February 2025

.webp)

Principal Consultant

Reviewed By

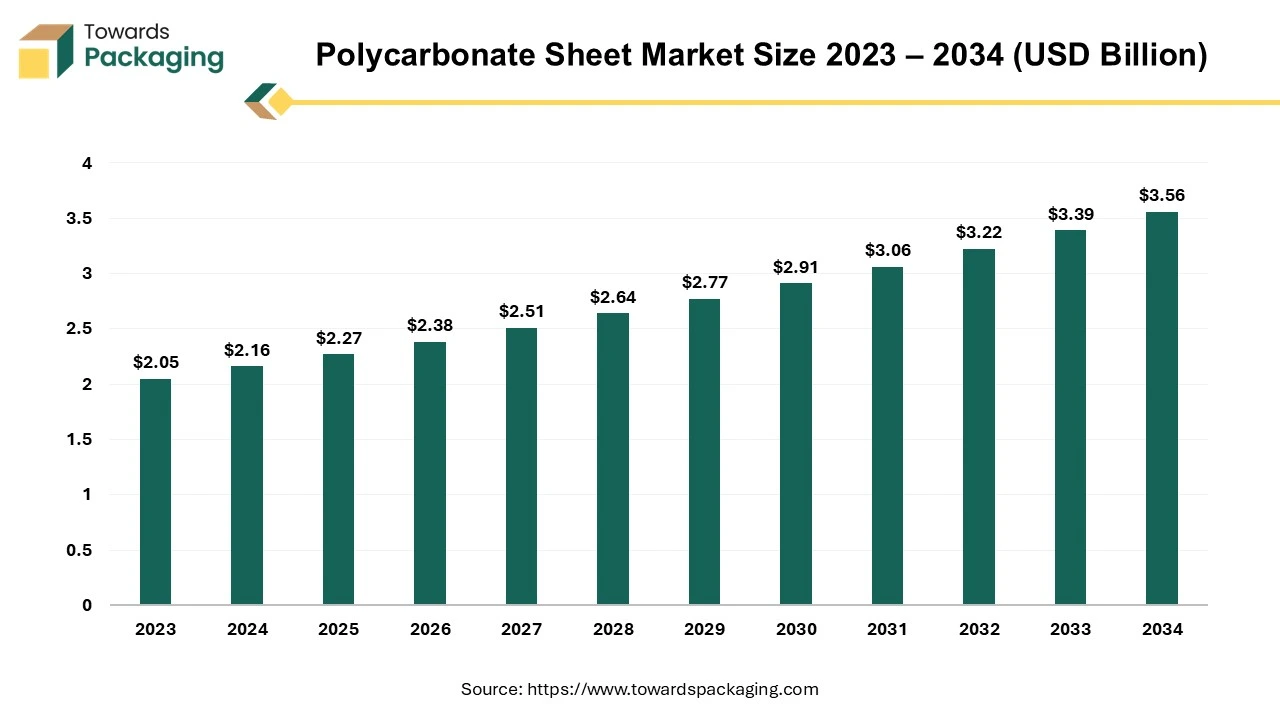

The polycarbonate sheet market is anticipated to grow from USD 2.27 billion in 2025 to USD 3.56 billion by 2034, with a compound annual growth rate (CAGR) of 5.15% during the forecast period from 2025 to 2034.

The demand for polycarbonate sheets is increasing in greenhouse buildings, leading to an expansion of the market. Additionally, the market is significantly enhancing due to the increased utilization of polycarbonate sheets in the automotive industry. The ongoing developments of sustainable polycarbonate sheets are projected to boost the market growth in the forecast period.

The polycarbonate sheets are designed from polycarbonate resin with properties like lightweight, transparency, and impact resistance that are rapidly used in industries like automotive, construction & building, agriculture, electrical, and healthcare. Several polycarbonate sheet types, including solid, corrugated, and multi-wall, are emerging in the market. Increasing regulatory demands for safety and security and commitment to the reduction of plastic use and carbon emissions are encouraging innovations & developments in the cutting-edge polycarbonate sheet market.

