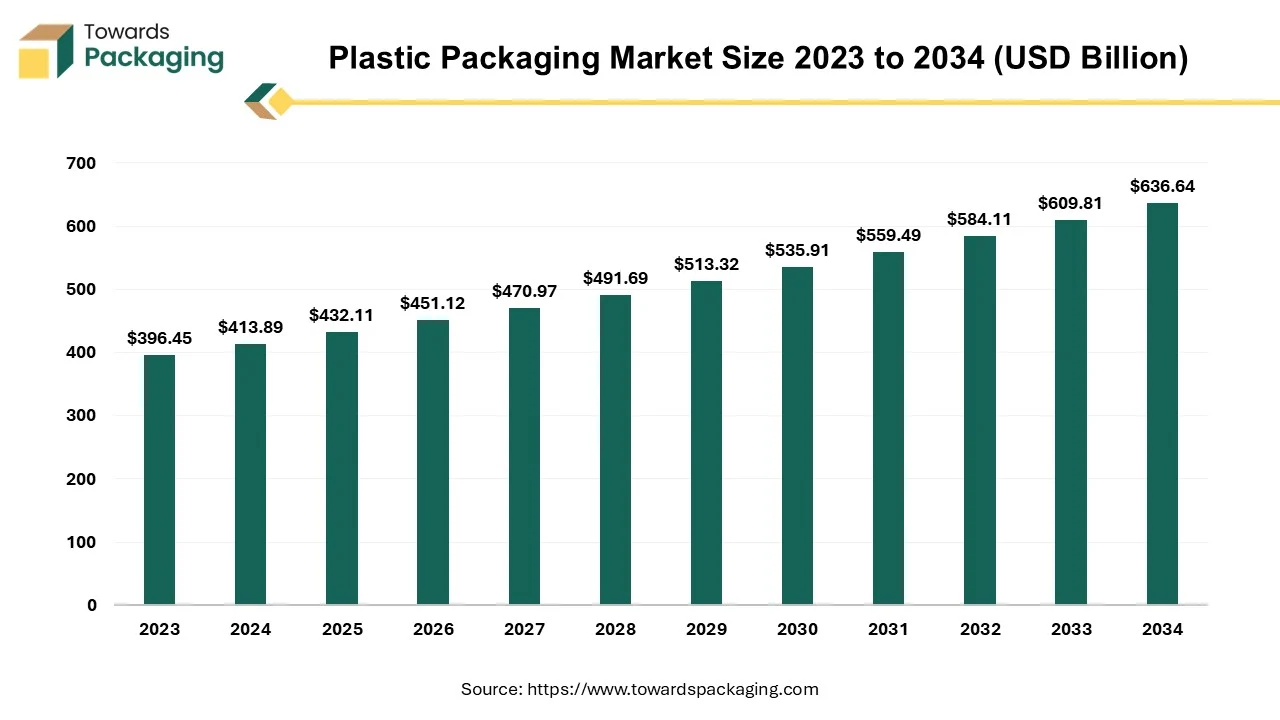

The plastic packaging market is projected to reach USD 664.65 billion by 2035, growing from USD 451.11 billion in 2026, at a CAGR of 4.4% during the forecast period from 2026 to 2035. Our report covers segment data (materials: PET leading in 2024; products: rigid leading; technologies: extrusion leading; applications: food & beverages leading), regional analysis across NA, EU, APAC, LA, MEA (with APAC dominating 2024 and North America set for strong growth), company profiles, competitive analysis, value chain mapping, trade statistics, and a manufacturers & suppliers database.

The utilization of various semi-synthetic or synthetic materials to enclose, protect, transport, and display products is known as plastic packaging. The plastic packaging is extensively utilized for packaging materials worldwide, due to its versatility, durability, and cost-effectiveness. The common plastics utilized in packaging have been mentioned here as follows: polyethylene, polyethylene terephthalate, polystyrene, polyvinyl chloride, and bioplastics among others.

There are several different types of plastic packaging which have been mentioned here as follows: flexible plastic packaging, rigid plastic packaging, blister packs & clamshells, and foamed plastic packaging. The advantages of plastic packaging have been mentioned here as follows: lightweight, durable, versatile, flexible, barrier properties, cost-effective and printability and aesthetic appeal.

Brands and manufacturers are prioritizing recyclable materials and post-consumer recycled (PCR) content. Single-use plastics are being phased out in favour of multi-use or recyclable plastic formats. Mono-material packaging (using only one type of plastic) is rising because it simplifies recycling.

