April 2025

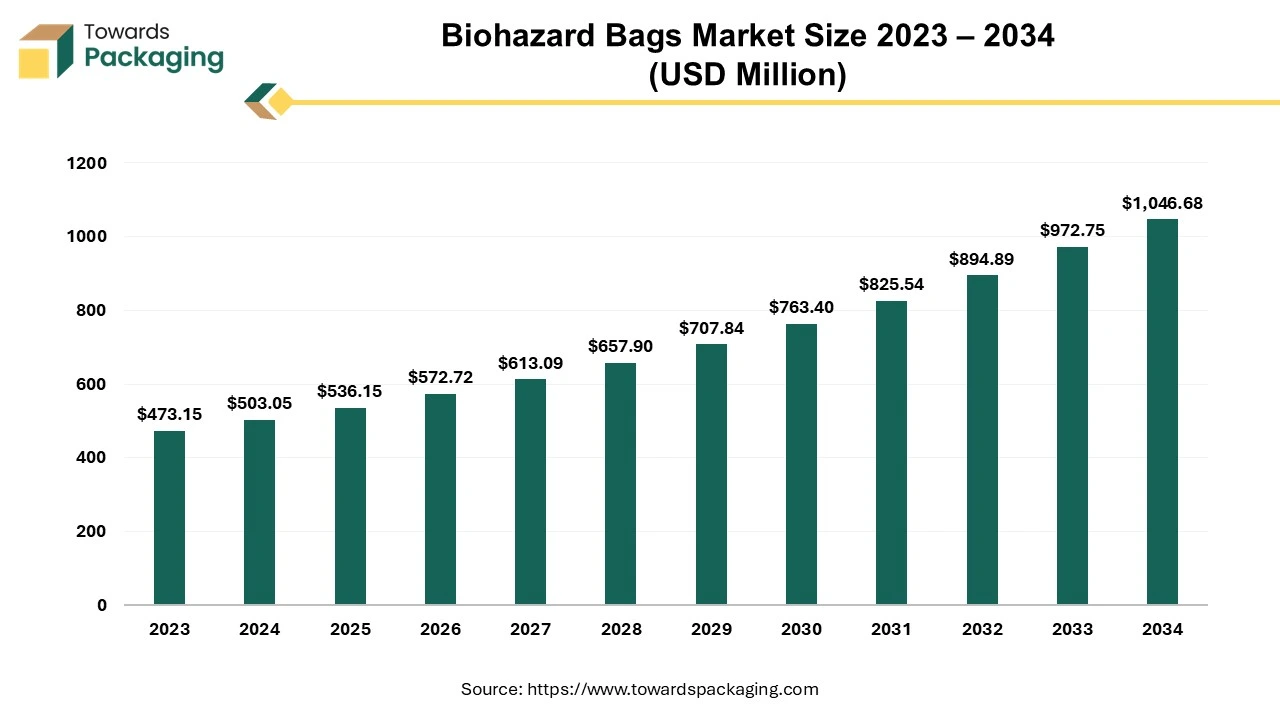

The biohazard bags market is projected to reach USD 1046.68 million by 2034, expanding from USD 536.15 million in 2025, at an annual growth rate of 7.60% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The biohazard bags market is expected to witness significant growth in the coming years. Biohazardous waste materials that represent a risk to human health or are possibly contagious are disposed of in biohazard bags. Biohazardous waste could be bodily tissues or fluids, or objects tainted by bodily tissues or fluids. To make it easier for trash disposal workers to recognize the type of waste contained within and how to dispose of it, biohazard waste bags are colored differently. Medical waste is often separated using red and yellow biohazard bags. Depending on the products and uses, there are numerous guidelines and limitations when it comes to using biohazard bags.

