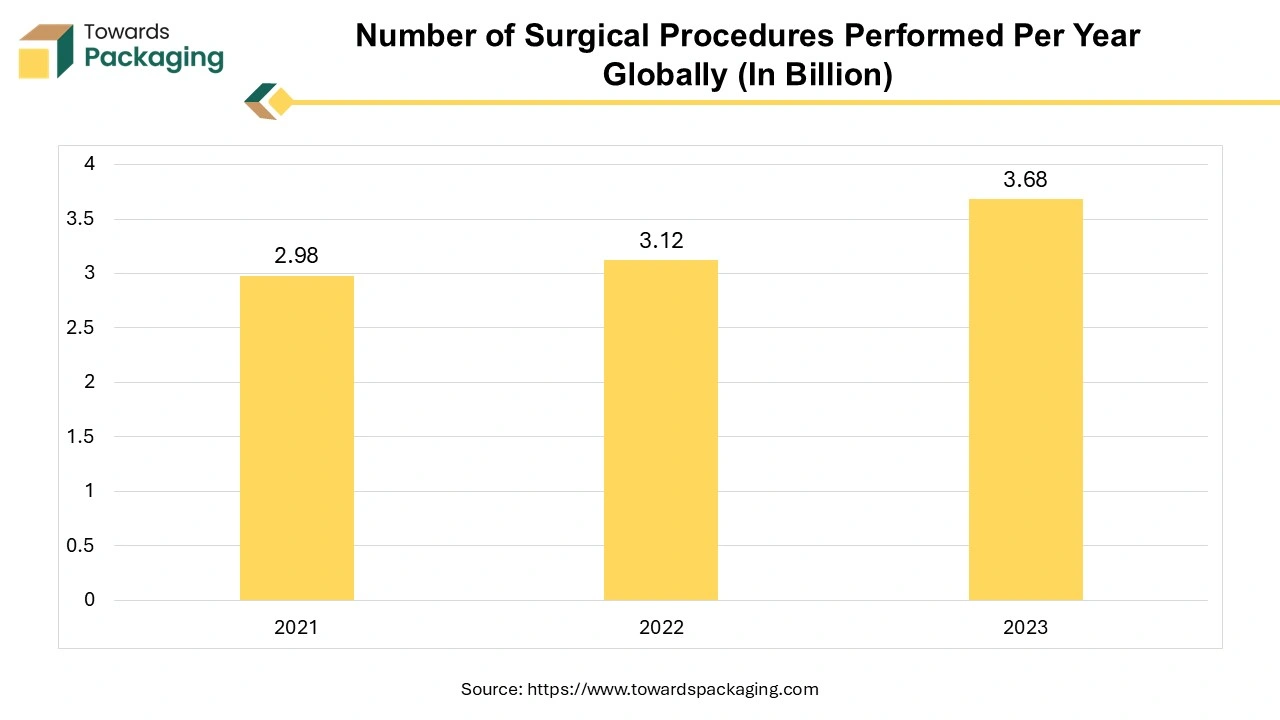

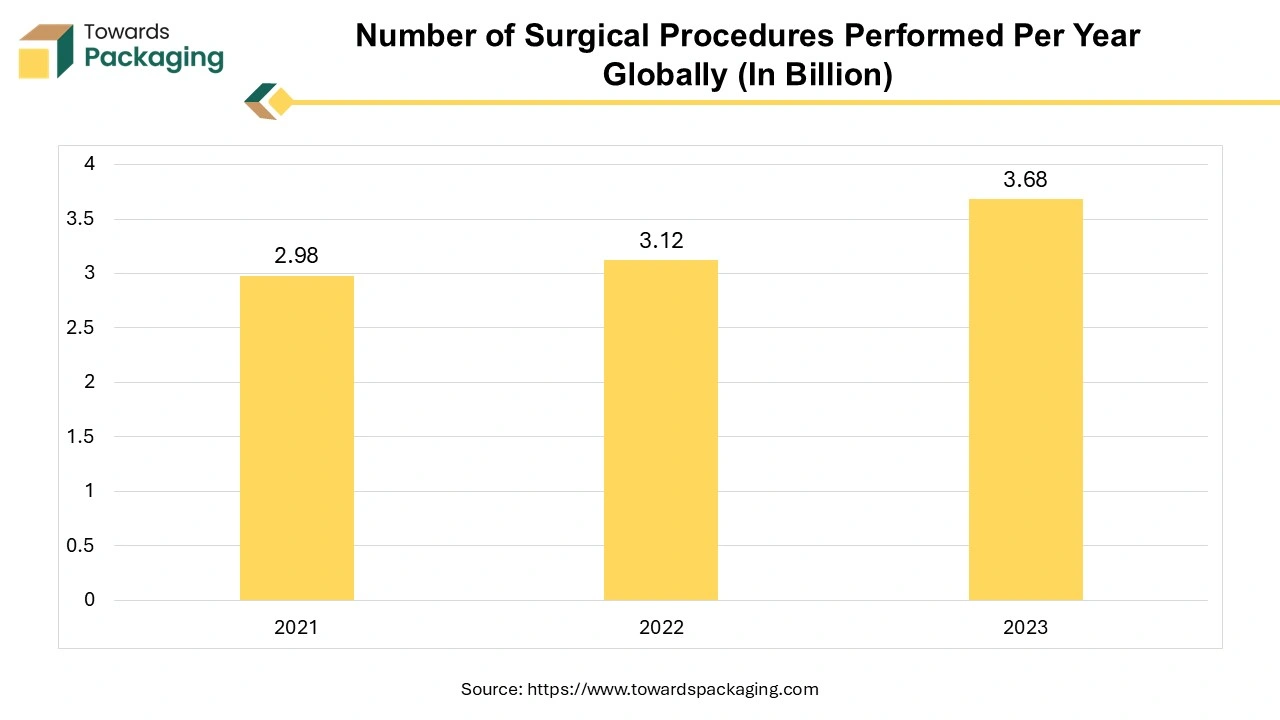

The rise in surgical interventions requires efficient fluid management during and after procedures. During surgery, IV fluids are critical for maintaining blood volume, electrolyte balance, and hydration, particularly in lengthy or complex procedures. Patients often require hydration before surgery to ensure optimal physiological conditions. Some patients may require additional nutrients through IV solutions post-surgery, increasing the use of specialized IV bags. A growing number of elective surgeries, driven by advancements in surgical techniques and technology, leads to higher demand for IV fluids. Minimally invasive surgeries often require IV fluid management, further increasing demand for IV fluid bags.

- According to the data published by the National Library of Medicine, about 400,000 coronary artery bypass graft (CABG) surgeries are performed each year in the U.S.

- According to the American College of Rheumatology, approximately 544,000 hip replacements and 790,000 knee replacements are performed annually in the U.S. As the population ages, this number keeps rising. Total joint replacement is considered one of the safest and most dependable medical procedures.

10 Key Factors Driving the IV Fluid Bags Market Growth

- Key players competing in the market are focusing on establishing their IV fluid bag brands in other countries, which is expected to drive the growth of the market in the near future.

- Emerging markets and trends for IV fluid bags are expected to drive the growth of the global IV fluid bags market over the forecast period.

- Increasing regulatory support is estimated to drive the market's growth over the forecast period.

- The increasing adoption of advanced technology for the production of IV fluid bags is estimated to drive the growth of the global IV fluid bags market in the near future.

- The increased use of IV fluids in emergency medicine for dehydration, shock, and trauma enhances the market for IV fluid bags.

- Establishing new hospitals and clinics, particularly in emerging markets, increases the availability and demand for IV fluid products, which is estimated to drive the growth of the IV fluid bags market.

- Greater recognition of the importance of hydration in medical treatment boosts the use of IV fluids across various settings, which has been observed to drive the growth of the IV fluid bags market.

