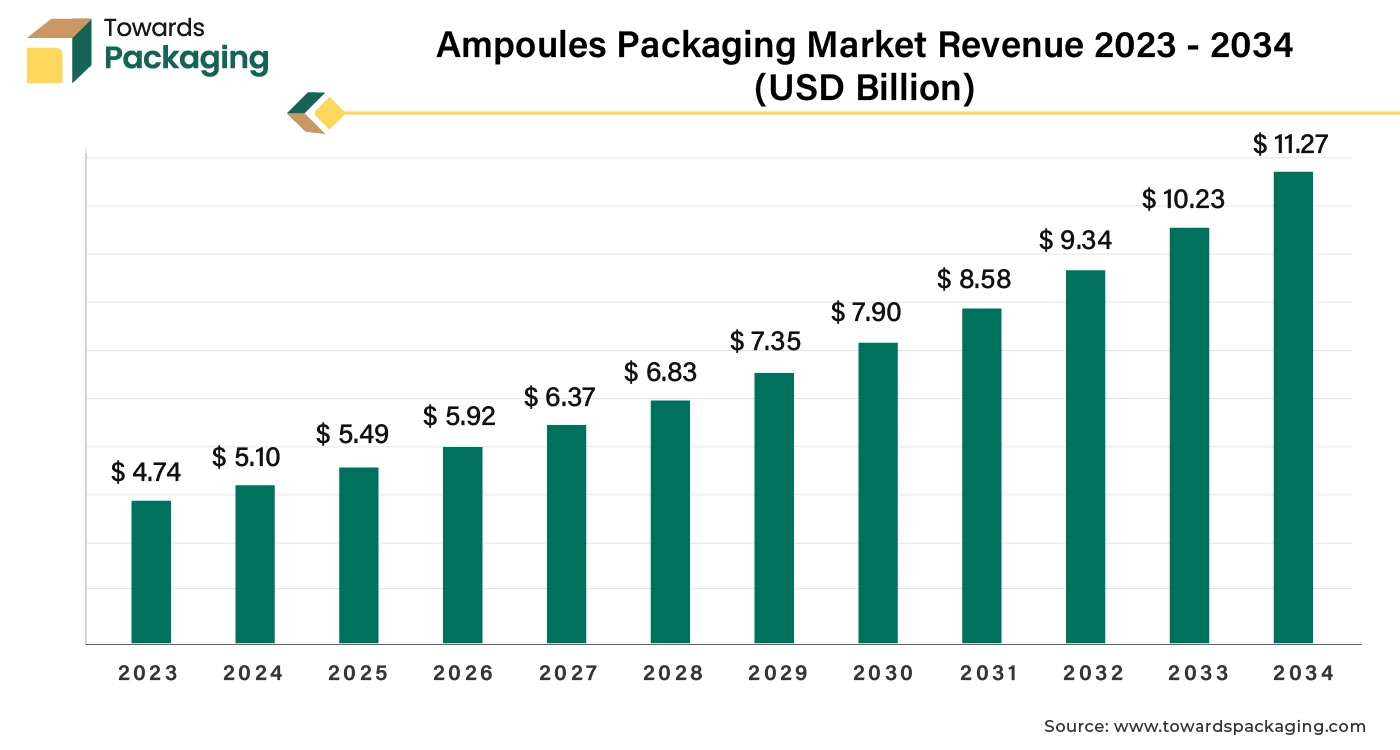

The ampoules packaging market is forecasted to expand from USD 5.90 billion in 2026 to USD 11.42 billion by 2035, growing at a CAGR of 7.60% from 2026 to 2035. This report covers detailed segmentation by material (glass, plastic, aluminum), end-user (pharmaceutical, personal care, and cosmetics), and region (North America, Europe, APAC, Latin America, and MEA). It provides competitive analysis, value chain analysis, and in-depth data on key players, manufacturers, and suppliers, along with regional trade and market dynamics.

Innovations in glass and plastic materials enhance the performance and safety of ampoules. Advances in manufacturing processes improve efficiency and reduce costs, supporting market growth. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing ampoules packaging which is estimated to drive the global ampoules packaging market over the forecast period.

