Automotive Plastic Compounding Market Outlook Scenario Planning & Strategic Insights for 2034

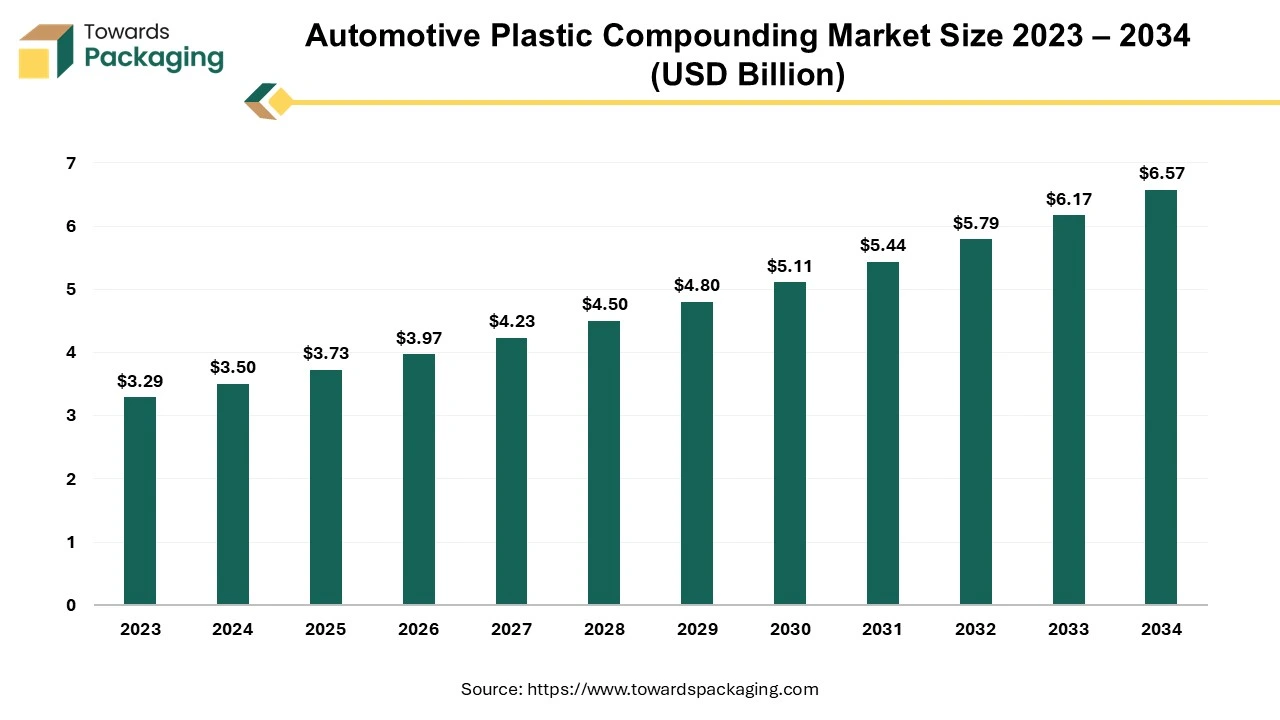

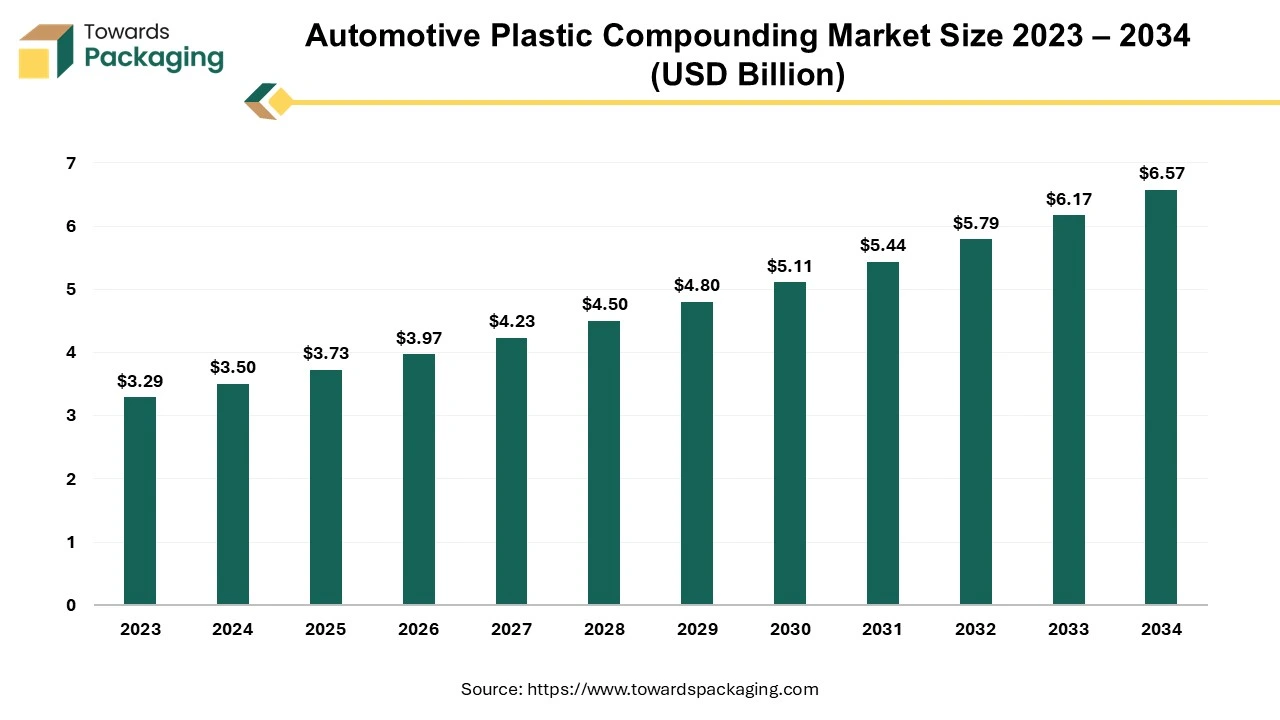

The automotive plastic compounding market is forecasted to expand from USD 3.97 billion in 2026 to USD 7.00 billion by 2035, growing at a CAGR of 6.50% from 2026 to 2035. The Automotive Plastic Compounding Market study includes market size and forecast to 2035, Asia Pacific dominance, fastest growth in North America, detailed segment data by polypropylene, polycarbonate and applications, plus trade data, value chain structure, manufacturer and supplier analysis, and competitive positioning of key global players.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing automotive plastic compounding which is estimated to drive the global automotive plastic compounding market over the forecast period.

Major Key Insights of the Automotive Plastic Compounding Market

- Asia Pacific dominated the automotive plastic compounding market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By product, the recycled fiber segment registered its dominance over the global automotive plastic compounding market in 2024.

- By application, the food & beverages segment dominated the automotive plastic compounding market in 2024.

Automotive Plastic Compounding Market: Plastic Material Manufacturing

Automotive plastic compounding means the process of customizing and improving plastic materials to meet the specific requirements of automotive applications. This involves blending base polymers (like polypropylene, polycarbonate, or ABS) with additives, fillers, reinforcements, and colorants to improve the material's properties.

The automotive plastic compounding designs plastics to meet requirements such as strength, durability, heat resistance, or aesthetics. The automotive plastic compounding can improve flowability or reduce cycle times during molding. In summary, automotive plastic compounding ensures that the plastic materials used in vehicles meet performance, regulatory, and aesthetic standards.

Major Trends in Plastic Compounding Market

- Biodegradable compounding: In response to rising environmental issues, producers are developing biodegradable compounds to reduce the ecological effect of plastics.

- Recyclable compounds: With the usage of recycled plastics in the compounding procedure, as it markets material circularity, lessers waste and foretells a more sustainable life cycle.

- Nanocomposites: Adding nanoplastics to plastics increases their properties such as conductivity, resistance, and thermal stability.These open the latest opportunities in high-level electronics and high-performance composite materials.

- 3D Printing in Plastic Production: 3D printing or additive production is transforming the way plastic products are created. This technology serves many advantages like on-demand production, waste reduction, customization, and fast prototyping.

- Self-healing plastic materials have the potential to repair small damage on their own which grows the product line and reduces waste too. Graphene-inspired polymers offer extreme conductivity, power, and flexibility for different high-performance uses.

- Smart packaging includes sensors and indicators to manage contamination, freshness, and product usage.

