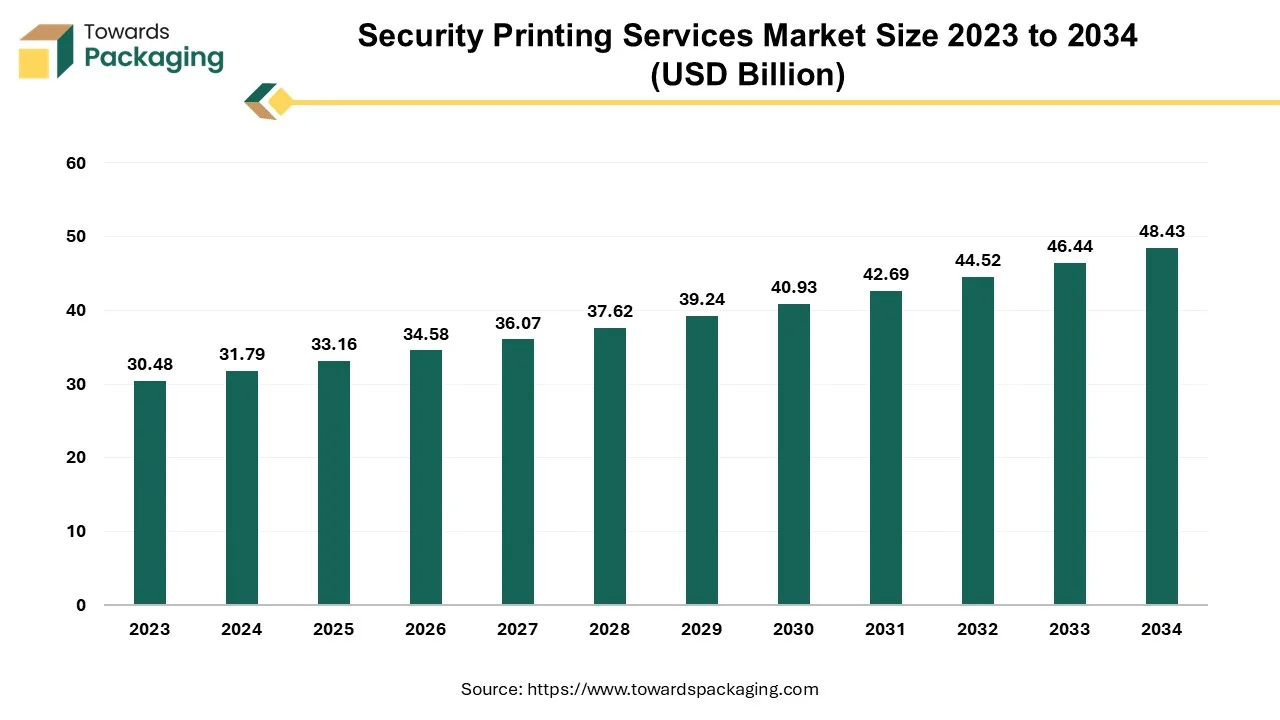

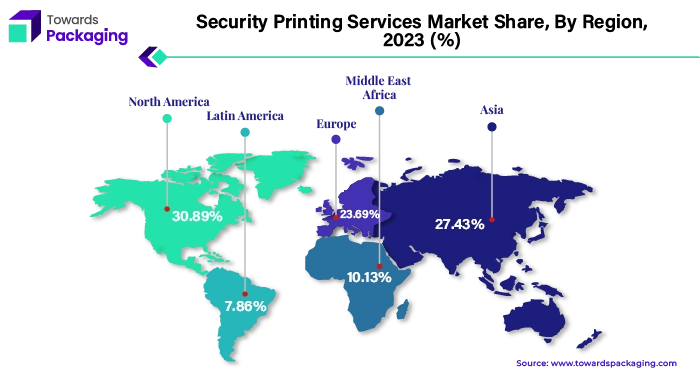

The Security Printing Services Market is projected to grow from USD 33.16 billion in 2025 to USD 48.43 billion by 2034, at a CAGR of 4.30%. This growth is driven by increasing incidents of counterfeiting and fraud, growing demand for secure documentation, and advancements in digital security printing. Key sectors like banknotes, legal documents, and personal identification are driving market demand. Additionally, the integration of sustainable printing solutions and cloud-based printing services is reshaping the industry, with North America and Asia-Pacific expected to lead regional growth.

