April 2025

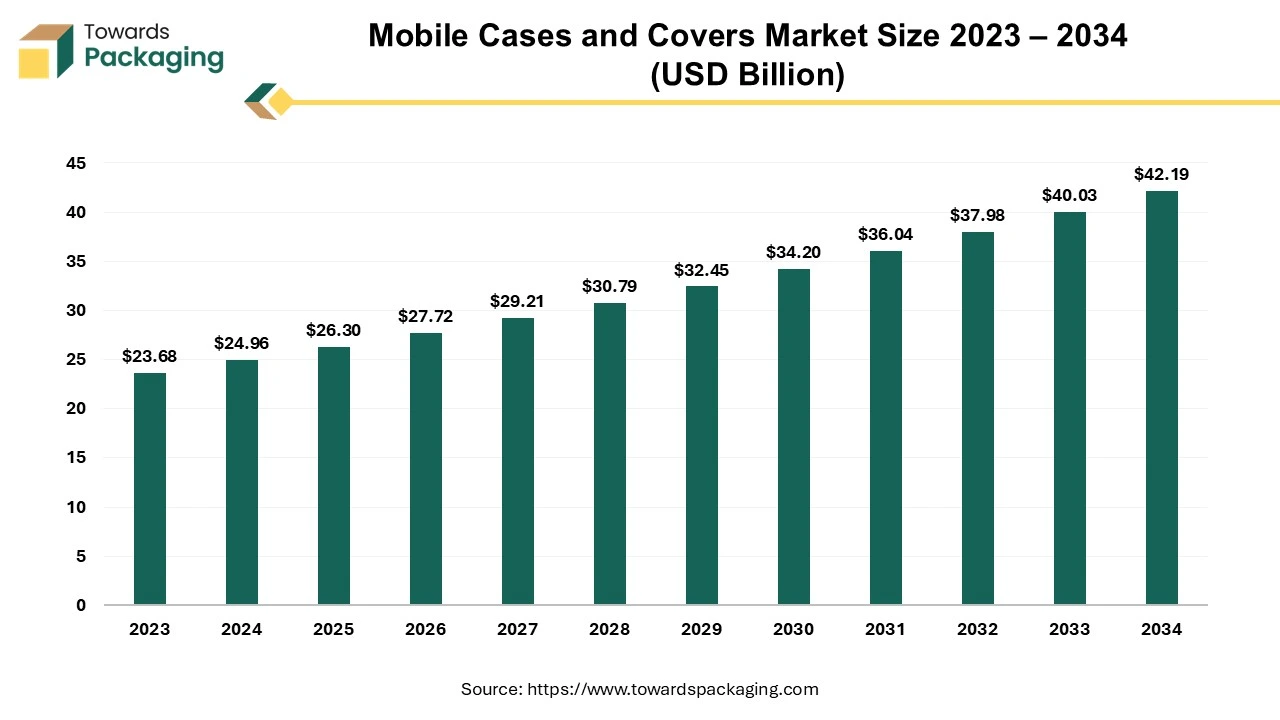

The mobile cases and covers market is expected to grow from USD 26.30 billion in 2025 to USD 42.19 billion by 2034, with a CAGR of 5.39% throughout the forecast period from 2025 to 2034.

The mobile cases and covers market include various smartphone and mobile device protection products. These attachments serve two functions: they protect smartphones from physical damage while allowing users to customize their devices with various patterns, colours, and materials. In today's fast-paced digital world, smartphones have evolved into essential instruments for communication, entertainment, productivity, and other activities. With the growing reliance on these gadgets, the necessity to safeguard them from accidental drops, scratches, and other risks has rapidly expanded the mobile cases and covers industry.

The market provides a diverse selection of choices, including silicone, plastic, metal, leather, and fabric protective cases, among others. These cases are available in various forms, including slim-fit designs, tough armor, wallet cases, flip covers, and customizable alternatives to accommodate users' preferences and needs.

| Top 5 Most Expensive Mobile Case | |

| Brands | Case Price |

| Buccellati iPhone Case | $208,000 |

| Goldgenie Donald Trump Case | $151,000 |

| Lux iPhone X Ingot 250 | $70,000 |

| Chanel Lambskin & Gold-Tone Metal Black Case | $1350 |

| Louis Vuitton Dauphine Case | $725 |

The mobile cases and covers market are driven by technical improvements, changing consumer lifestyles, fashion trends, and the ongoing launch of new smartphone models. Expanding e-commerce platforms has made these products more accessible to customers globally, accelerating market growth. Buccellati iPhone case and Goldgenie Donald Trump Case is world’s most expensive mobile case available in their retail stores.

