April 2025

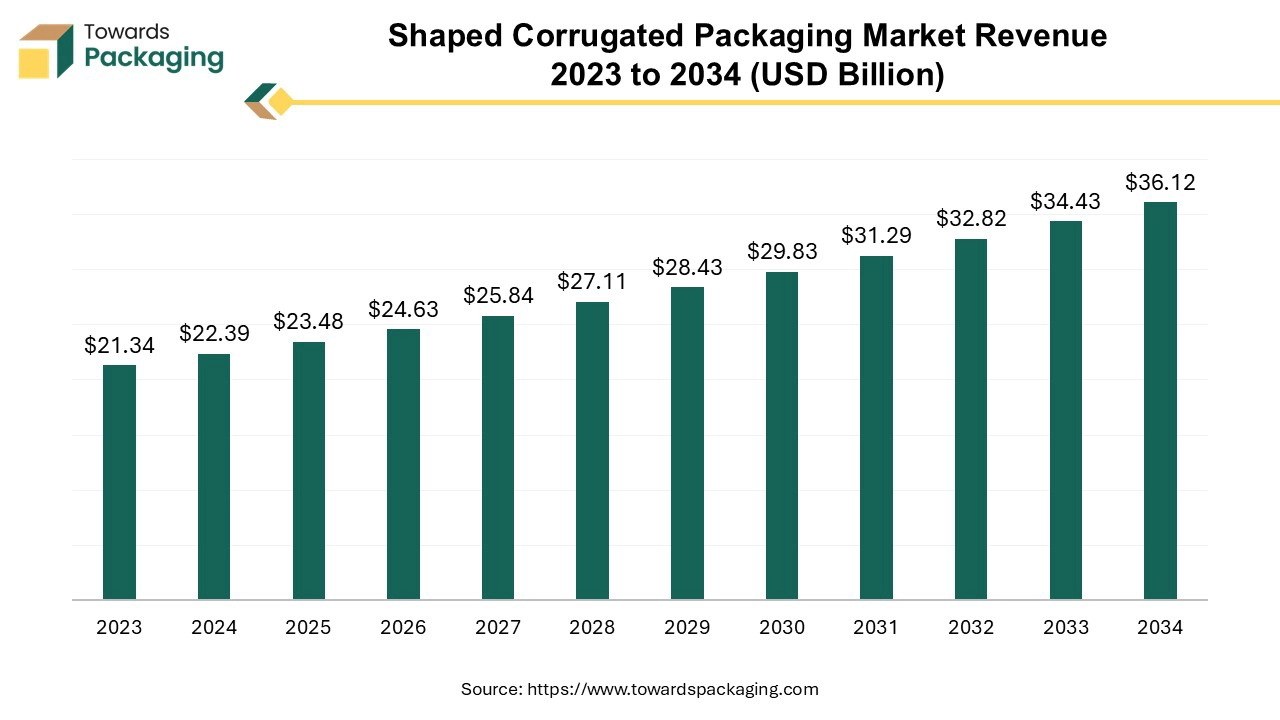

The shaped corrugated packaging market is forecasted to expand from USD 23.48 billion in 2025 to USD 36.12 billion by 2034, growing at a CAGR of 4.9% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Shifting consumer preference towards eco-friendly solutions, shaped corrugated packaging is becoming a growing trend as it is recyclable and lower environmental effects than typical plastic packaging, which is estimated to drive the global shaped corrugated packaging market over the forecast period.

The custom-designed packaging made from corrugated cardboard that is cut or molded into specific shapes to better fit products is known as shaped corrugated packaging market. The shaped corrugated packaging offers excellent protection for products during transit and handling. Custom shapes assists in enhancing brand visibility and create a unique unboxing experience. It can be designed to fit products perfectly, minimizing wasted space and reducing shipping costs. The corrugated material is often recyclable and environment friendly. Shaped corrugated packaging can be utilized for an extensive range of products, from electronics and cosmetics to and beverage items.