The security printing services market is anticipated to witness significant growth during the forecast period. Security printing produces documents that are difficult to counterfeiting and frauds using unique methods. Security printing for the documents includes printing of passports, identity cards, banknotes, product authentication, checks, tamper-evident labels, stock certificates and postal stamps. Distinct printing methods are being utilized for different uses.

The increasing rate of imitation and counterfeiting coupled with the growing awareness about product and document security is anticipated to augment the growth of the market within the estimated timeframe. The market is further driven by the development of sustainable security printing solutions along with the adoption of digital solutions. Furthermore, the regulatory requirements mandating strong security measures in the government and financial sectors is also likely to contribute to the growth of the market in the years to come.

Rising counterfeiting and fraud threats are a key driver of the security printing services market, as organizations and governments seek to protect their assets, products, and documents from illegal duplication and tampering. Increasing cases of counterfeit currency, forged legal documents, and fake branded products have heightened the need for advanced security printing solutions. These threats compel banks, governments, and corporations to adopt technologies such as holograms, watermarks, microtext, and RFID to ensure authenticity and prevent losses. Additionally, growing consumer awareness and demand for genuine products further encourage businesses to invest in secure printing. As a result, the market for security printing services continues to expand, driven by the need to combat fraud and maintain trust.

The increasing incidents of counterfeit government documents and identity thefts are anticipated to augment the growth of the security printing services market during the forecast period. Consumers increasingly depend on the passports for the remote identity validation as part of Right to Work, Right to Rent and digital identification checks for DBS applications, hence the emergence of the forged documents like passports is not overly unexpected.

According to the data by TrustID, passports continued to be the most frequently viewed fake document by the consumers in 2023, a finding that is consistent for the previous three years of the data. In 2023, they accounted for almost 48% of all the false documents, a marginal rise as compared to 2022. Across the year, there has been a continuous pattern of the male applicants presenting the majority of the falsified passports, whereas female applicants have only presented a small percentage of those seen.

As per the Federal Trade Commission (2024), in 2022, there were almost 1.1 million identity theft reports obtained and in 2023, 1 million accusations were submitted. With 102,000 incidents, the government document fraud increased by 68% in 2023 as compared to 2022. In 2021, it was the most prevalent kind of identity theft. The only frauds that showed a rise in the reports in 2023 were those involving the official documents, government benefits and phone or utility fraud, with the latter seeing a 2% increase.

These documents are practically hard to forge due to security printing, which adds elements like the holograms, microtext and watermarks. Expert security measures guarantee the authenticity and protection of the documents. It also provides a means of reducing expenses, particularly those brought on by the counterfeit issues and producing documents fast. A variety of alternatives are offered by secure print services to ensure the authenticity of documents and to avoid counterfeiting that might give unauthorized parties access to confidential data.

The data vulnerability and hardware security is likely to limit the growth of the market during the forecast period. Since security printing involves the production of highly sensitive and valuable documents and products, the integrity of the printing process is paramount. Security experts have warned that the printers remain a major source of vulnerability in the companies, especially when the distant workers need printing tools or gain access to the office printers. This warning has been prompted by a wave of printer-related risks in 2023. Unsecure printing processes have resulted in the data losses for the majority of the enterprises. The biggest effects of the data breach, aside from the monetary loss, are missed opportunities to rectify the incident and the disruptions to the corporate operations. One of the other reasons for the data thefts is the risks related to the home printing, such as workers not properly deleting the sensitive data.

Most of the companies do not monitor or record activity on their printers and many might have no idea where the printers are located or what security state or setup they are in. Multifunction printers (MFPs) are also a common investment for the companies due to their convenience, particularly when they are networked. MFPs enable users to access the advanced functionality regardless of their location, whether employees are part of a remote team or connect to the company services locally. However, if unchecked remote access abilities are allowed, a company may be at risk of external cyberattacks.

The protection of the printer itself serves as another issue of print security that is frequently disregarded. The possibility of theft or damage increases when hardware is left in an exposed location. Most of the modern printers have a hard drive that retains copies of the papers that are printed or scanned. This implies that private information could be accessed if the printer was stolen. Therefore, if an efficient labeling technology is not discovered, process standardization may be difficult and this is likely to limit the market growth within the estimated timeframe.