The mobile cases and covers market aim to protect costly devices while allowing users to express themselves and customize their styles, making it an essential component of the ever-expanding mobile technology ecosystem.

For Instance,

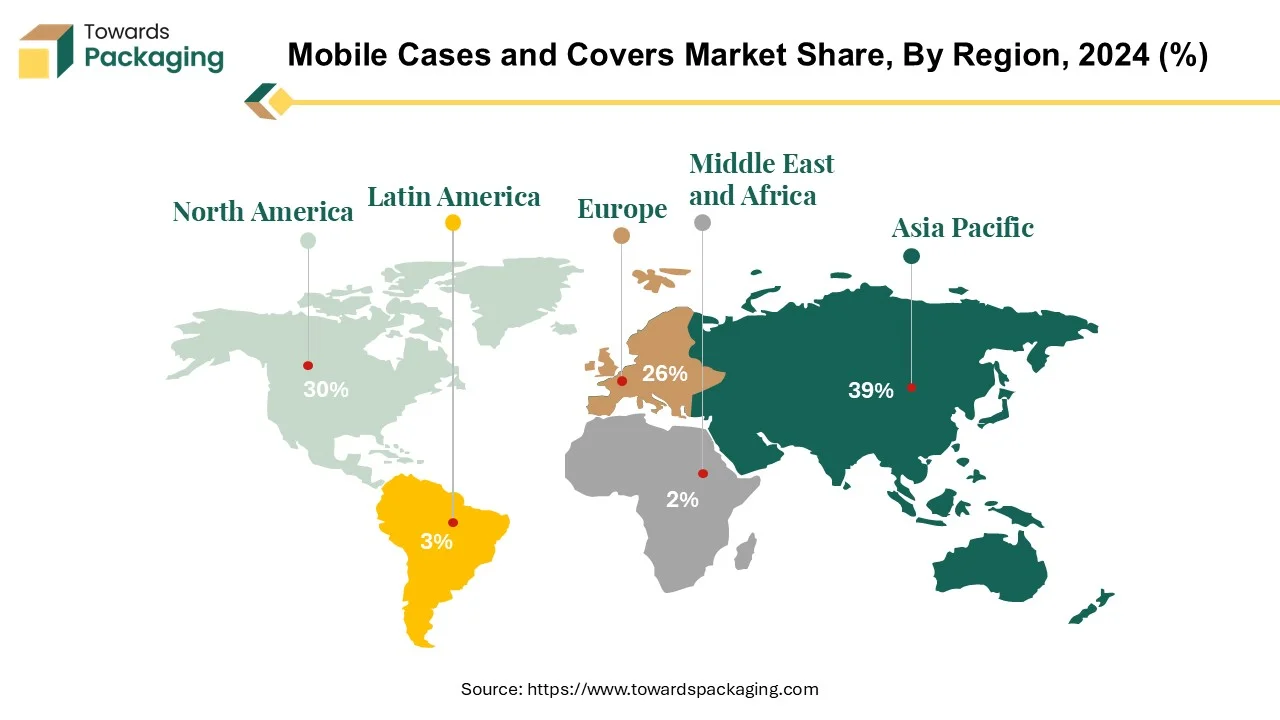

The Asia Pacific area dominates mobile cases and accounts for most of the market, demonstrating tremendous development and innovation. China, India, Japan, South Korea, and Southeast Asia are among the countries that make up the region. Several significant causes contribute to its significance.

The Asia Pacific area has a large customer base with an increasing preference for smartphone usage. Rapid urbanization, rising disposable incomes, and a tech-savvy younger population have fuelled demand for smartphones and related accessories such as cases and covers. Some of the world's largest producers of mobile cases and covers are based in the region, and they use innovative manufacturing technology and cost-effective production techniques. China, in particular, has developed as a global manufacturing powerhouse for smartphone accessories, providing a diverse selection of products at reasonable rates.