- Bioplastics from fungi and algae are the latest bio-based materials which further reduce dependence on fossil fuels.

Market Trends

Recycling and Sustainability

Companies are focusing on using recycled and bio-based materials to meet sustainability goals. For instance, mechanically recycled plastic compounds and bio-based polyamides are gaining traction in automotive applications.

Advanced Technology for Automotive Compounding

Innovations in plastic compounding, such as nanocomposites and advanced polymer blends, are enabling enhanced performance in terms of mechanical strength, heat resistance, and durability, catering to stringent automotive standards.

Customization and Design Flexibility

Automotive manufacturers are leveraging plastic compounding for customized solutions that offer superior aesthetics, aerodynamic properties, and safety features. This includes UV resistance, color matching, and flame retardancy.

How Can AI Improve the Automotive Plastic Compounding Industry?

Integrating AI into the automotive plastic compounding industry offers numerous benefits by enhancing sustainability, innovation and efficiency. The artificial integration can analyze large datasets to predict the best combinations of polymers and additives for specific automotive applications, durability, optimizing strength, and lightweight properties. Machine learning models can predict how different compounds will perform under various conditions, minimizing the need for extensive physical testing.

The integration of artificial intelligence predictive analytics can detect defects in compounded materials more accurately than traditional methods, ensuring higher quality standards. Automated inspection systems can monitor production in real-time, identifying inconsistencies early in the process.

Driver

Rise Sales of Electric Vehicles (EVs)

The emergence of electric vehicles increases the demand for advanced materials that offer lightweight properties, heat resistance, and durability for components like battery casings and thermal management systems. The growth in the sales of the electric vehicles has risen the demand for automotive plastic compounding, which has estimated to drive the growth of the automotive plastic compounding market over the forecast period.

Electric vehicles manufacturers are looking for recyclable and sustainable materials to align with environmental goals. Advances in compounding techniques allow the integration of recycled content into automotive-grade plastics. The expansion of electric vehicles infrastructure drives demand for plastic compounds in charging station components, such as enclosures and connectors.

According to data from the Vahan Dashboard, sales of electric vehicles (EVs) in India decreased month over month in the majority of categories in November 2024 as compared to October 2024. E-rickshaws plummeted 8.2% to 40,386 units, while electric two-wheelers (E2W) fell 14.9% to 118,944 units.

While E-Carts fell 7.9% to 5,423 units and Electric Three-Wheelers (L5 Cargo/Goods) fell 11.2% to 2,251 units, the only category to see growth was Electric Three-Wheelers (L5 Passenger), which increased 3.9% to 15,355 units. Electric buses fell precipitously by 59.5% to 161 units, while electric four-wheelers (E4W) suffered a notable reduction of 22.9% to 8,613 units.

Restraint

Recycling Challenges & Environmental Regulations

The key players operating in the market facing issue in fulfilling environmental regulations and competition from alternative material, which may restrict the growth of the automotive plastic compounding market. High costs of specialized polymers and additives, such as high-performance engineering plastics and flame retardants, can limit their adoption, especially in cost-sensitive markets. The upfront cost of transitioning from traditional materials like metal to plastic compounds can deter smaller manufacturers.

Some compounded plastics, particularly those with multi-material blends or added reinforcements, are difficult to recycle, raising concerns about end-of-life disposal and environmental impact. Inadequate recycling systems in many regions hinder the industry's ability to meet sustainability demands. Governments worldwide are enforcing stricter regulations on plastic usage and waste, which may limit the growth of certain compounded plastics. Increased focus on bio-based or biodegradable materials could reduce demand for traditional compounded plastics.

In some applications, plastics may still fall short compared to metals in terms of mechanical strength, thermal stability, or fatigue resistance, restricting their use in critical automotive components. Growing competition from lightweight alternatives like advanced alloys, composites, or natural fibers can limit the demand for plastic compounds. Disruptions in the supply of polymers or specialty additives, due to geopolitical issues or natural disasters, can impact production and increase costs.

Opportunity

Initiatives for Launching Sustainable Material

Increased focus on environmental sustainability is rising demand for recyclable, biodegradable, and bio-based plastic compounds. Opportunities exist in developing compounds that integrate recycled materials while maintaining high performance, aligning with global sustainability goals. Plastic compounds with lower carbon footprints during production and usage are gaining favor among automakers.

