Food Packaging Market Analysis Trends, Segments and Forecast

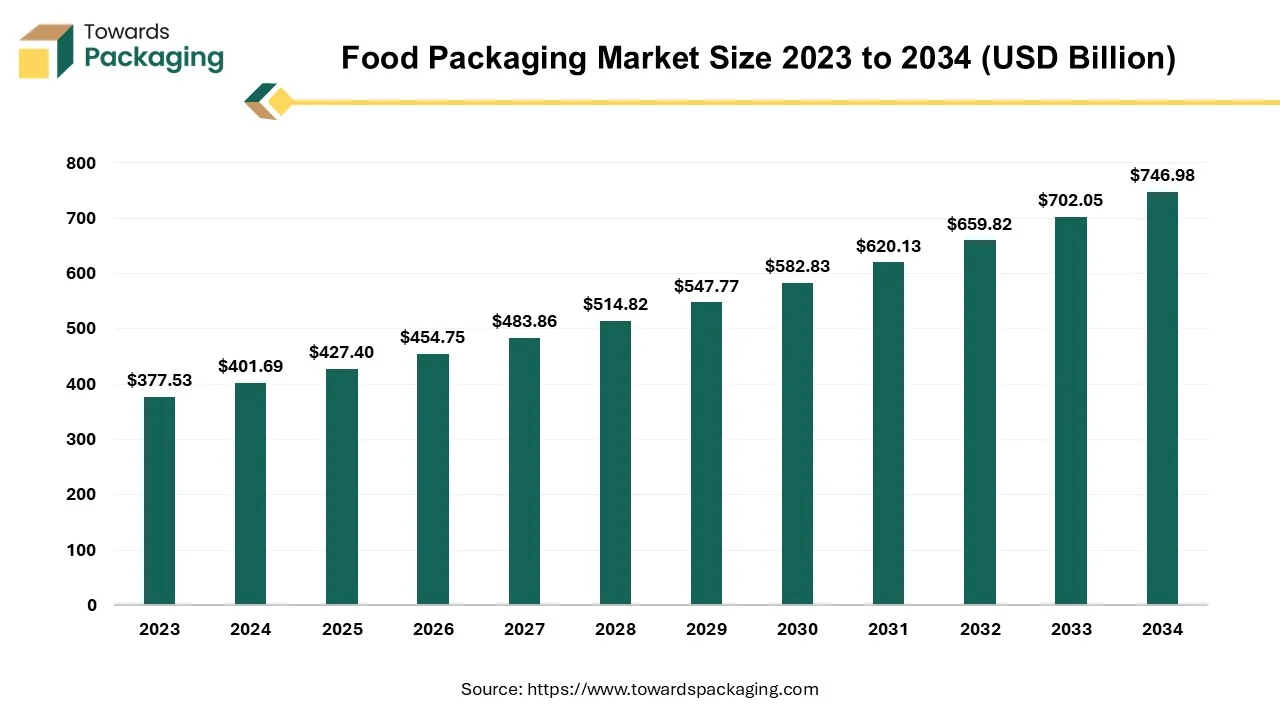

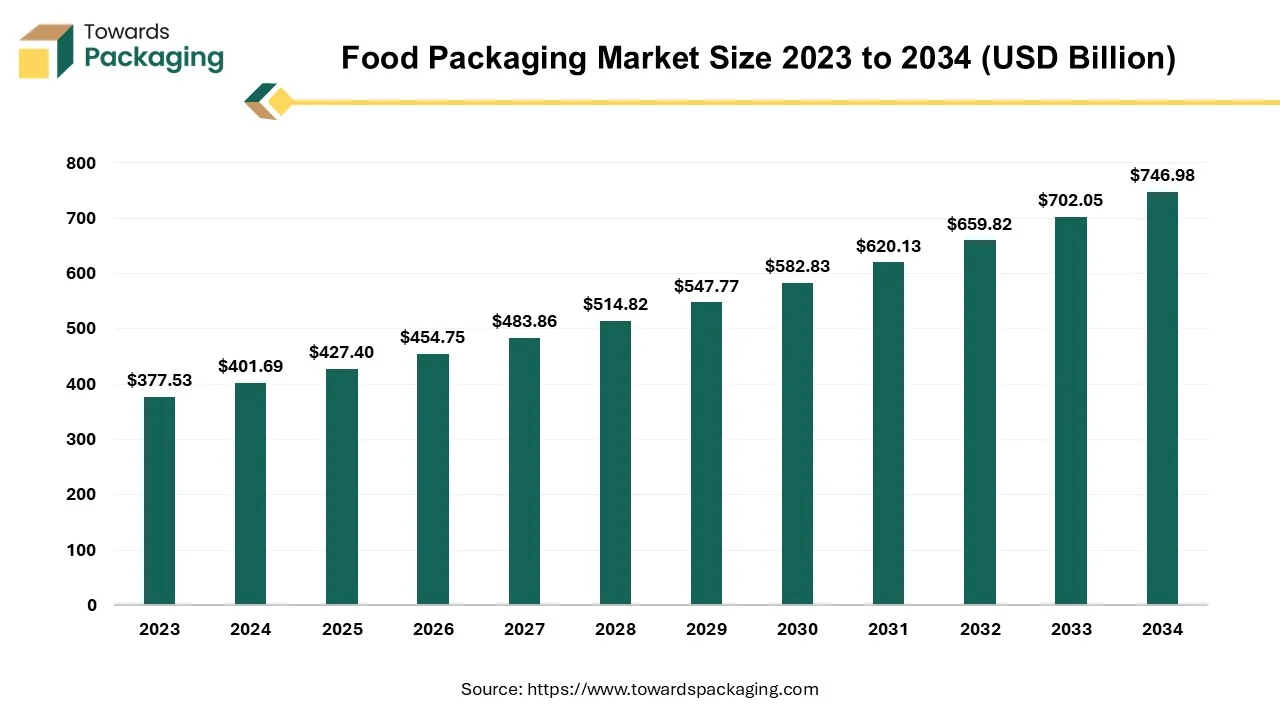

The global food packaging market is set to grow from USD 427.40 billion in 2025 to USD 746.98 billion by 2034, with a CAGR of 5.7%. This report offers comprehensive data on market segments, regional analysis, and the competitive landscape, including key players like Tetra Pak, Amcor, and Ball Corporation. It covers the global market's material types, including plastics, paper-based materials, and metals, with a focus on flexible packaging. Regional insights from North America, Europe, Asia Pacific, Latin America, and MEA are also included.

Major Key Insights of the Food Packaging Market

- Asia Pacific dominated the food packaging market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By type, the flexible segment registered its dominance over the global food packaging market in 2024.

- By material, the plastics segment dominated the market with the largest share in 2024.