Ampoules packaging refers to the type of container used to hold and preserve liquid medications, vaccines, or other substances. Ampoules are small, sealed vials typically made of glass, and they are designed to be broken open to access their contents. The packaging ensures that the contents remain sterile and protected until they are used.

In medical and pharmaceutical settings, ampoules are often used for injectable drugs and are packaged in a way that maintains their integrity and safety. Ampoules packaging is a specialized form of packaging designed to ensure the safe and sterile containment of liquids, typically used in pharmaceuticals and medical applications.

The key players operating in the market are focused on geographic expansion and launching their brand in other countries which is expected to drive the growth of the ampoules packaging market in the near future. Increasing focus on cost reduction and production efficiency can drive the specialty market growth further. The global packaging market size is growing at a 3.16% CAGR.

Ampoules are usually made from glass, although plastic variations exist. Glass is preferred for its inert properties and ability to provide an effective barrier against contamination. Ampoules come in various shapes and sizes, typically ranging from 1 ml to 10 ml or more. The shape is often a cylindrical or conical form, which facilitates easy breaking or opening. The ampoule is sealed by melting the neck of the glass tube, creating a hermetic seal. This process ensures that the contents remain sterile and uncontaminated until the ampoule is opened.

The sealed environment prevents exposure to air, moisture, and contaminants, which is crucial for injectable medications and vaccines. Typically, ampoules are designed for single use. This minimizes the risk of contamination and ensures accurate dosing. Once opened, the entire content is generally used immediately.

Ampoules are often packaged in protective materials to prevent breakage during transportation. This may include blister packs, cardboard cartons, or plastic trays. Each ampoule is labeled with essential information such as the name of the drug, dosage, expiration date, and batch number. Proper labeling is crucial for ensuring correct usage and traceability.

Industry Growth Overview

Expansion of the pharmaceutical industry, rising biologics production, and stringent regulatory requirements are fueling market growth. Automation in ampoule filling and sealing is also increasing efficiency.

Sustainability Trends

Use of lightweight glass, recyclable materials, and energy-efficient manufacturing reduces environmental impact. Pharmaceutical companies are moving toward eco-friendly and safe packaging options.

Startup Ecosystem

Startups are innovating in automated filling, labeling, and inspection systems. They focus on precision, contamination-free processes, and digital traceability for pharmaceutical packaging.

AI-driven inspection systems can detect defects in ampoules, such as cracks, contamination, or inconsistent fill levels, with high precision. This ensures higher product quality and reduces waste. AI can optimize manufacturing processes by predicting equipment failures, scheduling maintenance, and improving overall machine performance, leading to reduced downtime and increased productivity.

AI algorithms can forecast demand more accurately, manage inventory levels efficiently, and streamline logistics, reducing costs and ensuring timely delivery of packaging materials. AI tools can assist in designing ampoules and packaging solutions that meet specific requirements and preferences, enabling more personalized and innovative packaging options. AI can automate repetitive tasks such as filling, sealing, and labeling ampoules, which enhances speed, accuracy, and consistency in the packaging process.

AI can analyze market trends, customer preferences, and production data to provide actionable insights, helping companies make informed decisions and adapt to changing market conditions.

AI can assist in ensuring that ampoules meet stringent regulatory standards by monitoring compliance data and generating necessary documentation. AI can enhance safety by monitoring and managing the conditions under which ampoules are filled and sealed, reducing the risk of contamination and ensuring the integrity of the product. By leveraging AI, the ampoules packaging market can experience improved quality control, efficiency, and innovation, ultimately leading to better products and more effective market strategies.

