April 2025

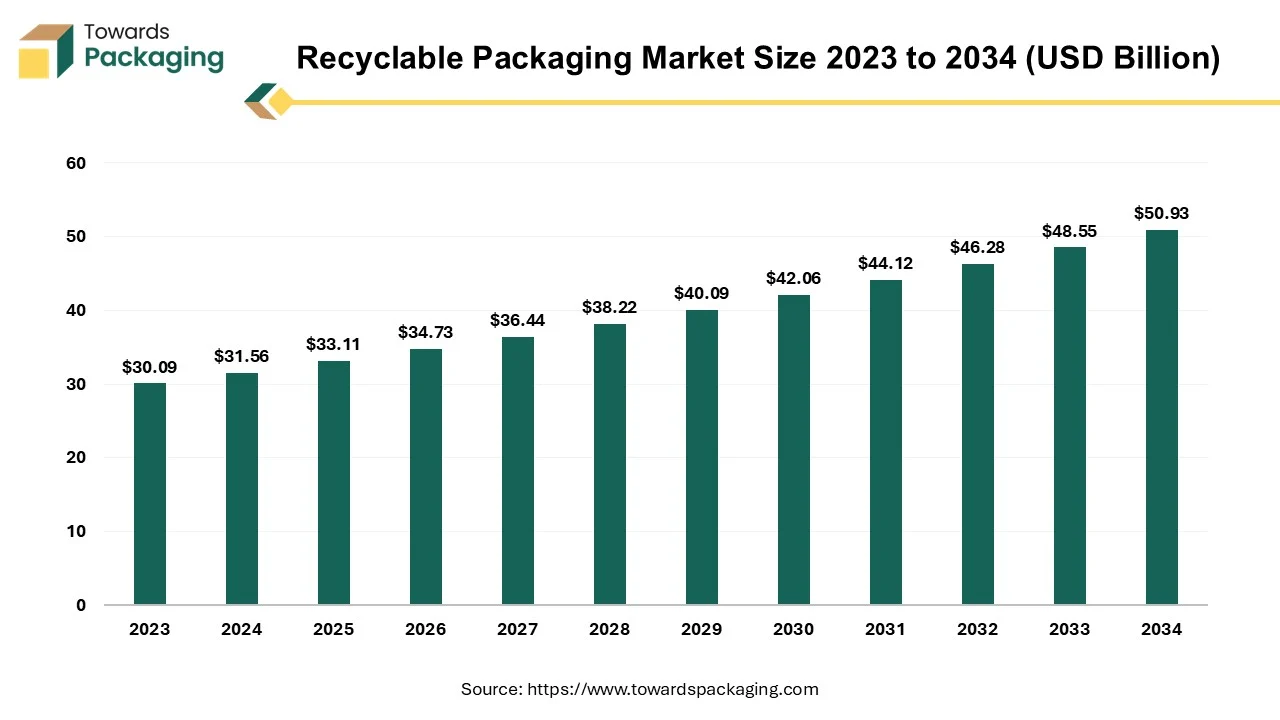

The global recyclable packaging market is anticipated to grow from USD 33.11 billion in 2025 to USD 50.93 billion by 2034, with a compound annual growth rate (CAGR) of 4.9% during the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing recyclable packaging which is estimated to drive the global recyclable packaging market over the forecast period.

Any type of packaging that can be recycled and reused is considered recyclable. Fortunately, using recyclable materials to package items is now simpler than ever. Many businesses decide to employ recyclable materials in their packaging in an effort to lessen their influence on the environment and the amount of waste they send to landfills. Whatever the reason, these businesses' dedication to recycling is having a significant impact because packaging is still a major source of garbage in the US, Canada, and the rest of the world.