The Asia Pacific region's customer preferences are dynamic, driving ongoing innovation and diversification in the mobile cases and covers industry. Manufacturers are continuously striving to create innovative designs, materials, and features designed to fulfill consumers' changing needs. The growing use of e-commerce platforms and digital payment systems has made mobile accessories accessible throughout the region. Online marketplaces offer consumers various options and simple purchase experiences, which fuels industry growth. The existence of top smartphone firms located in Asia Pacific, such as Samsung, Xiaomi, and Huawei, promotes a vibrant mobile accessory ecosystem. Collaborations between device manufacturers and accessory suppliers help to provide novel and compatible solutions.

The Asia Pacific region's dominant position in the mobile cases and covers market is attributed to its strong consumer base, manufacturing prowess, innovation-driven market dynamics, and supportive technological infrastructure, making it a key player in the global landscape of smartphone accessories.

For Instance,

North America is a major mobile case and cover market player, ranking second globally. With the continual rise in smartphone penetration, North America's market share for mobile accessories has increased significantly. Between 2022 and 2030, smartphone connections in the region increased from 84% to 90%, indicating customers' growing reliance on mobile devices. Several reasons contribute to North America's dominant mobile case and cover market position. The region's consumer base is mature and technologically savvy, with a strong preference for high-quality electronics and accessories. This consumer demography, constant innovation, and a trendsetting culture drive demand for premium and inventive mobile cases and covers.

North America is home to prominent smartphone makers and digital behemoths such as Apple, Samsung, and Google, whose flagship products set industry standards and drive accessory trends. The popularity of mobile gadgets drives up demand for suitable and elegant cases and covers, generating a profitable market opportunity for both established brands and developing competitors in the region. North America's excellent e-commerce infrastructure and extensive use of digital payment systems allow consumers to have seamless online purchase experiences. Online marketplaces and direct-to-consumer channels make it easy for buyers to discover a variety of mobile accessories, resulting in increased sales and market growth.

North America's emphasis on consumer preferences, product customization, and brand loyalty creates a competitive environment where businesses must constantly adapt to suit changing needs. As a result, the region continues to be at the forefront of mobile case trends, setting design, functionality, and user experience standards.

For Instance,

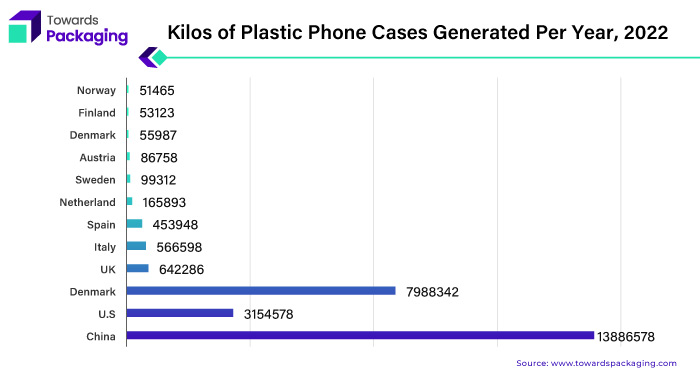

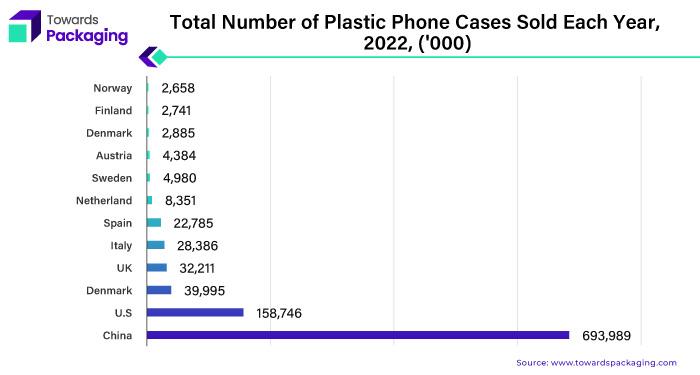

Plastic is the primary material used in phone cases and covers, and its extensive use and disposal raises considerable environmental problems. Plastic production reaches 380 million tonnes annually, demonstrating its widespread presence in various industries, including smartphone accessories. With about 6.37 billion smartphone users globally, accounting for 80.63% of the global population, more than one billion plastic phone cases are sold yearly. This large market size creates considerable problems for environmental sustainability, especially given the continual accumulation of plastic trash in landfills.