- Stringent regulations and quality assurance foster trust in IV fluid products, driving market growth.

- The shift toward home healthcare and outpatient services necessitates portable, user-friendly IV fluid solutions.

- Efforts to improve health outcomes in underserved areas increase the demand for IV fluid access and availability.

Market Trends

- Sustainability Initiatives: Increasing demand for environmentally friendly and recyclable materials is driving the development of biodegradable IV fluid bags.

- Growing Home Healthcare: A shift towards home healthcare services is increasing the demand for portable and easy-to-use IV fluid bags for at-home treatments.

- Customization and Variety: Rising demand for specialized IV fluids (like nutritional and electrolyte solutions) is leading manufacturers to diversify their product offerings.

- Increased Regulatory Scrutiny: Stricter regulations on quality and safety are pushing manufacturers to enhance the reliability and sterility of IV fluid bags.

Market Opportunities

Rising Aging Population

An aging demographic leads to higher hospitalization rates and surgical procedures, increasing the demand for IV fluids. Elderly adults are more likely to undergo surgeries, necessitating IV fluids for anesthesia and post-operative recovery. Older adults often have chronic diseases that require regular treatment, including hydration through IV fluids. Older Patients with chronic conditions such as diabetes, kidney disease, and heart failure often require regular hydration and electrolyte management through IV fluids.

Some geriatric people with chronic diseases aged above 60 may need IV fluids for nutritional support, especially if they have difficulty eating or absorbing nutrients.

- For instance, according to data published by the World Health Organization (WHO) in October 2023, by 2024, 10% of people worldwide will be 65 years of age or older, indicating that the population is aging. Additionally, life expectancy at birth is rising, with projections indicating that it will reach 77.4 years in 2054 after reaching 73.3 years in 2024.

- According to the data published by the World Population Prospects 2024, it is estimated that the global population will peak in the mid-2080s. According to estimation by the WHO, the European Region's population of those over 65 will surpass that of people under the age of 15.