- By packaging type, the bottles segment registered its dominance over the global food packaging market in 2024.

- By food type, the frozen food segment dominated the food packaging market in 2024.

- By application, the bakery & confectionery segment dominated the food packaging market in 2024.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2024 |

USD 401.69 Billion |

| Projected Market Size in 2034 |

USD 746.98 Billion |

| CAGR (2025 - 2034) |

5.7% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Material, By Type, By Application, By Packaging Type, By Food Type and By Region |

| Top Key Players |

International Paper Company, Mondi, Smurfit Kappa Group, Eastern Pak Limited, Packaging Corporation of America |

Food Packaging Market: Storage & Preservation of Food Items

The methods and materials utilized to protect, contain, preserve, transport, and present food products is known as food packaging. It acts as a barrier between food and external factors like moisture, contamination, light, air, and physical damage ensuring the food remains fresh, safe, and appealing from production to consumption. The food packaging serves as practical purposes like: providing information (nutritional facts, expiry date, ingredients), facilitating storage and handling, supporting marketing and branding through design and messaging.

The food packaging provides protection from chemical, physical and biological damage. The food packaging offers preservation and helps to extend shelf-life by controlling exposure to air, moisture, and microorganisms. The food packaging holds the food in a convenient form for transport, storage, and use.

Market Trends

Eco-Friendly & Sustainability Packaging

Growing demand for biodegradable, recyclable, and compostable materials (like paper, cardboard, plant-based plastics). Shift away from single-use plastics due to environmental concerns and government regulations. Lightweight packaging to reduce carbon footprint and transportation costs.

Rise of Convenience Packaging

Consumers prefer packaging that is easy to open, resealable, microwavable, and portable. Growth of on-the-go food packaging solutions for busy lifestyles. Single-serve and portion-controlled packaging are increasingly popular, especially for snacks and ready-to-eat meals.

Smart & Intelligent Packaging

QR codes and NFC tags for traceability and product information. Active packaging with oxygen absorbers or moisture control to extend shelf life. Time-temperature indicators (TTI) to monitor freshness and ensure food safety.

Aesthetic and Premium Packaging

Brands are investing in high-quality, visually appealing designs to stand out on shelves and online platforms. Utilization of natural textures, earthy tones, and eco-friendly inks to communicate sustainability values. Transparent packaging to allow consumers to see the product inside, building trust.

Health and Safety Focus

Post-pandemic, consumers expect hygienic, tamper-evident packaging. Increased demand for contactless delivery packaging that ensures food safety.

Personalization & Customization

Customized packaging solutions for limited edition, seasonal promotions, or personalized messages. Brands using packaging as a tool for direct consumer engagement and storytelling. Packaging that highlights local culture works well, especially for genuine goods and regional delicacies that have strong ties to their home location. Highlighting the product's advantages and building a closer relationship with the audience can be achieved by including local designs, images, and cultural components.

Technological Advancements in Materials

Development of edible packaging and water-soluble films. Utilization of nanotechnology for better barrier properties and antimicrobial coatings. Flexible packaging replacing rigid packaging for many food products due to its light weight and adaptability.

Life cycle assessments (LCA) Trends

Manufacturers are taking into account the environmental impact at every level of the production process, not just how to enhance packaging at the end of its useful life. Manufacturers are beginning to view the entire process more holistically, from acquiring raw materials and the production stage to shipping items to customers.

How Can AI Improve the Food Packaging?

AI-powered vision systems can detect defects in packaging (like tears, leaks, poor sealing, or incorrect labeling) much faster and more accurately than manual inspections. Real-time monitoring ensures consistent packaging quality, reducing waste and recalls. AI-driven robots streamline packaging lines, improving speed and reducing human error. Predictive maintenance of machinery using AI can prevent breakdowns and reduce downtime. Dynamic adjustment of packaging processes based on real-time data (like material availability or order flow).

AI enables interactive packaging - QR codes or smart labels connected to AI systems can give consumers real-time info on freshness, ingredients, traceability, and sustainability. Personalized consumer experiences through AI algorithms that tailor information and promotions based on consumer behavior. AI can predict demand fluctuations, optimize inventory levels, and reduce overproduction or understocking of packaging materials. The AI integration improved logistics planning to ensure timely delivery of packaging materials and finished goods. AI models help companies design eco-friendly packaging, optimizing material use while maintaining durability and aesthetics. Lifecycle analysis tools powered by AI can evaluate the environmental impact of different packaging materials and designs. AI enables mass customization of packaging, allowing brands to create personalized designs or targeted messages based on customer data. AI-driven design tools can generate innovative packaging concepts faster than manual methods. Integration with AI chatbots and apps that allow consumers to scan packaging and get instant answers about product origin, nutritional value, allergens, and eco-credentials. AI-enhanced AR experiences via packaging for interactive marketing.

AI in packaging design helps extend shelf life by developing smarter barrier properties and monitoring freshness. Smart sensors integrated with AI algorithms can alert suppliers and consumers when food is nearing spoilage. AI can make the food packaging industry smarter, faster, safer, and more sustainable. From production efficiency to consumer engagement and eco-friendly innovations, AI is unlocking new levels of performance across the packaging lifecycle.

Driver

Globalization of Food Trade & Innovation of New Food Packaging Material

Rising awareness of health and nutrition drives demand for clear, informative packaging showing nutritional facts and ingredients transparency. As international trade expands, food packaging must ensure product integrity during long-distance transport, increasing the need for high-performance packaging.

For instance, in March 2025, Ahlstrom Oyj, a company focused on combining fibers into innovative and sustainable specialty materials, revealed the introduction of the LamiBak Flex, the new addition to its LamiBak range of high-performance base papers. Ahlstrom provides brands and converters with a flexible platform for flexible packaging made of paper. LamiBak Flex offers exceptional barrier qualities for a variety of food applications, such as pouches, sachets, and flow packs, and is perfectly suited for additional processing techniques like coating, metallization, or extrusion. Because of its sophisticated design, less primer coating is required, resulting in outstanding barrier qualities, cost optimization, and a recyclable and sustainable profile.

Restraint

Strict Regulatory Compliance and Recycling & Waste Management Challenges

The key players operating in the market are facing issue due to stringent regulatory affairs and waste management challenges, which has estimated to restrict the growth of the food packaging market in the near future. The food industry faces tight regulations on packaging safety, labeling, and material usage. Meeting these evolving standards requires investment in R&D and compliance, which can delay product launches. Even recyclable packaging often ends up in landfills due to lack of proper recycling infrastructure in many regions. This limits the impact of sustainable packaging efforts and creates skepticism among eco-conscious consumers.