The shaped corrugated packaging market refers to the segment of the packaging industry focused on producing and distributing corrugated packaging that is designed in specific shapes rather than standard, flat designs. The creation of shaped corrugated packaging that is tailored to fit unique product shapes or branding requirements. Advances in manufacturing technologies that allow for more complex and varied shapes. A growing need for distinctive and protective packaging solutions driven by trends in retail, e-commerce, and consumer preferences. This market encompasses the production, distribution, and use of shaped corrugated packaging solutions, which aim to provide better protection, enhanced branding opportunities, and improved logistics.

AI-powered design tools can analyze data on product dimensions, shipping conditions, and consumer preferences to provide more effective and efficient packaging solutions. This aids in creating unique designs that optimize protection while utilizing the least amount of material. Due to AI's ability to predict trends and demand patterns, producers may better control costs by minimizing waste and adjusting production schedules and inventory levels. In real time during production, AI-driven computer vision systems may check packaging for flaws or irregularities, guaranteeing high standards and lowering the number of returns or rejects. Artificial intelligence (AI) has the potential to improve supply chain logistics through better inventory management, delay prediction, and supplier, manufacturer, and distributor coordination.

By incorporating client preferences and input into the design process, AI tools can facilitate more customized packaging solutions, improving the overall customer experience. AI can help produce environmentally friendly materials and processes by evaluating the effects of various packaging options on the environment and optimizing for sustainability. The shaped corrugated packaging sector can gain increased productivity, improved product safety, and more creative packaging solutions by utilizing these AI capabilities.

More recently, Bollegraaf, industrial equipment supplier based in U.K. and Greyparrot, AI waste analytics platform signed partnership to incorporate Al into already-operational recycling facilities for packaging material, offer transparency during the recycling process, and give visibility in the waste stream.