The expansion of the global healthcare and diagnostic sectors coupled with the rising prevalence of the chronic diseases are expected to augment the growth of the biohazard bags market during the forecast period. Furthermore, the stringent government regulations and compliance requirements for the safe handling and disposal of biomedical waste are also anticipated to augment the growth of the market. Additionally, the surge in home healthcare services and self-diagnostics and the increasing frequency of infectious disease outbreaks as well as the growing awareness about waste segregation practices are also projected to contribute to the growth of the market in the near future.

The regulatory landscape for the biohazard bags market is shaped by stringent global, regional and local regulations aimed at guaranteeing safe handling, transportation as well as disposal of the biohazardous waste. These regulations not only drive demand for high-quality, compliant products but also shape the innovation and manufacturing practices within the market.

International Standards To guarantee proper control and disposal, the biological waste treatment is regulated by various international standards. Guidelines for the safe treatment of the biomedical waste are provided by the organizations such as United Nations Environment Programme (UNEP) and the World Health Organization (WHO). To stop the spread of the illnesses as well as maintain the environment, it is fundamental that these international criteria be followed.

National Legislation Laws and regulations pertaining to the management of the biological waste vary from nation to nation. By doing this, each country can modify its rules to fit its own requirements and as per the capacities. Biomedical waste segregation, storage, transportation and disposal are frequently governed by the national laws. For waste management firms and healthcare facilities, compliance to these laws is not only required, but also important.

Classification and Segregation The objective of these rules is to protect the environment along with the people who come in touch with these toxic substances. Segregation of the waste must occur at the source of generation, not later. All of the wards and waste storage space should have posters or signs about the segregation of the biomedical waste. There should be a sufficient quantity of color-coded bins, containers, and bags at the location where biomedical waste is generated.

Collection & Storage The waste should be collected in a leak-proof, solid-walled container that has been coated with an autoclavable biohazard bag. The biohazard sign must be displayed on the container and it must have a cover. When the container is not being used, it must be closed. When the bag is full, it should be moved to the floor container and quickly secured. To avoid bag punctures throughout the waste handling procedure, collect the serological pipettes separately.

Treatment & Disposal Before being transported to the specified biohazardous waste pickup location, bags should be properly sealed and kept in a suitable secondary container that is resistant to leaks. (To avoid leaks during handling, bulky bags should be double-bagged.) When treating bagged garbage on-site, a known autoclave cycle that has been verified to effectively sterilize this waste must be used.

The market for biohazard bags is bound to a complicated regulatory framework. Biohazardous waste management techniques will develop along with healthcare, with an increasing focus on both innovation and sustainability. The issues of disposing of biohazardous waste in the future will require proper education, commitment to rules, and the utilization of innovative technology.

