April 2025

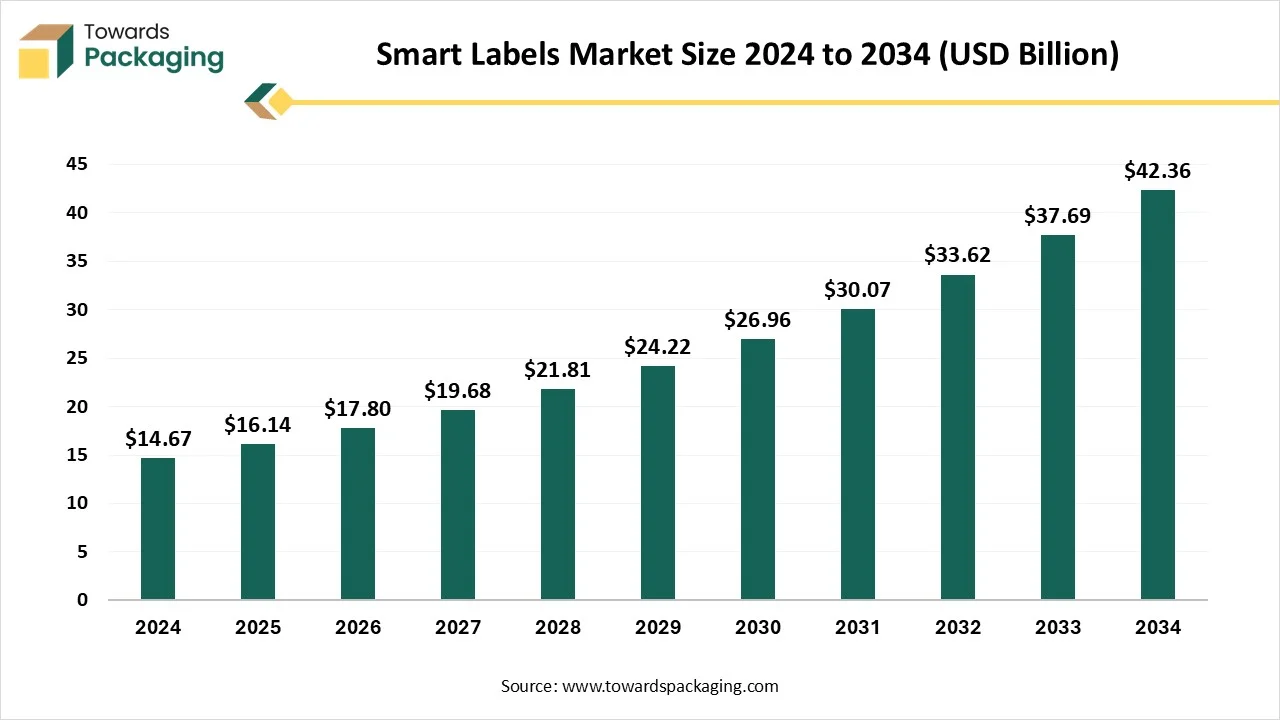

The smart labels market is expected to increase from USD 16.14 billion in 2025 to USD 42.36 billion by 2034, growing at a CAGR of 11.32% throughout the forecast period from 2025 to 2034.

The smart labels market is experiencing steady growth within the estimated timeframe. A smart label is one which integrates technology to broaden the use and information on labels or packaging beyond what can be printed using conventional techniques. This can be in the form of near field communication (NFC), QR codes and RFID tags, among other types. To enable an interaction, these labels depend on a user's interaction through an end-user device such as a smartphone. The QR code is among the most widely used smart labels. Customers can simply add this discreet square to product labels so they can be scanned by their mobile devices. These labels are capable of storing and transmitting data, supporting real-time tracking, monitoring as well as improved communication between products and systems. Smart labels are used across industries like retail, logistics, healthcare and food & beverage to increase transparency, security and operational efficiency.

