April 2025

Principal Consultant

Reviewed By

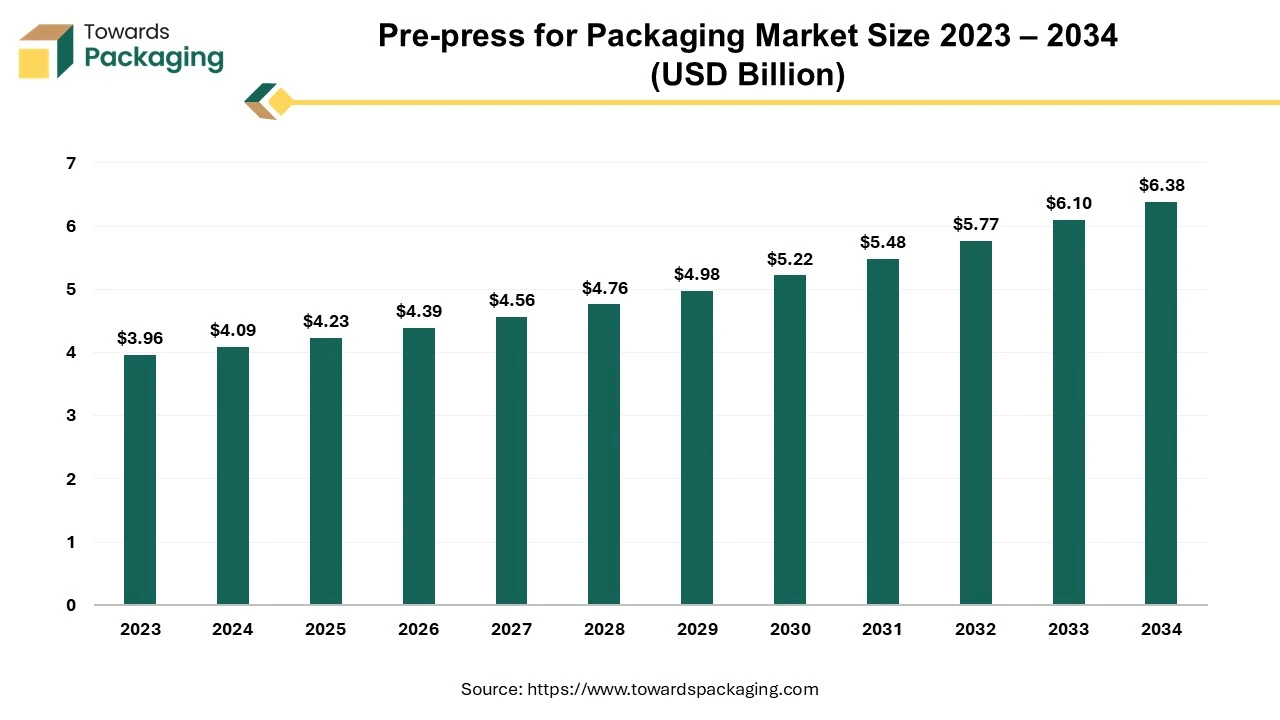

The pre-press for packaging market is anticipated to grow from USD 4.23 billion in 2025 to USD 6.38 billion by 2034, with a compound annual growth rate (CAGR) of 4.54% during the forecast period from 2025 to 2034.

The pre-press for packaging market is projected to witness considerable progress in the future. The best way to think of prepress packaging is as the graphic preparation that is required to transform the design of the packaging into a real product. It includes all of the procedures required to cut and print on the packaging of the product. Among other things, this graphic work preparation comprises die-lines and proofs, which are important to guarantee that the final result will be entirely up to the grade. Even the smallest error can have a considerable financial impact as the packaging is frequently manufactured in large quantities.

Prepress is an important phase in the design-to-print lifecycle that lies amid the design and print procedures. Utilizing prepress to its fullest potential can guarantee legal compliance, quality and unity across printed product lines for organizations seeking to streamline the packaging design activities. This quality control component is a real safety net of importance for companies aiming to securely accelerate development, specifically considering the abundance of data and graphic pictures that appear on a piece of packaging.

The rising demand for personalized and customized packaging in the consumer goods and luxury segments along with the rapid advancements in the digital printing to improve the efficiency and accuracy are expected to augment the growth of the pre-press for packaging market during the forecast period.

Furthermore, the surge in the e-commerce sector as well as expanding food and beverage, pharmaceutical and cosmetics industries are also anticipated to augment the growth of the market. Additionally, the globalization and the need for consistent branding across markets coupled with the rise of smaller brands and startups and the growing utilization of 3D modeling tools are also projected to contribute to the growth of the market in the near future.

