April 2025

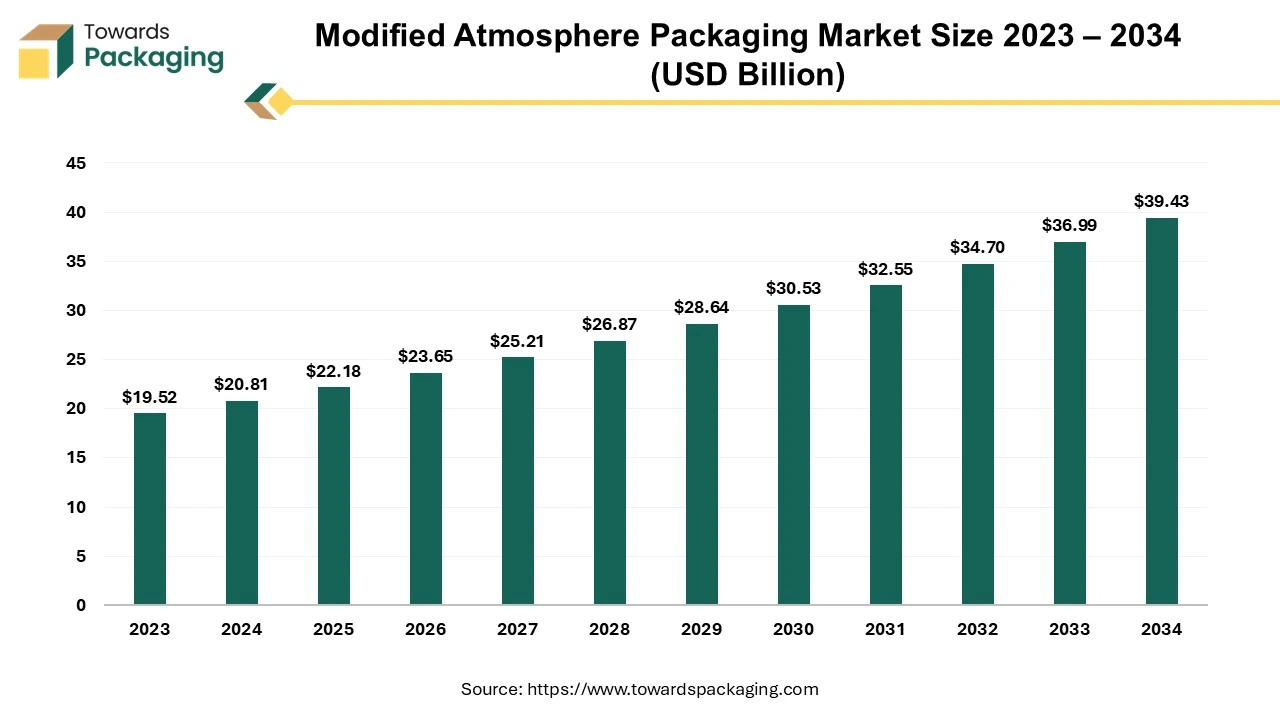

The global modified atmosphere packaging market size was evaluated at US$ 19.52 billion in 2023 and is expected to attain around US$ 39.43 billion by 2034, growing at a CAGR of 6.6% from 2024 to 2034.

Modified atmosphere packaging is a packaging technology that has gained significant traction in various industries, primarily due to its ability to extend the shelf life and freshness of perishable products. This market is experiencing robust growth and transformation, driven by evolving consumer preferences, increasing demand for convenience foods, and the imperative to reduce food waste. MAP is a packaging technique that involves altering the composition of gases inside a package to preserve the quality of fresh products, such as fruits, vegetables, meats, and seafood.

Different atmospheres can have varying effects on the growth of microorganisms. Certain technologies are employed to hinder microbial growth, including modified atmosphere packaging (MAP), Controlled Atmosphere Packaging, Controlled Atmosphere Storage, and Hypobaric Storage. When extending the shelf life of foods using MAP or related technologies, a significant safety concern arises from the potential loss of sensory cues for spoilage detection provided by bacterial growth. In other words, a food product may appear acceptable regarding its sensory qualities but still be unsafe. Combining antimicrobial atmospheres with other techniques allows for creating hurdle technology strategies that can further enhance food quality and safety.

