April 2025

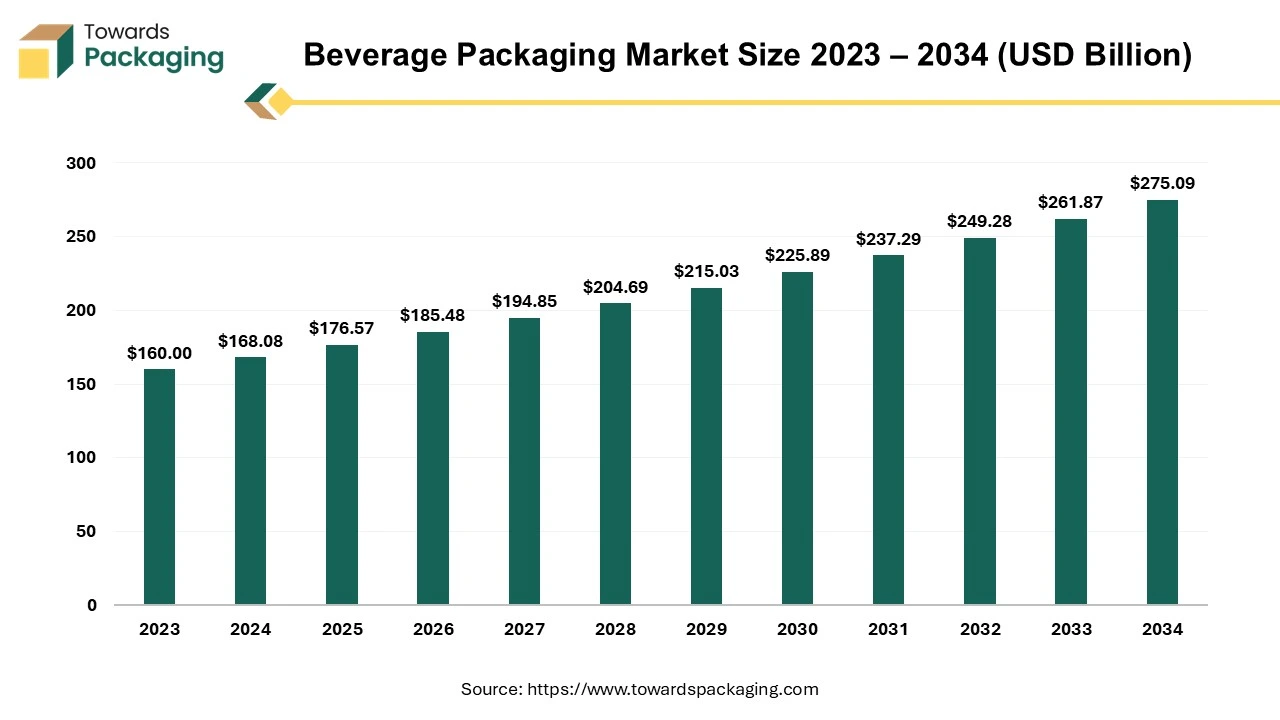

The global beverage packaging market is set for substantial growth, with its valuation expected to increase from USD 176.57 billion in 2025 to USD 275.09 billion by 2034, registering a CAGR of 5.05% during the forecast period (2025–2034).

Beverage packaging is known as any sort of packaging developed to hold liquids for consumption. These products serve several purposes, including protecting the beverage from contamination, maintaining freshness, providing convenience for storage and transport, and offering a platform for branding and product information.

Glass bottles are a traditional type of packaging solutions made from limestone soda ash, and melted sand. Frequently utilized for alcoholic beverages (like beer, wine, and spirits), soft drinks, and sometimes for juices and water. Non-reactive, maintaining the original taste of the beverage. They are also reusable and recyclable.

The key players in the market are focusing on using recycled content and biodegradable alternatives to reduce environmental impact. For instance, Ball Corporation reported that 70% of its beverage packaging globally contains recycled content, with plans to increase this to 85% by 2030. There's a move away from single-use plastics towards materials like metal, glass, or compostable options. Bacardi Limited announced plans to utilize 100% biodegradable plastic packaging manufactured with plant-based oils for all its brands by 2024.

