February 2025

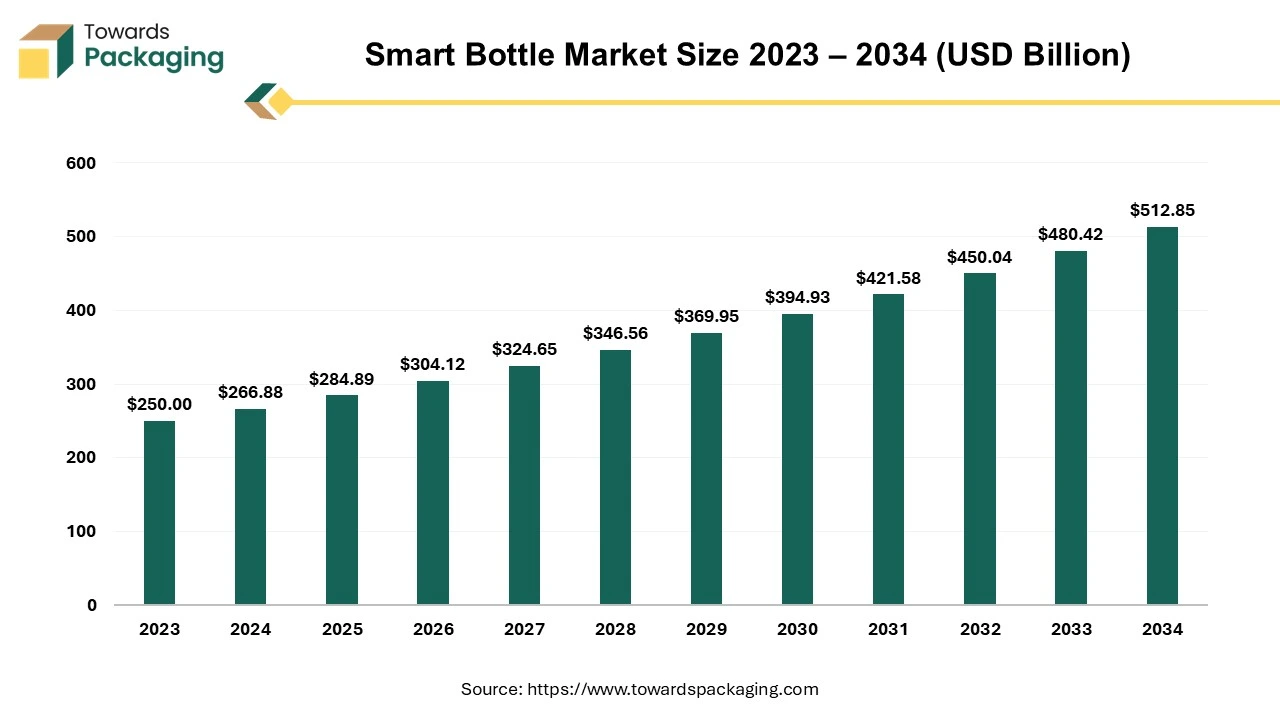

The global smart bottle market size reached USD 266.88 billion in 2024 and is projected to hit around USD 512.85 billion by 2034, expanding at a CAGR of 6.75% from 2025 to 2034. Key market players are actively adopting inorganic growth strategies, such as acquisitions and mergers, to enhance technological advancements in smart bottle manufacturing. These efforts are expected to drive market expansion throughout the forecast period.

Unlock Infinite Advantages: Subscribe to Annual Membership

Smart bottle has technology utilized to track water intake and provide reminders to stay hydrated. A smart bottle refers to a bottle equipped with technology, such as sensors, Bluetooth connectivity, or smartphone app integration, designed to offer advanced features beyond traditional bottles. Smart bottles are commonly used for hydration tracking, fitness, or health-related purposes.

Modern smart bottles are leveraging the Internet of Things (IoT) to offer features such as hydration tracking, reminders, and seamless integration with smartphones, fitness trackers, and smartwatches. This connectivity allows users to monitor their hydration habits, set personalized goals, and receive real-time notifications, enhancing the overall user experience.

