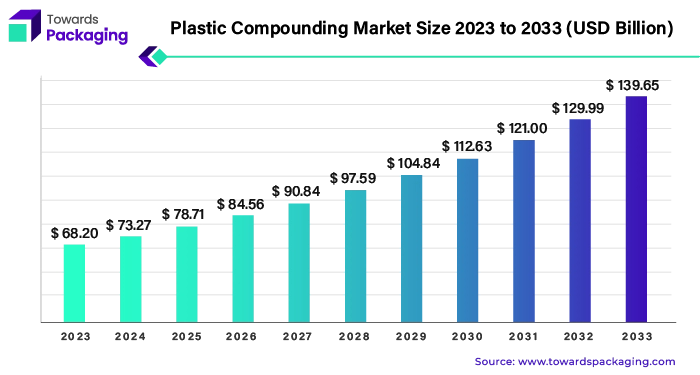

The plastic compounding market is forecasted to expand from USD 84.56 billion in 2026 to USD 161.18 billion by 2035, growing at a CAGR of 7.43% from 2026 to 2035. We quantify demand by source (fossil-based 57% share in 2024, recycled fastest-growing; bio-based scaling), product (PP 31% share in 2024, PE fastest; plus PVC, PS, PET, ABS, PC, PA, TPO/TPV, etc.), and application (automotive 26% in 2024, packaging fastest).

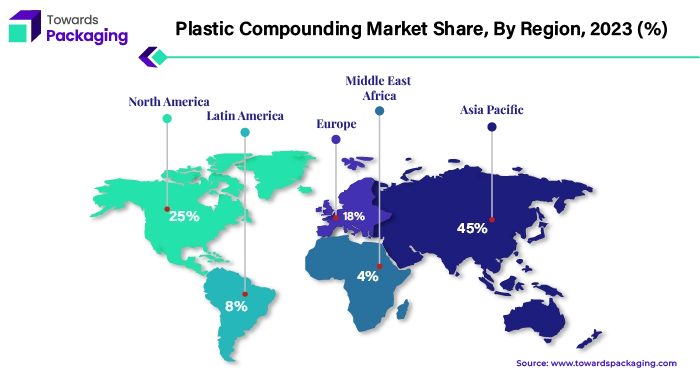

Regional coverage spans North America, Europe, Asia Pacific (leader at 45% in 2024), Latin America, and MEA. Deliverables include competitive benchmarking (BASF, Dow, SABIC, LyondellBasell, DuPont, Covestro, LANXESS, Solvay, Asahi Kasei, RTP, Ravago…), value chain analysis (feedstocks → compounding → conversion), trade statistics and corridor balances, and manufacturer/supplier databases with capacity, grades, and footprints.

Plastic compounding benefits include cost efficiency, sustainability, improved processing, and improved material performance. Applications include aerospace and defense, optical media, medical devices, industrial machinery, consumer goods, packaging, electrical and electronics, building and construction, and the automotive sector. These factors help to the growth of the market.

The plastic compounding market incorporates the manufacturing and distribution of compounded plastics, which involves combining different polymers, colorants, reinforcements, fillers, or additives to enhance their properties. The enhanced properties include improved flame retardancy, strength, and durability. Plastic compounding benefits include improved material performance as compared to basic polymers alone; plastic compounds with reinforcements, fillers, and additives exhibit improved chemical, electrical, thermal, or mechanical properties. The advantages of plastic compounding include versatility and customization to achieve particular colors, provide UV tolerance, improve fire retardation, and ensure food safety. These factors help to the growth of the market. The packaging market size to grow at a 3.16% CAGR between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 78.71 Billion |

| Projected Market Size in 2035 | USD 161.18 Billion |

| CAGR (2025 - 2035) | 7.43% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Source, By Product, By Application and By Region |

| Top Key Players | Amcor, Be Green Packaging, DS Smith, DuPont, Evergreen Packaging |

Artificial Intelligence is changing the plastic compounding industry by changing different stages of the manufacturing process. AI-powered algorithms can track huge datasets from material characteristics, processing conditions, and the final product achievement in order to predict the optimal compounding formulations. This leads to the development of material properties, reduced waste, and smoother resource use, enabling manufacturers for various applications, thereby mainly lowering growth cycles and material costs too. Additionally, AI is instrumental in predictive maintenance for the purpose of compounding machinery, lowering downtime, and growing operational efficiency. It allows real-time quality control by analysing the anomalies in the manufacturing line, ensuring the product quality, and reducing the defects. The use of AI also includes responsive and adaptive market operations.

