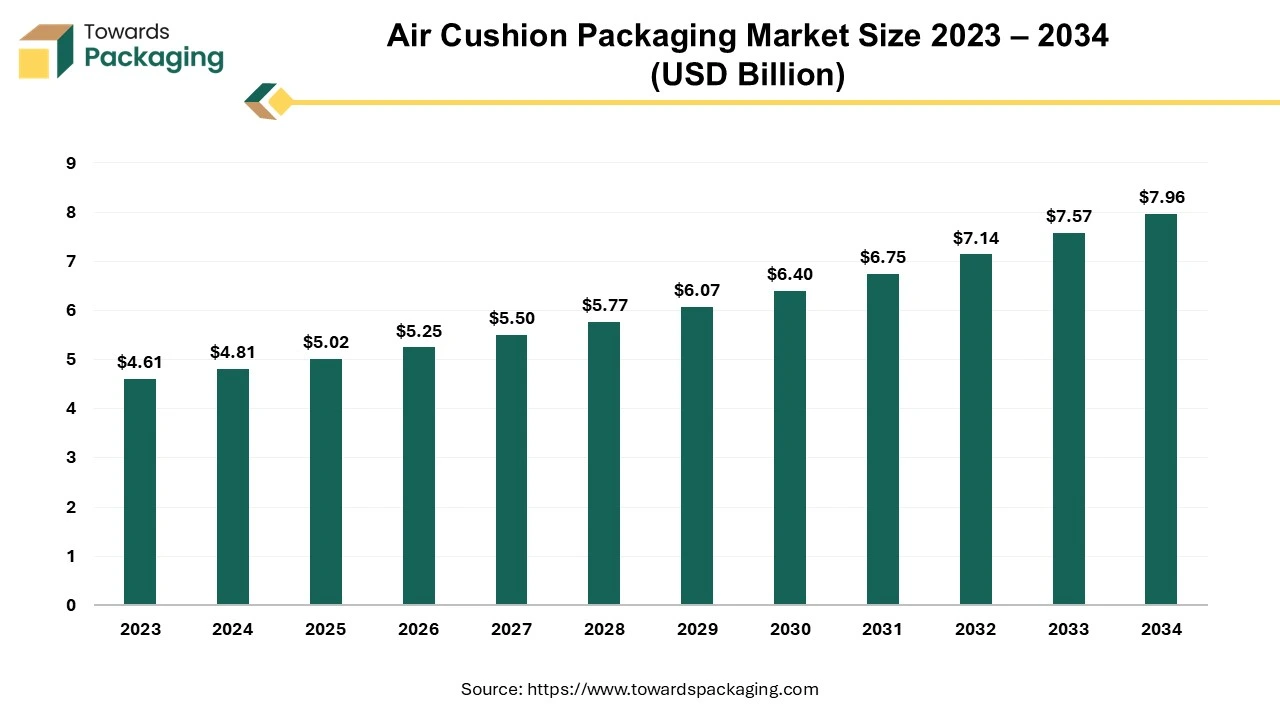

The air cushion packaging market is forecasted to expand from USD 5.32 billion in 2026 to USD 8.38 billion by 2035, growing at a CAGR of 5.18% from 2026 to 2035.

The air cushion packaging market is projected to witness considerable progress in the future. Air Cushion is a secure packaging option that replaces loose fill packing peanuts, bubble wrapping and paper void fill. Air cushions are a great way to save space since they come in rolls and can be inflated by a tiny machine as needed.

Air cushions are an excellent sustainable option for void fill as, on average, they only contain 1 percent material and 99 percent air. Using air to fill the gap inside the box greatly lowers the amount of resources utilized during packing, in addition to the cost of materials and shipment. The air cushion also has the advantage of not having any sharp or abrasive edges while remaining dust-free. It won't cause the products to get scratched, scraped, or dusty.