Increasing interest in bio-based plastics like PLA (Polylactic Acid), PHA (Polyhydroxyalkanoates), and bio-PET. Compostable plastics are gaining traction in foodservice packaging and single-use items.

Manufacturers are designing packaging with thinner walls and lighter materials to reduce material use and lower carbon footprints. The lightweighting helps in reducing shipping costs and environmental impact.

Integration of QR codes, NFC chips, and sensors to enhance traceability, provide product information, or ensure tamper evidence. Particularly important in food & beverage, healthcare, and luxury sectors.

Refill stations and reusable packaging models are expanding, especially in personal care, household cleaners, and beverages. Durable plastic containers are part of the circular economy push.

New developments in barrier coatings and multilayer structures to improve shelf life, especially for food, beverages, and pharmaceuticals. Efforts are ongoing to develop recyclable barrier solutions.

Brands increasingly use plastic packaging to create custom, limited-edition, or personalized designs for promotions and seasonal products.

From 1950 to 2015, the world saw an extraordinary rise in the production and use of polymer resins, synthetic fibers, and chemical additives. However, the management of plastic waste has struggled to keep up with this rapid growth.

Before 1980, plastic recycling and incineration were nearly nonexistent. Only in the following decades did nonfiber plastics start seeing efforts toward recycling and controlled disposal. By 2014, global recycling and incineration rates for nonfiber plastic waste had reached 18% and 24%, respectively. While these numbers reflect gradual progress, they still leave the majority of plastic waste to be discarded.

The cumulative generation and disposal of plastic waste from 1950 to 2015 illustrate the long-term environmental impact of global plastic production. Solid trend lines show historical data (1950-2015), while dashed lines project future figures up to 2050, based on the continuation of past growth and waste management patterns.

Given the scope of this analysis, there are assumptions and simplifications. The results have been rounded to the nearest 100 million metric tons (Mt) to account for data variability. Some sources of uncertainty include the lifespan of different product categories and the accuracy of recycling and incineration rates outside well-documented regions like Europe and the U.S.

Adjusting the mean product lifetimes by one standard deviation (±1 SD) changes cumulative primary plastic waste generation from 5,900 Mt to a range of 4,600-6,200 Mt (a margin of -4% to +5%). Similarly, changing global incineration and recycling rates by ±5%, and adjusting historical trends accordingly, shifts total discarded plastic waste from 4,900 Mt to a range of 4,500-5,200 Mt, a variation of -8% to +6%.

Over the last 65 years, plastic production has expanded faster than any other manufactured material. Ironically, the very traits that make plastics valuable durability, light weight, and resistance to degradation also make them persistent pollutants in the environment. Without well-designed systems for managing plastic waste at the end of its life, we are essentially running a global, uncontrolled experiment, allowing billions of tons of plastic to accumulate in both terrestrial and aquatic ecosystems.

Over the past 70 years, the production of plastic resins and synthetic fibers has grown rapidly. In 1950, production was just 2 million metric tons (Mt), but by 2015, it reached about 380 Mt, growing at an average rate of 8.4% per year. This is more than twice the growth rate of global GDP during the same period. Between 1950 and 2015, the world produced nearly 7,800 Mt of plastics, and half of this amount was made in the last 13 years, showing a huge rise in demand.

Today, China is the largest producer of plastics, making up about 28% of total resin production and 68% of the world’s polyester, polyamide, and acrylic (PP&A) fiber production. While alternatives like bio-based and biodegradable plastics are available, they only account for around 4 Mt of global production, which is still small compared to traditional plastics and is not included in this analysis.

The data collected from different industry sources provides a clear picture of global plastic production, including resins, fibers, and additives. This is important because there has been limited data on fibers and additives in the past. The findings show that nonfiber plastics are made up of about 93% polymer resin and 7% additives by weight. When you include additives, total nonfiber plastic production since 1950 comes to 7,300 Mt, with an additional 1,000 Mt from PP&A fibers. Among additives, plasticizers, fillers, and flame retardants make up about 75% of the total used.

Looking at the types of plastics, polyethylene (PE) is the most common, making up 36% of nonfiber plastics. Polypropylene (PP) follows with 21%, and polyvinyl chloride (PVC) accounts for 12%. Other plastics like polyethylene terephthalate (PET), polyurethane (PUR), and polystyrene (PS) each make up less than 10% of total production. On the fiber side, polyester (mostly PET-based) makes up nearly 70% of all PP&A fibers. These seven types of plastics together make up about 92% of all plastics ever produced.