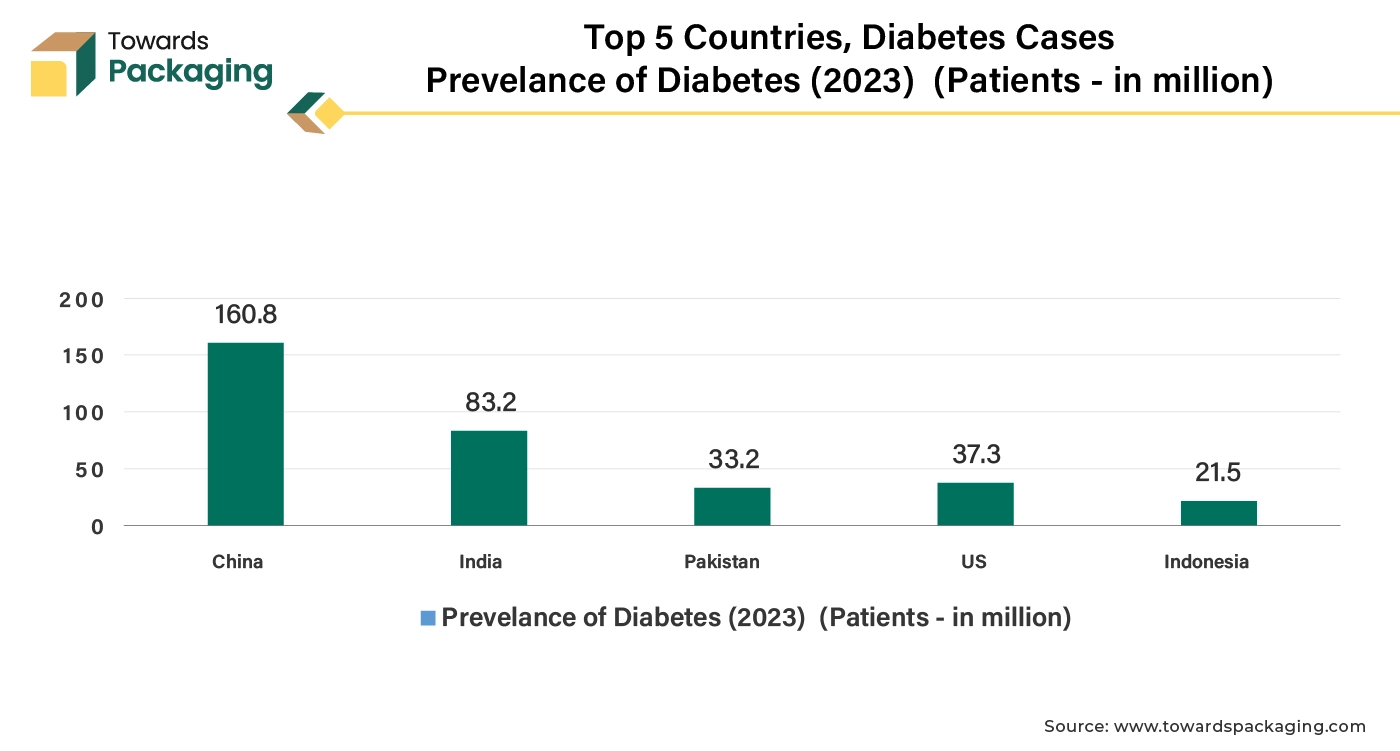

Growing prevalence of chronic diseases like diabetes and cancer drives the need for injectable drugs, which are commonly packaged in ampoules. Ampoules offer precise measurement and dosing of medications, which is crucial for managing chronic diseases that require consistent and accurate drug administration. Ensures that patients receive a consistent dose with each administration, important for chronic conditions where stable drug levels are necessary. Ampoules provide a high level of sterility, reducing the risk of contamination, which is critical for patients with chronic diseases who may have compromised immune systems. Chronic diseases like diabetes, hypertension, and rheumatoid arthritis are on the rise globally. The management of these conditions often involves injectable treatments, boosting demand for ampoules.

The ampoules packaging market face restriction in expansion due to the challenges occurring in manufacturing of ampoules as well as alternative packaging options available make it more challenging. he production and material costs of ampoules, especially those made from high-quality glass, can be relatively high compared to other packaging options. Glass ampoules are fragile and prone to breakage, which can lead to product loss and safety concerns.

This can limit their use in certain applications. The availability of alternative packaging solutions such as plastic vials, blister packs, and prefilled syringes, which may offer better safety, convenience, or cost-efficiency, can limit the growth of ampoules. Stringent regulations regarding the safety and quality of pharmaceutical packaging can pose challenges for manufacturers, potentially affecting market growth. The environmental impact of glass waste and challenges in recycling can lead to increased scrutiny and drive demand toward more sustainable packaging solutions.

