January 2025

.webp)

Principal Consultant

Reviewed By

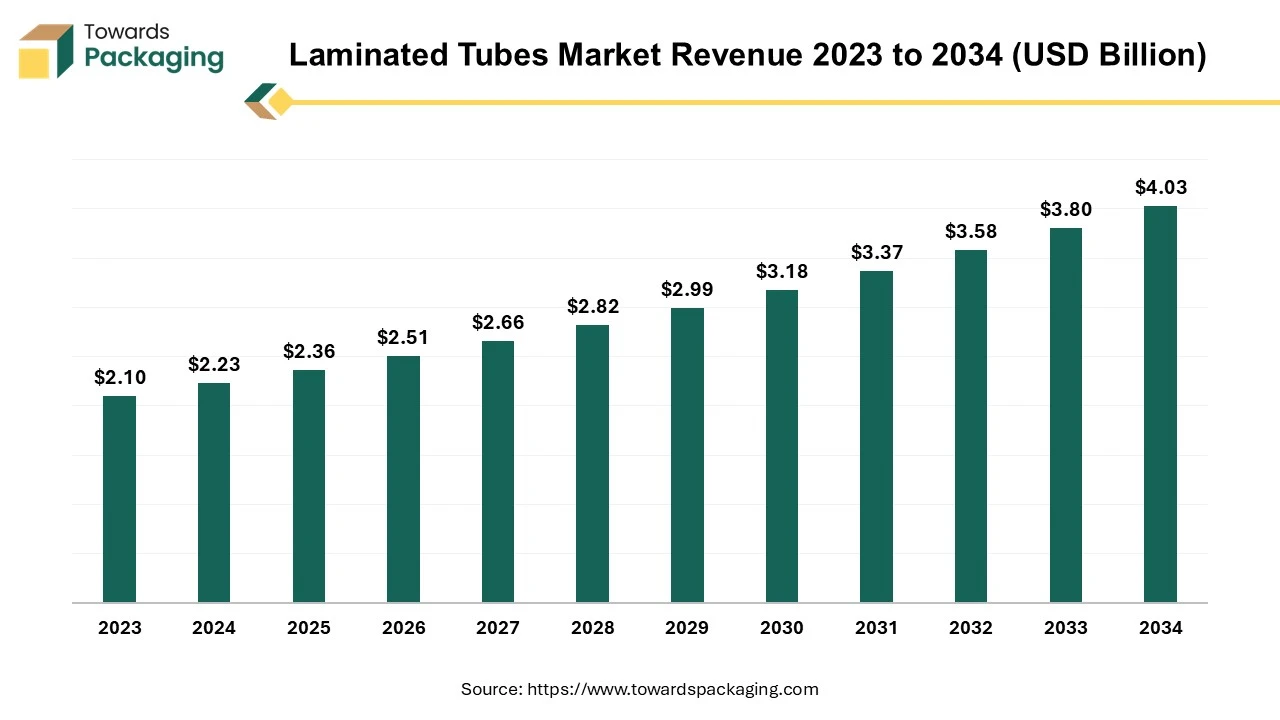

The global laminated tubes market size reached US$ 2.10 billion in 2023 and is projected to hit around US$ 4.03 billion by 2034, expanding at a CAGR of 6.1% during the forecast period from 2025 to 2034. The increasing regulatory support for laminated tubes will continue aiding market growth in the forecast period.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing laminated tubes which is estimated to drive the global laminated tubes market over the forecast period. Emerging markets and trends for laminated tubes is expected to drive the growth of the global laminated tubes market over the forecast period.

Laminated tubes are cylindrical structures made from layers of material, typically paper, plastic, or foil, that are bonded together to form a composite tube. This manufacturing technique enhances the physical properties of the tube, making it more suitable for various applications, particularly in packaging. Laminated tubes consist of multiple layers. Each layer serves a specific purpose, such as providing strength, barrier properties, or aesthetic appeal. The production of laminated tubes typically involves lamination, forming, and finishing. The individual layers of laminated tubes are bonded together using adhesives or heat. The laminated sheet is then rolled and shaped into a tube. Ends are sealed, and additional features (like nozzles or caps) may be added.

