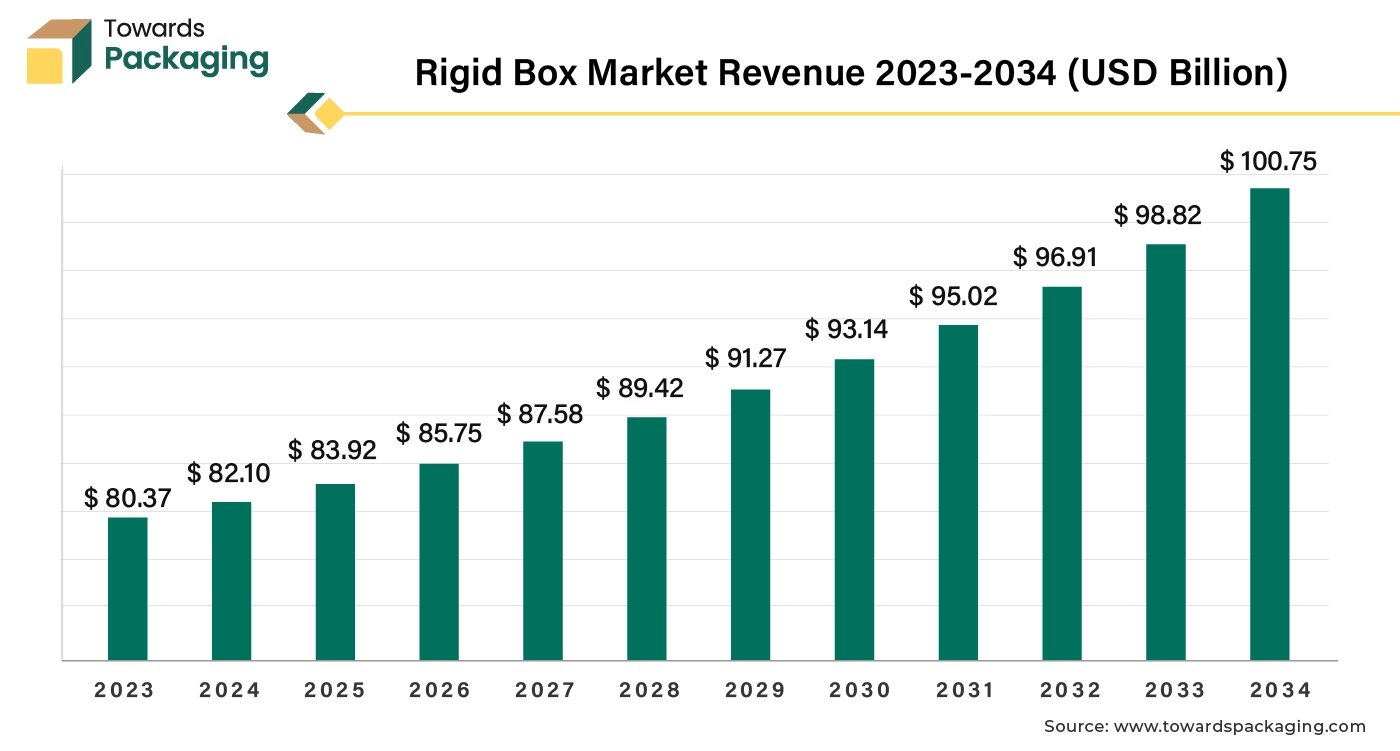

The rigid box market is forecasted to expand from USD 85.55 billion in 2026 to USD 102.97 billion by 2035, growing at a CAGR of 2.08% from 2026 to 2035. This section provides a comprehensive analysis of the market size, detailed segmentation (by product, material, and end-use industry), and key regional data including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Additionally, it covers competitive insights, value chain analysis, and a breakdown of key manufacturers and suppliers shaping the market’s landscape.

Due to rapid industrialization and as the global robust economic growth has increased disposable income and purchasing power, the demand for luxury goods with premium packaging increased, which is estimated to drive the growth of the rigid box market over the forecast period.

Rigid boxes are a type of packaging box manufactured of more durable, thicker cardboard, or paperboard material. They are made to be pre-assembled, which results in a strong, stable construction that is difficult to fold or collapse. High-end or luxury goods that require better protection and a superior presentation are usually packaged in rigid boxes. Products like electronics, jewellery, cosmetics, perfumes, and high-end consumer goods are frequently packaged in rigid boxes. Numerous printing and finishing choices, including as foil stamping, embossing, debossing, spot UV, and matte or gloss lamination, are available to customize them. As a result, the brand image is strengthened and increased brand recognition is possible.

