April 2025

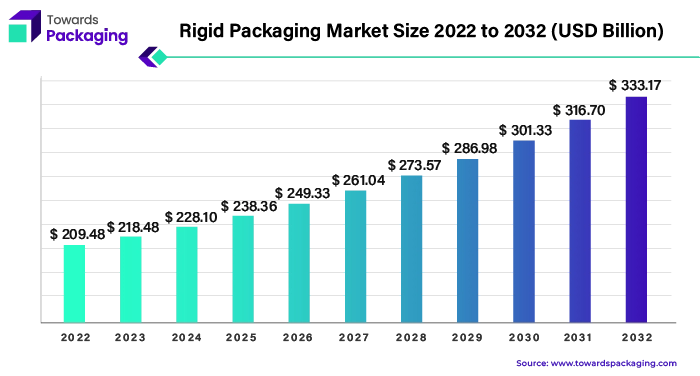

The global rigid packaging market size reached US$ 228.97 billion in 2024 and is projected to hit around US$ 365.92 billion by 2034, expanding at a CAGR of 4.8% during the forecast period from 2024 to 2034.

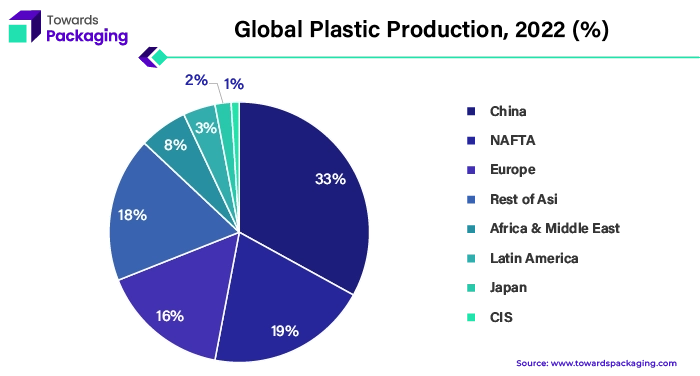

The rigid packaging sector makes prominent use of plastic owing to their numerous advantages, include becoming durable, portable, chemically impermeable, and reasonably priced. Considering 31% of the world's plastic utilisation volume going to the packaging, the industry certainly is dominating with the manner when plastics are used. Comparing to other forms of packaging, rigid packaging is more lightweight. It also reduces food waste and spoiling, protects against breakage, and offers a host of other advantages. Rigid plastic widely used in various industries such as food and beverage, personal care, healthcare and others.

Rigid packaging is often chosen since it is lightweight than components including glass or metal and consumes less electricity to transport. The carbon footprint of a product can be reduced by up to 40% by switching from glass bottles to plastic equivalents, according to recent research. This emphasises rigid plastic packaging's sustainability, which makes it a sensible option for both producers and customers.

Contrary to popular belief, flexible packaging is more eco-friendly than rigid packaging, while glass jars require more energy to produce than flexible pouches, glass has the benefit of being infinitely recyclable and reusable. Even though stiff plastic packaging requires more energy and materials to produce, the plastics used are frequently obtained domestically and can contain recycled content. A large amount of glass is manufactured globally, which increases the amount of energy required for transportation and leaves a larger carbon imprint. There are more considerations for sustainability in packaging decisions than just material type.

For Instance,

Eco-friendly and Sustainable Packaging: Due to rising concerns about global warming the demand for rigid packaging solutions that are recyclable or manufactured from recycled materials has increased. This trend is driven by consumers' increased awareness of environmental issues, including plastic waste and pollution. Companies are investing in alternative materials like biodegradable plastics and plant-based polymers to reduce environmental impact. Packaging is being designed with reduced material usage and improved recyclability, focusing on minimalistic designs and less waste.

Premiumization of Products: As consumers increasingly demand for higher-quality products, there is a rising trend towards premium packaging solutions. Rigid packaging, particularly glass and high-quality plastic, is utilized to convey freshness, luxury, and quality. This is particularly evident in the food and beverage sector, where glass bottles, jars, and rigid containers are being used to differentiate premium products.