Innovations in sensor technology have enabled smart bottles to provide real-time data on water consumption, temperature, and even water quality. These sensors can sync with mobile applications, allowing users to monitor their daily hydration levels and receive timely reminders to stay hydrated.

With a growing emphasis on preventive healthcare, consumers are increasingly adopting smart bottles to monitor and improve their hydration habits. Features like hydration tracking, drinking reminders, and integration with health apps are becoming standard, catering to health-conscious individuals aiming to maintain optimal hydration levels.

Beyond general consumer use, smart bottles are gaining traction in medical settings. They are utilized to monitor patient hydration, manage medication intake, and assist in recovery processes, particularly for individuals with chronic conditions or those recovering from surgery. This expansion highlights the versatility and growing importance of smart bottles in healthcare.

As environmental awareness increases, manufacturers are focusing on creating smart bottles using eco-friendly materials and promoting reusable designs. This approach not only appeals to environmentally conscious consumers but also aligns with global efforts to reduce plastic waste and promote sustainability.

AI algorithms can analyze user-specific data such as age, weight, activity level, location (weather), and health goals to provide tailored hydration recommendations. This makes smart bottles more appealing to health-conscious consumers. AI can process data from sensors in real time to provide instant feedback on hydration levels, liquid temperature, or water quality. This capability allows users to make immediate adjustments and ensures accuracy in tracking hydration habits.

AI can identify patterns in user behavior and predict future hydration needs. For instance, if a user tends to forget to drink water in the afternoon, the smart bottle can proactively increase reminder frequency during that time. AI-powered smart bottles can sync with health and fitness apps to provide insights into overall wellness. For example, hydration data can be combined with workout and sleep patterns to create comprehensive health reports.

AI can monitor the health of smart bottle components (like sensors and batteries) and predict when maintenance or replacements are needed, increasing product longevity and customer satisfaction. AI-driven customer insights can help companies target their audience more effectively, create personalized marketing campaigns, and enhance user retention with tailored recommendations.