Compared to other forms of packaging, rigid boxes have a number of benefits, including as superior presentation, sustainability, durability and protection, shelf appeal, and personalization. Considering of these advantages, rigid boxes are a common option for a variety of products that need to be presented elegantly and with a high degree of protection. In addition to its superior stability and luxurious feel, rigid packaging is a favoured option for some products. Because of this, in addition to set-up boxes, premium, or high-end packing, given its weight and cost.

AI has ability to significantly enhance the rigid box industry. Integration of AI with the tools utilized for manufacturing rigid box can help in innovation and designing efficient packaging by analyzing consumer choice and market trends, thereby improving aesthetics and functionality. AI has forecasting ability to analyze demand patterns, assisting manufacturers to optimize production schedules, reduce waste and manage discovery of rigid box more effectively. Machine learning algorithms can identify and inspect defects in rigid box packaging while manufacturing process, ensuring higher quality production and reducing the rate of faulty products.

The artificial intelligence has ability to enhance supply chain efficiency by predicting potential disruptions, improving procurement processes and optimizing logistics. The artificial intelligence-powered machine vision systems hold ability to automatically inspect defect in rigid box manufacturing process and even tiny defects at extremely high speeds with accuracy. Integration of the in the rigid box packaging system assists in creating personalized packaging solutions based on the data provided by the consumers, which will improve customer experiences and enable more focused marketing. By analysing the data, artificial intelligence (AI) can provide the most economical solutions for packaging design and production, cutting expenses while maximizing material consumption.

By providing useful insights regarding environmental effects and suggesting more materials and procedures, artificial intelligence (AI) can help in the development of eco-friendly packaging solutions. Automation powered by AI has the potential to improve overall efficiency by streamlining manufacturing procedures, accelerating production, and lowering human costs. These advancements assist producers of rigid boxes in meeting changing customer demands, remaining competitive, and running their businesses more sustainably.