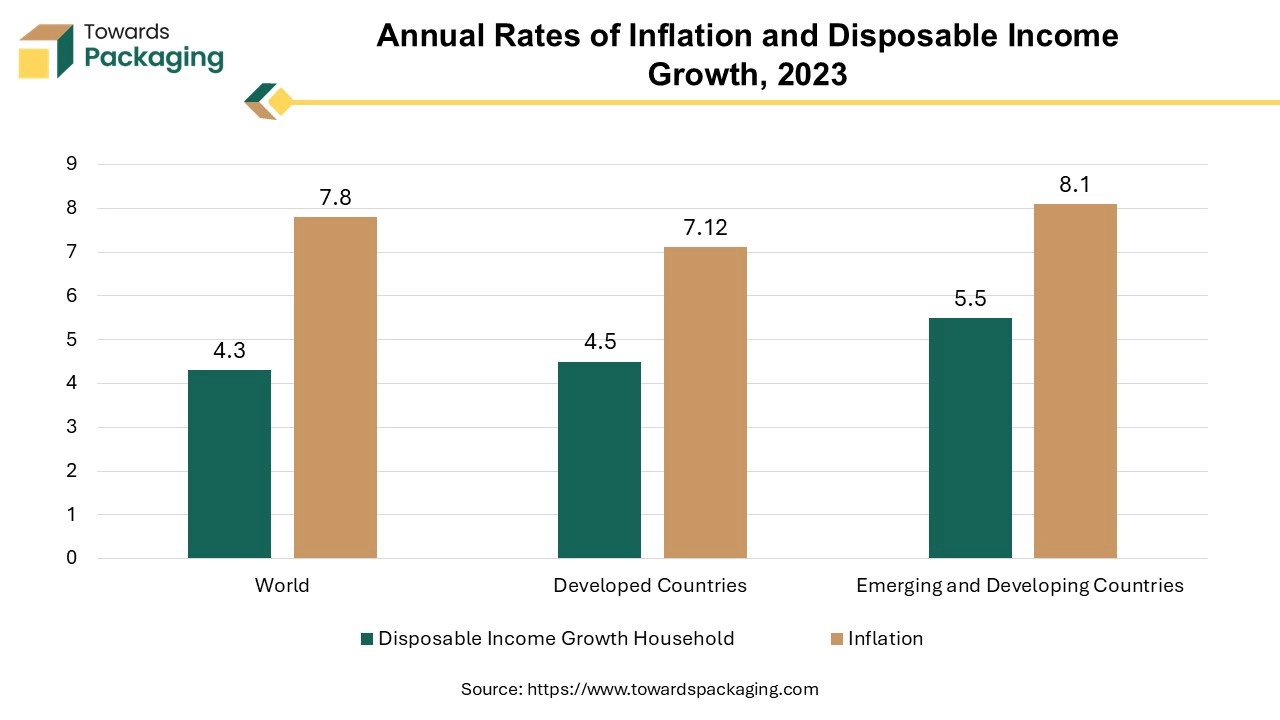

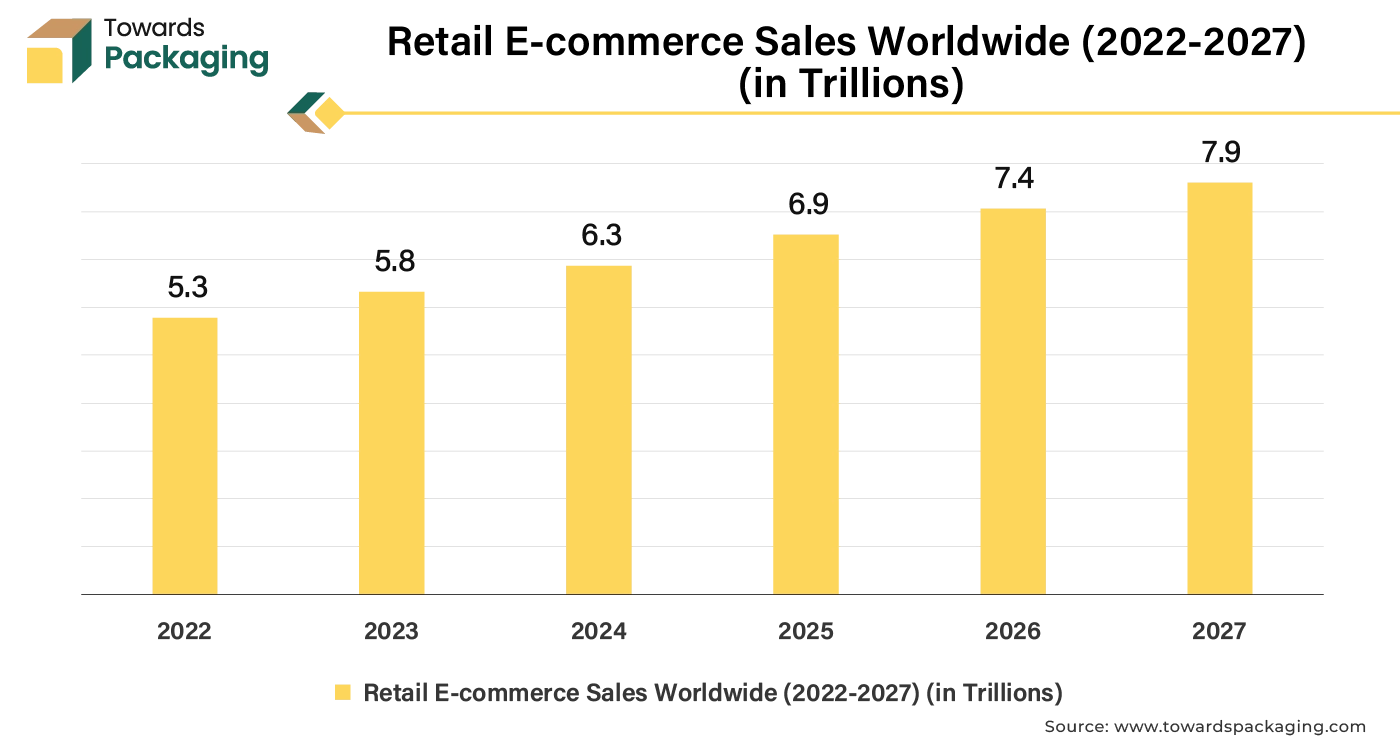

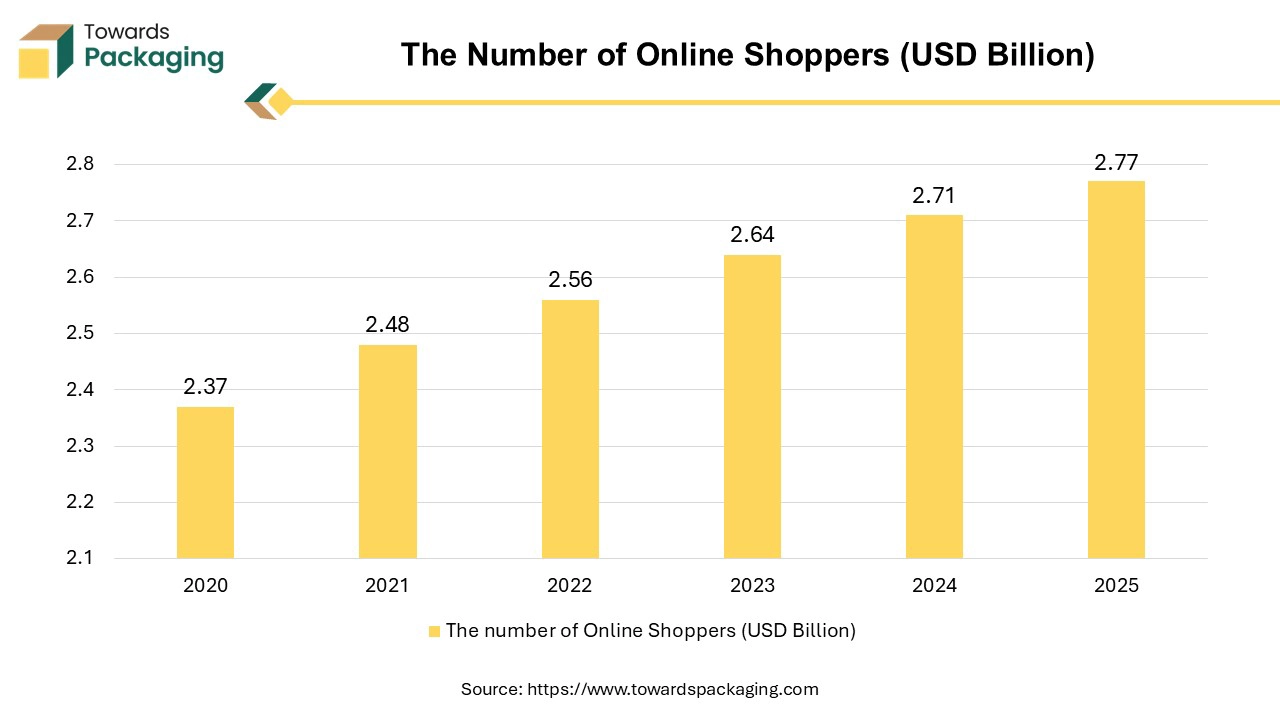

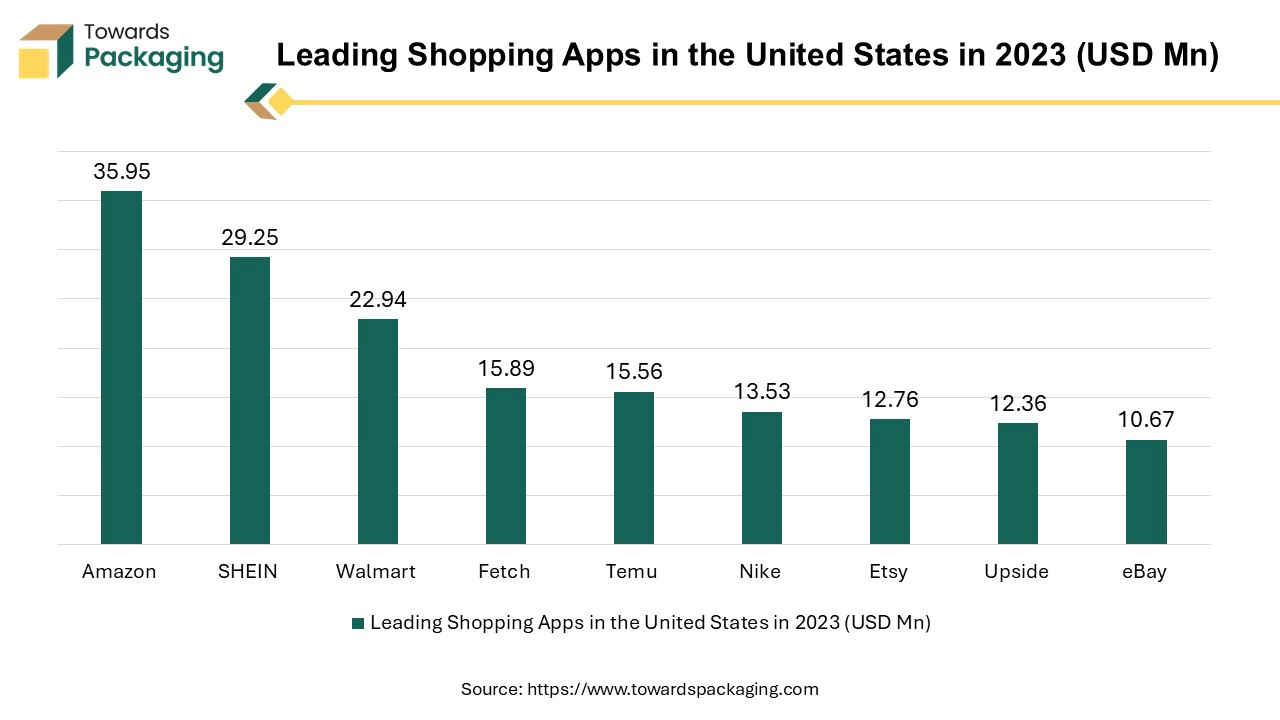

Rising disposable income has increased the trend for the online shopping among the global population. Consumers are able to shop from anywhere at any time without the requirement to travel to physical stores, making it a time-saving option. The online platforms provide a wide range of commodities and brands, often more extensive than what’s available in physical stores. Shoppers are being easily able to compare cost prices and find the best deals, which is often more difficult in brick-and-mortar stores.

E-commerce sites utilize algorithms to recommend products based on past purchases and browsing behaviour, enhancing the shopping experience. Shaped corrugated can be customized to fit