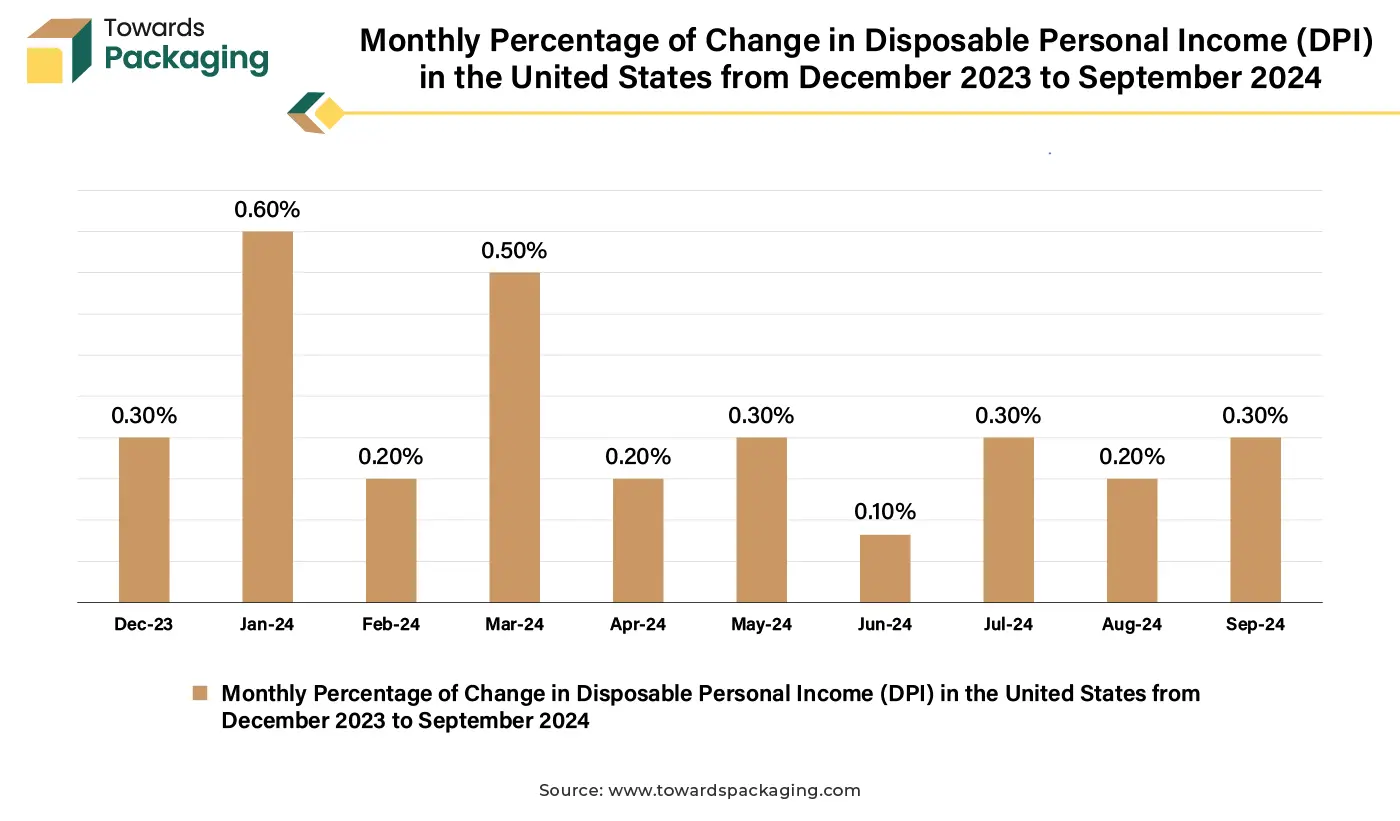

With rising disposable incomes, consumers are more willing to spend on premium, tech-enabled products like smart bottles. Due to increase in disposable income the expenditure on luxury and premium products has risen, which has estimated to drive the growth of the smart bottle market. As disposable income rises, consumers are more likely to invest in lifestyle-enhancing products, including smart bottles, which are typically priced higher than regular bottles.

Higher income levels reduce price sensitivity, making advanced products with technological features more accessible to a broader audience. A rise in disposable income allows people to prioritize health and wellness. Smart bottles, which promote better hydration habits and support fitness goals, cater to this increasing focus on self-care. Rising income levels, especially in urban areas, lead to lifestyle upgrades, including the adoption of smart devices that simplify daily tasks and enhance convenience.

People with higher disposable incomes are more open to trying new and innovative products, creating an opportunity for smart bottle brands to capture their attention through marketing and unique features. Brands targeting high-income groups with attractive designs, eco-friendly materials, and advanced features can capture a larger market share as disposable incomes rise. India's disposable income hit a record high in 2024. By the end of 2024, India's disposable income is expected to reach 31,713,013,000 USD million, according to Trading Economics.

The key players operating in the market are facing issue due to complex manufacturing technology, battery life and maintenance issues, which has estimated to restrict the growth of the smart bottle market in the near future. Many consumers are still unaware of smart bottles and their benefits, particularly in less technologically advanced or rural areas. The advanced features of smart bottles, such as app integration and sensor usage, can intimidate or confuse less tech-savvy users. If the technology is not user-friendly, it can lead to poor adoption rates.

Many smart bottles rely on batteries or require regular charging, which can be inconvenient for users. Over time, battery degradation or malfunctioning sensors can reduce the functionality and appeal of the product. Regular reusable bottles are far cheaper, more durable, and widely available, providing stiff competition for smart bottles.

Smart bottles are finding applications in healthcare for monitoring hydration in patients, managing medication schedules, and aiding recovery processes. They are particularly useful for the elderly or individuals with chronic conditions.

Educational campaigns about the negative health effects of dehydration, such as fatigue, reduced productivity, and kidney issues, drive demand for hydration-focused products like smart bottles. Rising awareness about the importance of staying hydrated for overall health is encouraging consumers to adopt smart bottles with features like hydration tracking and reminders. Increased focus on fitness and preventive healthcare has made smart bottles popular among health-conscious individuals and athletes.

The metal segment held a dominant presence in the smart bottle market in 2024. Metal bottles, typically made of stainless steel or aluminum, are highly durable, resistant to dents, and can withstand rough handling, making them ideal for everyday and outdoor use. They have a longer lifespan compared to plastic smart bottles, reducing the need for frequent replacements. Metal smart bottles often come with double-wall insulation technology that keeps beverages hot or cold for extended periods. This feature appeals to users who want temperature control, particularly for outdoor activities, work, or travel.