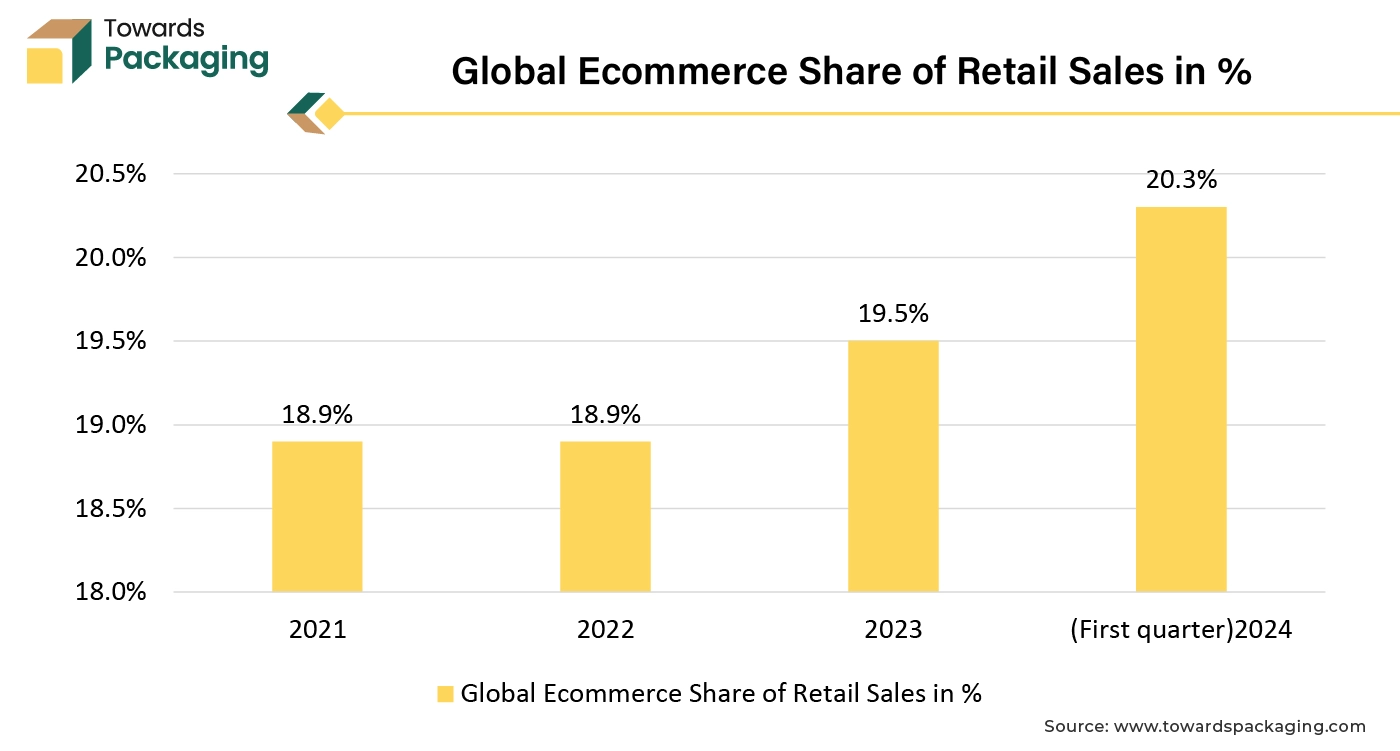

Consumers increasingly prefer premium and aesthetically pleasing packaging, which is driving demand for rigid boxes. These boxes are often used for high-end products like cosmetics, electronics, and luxury goods. The growth of online shopping has increased the need for durable and attractive packaging to enhance the unboxing experience and ensure product protection during shipping. Companies are using rigid boxes as a way to stand out in competitive markets. The premium appearance and customizable options of rigid boxes help in creating a strong brand identity. There is a growing emphasis on sustainable and recyclable packaging materials. Rigid boxes, often made from paperboard, can be designed to be more eco-friendly compared to other packaging options.

Innovations in packaging technology, such as improved printing techniques and customization options, are enhancing the appeal and functionality of rigid boxes. The increasing demand for luxury goods, including high-end cosmetics, electronics, and fashion items, is contributing to the rise in rigid box usage, as these products often require premium packaging.

For instance,

The key players operating in the market are facing strong competition from the alternative packaging solutions available, which is estimated to restrict the growth of the rigid box market over the forecast period. Rigid boxes generally require more expensive materials and manufacturing processes compared to flexible packaging, which can increase overall costs. Although rigid boxes can be made from recyclable materials, the production process and disposal can have a larger environmental footprint compared to some other packaging options. The availability of alternative packaging solutions, such as flexible or biodegradable options, may appeal to businesses looking to reduce costs or enhance sustainability.

Expanding into emerging markets where disposable incomes are rising can offer significant growth opportunities. These regions often see an increase in demand for both premium and functional packaging solutions. The need for secure and protective packaging in the pharmaceutical and healthcare industries is growing. Rigid boxes offer excellent protection and can be designed to comply with regulatory standards, creating opportunities in these sectors. As sustainability becomes a higher priority for consumers and companies alike, there is growing demand for eco-friendly and recyclable rigid box options. Innovations in materials and processes that reduce environmental impact can create new market opportunities. The key players operating in the market are focused on developing innovative technology for manufacturing sustainable rigid packaging solution, which is estimated to create lucrative opportunity for the growth of the rigid box market in the near future.

For instance,

The slotted box segment held the dominating share of the rigid box market in 2024. The rigid slotted box is easy to assemble as compared to other box type and require minimal handling, which reduces labor cost and fasten up packaging processes. The rigid slotted boxes have potential to be used across wide range of industries and for different types of products, making them a luxury packaging solution. The design of slotted box allows efficient storage and stacking, which is beneficial for logistics and warehouse management. The rigid slotted box provides good protection to the products during shipping and handling and can be easily customized with prints, labels and designs, which makes them ideal choice for branding and marketing purpose. The growth in the frequency of online shopping has observed to increase the demand for the slotted box which is estimated to drive the growth of the segment over the forecast period.

For instance,

The telescope box segment is estimated to grow at fastest rate over the forecast period. The telescopic box come with a separate lid and base design. As the design of the telescopic box offer elegant appearance they are used for packaging luxury products where the presentation is crucial. The key players operating in the market are focused on introducing new telescopic box to meet the rising demand in the market which is estimated to drive the growth of the segment over the forecast period.

For instance,

The paper & paperboard segment held the dominating share of the rigid box market in 2024. The main reason behind extensive use of the paper and paperboard material for manufacturing rigid boxes is that it allows customization and can be easily printed. Paperboard surfaces accept printing well, enabling high-quality graphics, labels and branding to be applied directly to the packaging. The paper & paperboard material rigid box is easy to print which is helpful for marketing and branding. Moreover, the paper & paperboard material is often made from recycled materials and it is even recyclable itself. The key players operating in the market are highly introducing their products in the paper & paperboard rigid box due to the ease of branding and recyclable nature at same time, which is estimated to drive the growth of the segment over the forecast period.