Advances in packaging technology may not always be compatible with traditional ampoule designs, potentially hindering their adoption in new markets. Shifts in consumer and industry preferences toward more user-friendly and efficient packaging solutions can impact the demand for ampoules.

There is a growing emphasis on preventive healthcare to reduce the incidence of infectious diseases and protect public health. Vaccines are highly effective in preventing diseases that can cause significant morbidity and mortality. Increased vaccination helps in controlling outbreaks and preventing the spread of diseases.

International organizations such as the World Health Organization (WHO) and GAVI (the Vaccine Alliance) are promoting vaccination as a means to achieve global health targets and eradicate certain diseases. Advances in vaccine technology and production methods have made vaccines more effective, safer, and easier to distribute.

There is greater public awareness of the benefits of vaccination, driven by educational campaigns and information dissemination. Vaccination programs aim to achieve herd immunity, which reduces the spread of contagious diseases and protects those who cannot be vaccinated.

For instance,

The glass segment held the dominating share of the ampoules packaging market in 2024. Glass is highly resistant to chemical reactions, making it ideal for storing pharmaceuticals and other sensitive substances without reacting with or contaminating the contents. Glass provides an excellent barrier against gases, moisture, and light, which helps in maintaining the stability and efficacy of the product inside the ampoule. Transparent glass allows for easy visual inspection of the contents, which is crucial for ensuring the quality and consistency of the product.

Glass is non-reactive and does not leach harmful substances into the contents, making it a safe choice for packaging pharmaceuticals and other critical products. Glass can withstand high-temperature sterilization processes, which is essential for ensuring that ampoules are free from contaminants before filling. The breakable nature of glass provides a clear indication of tampering or breaches in the packaging, enhancing the security and integrity of the product.

While glass is fragile, it is also durable under proper handling and storage conditions, providing reliable protection for its contents. These attributes make glass a preferred material in the ampoules packaging industry, particularly for high-value and sensitive products. Focusing on the advantages offered by the glass ampoules the key players operating in the market are focused on expanding the manufacturing capacity of glass ampoules packaging to meet the high demand from consumers.

For instance,

The pharmaceutical segment held a significant share of the ampoules packaging market in 2024. Ampoules are hermetically sealed, ensuring that their contents remain sterile until they are opened. This is crucial for injectable medications and other sterile products. The sealed nature of ampoules protects the contents from environmental contaminants, such as dust, moisture, and microorganisms.

Ampoules are often pre-measured, providing precise doses of medication, which is essential for ensuring correct administration and treatment efficacy. The breakable design of ampoules provides a clear indication if the packaging has been tampered with or compromised, enhancing product safety. Glass ampoules offer excellent barrier properties against gases and light, which helps in maintaining the stability and effectiveness of sensitive pharmaceutical products. Glass ampoules offer excellent barrier properties against gases and light, which helps in maintaining the stability and effectiveness of sensitive pharmaceutical products.

Ampoules meet stringent regulatory requirements for packaging in the pharmaceutical industry, ensuring that they adhere to safety and quality standards. They are designed for single use, which simplifies the administration of medication and minimizes the risk of dosing errors or contamination. These factors collectively contribute to the widespread use of ampoules in the pharmaceutical industry, particularly for injectable drugs and other products requiring high levels of sterility and protection.

With this investment, AbbVie strengthens its pipeline in oncology and immunology and grows its worldwide production network. The corporation has already spent the last ten years investing US$740 million in the Singapore site.

Asia pacific region held the largest share of the ampoules packaging market in 2024. The rise in pharmaceutical manufacturing in countries like China and India drives demand for ampoules as a packaging solution for injectable and other medications. Increased healthcare spending and expanding healthcare infrastructure across Asia Pacific contribute to the need for efficient and secure packaging solutions.

Regulatory frameworks in the region that ensure high standards for drug packaging and safety support the use of ampoules. The preference for single-dose ampoules in clinical and home settings ensures sterility and convenience, driving ampoules packaging market growth. These factors collectively contribute to the dynamic expansion of the ampoules packaging market in Asia Pacific.