Shift from Plastic to Alternative Materials: There is a gradual shift away from single-use plastic in favour of alternative rigid packaging materials such as glass, metal, and paperboard. This trend is especially strong in consumer goods, food & beverages, and cosmetics industries. Glass is regaining popularity for its premium feel and sustainability attributes, though it remains heavy and costly compared to plastic.

Customization and Personalization: Consumers are increasingly preferring personalized products, and packaging plays a role in this trend. Brands are focusing on offering customized packaging designs, whether through colors, shapes, or branding elements, to appeal to specific consumer groups.

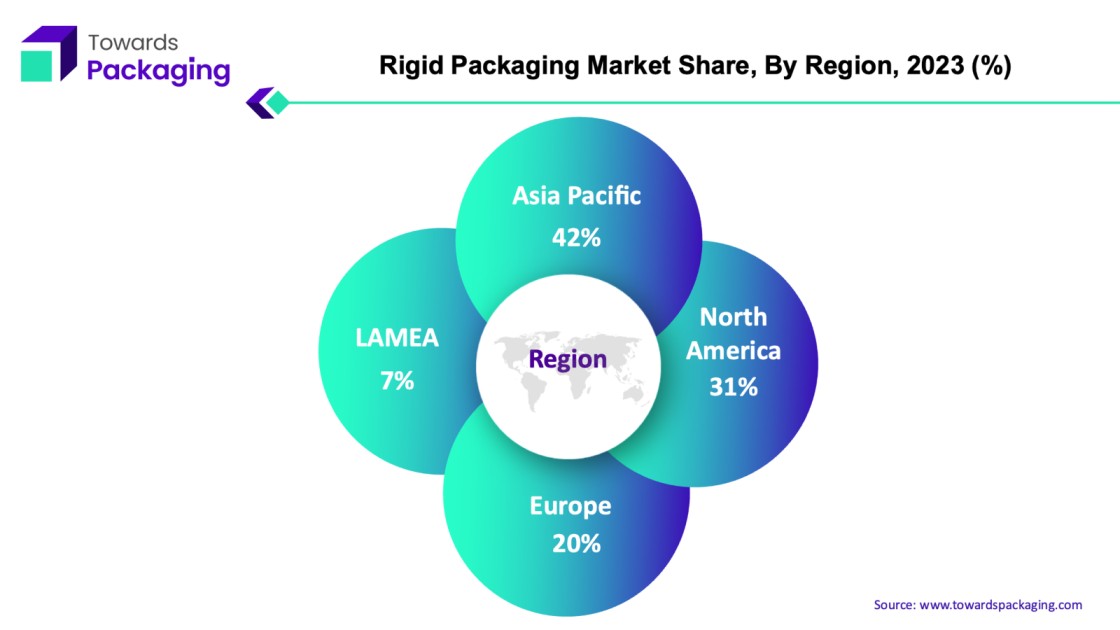

The Asia Pacific region has become the leading global market for rigid packaging, primarily due to the expansion of firms in the cosmetics and food & beverage industries. The region dominates globally in rigid packaging to a significant degree as a result of this multitude of producers. The Asia Pacific region's enormous populace, particularly in developing countries like India and China, and their fast growth in economies are major factors driving the market. specifically, the emerging markets of China, India, Bangladesh, and other countries are major drivers of the rigid packaging industry.

In Asia Pacific, a growing middle class and a rising percentage of single-person families choosing smaller packing units are two of the causes driving the growing need for rigid packaging. Furthermore, the region's need for rigid packaging is fueled in part by urbanisation and the rise in e-commerce. The market is dynamic and producers must adapt and innovate to satisfy the demands of the changing consumer tastes and lifestyles reflected in these trends. Due to its enormous growth potential in the face of a quickly changing economic environment, the Asia Pacific area remains a major hub for manufacturers of rigid packaging.