Many technologies are employed to inhibit the growth of microorganisms, with many relying on temperature control to enhance their inhibitory effects. These technologies encompass modified atmosphere packaging (MAP), Controlled Atmosphere Packaging, Controlled Atmosphere Storage, and Hypobaric Storage, as described in Loss and Hotchkiss. Controlled atmosphere and modified atmosphere packaging have the potential to significantly prolong the shelf life of specific food products.

For example, using gases such as CO2, N2, and ethanol is prevalent in MAP applications. Generally, the inhibitory impact of CO2 becomes more pronounced at lower temperatures due to its increased solubility in colder conditions. CO2 dissolves in the food, leading to a reduction in its pH. Nitrogen, on the other hand, is an inert gas with no direct antimicrobial properties. Its primary use lies in displacing oxygen within food packages, either alone or in combination with CO2, thereby indirectly inhibiting the growth of aerobic microorganisms. Table 3–8 provides examples of gas combinations utilized in MAP applications for meat, poultry, seafood, hard cheeses, and baked goods.

As consumers increasingly prioritize freshness, quality, and health-conscious choices, MAP enables retailers and manufacturers to deliver products with extended shelf life and better taste, meeting these expectations. It significantly reduces food spoilage and waste by slowing down the natural deterioration process of perishable items. This aligns with sustainability goals and cost-efficiency measures across the supply chain. Expanding global food trade has necessitated packaging solutions that ensure products reach distant markets in optimal condition, making MAP an essential tool for international trade. Ongoing advancements in MAP technologies, including improved gas composition control and packaging materials, are enhancing the effectiveness and versatility of this packaging method.

Artificial Intelligence (AI) is making a significant mark on the packaging industry including relatively recent packaging technologies like modified atmosphere packaging. Food packaging plays an important role because it needs to maintain specific quality and safety standards in their products. With AI technology, utilization of sensors, real-time data and monitoring, temperature control etc., is possible to maintain the value of the food.

In estimation, food products packaged using AI-based technologies extend shelf life by up to 40% which reduces wastage. The integration of AI into packaging helps optimizing supply chain and distribution with using unique identification like RFID, QR code etc. Adopting this innovative technology ensures quality control and food safety, improve operational efficiency, improve warehouse functioning, consistency in products etc., help propel the market growth.

Expanding into emerging markets presents significant growth opportunities for MAP, where rising disposable incomes and changing dietary habits drive demand for packaged, fresh foods. The health and wellness trend is driving the need for packaging that preserves the nutritional value of products, creating opportunities in the MAP market for health-focused items.

Collaborative efforts among food producers, retailers, and packaging manufacturers can optimize MAP solutions to reduce food waste throughout the supply chain. Investment in research and development to create more efficient MAP solutions, including automation and intelligent packaging, can open doors to new applications and markets. The modified atmosphere packaging market is poised for continued growth, driven by consumer preferences, environmental concerns, and advancements in packaging technology. Companies that adapt to these trends and seize emerging opportunities stand to thrive in this dynamic sector.

The modified atmosphere packaging market is witnessing significant shifts and advancements on a global scale as it continues to be a crucial player in food preservation, extending product shelf life, and reducing food waste. This overview will delve into the key global trends shaping the MAP market in 2023.

Sustainability is no longer just a buzzword; it's a central theme in the MAP market. As consumers become more environmentally conscious, there is a growing demand for sustainable packaging options. Manufacturers are increasingly focusing on eco-friendly MAP materials, such as biodegradable films and recyclable packaging, to reduce the environmental impact of their products. This trend aligns with global efforts to reduce plastic waste and carbon emissions, making sustainable MAP a crucial market driver.

The MAP industry is embracing technology with open arms. Innovative packaging solutions are emerging, incorporating sensors and IoT (Internet of Things) technology to monitor and report on product conditions in real time. This innovation allows for better quality control, traceability, and transparency throughout the supply chain. Companies are utilizing data collected from intelligent packaging to optimize production processes and enhance the overall customer experience.

Consumer preferences are becoming increasingly diverse, and businesses are responding by offering customized and personalized MAP solutions. This trend extends beyond traditional product offerings to encompass packaging that caters to specific dietary needs, portion sizes, and convenience preferences. Customized MAP not only enhances consumer satisfaction but also contributes to reduced food waste by aligning packaging with individual requirements.

Gas composition within MAP packages is critical for product preservation. Advanced gas control technologies are gaining prominence, allowing precise adjustment of gas compositions to cater to the specific requirements of different products. This ensures that each item enjoys an optimal environment, preserving its freshness and extending its shelf life.