The surge in the e-commerce due to the widespread availability of the internet and affordable smartphones as well as availability of attractive discounts, seasonal sales, and loyalty programs is anticipated to augment the growth of the pre-press for packaging market during the forecast period.

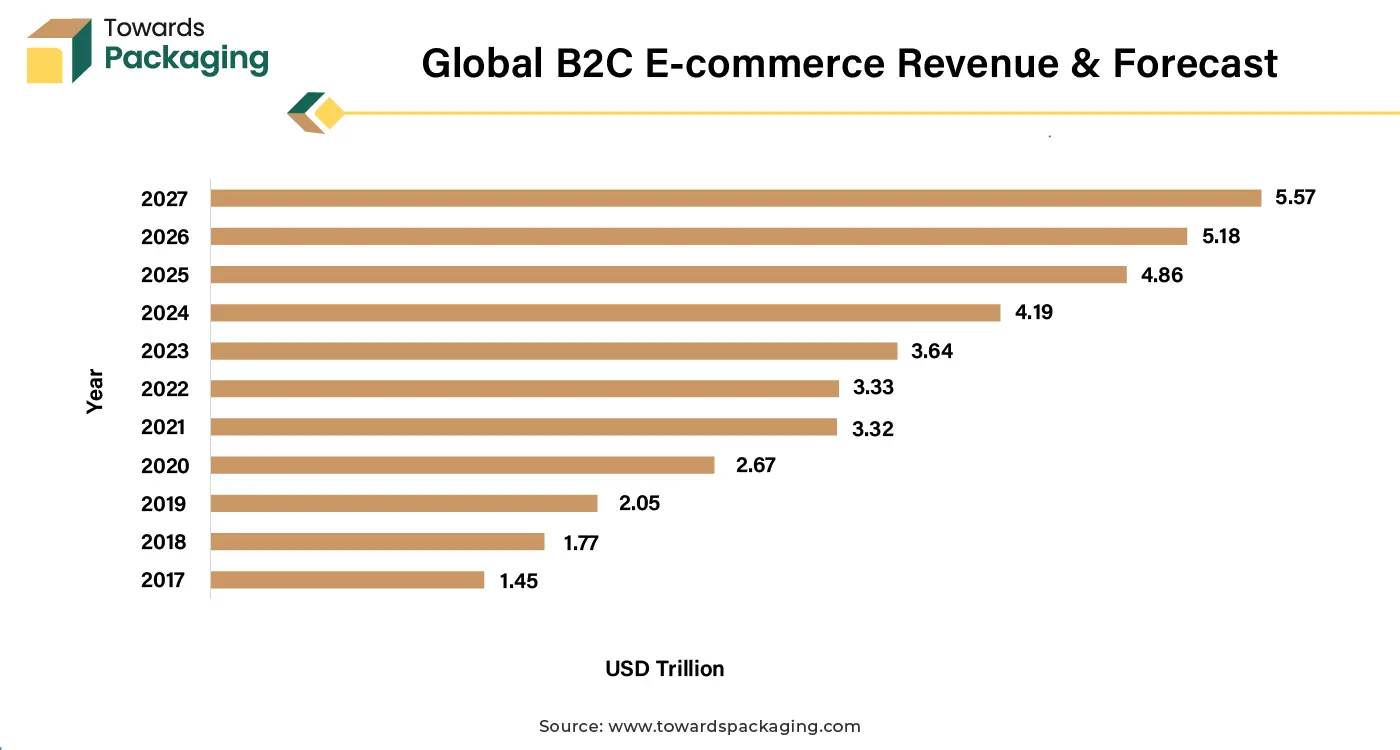

According to the International Trade Centre, there is a consistent and substantial growth in the e-commerce sales. Starting at USD 1.45 trillion in 2017, the market has experienced a constant upward trend, reaching an estimated value of USD 3.64 trillion in 2023. The e-commerce revenue is further expected to reach a value of USD 5.57 trillion by 2027.

The COVID-19 pandemic acted as a key accelerator, with a prominent spike in the e-commerce adoption in 2020, as evident from the jump from USD 2.05 billion in 2019 to USD 2.67 billion in 2020. Consequently, this has led to an amplified demand for personalized and premium packaging designs, requiring sophisticated pre-press processes to guarantee precision and consistency.

Furthermore, brands can stand out on the shelves and inspire consumers to make purchases with clear beautiful packaging designs as well as printing. As a storytelling tool, packaging lets brands to interact directly with the consumers while showcasing their identity and values. In an increasingly competitive environment, choosing the appropriate branding and packaging design can help visually communicate the message, specifically as customers today deal with an ever-increasing number of options when making purchases.