The increasing demand for real-time tracking and inventory management across industries is expected to augment the growth of the smart labels market during the forecast period. Furthermore, the rise in the products such as pharmaceutical and luxury goods sectors along with the growing e-commerce sector and the growing international trade are also anticipated to augment the growth of the market. Additionally, the advancements in the technology like the integration of RFID, NFC and IoT as well as the consumer preference for transparency regarding product origin and ingredients coupled with the shift towards automation and digital transformation in the manufacturing and supply chains is also projected to contribute to the growth of the market in the near future.

| Metric | Details |

| Market Size in 2024 | USD 14.67 Billion |

| Projected Market Size in 2034 | USD 42.36 Billion |

| CAGR (2025 - 2034) | 11.32% |

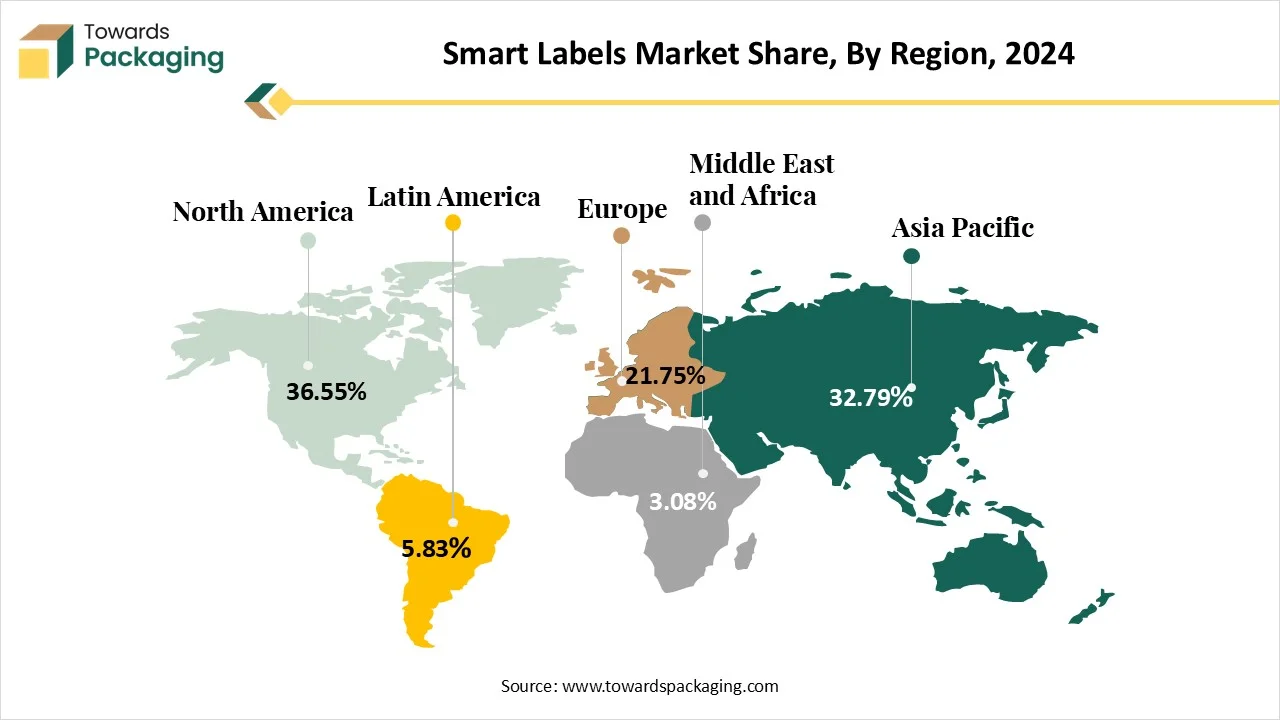

| Leading Region | North America |

| Market Segmentation | By Technology, By Component, By Application, By End Use and By Region |

| Top Key Players | CCL Industries Inc., SATO Holdings Corporation, All4Labels Global Packaging Group |

The rising need for anti-counterfeiting measures across various industries owing to the increasing prevalence of the counterfeit products is anticipated to support the growth of the smart labels market during the estimated timeframe. These fake goods can negatively impact a company's brand image as well as cost them millions and billions of dollars annually. Furthermore, they can lead to major health and safety problems since these products may not always adhere to the laws in force, in addition to being the source of discontent for consumers who are deceived into purchasing phony, poor quality products.