The integration of smart technologies improves product information and consumer engagement. These features provide instant access to product details, promotions, or brand stories. Crown Holdings' CrownConnect technology has been adopted by over 100 beverage brands globally, resulting in a 25% increase in consumer engagement. AR packaging offers interactive experiences, such as virtual tastings or brand narratives, enhancing consumer interaction.

Nowadays consumers favour clean, straightforward packaging that reflects authenticity. Minimalist aesthetics are simple designs with neutral palettes and clear typography convey quality and modernity. The transparent packaging allows visibility of the product builds trust and emphasizes purity, especially in health-conscious markets.

Governments are enforcing laws to minimize packaging waste, compelling companies to adopt sustainable practices. The European Parliament's Directive 94/62/EC focuses on limiting packaging waste and promoting recycling. There's a rising expectation for brands to disclose product origins and sustainability efforts, influencing packaging design and material choices. These trends indicate a dynamic shift in the beverage packaging industry towards sustainability, technological integration, and consumer-centric designs, shaping the future of beverage packaging.

The integration of artificial intelligence significantly enhances the beverage packaging industry by improving various aspects of production, design, supply chain management, and customer engagement. The artificial intelligence integration can help in product optimization and quality control. AI algorithms assist in predict when machinery will require maintenance, reducing downtime and preventing costly breakdowns. AI-powered vision systems help in inspecting packaging for defects (e.g., cracks, improper sealing) at high speed, ensuring consistent quality. The artificial intelligence integration assists in optimization of manufacturing processes, adjusting parameters in real-time to improve efficiency and reduce waste.

The integration of artificial intelligence saving energy and developing sustainable beverage packaging. The artificial intelligence integration has ability to optimize inventory levels, ensuring that raw materials and finished products are stocked efficiently. AI systems helps in monitoring and optimizing energy usage in production facilities, contributing to lower carbon footprints. AI can identify opportunities to reduce waste during production and in the design of more recyclable or biodegradable solutions.

Rise of e-commerce and food delivery services increases the demand for durable and secure packaging solutions for beverages. Beverage subscription services require innovative packaging that ensures freshness and convenience, further driving the industry growth.

The key players operating in the market are facing issue due to competition from alternative beverage packaging and market saturation, which has restricted the growth of the beverage packaging market in the near future. The beverage packaging market is highly competitive, with numerous players offering similar products, leading to price wars and reduced profit margins. In mature markets, high levels of market penetration limit the scope for further growth, especially for traditional packaging solutions types like plastic bottles.

The negative environmental impact of plastic packaging, particularly single-use plastics, has led to increased regulatory scrutiny and bans, restraining market growth. Stringent regulations aimed at reducing packaging waste, such as taxes on plastic packaging and mandates for recyclability, increase production costs and limit the use of certain materials. Rising consumer awareness about environmental issues leads to a preference for alternative packaging, reducing demand for traditional plastic packaging.

Rising consumption of carbonated drinks, alcoholic beverages, bottled water, and ready-to-drink (RTD) products fuels the demand for various types of beverage packaging. The rise in health-conscious consumers boosts the demand for packaged health drinks, juices, and functional beverages, contributing to packaging industry growth. Increasing launch of the new beverages has increased the demand for the beverage packaging packaging, which has created the opportunity for growth of the beverage packaging market in the near future.

Beverage companies utilize unique and attractive packaging to differentiate their products and enhance brand appeal, driving demand for creative and functional designs. The trend of personalized packaging, driven by consumer desire for unique experiences, promotes the growth of customizable solutions.

The plastic segment held a dominant presence in the beverage packaging market in 2024. Plastic is extensively utilized in manufacturing beverage packaging due to several key advantages that make it a versatile and cost-effective material for this purpose. Plastic packaging are lightweight, minimizing shipping costs and making them easier to transport compared to heavier materials like glass or metal. Plastic is resistant to breakage, which minimizes product loss and ensures safer handling during transport and storage.

Plastic is generally cheaper to produce than materials like glass or aluminum, making it an economical choice for manufacturers. The production process for plastic packaging solutions is highly scalable, guaranteeing for mass production at relatively low costs.

Plastic can be easily molded into an extensive variety of shapes and sizes, catering to different consumer needs and preferences. It allows for innovative design features such as ergonomic shapes, handles, and resealable closures, enhancing user convenience. Transparent plastics like PET allow consumers to see the product inside, which can be appealing for products like water, juices, and other clear beverages.

