April 2025

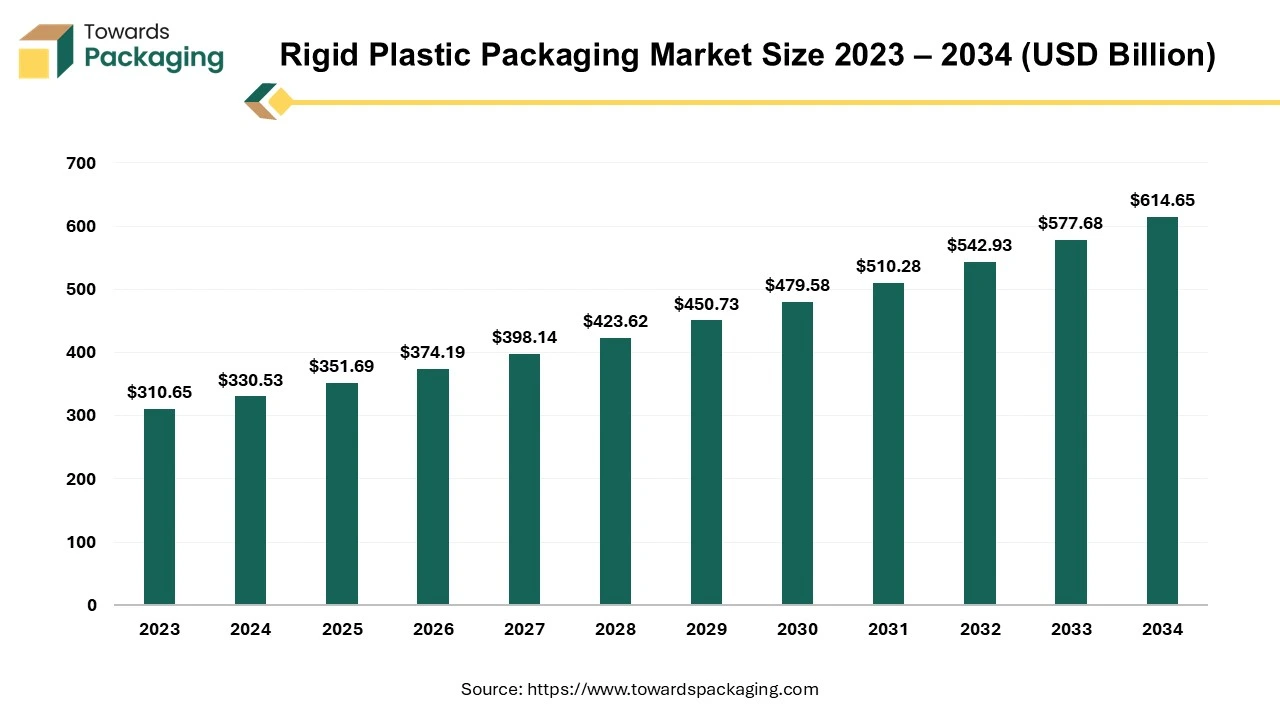

The rigid plastic packaging market is forecasted to expand from USD 351.69 billion in 2025 to USD 614.65 billion by 2034, growing at a CAGR of 6.4% from 2025 to 2034.

Rigid plastic packaging is widely utilized across various industries, including pharmaceuticals, food and beverages, electronics, personal care, and more. Among these, the food and beverage industry is a significant consumer of rigid Plastic packaging products. The increasing popularity of convenient and ready-to-eat food products is expected to drive substantial growth in the market in the years ahead. This trend presents a promising opportunity for the rigid Plastic packaging industry to capture significant market share and expand its presence.

The global growth of various sectors, such as food and beverage, healthcare, personal care, and more, drives the rising demand for rigid plastic packaging. Rigid plastic packaging offers valuable attributes within these industries, including durability, lightweight construction, and versatile packaging options. Manufacturing processes such as extrusion, injection molding, blow molding, thermoforming, and others are employed to produce these packaging components. Rigid plastic packaging made from materials like polyethylene expanded polystyrene, and others are utilized to ensure prolonged product preservation. Furthermore, a significant factor contributing to the expansion of the rigid plastic packaging market is the increasing sales of packaged goods, influenced by evolving consumer lifestyles.