- For instance, in January 2024, The Renault group's Dacia, a Romanian carmaker, and LyondellBasell announced their partnership on the external design of the new Dacia Duster family SUV type. The robust "Starkle" material is available on the Dacia Duster thanks to LyondellBasell's CirculenRecover portfolio. The new Duster model uses recycled materials in its CirculenRecover polypropylene (PP) components.

The rising in demand for engineering plastics and advanced compounds, such as polycarbonate blends, thermoplastic elastomers (TPEs), and polyphenylene sulfide (PPS), is rising for applications requiring strength, heat resistance, and durability. Incorporating nanotechnology into plastic compounding can enhance properties like stiffness, strength, and thermal resistance, creating opportunities for more sophisticated automotive applications.

Automotive Plastics Compounding Market Future Outlook

| Aspect | Future Focused Insight |

| Market essence | Engineered plastics for vehicles enabling lightweighting, durability, and heat resistance; used in interiors, bumpers, under-the-hood parts, and E components. |

| Future challenges |

|

| Regional outlook |

|

| Future opportunities |

|

| Strategic takeaway | Focus on sustainable, lightweight, and high-performance plastics to capture EV & hybrid growth; regional strategy is key for competitive advantage |

Which Product Dominated the Automotive Plastic Compounding Market in 2024?

The polypropylene segment held a dominant presence in the automotive plastic compounding market in 2024. polypropylene is one of the lightest polymers, significantly reducing the weight of automotive components, which improves fuel efficiency in traditional vehicles and extends battery range in electric vehicles (EVs). Polypropylene is utilized for door panels, dashboards, trims, and consoles due to its durability, aesthetic appeal, and customization options.

Polypropylene provides an excellent balance of stiffness and impact resistance, making it suitable for both rigid and semi-flexible applications. It offers long-term durability, maintaining its performance under varying environmental conditions.

Polypropylene's combination of mechanical properties, cost-effectiveness, lightweight, and versatility makes it indispensable in automotive plastic compounding. It meets the industry's requirements for design flexibility, durability, and sustainability, ensuring its continued dominance in automotive applications.

Large Consumer Base: Polycarbonate (PC) to Grow at Faster Rate

The polycarbonate (PC) segment is expected to grow at the fastest rate in the automotive plastic compounding market during the forecast period of 2024 to 2034. Polycarbonate is highly resistant to impact, making it ideal for automotive parts like bumpers, dashboards, and protective shields, which require durability and crash resistance.

Cutting-down vehicle weight is crucial for improving fuel efficiency and meeting emissions standards. Polycarbonate is much lighter than glass and metals, helping manufacturers achieve these goals. Polycarbonate's insulating properties are beneficial for the growing trend of electric vehicles (EVs), where safety in managing electrical components is crucial.

Why did the Interior Segment Dominate the Automotive Plastic Compounding Market in 2024?

The interior segment registered its dominance over the global automotive plastic compounding market in 2024. Luxury car buyers expect high-quality, visually appealing interiors. Automotive plastics, especially those with advanced finishes, textures, and colors, allow for greater design flexibility compared to traditional materials like wood or metal. Plastics can be molded into complex shapes and combined with coatings to create high-end aesthetics, such as gloss, matte, or metallic finishes.

Luxury cars are increasingly integrating high-tech features like touchscreens, wireless charging stations, ambient lighting, and advanced climate control systems. Plastic materials are crucial for the housing and support of these electronic components. The ability of plastics to be molded with precision allows designers to incorporate intricate shapes and seamless interfaces for a modern, high-tech interior.

The growing demand for luxury car interiors is pushing the need for automotive plastic compounding because plastics offer the ideal combination of aesthetic flexibility, lightweight performance, durability, advanced functionality, and sustainability attributes highly valued in the luxury automotive sector.

Asia Pacific’s Well Established Electric Vehicles Industry to Support Dominance

Asia Pacific region dominated the global automotive plastic compounding market in 2024. Governments in the region, particularly in China, Japan, and South Korea, provide incentives for electric vehicle adoption. This includes subsidies and mandates for lightweight, fuel-efficient vehicles, indirectly promoting the use of plastic compounds in automotive applications.