In terms of use, packaging is the biggest market, taking up about 42% of nonfiber plastic production. The main materials used for packaging are PE, PP, and PET. The building and construction sector is the second-largest consumer, using around 19% of nonfiber plastics, with PVC making up almost 69% of plastic used in this sector.

Predictive analytics is one of the most popular corporate applications for Al. Packaging producers are using algorithms driven by Al to predict demand for particular goods. Al is able to estimate future demand with accuracy by examining past sales data, patterns of client behavior, and even outside variables like market trends or economic conditions. Production schedules may be optimized, waste can be decreased, and sufficient packaging materials can be made accessible as needed by manufacturers.

Mecalux, an intralogistics company, and the Massachusetts Institute of Technology Center for Transportation & Logistics (MIT CTL) have started a five-year effort to expedite the adoption of self-learning artificial intelligence (Al) in logistics. Teams from Mecalux and MIT's Intelligent Logistics Systems Lab intend to establish two main research areas during the project's first year. Using cutting-edge modeling, optimization, and machine learning approaches, the first area will concentrate on boosting the efficiency of autonomous warehouse robots with the goal of creating a "swarm intelligence" system that will allow several robots to function as a single unit and make choices collectively.

Modern technologies that improve functionality and customer engagement are driving a significant revolution in the packaging sector. Packaging that changes color is one invention that is gaining traction. This cutting-edge packaging technology, which offers special features that react to environmental stimuli like temperature, light, and pH, has the potential to completely change how products are presented to consumers. Artificial intelligence (Al) is being used to further improve color-changing packaging's capabilities, elevating efficiency, quality assurance, and customized experiences.

Key regulatory requirements impacting the plastic packaging market focus on reducing environmental impact and improving circularity. These include minimum recycled content requirements for packaging materials, recycling or reusable packaging design specifications, and Extended Producer Responsibility (EPR) regulations that impose responsibility for the collection, recycling, and management of plastic waste on manufacturers and brand owners. Along with stringent reporting, labeling, and traceability requirements to track plastic use and waste flows, many nations have also implemented single-use plastic bans or restrictions.

Regulations about food contact and chemical safety also restrict the use of hazardous materials in packaging, which influences design strategies, material selections, and compliance costs throughout the plastic packaging sector.

Sustainability investments improve ROI in the plastic packaging market by lowering long-term compliance costs, reducing material waste, and strengthening market competitiveness. Companies can avoid regulatory fines, take advantage of lower eco-modulated EPR fees, and lessen their reliance on fluctuating virgin plastic prices by switching to recyclable designs and incorporating recycled content. Additionally, these investments give access to high-end FMCG and food and beverage customers who value sustainable and compliant packaging suppliers, resulting in increased order volumes and pricing power. Stronger and more consistent returns are eventually obtained by offsetting upfront capital expenditures with increased operational effectiveness, regulatory resilience, and brand reputation.