Increased demand for plastic products helps the growth of the market. There are many benefits of plastic products' strong weatherability because of their ability to achieve tight seals. Good safety and hygiene properties for food packaging. Lightweight with a high strength to weight ratio than the other materials, which makes it easy for transportation. Thermally and electrically insulating, secure, very versatile, very durable, different textures are possible, hygienic, shatter resistant, non-biodegradable, resistant to chemicals, hardness, permeability, transparency, stability, recyclability, reactivity, solubility, flammability, safety, and inexpensive properties are helpful for the growth of the market. Applications of plastic compounding in toys, electronics, automotive, construction, textiles, packaging, medical devices, etc. These factors help to the growth of the plastic compounding market.

Adverse effects of plastic compounding include endocrine disruption, which may lead to birth defects, cancers, developmental problems, and immune system suppression problems in children. Carcinogens, as in the case of DEHP (diethyl hexyl phthalate), and direct toxicity, as in cases of mercury, lead, and cadmium. It also includes agrochemical microplastics, which may be hazardous to health and the environment. Due to the difference in filling pattern and melt profile of individual alloys, plastic compounding has a downside. This may lead to cosmetic defects. Challenges in plastic compounding include equipment costs, environmental concerns, and quality control. Advanced plastic compounding equipment may be expensive, environmental concerns regarding toxicity and biodegradability, and inconsistent mixing may lead to a reduction in product performance, and achieving uniformity in plastic compounding is necessary. These factors may restrict the growth of the plastic compounding market.

Sustainability trends and advances in material science are creating immense opportunities in the plastic compounding market. Rising environmental concerns are accelerating the shift toward bio-based and biodegradable polymers, creating opportunities for innovation in eco-friendly materials. The growing use of natural fibers and renewable fillers opens doors for manufacturers to meet sustainability targets and cater to environmentally conscious markets.

The incorporation of nanomaterials such as carbon nanotubes and graphene offers the potential to develop polymers with superior thermal, mechanical, and electrical performance. These enhancements are highly sought after in automotive, aerospace, and electronics, providing compounding firms with access to high-value markets. The development of smart polymers with features like shape-memory, self-healing, and enhanced conductivity is unlocking opportunities in wearable technology and advanced manufacturing. These materials are set to drive the next generation of high-performance, responsive applications.

Moreover, the adoption of AI and machine learning in compounding processes offers the chance to improve efficiency, consistency, and product quality. Companies that integrate these technologies can gain a competitive edge through smarter, more adaptive production systems.

The use of advanced technology in plastic compounding with the development of bio-based and sustainable additives. Plastic compounding continues to develop by providing innovative solutions for a more environmentally friendly and sustainable future. Advanced technology in plastic compounding may be helpful in overcoming the challenges regarding quality control, equipment costs, and environmental concerns. Unique requirements of plastic compounding in different industries like healthcare, construction, packaging, electronics, and automotive, there are advanced technologies necessary. These factors help to the growth of the plastic compounding market.

The fossil-based segment dominated the market in 2024. In fossil-based plastic compounding, hydrocarbons from fossil fuels are the primary source material, which comes from non-renewable sources. These fossil-based plastic compounding materials include polypropylene (PP), polyethylene (PE), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and others. Fossil-based plastics are highly used for packaging material. These are extremely durable plastics used in the automobile and construction industry. Their lightweight and durable property makes them more eco-friendly and an alternative for many metals. For prolonging the shelf life of many products like foods, fossil-based plastic compounding material use can be an affordable solution. These factors helped to the growth of the fossil-based segment and contributed to the growth of the plastic compounding market.

The recycled segment is estimated to be the fastest-growing during the forecast period. In the plastic recycling process, compounding is the final step. It involves the transformation of resized or shredded plastics into usable products for manufacturers. These resized plastics are formed into pellets that are used to produce other plastic products. Plastic compounding can help to support sustainability by using recycled plastic compounding as the basis material. It also helps to reduce waste reduction and improve the circular economy by improving the capacity and strength of plastic items to be recycled. Plastic recycling is important because plastic waste causes many issues, including health concerns, pollution, and animal fatalities. Recycling also helps to reduce irritants and pollutants in the environment. These factors helped the growth of the recycled segment and contributed to the growth of the plastic compounding market.