Market Challenge

- Competition from Alternatives: Increasing use of oral rehydration solutions and other alternatives for fluid management may reduce the reliance on IV fluids.

- Risk of Contamination and Infections: Concerns about the potential for contamination and hospital-acquired infections may lead to hesitance in using IV fluids in certain situations.

- Changing Healthcare Policies: Shifts in healthcare policies and reimbursement structures may impact the demand for IV fluids in specific contexts.

Regional Insights

North America’s Well-Established Healthcare Infrastructure to Support Dominance

North America dominated the IV fluid bags market in 2024. North America boasts a highly developed healthcare system with state-of-the-art hospitals, clinics, and healthcare facilities, leading to increased demand for IV fluids. The region has a significant number of individuals with chronic diseases, driving the need for regular fluid management and hydration therapies. The increasing launch of new IV hydration therapy centers in North America is estimated to drive the growth of the IV fluid bags market in the North American region in the near future.

- For instance, in May 2024, XWELL, Inc., a health and wellness holding company, revealed the launch of the new IV hydration drip therapy center at its Miami International Airport (MIA) XpresSpa location in Florida, U.S.

Asia Pacific’s Expanding Healthcare Access to Boost the Market at Faster Rate

Asia Pacific is anticipated to grow at the fastest rate in the IV fluid bags market during the forecast period. Rapid expansion of healthcare facilities, including hospitals and clinics, enhances access to IV fluid therapies across urban and rural areas. A large and growing population, combined with increasing urbanization, leads to higher healthcare demands, including the use of IV fluids. A higher volume of surgical interventions due to improved healthcare access and advances in medical technology drives demand for IV fluid management. Economic development in several Asia Pacific countries has led to increased healthcare spending and investment in modern medical practices, including IV therapy. An increase in lifestyle-related diseases (e.g., diabetes, cardiovascular diseases) necessitates more hospital visits and treatments requiring IV fluids.

- For instance, according to the guidelines for the prevention and treatment of type 2 diabetes in China (2023 edition), the epidemiology of diabetes among adults has reached 11.2%, and the number of adults with diabetes in China is estimated at 141 million, with an undiagnosed diabetes patient ratio of 51.7%.

Europe is a significant market for IV fluid bags, characterized by stringent regulatory standards and a strong emphasis on patient safety. Europe has matured IV fluid bags market due to highest consumption.

Market Segments

Flex Plastic Intravenous (IV) Fluid Bags led the Market in 2024

The flex plastic intravenous (IV) fluid bags segment held a dominant presence in the IV fluid bags market in 2024. Flex plastic intravenous (IV) fluid bags are easier to handle and transport compared to traditional glass bottles, reducing risk of breakage. The flexible design minimizes exposure to contaminants, maintaining sterility.

Expansion in Hospital Facility to Support Dominance

The hospital segment dominated the global IV fluid bags market in 2024. Hospitals treat a large number of patients requiring IV therapy for hydration, medication delivery, and nutrition, leading to significant demand for IV fluid bags. IV fluid bags are used for a variety of treatments, including surgical procedures, emergency care, and managing chronic conditions, which broadens their use in hospitals.

Hospitals often invest in the latest medical technologies, which include sophisticated IV delivery systems that require compatible fluid bags. A rise in chronic diseases, surgeries, and emergencies increases hospital admissions, subsequently elevating the need for IV fluids. Hospitals must adhere to strict regulatory standards for patient care, necessitating the use of high-quality, sterile IV fluid bags. These factors collectively contribute to the growth and dominance of the hospital segment in the IV fluid bags market.

New Advancements in the IV Fluid Bags Industry

- In February 2023, Bowmed Ibisqus Ltd, a pharmaceutical company, unveiled its ready-to-administer Levofloxacin IV fluid bag. Customers may like the product's more convenient dosage form and the advantages it offers in terms of lowering glass waste because it comes in a standard 500 mg/100 ml dose that comes in a 10-pack. To shield the product from light, the bag is wrapped in foil, which also prominently shows the important product details.

- In April 2024, Baxter International Inc. announced the expansion of its pharmaceutical product portfolio with five injectable product and intravenous fluid dosage bag launches in the U.S.

IV Fluid Bags Market Top Companies

- Baxter

- SSY Group

- B.Braun

- Fresenius Kabi

- Pfizer

- Otsuka

- Cisen Pharmaceutical

- Renolit

- Technoflex

- Huaren Pharmaceutical

- CR Double-Crane

- ICU Medical

- Pharmaceutical Solutions Industry Ltd

- Vioser

- Sippex

- Well Pharma

- Zhejiang CHIMIN

IV Fluid Bags Market Segments

By Type

- Flex Plastic Intravenous (IV) Fluid Bags

- Semi-rigid Intravenous (IV) Fluid Bags

- Glass Bottles

By Application

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait