April 2025

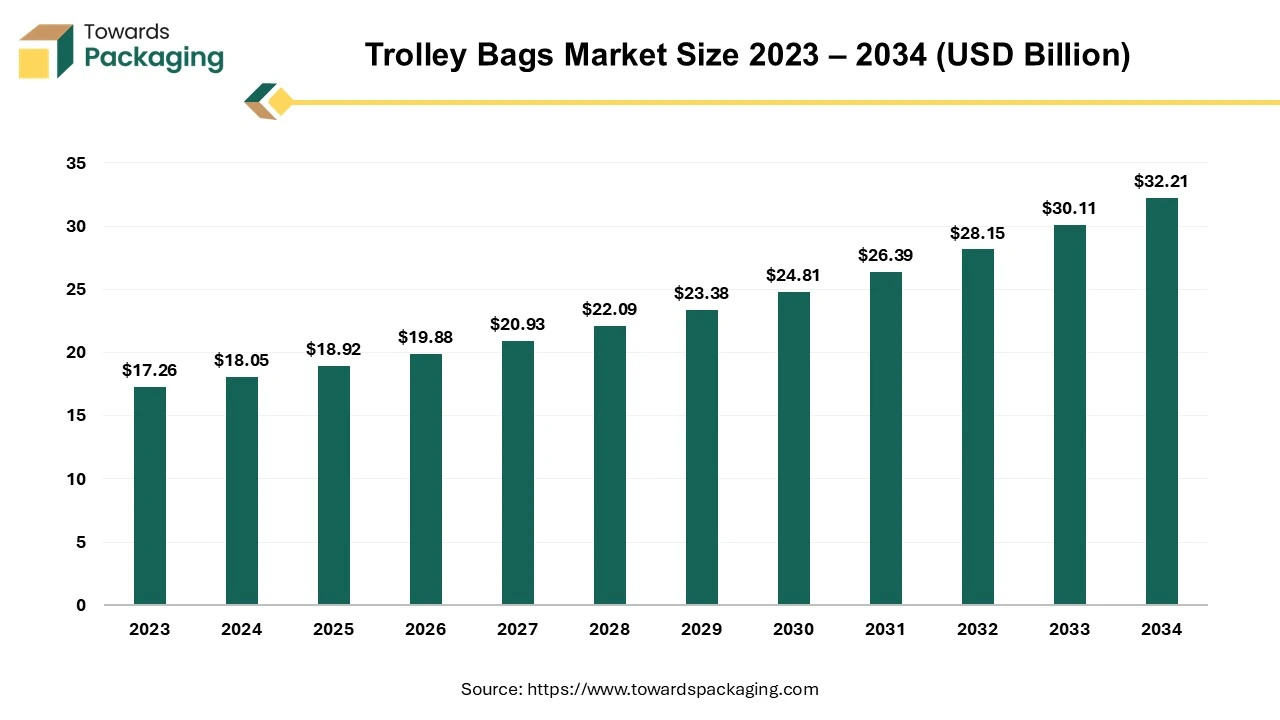

The global trolley bags market size was evaluated at US$ 18.05 billion in 2024 and is expected to attain around US$ 32.21 billion by 2034, growing at a CAGR of 5.85% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The trolley bags market is expected to grow at a substantial rate during the forecast period. Trolley bags are wheeled luggage that is designed for easy transportation, commonly utilized for travel, business trips and also for the daily commuting. They consist of extendable handles and durable wheels that help users to move them effortlessly without carrying the heavy loads. Available in various sizes, materials, and designs, trolley bags suits different travel needs, from short trips to the long vacations. They come in hard-shell and soft-shell variants made-up of materials like polycarbonate, ABS plastic and fabric guaranteeing durability and flexibility. Modern trolley bags frequently comes with features such as TSA locks, expandable compartments and smart technology like GPS tracking and USB charging ports. With the growing travel demand and evolving consumer preferences, trolley bags have become an essential accessory for convenience, organization as well as style.