products snugly, offering better protection while shipping and minimizing the risk of damage. Custom-shaped packaging allows brands to create unique, eye-catching designs which enhance brand identity and improve the unboxing experience.

The key players operating in the market face problem with the supply chain due to high cost of manufacturing of shaped corrugated packaging which restricts the growth of the shaped corrugated packaging market. Due to the requirement for unique moulds and tooling, the manufacture of corrugated packaging with custom shapes is frequently more expensive than that of ordinary packaging. The intricate engineering and design needed for shaped corrugated packaging can be expensive and time-consuming. Additionally, its intricacy may raise the possibility of manufacturing flaws. The inability to alter sizes or designs once manufacturing begins may be a drawback for businesses that must make regular adjustments to their packaging.

Innovations in design and manufacturing technologies, such as digital printing and automated cutting, can reduce production costs and complexity, making shaped corrugated packaging more accessible. The key players operating in the market are focused on developing advanced technology for packaging industry, which is estimated to create lucrative opportunity for the growth of the shaped corrugated packaging market.

Rectangular sheets segment held the dominating share of the global shaped corrugated packaging market in 2024. Rectangular sheets are easy to customize in terms of size, thickness, and strength to meet specific packaging requirements. They are generally affordable as they have low manufacturing cost, which helps to keep overall packaging costs low.