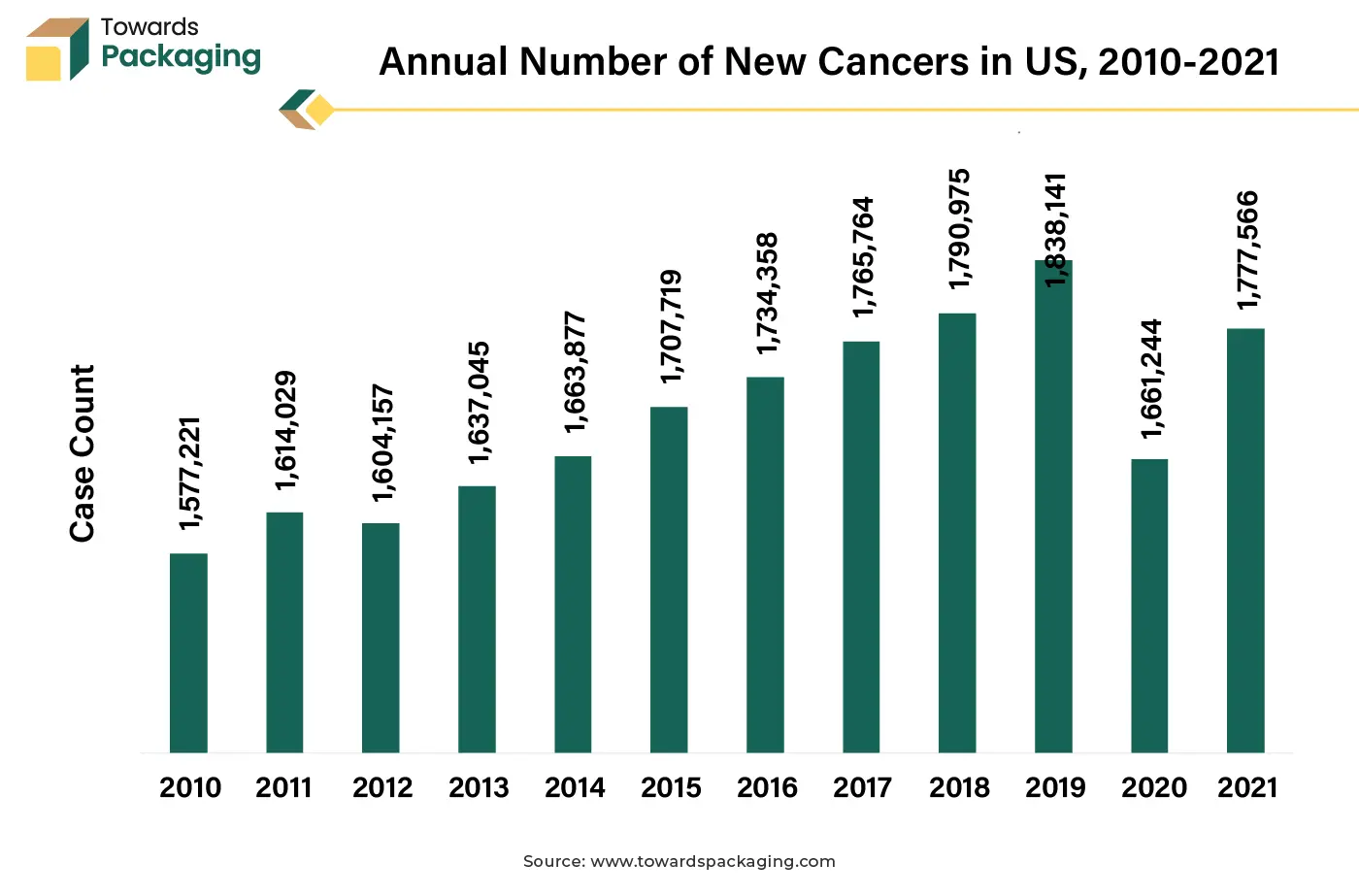

The rising prevalence of chronic and infectious diseases due to the aging global population and escalated rates of hypertension as well as environmental factors is anticipated to augment the growth of the biohazard bags market during the forecast period. According to the World Health Organization, Noncommunicable diseases (NCDs) account for 74% of all deaths worldwide, killing 41 million people yearly. The majority of NCD deaths, 17.9 million per year, are due to the cardiovascular illnesses, followed by cancer (with 9.3 million), chronic respiratory conditions (with 4.1 million) and diabetes (with 2.0 million). Also, as per Centers for Disease Control and Prevention, 1,777,566 new cases of cancer were identified in the US in 2021. There were 439 new cases of cancer recorded for every 100,000 persons.

Furthermore, as per the World Health Organization, approximately 39.0 million individuals worldwide were predicted to be HIV positive at the end of 2022, with 37.5 million of them being 15 years of age or older and 1.5 million being children under the age of 15. Also, in 2022, a projected 10.6 million individuals worldwide contracted tuberculosis (TB), with 33% of those affected being women, 55% being men, and 12% being children under the age of 15. Such diseases need regular medical attention, tests and therapeutic interventions. These activities result in the disposal of items such as syringes, blood bags, test kit, and other potentially hazardous materials, all of which requires safe segregation as well as disposal with the utilization of biohazard bags. Consequently, the demand for biohazard bags for safe handling and disposal continues to surge.