The rising travel and tourism worldwide along with the growing urbanization and changing lifestyles is expected to augment the growth of the trolley bags market during the forecast period. Furthermore, the advancements in the materials and technology such as polycarbonate shells, anti-theft features, GPS tracking and USB charging as well as the increasing brand awareness and marketing strategies by key players are also anticipated to augment the growth of the market. Additionally, the expanding airline travel and baggage policies as well as the growing disposable incomes coupled with the rise of the e-commerce and digital retail platforms is also projected to contribute to the growth of the market in the near future.

The growth of the global travel and tourism owing to the rising disposable incomes and expansion of the budget airlines and competitive airfare pricing as well as the increase in the infrastructure development, visa relaxations and tourism campaigns is anticipated to support the growth of the trolley bags market during the estimated timeframe. The most recent World Tourism Barometer from UN Tourism estimates that 1.4 billion tourists traveled overseas in 2024, representing a nearly complete (99%) recovery from pre-pandemic levels.

The strong post-pandemic demand, solid performance from major source economies, and the continued rebound of destinations in Asia and the Pacific are the main drivers of this 11% rise in international tourist arrivals compared to 2023, or 140 million more visitors. Strong demand that supports the socioeconomic development of both established and future locations is predicted to fuel the rise through 2025.

As international and domestic travel for business and recreation grows, so does the demand for functional luggage. For corporate trips, business people need elegant segmented trolley bags but leisure travelers want spacious, secure as well as visually pleasing holiday options. Trolley bag manufacturers are innovating with lightweight materials guaranteeing continued market expansion within the estimated timeframe.

The frequent changes in the airline baggage policies are anticipated to hamper the growth of the trolley bags market during the estimated timeframe. Nowadays, airlines enforce both weight and size restrictions far more severely than they did in the past. Many airlines have posted bag sizes at their gates, and bags are measured at check-in. Carry-on luggage should, in general, not exceed 22 inches (56 cm) in length, 18 inches (45 cm) in breadth, and 10 inches (25 cm) in depth. Wheels, side pockets, handles and other features are incorporated in these measurements.

Also, certain flights have weight restrictions, usually beginning at 5 kg/11 lbs. Due to this, there is less demand for massive, heavy-duty baggage, which has an impact on sales for companies who make larger bags. Also, many of the low-cost carriers (LCCs) now charge additional fees for checked baggage, prompting passengers to travel light and fit all their essentials into carry-on-compliant trolley bags.

Furthermore, the quantity of liquids, aerosols and gels that can be carried in carry-on luggage is restricted by security requirements. Governments are increasingly adopting the regulations established by the United Nations' aviation standard-setting body, the International Civil Aviation Organization. According to the ICAO's current regulations, which are in effect in the majority of countries, aerosols, liquids as well as gels must be in 100 ml or similar containers and kept in clear, resealable plastic bags with a maximum volume of one liter.

Additionally, different airlines have differing baggage allowances, which cause uncertainty among passengers and influence their luggage selection. For example, one airline may accept 21-inch cabin bags while another limits them to 19 inches, which makes it difficult for the customers to purchase a one-size-fits-all trolley bag. As airlines continue to implement cost-cutting baggage rules, the trolley bag market faces obstacles in expansion, forcing organizations to focus on regulation-friendly designs to maintain growth.

The steady increase in corporate and business travel worldwide attributed to the expanding trade relations and the rise of the multinational corporations along with the improved airline connectivity is likely to augment the growth of the trolley bags market in the years to come.

Furthermore, although projected business travel expenditures vary by region, they are generally positive, with 48% of respondents projecting higher volume and 57% higher spending in 2025 compared to 2024. With 63% of respondents saying they intend to spend "more" or "a lot more" in 2025, Asia Pacific travel buyers exhibit the highest levels of optimism, followed by North American travelers (57%). When it comes to expected trip volume and expenditure, European consumers are a more conservative. While half (50%) of the European purchasers predict "more" or "a lot more" spending, only one-third (37%) of them foresee increasing travel volume, the lowest of any region. As the companies expand globally along with the increase in business travel spending, it is expected to create demand for trolley bags designed specifically for business needs in the near future.