For Instance,

North America is expected to grow at a significant rate over the forecast period. The robust advancements in the rigid thermoform plastic packaging industry are responsible for this region's expansion. Numerous benefits of thermoforming include its lower cost and adaptability. The rigid thermoform plastic packaging industry has seen enormous growth in product manufacture, creating a sizable client base that is fueling the expansion of the North American rigid packaging market. The key players operating in the North America region are focused on adopting inorganic growth strategies like partnership/collaboration to develop rigid packaging, which is estimated to drive the growth of the rigid packaging market in the near future.

For instance, in April 2024, Eastman Chemical Company, chemical industry headquartered in Tennessee, U.S. collaborated with the Sealed Air Corporation, North Carolina, U.S., to introduce certified lightweight tray, innovated to replace typical polystyrene foam substitutes in protein packaging applications. Eastman's Aventa Renew material, which is composed of wood pulp and acetyl from a portfolio of recycled materials, is used to make the new tray. Eastman explains that the latter has up to 43% recycled content that has been approved by ISCC PLUS through a mass balance allocation procedure.

North America is the rigid packaging sector's second-greatest market. North America is acknowledged as the world's top region in packaging consumption and is home to major players in the industry, including International Paper, Tetrapak, Reynolds Group, Ball Corporation, and Owens-Illinois. In the course of the region, rigid materials are widely used in a variety of applications.

The US has the biggest market share for rigid packaging in North America. This dominance is a direct result of the nation's substantial consumer base, advanced technology, and strong industrial infrastructure. The food and beverage, pharmaceutical, personal care, and household product industries are just a few of the diverse industries that make up the U.S. rigid packaging market.

North America's standing as a major participant in the global rigid packaging scene is strengthened by the existence of top packaging companies, ongoing innovation, and research and development spending. Furthermore, producers in the region are compelled to implement eco-friendly practices and provide recyclable packaging solution due to strict restrictions pertaining to packaging materials and sustainability activities.

North America's leading position in the rigid packaging market underlines how important it is to the development of industry trends and innovation in response to changing consumer needs and legal regulations.

For Instance,

| Product | Description | Loading Port | Unloading Port | Country of Origin | Quantity | Weight (kg) | Arrival Date |

| Paper and Paperboard | Coated on one or both sides with kaolin (China clay) or other inorganic substances. | Shanghai, China | New York/Newark Area, Newark, NJ, USA | Japan (JP) | 108 Rolls | 49,734 | 2024-09-27 |

| Plastic Packaging | Plastic packaging. | Liverpool, UK | New York/Newark Area, Newark, NJ, USA | United Kingdom (GB) | 542 Cartons | 15,664 | 2024-09-27 |

| Metal Packaging | Metal packaging on 24 pallets. | Genoa, Italy | New York/Newark Area, Newark, NJ, USA | Italy (IT) | 1,056 Packages | 3,147 | 2024-09-26 |

| Plastic Packaging | Plastic packaging. | Valencia, Spain | Savannah, GA, USA | Spain (ES) | 2,678 Boxes | 19,562 | 2024-09-25 |

| Plastic Packaging | Plastic Packaging | Liverpool, UK | New York/Newark Area, Newark, NJ, USA | United Kingdom (GB) | 1 Package | 93 | 2024-09-25 |

| Paper and Paperboard | Coated on one or both sides with kaolin (China clay) or other inorganic substances. | Pusan, South Korea | New York/Newark Area, Newark, NJ, USA | Japan (JP | 102 Rolls | - | 2024-09-27 |

A global market with a total worth of USD 310.65 billion is anticipated for rigid plastic packaging in 2023, attributed to its widespread adoption in a variety of sectors such as health care, food & beverage, electronics, and personal care. Rigid plastic bottles, especially in the food and beverage industry, are the main container for a wide range of goods, including water, carbonated soft beverages, juices, food items, cosmetics, personal hygiene products, and pharmaceuticals.

Despite an integrated stream containing additional components such as plastics, glass, paper/cardboard, steel, and aluminium, household rigid plastic packaging is usually collected in Australia. A Materials Recovery Facility (MRF) sorts this combined or commingled material so as to separate its several material streams.