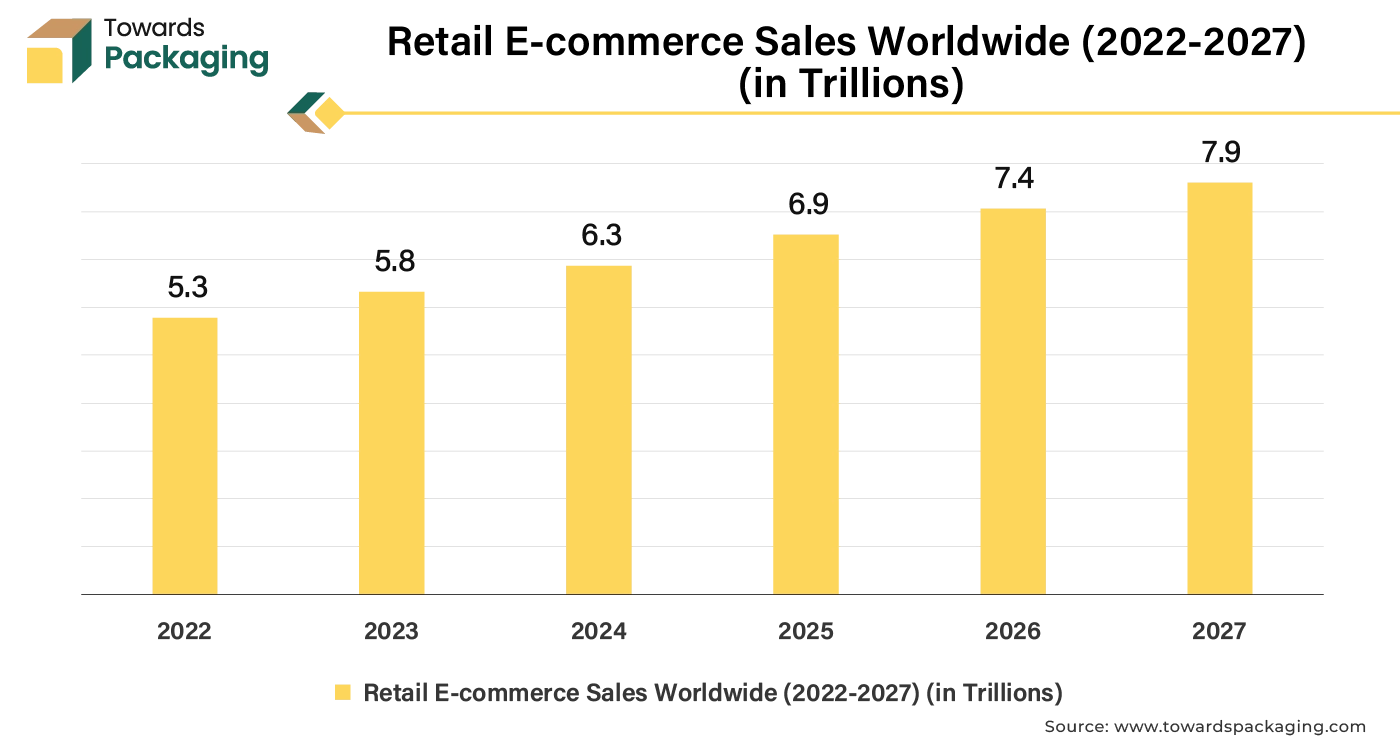

Massive boom in online shopping globally (Amazon, Flipkart, Alibaba, etc.). Demand for durable, lightweight, protective, and tamper-evident packaging is rising. Plastic packaging is ideal for safeguarding goods during transit and reducing shipping costs. For instance, in January 2025, according to the data published by the National E-commerce association, it has been estimated that the in 2025, internet sales will account for 21% of retail sales, the largest percentage to date. By 2027, it is anticipated that 22.6% of all retail transactions will take place online. Since 2021, the percentage of retail purchases made online has increased by an average of 0.32% year.

The key players operating in the plastic packaging market are facing issue such as plastic waste crisis and competition from the alternative material packaging, which has been estimated to restrict the growth of the plastic packaging market in the near future. Setting up advanced recycling systems (chemical recycling, pyrolysis) requires high capital investments. Many small and medium-sized packaging firms struggle to afford such investments.

Public concerns about chemicals leaching from plastic packaging into food and beverages (e.g., BPA, microplastics). Global events (like the COVID-19 pandemic and geopolitical tensions) have disrupted plastic resin supply chains, causing delays and shortages. Many countries and regions (EU, Canada, parts of Asia, and U.S. states) are banning or limiting single-use plastics. Land and ocean pollution due to non-biodegradable plastic waste has led to increased scrutiny and restrictions.

Growth of reusable, recyclable, and bio-based plastic packaging solutions. Brands and packaging companies investing in eco-design to meet consumer and regulatory norms demand. Closed-loop systems and advanced recycling technologies (like chemical recycling). Hence, due to rising demand and introduction of the plastic packaging, it has estimated to create lucrative opportunity for the growth of the plastic packaging market over the forecast period.

The polyethylene terephthalate (PET) segment held a dominant presence in the plastic packaging market in 2024. The polyethylene terephthalate (PET) has barrier properties which offer a strong barrier against gases (like oxygen), moisture, and chemicals. This is crucial for beverage, food, and pharmaceutical packaging to preserve freshness and extend shelf life. The polyethylene terephthalate (PET) is lightweight, which minimizes shipping and handling costs. Consumers appreciate visibility, especially for fresh and colourful products. The polyethylene terephthalate (PET) can be easily blown, molded, and thermoformed into different shapes and sizes.

The rigid product type segment accounted for a significant share of the plastic packaging market in 2024. Rigid plastic packaging provides excellent protection against physical damage (punctures, impact, crushing). Plastic packaging is ideal for fragile items, electronics, food, and consumer goods, as it maintains product quality integrity during transportation and storage. Rigid packaging provides better barrier properties against oxygen, moisture, contaminants.