For instance,

The food & beverages segment to witness significant growth over the forecast period. Since the disposable incomes among middle class households in growing constantly, the consumer’s aspirations are expanding, their choices about convenient food and beverages options is clear. The riding number of working women and their hectic lifestyles are the main drivers of this consumption trend. The rigid boxes are commonly utilized for the packaging of food and beverage goods such as drinks, juices cans, snacks, and confections.

Rigid boxes guarantee that these goods reach their destination undamaged and also offer protection against damage during storage and transit. Both manufacturers and consumers place the highest priority on food and beverage safety. High levels of product protection are provided by rigid packaging, which reduces the possibility of contamination and upholds sanitary requirements. Customers are reassured by tamper-evident measures, like safety seals and closures, that the product is untainted and safe to eat. Furthermore, non-reactive hard packaging materials like glass and certain polymers avoid any unfavourable interactions between the contents and the packing.

For instance,

North America witness the highest revenue shares for the year 2024. North America have the ideal global brands and well established manufacturing units and distribution network in the country to cater the rising demand of the rigid box. Due to these reason North America is able to gain from effective logistics and economies of scale as a result. Access to superior and personalized solutions is made simple by the existence of prominent package manufacturers. The region's position is further strengthened by businesses' ongoing investments in automation and cutting-edge packaging technologies.

Tight health and safety laws have forced manufacturers to provide goods in packages with longer shelf lives and sealed to prevent tampering. Innovative stiff materials that can effectively safeguard products are thus required. Smaller rigid containers could benefit from consumers' growing preference for smaller package sizes. Market revenues are further augmented by demand from businesses including beer, liquor, and personal care.

New uses for rigid boxes, trays, and tubes in the online retail supply chain are being introduced by the rapidly expanding e-commerce sector. The key players operating in the North America region are focused on introduction of the new rigid box packaging solution, which is estimated to drive the growth of the rigid box market over the forecast period.