Market Opportunity

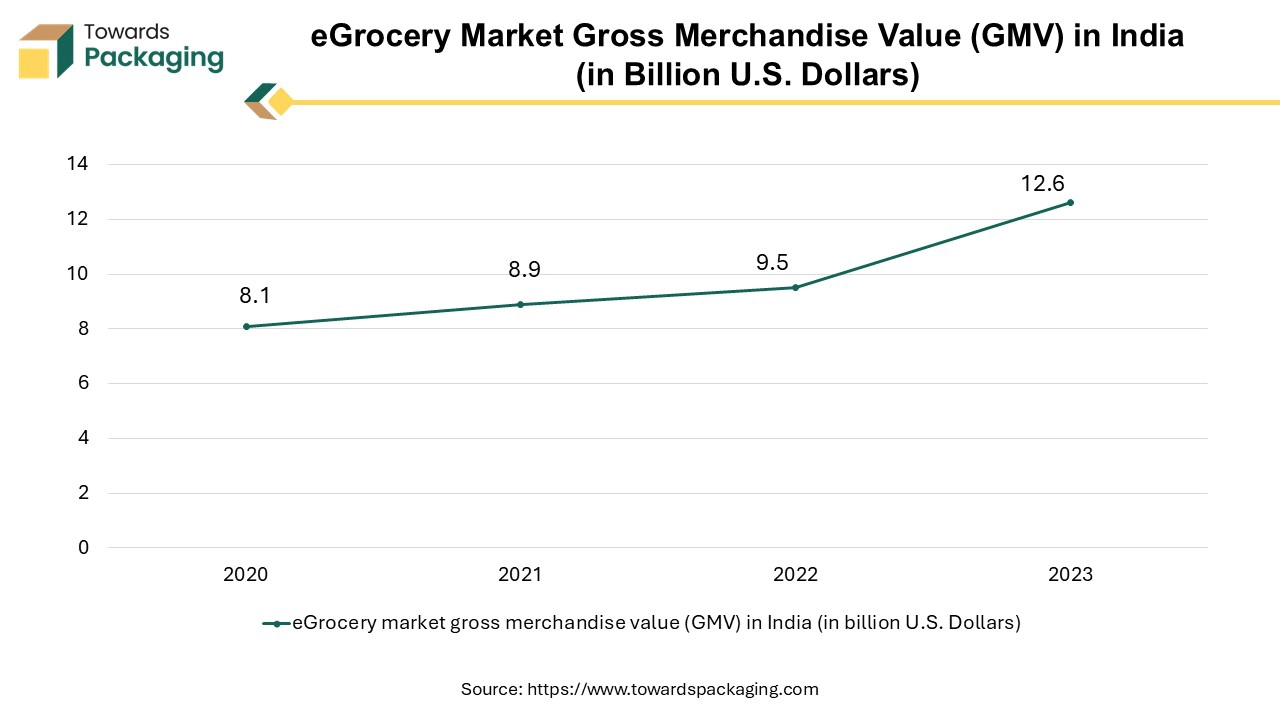

Urbanization & Growth of Online Food Delivery

Rapid urbanization means smaller households and higher demand for portion-controlled and single serving packaging. Growth of fast food and takeaway culture boosts the demand for smart packaging solutions. The growth in online grocery shopping and food delivery apps has developed high demand for tamper-proof, durable, and insulated packaging. Safe, hygienic packaging is essential for transporting and ready-to-eat food items.

Segmental Analysis

Flexible Segment to Led the Market in 2024

The flexible segment held a dominant presence in the food packaging market in 2024. Flexible packaging is much lighter than rigid alternatives like glass or metal. It takes up less space during transportation and storage, reducing logistics costs. Flexible packaging materials (like plastic films, foils, and laminates) are cheaper to produce and transport. Lower material usage means lower production and shipping costs. Suitable for a wide range of food items: snacks, frozen foods, baked goods, dairy, sauces, beverages, pet food, and more.

Advanced barrier properties protect food from oxygen, moisture, UV light, and contaminants. Flexible packaging can be designed in varied shapes, sizes, and functionalities — pouches, sachets, wraps, vacuum packs, stand-up pouches, etc. Increasing use of recyclable and compostable films improves environmental impact. Flexible packaging is popular in food packaging because it offers the perfect balance of cost-efficiency, convenience, protection, and branding potential, all while supporting modern manufacturing needs and sustainability goals.

Plastics Segment Show Significant Share in 2024

The plastic segment accounted for a significant share of the food packaging market in 2024. Plastics provide strong protection against moisture, oxygen, light, and contaminants. This extends the shelf life of food products and preserves quality, taste, and safety. Plastic materials are cheaper to produce compared to alternatives like glass, metal, or biodegradable materials. Suitable for mass production and helps keep overall packaging costs low, especially for large-volume food producers. Plastics are lightweight yet strong, making them ideal for transportation and reducing shipping costs. Clear plastic packaging allows consumers to see the product inside, which builds trust and enhances shelf appeal. Plastic packaging supports resealable options, easy-open designs, and microwaveable solutions.

Growing Bakery & Confectionery Industry to Promote Dominance

The bakery & confectionery segment registered its dominance over the global food packaging market in 2024. Bakery products (bread, cakes, pastries) and confectionery items (chocolates, candies, sweets) are consumed daily worldwide. Rising trends of snacking culture, indulgence, and gifting fuel constant demand. Bakery and confectionery items are perishable and require effective packaging to maintain freshness, texture, and flavor. Brands invest in premium packaging to stand out, particularly during festivals, holidays, and special occasions.

Flexible pouches, wrappers, boxes, tins, trays, and flow wraps, bakery and confectionery use diverse packaging formats. Rise of online bakeries and chocolate delivery services fuels demand for protective and attractive packaging solutions. Growing shift toward eco-friendly packaging solutions, especially paper-based and biodegradable wraps for bakery products. Advanced techniques like modified atmosphere packaging (MAP), vacuum sealing, and anti-fog films help preserve bakery freshness.

Bottles Segment Led the Market in 2024

The bottles segment to segment dominated the food packaging market globally. Bottles provide an airtight seal, which protects food from contamination, oxidation, and spoilage. Extends shelf life, especially for sauces, oils, syrups, beverages, and dairy products. Suitable for a wide range of food products: juices, milk, dressings, oils, honey, ketchup, sauces, yogurt drinks, and condiments. Bottles are easy to carry, pour, and reseal, making them perfect for on-the-go consumption and household use. Bottles (especially PET, glass, and certain bio-plastics) are strong and shatter-resistant, ensuring safe transportation and handling.

Many bottles (like clear PET or glass) allow consumers to see the product, which builds trust and attracts buyers. Bottles come in various shapes, sizes, and designs, allowing brands to stand out. Labels and embossing make them an excellent medium for brand identity and marketing. Bottles help with measured dispensing — especially useful for dressings, oils, and beverages. Bottle packaging works seamlessly with automated filling and capping lines, increasing efficiency for large-scale food production.