The rapid expansion of the e-commerce sector along with the growing consumer awareness about environmental sustainability has led to a shift toward eco-friendly and recyclable packaging are expected to augment the growth of the air cushion packaging market during the forecast period. Furthermore, the lightweight as well as cost-effective nature of the air cushion packaging makes it a preferred choice over the traditional alternatives like foam and bubble wrap.

Also, the rise in the demand for electronics and fragile items is further anticipated to augment the growth of the market. Additionally, the increasing focus of the companies on reducing carbon footprints coupled with the growth of the global supply chain and rising investments in the industrial automation are also projected to contribute to the growth of the market in the near future.

2025 has been highlighted as a potential tipping point for the adoption of scaled reusable packaging systems by the World Economic Forum. This is expected to indirectly influence the air cushion packaging market by providing alternative solutions for product protection during transit.

| Metric | Details |

| Market Size in 2025 | USD 5.06 Billion |

| Projected Market Size in 2035 | USD 8.38 Billion |

| CAGR (2025 - 2035) | 5.18% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Functionality, By Application and By Region |

| Top Key Players | Sealed Air Corporation, Pregis Corporation, Storopack Hans Reichenecker GmbH, Smurfit Kappa Group, Intertape Polymer Group (IPG) |

The demand for lightweight and cost-effective packaging is anticipated to augment the growth of the air cushion packaging market during the forecast period. This shift is motivated by the two advantages that is lowering the transportation-related CO2 emissions and reducing the impact on the landfills. Since air cushion packaging is lightweight, it has a lower environmental effect without affecting functionality or durability. This transformation requires packagers to rethink their printing technology and equipment to make sure they are compatible with lighter materials while preserving the integrity of key product information.

Thus, the companies save costs when package weight is reduced. Shipping organizations estimate the expenses by calculating how a cargo's weight and volume correlate with one another. As a result, packaging that is lightweight reduces the transportation costs along with the material acquisition expenses.

Moreover, companies can show their dedication to sustainability and comply with the waste reduction regulations by implementing lighter and more efficient packaging options. Also, lightweight packaging can provide customers more portability and convenience. For example, compared to big, bulky containers, lightweight options like air cushions could be easier to transport and store. Customer satisfaction may increase as a result of the improved user experience.

In addition, air cushions are a desirable alternative for the enterprises of all sizes since they can be produced on-site using small equipment, which also lowers handling and storage expenses. As industries increasingly prioritize operational efficiency and sustainability, lightweight packaging options have gained immense popularity. Air cushion packaging, with its minimal material usage and superior protective capabilities, offers an ideal solution to these needs.

The presence of alternative cost-effective packaging solutions is likely to hinder the growth of the air cushion packaging market during the estimated timeframe. The popularity of corrugated packing can be attributed to its exceptional durability and lightweight nature. It tends to be reasonably priced and obtainable from a wide range of retailers. Approximately 90 percent of all products are being delivered using this method in some way. It is reusable and made entirely with recyclable materials. It is also quite renewable as it is created from pine and birch trees, which grow quickly, and it can be easily recycled back into new corrugated packaging. Corrugated packaging is an affordable option which is secure enough to guarantee the safety of the goods. Additionally, this packaging can be specially made to fit a product without wasting too much material.

Furthermore, the mushroom packaging, which looks like foam, is a relatively new substitute. In fact, mushroom packaging is more durable and resistant to flames compared to its foam equivalent. Above all, it is biodegradable and entirely renewable. It can actually be decomposed in individual compost piles. It only contributes 10 percent of the greenhouse gas emissions that come from the production of plastic. A wide range of forms and sizes can be created by molding this substitute packaging material. The attractiveness of this packaging option is further improved by the material's affordability. Thus, even if air cushions provide advantages such as lightweight design and on-site production, the need for initial investment in machinery and a narrower application range can limit their adoption.