Thus, brands are prioritizing innovative packaging options to create strong, lasting impressions on the consumers. Pre-press packaging helps attracting consumers by proving packaging that is visually appealing, functionally effective, and conveys brand message.

The complexity of processes involved in providing seamless packaging production is likely to hinder the growth of the market within the estimated timeframe. For printing to be accurate as well as consistent and to assure the colors produced match the intended ones, color tolerances must be effectively managed. Color discrepancies may result from lack of attention to color management at prepress; for instance, utilizing an RGB color space will result in a drastically different image from what has been accepted on screen.

It is not only expensive but also challenging to rework a design midway through the production cycle. It can be difficult to achieve color accuracy for a variety of reasons such as variations in substrates, equipment and ambient conditions. Ineffective color management can result in the waste of resources, time as well as materials. For instance, color disparities might require several proofs and modifications for a print job, which could lead to delays and higher production expenses.

Furthermore, the resolution of many images used for the online publication is insufficient to print at larger sizes than postage stamps. These images frequently come from online sources and do not meet high standards of quality. These photographs don't appear attractive in print and give the impression that any publication is low-quality when left in RGB, usually with lossy compression.

Additionally, the need for substrate compatibility is a challenge, as packaging sometimes comprises numerous layers and materials. Each material has distinct printing and bonding properties, demanding precise pre-press modifications to minimize misalignment, smearing, or durability difficulties. These issues are specifically complicated for the small to medium-sized enterprises, which lack the means to invest in advanced pre-press options.

Recent years have seen major developments that have permanently altered the growth of the digitally produced layouts for the printing and packaging industries. This also applies to developments in the pre-press technologies. Considering the growing volume of printed products manufactured and the importance of package design, pre-press printing is no longer a craft but instead a field fueled by technological breakthroughs. The most profound developments in digital marketing can be seen in the transformation of computer-designed files into print-ready formats. Digital printing quality is currently the best in the world.

The introduction of digital methods in press printing has undoubtedly increased the degree of personalization of direct mail parts, which were previously restricted by the limitations of the offset printing. Therefore, it is now possible to obtain excellent quality pre-press printing that is perfectly readable and visible promoting a precise understanding of the information being given.

Furthermore, there have been numerous improvements and interventions made by smart technology. Each printing and pre-printing device has a massive data backup that is connected to a designer who analyzes performance in real time and actively increases the uptime. This quickly results in problem-solving criteria. Digitally recorded data makes it easier for new users to extract the older information and understand the purpose of follow-ups. AI integration can even analyze and optimize designs by predicting color consistency and identifying potential errors, thus minimizing the costly reworks.

Also, advanced digital technologies have been deployed by some of the top printers to guarantee accurate alignment and formatting of layouts, precise color code matching between computer-shown layouts and printed files and the display of a precise copy or proof before the design is printed. As these technologies continue to evolve, they open significant opportunities for the pre-press industry to deliver innovative and cost-effective options personalized to the needs of the modern packaging.

The flexographic printing segment held largest market share of 60.57% in 2024. Flexography performs well in both overall quality and high-speed output. It is generally suitable for the majority of large-scale printing operations and is quite efficient in many aspects. Flexographic printing is preferred by most of the enterprises due to its versatility and cost-effectiveness.

Also, the cost of making flexographic image carriers is normally lower compared to that of offset plates, and they are also usually more durable, allowing for multiple reuses before needing to be replaced. Flexography is currently being used in conjunction with digital printing technology to create effective hybrid approaches that perform better than the majority of conventional offset presses. In many situations, flexography outperforms other printing methods due to its advantages in productivity and flexibility. Many different in-line processes can be accommodated and integrated with a flexographic press, making it a wise long-term investment.

The food and beverage segment held largest market share of 55.62% in 2024. This is due to the increasing demand for packaged and ready-to-eat foods, urbanization, changing lifestyles and the rise in dual-income in the households.

Furthermore, the growing need for compliance with stringent food safety regulations as well as the increasing percentage of consumers looking for clear, transparent packaging that highlights the nutritional information and ingredient details is also expected to contribute to the segmental growth of the market. Additionally, the increasing use of branding and visual appeal to influence purchase decisions and surge in online grocery shopping and meal delivery services is also expected to support the growth of the segment in the global market in the years to come.