The surface of rectangular sheet of corrugated packaging can be printed easily, allowing for branding and product information to be easily included. The rectangular shape facilitates efficient use of space and stacking during storage and transportation, optimizing logistics.

The rectangular sheet segment holds dominating share as it offers a balance of protection, cost-effectiveness, and environmental benefits, making them a consumers’ choice for packaging solutions. The key players operating in the market are focused on innovating and launching the automated machine for manufacturing rectangular corrugated sheets, which is estimated to drive the growth of the segment over the forecast period.

The multi depth boxes are widely used for the shipping of goods as it reduces the need for multiple box sizes, leading to savings in inventory costs, transportation, and storage. The multi depth boxes can be adjusted to fit products more precisely, reducing the need for additional filler material. This helps in optimizing shipping space and can lower shipping costs.

Multi depth boxes are convenient for both packaging and unpacking allowing for quick adjustments and flexible packaging solutions. Range of sizes are available within multi depth box which helps streamline inventory and reduce the complexity of managing different box sizes, leading to more efficient shipping space and can lower shipping costs.

The multi depth box are used in widely in various sectors such as retail packaging, E-commerce shipments, food industry, automotive parts and pharmaceuticals industry. The key players operating in the market are focused on developing manufacturing solutions for multi depth corrugated packaging options which is estimated to drive the growth of the segment over the forecast period.

A Flute segment held the dominating share of the shaped corrugated packaging market in 2024. A flute, with a thickness of approximately 5 millimeters or ¼ inch, is the thickest corrugated flute that is currently in stock. This indicates that one linear foot of packaging contains roughly 36 flutes.

Since of its extra-thick fluting, an A flute is perfect for delicate objects that require further protection. For heavy objects that need a sturdy packaging structure, this flute is also perfect. A flute corrugated boxes offers better insulation, which assists in maintaining temperature-sensitive products.

Growing E-commerce sector supports the dominance of a flute corrugated market. The requirement of the A flute corrugated boxes has increased due to rise in online shopping of electronic items as it requires robust packaging solutions to ensure products arrive in good condition. The A flute corrugated cardboard boxes can be utilized for wide applications, from storage of electronic items, glass utensils and shipping to retail packaging, making them a popular choice across different industries.

With a thickness of roughly 3.2 millimeters, or 11/64 inches, the C is the second-thickest corrugated flute on the market. According to this, a single linear foot of packaging contains roughly 41 flutes. Since it is not easily compressible and resists crusting, a C flute is perfect for shipping boxes. B flute, it offers a fantastic printing surface for marketing and branded products as well.

C flute provides good balance of cushioning and strength, making it suitable for protecting a wide range of products during transit and storage. The rise in trend of online shopping has significantly grown the need for sustainable and sturdy packaging solutions to ensure that products are been shipped in good condition.

The key players operating in the market are focused on developing and introduction of the C flute corrugated cardboard to meet the rising demand of the sustainable and sturdy corrugated boxes, which is estimated to drive the growth of the segment over the forecast period.

Important characteristics and advantages include: - Production of custom packaging on demand for a range of product sizes and specifications, combining inventory and SKU management; - Benefits related to flexibility and lead time, allowing for quick adaptation to changing packaging requirements without causing service interruptions. With a 100% Forest Stewardship Council (FSC) certification, Kite Packaging Ltd. company’s fan fold may support companies in fulfilling their social responsibility obligations.

Triple wall segment is estimated to show significant growth over the forecast period in the shaped corrugated packaging market. Rise in global trade has increased the need of triple wall corrugated box.

A triple-wall board comprises seven layers, with three layers of flux enclosed by four layers of liner. This board resembles three boxes combined. Chemical containers and shipping crates are frequently made with triple wall packing, the strongest kind of board now in use. The triple wall type corrugated box are sturdy and tough of all patterns of wall and developed of three layers of corrugated medium and four layers of liner board. As the triple wall boxes have a higher load-bearing capacity, making them suitable for stacking and handling heavier loads, which is important for heavy bulk shipping and storage.