The global shift towards the eco-friendly and recyclable packaging materials are expected to create growth opportunity for the air cushion packaging market in the near future. The growing awareness about the environmental sustainability, consumers and organizations are prioritizing packaging options that minimize the ecological impact. Air cushion packaging manufacturers are focusing to capitalize on this shift by making products that are made-up of biodegradable, compostable and fully recyclable materials. For instance:

Pregis's Renew Zero air cushions are manufactured from retrieved plant-based waste and actual consumer waste. Renew Zero air cushions are made with the use of 50 percent of the recycled sustainable plant-based waste such as husks and leaves and 50% recycled consumer plastic waste such as wraps and bags. The air cushions can be recycled 100% of the time. From cradle to gate, the air cushions are CO2-neutral.

Another example of a sustainable option is the PaperWave bio paper air cushions from Floeter. These air cushions are said to be composed entirely of recycled paper and are biodegradable according to the FSC certification. The air cushion films are apparently inflated right at AirWave packaging stations, saving energy and greenhouse gas emissions which might otherwise be utilized for transportation. They are believed to contain 5% and 95% air upon inflation, making them a practical and reasonably priced way to secure goods while they are being transported.

Sustainable air cushions can help companies lower their carbon footprints, specifically in the e-commerce and logistics sectors, where packaging usage is extensive. This trend is also fueled due to the stringent government regulations along with the international initiatives that are aimed at reducing the plastic waste and carbon emissions. This move promotes innovation and guarantees long-term market viability by balancing the combined needs of sustainability and operational efficiency.

The void-filling segment held largest market share of 35.15% in 2024. This is owing to the growing demand from industries such as e-commerce, logistics, consumer electronics and retail. Air cushions work well for filling gaps and providing padding around and between the products. An "air system" will fill and seal each pocket, ready for use, when it is supplied on a roll. The package's recipient can simply "pop" the pockets for convenient disposal or keep and reuse the packaging. They absorb shock and reduce product movement during transit, protecting the product. Void fillers can be a visually pleasing element of the complete packaging design, even though they serve a functional purpose. Traditionally, these cushions are made-up of plastic, but more recently, recycled materials and paper have been used as sustainable substitutes.

The consumer electronics & appliances segment held largest market share of 35.42% in 2024. This is due to the increasing consumer demand and expanding global connectivity. Furthermore, the rapid innovation in electronics such as the development of the smartphones, smart home devices, wearable technology and high-performance laptops is also expected to contribute to the segmental growth of the market. Additionally, the increasing penetration of the Internet of Things (IoT) and smart technologies into their daily operations is also expected to support the growth of the segment in the global market in the years to come.