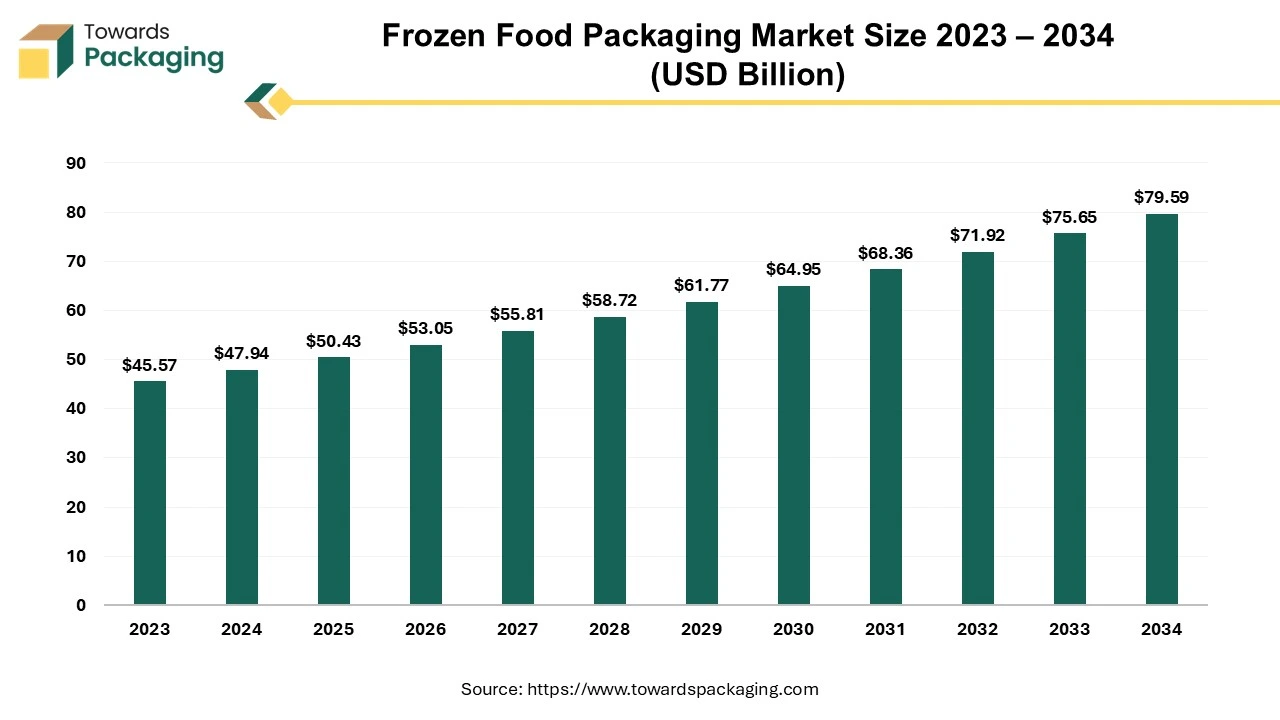

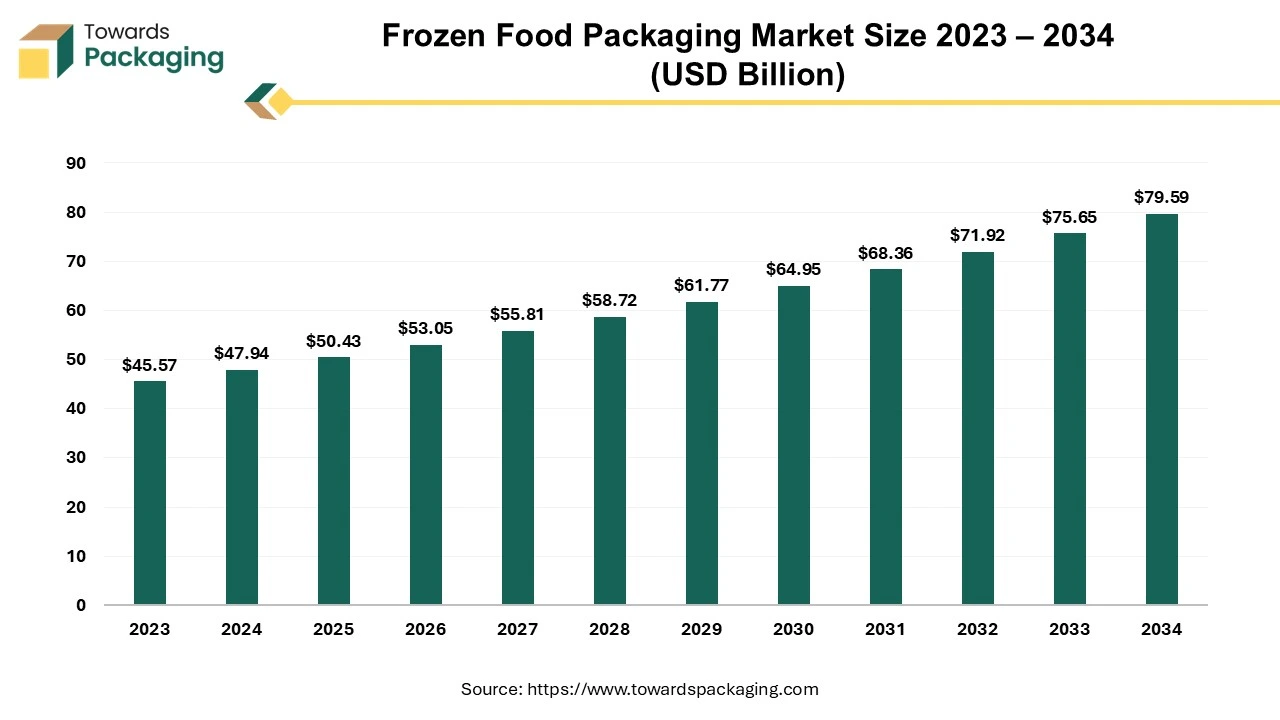

Frozen Food to Dominated the Market

The frozen food segment led the global food packaging market. Frozen food aisles are competitive, and visual appeal matters. Frozen food includes vegetables, fruits, meat, seafood, snacks, ready meals, and desserts. Each category requires specialized packaging to cater to specific needs (e.g., steamable vegetable bags, vacuum-sealed meat packs). Frozen foods are distributed over long distances and require strong packaging to handle temperature fluctuations and rough handling. Frozen food packaging ensures a long shelf life, making it viable for long-term storage. Frozen foods are exposed to cold, dry air that can cause freezer burn (dry, tough, discoloured spots). Specialized packaging acts as a moisture barrier, keeping the food sealed and preventing dehydration.