Security printing is evolving from traditional ink and paper-based features to a multilayered system that combines physical and digital authentication. Future opportunities lie in integrating digital technologies such as blockchain, biometrics, and AI to enhance security across a wide range of products and documents beyond just banknotes and IDs. The demand for secure, government-issued documents remains high, driven by the need to prevent identity fraud and comply with international standards. Hybrid documents, which combine physical and digital security elements, are emerging, for example, ID cards with QR codes linked to blockchain-verified digital identities. Similarly, embedding RFID, QR, and NFC tags in product packaging enables smart packaging that enables rapid authentication and enhances consumer trust.

The growing demand from banking and financial sector across the globe is likely to offer a lucrative opportunity for the growth of the security printing services market in the near future. The current digital transformation has completely changed how the organizations and consumers handle their finances. Strong security measures are necessary for every part of the financial operations. Even with strict laws governing data security, traditional printing methods can still be compromised, greatly increasing the risk to the private data. High-level data standards for security help protect client data as well as prevent the data breach threats, though the banking and financial sector is not frequently targeted.

However, it's common to neglect the printers as well as the copiers when thinking about the increased security. Data security is not adequately protected by strong security features in the traditional printing. The need for secure print services is growing as a result of these old printing methods, which frequently lead to misplaced print jobs and inaccurate data. Furthermore, the unauthorized individuals having access to the private documents pose a significant risk to the financial institutions. An additional degree of security is offered by the secure printing solutions, which allow user authentication prior to the document printing. With safe print solutions, printing expenses can be drastically decreased while upholding the strict security standards.

Also, streamlining organizational printing requirements, optimizing new as well as the current print infrastructure to increase the productivity, lower the costs and guarantee document security with complete support and service are all made possible by the managed print services. Through reducing the threat of unwanted access to the sensitive data, this modern security technique protects against the possible data breaches. Easy upkeep, remote tracking and monitoring and a smaller carbon footprint are some of the benefits of the managed print services.

The legal & government documents segment captured a significant market share of 24.79% in 2024. The growing security standards for official documents such as passports, national identification cards, visas and legal contracts is anticipated to augment the segmental growth of the market. For instance, the Regulation (EU) 2019/1157 of the European Parliament and of the Council. By means of this Regulation, the security requirements that apply to identity cards granted by Member States to their people and residence documents granted by Member States to Union citizens and their families in the exercise of their right to free movement are strengthened.

Secure printing is intended to stop counterfeiting while maintaining the legality as well as the authenticity of these kinds of documents. Advanced security elements such watermarks, holograms and microprinting, are essential to the security printing process as they act as trustworthy indicators of authenticity, prevent duplication, and make forgeries very difficult. As a result, governments have an obligation of investing in innovative security printing technology to safeguard individuals from fraud, identity theft and other illegal activity.

Asia Pacific is expected to grow at a fastest CAGR of 6.51% during the forecast period in the global security printing services market. The increasing rate of fake currency is projected to contribute to the growth of the market across the region. The National Crime Control Bureau (NCRB) reports that since 2016, when the Central Bank demonetized the Rs 1,000 and Rs 500 notes, law enforcement authorities across have seized FICN with a face value of Rs 245.33 Crore. Also, according to the May 2022 RBI annual report, in comparison to the previous year, the quantity of counterfeit 500 notes discovered by the financial system more than doubled to 79,669 pieces in the fiscal year 2021–2022. 13,604 pieces of counterfeit notes worth 2,000 were found in the system in 2021–2022, an increase of 54.6% over the previous fiscal year. Furthermore, increased demand for secure documents and products across various sectors such as banking, government, healthcare, and retail is likely to support the regional growth of the market.

North America held largest market shares of 30.89% and is expected to grow at a considerable CAGR of 3.56% during the forecast period. This is due to the growing healthcare industry and demand to combat counterfeit drugs and guarantee the authenticity of medical records and prescriptions across the region. Also, the increasing frauds in passports, ID cards and other official documents are further expected to drive the demand for labels in the years to come. Furthermore, the increasingly aware of the risks associated with counterfeit products is also expected to increase the demand for automotive labeling in the years to come.