Additionally, growing customized and sustainable demands are improving the importance of cutting-edge technologies in manufacturing industries. With growing industrial demands for cutting-edge polycarbonate sheets and government initiatives worldwide, doors are opening for the growth of the polycarbonate sheet market.

The integration of AI in manufacturing is beneficial to improving the properties of polycarbonate sheets. AI is helping with market transformation by enhancing the durability, flexibility, and efficiency of polycarbonate sheets. Increased demands for polycarbonate sheets among various industries are responsible for the rise in manufacturers' adoption of AI and IoT technologies.

AI algorithms help manufacturing companies reduce production costs by optimizing, monitoring the process, and enhancing productivity. Data-driven services help to maintain the quality and efficiency of the products. Also, helps to enhance customer engagement. Integration of AI and IoT technologies is enabling manufacturing industries to generate opportunities to expand and generate room for data-driven services and product-as-a-services in the industry. Growing market competition and changing shifts for sustainable products are highlighting the need for AI and IoT technologies in the industry.

The demand for polycarbonate sheets has increased in industries like building & construction, automotive, electrical & electronics, aerospace, healthcare, and agriculture. The growing building and construction industries require high-durable, energy-efficient, and high-barrier-resistant polycarbonate sheets for roofing and cladding.

High clarity and temperature-evident properties of polycarbonate sheets are raising their implantation for walls, windows, roofs, and other components. Similarly, the lightweight and durable nature of polycarbonate sheets is making them popular in the automotive and transportation sectors for utilization in vehicle glazing. The automotive industry is rapidly adopting polycarbonate sheets in signage applications due to their transparency and weather resistance capabilities.

The electrical and electronics industries are driving the adoption of polycarbonate sheets for LED lights for more transparency, durability, and barrier resistance. Furthermore, the market is predicted to expand due to the increased utilization of polycarbonate sheets in aircraft and aerospace applications. This is one of the reasons the aerospace industry is driving the adoption of polycarbonate sheets for ballistic and blast-resistant utilizations.

Growing greenhouses are seeking sustainable and eco-friendly materials, including polycarbonate sheets. Several manufacturers are committed to the reduction of carbon emissions, which encourages the development of sustainable and biodegradable polycarbonate sheets. Additionally, the polycarbonate sheet market is expanding further due to the increased adoption of the sheets among healthcare and pharmaceutical industries for medical devices and instruments.

The growing shift toward zero plastic use is driving demand for recyclable polycarbonate sheets. Government concerns and regulatory compliance are encouraging manufacturers to develop recyclable and biodegradable polycarbonate sheets to maintain environmental sustainability and reduce plastic waste. The developments of biodegradable sheets are transforming the market by providing sustainable alternatives and high-quality sheets compared to conventional polycarbonate sheets.

Advanced technology and ongoing research and developments are game changers of the polycarbonate sheet market. Cutting-edge technology like nanotechnology and coating technology are improving the durability and performance of polycarbonate sheets. Additionally, the development of multi-wall polycarbonate sheets has increased due to increased demand for high-strength sheets in the automotive and construction industries.

The adoption of corrugated polycarbonate sheets provides high durability, flexibility, and performance, making them prior demands in industries like food, construction, automation, and agriculture. The advanced technology is helping to enhance the chemical resistance, moisture resistance, and scalability of the polycarbonate sheets, leading to reduced costs and prior preference in various sectors.

Environmental impacts: Environmental impact is the crucial factor hampering the growth of the polycarbonate sheet market. The manufacturing of polycarbonate sheets needs high energy consumption and generates carbon dioxide.

Environmental regulation: As the production of polycarbonate sheets contributes to material waste and drives impacts on the environment, regulatory frameworks have drawn several restrictions, including restrictions on the utilization of raw materials like BPA (Bisphenol A) and limitations on the use of chemical materials for maintenance safety. Manufacturing industries need to meet all regulatory compliance, which impacts productivity.