Regional Insights

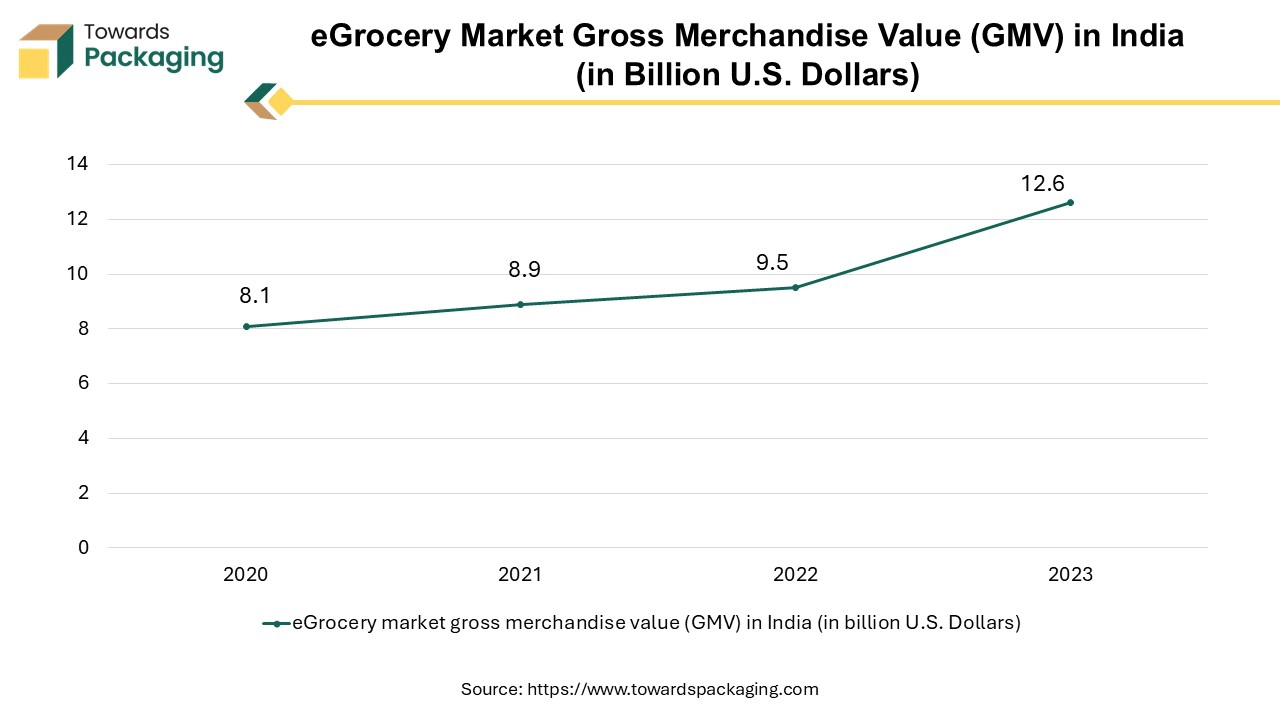

Asia’s Expanding Online Shopping to Promote Dominance

Asia Pacific region held the largest share of the food packaging market in 2024, owing to rising online food ordering culture in the region. Asia Pacific region’s food processing industry is growing fast due to increasing demand for processed, dairy, snacks, frozen and beverages. This directly rises the demand for efficient and attractive packaging solutions. Huge growth in online food delivery services and e-commerce grocery platforms in China, India and Japan has driven the market growth. Asia-Pacific is home to major packaging material manufacturers-paper, plastics, metal, and flexible packaging suppliers. Government across Asia Pacific are promoting food safety standards and hygienic packaging, which rise demand for advanced packaging solutions. Growth of local packaging companies and international players setting up production in Asia Pacific.

China Food Packaging Market Trends

China food packaging market is growing owing to china’s massive population (over 1.4 billion people) creates immense demand for packaged food. Rising middle-income group is increasingly seeking premium, hygienic, and branded food products, which boosts packaging demand. China has the world’s largest e-commerce market, with giants like Alibaba, JD.com, and Meituan. China is investing in smart packaging technologies like QR codes for traceability and anti-counterfeiting measures.

North America’s Well Equipped Infrastructure to Support Growth

North America is anticipated to grow at the fastest rate in the food packaging market during the forecast period. Stringent U.S. FDA and CFIA (Canada) regulations for food safety and labelling has set high food safety standards and regulations. This necessitates advanced packaging solutions that ensure hygiene, freshness, and traceability. North America has an advanced cold chain logistics network supporting the packaging of dairy, meat, frozen foods, and seafood. The North America region requires insulated and moisture-resistant packaging. The U.S. and Canada are major exporters of packaged food products.

U.S. Food Packaging Market Trends

U.S. food packaging market is growing at rapid rate owing to expansion of cold chain infrastructure. In the U.S. region there is growth in frozen and refrigerated food sales, especially post-pandemic, drives demand for insulated and moisture-resistant packaging. The U.S. packaging industry invests heavily in automation, sustainable materials, and design innovation. Strong demand for U.S. made packaged food in global market boosts durable and compliant packaging solutions for export.

The rise of online grocery shopping and meal delivery services (Instacart, DoorDash, Amazon Fresh) demands packaging that enables product protection, freshness, and tamper evidence. Growth of meal kits also increases demand for individual and recyclable packaging solutions. U.S. consumers increasingly prefer environmentally responsible packaging, driving growth of biodegradable, compostable materials, recyclable and lightweight packaging solutions.

Global Trade Flow and Market Value by Region, 2024 (Food Packaging Products – HS Code 4819: TOTAL CPC – TOTAL MOT)

Asia-Pacific Trade Flow and Market Value, 2024 (Product: 4819 - TOTAL CPC - TOTAL MOT)

| Country |

Trade Flow |

Trade Value (US$) |

Net Weight (kg) |

Quantity (kg) |

| Australia |

M |

$511,564,654 |

210,687,781.50 |

210,687,782 |

| Australia |

X |

$32,372,365 |

0 |

36,540 |

| China |

M |

$98,568,430 |

17,202,849.30 |

17,202,849 |

| China |

X |

$6,609,741,393 |

1,955,847,338 |

1,955,847,338 |

| Sri Lanka |

M |

$10,295,284 |

3,887,377.30 |

3,887,377 |

| Sri Lanka |

X |

$32,597,116 |

12,726,793.90 |

12,726,794 |

| India |

M |

$133,700,162 |

44,357,329.90 |

44,357,330 |

| India |

X |

$321,795,607 |

191,810,012.30 |

191,810,012 |

| Singapore |

M |

$233,048,321 |

88,924,165.10 |

88,924,165 |

| Singapore |

X |

$131,378,428 |

32,852,622.50 |

32,852,622 |

Europe Trade Flow and Market Value, 2024 (Product: 4819 - TOTAL CPC - TOTAL MOT)