The metal cans segment is expected to grow at the fastest rate in the beverage packaging market during the forecast period of 2024 to 2034. Metal cans, especially aluminum, provide an excellent barrier against light, oxygen, and moisture, which helps preserve the flavor, carbonation, and freshness of beverages, particularly for carbonated drinks and beer. Aluminum cans are one of the most recyclable beverage packaging, with a well-established recycling infrasructure. They can be recycled indefinitely without loss of quality, reducing the environmental impact.

The recycling process for aluminum requires significantly less energy compared to producing new aluminum, making it a more sustainable option. Additionally, using recycled aluminum reduces the carbon footprint of the packaging.

Metal cans are lightweight, cutting-down shipping costs and energy consumption during transportation. Their compact and stackable design also makes them convenient for storage and display. Extensive range of Beverages: Metal cans are utilized for a variety of beverages, including carbonated drinks, alcoholic beverages, juices, teas, and energy drinks, due to their versatility and protective properties.

The bottle & jar segment accounted for a considerable share of the beverage packaging market in 2024. Pre-packaged beverages in bottles and jars offer convenience for on-the-go consumption, appealing to busy consumers. Many bottled and jarred beverages are marketed as healthier options, such as natural juices, smoothies, and functional drinks (like kombucha or protein shakes), aligning with consumer preferences for health-conscious products.

Bottled and jarred beverages often come in premium packaging, enhancing their appeal as higher-quality products. This can justify higher prices and attract consumers looking for luxury or artisanal products. As the bottle & jar packaging assists to preserve the aroma, taste and freshness of the beverages for a longer period.

The alcoholic beverages segment registered its dominance over the global beverage packaging market in 2024. Alcoholic beverages, including wine, beer, and spirits, have a consistent and high level of consumer demand across various demographics, making them a significant segment in the beverage industry. The diverse range of alcoholic beverages requires various types of packaging, such as glass bottles for wine and spirits, aluminum cans for beer, and specialty beverage packaging for craft or premium products, driving the demand for an extensive array of packaging. Consumers are increasingly seeking premium and artisanal alcoholic beverages, which often come in high-quality, aesthetically pleasing packaging solutions that enhance the product's appeal and justify higher prices.

The alcoholic beverage industry is subject to strict regulations regarding packaging to ensure product quality, safety, and authenticity. This necessitates durable, tamper-evident, and high-quality packaging. The international expansion of alcoholic beverage brands increases the demand for beverage packaging as they cater to a broader market, each with its own packaging preferences and regulations.

Asia Pacific region dominated the global beverage packaging market in 2024. Asia Pacific region has a vast and rapidly growing population, particularly in countries like India and China. This large consumer base drives high demand for beverages and, consequently, beverage packaging. Economic growth in the Asia Pacific has led to increased disposable incomes, enabling consumers to spend more on packaged beverages, including premium and convenience products.

The growing middle class in many Asia Pacific countries has led to increased consumption of a variety of beverages, including soft drinks, bottled water, and alcoholic beverages, all of which require packaging. Many countries in the Asia Pacific region are major manufacturing hubs for beverage packaging, benefiting from economies of scale and export opportunities. Cultural preferences for certain types of beverages, such as tea in China and India or sake in Japan, contribute to the high demand for specific beverage packaging.

North America region is anticipated to grow at the fastest rate in the beverage packaging market during the forecast period. North America region boasts a well-established and diverse beverage industry, with a wide range of products from global and local brands. This diversity requires various types of packaging solutions, increasing the demand for packaging solutions. North America is home to advanced manufacturing facilities and technological innovations in packaging, leading to high-quality, efficient, and sustainable beverage packaging production.

The relatively stable economic environment in North America supports steady consumer spending on a wide range of beverages, ensuring consistent demand for beverage packaging. The busy lifestyles of North American consumers lead to a preference for convenient, ready-to-drink beverages, contributing to the high demand for packaged products. These factors collectively attribute to the dominance of the North American region in the global beverage packaging market.

According to Sanjeev Agarwal, Chairman of Moon Beverages Limited (a division of the MMG Group), PET plastic bottles are valuable after their initial use. He praised the introduction of rPET. New PET bottles from companies are recyclable and can be recycled again, giving them a second chance at life. A significant step towards embracing plastic circularity in India is the use of recycled PET.

By Material

By Product

By Application

By Region

April 2025

April 2025

April 2025

April 2025