The integration of Artificial Intelligence (AI) in the trolley bags market is redefining travel convenience by introducing smart, tech-enabled luggage that improves the security, efficiency as well as the user experience. To improve accuracy and efficiency, AI is also being incorporated into luggage handling procedures. These systems detect and manage the luggage during its trip utilizing a variety of technologies such as computer vision, machine learning algorithms, and radio-frequency identification (RFID). AI-powered trolley bags now come equipped with GPS tracking, biometric locks, auto-follow technology, weight sensors and USB charging, suiting to modern travellers’ needs. For instance

Arista Vault's Follow Me Smart Luggage is transforming travel with its hands-free design. Follow the buyer with ease for 10 kilometres, ride for 5 km and has a 33L capacity. Smooth mobility is guaranteed by sophisticated AI sensors that prioritize security. A strong 2Nm torque supports speeds of up to 12 km/h.

Similarly, the Ovis Smart Luggage Followed Me is a smart bag that uses artificial intelligence to drive itself. While allowing the owner to have their hands free, it will follow them around the terminal, train station, or sidewalk. With the help of the sensors, it can follow the owner around at their walking pace without running into anything.

Beyond product innovation, artificial intelligence is altering the customer interactions and corporate operations. Brands utilize AI to personalize marketing, predictive analytics and virtual assistants, helping customers in finding the appropriate trolley bag based on their travel habits as well as interests. Artificial intelligence based chatbots and recommendation engines improve the online shopping experience, while automated supply chain management increases the inventory accuracy and shipping efficiency. Leading manufacturers are investing extensively in the AI tech, pointing to a future in which trolley bags are more than simply accessories, but intelligent travel companions that improve security, convenience and complete the travel experience.

The hard-shell segment held largest share of 72.18% in the year 2024. The strong and long-lasting polycarbonate utilized to make the hard-shell suitcase functions as an outer layer of protection. This travel bag is resistant to harm from rough luggage handling because of its sturdy material. It protects the priceless possessions and breakable objects. As a result, the hard-shell suitcase is very durable. It is also resistant to deterioration.

The hard-shell suitcase is also ideal for the formal trips. It gives any formal attire a dash of elegance as well as modernism. Hard-shell suitcases feature an elegant look and a contemporary style. The hard-shell suitcases also have zippers for fastening. To further secure the valuable possessions, many of them additionally feature an extra numerical lock mechanism. The above mentioned factors are expected to support the growth of the segment during the forecast period.

The specialty stores segment held largest share of 41.39% in the year 2024. This is due to the personalized shopping experiences, premium product availability as well as the expert guidance. Unlike general retail stores, specialty stores focus solely on luggage and travel accessories, guaranteeing a wide selection of trolley bags. Customers benefit from personalized assistance, helping them to choose the right luggage based on their travel needs, durability preferences and airline regulations.

Furthermore, the availability of customization services such as engraving, monogramming, and accessory add-ons is also likely to support the growth of the segment in the global market. Additionally, the strong presence of leading brands and high-footfall locations along with the accessibility to new arrivals and limited editions is expected to contribute to the segmental growth of the market during the forecast period.