Stringent food safety regulations continue to drive innovation in the MAP market. Companies invest in technologies and processes that ensure compliance with global food safety standards. This includes improved packaging materials, enhanced sealing techniques, and comprehensive quality control measures. Regulatory compliance not only guarantees product safety but also builds consumer trust.

Consumers are increasingly interested in the origins of their food products and the supply chain processes involved. To meet this demand, MAP packaging incorporates transparency and traceability features. QR codes, RFID tags, and other technologies enable consumers to access detailed information about the product's journey from farm to table. This transparency builds trust and fosters brand loyalty.

The health and wellness trend influences MAP packaging choices, especially for fresh produce and ready-to-eat meals. Packaging solutions are designed to maintain health-conscious items' nutritional value, freshness, and flavor. This trend caters to consumers who seek minimally processed foods with maximum health benefits.

Geographic boundaries do not limit the MAP market. As emerging markets experience rising incomes and changing dietary habits, the demand for packaged, fresh foods is rising. Companies are expanding their presence in these regions, presenting significant growth opportunities for the MAP industry.

This market is evolving rapidly, driven by sustainability concerns, technological innovation, and changing consumer expectations. Businesses that adapt to these global trends by offering sustainable, technology-driven, and customizable solutions are well-positioned to thrive in this dynamic and competitive market. MAP is no longer just about preserving food; it's about reshaping how we think about packaging and its impact on the environment and consumer experiences.

The COVID-19 pandemic, which emerged in late 2019 and persisted into 2020 and beyond, had a profound impact on industries across the globe. The modified Atmosphere Packaging (MAP) market, closely tied to the food industry and supply chain logistics, experienced challenges and opportunities during this unprecedented crisis. In this overview, we will discuss the critical impacts of the pandemic on the MAP market in business language.

One of the immediate and significant impacts of the pandemic on the MAP market was the disruption in global supply chains. Lockdowns, travel restrictions, and labor shortages disrupted the production and distribution of packaging materials, affecting MAP manufacturers' ability to meet demand. This led to delays in product delivery and increased logistics and raw materials procurement costs.

As consumers stockpiled food and shifted toward home cooking during lockdowns, there was a surge in demand for products with extended shelf life. MAP packaging, known for preserving freshness and quality, became even more crucial during this time. Food manufacturers and retailers turned to MAP solutions to meet the increased demand for packaged foods and reduce food waste.

The pandemic accelerated the shift towards e-commerce in the food industry. With more consumers opting for online grocery shopping and food delivery services, the need for packaging that could protect products during transit and maintain their quality became paramount. MAP packaging was pivotal in ensuring food products arrived at consumers' doorsteps in optimal condition.

Consumers became increasingly concerned about the safety and hygiene of packaged food products during the pandemic. MAP packaging, with its airtight seals and protective barriers, reassured consumers that their food had not been tampered with and was safe to consume. Manufacturers emphasized these features in their marketing to build consumer trust.

MAP production facilities faced challenges related to workforce safety and social distancing requirements. Implementing these measures slowed down production lines and, in some cases, reduced manufacturing capacities. This, coupled with increased demand, created a supply-demand gap and put upward pressure on prices.

Despite the challenges, the pandemic created opportunities for innovation in the MAP market. Manufacturers began exploring new materials and packaging designs to meet the evolving needs of consumers and businesses. This included packaging with antimicrobial properties and improved reseal ability, catering to the growing demand for convenience.

The pandemic highlighted the issue of food waste as supply chain disruptions led to the disposal of large quantities of perishable goods. This awareness prompted businesses to reevaluate their packaging strategies and invest in solutions like MAP to minimize food losses and enhance the shelf life of products.

The pandemic prompted regulatory authorities to introduce or modify food packaging and safety guidelines. MAP manufacturers had to adapt to these changes swiftly to ensure compliance and maintain business continuity. This underscored the importance of staying informed about evolving regulations in the industry.

The COVID-19 pandemic had a significant impact on the modified atmosphere packaging market. It highlighted the critical role of MAP in preserving food quality, reducing waste, and ensuring the safety of packaged products. While the industry faced challenges related to supply chain disruptions and production constraints, it also seized opportunities for innovation and growth. As the world adapts to the "new normal," MAP remains a vital component of the global food packaging landscape, catering to changing consumer behaviors and industry demands.