The inconsistent waste management infrastructure is expected to hinder the growth of the market within the estimated timeframe. Only 61% of hospitals in 2021 provided basic health-care waste services, according to WHO/UNICEF. In fragile environments, the problem is far worse; according to statistics from 2023, just 25% of the healthcare institutions provide basic health waste disposal services. Medical waste (MW) generation in the healthcare facilities has substantially increased in response to the contemporary facilities and technological advancements. After radiation, the MW is regarded as the second most dangerous waste in the world. Even though hazardous MW makes up just 10% to 25% of all waste, improper handling of this waste can result in a number of problems such as the spread of infectious diseases, contaminated neighborhoods, and various kinds of environmental deterioration.

A number of additional challenges to the current medical waste management policies and procedures around the world were posed by the COVID-19 epidemic. Due to their limited resources and ineffective management, emerging economies are having difficulty managing waste properly and efficiently. Additionally, MW incineration is frequently given precedence over recycling. Emerging economies do not yet have access to several eco-friendly methods of disinfection and disposal like chemical disinfection, autoclaving, pyrolysis, microwaves, etc. This is why an extensive amount of experts have identified the MWM as a key issue in the context of emerging economies. In some cases, hospitals and clinics may not even have access to certified biohazard bags, resorting to non-compliant alternatives that fail to meet safety standards and this is further likely to limit the market growth.

The expansion of the global healthcare and diagnostic sectors presents a substantial growth opportunity for the biohazard bags market. The rapid advancements in the medical technology coupled with the increasing healthcare access, have led to the establishment and expansion of the new hospitals, clinics, and diagnostic laboratories across the world. For instance

These facilities generate substantial amounts of biomedical waste such as infectious materials, sharps along with the other hazardous waste, demanding effective disposal options such as biohazard bags. Additionally, the growing focus of healthcare sector on the regulatory compliance and infection control is further likely to increase the demand for certified biohazard bags in the years to come.

The polyethylene segment held largest market share of 61.18% in 2024. This is due to its properties such as durability, flexibility and resistance to the moisture and chemicals. The most popular materials used for biohazard bags are high-density polyethylene (HDPE) and low-density polyethylene (LDPE), which provide a combination of strength and cost-effectiveness, making them suitable for the safe containment and disposal of medical waste. Furthermore, the material's recyclability corresponds with the growing demand for sustainable waste management procedures, making it an eco-friendly option for healthcare organizations looking for ways to minimize their environmental imprint. The low cost of HDPE when compared to the competing materials makes it an appealing choice.

The hospitals & clinics segment held largest market share of 56.21% in 2024. This is owing to the high volume of biomedical waste generated by these facilities, which operate at the forefront of the patient care. Hospitals and clinics handle diverse medical procedures like surgeries, diagnostic tests and treatments for various diseases that produce hazardous waste requiring proper containment and disposal. Furthermore, the rise in healthcare infrastructure development as well as the expanded number of hospitals and clinics is also expected to contribute to the segmental growth of the market. Additionally, the strict regulatory requirements mandating proper waste segregation and disposal practices in healthcare facilities is also expected to support the growth of the segment in the global market in the years to come.