For example, the European Union’s Registration, Evaluation, Authorization, and Restriction of the Chemicals (REACH) regulation, which was promoted in 2007, requires manufacturing companies to register and ensure the safe utilization of the chemicals.

The Polycarbonate (Quality Control) Amendment Order, issued in 2024 by the Ministry of Chemicals and Fertilizers (MoC&F) of India, requires all polycarbonate products to meet the Standard Mark, which is issued by the Bureau of Indian Standards (BIS) under a license.

The Role of Innovation and Consumer Demand

The polycarbonate sheet market is witnessing a shift toward sustainability. Consumers are seeking sustainable and energy-efficient materials. The building and construction industry is playing a crucial role in this shift. The implementation of solar panels and greenhouses is rising around the globe. The properties of light transformation and insulations are driving demands for polycarbonate sheets in solar panels and greenhouses.

With growing consumer concerns and government support for innovations in sustainable materials, the competition between manufacturing companies has risen. With growing advancements in polycarbonate sheets for more durability, recyclability, low energy consumption, and enhanced performance, they are likely to cover all sectors, especially green building industries.

The rapid growth in industrialization is helping the Asian region have a stable economic condition. The government is continuously supporting by investing in infrastructure developments like bridges, buildings & constructions, and agriculture sectors. Growing construction industries are fueling demands for polycarbonate sheets in the region. China is the leading market in Asia due to its expanded manufacturing sector. Additionally, countries like India and Japan are witnessing spectacular market growth due to the growing adoption of advanced technologies in the country. Moreover, trade agreements in the Asia-Pacific region, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), are encouraging polycarbonate sheet market expansion in the region.

North America accelerated to witness significant market growth in the forecast period due to the availability of major manufacturing and construction industries in the region. The presence of a well-established construction industry is driving demands for building materials like polycarbonate sheets in the region. The United States held the largest market share in North America due to rising cutting-edge manufacturing capabilities. The easy access to high-quality polycarbonate sheets is increasing its adoption rate.

Additionally, ongoing research & development of sustainable materials are significantly transforming countries' market growth. With government and regulatory frameworks encouraging the development of sustainable building materials, the polycarbonate sheet market is projected to expand in the region.

By type, the solid segment dominated the polycarbonate sheet market, mostly due to its durability and resistance properties. Solid polycarbonate sheets have more impact resistance properties compared to other types. The lightweight of solid polycarbonate sheets is driving the growth of the segment. The segment is further growing due to the continued adoption of solid polycarbonate sheets due to their high optical clarity.

The high-light transmission of solid polycarbonate sheets makes them more attractive. Solid polycarbonate sheets have excellent UV radiation resistance, which is beneficial to maintaining the clarity and color stability of the sheets. Additionally, the segment is expected to continuously lead the market due to its affordability and sustainability. Solid polycarbonate sheets are recyclable, which helps to reduce waste and environmental impact.

The building and construction application segment dominated the market. The utilization of polycarbonate sheets is wide in the building and construction sector due to their ability to withstand high impact, which is convenient for building roofs and facades. Polycarbonate sheets provide high optical clarity and UV resistance properties, which drive consumer attraction, as consumers are always seeking transparent yet protective sheets for their buildings.

The lightweight sheets make them easier to install, helping to reduce time and cost. Polycarbonate sheets are available in various shapes and sizes, making them attractive to install on buildings and constructions. The need for high-durable, clarity-providing, flexible, and affordable sheets for building and construction is driving the adoption of polycarbonate sheets.

The agreement is the start of the strategic, collaborative partnership with Deepak. Trinseo is actively looking for opportunities to expand the company's technology portfolio and higher-growth areas like India.

“Its excellent thermoformability, high modulus, and durability are what make the highlight of the LEXAN sheet series; the company is committed to meeting with new rail regulations.”

By Type

By Application

By Region

February 2025