The Asia-Pacific region has a well-established supply chain for both EV production and plastic compounding, including raw material availability and processing capabilities, making it easier for manufacturers to source and integrate advanced plastic compounds.

The close collaboration between EV manufacturers and the plastic compounding industry in the Asia-Pacific region fosters innovation and rapid product development, further strengthening both sectors. Asia-Pacific's EV market is a leader in innovation, with manufacturers frequently designing new models that require advanced materials for batteries, interiors, exteriors, and thermal management. Local plastic compounders benefit by developing specialized materials tailored to these needs.

China Automotive Plastic Compounding Market

China plays a distinctive role in supporting the automotive plastic compounding market through its dominance in the EV industry. Its rapid EV adoption and production, coupled with its global leadership in battery technology, fuels the demand for lighter, more fuel-efficient materials like plastic compounds. Furthermore, the dominance of China in battery technology, particularly in lithium-ion batteries and sodium-ion batteries, spurs the necessity for lighter and more efficient vehicle components made from plastic compounds.

Japan Automotive Plastic Compounding Market

Japan is also experiencing growth in the EV market, which contributes to the trend through its EV production and commitment to zero-emission goals, further increasing the demand for automotive plastic compounds. Japanese automakers are actively developing and launching new EV models, which fosters the demand for lighter and more fuel-efficient materials like plastic compounds. Moreover, the minicar market of Japan, comprising small, affordable EVs, also contributes to the need for plastic compounds, as these vehicles often utilize lighter and more efficient materials.

North America’s Shift Towards Automotive Technology to Support Rapid Growth

North America region is anticipated to grow at the fastest rate in the automotive plastic compounding market during the forecast period. Automakers are under pressure to improve fuel efficiency and reduce emissions. Plastics are replacing traditional materials like metal because they offer weight savings without compromising strength or durability.

Government regulations, such as the Corporate Average Fuel Economy (CAFE) standards in the U.S., are further accelerating the adoption of lightweight materials. Key players in North America are heavily investing in research to create high-performance compounds that cater to the growing demand for advanced automotive applications. Despite fluctuations, North America remains a significant hub for automotive production, creating consistent demand for high-quality plastic materials.

The U.S. Automotive Plastic Compounding Market

The U.S. plays a distinct role in the automotive plastic compounding market. This is primarily driven by its robust automotive manufacturing sector, with major players like General Motors, Ford, and Tesla, and growing adoption of advanced technologies and sustainable practices. Furthermore, the focus on lightweight materials for fuel efficiency and compliance with environmental regulations by country contributes to the demand for specialized plastic compounds in vehicle production. Additionally, the trend towards electric vehicles and autonomous technologies further fuels the demand for such materials in various automotive applications.

MEA

The MEA automotive plastic compounding market is growing because of the growing demand for lightweight vehicles and automobile production. Utilizing engineering plastics lowers vehicle emissions and increases fuel economy. Government programs to support regional auto production encourage market growth. However, rapid growth is constrained by expensive raw materials and constrained local supply chains.

In the UAE, the demand for luxury cars and rising car sales are driving up the use of plastics. To increase vehicle efficiency, high-performance and lightweight materials are used. The market for engineering plastics is further increased by investments in electric and hybrid vehicles. Advanced applications are made possible by access to imported materials and a robust infrastructure.

The Latin American market is expanding because of an increase in the production and export of cars. Plastic compounds assist automobiles in meeting safety and lightweight regulations. Demand is further supported by the growing use of EVs and contemporary vehicle designs. Countries with high reliance on imports and low domestic production capacity see slower market growth.

Brazil

Brazil is the largest automotive plastic compounding market in Latin America due to its strong automobile industry's use of polymers for interior, bumpers, and under the hood component sis, increasing government policies promoting local automotive manufacturing support market development. Rising demand for lightweight and sustainable vehicles further drives growth.

New Advancements in Automotive Plastic Compounding Industry

- In July 2024, LyondellBasell, leading chemical company announced the introduction of its new Schulamid ET100 product line, a ground-breaking polyamide-based compound. This new technology, which is intended for vehicle interior structural solutions like door window frames, demonstrates LYB's innovative capabilities in engineered polymers.