For instance,

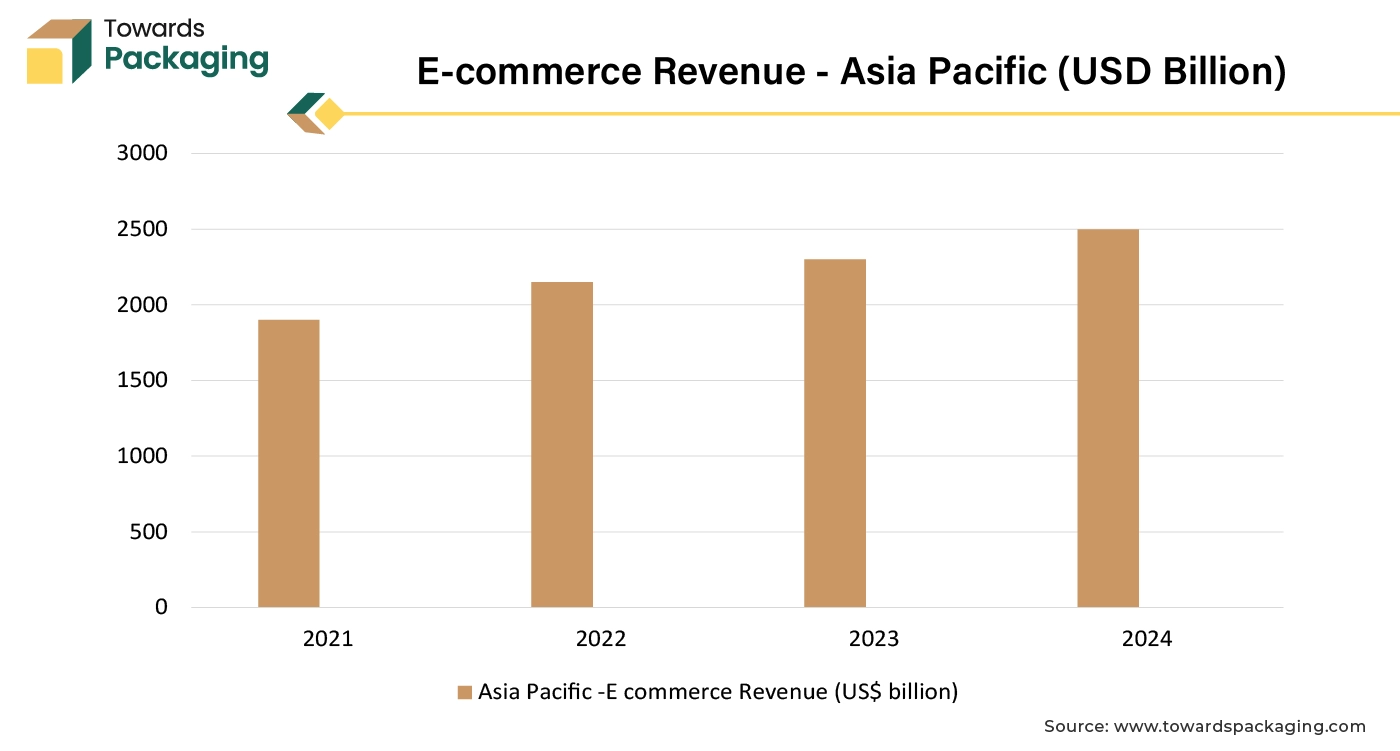

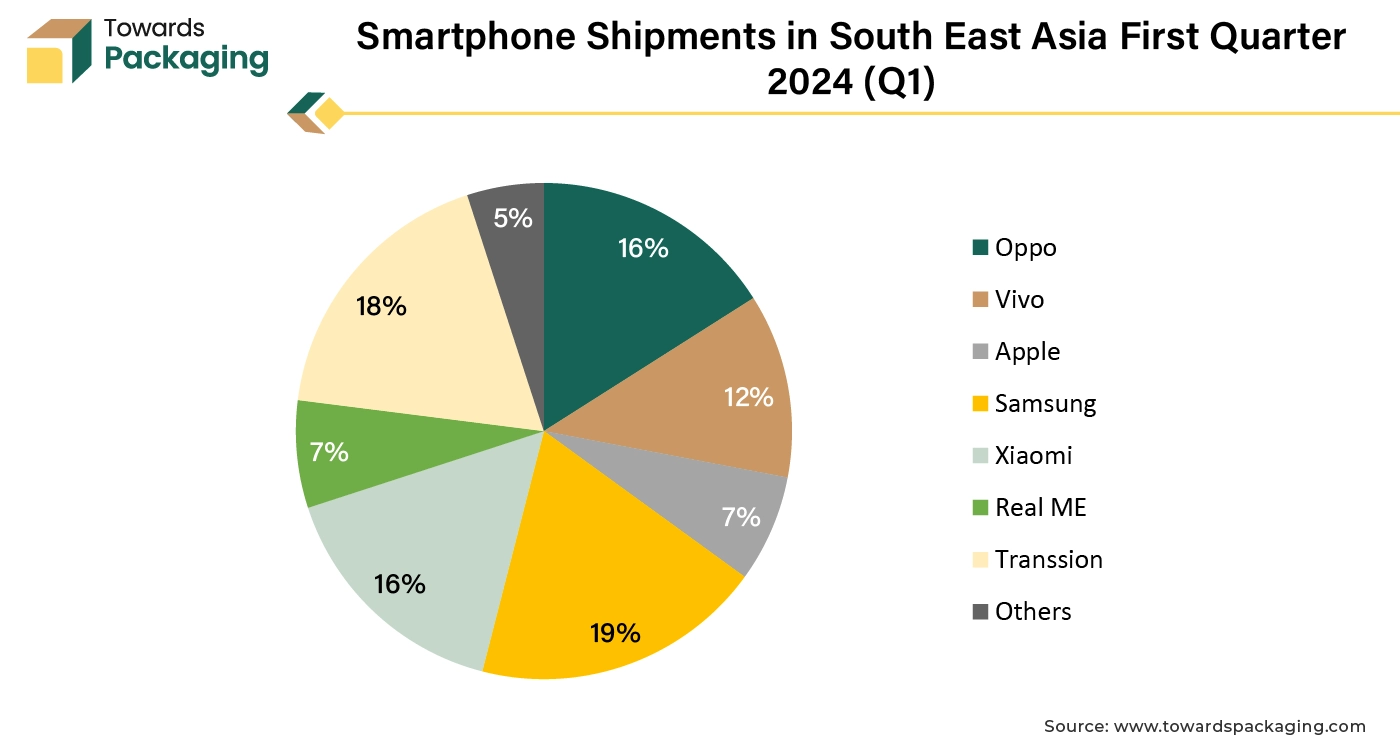

Asia Pacific region is estimated to grow at fastest rate over the forecast period. Rapid industrialization, rise in the middle-class population and increase in disposable income have fueled the demand for packaged consumer goods. The electronic, cosmetics, pharmaceutical and automobile industries have taken boom in the China, India, Korea and Japan which has risen the demand for the rigid box packaging for branding purpose. The key players operating in the Asia Pacific region are focused on launching new rigid box packaging solution to meet the rising demand which is estimated to drive the growth of the rigid box market in the Asia Pacific region over the forecast period.