The modified atmosphere packaging (MAP) market is a dynamic and evolving industry that plays a pivotal role in preserving the freshness and quality of perishable products. While its impact is felt globally, the market exhibits intriguing regional variations in adoption, preferences, and growth trajectories. A comprehensive regional analysis is crucial for businesses seeking to understand and navigate the nuances of the MAP market. This analysis delves into critical regions and offers insights into market dynamics, challenges, and prospects.

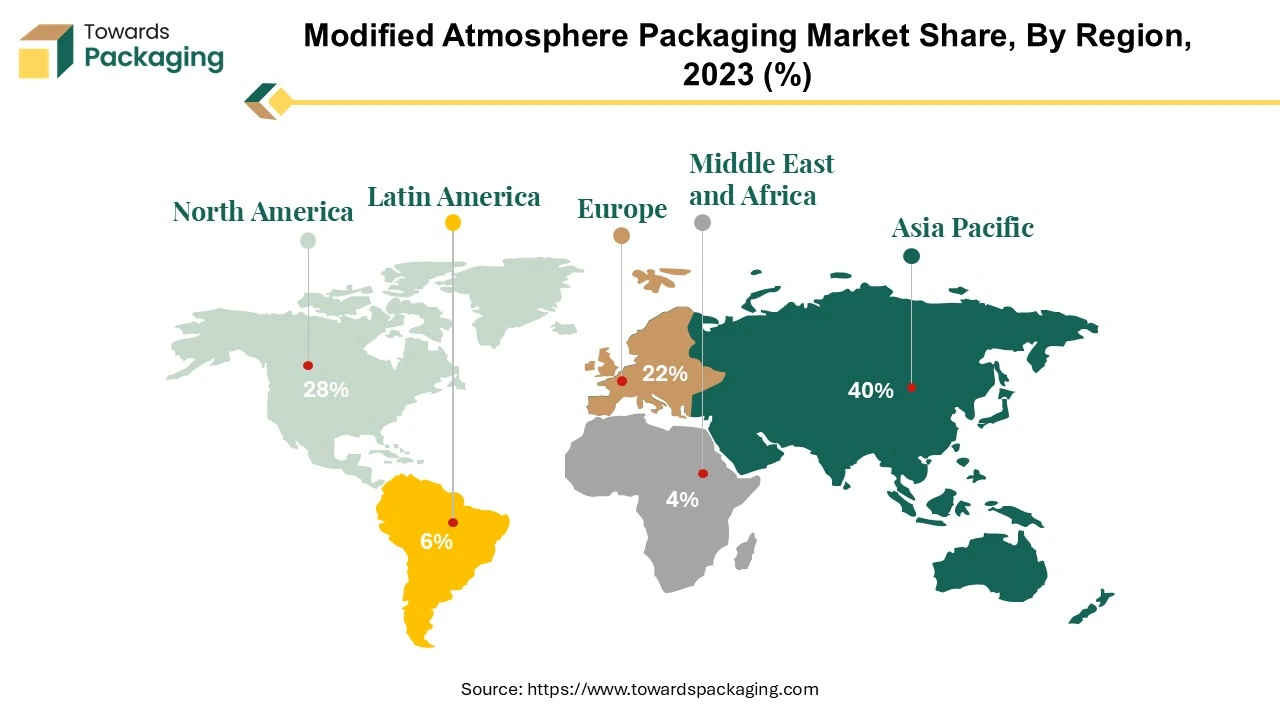

The Asia-Pacific region is experiencing a burgeoning demand for MAP solutions. Emerging economies like China and India are witnessing increased disposable incomes and a shift toward convenience foods. This, coupled with rapid urbanization, has created a substantial market for MAP. The future of MAP in Asia-Pacific is poised for remarkable growth as the food supply chain evolves and embraces more sophisticated packaging solutions. Tailoring MAP to preserve unique regional foods and accommodating diverse consumer preferences will be critical for success in this region.

North America is a mature MAP market with a strong presence in the United States and Canada. The region's well-established food industry has been a driving force for MAP adoption. The demand for convenience foods, including pre-packaged salads and ready-to-eat meals, has significantly boosted the use of MAP in this region. Additionally, the heightened focus on sustainability has increased the use of eco-friendly MAP materials. Future trajectories in North America will likely be shaped by innovations in packaging technology, including intelligent packaging solutions and the integration of MAP with e-commerce for efficient food delivery.