The extrusion segment registered its dominance over the global plastic packaging market in 2024. Extrusion is fast and continuous, making it ideal for mass production of plastic packaging. It enables for high output rates, minimizing manufacturing costs and meeting large-volume demands. Co-extrusion technology enables multiple materials to be combines in layers. This provides enhanced barrier properties against oxygen, moisture, UV), mechanical strength and customized functionality (like easy-peel layers). Extrusion has low material waste, especially with in-line recycling systems.

The food & beverage segment dominated the plastic packaging market globally. As food and beverage companies expand into urban markets, e-commerce platforms, and convenience stores, demand for packaged goods increases. Plastic packaging offers lightweight, cost-effective, and durable solutions that are accurate for packaged snacks, ready-to-eat meals, beverages, dairy, etc. Consumers want on-the-go, single serve, and easy-to-carry food and drink options. Plastic packaging provides shelf-life extension which is crucial for long-distance shipping and export.

Asia Pacific held the largest share of the plastic packaging market in 2024, owing to technology advancements for manufacturing plastic packaging in the region. Asia Pacific is home to over 60% of the global population, with fast growing urban centers in India, China, Southeast Asia, etc. Asia Pacific is lately from 2022 after Covid-19 pandemic seeing a boom in food delivery services, processed foods, snacks, and beverages. Growing demand for healthcare, pharmaceutical, and hygiene products in Asia Pacific region has driven the market growth. For instance, in April 2025, Nelipak Corporation ("Nelipak"), a prominent worldwide producer of packaging solutions for pharmaceutical drug delivery, medical devices, diagnostics, and other demanding applications, announced that it is strengthening its dedication to providing direct customer service as well as through its preferred partners to customers in the Asia-Pacific region.

China plastic packaging market is estimated to grow owing to continuous advanced in the plastic packaging. Emissions of volatile organic compounds (VOCs) from China's printing and packaging sectors show clear regional variations, with certain areas experiencing extremely high levels of uncontrolled VOC emissions. Seventy percent of all VOC emissions from packaging printing come from the printing of plastic packaging, making it a particularly significant source of pollutants.

China produced 12.7 million tons of plastic packaging in 2022, and 13.3 million tons are expected to be produced in 2023, according to data from the China Packaging Federation. It is anticipated that China will produce 15.3 million tons of plastic packaging by 2026.

The majority of the more than 100,000 paper packaging businesses are found in industrial belts around the coast. On March 28, 2025, according to the data published by the China Packaging Federation and the Institute of Macroeconomy Research of the National Development and Reform Commission, suggests that China establish a sustainable development blueprint for plastic packaging that includes green alternatives for raw materials, ecological design, source reduction, process supervision, recycling, and safe disposal.

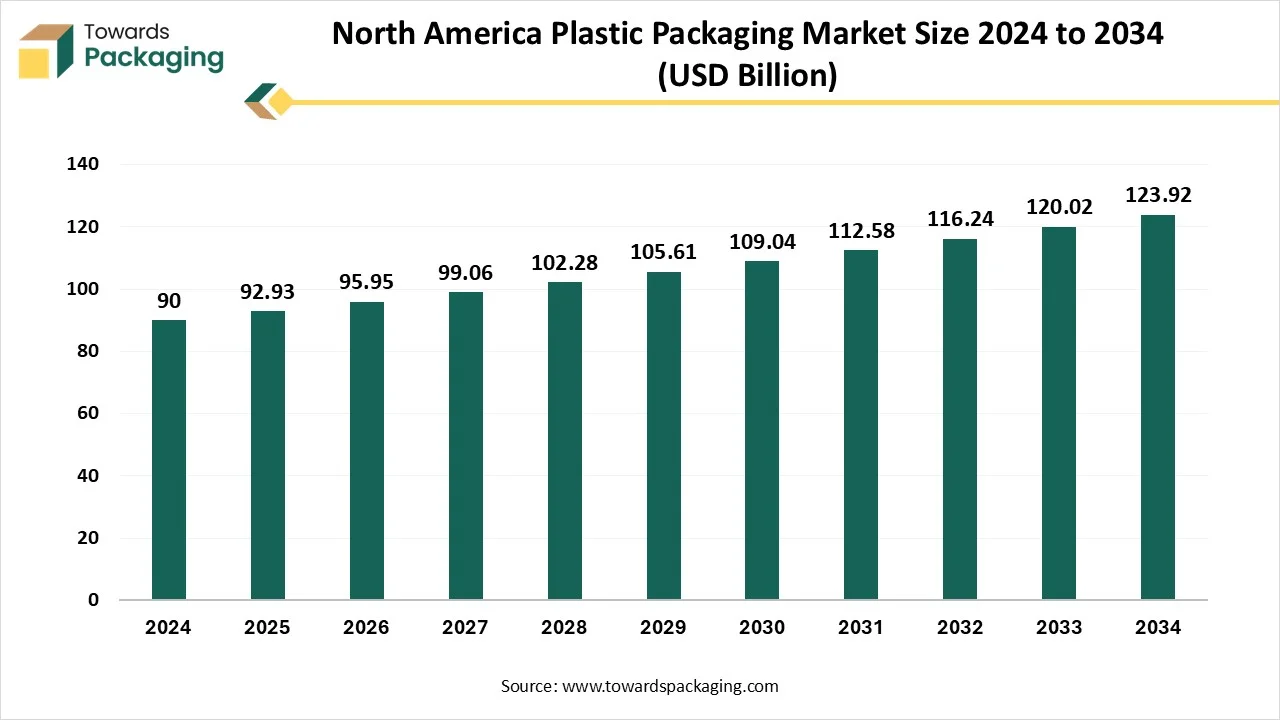

North America region is anticipated to grow at the fastest rate in the plastic packaging market during the forecast period. North America has one of the largest processed food and beverages markets globally. Rising consumption of packaged foods, frozen products, dairy, and beverages fuels plastics packaging demand. The modernization and busy-lifestyle in North America region supports consumption of ready-to-cook meals, which require proper plastic packaging to extend shelf life. North America has a robust industrial base, requiring strong and durable packaging for lubricants, chemicals, and industrial goods. Brands in North America invest heavily in customized packaging to stand out.

The North America plastic packaging market is predicted to expand from USD 92.93 billion in 2025 to USD 123.92 billion by 2034, growing at a CAGR of 3.25% during the forecast period from 2025 to 2034. The increasing demand for suitable packaging in that region has fuelled the innovation technology in the North America plastic packaging market. The altering existence influences the packing industry in North America, fulfilling customer demands for suitability and the increasing number of single-person families. The United States, because of the growing demand for suitable packing, is seeing individuals demand easy-to-transport packaging solutions.

The North America plastic packaging market includes the production, transformation, and application of plastic-based materials used for packaging goods across various sectors. Plastic packaging provides a lightweight, durable, and versatile solution for preserving product integrity, enhancing shelf life, and reducing transportation costs. It is widely adopted in industries such as food and beverage, pharmaceuticals, personal care, and e-commerce. Plastic packaging formats include both rigid (e.g., bottles, containers) and flexible (e.g., films, pouches) options, with innovations focused on sustainability and recyclability.

U.S. plastic packaging market is driven by the continuous efforts in improving plastic packaging. For instance, the U.S. Plastics Pact's "Roadmap to 2025," which Henkel helped launch, is an aggressive national strategy that outlines how the U.S. Pact, Henkel, and other signatories, known as Activators, will accomplish each of the four 2025 targets through particular actions, responsibilities, and interim timeframes in order to realize a circular economy for plastics in the United States by 2025.

The U.S. Plastics Pact was established in August 2020 as a part of the Ellen MacArthur Foundation's global Plastics Pact network, which brings together a diverse range of stakeholders from various industries to support a national strategy and shared vision to address plastic waste at its source by 2025. The Pact is led by The Recycling Partnership and World Wildlife Fund (WWF).

Europe region is seen to grow at a notable rate during the predicted timeframe. Europe is a global leader in recycling infrastructure and sustainable packaging mandates. EU regulations like European Green Deal and Single-Use Plastics Directive drive innovation in recyclable, reusable, and biodegradable plastic packaging. Europe is at the forefront of mechanical and chemical recycling techniques. Europe’s food exports and processed food industries are major consumers of plastic packaging.

The European Union has set a goal to achieve a minimum recycling rate of 55% for plastic packaging waste by 2030. As of 2023, Belgium and Latvia were the only countries to have already reached this target, with recycling rates of 59.5% and 59.2%, respectively. Other countries, such as Slovakia (54.1%), Czechia (52.4%), Germany (52.2%), and Slovenia (51.5%), are close to meeting this goal.

Several other EU nations reported plastic packaging recycling rates between 45% and 50%, showing steady progress toward compliance with the 2030 target. However, a number of countries are still lagging behind. Hungary had the lowest recycling rate at just 23.0%, followed by France (25.7%), Austria (26.9%), and Denmark (27.8%), indicating significant gaps in recycling performance.

Additionally, countries like Croatia, Sweden, Finland, and Ireland reported plastic recycling rates below 30% in 2023. These figures highlight the disparities in recycling efficiency across Europe, underscoring the need for continued efforts to improve recycling practices in these regions.

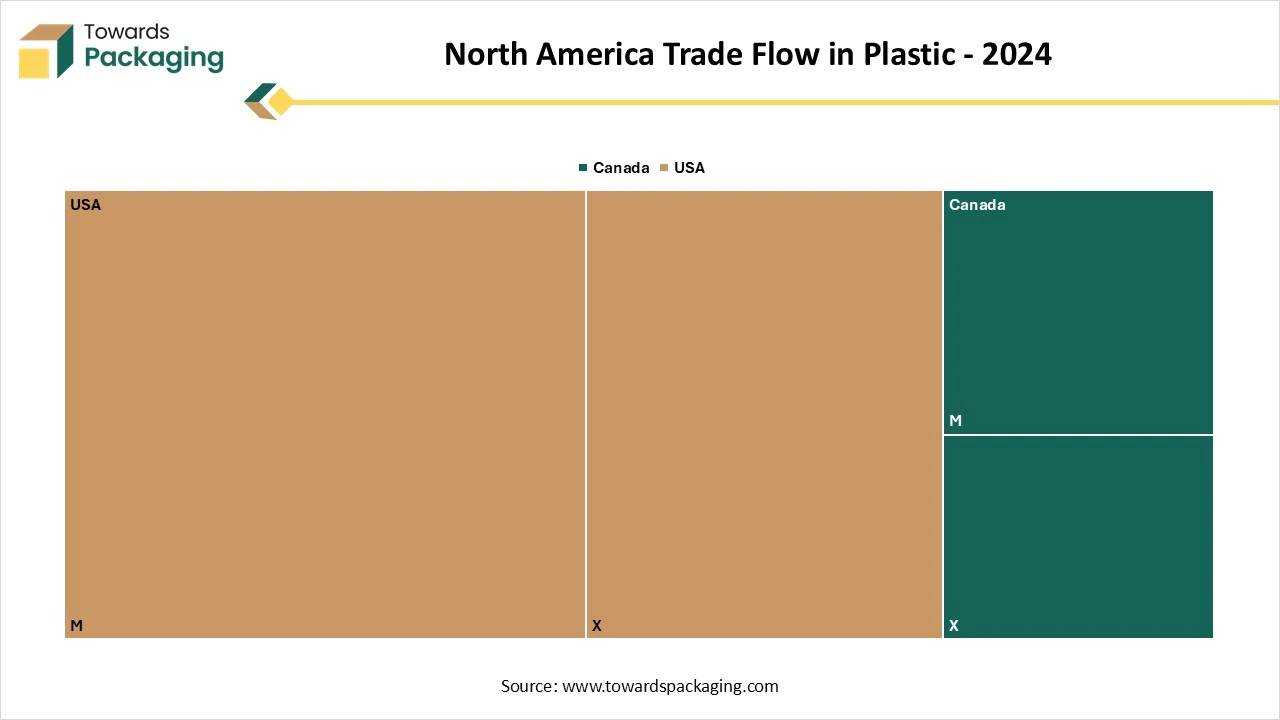

| Country | Trade Flow | Trade Value (US$) | Net Weight (kg) | Quantity (kg) |

| Canada | M | $2,833,494,576 | 528,599,987.40 | 528,599,987 |

| Canada | X | $2,369,688,160 | 509,466,194 | 509,466,194 |

| USA | M | $10,039,349,048 | 2,236,071,070.90 | 2,236,071,071 |

| USA | X | $6,856,609,728 | 1,044,313,876.20 | 1,044,313,876 |

| Country | Trade Flow | Trade Value (US$) | Net Weight (kg) | Quantity (kg) |

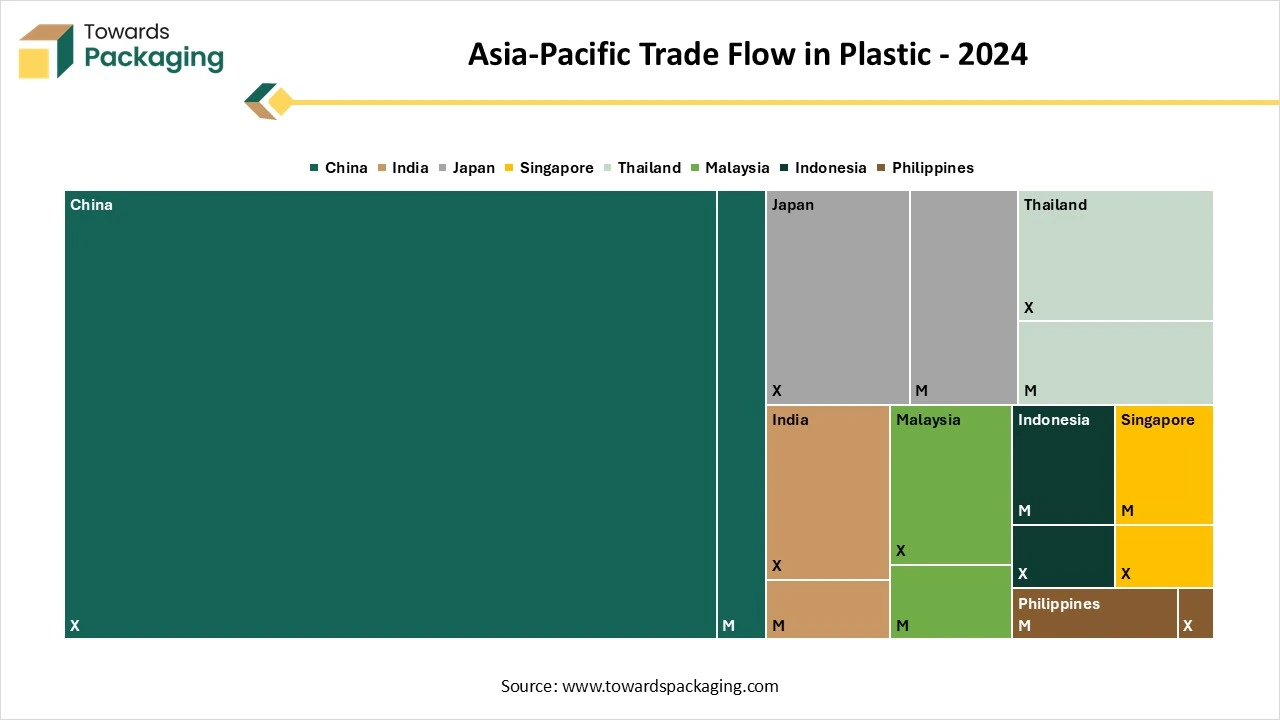

| China | M | $1,152,158,769 | 179,564,335.80 | 179,564,336 |

| China | X | $15,212,578,886 | 3,470,133,298.40 | 3,470,133,298 |

| India | M | $380,777,112 | 0 | 0 |

| India | X | $1,127,454,057 | 486,073,081.30 | 486,073,081 |

| Japan | M | $1,212,663,524 | 273,417,469.10 | 273,417,469 |

| Japan | X | $1,600,092,344 | 308,163,760.90 | 308,163,761 |

| Singapore | M | $614,892,535 | 158,432,174.80 | 158,432,175 |

| Singapore | X | $325,032,301 | 74,407,727.60 | 74,407,728 |

| Thailand | M | $844,759,512 | 213,803,637.90 | 213,803,638 |

| Thailand | X | $1,332,887,053 | 0 | 0 |

| Malaysia | M | $473,708,053 | 0 | 0 |

| Malaysia | X | $1,011,675,754 | 483,043,107.80 | 483,043,108 |

| Indonesia | M | $640,343,381 | 183,170,435.90 | 183,170,436 |

| Indonesia | X | $335,189,141 | 0 | 0 |

| Philippines | M | $437,841,668 | 182,092,469.40 | 182,092,469 |

| Philippines | X | $95,983,257 | 29,770,272.40 | 29,770,272 |

Raw Material Sourcing: Raw material sourcing focuses on polymers such as polyethylene, polypropylene, PET, and PVC derived from petrochemical feedstocks. Stable supply and price volatility management are critical to ensure consistent packaging production.

Logistics and Distribution: Logistics and distribution ensure efficient movement of plastic packaging products from manufacturers to food, beverage, pharmaceutical, and consumer goods companies. Strong warehousing, transportation networks, and supply chain optimization are essential for timely delivery.

Recycling and Waste Management: Recycling and waste management focus on collecting, sorting, and processing post-consumer plastic waste to support circular packaging models. Increasing regulatory pressure is driving investments in advanced recycling and waste reduction technologies.

By Material

By Product

By Technology

By Application

By Region

February 2026

February 2026

February 2026

February 2026