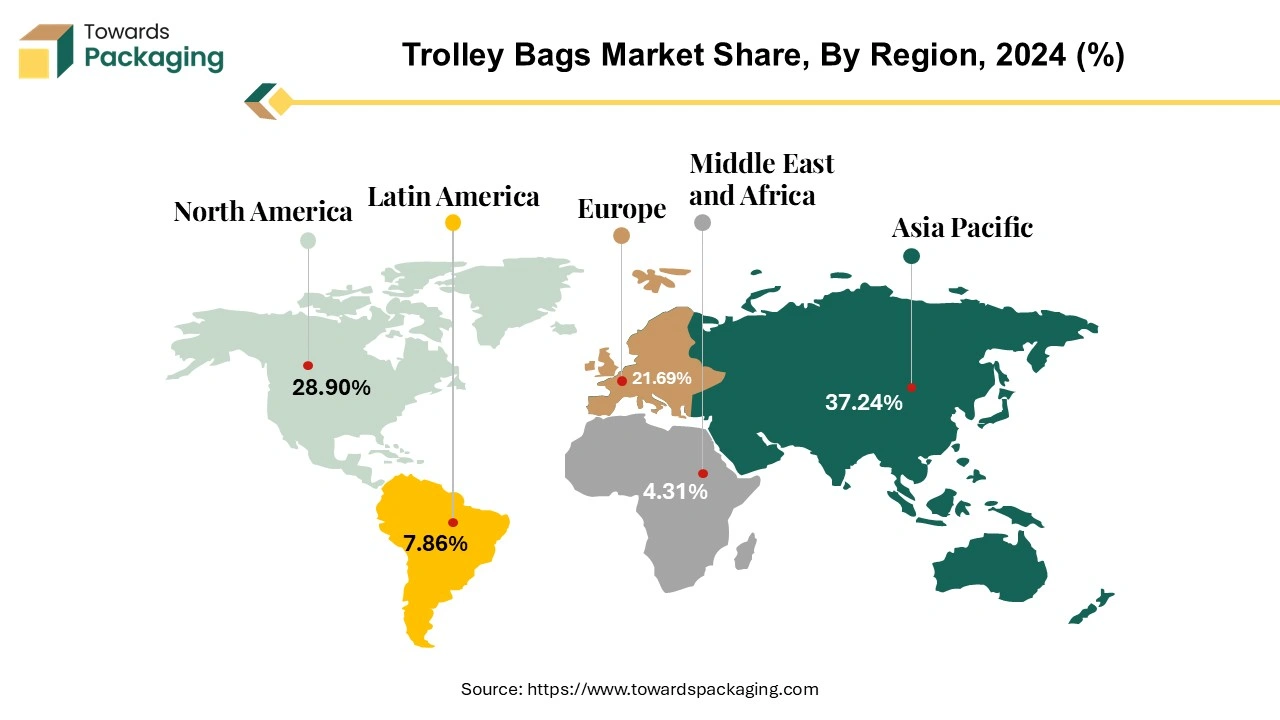

Europe held considerable market share of 21.69% in the year 2024. This is due to the open borders, Schengen agreements and a strong tourism industry across the region. According to the Eurostat's estimates, 62% of EU citizens who are 15 years of age or older traveled for personal reasons in 2022, meaning they completed at least one trip for leisure, vacation, or visiting friends and family. With 271 million nights spent in tourist accommodations in 2022—or 22% of all EU nights—Spain was the most popular EU destination for foreign visitors.

Additionally, the rising trend of short city breaks, weekend escapes coupled with the domestic tourism are also further expected to contribute to the regional growth of the market. Also, the existence of the major financial hubs like London, Paris, Frankfurt and Zurich are also expected to support the regional growth of the market.

Asia Pacific is likely to grow at a considerable CAGR of 7.77% during the forecast period. This is due to the growing middle-class population with higher purchasing power in India, China and Southeast Asian countries. According to the National Bureau of Statistics, the median disposable income per capita in China in 2022 increased by 4.7 percent year over year and reached RMB 31,370.

Additionally, the rapid globalization and expansion of multinational corporations are also expected to contribute to the regional growth of the market. Furthermore, the improved transport networks, airport expansions and better connectivity are likely to contribute to the regional growth of the market.

By Product Type

By Price Range

By Distribution Channel

By Region

April 2025

April 2025

April 2025

March 2025