The cosmetics and personal care industry relies on rigid plastic packaging to cater to a wide range of product applications, including sun care, skin care, oral care, perfume, body care, ornamental cosmetics, and hair care. These packaging solutions offer benefits such as secure storage, enhanced product durability, and prolonged shelf life. The demand for rigid plastic packaging is witnessing significant growth in tandem with the rapidly expanding cosmetics and personal care sector, particularly in emerging economies.

For Instance,

The rise in demand for rigid plastic packaging can be attributed to several factors within the cosmetics and personal care sector. The growing consumer base, coupled with changing lifestyles and increasing disposable income, has fuelled the demand for these products. As consumers become more conscious about personal grooming and appearance, the need for high-quality packaging that preserves product integrity and offers convenience becomes paramount. With its versatility, durability, and aesthetic appeal, rigid plastic packaging meets these requirements effectively.

Furthermore, the cosmetics and personal care industry in emerging nations presents immense potential for market expansion. Rapid urbanization, a rising middle-class population, and changing beauty trends contribute to the sector's robust growth. As these markets continue to flourish, the demand for rigid plastic packaging will experience a parallel upsurge. Manufacturers of rigid plastic packaging are strategically positioning themselves to capitalize on these opportunities by investing in advanced technologies, innovative designs, and sustainable practices.

In addition to market growth, regulatory considerations also play a crucial role in shaping the demand for rigid plastic packaging in the cosmetics and personal care sector. Increasing focus on sustainability and environmental responsibility has shifted towards eco-friendly packaging solutions. Rigid plastic packaging manufacturers are actively exploring options such as recyclable and biodegradable materials and implementing efficient waste management systems throughout the product life cycle. These initiatives align with the industry's commitment to reducing the environmental footprint and meeting the evolving expectations of conscious consumers.

The rising demand for eco-friendly packaging products creates a hindrance in rigid plastic packaging market development. There are strict government rules associated with the packaging market which is a major issue to disturb the growth of the market.

The Asia Pacific region has emerged as the dominant market for rigid plastic packaging, and this is expected to continue throughout the forecast period. With their growing economies and increasing economic activity, nations such as China and India are projected to drive rapid growth in the rigid plastic packaging industry. Moreover, the expanding populations in these countries create a substantial market for fast-moving consumer goods (FMCG) and consumer durables, fuelling the expansion of the rigid plastic packaging sector.

Rigid plastic packaging remains widely prevalent in Latin America and is experiencing promising regional growth rates. Key factors contributing to its popularity include convenience, practicality, portability, and storage efficiency, which are prioritized over environmental considerations. This is particularly evident as many economies in the region face challenges such as economic or political instability and the pandemic's ongoing repercussions.

Several key factors have contributed to the growth of the rigid plastic packaging market in recent years. Industrialization, particularly in developing economies, has led to increased manufacturing activities and the subsequent demand for packaging solutions. The convenience food industry, emphasizing ready-to-eat and on-the-go products, has also significantly driven the market. The rise in disposable income and higher consumption levels has further propelled the demand for packaged goods, thereby stimulating the growth of the rigid plastic packaging industry. Additionally, the surge in e-retail sales has created new opportunities and increased the need for efficient packaging solutions that can withstand the demands of online shipping and ensure product protection.

Overall, the market for rigid plastic packaging has witnessed substantial expansion due to a combination of industrialization, the growth of the convenience food sector, increasing manufacturing activities, rising disposable income levels, growing consumption patterns, and the surge in e-retail sales. With the Asia Pacific region leading the way and countries like China and India driving growth, the rigid plastic packaging industry is expected to continue its upward trajectory in the coming years.