| Country |

Trade Flow |

Trade Value (US$) |

Net Weight (kg) |

Quantity (kg) |

| Belgium |

M |

$793,939,469 |

423,947,443.60 |

423,947,444 |

| Belgium |

X |

$718,768,424 |

402,563,511.70 |

402,563,512 |

| France |

M |

$2,205,946,092 |

0 |

0 |

| France |

X |

$739,473,962 |

0 |

0 |

| Germany |

M |

$1,750,426,806 |

0 |

0 |

| Germany |

X |

$3,453,648,291 |

1,502,849,917.80 |

1,502,849,918 |

| Greece |

M |

$313,101,482 |

106,080,404.60 |

106,080,405 |

| Greece |

X |

$157,332,010 |

51,768,630.60 |

51,768,631 |

| Italy |

M |

$772,413,693 |

212,001,542.20 |

212,001,542 |

| Italy |

X |

$1,503,887,683 |

0 |

0 |

North America Trade Flow and Market Value, 2024 (Product: 4819 - TOTAL CPC - TOTAL MOT)

| Country |

Trade Flow |

Trade Value (US$) |

Net Weight (kg) |

Quantity (kg) |

| Canada |

M |

$1,191,169,053 |

492,179,951.30 |

492,179,951 |

| Canada |

X |

$987,155,632 |

351,231,502 |

351,231,502 |

| USA |

M |

$3,505,062,589 |

0 |

0 |

| USA |

X |

$2,300,965,655 |

0 |

0 |

Future of Frozen Food Packaging Market

The frozen food packaging market is projected to reach USD 79.59 billion by 2034, growing from USD 47.94 billion in 2025, at a CAGR of 5.2% during the forecast period from 2025 to 2034. The growing preference for convenient, ready-to-eat meals and the rapid expansion of e-commerce grocery platforms have significantly fueled the market. The rise in cold chain logistics and smart, sustainable packaging innovations has further accelerated industry adoption.

The specialized packaging materials and designs that protect food products stored at sub-zero temperatures (-18 degree Celsius) is known as frozen food packaging. It ensures food safety, freshness, extended shelf life by preventing moisture loss, freezer burn, and contamination. The frozen food packaging is temperature resistant, moisture resistant and vapour barrier. Different types of material utilized for manufacturing frozen food packaging have been mentioned here as follows: aluminium foil, plastic films, paperboard & cardboard, vacuum, and clamshell containers and rigid trays.

Future of Plastic Food Packaging Market

The plastic food packaging market is anticipated to grow from USD 63.15 billion in 2025 to USD 97.13 billion by 2034, with a compound annual growth rate (CAGR) of 4.9% during the forecast period from 2025 to 2034.

Food packaging is a coordinated system that prepares food for transit, distribution, storage, retailing, and eventual consumption by the end users while maintaining optimal cost efficiency. It is essential in modern civilization because it allows for the safe and efficient handling and distribution of commercially prepared foods. Poor packaging is responsible for more than 25% of worldwide food waste, according to the World Packaging Organisation (WPO).