Metal smart bottles are reusable and made from recyclable materials, aligning with the growing preference for eco-friendly and sustainable products. They help reduce single-use plastic waste, attracting environmentally conscious consumers. Their durable structure makes them ideal for embedding such technologies without compromising usability. Metal bottles are versatile and can be used for water, coffee, tea, or even carbonated drinks, making them multifunctional.

The USD 20-USD 40 segment led the global smart bottle market. USD 20 to USD 40 is affordable for most middle-income consumers, making these bottles accessible to a larger audience. This price range offers an entry point for people looking to invest in smart technology without feeling like they’re overspending on a bottle. Consumers aiming to maintain hydration habits or integrate tech into their daily routines find this price point attractive. It is a comfortable price to experiment with smart technology, especially for first-time buyers. At this price, bottles are often made with durable materials like stainless steel or BPA-free plastics, offering quality and longevity without pushing into luxury territory.

The water bottle segment accounted for a considerable share of the smart bottle market in 2024. Water is the most consumed beverage worldwide, making a smart water bottle a product with universal appeal. Staying hydrated is essential for health, and smart bottles help users monitor and maintain their daily water intake effectively. Growing awareness about the benefits of proper hydration, such as improved energy, skin health, and cognitive performance, has increased demand for water-tracking devices.

Smart water bottles offer features like hydration reminders and goal-setting, aligning with these trends. Water is consumed in various settings, such as homes, offices, gyms, and outdoor activities, making smart bottles for water applications versatile and widely usable. Many smart bottles include temperature control or insulation, making them suitable for cold or hot water consumption across different climates and preferences.

The direct retail sales segment registered its dominance over the global market in 2024. Selling directly to consumers allows brands to engage with their customers more effectively, provide personalized experiences, and offer tailored product recommendations. Retail channels provide a direct line of communication with customers, making it easier for brands to gather feedback and improve product offerings.

By selling directly to consumers (via online stores or physical locations), companies avoid distributor or retailer markups, leading to higher profit margins. Direct sales allow brands to maintain consistent pricing, promotions, and discounts, ensuring better control over their revenue. Direct sales allow companies to build stronger brand recognition and loyalty by managing the entire customer experience. Retailers can implement their own marketing strategies, promotions, and loyalty programs to retain customers and encourage repeat purchases. Direct sales allow brands to control inventory and shipping, improving logistics efficiency and customer satisfaction.

North America region dominated the global smart bottle market in 2024. North America has a large base of people who participate in outdoor sports, hiking, cycling, and other physical activities where smart bottles are especially useful. Many consumers use fitness trackers, and smart bottles that integrate with these devices help track hydration as part of overall fitness goals. Many smart bottle brands partner with both physical and online retailers across North America, ensuring widespread availability in stores and websites. Major retail chains in the U.S. and Canada, such as Target and Walmart, stock these products, increasing visibility and reach. North American markets are characterized by strong consumer spending, which directly supports the purchase of high-tech lifestyle products like smart bottles.

Asia Pacific region is anticipated to grow at the fastest rate in the smart bottle market during the forecast period. Asia Pacific region is undergoing significant urbanization, particularly in countries like China, India, and Southeast Asia, which leads to increased demand for modern lifestyle products such as smart bottles. The growing middle class in Asia Pacific region is seeing higher disposable incomes, making smart bottles more accessible to a larger consumer base. Rising health awareness, especially in countries like China and India, is driving the adoption of products that promote healthy living.

Smart bottles, which help users track hydration, align with the region's growing focus on health and fitness. Many APAC countries are experiencing a boom in fitness culture, with consumers investing in products that support their workout routines and overall well-being, including smart bottles. In countries like India, China, and Australia, outdoor activities such as hiking, biking, and running are becoming more popular. Smart bottles cater to these activities by offering features like hydration reminders, temperature control, and easy portability.

By Type

By Price Range

By Application

By Sales Channel

By Region

February 2025

February 2025

February 2025

February 2025