The bio-based segment is significantly growing during the forecast period. Bio-based plastic compounding involves the process of using additives and fillers in biodegradable polymers to improve their properties. Bio-based plastics are produced from renewable biomass sources like recycled food waste, sawdust, woodchips, straw, cornstarch, and vegetable fats and oils. Biobased plastic compounding offers many benefits, including independence from fossil fuels, a lower carbon footprint compared to fossil-based plastic compounding, and degradable and durable options.

The benefits of bio-based plastics include helping to improve end-of-life scenarios for recycling and disposal, developing innovative alternative solutions as compared to conventional plastics, reducing dependence on fossil resources, lowering the carbon footprint, saving fossil resources by using biomass which regenerates and provides the unique potential of carbon neutrality, reducing effects of climate change, and reducing fossil fuel use. These factors help the growth of the bio-based segment and contribute to the growth of the plastic compounding market.

The polypropylene (PP) segment dominated the market in 2024. Polypropylene (PP) is a plastic material used for plastic compounding that has many benefits, including it is an insulator as it does not conduct electricity, it has high tensile strength, it is fatigue resistant and malleable, it can be remolded or molded into any shape without degradation, it is highly resistant to chemical leaking and corrosion which make it suitable for piping systems, and it does not react with acids which make it ideal for containers which hold acidic liquids. It also helps to improve material performance, customization and versatility, cost efficiency, improved processing, and sustainability. These factors help the growth of the polypropylene (PP) segment and contribute to the growth of the plastic compounding market.

The polyethylene (PE) segment is estimated to be the fastest-growing during the forecast period. Polyethylene (PE) is used for plastic compounding due to its benefits, including easy to clean and eco-friendly, broad range of use temperatures, good gas and moisture barrier properties, lightweight, durable, water resistance, transparency, thin and strong films, tough and wear resistance, easy to process for injection molding, chemical resistance to dilute acids and solvents, electrical insulation, and low cost and easy availability. It will stretch rather than break. These factors help the growth of the polyethylene (PE) segment and contribute to the growth of the plastic compounding market.

The automotive segment dominated the market in 2024. The automotive sector progressively uses plastic compounds to replace traditional metal components because of their benefits, including lightweight nature, cost-effectiveness, design flexibility, environmental regulations, demand for automotive parts, and shift towards electric vehicles, which need lightweight materials. In the automotive industry, there are many plastic applications, including interior trim, body panels, and engine parts. The plastics used in exterior parts include trims, air dams, fenders, bumpers, weatherstripping, wheel covers, seals, body panels, and interior parts, including decorative pieces, instrument panel skin, seat and associated parts, steering wheels, door panels, dashboard, and instrumental panels. These factors help the growth of the automotive segment and contribute to the growth of the plastic compounding market.

The packaging segment is expected to be the fastest-growing during the forecast period. Plastic compounds are highly used in the packaging sector because they protect and preserve things like foods, clothes, and other food items that need protection from damage due to direct contact with water or moisture. Plastic compounds provide protective barriers for products. Plastic packaging is cost-effective as compared to other materials, versatile as they can be molded into different shapes and sizes, and lighter than other materials like glass and metal, which helps to reduce carbon emissions and transportation costs, and is strong and durable, which helps to protect products at the time of transportation. These factors help to the growth of the packaging segment and contribute to the growth of the plastic compounding market.

Asia Pacific dominated the plastic compounding market by 25% in 2024. Increased infrastructure and supply chain facilities help to grow the market in the Asia Pacific region. The region's contribution is mainly attributable to the fast-expanding industrialization and urbanization in emerging nations, as well as to increased manufacturing production, a booming e-commerce industry, and favorable demographics. In order to address the growing demand for consumer electronics in countries like China, India, Japan, and South Korea, there will likely be a greater need for plastic compounding in applications like washing machines, cars, and refrigerators.

In addition, the need for electronic gadgets is growing across a range of markets. For example, BenQ India, a consumer electronics manufacturer, achieved significant milestones in October 2023 when it surpassed Japan to become the largest market in the Asia Pacific region. The primary cause of this rise has been India's rising demand for display items and consumer electronics in recent years.