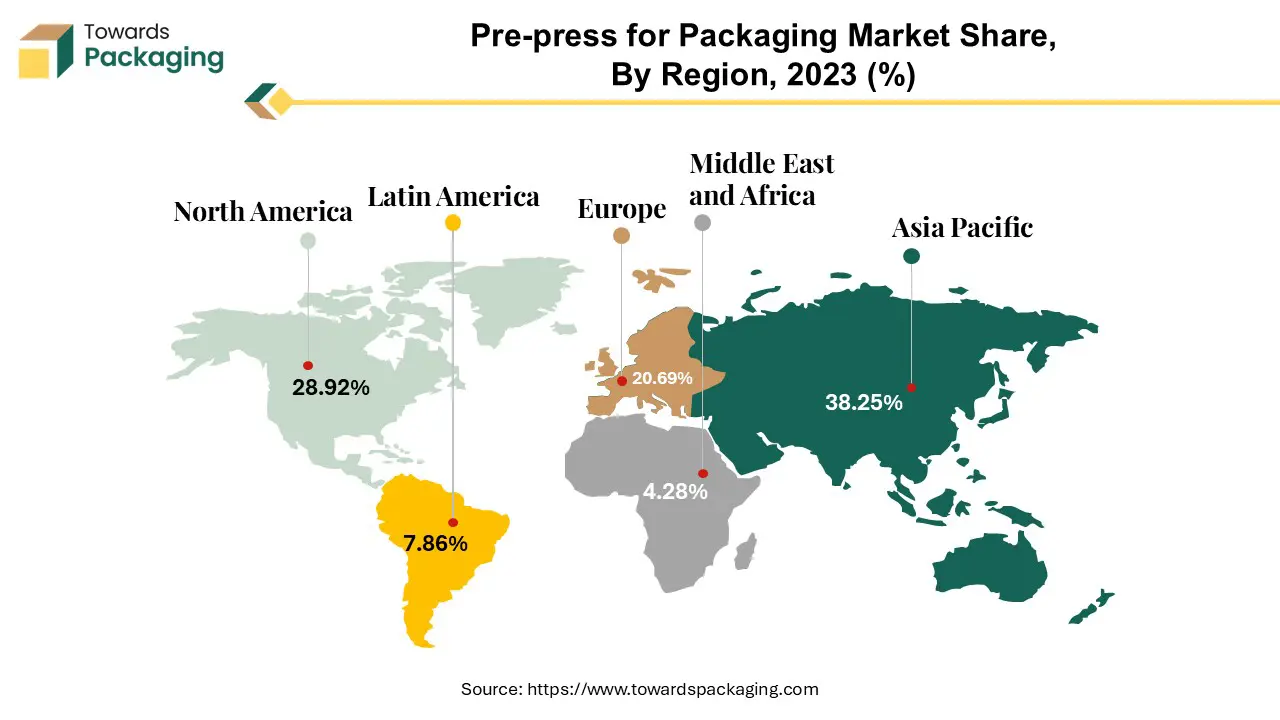

Asia Pacific is likely to grow at fastest CAGR of 6.33% during the forecast period. This is due to the exponential growth of the online retail in economies such as China, India, and Southeast Asia. Also, the growth in the food and beverage industry with the rising demand for packaged food and beverages in urban areas is likely to contribute to the regional growth of the market. As per the Ministry of Economy, Trade and Industry, Statistics Bureau of Japan, Japan's total retail food and beverage revenues in 2022 were valued at about $327 billion. Sales increased by almost 3.75% from $314.77 billion in 2021.

With 35 percent of retail food sales, supermarkets continue to dominate the industry, with the remaining share being generated by convenience stores, pharmacies, and online food and beverage purchases. Furthermore, the rapid urbanization, busier lifestyles and increasing preference for single-serve packaging is also expected to contribute to the regional growth of the market.

North America held largest market share of 28.85% in 2024. This is owing to the presence of major packaging companies like Amcor, Berry Global and DS Smith. Furthermore, the growing focus on branding and customization to stand out in the highly competitive markets as well as the stringent packaging and labeling regulations packaging in industries like food and pharmaceuticals is also expected to contribute to the regional growth of the market.

Additionally, the rapid expansion of online shopping in the U.S. and Canada is also expected to contribute to the regional growth of the market. According to the Statistics Canada, over 27 million people in Canada used e-commerce in 2022, making over 75% of the country's total population. In 2025, this percentage is anticipated to increase to 77.6%. By 2025, online retail sales are predicted to reach US$40.3 billion. Also, the well-established consumer base for food, beverages, personal care and pharmaceuticals is also anticipated to promote the growth of the market in the region in the near future.

By Technology

By Packaging Type

By End-User

By Region

April 2025

April 2025

March 2025

March 2025