According to the U.S. Customs and Border Protection (CBP), about 90% of the entire amount seized in FY 2024 came from China and Hong Kong. With 5,132,402 items, handbags and wallets accounted for 15.8% of all IPR (Intellectual Property Rights) seizures in the FY 2024, making them the most commonly seized category. With seizures of over $1.6 billion (USD), or 30% of the entire value of items confiscated in the FY 2023, jewelry was one of the most valuable products when measured in terms of total MSRP value.

This increase in the fake branded items has pushed companies to adopt advanced solutions to protect their brand integrity and consumer trust. Smart labels are beneficial for authentication as well as traceability. These labels store encrypted product data that can be scanned and confirmed at any stage of the supply chain to guarantee that only trustworthy products reach the end customers. Since the organizations want to protect their consumers and reputation, the utilization of the smart labels as an anti-counterfeiting option is gaining popularity worldwide.

The inconsistent performance of the smart labeling technologies due to signal and scanning reliability issues is expected to limit the growth of the smart labels market during the estimated timeframe. Smart labels such as RFID and QR code technologies, are susceptible to a range of environmental and technical factors that can affect their functionality. RFID systems utilize radio waves to function, which makes them open to signal interference from electrical equipment, heavy machinery and wireless equipment. Furthermore, crosstalk that is the interference between many RFID scanners in close range to one another can result in missed or false readings. Physical barriers like walls, metal surfaces as well as liquid-filled containers exacerbate these problems through reflected or absorbing signals, thus decreasing the data transmission's practical range and accuracy.

Another problem with RFID systems is alignment; if the antennas on the RFID tag and reader are not aligned, communication may completely stop. An additional concern is tag density that implies if the tags are too close in proximity; their signals may conflict and distort the data. Surfaces that are not optimal for tagging, unless properly insulated tags are used, have the potential to hamper successful transmission. Similar difficulties with scannability arise when QR codes are printed on low-quality surfaces or in low resolution. Images that are stretched, blurry as well as otherwise distorted may be difficult for scanners to correctly decode. Additionally, a low contrast in colors between the background and the QR code makes it harder to read and less visible. These performance reliability issues demoralize user confidence and can deter adoption, specifically in critical applications like logistics, healthcare and inventory management.

The rising consumer demand for transparency and detailed product information is likely to augment the growth of the smart labels market in the years to come. Today the consumers are better informed and conscious than ever before, placing a high value on knowing exactly what they are buying when it comes to food, cosmetics, apparel and pharmaceuticals. Factors such as ingredient safety, product origin, ethical sourcing and manufacturing processes as well as the environmental impact are important while making the purchasing decisions. This shift in the consumer behavior is owing to the increasing awareness of health, environmental concern and ethical consumption alongside the growing mistrust toward misleading product claims.

According to the research by the Food Industry Association (FMI), the demand of customers for transparency has continuously increased—from 69 percent in 2018 to 76 percent in 2023, supported primarily by millennials and parents. In response, many organizations have started using front-of-pack labeling, which 63% of the consumers find useful and 87% of the buyers have observed. Nonetheless, compared to 50% in 2021, 55% of the consumers still look for more information than what is on the label. Interestingly, 82% of the consumers said they will probably scan a product or the QR code to get more information, indicating an increasing dependence on digital tools to make well-informed decisions.

Smart labels solve these problems through providing an engaging and informative experience. Technologies such as QR codes and NFC tags help consumers to instantly access a wealth of information via simply scanning the label with their smartphone. This can consist of the data such as nutritional content, allergen warnings, sourcing certifications, manufacturing date, expiry and even the sustainability metrics like carbon footprint and packaging recyclability. This satisfies the consumer’s need for transparency and it also creates an opportunity for the brands to build deeper engagement and trust. As transparency becomes a key factor in consumer decision-making, smart labels work as a vital bridge between brands and consumers, contributing both value and credibility in the product experience.