Asia Pacific dominated the plastic compounding market in 2024. The market growth in the market is attributed to the increasing demand for consumer products including washing machines and refrigerators, rising significant investments in Asian countries, rising favorable regulations, growing e-commerce industry, and increasing manufacturing output. China, India, Japan, and South Korea are the significant countries driving the market growth. China and India are the major countries in the plastic compounding market.

China Market Trend

China's plastic compounding market is driven by the robust foundry dominant position in global manufacturing. China is the world's largest producer and exporter of plastic materials, accounting for 31% of global plastic resin production as of 2020. With over 15,000 plastic manufacturing companies generating more than USD 366 billion in revenue in 2016, China's extensive industrial base provides a solid foundation for the plastic compounding sector. China's plastic compounding market held a 56.8% share of the total market revenue in 2023, driven by strong growth in the automotive, electronics, and construction sectors.

The automotive industry, in particular, benefits from government subsidies and incentives for electric vehicles (EVs), spurring demand for lightweight, high-performance plastic compounds. China is at the forefront of integrating advanced technologies in polymer science, including nanotechnology and computational simulations. These innovations enable the production of plastic compounds with specialized properties such as extreme temperature resistance and high electrical conductivity, expanding their applications in sectors like aerospace, medical devices, and renewable energy technologies.

The Chinese government has implemented policies to promote the use of sustainable and recyclable materials, aligning with global environmental concerns. Additionally, significant investments in infrastructure and urbanization have bolstered the demand for plastics in construction and consumer goods. China is increasingly emphasizing sustainability and the implementation of circular economy principles, encouraging the development of compounded plastics designed to be recycled, reused, or biodegraded. This shift not only addresses environmental concerns but also offers cost-effective solutions in the long run, enhancing the competitiveness of Chinese manufacturers in the global market.

Europe is expected to grow fastest during the forecast period. The market growth in the region is driven by factors such as increasing high tensile and rigidity strength, increasing production of electric vehicles, and increasing demand for plastic compounding from the pharmaceutical, healthcare, electronics, and electrical industries. Due to the properties of plastic compounding such as low density, high heat resistance, corrosion inhibition, and electric insulation, they are preferred material, which further drives the growth of the plastic compounding market in Europe.

North America’s Established Infrastructure and Supply Chain to Project Steady Growth

The North American market is expected to grow at a notable rate in the foreseeable future. The U.S. and Canada are major automotive manufacturing hubs. Lightweight plastic compounds are in high demand to meet fuel efficiency and emission standards. North America has a mature consumer goods industry that drives demand for high-performance plastic packaging materials. North America, especially the U.S., has access to low-cost shale gas, which is a key feedstock for ethylene and propylene essential building blocks for many plastic compounds.

Major North American players in the chemical and materials sector (e.g., Dow, ExxonMobil, LyondellBasell, SABIC Americas) have advanced research & development facilities. The North America region has a well-developed transportation network, enabling efficient distribution. Although environmental regulations are tightening, the U.S. regulatory framework still allows flexibility for innovation and new material development. Numerous global and regional compounding companies are headquartered or have major operations in North America, providing technological leadership and market reach.

U.S. Market Trends

The U.S. plastic compounding market is driven by the Strong Demand from End-Use Industries and government regulations and incentives. Federal agencies such as the National Highway Traffic Safety Administration (NHTSA) and the Environmental Protection Agency (EPA) are promoting the use of lightweight and fuel-efficient materials in vehicles. These regulations are encouraging the adoption of plastic compounds in automotive manufacturing.

Latin America

The plastic compounding industry in Latin America is expected to change mainly through the year 2031, driven by sustainability, technological invention, and rising industrial demands. Custom-engineered compounds will gain attention in medical devices, electric vehicles, and intelligent electronics. Automation in compounding lines, AI-dependent formulation, and real-time quality control prediction tools are likely to become cornerstones. Also, growth in chemically and biodegradable recycled polymers will change material sourcing. By year 2031, Latin America will be situated as a regional compounding hub assisted by policy alignment, industrial research and development, and infrastructure.

Middle East and Africa

The strong development of plastic compounding in the Middle East and Africa is due to the integration of technological advancements and growing sector demands. An initial driver is the growing need for lightweight materials, specifically in the automotive and aerospace sectors. Plastic compounds are substituting the regular materials like metal, allowing the vehicle producers to lower overall weight, which in turn develops complete efficiency and lower emissions. This trend is important for aligning with strict environmental regulations globally.

By Source

By Product

By Application

By Region

January 2026

January 2026

January 2026

January 2026