India Ampoules Packaging Market Trends

The ampoules packaging market in India is growing rapidly due to the nation's robust pharmaceutical manufacturing sector and growing production of vaccines and injectable medications. Glass ampoules are being used for safe and sterile drug delivery due to rising exports, government support for pharmaceutical manufacturing, and rising domestic healthcare demand. The market is expanding thanks to ongoing investments in cutting-edge packaging lines and adherence to international quality standards.

North America region is anticipated to grow at the fastest rate in the ampoules packaging market during the forecast period. The highly developed healthcare infrastructure in North America increases the demand for efficient and reliable drug packaging solutions, including ampoules. Continuous innovation and development in the pharmaceutical sector, including the introduction of new injectable drugs and biologics, drive the need for ampoules.

The growing focus on biopharmaceuticals, which often require specialized packaging like ampoules for stability and safety, fuels ampoules packaging market growth. The prevalence of chronic conditions such as diabetes and cancer leads to a higher demand for injectable medications, which are frequently packaged in ampoules.

For instance,

Ampoules are valued for their ability to maintain the sterility and safety of medications, which is crucial in North America's healthcare system. Advances in ampoule production technologies, including improved materials and automated manufacturing processes, contribute to the growing adoption of ampoules. These factors collectively support the expansion of the ampoules packaging market in North America.

| SCHOTT Pharma | Healthcare Company |

| Headquartered | German, Europe |

| Strategic Development | In 2023, SCHOTT Pharma, announced strategically expands its injectable manufacturing unit in Serbia, Europe by investing in new production facility. |

| Recent Development | In January 2024, SCHOTT Pharma revealed the introduction of the new production facility for glass production in Europe. |

| Ormaie | French Perfume Industry |

| Headquartered | France, U.K. |

| Recent Development | In September 2023, Ormaie, revealed the introduction of the perfume collection in smaller size refillable glass ampoules which is made out of 100% natural ingredients. |

U.S. Ampoules Packaging Market Trends

In the United States, the ampoules packaging market is driven by the existence of a robust biotechnology and pharmaceutical sector. Ampoules are consistently used due to the high demand for biologics, specialty injectables, and emergency medications. Strict drug safety and sterility regulations push producers to depend on premium ampoule packaging, which leads to consistent but value-driven market expansion.

Europe represents a mature but stable market for ampoule packaging, backed by robust pharmaceutical manufacturing and strict regulations. Drug safe traceability and environmentally friendly packaging are highly valued in the area. The growing use of injectable treatments and the existence of top pharmaceutical firms in several European nations support demand.

Germany Ampoules Packaging Market Trends

Germany plays a key role in the European ampoules packaging market due to its sophisticated pharmaceutical sector and commitment to high-quality production. The demand for premium glass ampoules is fueled by the nation's leadership in pharmaceutical exports and precision packaging technologies. Sustained market growth is supported by automation, ongoing innovation, and adherence to stringent safety regulations.

The ampoules packaging market in Latin America is expanding gradually as pharmaceutical production rises and healthcare access improves. Ampoule packaging is becoming more popular due to the growing demand for injectable medications and increased investments in healthcare infrastructure. Enhancements to regulations and a greater emphasis on medication safety are also driving market growth throughout the region.

Brazil Ampoules Packaging Market Trends

Brazil dominates the ampoules packaging market in Latin America due to its sizable population, developing healthcare systems, and increasing capacity for pharmaceutical production. The use of ampoules is increasing due to the growing need for injectable medication and hospital-based treatments. Stricter regulatory oversight and increased local production are bolstering the nation's market growth.

The ampoules packaging market in the MEA regions is developing steadily, supported by a rise in local manufacturing, pharmaceutical imports, and healthcare spending. The use of ampoules is being encouraged by the rising demand for injectable medications to treat infectious and chronic diseases. Long-term growth opportunities are being created by improving healthcare infrastructure despite the market's smaller size in comparison to the developed regions.

UAE Ampoules Packaging Market Trends

In the UAE, the ampoules packaging market is growing due to the nation's aspirations to become a regional pharmaceutical hub and the growth of healthcare facilities. The use of ampoules is being driven by an increase in the demand for sterile single-dose injectable medications. High standards for medical packaging and government programs to encourage domestic drug production are further bolstering market growth.

By Material Type

By End User

By Region

January 2026

January 2026

January 2026

January 2026