Artificial intelligence and automation are the emerging technologies that are influencing the label and packaging printing sector. Although smart labels are not new, they are undoubtedly more common and valuable currently than they were a few years ago. AI can be applied to the sales and marketing divisions of label and packaging firms. AI can also be utilized by label organizations for closed captioned videos, AI-generated artwork, website material and social media copy. The smart labeling industry is going through a major transformation and working on developing smart solutions to improve the efficiency and reduce the costs associated with regulatory compliance in response to the rapid growth and scaling demands. For instance:

HCLTech recently introduced a smart labeling solution. This AI-powered system streamlines the entire labeling process. The majority of labeling tasks can be automated through the solution, increasing productivity, efficiency, as well as compliance. With the help of the solution, business users can automatically construct all pertinent sections of the patient information leaflet (PIL) document utilizing the derived source scientific labels (SmPCs) with a web-based interface. It applies transformation rules between the two documents and makes use of auto-detection and defined mapping between different sections. Additionally, the solution makes use of the text summary function to transform intricate medical information into an understandable PIL.

Additionally, AI facilitates the development of the self-learning smart labels that adapt based on the usage patterns and environmental factors, further escalating their application across industries like healthcare, food and manufacturing. Organizations can utilize AI to automate the label design process and generate attractive labels by utilizing smart algorithms. As a result, AI is not only improving the functionality of the smart labels but also driving growth in the global market.

The RFID labels segment held largest share of 46.64% in the year 2024. RFID tags are intelligent labels that hold information to be transmitted to RFID readers or RFID arcs through radio frequency. To identify a certain product, these labels must communicate with RFID readers or scanners. Furthermore, every package that is RFID-tagged has a unique code that enables error-free identification without requiring proximity between the RFID scanners and the tags. These features make RFID tags an excellent tool for automating tasks like inventory control and the movement of items into and out of a warehouse. Additionally, through facilitating the tracking of the company's assets after they leave the storage facility, RFID tags improve logistics traceability and increase supply chain efficiency and security, all of which are expected to support the segment's growth throughout the projected period.

The retail segment held largest share of 27.34% in the year 2024. This is due to the rising consumer demand, rapid digital transformation and the growth of the e-commerce sector and Omni-channel strategies. Furthermore, the rising internet penetration as well as the growing e-commerce platforms, digital payments, and data analytics is also likely to support the growth of the segment in the global market. Additionally, the innovation in product offerings and the competitive pricing strategies coupled with the improved last-mile delivery, service efficiency and the customer satisfaction is expected to contribute to the segmental growth of the market during the forecast period.

North America held considerable market share of 36.55% in the year 2024. This is due to the increasing demand for the real-time tracking, accurate inventory management, and improved security features across the region. Also, the stricter regulations regarding product traceability and safety specifically in the sectors like food and pharmaceuticals are also expected to support the regional growth of the market. For instance, in the US, the Food and Drug Administration is in charge of guaranteeing that foods marketed in the US are safe, nutritious, and appropriately labeled. Juice-containing beverages are subject to special regulations that call for precise proportion disclosures. Additionally, the growing focus on developing sustainable labels coupled with the growing adoption of the technologies for combating counterfeiting are also further expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at a considerable CAGR of 13.83% during the forecast period. This is due to the growing demand for transparency regarding the product information. Additionally, the surge in online shopping along with the expansion of the warehouses and third-party logistics (3PL) services are also expected to contribute to the regional growth of the market. According to the National Bureau of Statistics of China, the online retail sales in China increased by 7.2 percent reaching 15,522.5 billion Yuan as compared to the previous year. The online retail sales of the physical items accounted for 26.8% of the overall retail sales of consumer goods, with 13,081.6 billion Yuan, an increase of 6.5 percent. Furthermore, the growth in the healthcare sector and rising investments in the digital workshops, smart factories as well as automation solutions are likely to contribute to the regional growth of the market.

By Technology

By Component

By Application

By End Use

By Region

April 2025

April 2025

March 2025

March 2025