- In April 2024, LOTTE Chemical is set to transform the traditional paradigms of vehicle design with their innovative translucent polypropylene (PP) compound solution. High light transmittance and reduced haze are only two of the remarkable qualities that set this novel product apart from conventional PP compounds. In the context of the automotive industry's transition to electric cars (EVs) and autonomous driving technologies, it is anticipated to usher in a new era of intelligent integrated design solutions. Particularly when it comes to designing external systems like grills and bumpers, the translucent PP compounds provide previously unheard-of possibilities. These ideas aim to improve the overall design aesthetics of automobiles by incorporating sensors and hidden lighting to produce visually appealing effects.

- In May 2024, With certified sustainable materials, Cabot Corporation has introduced its new REPLASBLAK universal circular black masterbatches. this launch. As the first universal circular black masterbatches in the industry with content approved by the International Sustainability & Carbon Certification (ISCC PLUS), Cabot has unveiled two new products that will be launched. Powered by EVOLVE Sustainable Solutions, the new REPLASBLAK universal circular black masterbatches will allow Cabot to keep providing the high-performance, quality, and dependability that the plastics industry needs at scale for certified circular solutions. Advanced sustainable solutions that promote a circular economy and lower greenhouse gas (GHG) emissions are becoming increasingly necessary as a result of the worldwide shift toward a lower carbon future.

Value Chain Analysis

Raw Materials Sourcing

This market relies on engineering plastics and polymer additives to meet strength, durability, and lightweight requirements.

Key players: BASF, SABIC, Covestro, LyondellBasell.

Logistics and Distribution

Close coordination with automotive OEMs and Tier-1 suppliers ensures timely material delivery and production efficiency.

Key players: BASF, LANXESS, Celanese.

Recycling and Waste Management

Recyclable and bio-based compounds are gaining traction to meet automotive sustainability targets.

Key players: BASF, SABIC, DSM Engineering Materials.

Automotive Plastic Compounding Market Top Key Players

- LyondellBasell Industries Holdings B.V.

- BASF SE

- SABIC

- Dow

- Ferro Corporation

- Ascend Performance Materials

- Washington Pen

- Ravago

- KRATON CORPORATION

- Chevron Phillips Chemical Company LLC

- SCG Chemicals Public Company Limited

Latest Announcements by Automotive Plastic Compounding Industry Leaders

- In June 2024, Advanced Products & Mobility, Commercial Excellence & Business Intelligence, Shanila Baseley, Global Commercial Vice President at Borealis, stated, strong collaborations and creative thinking are needed to hasten the shift to a circular economy. As another proof of the Borealis company’s dedication to reimagining necessities for sustainable living, the Borealis company is pleased that the Borealis company’s partnership with Plastivaloire and Stellantis in the spirit of EverMinds has produced this noteworthy advancement in the automotive industry's sustainability.

Recent Developments

- On 26 July 2024, LyondellBasell which is a top company in terms of chemical industry is delighted to reveal the launch of its latest Schulamid ET100 product line-an discoverable polyamide-based compound product. (Source: LYB launches)

- On 24 September 2024, Americhem Healthcare which is a top-recognized manufacturer and developer of custom color masterbatch, engineered compounds, functional additives, and performance technologies magnified its efforts in Europe to assist material selection and medical device growth. (Source: Business Wire)

- On 22 May 2025, PPG disclosed its latest PPG EnviroLuxe Plus powder coatings which is a sustainable invention that mixes up to 18% post-industrial recycled plastic and is produced without the usage of per- and polyfluoroalkyl substances that is crafted to match the involving demand of environmentally friendly producers, this product displays PPG’s current loyalty to performance and sustainability.

- On 22 May 2025, STEER World revealed the iSeries which is the latest twin-screw extruder platform crafted for India’s rising plastics industry as it serves scalable, smart, and cost-effective compounding solutions. (Source: Manufacturing Today India)

Automotive Plastic Compounding Market Segments

By Product

- Polypropylene (PP)

- Polyethylene (PE)

- Thermoplastic elastomers (TPE)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Systems (ABS)

- Styrene Acrylonitrile (SAN)

- Polymethyl methacrylate (PMMA)

- Polyoxymethylene (POM)

- Blends (PC/ABS, ABS/PBT, PS/PP)

By Application

- Interior

- Exterior

- Under the Hood

- Structural Parts

- Electrical Components & Lighting

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (2)