Almost all, of the rigid plastic packaging is then automatically sorted using optical polymer sorting machinery once it has been separated from other materials. The various polymer kinds can be distinguished by this apparatus by the use of near-infrared (NIR) spectrum absorption. Several kinds of stiff plastics are recognised and distinguished for recycling or other suitable disposal techniques through this sorting procedure.

By using this method, hard plastic packaging may be recovered more effectively for recycling, and it also emphasises how important technology improvements are to waste management procedures. Reducing environmental impact and increasing recycling rates by diverting rigid plastics from landfills and supporting circular economy concepts are the goals of countries such as Australia that have implemented automated sorting processes.

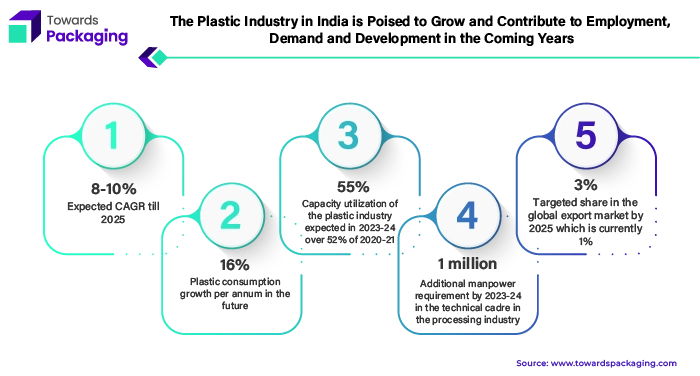

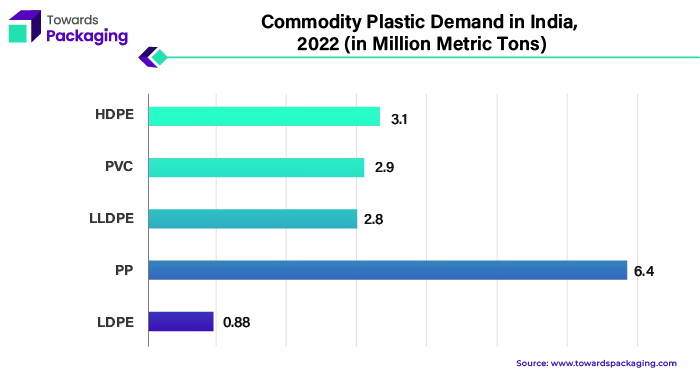

PP is the leading plastic commodity in India, used for various applications. Rigid plastic packaging, often known as "rigids" in the industry, is mostly made of polypropylene (PP) or high-density polyethylene (HDPE) . These products include containers without open tops and instead have separate closures, lids, or covers. These are frequently used to package a variety of consumer goods, including beverages, personal care products, and food items.

For Instance,

Boxes are a prominent product category in the rigid packaging market because of their adaptability, robustness, and broad industry applicability. Boxes are a fundamental component of packaging solutions, providing a wide range of items with protection, confinement, and organisation. To meet varied packaging needs, they are available in a variety of sizes, shapes, and materials, such as cardboard, corrugated board, plastic, and metal.

Specifically cardboard and corrugated boxes are very preferred because of their affordability, portability, and environmental friendliness. Their frequent applications include shipping, storing, and retail packing; they offer a reliable, lightweight way to move items with the least amount of environmental effect.

plastic boxes are transparent, resistant to moisture, and have designs that can be customised, which makes them perfect for product display and guaranteeing product exposure on store shelves. Contrarily, metal boxes offer unmatched strength and security, which is why they are frequently used to package expensive or delicate goods that need special protection while in transportation.

Because they can accommodate a wide range of packaging requirements from food and beverage to electronics, pharmaceuticals, and other industries, boxes are essential to the rigid packaging business. Their versatility, robustness, and efficiency render them essential constituents of contemporary packaging systems.