For instance,

For instance,

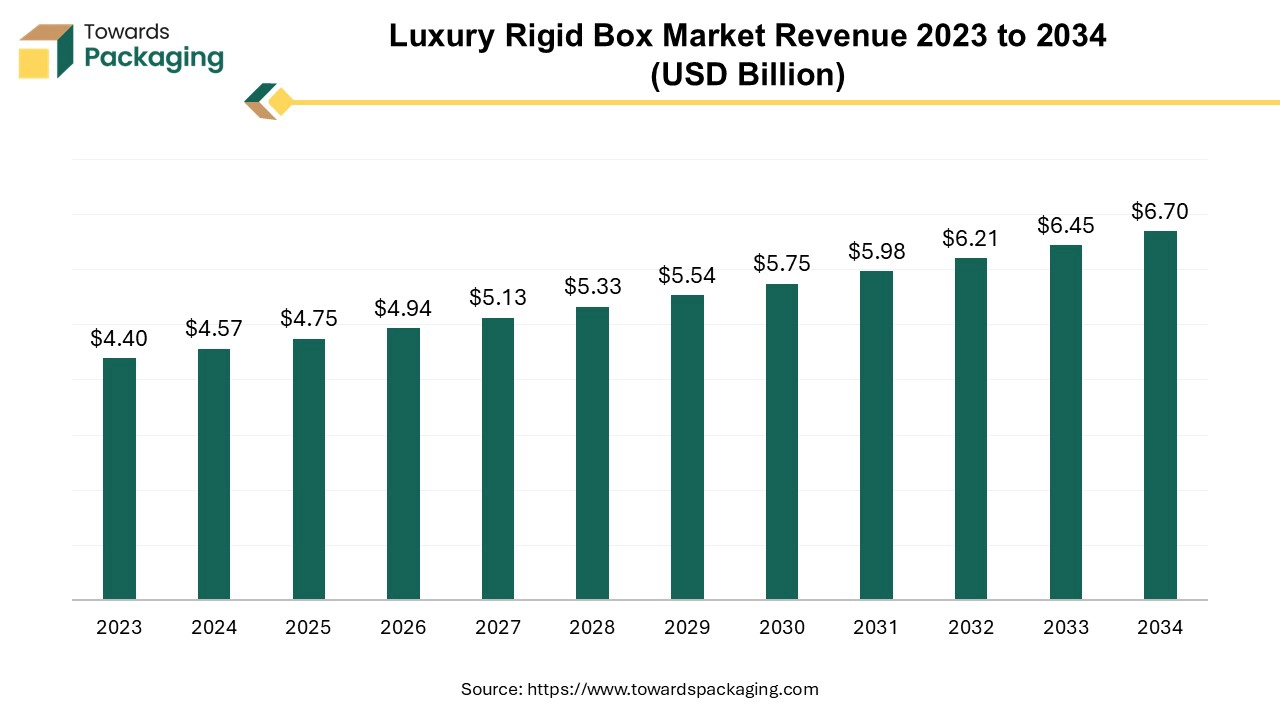

The luxury rigid box market is expected to increase from USD 4.75 billion in 2025 to USD 6.70 billion by 2034, growing at a CAGR of 3.9% throughout the forecast period from 2025 to 2034.

There is a rising demand for eco-friendly materials and practices within the luxury rigid box market. Brands are increasingly seeking sustainable packaging options that maintain luxury aesthetics while minimizing environmental impact. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing luxury rigid box which is estimated to drive the global luxury rigid box market over the forecast period.

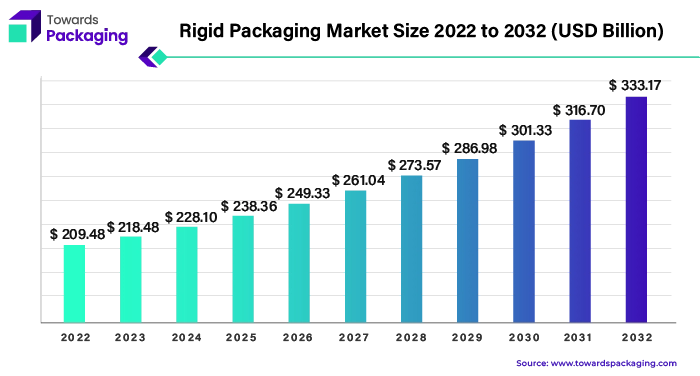

The global rigid packaging market size reached US$ 228.97 billion in 2024 and is projected to hit around US$ 365.92 billion by 2034, expanding at a CAGR of 4.8% during the forecast period from 2024 to 2034.