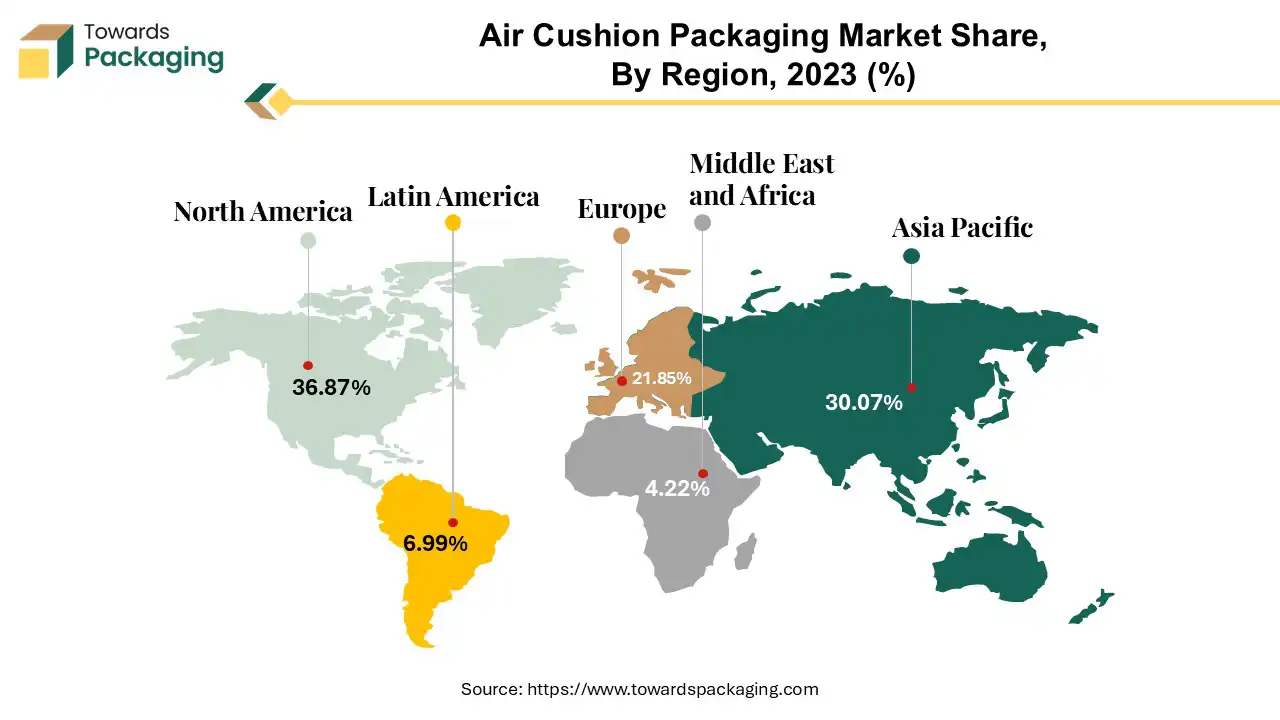

Asia Pacific is likely to grow at fastest CAGR of 7.13% during the forecast period. This is due to the increasing manufacturing and consumption of consumer electronics inn countries like China, South Korea, India and Japan. As per the Ministry of Industry and Information Technology, China produced 374 million phones in the first three months of 2024, a 13.6 percent rise from the previous year. In addition, the production of integrated circuits increased by 40% reaching 98.1 billion units. Also, the increasing disposable income along with the rising population in China and India is likely to contribute to the regional growth of the market. Furthermore, the growing healthcare sector and demand for temperature-sensitive and fragile products is also expected to contribute to the regional growth of the market.

Retail Modernization: Key Trend in China’s Market

China is leading the regional market due to countrywide advancements in retail modernization. China has witnessed rapid growth in e-commerce. The well-established industries, including food& beverage and a strong manufacturing base, drive adoption of advanced packaging solutions, such as air cushion packaging.

North America held largest market share of 36.87% in 2024. This is owing to the developed e-commerce ecosystem led by giants like Amazon, Walmart and eBay as well as the high volume of online shopping. Furthermore, the high levels of industrial automation and efficient supply chains as well as the stringent regulations in the packaging industry are also expected to contribute to the regional growth of the market. Additionally, the growing percentage of active trade agreements and significant imports and exports between the U.S., Canada and Mexico is also expected to contribute to the regional growth of the market. Moreover, the increasing consumers demand for quick delivery and damage-free products is also anticipated to promote the growth of the market in the region in the near future.

The Rise in E-commerce: The Rise in the U.S. Market

The U.S. is a major player in the North American air cushion packaging market, driven by the rapid growth of e-commerce in the country, driving demand for protective packaging solutions, including air cushions. The U.S. is the hub for advanced manufacturing expertise, driving innovation and development of high-quality packaging solutions. Retail companies in the U.S. are focusing on adopting more efficient and space-saving packaging solutions to reduce shipping costs as well as waste, creating great opportunities for air cushion packaging solutions.

Amazon and Furniture company West Elm have replaced plastic cushioning with fiber-based, curbside recyclable packaging and paper-based protective packaging in 2024 for North America.

By Functionality

By Application

By Region

January 2026

January 2026

January 2026

January 2026