The rigid plastic packaging market's leading segment in market value and market share has emerged as the bottles and jars category. Additionally, it is anticipated to have the second-highest Compound Annual Growth Rate (CAGR) throughout the forecast. According to the LAMEA region, the expected CAGR for this category is 3.3%. Water, cosmetics, carbonated soft drinks, food, juice, personal care products, and pharmaceuticals are all packaged using rigid plastic bottles. PET, PP, PS, PE, HDPE, and PVC are the main materials used to make these bottles and jars.

For Instance,

This market is expanding due to the growing retail industry and rising consumer disposable income. The market is further stimulated by the rising demand for beverages and home care products, ongoing urbanization, and population growth.

The food and beverage sector emerged as the dominant market for rigid plastic packaging in 2024, with significant growth anticipated in the South African region, projected at a Compound Annual Growth Rate (CAGR) of 4.1% from 2022 to 2030. Rigid plastic packaging offers numerous advantages to containers, including taste preservation, durability, extended lifespan, and lightweight properties. Bottles, cans, jars, and other forms of rigid plastic packaging containers ensure the security and protection of food items, preventing contamination. The demand for rigid plastic packaging is rapidly increasing in developing countries such as the United States, Canada, China, India, and other nations, primarily driven by the expanding food and beverage sector. As the food and beverage industry grows, the demand for rigid plastic packaging will rise accordingly.

In response to the global pandemic, governments worldwide are implementing extensive investments in healthcare infrastructure development within developing nations. These strategic initiatives aim to enhance these regions' healthcare capabilities and facilities. Notably, rigid plastic packaging has emerged as a vital component in ensuring the safety and integrity of medical supplies, such as pharmaceuticals, needles, tablets, syrups, surgical equipment, and other essential items. The inherent qualities of rigid plastic packaging, including its strength, cleanliness, clarity, and lightweight nature, make it an ideal choice for securely storing these medical products.

The escalating growth of the healthcare sector on a global scale is anticipated to significantly contribute to the rising demand for rigid plastic packaging. Projections based on the staff research report of the "US-China Economic and Security Review Commission" indicate that the Chinese healthcare market alone is expected to reach a staggering 16 trillion RMB (equivalent to approximately US$ 2.3 million) by 2030. These estimations further support the notion that the expansion of the healthcare industry will serve as a driving force behind the growth of the rigid plastic packaging market.

Therefore, during the forecast period, it is anticipated that the increasing prominence of the healthcare sector will fuel the expansion and market opportunities for rigid plastic packaging. This emerging trend opens avenues for businesses operating in this sector to capitalize on the growing demand. Companies involved in the production, supply, and distribution of rigid plastic packaging are poised to benefit from this anticipated surge in market growth.

To fully leverage this opportunity, businesses need to align their strategies with the evolving needs of the healthcare sector. This includes investing in research and development to create innovative and specialized packaging solutions that cater to the specific requirements of the medical industry. Moreover, companies should focus on establishing strong partnerships and collaborations with healthcare organizations, government bodies, and regulatory authorities to ensure compliance with industry standards and regulations.

Furthermore, businesses should prioritize sustainability and environmental consciousness in their packaging practices. Like many others, the healthcare industry is increasingly concerned with minimizing its ecological footprint. Therefore, implementing eco-friendly packaging solutions, such as recyclable and biodegradable materials, can provide a competitive advantage while addressing the industry's sustainability goals.

In conclusion, the ongoing investments by governments in healthcare infrastructure development, combined with the projected growth of the healthcare sector, create a favourable business environment for the rigid plastic packaging market. Companies that proactively adapt their strategies to meet the demands of this expanding market while prioritizing sustainability are well-positioned to capitalize on emerging opportunities and achieve long-term success in this dynamic industry.

The rigid plastic packaging market is experiencing a surge in demand across various end-use industries, including food and beverages, cosmetics and toiletries, and healthcare. Among these industries, the food and beverage sector has consistently held the highest share in the overall packaging industry. The growth in this sector has significantly impacted the packaging market as a whole.

In particular, the retail industry is undergoing a notable transformation from unorganized to organized retail, which is expected to further drive the demand for rigid plastics as packaging materials. This shift in the retail landscape is likely to create new opportunities and stimulate the growth of the rigid plastic packaging market.