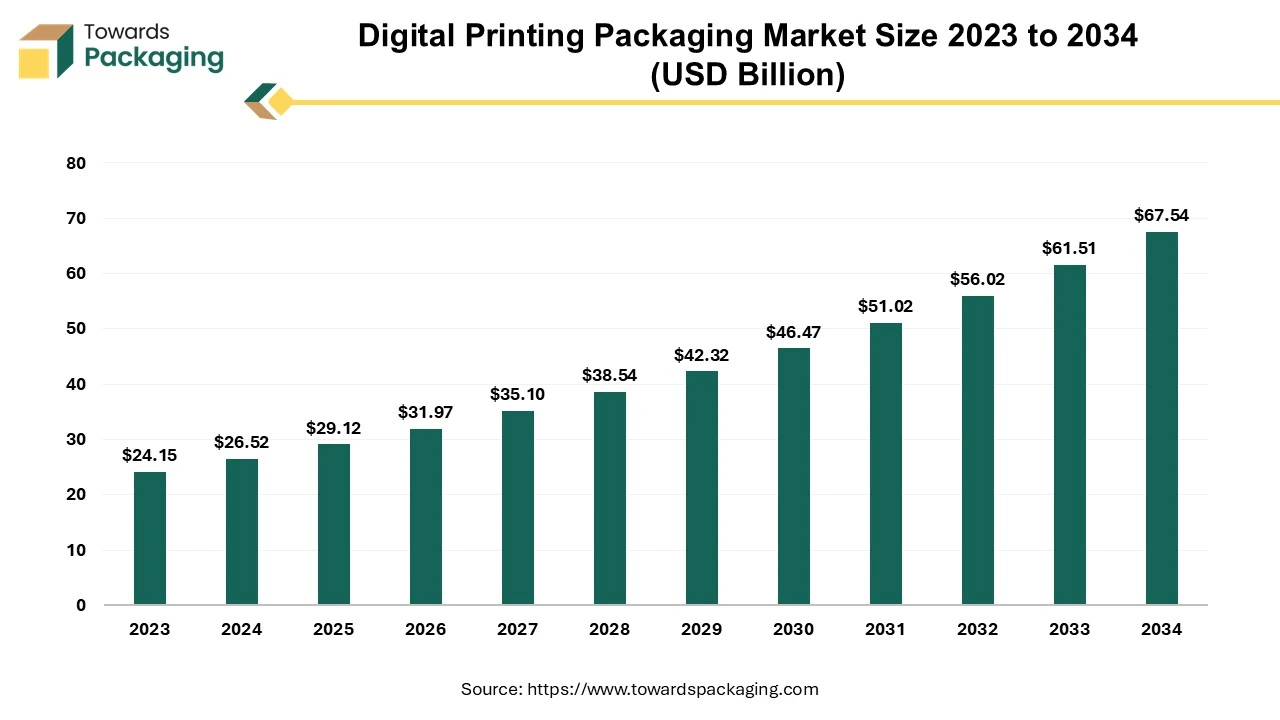

The digital printing packaging market is expected to increase from USD 29.12 billion in 2025 to USD 67.54 billion by 2034, growing at a CAGR of 9.8% throughout the forecast period from 2025 to 2034. The rapid shift toward personalization, smart automation, and eco-conscious solutions is fueling the rise of innovative print formats that meet evolving consumer and industry demands.

Digital printing in packaging involves the direct transfer of a digital file, typically a PDF or JPEG, directly to a printer to apply designs or information onto packaging materials. The segment of the packaging industry that utilizes digital printing technologies for creating packaging materials. In this context, digital printing involves the direct printing of digital-based images onto various packaging substrates such as paper, cardboard, plastic, and others. This approach differs from traditional printing methods like offset and flexography, offering advantages such as shorter print runs, customization capabilities, and quicker turnaround times.

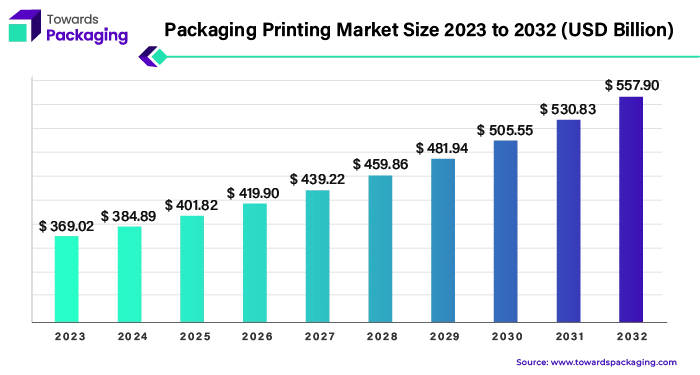

The packaging printing market is anticipated to grow from USD 404.52 billion in 2025 to USD 611.59 billion by 2034, with a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2034.