The rigid packaging sector makes prominent use of plastic owing to their numerous advantages, include becoming durable, portable, chemically impermeable, and reasonably priced. Considering 31% of the world's plastic utilisation volume going to the packaging, the industry certainly is dominating with the manner when plastics are used. Comparing to other forms of packaging, rigid packaging is more lightweight. It also reduces food waste and spoiling, protects against breakage, and offers a host of other advantages. Rigid plastic widely used in various industries such as food and beverage, personal care, healthcare and others.

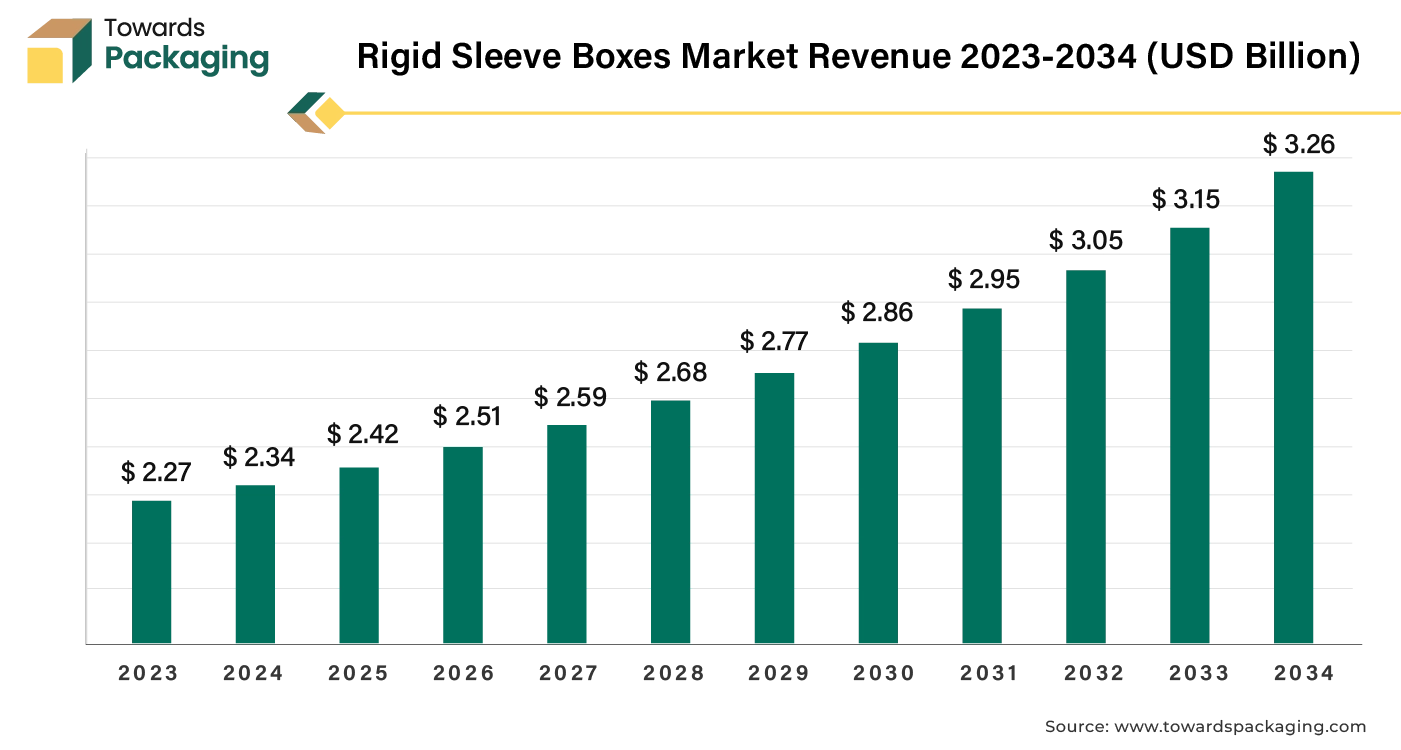

The rigid sleeve boxes market is forecast to grow from USD 2.42 billion in 2025 to USD 3.26 billion by 2034, driven by a CAGR of 3.54% from 2025 to 2034.