The ability of packaging materials to be gathered, sorted, processed, and recycled into new goods is known as recyclable packaging. If a packaging materials can be recovered and utilized or reprocessed into new products or packaging materials after its initial use, it is deemed recyclable. A key component of sustainable packaging is its ability to be recycled, which lowers the quantity of waste that ends up in landfill and conserves natural resources by encouraging the creation of new products utilizing recycled materials.

| Metric | Details |

| Market Size in 2024 | USD 33.11 Billion |

| Projected Market Size in 2034 | USD 50.93 Billion |

| CAGR (2025 - 2034) | 4.9% |

| Leading Region | Europe |

| Market Segmentation | By Material, By Type of Packaging, By Application and By Region |

| Top Key Players | Amcor, Tetra Laval, Ardagh Group SA, Ball Corporation, Elopak AS, Emerald Packaging, PlastiPak Holdings Inc., Sealed Air Corporation, Uflex Limited, WestRock Company, Be Green Packaging |

Companies are increasingly moving away from single-use plastics, adopting recyclable materials like cardboard, paper, glass, and biodegradable plastics. This transition is fuelled by consumer demand for eco-friendly products and heightened awareness of environmental impacts.

Advancement in material science are leading to the development of new recyclable packaging solutions with enhanced performance. Bio-based plastics derived from renewable sources are gaining traction as viable alternatives to traditional plastics.

The increase of e-commerce has spurred the need for recyclable packaging that can withstand shipping demands while minimizing environmental impact. The key players operating in the market are investing in innovative designs that are both sustainable and durable.

There is a rising emphasis on designing packaging with end-of-life recycling in mind, promoting a circular economy. This involves collaboration between governments and industry stakeholders to ensure products are recyclable and materials are reused.

Technology innovations, including AI and digital labelling, are transforming packaging processes. AI optimizes packaging design for better recyclability, while digital labels offer transparent information on environmental impacts, improving consumer trust.

Edible packaging manufactured from natural ingredients like rice, seaweed, and potatoes is emerging as a solution to minimize plastic waste. Additionally, plant-based plastics derived from renewable sources are being adopted for their biodegradability and composability.

Smart Packaging solutions equipped with sensors and IoT technology are being developed to monitor product freshness, detect tampering, and offer real-time data on supply chain logistics. These innovations aim to minimize waste and enhance efficiency.

Legislative actions, such as California’s plastic pollution prevention and packaging producer responsibility act, are pushing companies to take greater responsibility for the lifecycle of their packaging. Such regulations promote a circular economy and minimize plastic waste.

AI’s empowerment of smart packaging offers a promising path toward increased sustainability. Smart packaging may track and monitor a product’s journey from manufacturing to consumption utilizing RFID tags, sensors, and other technologies. It is possible to collect useful information on handling circumstances, temperature, humidity, and possible pollutant exposure. Companies can reduce their environmental effect by making well-informed decisions due to this data. For instance, supply chain optimization can aid in lowering carbon footprints, and areas for packaging waste reduction can be discovered. Optimizing the use of packaging materials and energy across production processed is another way to cut costs.

AI is essential to the creation of effective and environmentally friendly packaging solutions. It helps with waste reduction, packaging process simplification, and the identification of the best packaging materials and designs. Businesses can create environmentally friendly substitutes and get rid of needles packaging materials by utilizing AI-driven technologies. AI also assists in locating and getting rid of items that aren’t recyclable or biodegradable, opening the door for more environmentally friendly packaging techniques.

Due to modernization and busy lifestyle, the online shopping has taken boom. The rising trend of online shopping has developed a demand for lightweight, protective, and recyclable packaging to minimize waste and shipping costs. Hence, the booming online e-commerce platform has estimated to drive the growth of the recyclable packaging market in the near future.

For instance, in January 2025, according to the data published by the National E-Commerce Association, it has been estimated that about 58% of American consumers said they have bought a product after seeing it on social media. The same was reported by 40% of respondents in Germany and 44% of respondents in the U.K. This demonstrates the enormous potential for companies to use social media as well as E-commerce platform in various nations. Millennials are predicted to be the largest group in this sector by 2025, accounting for 33% of worldwide social commerce spending. They are closely followed by GenZ consumers, who are expected to make up 29% of the market.

The key players operating in the market are facing issue due to lack of infrastructure and material performance limitations, which has estimated restrict the growth of the recyclable packaging market in the near future. Some recyclable materials may not provide the same durability, barrier protection, or shelf life as traditional packaging, especially for perishable goods. To guarantee proper package recycling, more recycling facilities and collection mechanisms are required. Many areas struggle with antiquated infrastructure that must be updated to handle the growing amount of packaging garbage. Economic obstacles make things much more difficult by preventing investment in necessary improvements and expansions.