The market for packaging printing, which includes techniques like rotogravure and flexographic printing, has been expanding significantly as due to of various factors. Flexographic printing is currently used in around 40% of all printed packaging used worldwide, and its use is growing at a pace of about 5% per year. The increasing demand for packaged goods across a range of industries accounts for this growth. A major supermarket often has over 40,000 packaged products on the shelves, all competing for the attention of consumers. When it involves attracting in customers and influencing their decisions for purchase, packaging is important. Packaging provides primarily for goods other than keep them together in place. It helps to properly exhibit, preserve, and safeguard goods.

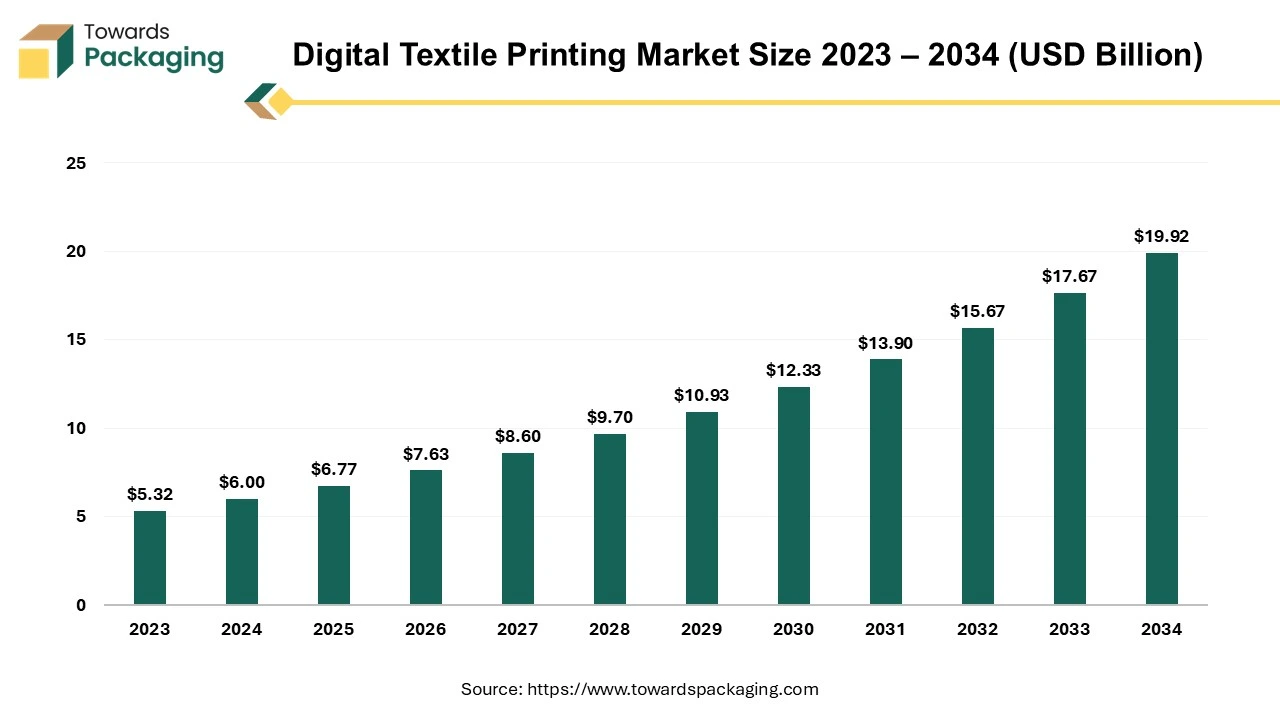

The global digital textile printing market was valued at USD 6.77 billion in 2025, is expected to reach approximately USD 19.92 billion by 2034, growing at a CAGR of 12.75% from 2024 to 2034. Key market players are increasingly adopting inorganic growth strategies, such as mergers and acquisitions, to drive technological advancements and expand their market presence.

Digital textile printing is a process of printing designs onto fabrics utilizing digital technology. Unlike traditional methods such as screen printing, digital printing enables for more precise and versatile printing directly onto the textile. Digital printing allows intricate and detailed designs with unlimited color combinations. It allows for quick changes to designs without the need for extensive setup. Small production runs and custom designs are more feasible with digital printing, making it ideal for personalized items or limited-edition products.