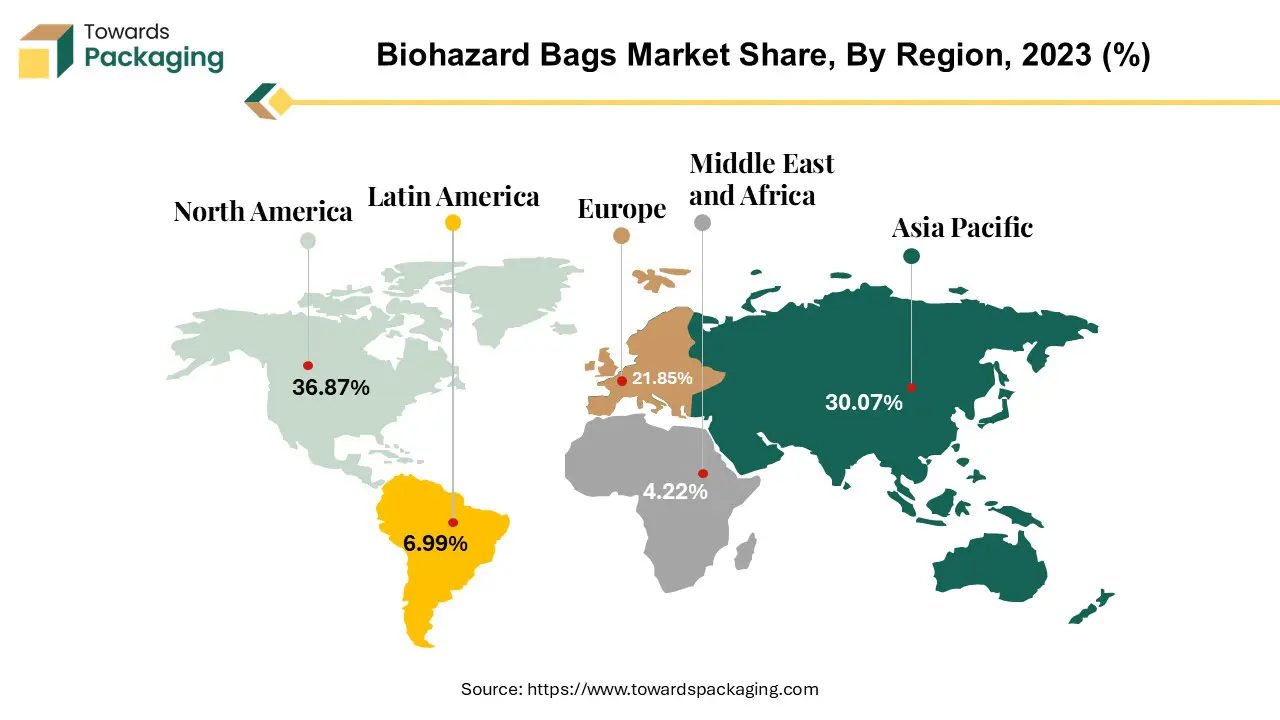

Asia Pacific is likely to grow at fastest CAGR of 9.91% during the forecast period. This is due to the increasing biohazard waste across the region. As per the annual report on Biomedical Waste Management by Central Pollution Control Board, About 705 tonnes of biomedical waste were produced daily in India in 2022; 645 tons of that were treated and disposed of by CBWTFs (Common Biomedical Waste Treatment Facilities) and captive treatment facilities. Also, the large and growing population combined with increasing urbanization is likely to contribute to the regional growth of the market. Furthermore, the increasing investments in the healthcare infrastructure across countries like China, India, and Southeast Asia is also expected to contribute to the regional growth of the market.

North America held largest market share of 36.87% in 2024. This is owing to the presence of highly developed healthcare systems with extensive networks of hospitals, clinics, and diagnostic laboratories. Furthermore, the growing prevalence of chronic and infectious diseases as well as the stringent biomedical waste management regulations is also expected to contribute to the regional growth of the market. According to the Statistics Canada, in 2021, nearly half (45.1%) of Canadians had at least one significant chronic illness. The most prevalent chronic diseases were high blood pressure (17.7%), arthritis (19.5%), obesity (29.2%), and overweight (35.5%). Additionally, the growth in the research and diagnostic activities is also anticipated to promote the growth of the market in the region in the near future.

By Material Type

By Capacity

By End-Use

By Region

April 2025

April 2025

March 2025

February 2025