Rising awareness and growing middle-class consumption in developing countries open up new demand for recyclable and sustainable packaging solutions. Opportunities exist in developing advanced recyclable materials (like mono-material plastics, biodegradable films, and plant-based alternatives) that match or exceed traditional packaging performance. Hence, rising innovation of recyclable material for packaging has created lucrative opportunity for the growth of the recyclable packaging market in the near future.

The plastic segment held a dominant presence in the recyclable packaging market in 2024. As the plastic material is lightweight and durable it is extensively used as recyclable packaging. Plastic materials can be molded into a variety of shapes and sizes, making them suitable for diverse packaging needs from food containers to blister packs. In many countries, recycling systems for plastics like PET and HDPE are already in place, making them a more practical recyclable option.

The bottles & jars segment accounted for a considerable share of the recyclable packaging market in 2024. Mostly bottles and jars are manufactured from HDPE, PET, or glass materials that are extensively accepted in recycling programs and can be recycled multiple times without losing quality. Bottles and jars protect contents from contamination, damage, and spoilage especially for liquids, sauces, cosmetics, and pharmaceuticals. Many come with caps or lids, making them resalable, which is ideal for extended use and storage. Bottles and jars are easily integrated into automated filling, capping, and labelling lines, increasing manufacturing efficiency.

The food & beverages segment registered its dominance over the global recyclable packaging market in 2024. As the food and beverages sector produces a high volume of packaging waste, recyclable packaging is used extensively. Utilizing recyclable packaging assists to minimize environmental impact and supports corporate sustainability goals. Governments are enforcing stricter packaging regulations to minimize single-use plastics and promote recyclable materials especially in food and drink sectors. Recyclable packaging can be recovered and reused in the supply chain, helping to reduce waste management costs for manufacturers and retailers.