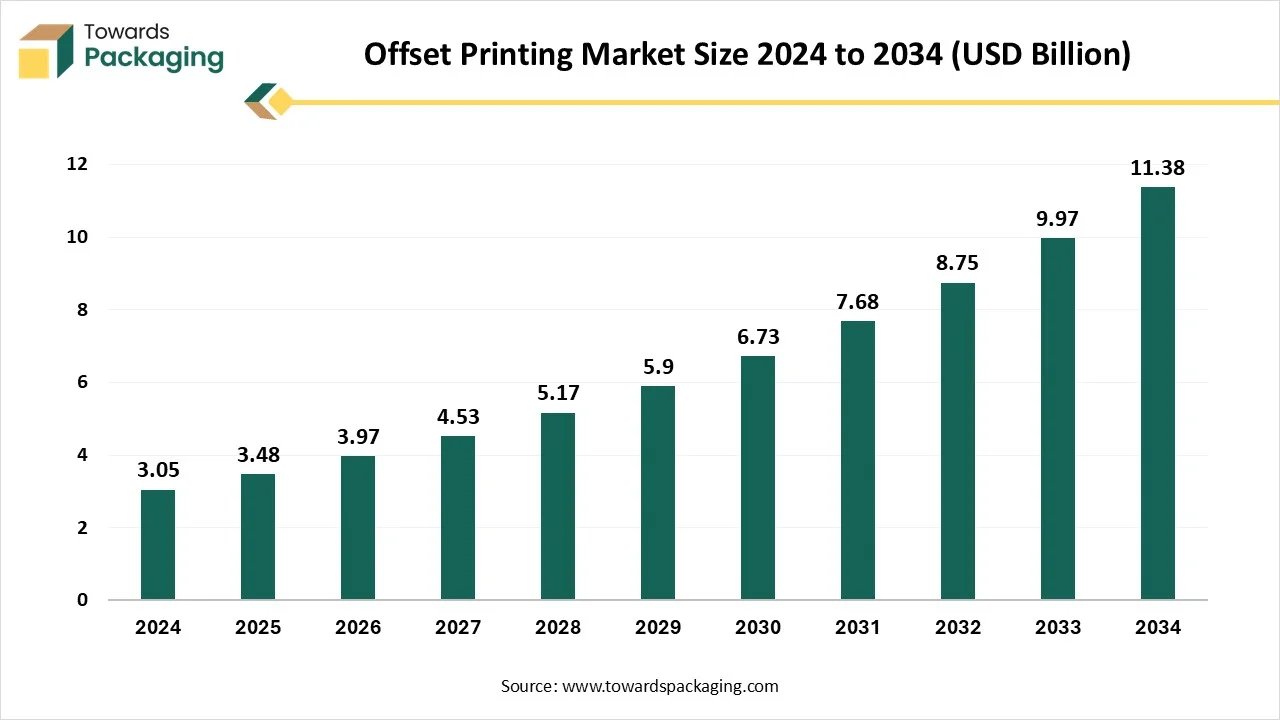

The global offset printing market is anticipated to grow from USD 3.48 billion in 2025 to USD 11.38 billion by 2034, with a compound annual growth rate (CAGR) of 14.13% during the forecast period from 2025 to 2034. The growing demand for high-quality printing solutions in the advertising, packaging, and publishing industries is expected to drive the global offset printing market over the forecast period. The key players operating in the market are focused on adopting innovative technologies to reshape the capabilities and efficiency of offset printing.

The market is also experiencing significant growth, driven by the rapid expansion of the e-commerce sector and growing consumer demand for personalized print products. LCDs continue to dominate the global offset printing market. Sustainability is becoming a key focus, and companies are increasingly adopting eco-friendly practices, such as recycled paper, vegetable-based inks, and waterless printing techniques, to meet environmental concerns. Additionally, the market is expanding in emerging regions, particularly Asia Pacific, fuelled by rapid economic growth and ongoing technological enhancements that boost both productivity and efficiency.

Offset printing, also commonly known as offset lithography. This method uses a sequence of rotating cylinders to stamp ink onto the receiving media, mostly paper. Offset printing is a multi-step process that widely uses etched metal plates, water-repellent inks, blanket cylinders, water, and impression cylinders. It is a method used to print longer runs of books, magazines, brochures, manuals, direct-mail pieces, posters, letterhead, paper-based labels, and packaging. In offset printing, each color of the print is applied separately, mainly depending on the four colors, such as magenta, cyan, yellow, and black. The offset printing method’s efficiency makes it most preferable for print orders of more than 1,000 copies.

By Application

By Region

November 2025

November 2025

December 2025

November 2025