The laminated tubes provide the barrier protection as it has multi-layer construction that offers excellent barrier properties against moisture, gases, and light, which is crucial for preserving the contents, especially in food and pharmaceutical packaging. Laminated tubes can be designed in various sizes, shapes, and graphics, making them versatile for branding. Compared to glass or rigid plastic containers, laminated tubes are generally lighter, making them easier to handle and transport. In conclusion, laminated tubes are a sophisticated packaging solution that combines functionality with aesthetic appeal, making them highly popular across various industries.

AI can significantly enhance the laminated tubes industry in several ways by providing predictive analytics, quality control ideology, supply chain optimization, design and customization. AI can analyze market trends and consumer preferences to forecast demand, helping manufacturers optimize production schedules and inventory management. Machine learning algorithms can monitor production processes in real-time, identifying defects or inconsistencies in laminated tubes, thus improving overall product quality.

AI can enhance automation in manufacturing, leading to faster production times and reduced labor costs while maintaining high precision. By analyzing social media and online reviews, AI can provide insights into consumer preferences and feedback, guiding product development and marketing strategies. Implementing AI technologies can lead to greater efficiency, reduced costs, and improved product offerings in the laminated tubes industry.

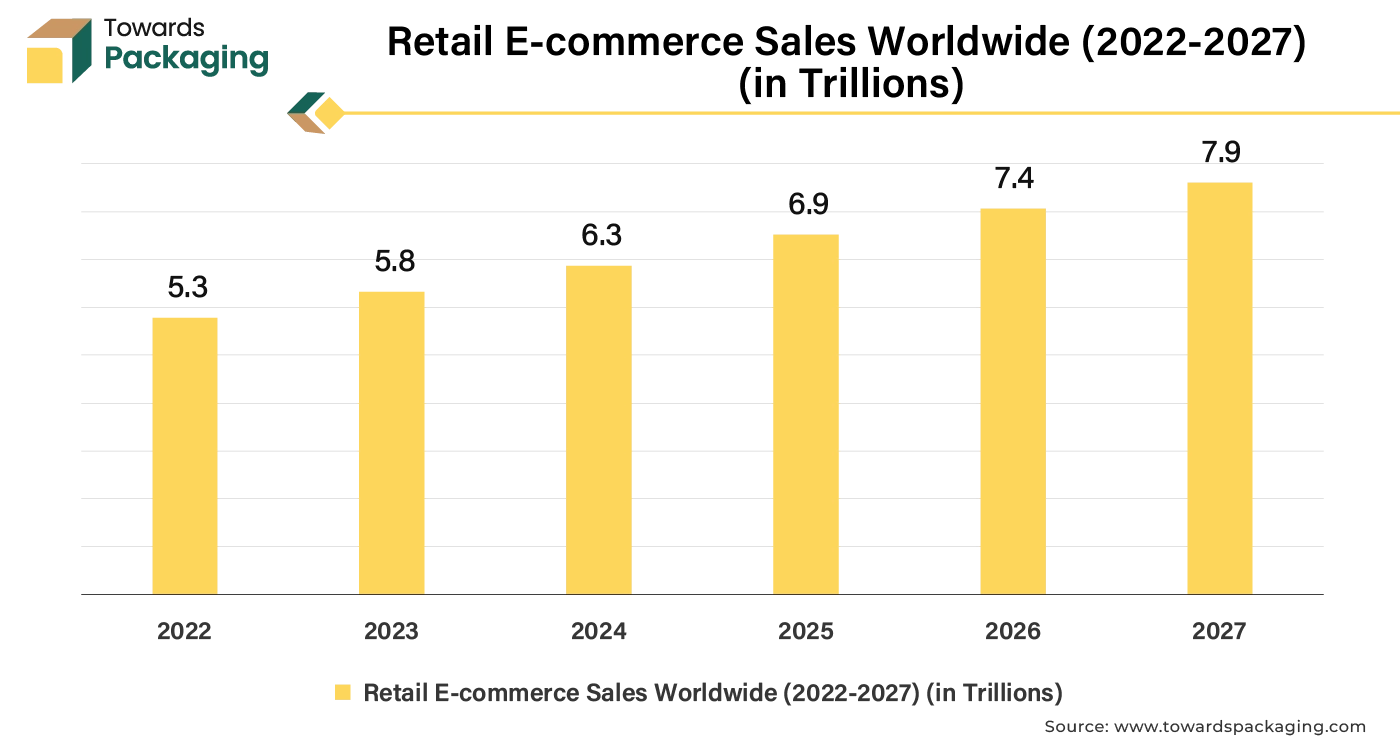

The rise of online shopping necessitates durable packaging solutions, which can lead to increased use of laminated tubes. These factors collectively contribute to the growth and evolution of the laminated tubes market. E-commerce enables brands to reach global markets. Laminated tubes can be tailored to meet various regional regulations and consumer preferences, facilitating international sales. Overall, the intersection of e-commerce growth and the laminated tubes market presents a significant opportunity for innovation and expansion in packaging solutions.

With more than 33 %percent of people purchasing online globally, the commerce sector is currently valued at US$6 trillion and is expected to grow to US$8 trillion by 2027. Globally, 2.71 billion people use social media stores or specialized commerce platforms to make purchases online.

The key players operating in the market are facing strong competition from the alternative packaging industry which restricts the growth of the laminated tubes market. The production of laminated tubes often involves higher costs due to the materials and technology required. This can deter smaller companies or those with tight budgets from using laminated tubes. The presence of alternative packaging solutions, such as plastic bottles, glass containers, and flexible pouches, can limit the market for laminated tubes, especially if these alternatives are cheaper or more readily available.

While laminated tubes can be designed for sustainability, the perception of plastics and multi-layer materials can pose a challenge, as consumers increasingly demand environmentally friendly packaging. The production process for laminated tubes can be complex and may require advanced technology, which might not be accessible to all manufacturers, especially in developing regions.