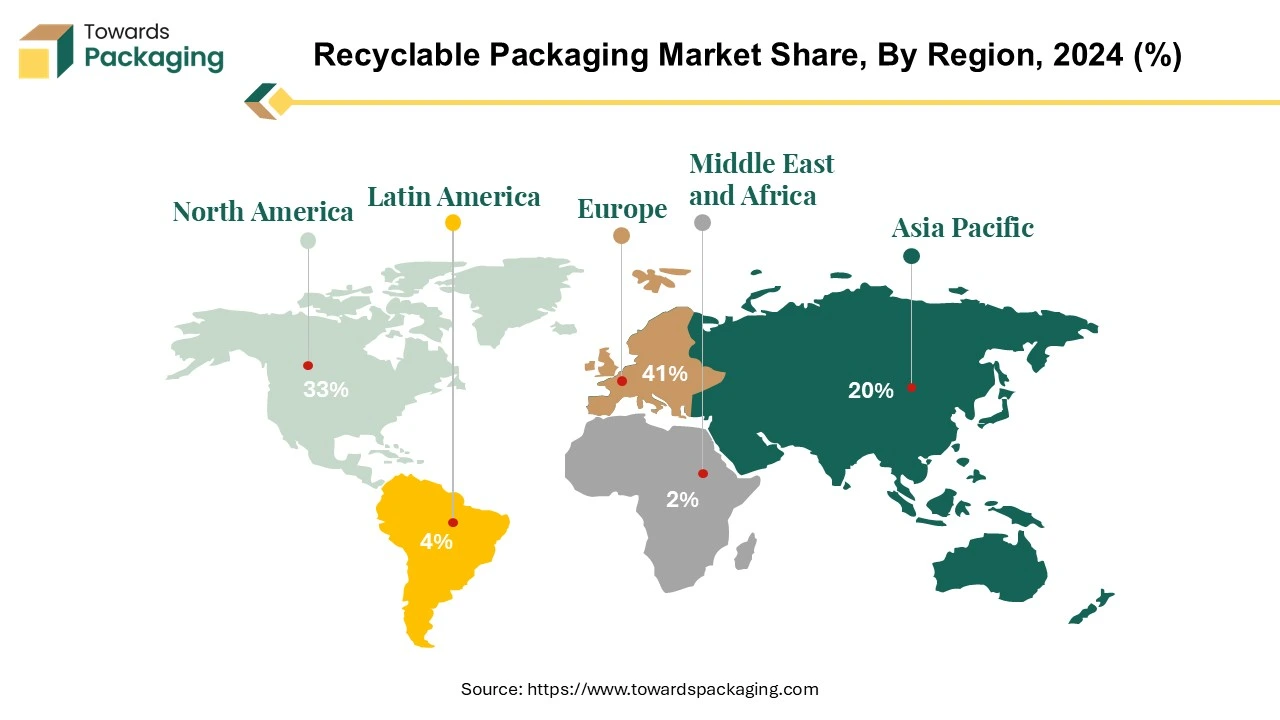

Europe region held the largest share of the recyclable packaging market in 2024, owing to strict government regulations. The Europe Union’s Green Deal, Circular Economy Action Plan, and packaging and packaging waste directive (PPWD) require all packaging in the EU to be recyclable or reusable by 2030. Countries like Germany, France, and the Netherlands have some of the world’s toughest recycling laws. Across Europe, manufacturers are legally responsible for the entire lifecycle of their packaging, including disposal and recycling pushing them to adopt recyclable materials.

Asia Pacific region is anticipated to grow at the fastest rate in the recyclable packaging market during the forecast period. Countries like China, India, Indonesia, and Vietnam are undergoing fast urbanization, increasing demand for packaged goods and in turn, recyclable packaging. Government across Asia Pacific are implementing stricter environmental regulations and banning certain non-recyclable plastics, creating a push for recyclable alternatives. For instance, India’s ban on single-use plastics in 2022; China’s phased restrictions on non-degradable plastic bags. Asia Pacific region is a global hub for low-cost, high-volume manufacturing, making it ideal for scalable production of recyclable packaging materials.

India Market Trends

The key players operating in the market are focused on launching recyclable packaging in India, which has estimated drive the recyclable packaging market in India. For instance, On February 28, 2025, Tetra Pak, packaging company, asserts that it is the first company in India’s food and beverage packaging sector to use ISCC PLUS certified recycled polymers in its packaging materials, in compliance with new national laws pertaining to the management of plastic waste. According to reports, the components include 5% ISCC plus certified recycled polymers that were procured and distributed utilizing the ISCC mass balance attribution method. The polymers, in turn, are produced utilizing a combination of chemically recycled and virgin ingredients; the recycled material is said to be of the same quality as its fossil-based counterpart and to comply with the same international food contract standards.

North America region is seen to grow at a notable rate in the foreseeable future, owing to large consumer base and well established food and beverages industry in the region. Laws like the U.S. Plastic Waste Reduction and Recycling Act, Canada’s Zero Plastic Waste Agenda, and state-level bans on single use plastic (e.g., in California and New York) push companies toward recyclable solutions. North American Consumers are increasingly eco-conscious and prefer products with sustainable packaging. This demand is pushing brands to adopt recyclable options to stay competitive. North America leads in material science and packaging innovation, making it easier to develop high-performance recyclable materials that meet both regulatory and consumer standards. North America region is home to leading packaging manufacturers like Amcor, Ball Corporation, and Sealed Air who drive innovation and scale for recyclable solutions.

U.S. Market Trends

U.S. recyclable packaging market is growing steadly as it holds economic strength, research & development for innovation of recyclable packaging, infrastructure, and policy support. The U.S. consumers are increasingly aware of environmental issues and are pushing brands toward recyclable, eco-friendly packaging especially among millennials and generation Z.

In January 2025, Cadbury sharing bars marketed in the British Isles will be available in packaging manufactured of 80% certified recycled plastic, according to Mondelez International. Beginning this year, the owner of the brand US gradually replacing the packaging for bars produced in Coolock, Ireland, and Bournville, England. Eventually, technologies will package about 300 million sharing bars a year using roughly 600 tonnes/661 tons of post-consumer recycled (PR) plastic. Together with Amcor and Jindal Films, Mondelez created the new packaging, which is recyclable and uses Amor’s AmFinti recycled plastic. With 80% recycled packaging, the brand is well-positioned in a legislative framework that promotes recycling and recycled material through laws like the Packaging and Packaging Waste regulation (PPWR) of the European Union.

By Material

By Type of Packaging

By Application

By Region

April 2025

April 2025

April 2025

April 2025