The growth of global trade has risen the demand for the triple wall robust packaging solutions. Triple-wall boxes provide the extra protection needed for shipping goods over long distances and through multiple handling stages.

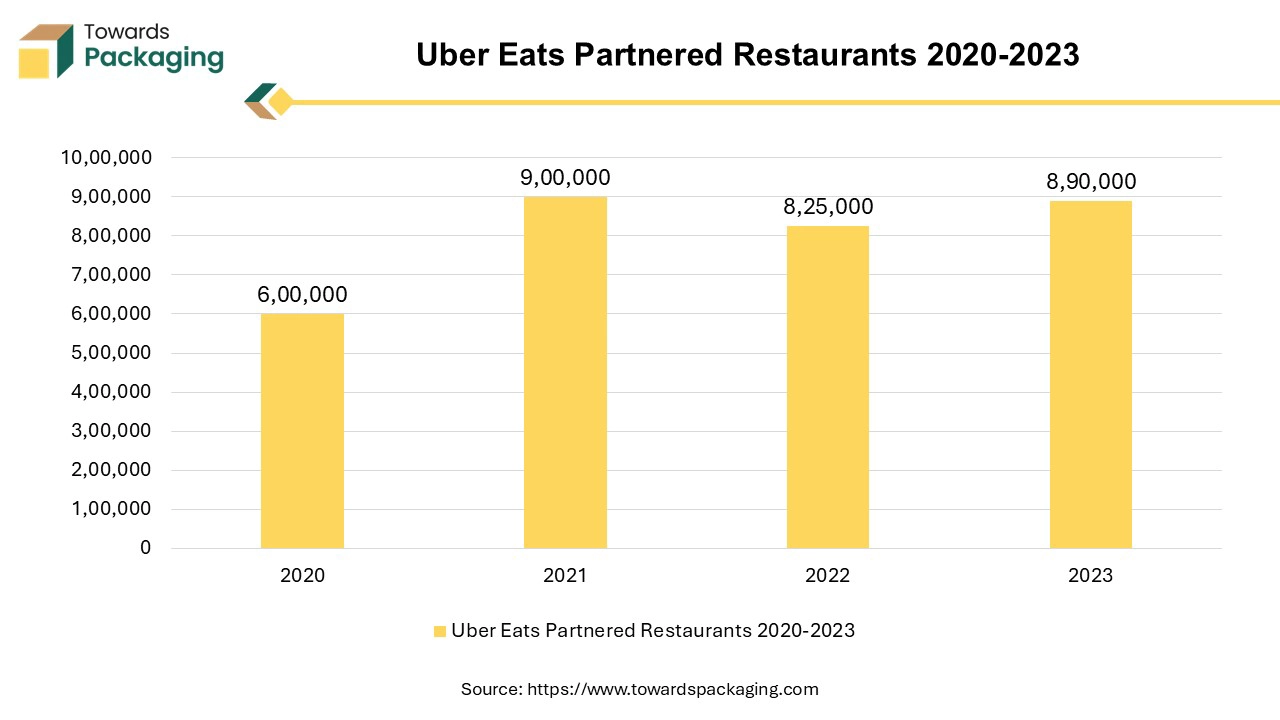

The food segment held the largest share of the global shaped corrugated packaging market in 2024. Food apps often allows access to a wide range of restaurants and cuisines, which demand different shaped corrugated packaging. The online food ordering apps offer features such as real-time order tracking, personalized recommendations, and easy reordering based on past purchases, improving the user experience.

The COVID-19 pandemic accelerated the adoption of online food ordering as people sought contactless transactions to minimize exposure. The Food ordering apps got boom as it allows customers to browse menus, place orders, and make payments from their smartphones or computers, eliminating the demand to visit cafes and restaurants in person or make phone calls.