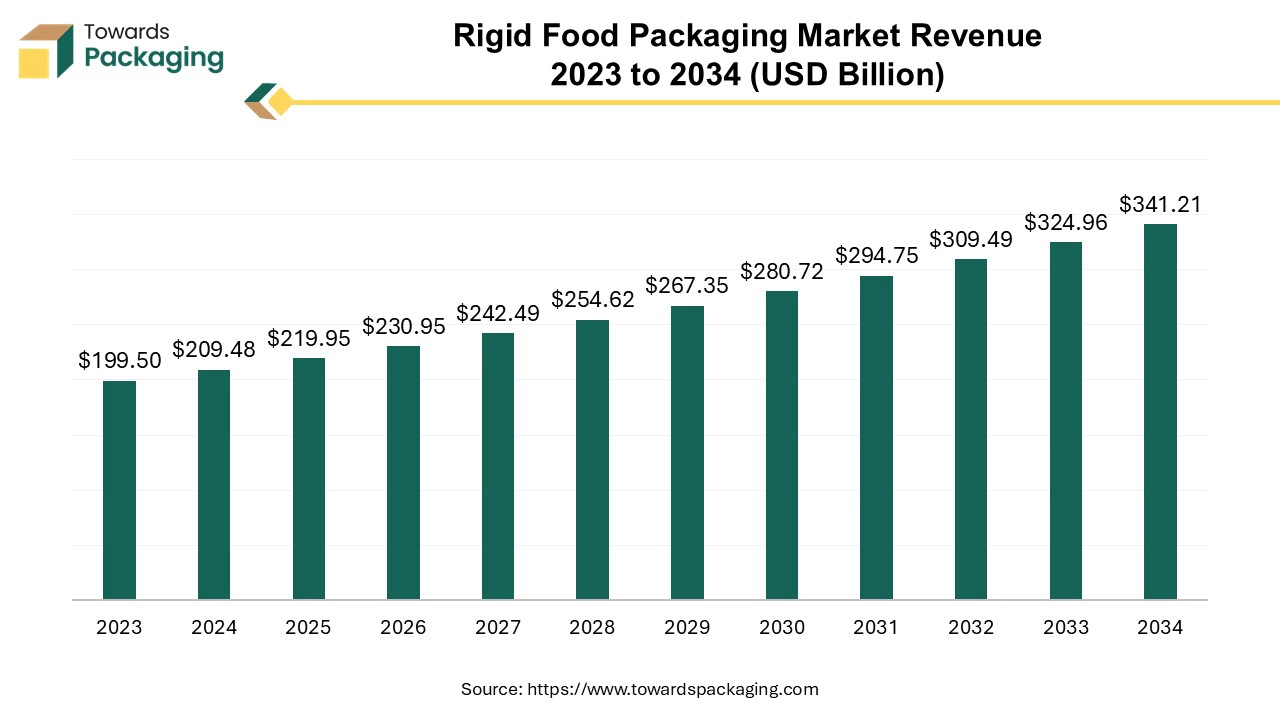

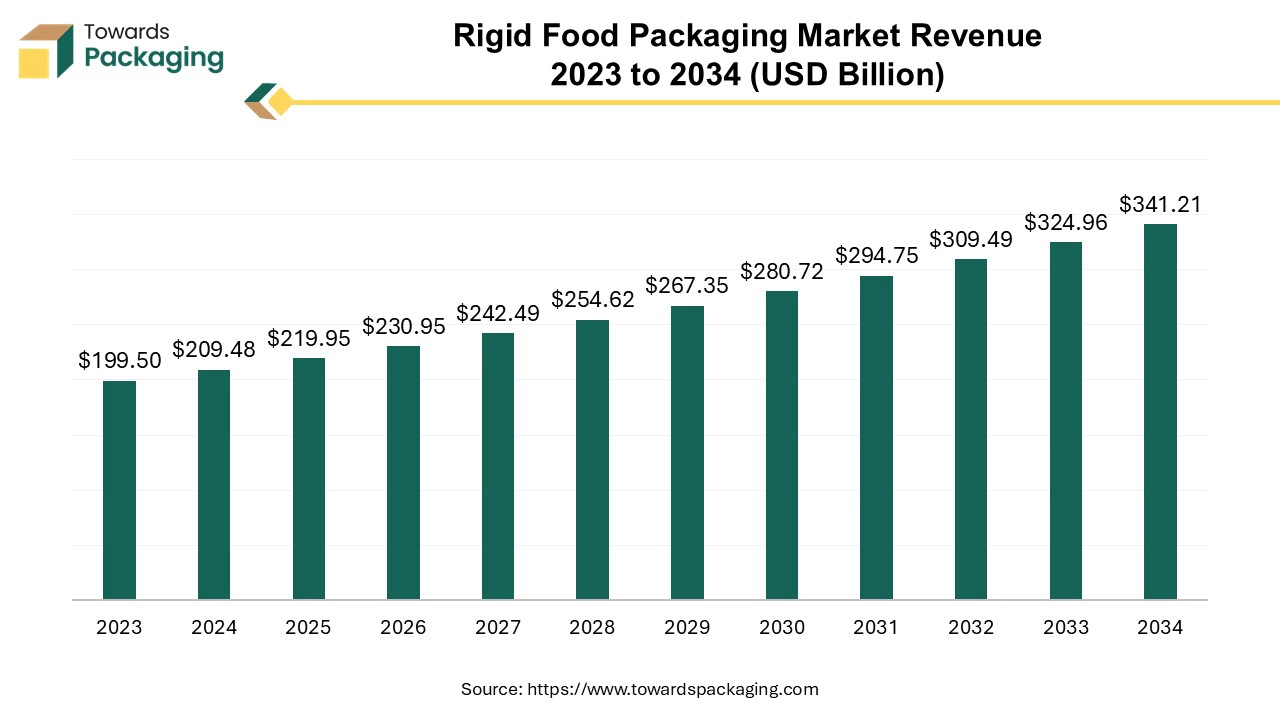

Future of Rigid Food Packaging Market

The global rigid food packaging market, valued at US$ 199.50 billion in 2023, is projected to reach approximately US$ 341.21 billion by 2034, growing at a CAGR of 5% from 2024 to 2034. This growth is driven by the increasing demand for ready-to-eat food and evolving consumer food preferences.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing rigid food packaging which is estimated to drive the global rigid food packaging market over the forecast period.