Compliance with packaging regulations, especially in industries like pharmaceuticals and food, can complicate the production and distribution of laminated tubes. In some regions, the laminated tubes market may be nearing saturation, leading to intense competition and price wars that can hinder profitability and growth. Changing consumer preferences towards minimalistic packaging or bulk buying can reduce demand for laminated tubes, particularly in markets focused on cost-effectiveness. Addressing these challenges is crucial for manufacturers looking to capitalize on the laminated tubes market's potential growth.

The beauty and personal care sectors are expanding, increasing the need for innovative and attractive packaging solutions, such as laminated tubes. Developing eco-friendly laminated tube options can attract environmentally conscious consumers, driving market growth. The key players operating in the market are focused on developing new laminate-based tube packaging for cosmetics, which is estimated to create lucrative growth opportunities for the laminated tubes market.

The aluminium segment held a dominant presence in the laminated tubes market in 2023. Aluminum offers excellent barrier protection against moisture, light, and oxygen, which is crucial for preserving the integrity and shelf life of sensitive products, especially in cosmetics and pharmaceuticals. Aluminum is lightweight, which helps reduce shipping costs and makes handling easier, benefiting various industries, including food and personal care. The metallic finish of aluminum can enhance the visual appeal of packaging, making products more attractive to consumers. It can also be easily printed on for branding.

Aluminum is highly recyclable, aligning with increasing consumer demand for sustainable packaging solutions. This recyclability helps reduce environmental impact. Aluminum can be easily shaped and combined with other materials in laminated structures, allowing for a variety of designs and functionalities tailored to different product needs. Aluminum works well with various sealants and adhesives, enhancing the overall effectiveness of the packaging. These properties make aluminum a preferred choice across various industrial sectors for producing high-quality laminated tubes. The key players operating in the market are focused on developing aluminium material tube packaging for the products, which is estimated to drive the growth of the segment over the forecast period.

In June 2024, Tubex, manufacturing company, uneviled the introduction of two new kinds of its 100% aluminum tubes. Recycled materials from post-industrial and post-consumer sources offer the solution; according to the corporation, they reduce CO2 emissions by 70% and production energy by 95%.

The plastic segment is anticipated to grow with the highest CAGR in the laminated tubes market during the studied years. Plastic is generally cheaper to produce than many other materials, making it a cost-effective choice for manufacturers. Many plastic materials offer good moisture barrier properties, helping to preserve the quality of the products inside. Plastic tubes can be easily sealed using various methods, ensuring product safety and longevity. These attributes make plastic a popular and practical choice for packaging across numerous industries, including cosmetics, pharmaceuticals, and food.