Phone covers are frequently made of blended fractions of materials, with soft components on the sides and more stiff elements on the back, which are sometimes lined with fleece or felt interiors. This mixture of materials hinders recycling efforts, compounding the environmental impact of plastic phone case production and disposal. Despite efforts to promote recycling, plastic trash accumulates in landfills worldwide. In Sweden, for example, fewer than 10% of all plastic generated annually is recycled, showing the ineffectiveness of present waste management procedures.

China is the leading country contributor to this industry when looking at plastic phone case distribution. A notable reminder of the environmental impact of these accessories is the weight of the plastic phone cases offered in nations like Germany and Norway. The weight of eight full-size male elephants, for example, is equal to the sales of plastic phone cases in Norway, yet the weight of 37 Ford 4WD cars is comparable to the sales in Germany. Promoting sustainable materials, enhancing recycling infrastructure, and educating customers about the significance of responsible consumption and disposal habits are all necessary to mitigate the environmental impact of plastic phone cases.

For Instance,

The back cover is a product that leads the mobile case and cover industry because of its popularity among consumers, functionality, and variety. Back coverings are essential to smartphone protection, providing critical shielding from scratches, impacts, and other harm while maintaining the device's fashionable appearance.

To meet the varying interests of consumers, back covers are offered in a range of materials, patterns, and features. Typical materials include leather, silicone, metal, plastic, and hybrid blends; each offers unique grip, durability, and style advantages. Furthermore, back coverings may have built-in kickstands, heat dissipation, or shock absorption capabilities for improved usability.

The back cover's popularity in the market for mobile accessories is due to its capacity to enhance and personalize the look of smartphones. Customers can customize their gadgets with various colors, patterns, textures, and finishes to match their preferences and way of life. Due to its ability to protect smartphones, attractive design, and customizable possibilities, the back cover is a global leader in the mobile case and cover industry and is a must-have accessory for smartphone owners everywhere.

For Instance,

Most distribution channels are offline, serving customers who want to inspect and buy things physically. Brick-and-mortar stores specializing in electronics, mobile accessories, and general consumer products frequently hold the most significant market share for offline distribution. These brick-and-mortar stores use in-store displays, sales associates' one-on-one assistance, and demos to draw clients in. They cater to various consumer tastes and budgets by offering many mobile cases and covers, from high-end, luxurious products to more affordable ones.

Customers may buy and utilize mobile cases and cover them immediately through offline distribution channels, saving them time and money by not waiting for shipping or delivery. Convenience like this helps explain why offline retail is still so popular in the mobile.

Despite the growing significance of online retail, offline distribution channels remain essential in the mobile case and cover market, providing a tactile and interactive purchasing experience that complements the convenience of e-commerce platforms. As a result, brick-and-mortar retailers continue to play a critical role in meeting the different demands of smartphone users globally.

For Instance,

The competitive landscape of the mobile cases and covers market is dominated by established industry giants such as Logitech International S.A., Krusell International, Belkin International, Inc., Spigen, Inc., Urban Armor Gear, LLC, Evutec Corp, Otter Products LLC, Vinci Brands LLC, Case-Mate, PITAKA, iPaky Inc., XtremeGuard, ZAGG Intellectual Property Holding Co., MOKO, Amzer, Griffin Technology, Inc., Incipio, LLC, C.G. Mobile and Shenzhen Ipaky Electronic Co., Ltd.These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Krusell is the world's first smartphone cover produced from biobased and industrially biodegradable bioplastic materials. Krusell's Bioserie is also the first mobile accessory in the world to receive USDA certification.

For Instance,

Case-Mate is a major player in the mobile case and cover market. It is well-known for its unique designs, high-quality materials, and dedication to offering superior protection for smartphones and other mobile devices. The company has established itself as a top brand in the sector, serving to a wide variety of global consumers.

For Instance,

By Material

By Product Type

By Distribution Channel

By Region

April 2025

April 2025

March 2025

March 2025