For Instance,

The beverage and food sectors are the main users of rigid packaging, although it is also used for packaging domestic goods, medications, and personal care items. A number of variables, most notably the growing need for single-serve packaging in ready-to-eat foods and beverages, are driving the usage growth trend. Furthermore, continuing improvements in material qualities make it easier to replace conventional packaging materials like glass with plastic. Among rigid plastic beverage bottles, carbonated soda is the most common end use in the beverage industry. Though it only accounts for 3% of the market, there has been a noticeable uptick in the use of rigid plastic packaging in the alcohol sector. Due to growing customer preferences for healthier and "good for you" beverage options, this market is seeing substantial growth.

Rigid packaging is a preferred option in a variety of industries due to its adaptability and versatility, and its use is expected to continue growing as a result of changing consumer tastes and technology advancements.

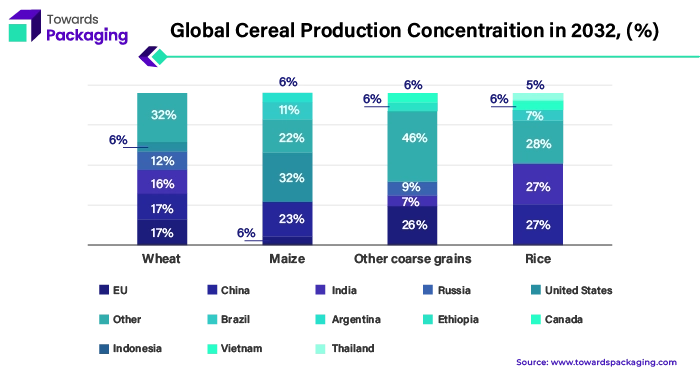

The expected increase in global cereal production is forecasted to result from improved yields and optimized utilization of arable land resources. Wheat, rice, maize, and other grains are packaged in rigid containers for efficient transportation, exportation, and retail distribution. These commodities are enclosed in rigid packaging solutions, providing essential moisture protection and product safeguarding throughout the supply chain.

For Instance,

A survey conducted in 19 countries with over 19,000 people shows that the majority strongly support cutting plastic production. Specifically:

Many people are also concerned about plastic’s impact on health:

This support is consistent across all countries surveyed, especially strong in Global South nations with higher plastic pollution levels. The lowest level of support was 60%, for preventing fossil fuel and chemical industry lobbyists from joining negotiations.

The competitive landscape of the rigid packaging market is dominated by established industry giants such as Bemis Company, Inc., Amcor Limited, Coveris Holdings S.A, Reynolds Group Holding, Berry Plastics Corporation, Sonoco, Sealed Air Corporation, Silgan Holdings, Inc., Plastipak Holdings, Inc., Consolidated Container Company, DS Smith PLC and Ball Corporation. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Innovation and sustainability are Plastipak's two main strategic focuses. The business makes significant investments in R&D to produce innovative packaging solutions that satisfy changing customer needs and market trends. By utilising recycled materials in its packaging products and investigating environmentally friendly manufacturing techniques, Plastipak places a high priority on sustainability.

For Instance,

Amcor uses a variety of strategies to hold onto its market-leading position in rigid packaging. Offering a wide range of rigid packaging solutions for a variety of industries, such as food and beverage, pharmaceuticals, personal care, and industrial applications, the company focuses on portfolio diversification.

For Instance,

David Clark, Vice President at Amcor plc., stated that the company has reducing waste and improving sustainability by 2025, by working with consumers and carrying out research and development for innovation rigid sustainable material. The Amcor plc. Putforth the Catalyst program which the company’s technical experts in direct contact with customers. In order create an extraordinary pipeline of innovations that address the largest practical and technical obstacles to packaging, Amor invests US$100 million annually in research and development (R&D). This dedication to research and development has yielded outstanding outcomes: This year, Amite Recyclable is brand-new, metal-free, recyclable packaging for a variety of food and medical uses. There have been notable advancements in the use of post-consumer recycled (PCR) content in rigid packaging, including the commercialization of numerous 100% PC solutions and the usage of over 100 million pounds of recycled content yearly.

By Material

By Product Type

By Application

By Geography

April 2025

April 2025

April 2025

April 2025