The 51 to 100 ml segment accounted for a notable share of the laminated tubes market in 2023. The 51 to 100 ml laminated tube is widely used for packaging personal care, cosmetics, and pharmaceutical products. This size range offers an adequate volume for personal care and cosmetic products, allowing consumers to use them over time without them expiring or becoming outdated. The compact design makes these tubes convenient for travel and everyday use, appealing to consumers who prioritize ease of transport. Laminated tubes are designed for easy squeezing, enabling precise dispensing of creams, gels, and ointments, which is especially important in personal care and pharmaceutical applications. In pharmaceuticals, these tubes can be designed to meet strict regulatory requirements for safety and efficacy, ensuring consumer trust. These factors make 51 to 100 ml laminated tubes an optimal choice for packaging in the personal care, cosmetics, and pharmaceutical industries.

The personal care & cosmetics segment registered its dominance over the global market in 2023. Laminated tubes provide excellent barrier properties against moisture, light, and oxygen, which helps preserve the integrity and shelf life of sensitive formulations. The design allows for easy dispensing of products, enabling consumers to control the amount used, which is especially important for creams, gels, and lotions. Laminated tubes can be printed with high-quality graphics and vibrant colors, enhancing brand visibility and attracting consumers in a competitive market.

Laminated tubes can be printed with high-quality graphics and vibrant colors, enhancing brand visibility and attracting consumers in a competitive market. Manufacturers can easily customize the size, shape, and design of laminated tubes, allowing brands to differentiate their products and cater to specific market segments. Many laminated tubes can be made from recyclable materials or designed with sustainability in mind, aligning with the growing consumer preference for environmentally friendly packaging. Laminated tubes can accommodate a wide range of formulations, from creams and lotions to serums and gels, making them suitable for various personal care and cosmetic products.

North America region dominated the global laminated tubes market in 2023. North American consumers increasingly prioritize quality, convenience, and aesthetic appeal in packaging, favoring laminated tubes for their functionality and design. The rise of e-commerce has amplified the demand for effective packaging that protects products during transit, further boosting the laminated tubes market. Many companies in North America are shifting towards sustainable practices, and laminated tubes can be designed to meet these eco-friendly requirements, appealing to environmentally conscious consumers.

North America is home to several innovative packaging manufacturers that leverage advanced technologies in the production of laminated tubes, enhancing product quality and performance. The region has robust supply chains and distribution networks, facilitating efficient delivery and accessibility of laminated tube products to manufacturers and consumers. Many established brands invest significantly in packaging to enhance brand identity, contributing to the demand for visually appealing and functional laminated tubes. These factors combine to position North America as a leading market for laminated tubes.

Asia Pacific region is anticipated to grow at the fastest rate in the laminated tubes market during the forecast period. Many international beauty brands are investing in the region, launching localized products that cater to the diverse needs of Asian consumers. These factors contribute to the robust growth of the cosmetics market in the Asia Pacific region. The booming beauty and personal care sectors in Asia Pacific region are driving demand for innovative packaging solutions, with laminated tubes being favoured for their versatility and aesthetic appeal.

Economic growth and an expanding middle class in countries like China and India are increasing consumer spending on packaged goods, including personal care and cosmetic products. The versatility of laminated tubes allows for a wide range of applications across various industries, including pharmaceuticals and food, expanding their market reach. Laminated tubes are lightweight and easy to use, catering to consumer preferences for convenient and portable packaging solutions. Increasing launch of the laminated packaging solution for medical sector, is estimated to drive the laminated tubes market in the Asia Pacific region.

In Asia Pacific, countries like India are expected to be a major contributor for the growth of laminated tubes market during the forecast period. The increasing emphasis on taking care of physical appearance amongst the younger generation has led to rising demand for branded, natural and herbal personal care products. In China, there is growing utilization of personal and beauty care. The demand for cosmetics and personal care products is growing with rising social media penetration, popularity of brand, appearance consciousness etc., combined with expanding ecommerce industry will boost the demand for laminated tubes. With a substantial young population, India and China will an important part in the growth of laminated tubes market in the Asia Pacific region.

By Material

By Capacity

By Application

By Region

January 2025

November 2024

February 2025

November 2024