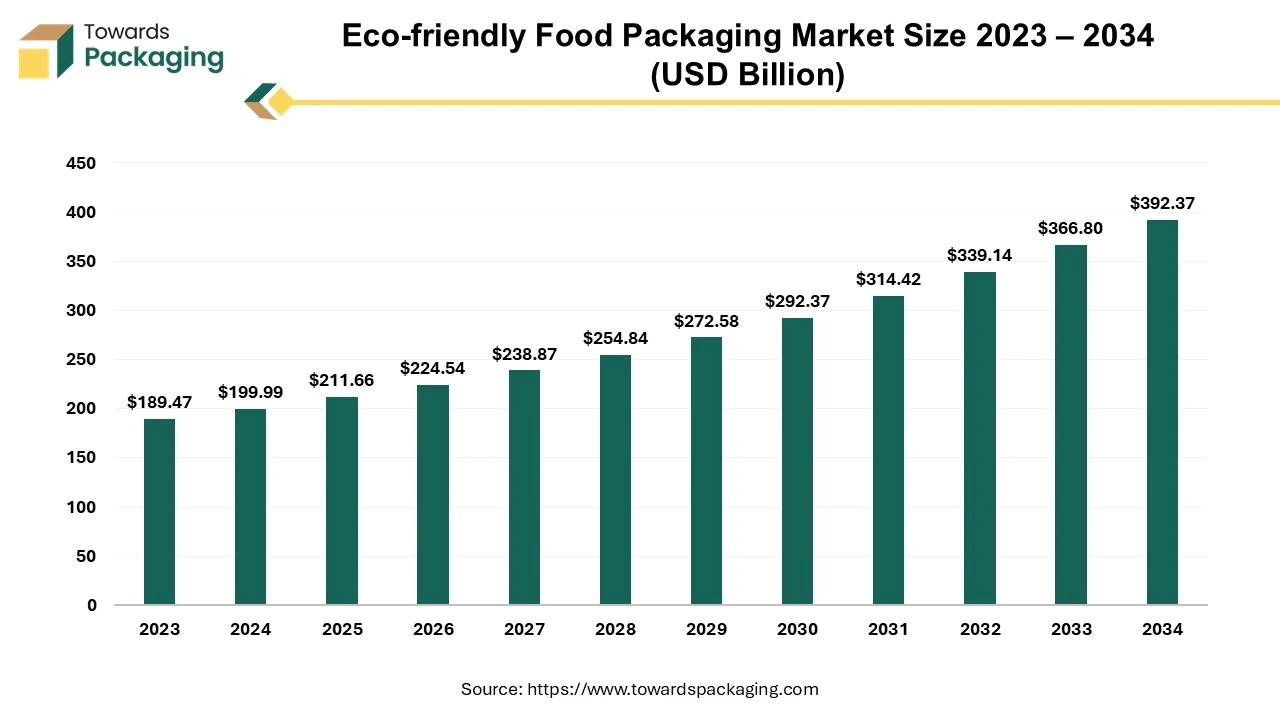

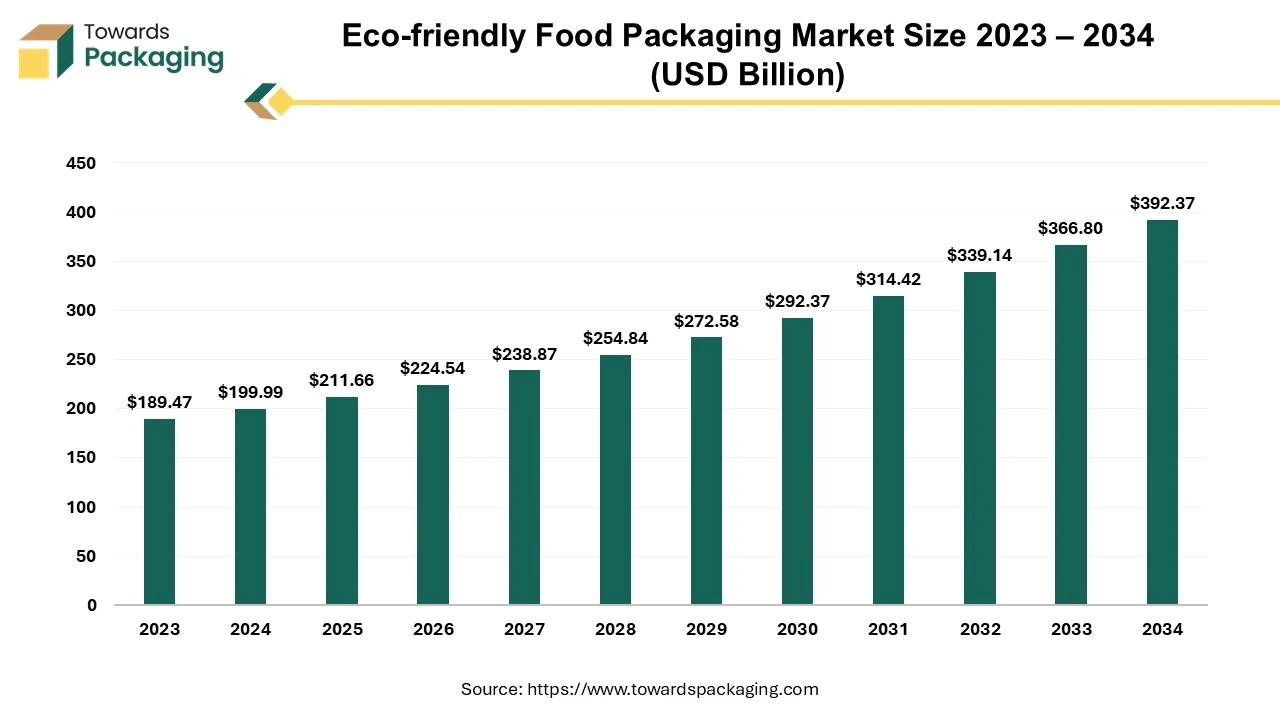

Future of Eco-friendly Food Packaging Market

The global eco-friendly food packaging market size reached US$ 199.99 billion in 2024 and is projected to hit around US$ 392.37 billion by 2034, expanding at a CAGR of 6.97% during the forecast period from 2025 to 2034.

The eco-friendly food packaging market is predicted to witness strong growth in the years to come. Eco-friendly food packaging materials can be recycled, composted, biodegradable or used again. Plastic food packaging can cause endocrine system disruption and accumulate in the ocean, among other health and environmental hazards. Eco-friendly packaging, fortunately, has many advantages for consumers, companies, and the environment. Plant-based extracts such as wheat, bamboo and wood, as well as sustainable bioplastics are frequently utilized in sustainable packaging for food. According to the research, eco-friendly packaging has a much lower rate of chemicals and also non-intentionally added substances (NIAS) migrating into food and the body than plastics. Eco-friendly alternatives are therefore safer compared to plastic packaging.

Global Food Packaging Market Players

Latest Announcements by Food Packaging Industry Leaders

- In March 2025, Guillaume Latourette, Vice President of Ahlstrom's Global Food Packaging division, stated that with LamiBak Flex, the Ahlstrom’s global food packaging division address the critical challenge of delivering high- barrier paper for flexible packaging while supporting sustainability goals. This innovation represents the future of functionalized base paper for converters and brands alike.

- In January 2025, according to Peter Voortmans, Commercial Director of Consumer Products Flexibles at Borealis, this new rLLDPE grade is a significant step towards a circular economy for plastics because of its remarkable 85% post-consumer recyclate content. As one of the ways the company is reimagining necessities for sustainable living, Borcycle M CWT120CL will assist Borealis company’s clients in reaching their sustainability goals while upholding the high performance standards necessary for demanding flexible packaging applications.

New Advancements in Food Packaging Industry

- In March 2025, Placon, a pioneer in sustainable, creative thermoformed food packaging, announced the debut of its new Fresh 'n Clear Dip Cup line for dips, spreads, and hummus. In response to growing consumer demand for more environmentally friendly food packaging choices for the expanding market for hummus, spread, and dip, the dip cup line was created. The dip cups and matching lids are constructed from Placon's exclusive EcoStar material, which has a #1 resin code and at least 10% recycled PET. Stacking and retailing are made simple by the product line's circular shape and recyclable crystal-clear packaging.

- In February 2025, Berry Global Group, Inc. partnered with Mars, a leader in snacks and sweets, to switch all of the packaging for its pantry jars for the M&M'S, SKITTLES, and STARBURST brands to 100% recycled plastic, excluding the jar lids. Building on the 2022 launch of the pantry jars with 15% recycled plastic, this accomplishment furthers Berry and Mars' ongoing partnership to create packaging with recycled material. Now, the revised jars are being distributed nationwide. The pantry jars, which come in three sizes (60, 81, and 87 ounces), are extensively recyclable. This shift to 100% recycled plastic will eliminate about 1,300 metric tons of virgin plastic each year, which is the equivalent of roughly 238 African elephants' weight. It also includes mechanically processed recycled content.

- In December 2024, The Lucid Infinity, created by Lucid Corp, is a ray of hope for the sustainability dilemma facing food packaging worldwide. The Lucid Infinity product line provides 100% recyclable, pad-less, and leak-proof food packaging choices that are both economical and environmentally beneficial. The unique two-piece tray design is designed to work without the use of conventional soaker pads or additives, and it captures purge at the bottom—a problem that soaker pads typically try to address. Made in-house, Lucid Infinity is a blend of PET (the world's most recycled plastic) and PCR (post-consumer recycled plastic), which directly enters the recycling process and promotes a more circular economy.

- In March 2025, Green Lab, the top producer of environmentally friendly packaging in Southeast Asia, has formally joined the American market. The company offering its eco-friendly packaging options in North America in 2025, Green Lab is a division of Frasers & Neave Group, one of the biggest SGX-listed corporations in Southeast Asia. With many container shipments already underway, the company provides eco-friendly food packaging that is competitively priced and performs as well as conventional solutions, along with FSC-certified, 100% recycled paper bags.

Food Packaging Market Segments

By Material

- Plastics

- Paper & Paper-based

- Glass

- Metal

- Others

By Type

- Flexible

- Rigid

- Semi-rigid

By Application

- Bakery & Confectionery

- Dairy Products

- Fruits & Vegetables

- Meat & Seafood

- Sauces & Dressings

- Others

By Packaging Type

- Bottles

- Cups

- Cans

- Pouches

- Trays

- Others

By Food Type

- Frozen Food

- Chilled Food

- Canned Food

- Shelf Stable Food

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait