April 2025

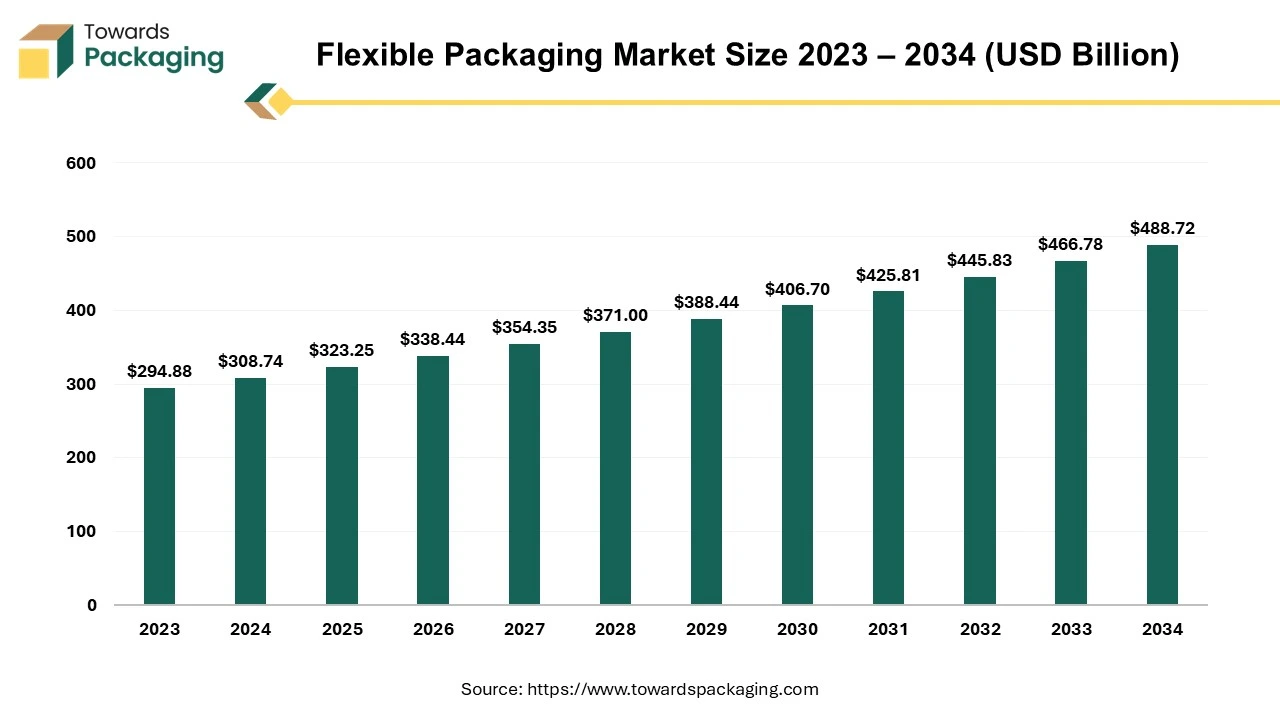

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

Rising environmental issue such as global warming, resource depletion, etc. has increased emphasis on sustainable packaging solutions. The companies are focusing on reducing plastic usage and improving recyclability to meet environmental regulations and consumer demand.

Increasing innovations in packaging technologies, including the integration of AI and automation, are enhancing efficiency and minimizing waste in packaging processes.

The industry is witnessing consolidation, with significant mergers aimed at expanding market share and capabilities. For instance, Amcor’s acquisition of Berry global group is set to create the world’s largest plastic packaging company.

The companies are under increasing pressure from both regulators and consumers to adopt environmentally friendly practices, leading to a focus on minimizing single-use plastics and enhancing sustainability efforts.

The Stand-up pouches, the staple of flexible packaging, have completely changed the packaging industry. They readily stand upright on store shelves because to their self-supporting construction, drawing attention with their seductive appearance. Stand-up pouches provide lots of room for product details and branding, enabling you to visually engage customers while telling brand's narrative. They work well for a variety of goods, including coffee, snacks, pet food, and personal hygiene products.

Lay flat pouches are especially designed for single-serve foods, spices, and powders. Their small size guarantees that little material is wasted, which makes them an environmentally friendly packaging option.

The consumers are demanding high-end flexible packaging as well as manufacturer want to showcase their brand, which has risen the demand for the customization. Customizable colors, typography and logos to reinforce brand identity. Eye-catching graphics and patterns to stand out on shelves. Unique pouch shapes (e.g., stand-up, spouted, or resealable) for differentiation. Custom die-cut designs for enhanced user experience.

The flexible packaging sector is progressively using artificial intelligence. Al is capable of streamlining supply chain management, quality assurance, and production procedures. It facilitates data analysis to increase productivity, cut waste, and improve product design. Al-powered devices can also help with predictive machinery maintenance, which lowers costs and boosts output.

Based on criteria including longevity, sustainability, affordability, recyclable nature, and biodegradability, it chooses the best materials for plastic packaging. Interactive elements like QR codes may be made possible by Al-powered packaging, providing customers with more interesting and educational experiences. Implementing Al in the market also has the benefit of gathering consumer behavior patterns and market data to help with decision-making on plastic packaging designs and tactics.

Booming E-commerce Use for Grocery Shopping

The rise of online shopping requires durable, lightweight, and cost-effective packaging for shipping. Flexible packaging reduces shipping costs due to its lower weight compared to rigid alternatives. Flexible packaging reduces shipping costs compared to rigid alternatives because it is lightweight and compact. Lower material usage means reduced production costs and more efficient storage. Groceries, especially perishables, require high-barrier packaging to protect against moisture, oxygen, and light. Vacuum-sealed pouches and modified atmosphere packaging (MAP) help maintain freshness. Many e-commerce grocery platforms prefer recyclable, biodegradable, and compostable packaging to reduce environmental impact. Mono-material flexible packaging is gaining traction due to its easier recyclability.

Competition from Rigid Packaging & Limited Barrier Properties Compared to Rigid Packaging

The key players operating in the flexible packaging market are facing issue due to competition from rigid packaging & fluctuating raw material costs. Flexible packaging may have lower resistance to extreme temperatures, punctures, and impact compared to rigid alternatives. Some products (e.g., carbonated drinks) require stronger barrier protection that flexible packaging cannot always provide. Prices of plastic resins, aluminium foils, and biodegradable films can be volatile due to supply chain disruptions. Dependence on petroleum-based raw materials makes the industry vulnerable to oil price fluctuations.

Eco-Friendly & Sustainability Packaging Trends

May e-commerce grocery platforms prefer recyclable, biodegradable, and compostable packaging to minimize environmental impact. Mono-material flexible packaging is gaining traction due to its easier recyclability. Hence, the increasing innovation and launch of the sustainable flexible packaging, which has estimated to create opportunity for the growth of the flexible packaging market in the near future.

For instance, in February 2025, Proquimia and Mondi, a world leader in environmentally friendly paper and packaging, have partnered to introduce paper-based stand-up pouches for dishwashing tabs in Spain and Portugal. In comparison to the previous plastic solution, the new solution has substantially fewer CO2 emissions from cradle to gate, according to Modi's internal product impact evaluation. There are twenty water-soluble dishwashing tablets in the flexible stand-up pouches. The new solution, which replaces the previously utilized plastic solution, was made using Mondis re/cycle FunctionalBarrier Paper 95/5.

The plastics segment dominated the flexible packaging market in 2024. Plastic is cheaper to produce and transport compared to alternatives like glass and metal. Plastics offer high strength-to-weight ratios, reducing shipping costs. Plastic material can be molded into various forms like pouches, wraps, and films. Plastic material allows for high-quality printing and branding customization. Flexible plastics offer tamper-proof and secure packaging solutions.

The pouches segment accounted for a significant share of the market in 2024. Pouches use less material than rigid packaging, reducing manufacturing and transportation costs. Multi-layered films of pouches offer strong protection against moisture, oxygen, and contaminants. Many pouches are now made with recyclable or biodegradable materials. Mono-material pouches improve recyclability and meet regulatory demands. Flexible and durable, reducing risk of damage during shipping. Pouches are ideal for direct-to-consumer brands and online grocery markets.

The flexography segment led the global flexible packaging market. Flexography printing technology Works on a wide range of substrates like plastic films, paper, foil, and biodegradable materials. Faster printing process compared to other methods like gravure. Flexography printing technology is ideal for printing on flexible packaging formats like pouches, bags, and wraps. It is water-based and UV-curable inks which reduce environmental impact. Flexography printing technology supports special effects like metallic finishes and matte-gloss combinations. Flexography printing technology ensures strong adhesion on flexible surfaces, making prints resistant to smudging or wear. Flexography printing supports special effects like metallic finishes and matte-gloss combinations. Works well with sustainable and recyclable packaging materials.

The food & beverage segment dominated the flexible packaging market globally. Urbanization and changing lifestyles in developing countries drive demand for packaged foods. Flexible packaging provides an affordable and efficient solution for local and multinational food brands. Flexible packaging allows high-quality printing and design customization to enhance brand appeal. Online grocery shopping and food delivery services require flexible, tamper-proof, and secure packaging. Flexible packaging solutions like pouches, sachets, and wraps enhance portability and shelf life. Growth in ready-to-eat meals, snacks, and frozen foods increases the need for lightweight, durable packaging.

Asia Pacific region held the largest share of the flexible packaging market in 2024, owing to expanding pharmaceutical industry and rise in demand for convenient packaging. Asia-Pacific serves as a major exporter of flexible packaging materials and finished products. Countries like China, India, and Japan dominate global flexible packaging supply chains. Increasing penetration of online shopping in Asia Pacific region fuels demand for lightweight, durable, and tamper-proof packaging. Expanding middle class with increasing disposable income boosts consumption of branded and convenience products. The flexible packaging lower production and labor costs make Asia-Pacific a global hub for flexible packaging production.

China Flexible Packaging Market Trends

China flexible packaging market is growing due to booming Ecommerce sector in the region. China is the world’s largest e-commerce market, driving demand for secure, lightweight, and durable packaging. China is a global hub for flexible packaging production with well-established supply chains. China is a leading exporter of flexible packaging materials and finished products. Foreign companies investing in China’s packaging industry to cater to domestic and international markets.

North America region held the largest share of the flexible packaging market in 2024, owing to growing food & beverage industry in the region. High demand for packaged, processed, and convenience foods in North America has driven the market growth. Growth of ready-to-eat meals, frozen foods, and snack segments. Demand for resealable pouches, single-serve packs, and easy-to-use packaging. Major packaging companies like Amcor, Sealed Air, Berry Global, and Mondi are headquartered or have significant operations in North America. Well-established logistics and transportation networks support packaging production and distribution.

U.S. Flexible Packaging Market Trends

U.S. flexible packaging market is growing at fastest rate due to strong food & beverage industry. U.S. regulations promoting recyclable, compostable, and biodegradable packaging. Growth in frozen foods, ready-to-eat meals, snacks, and beverage packaging in the U.S. region. Adoption of smart packaging with QR codes, NFC, and RFID for product tracking and authentication. Strong R&D and advancements in printing, coatings, and laminates in U.S. region to drive the market growth.

European is seen to grow at a notable rate in the foreseeable future. EU Regulations strict environmental laws, such as the European Green Deal and Single-Use Plastics Directive, push companies toward recyclable, biodegradable, and compostable flexible packaging. Growing eco-consciousness in Europe region drives demand for packaging with lower carbon footprints. The European food industry, particularly in snacks, ready-to-eat meals, and frozen foods, relies on flexible packaging to enhance shelf life, convenience, and portability. The European Plastics Pact and country-specific recycling targets promote investment in recyclable flexible materials. Companies are focusing on monomaterial packaging (e.g., 100% polyethylene or polypropylene) for easier recycling.

PPWR establishes explicit goals for recycled content and requires that all packaging be 100% recyclable by 2030. It also emphasizes how crucial it is to guarantee that all elements of the packaging value chain smoothly interact with recycling infrastructure.

Germany Flexible Packaging Market Trends

Germany flexible packaging market is growing owing to stringent regulatory laws imposed by the German government in the country. Germany is the margest market in Europe for flexible packaging, driven by strong manufacturing and food industries. The Germany country is pioneer in recycling with strict packaging waste laws (e.g., VerpackG law). Growth in biodegradable and recyclable films due to high environmental awareness. Major investments in smart and active packaging (e.g., temperature-sensitive and antimicrobial films).

By Raw Material

By Packaging Type

By Printing Technology

By Application

By Region:

April 2025

April 2025

April 2025

April 2025