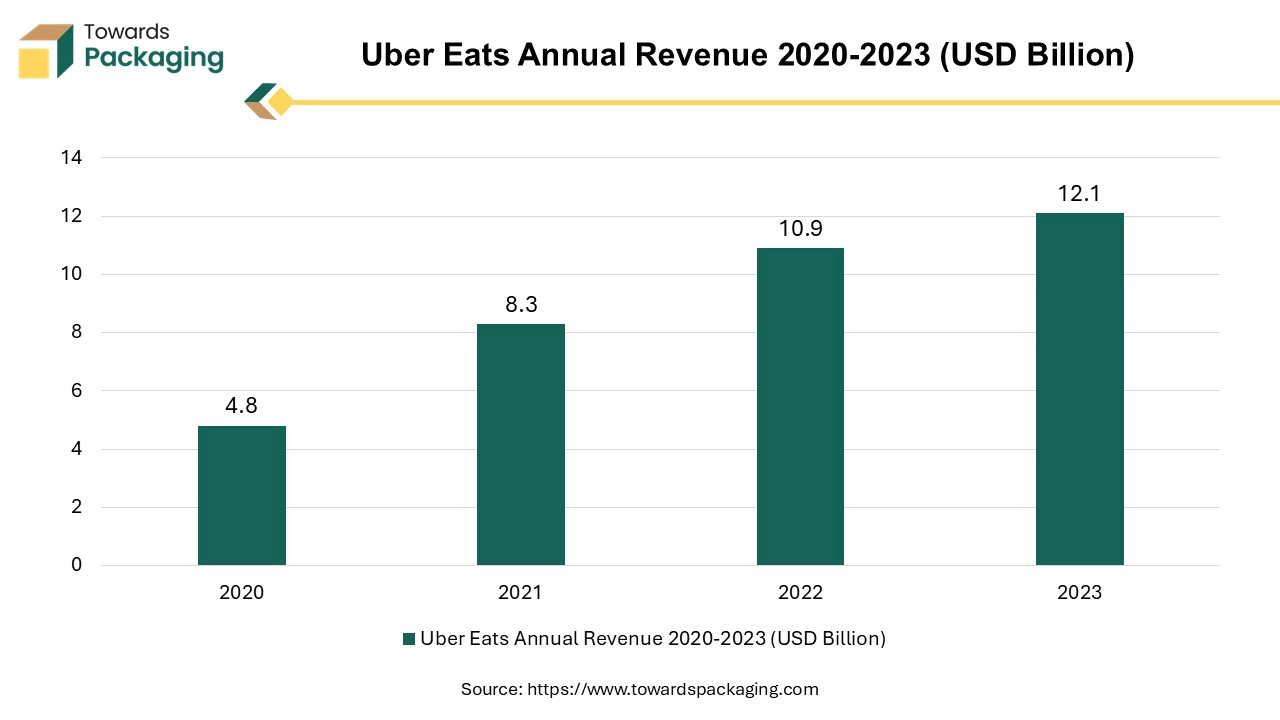

Here, is the representation of the revenue generated by online food delivery app which is supported by the people due to busy life-style.

Asia Pacific led the shaped corrugated packaging market in 2024. The expansion of modern retail formats such as supermarkets, hypermarkets, and convenience stores is contributing to the demand for diverse and innovative packaging solutions to enhance product appeal and shelf presence. Accelerated urbanization in the Asia Pacific region is driving the demand for convenient and efficient packaging solutions for a rising urban population that values convenience and on-the-go consumption. The key players operating in the market are focused on launching electronics and automobile products in shaped corrugated packaging which is estimated to drive the growth of the shaped corrugated packaging market in Asia Pacific region over the forecast period.

North America is observed to witness the fastest rate of expansion in the upcoming years. Rapid Urbanization and changing lifestyle has given boom to e-commerce sector in North America. The growing e-commerce platform in North America region has remarkably increased the demand for corrugated packaging, as it is extensively used for shipping goods securely and efficiently.

By Type

By Flute

By Combined Board

By End Use

By Region

April 2025

April 2025

April 2025

April 2025