The beverage sector emerges as a major consumer of rigid plastic packaging within the food and beverage industry. This is primarily due to the ability of rigid plastic packaging to preserve the quality and freshness of the products by effectively sealing the contents within the container. Several factors contribute to the increased consumption of rigid plastic packaging in the beverage industry.

Firstly, the rise in disposable income among consumers has led to changes in their lifestyles and purchasing habits. As a result, there is a growing demand for convenient and packaged beverage products that can be easily consumed on the go. Rigid plastic packaging provides a suitable solution, offering convenience and portability.

Secondly, product presentation and differentiation are crucial in the beverage industry. Rigid plastic packaging allows for attractive and eye-catching designs, enhancing the visual appeal of the products on store shelves. This visual appeal plays a vital role in capturing customer attention and influencing purchasing decisions.

Furthermore, the increasing demand for specific beverage products, such as packed bottled water and alcoholic beverages, is expected to contribute to the consumption of rigid plastic packaging. These products often require sturdy and reliable packaging solutions to ensure product safety and prevent leakage or contamination.

In conclusion, the demand is driven by various factors, including the growth of end-use companies such as healthcare and cosmetics, food and beverages, and toiletries. Within these industries, the food and beverage sector hold a significant share, with beverage manufacturing being a crucial customer of rigid plastic packaging. The rise in disposable income, product presentation, differentiation, changing customer lifestyles, and the demand for specific beverage products all contribute to the increased utilization of rigid plastic packaging. As the market continues to evolve, businesses operating in the rigid plastic packaging sector should align their strategies to meet the growing demands of these industries and capitalize on emerging opportunities.

A recent survey of 1,500 American consumers across California, New York, and Washington has shed light on a growing concern about plastic waste from packaging. The results reveal a notable difference in attitudes between the West Coast and the East Coast.

The survey found that 84% of Americans are worried about the amount of plastic waste generated by packaging. This concern is particularly pronounced on the West Coast, with California and Washington showing higher levels of apprehension compared to the East Coast. Consumers who prioritize sustainability are increasingly favoring compostable packaging over traditional or recyclable plastic options. Specifically, 54% of Californians, 57% of New Yorkers, and 64% of Washington residents expressed a preference for compostable packaging.

However, despite the benefits of compostable packaging, there remains a significant gap in consumer awareness. While many are familiar with recycled packaging, compostable options are less well-known, with reusable packaging coming in third. The survey highlights that more than half of Americans consider eco-friendly packaging alternatives essential in their daily lives. This sentiment is particularly strong in California (60%), Washington (56%), and New York (55%).

Moreover, the majority of respondents in all three states—California (75%), New York (71%), and Washington (72%)—are willing to pay an additional 5% for products that use sustainable packaging instead of conventional plastic. This data underscores a growing shift towards more environmentally friendly packaging solutions and a clear preference for compostable materials among American consumers.

In the competitive landscape of the rigid plastic packaging industry, companies are constantly striving to differentiate themselves and gain a competitive edge. Rigid plastic packaging has emerged as a popular choice across various sectors due to its durability, versatility, and cost-effectiveness. To succeed in this comparative landscape, businesses must focus on crucial factors such as sustainability, technological advancements, and meeting shifting consumer preferences. Sustainability has become a critical consideration with the increasing demand for environmentally friendly packaging solutions.

Companies invest in research and development to create sustainable alternatives like biodegradable or recyclable materials. Technological advancements also play a crucial role, enabling the development of innovative manufacturing processes, materials, and smart packaging solutions. Staying at the forefront of these advancements allows companies to offer cutting-edge packaging solutions that meet the evolving needs of their customers. Moreover, businesses must closely monitor market trends and consumer preferences to adapt their offerings accordingly. This includes addressing convenience, aesthetics, and eco-consciousness in packaging design. Streamlining supply chains and optimizing costs are essential to remain competitive in rigid plastic packaging. By embracing sustainability, technological innovation, and customer centric strategies, companies can position themselves for success in this competitive landscape.

By Type

By Production Process

By Material

By End User

By Geography

April 2025

April 2025

April 2025

April 2025