Europe stands as a critical player in the MAP market, driven by stringent regulations on food safety and a consumer preference for fresh, minimally processed foods. Countries like the United Kingdom, Germany, and France have robust MAP industries. The focus on reducing food waste has driven the adoption of MAP, especially for fresh produce. In the future, Europe is expected to witness innovations in MAP materials, such as biodegradable films, and increased collaboration between food producers and packaging manufacturers to enhance food quality and safety further.

Latin America presents a region of growing importance for the MAP market. Countries like Brazil and Mexico are witnessing an expanding middle class with a penchant for convenience foods. While the adoption of MAP is less widespread than in other regions, it is steadily rising. Over the coming years, the Latin American MAP market is expected to exhibit substantial growth potential, driven by increased consumer awareness of food safety and a need to reduce food waste.

The Middle East and Africa have unique market dynamics. The region's demand for MAP is primarily driven by preserving fresh produce in hot climates. MAP is commonly used for fruits, vegetables, and meat products. As the region experiences economic growth and changing dietary preferences, the MAP market is expected to expand, with an emphasis on eco-friendly and sustainable packaging materials.

The future of the MAP market lies in innovation and adaptation. The industry is expected to witness advancements in packaging materials, including biodegradable films, antimicrobial coatings, and improved barrier properties. Innovative packaging solutions incorporating sensors and IoT technology will enable real-time monitoring and quality control. Integrating MAP with e-commerce for efficient and safe food delivery is another avenue for future growth.

The MAP market's regional analysis reveals a landscape of diverse growth trajectories and unique challenges. Businesses operating in this sector need to tailor their strategies to the specific demands of each region. Innovative packaging solutions, sustainability initiatives, and responsiveness to regional preferences and regulations will drive future success in the MAP market. As the world continues prioritizing freshness, quality, and sustainability, the MAP market is poised to be a cornerstone of the global food packaging industry.

The competitive landscape of the modified atmosphere packaging (MAP) market is characterized by intense rivalry among key players, each striving to gain a competitive edge through product innovation, strategic partnerships, and expanding their global footprint. Several prominent companies dominate the market, shaping its trajectory and influencing the adoption of MAP solutions across various industries.

One of the key players in the MAP market is Sealed Air Corporation, a global leader renowned for its advanced packaging technologies. Sealed Air offers a comprehensive range of MAP solutions tailored to the specific needs of industries such as food and beverages, healthcare, and electronics. The company's focus on sustainable packaging solutions has resonated well with environmentally conscious consumers and businesses, giving them a significant competitive advantage.

Another major player in the MAP sector is Linde Group, a multinational industrial gases and engineering company. Linde provides innovative gas-based MAP solutions that enhance the shelf life of perishable products, ensuring their freshness and quality. The company's expertise in gas technologies and extensive research capabilities have positioned it as a preferred choice for businesses seeking reliable and efficient MAP solutions.

Amcor Limited, a global packaging solutions provider, is also a significant player in the MAP market. Amcor specializes in developing high-performance MAP films and trays that cater to diverse packaging needs. The company's emphasis on sustainable packaging materials and its commitment to reducing the environmental impact of packaging align well with the growing eco-conscious consumer base, giving it a competitive edge in the market.

Additionally, Bemis Company Inc., now part of Amcor following a merger, has significantly contributed to the MAP market. Bemis, known for its innovative packaging solutions, offers a wide range of MAP products that enhance food safety and extend shelf life. Their focus on research and development has allowed them to create cutting-edge MAP technologies, meeting the evolving demands of the food and beverage industry.

Multivac Group, a leading packaging machinery manufacturer, also plays a pivotal role in the MAP market. Multivac provides complete packaging solutions, including MAP systems, designed to optimize production processes and enhance the efficiency of packaging operations. The company's focus on automation and technological advancements has made it a preferred choice for businesses looking to streamline their packaging processes while ensuring the quality and freshness of their products.

The competitive landscape of the modified atmosphere packaging market is marked by the presence of established players such as Sealed Air Corporation, Linde Group, Amcor Limited, Bemis Company Inc., and Multivac Group. These companies continue to invest in research and development, collaborate with industry partners, and explore new market opportunities to maintain their competitive advantage. As the demand for MAP solutions continues to rise globally, these key players are expected to play a pivotal role in shaping the future of the packaging industry driving innovation and sustainability in the process.

By Type

By Raw Material

By Application

By Geography

April 2025

April 2025

April 2025

April 2025