Rigid sleeve boxes, also known as slipcases, are a type of packaging where a rigid outer sleeve slides over a separate inner box or container. A rigid sleeves box, often referred to as a rigid sleeve or rigid box, is a type of high-quality packaging used for premium products. They offer a sleek and protective design, often used for high-end products, books, and media items. The outer sleeve provides protection for the inner box, which is ideal for delicate or valuable items. Rigid sleeve boxes can be customized with various finishes, such as embossing, debossing, foil stamping, and spot UV coating, enhancing the aesthetic appeal. The design of rigid sleeve boxes offers a high-end, professional look, making it popular for premium and luxury products. Rigid Sleeve boxes are suitable for various products, including electronics, cosmetics, and collectible items. Overall, rigid sleeve boxes are valued for their combination of protection, presentation, and customizability.

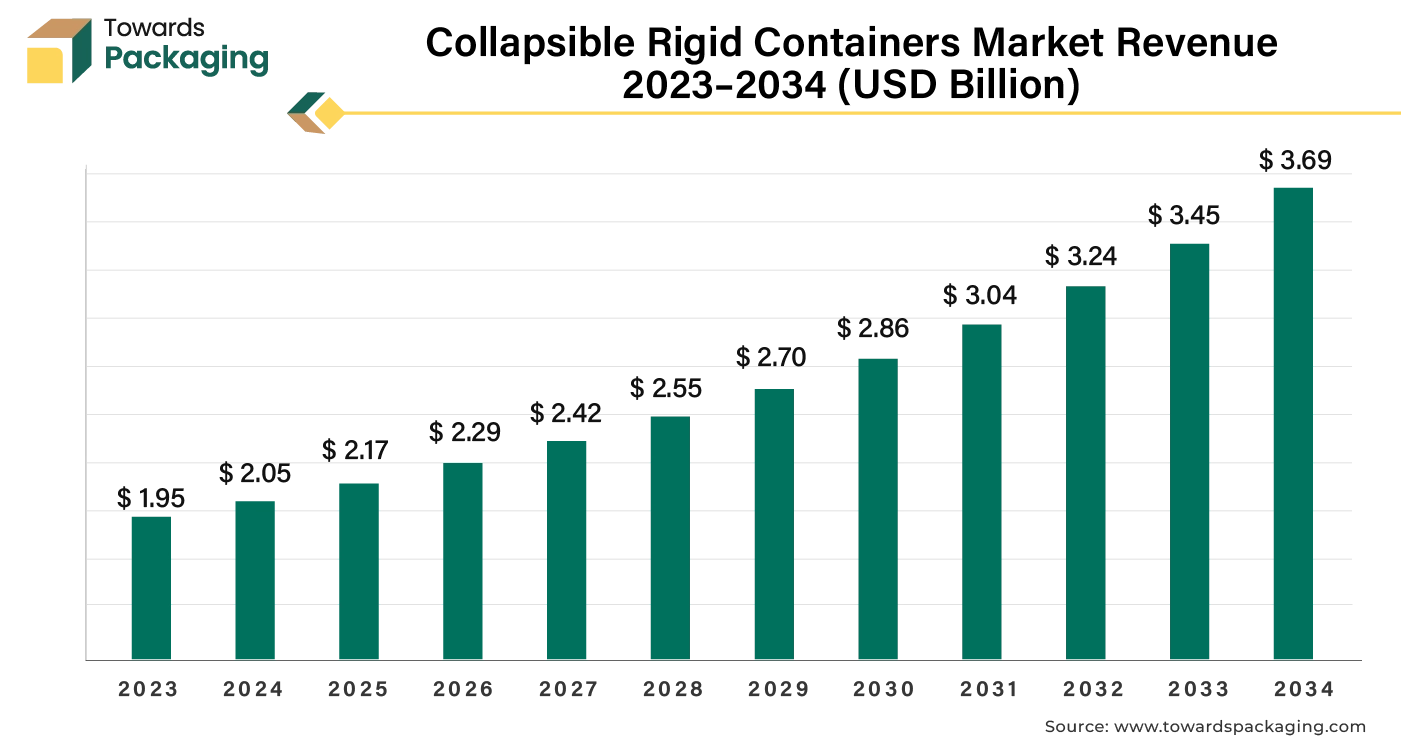

The collapsible rigid containers market is predicted to expand from USD 2.17 billion in 2025 to USD 3.69 billion by 2034, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

Rising regulations and industry standards around packaging safety and quality encourage the adoption of robust, complaint packaging solutions which is estimated to drive the global collapsible rigid containers market over the forecast period.

Packaging that combines the strength of rigid boxes with the flexibility of collapsible design is known as collapsible rigid boxing. Collapsible rigid containers are made of sturdy materials like cardboard or plastic, these boxes are able to hold their shape and offer strong protection for the contents inside. However, because they are made to be folded or collapsed when not in use, they take up less space in storage and during transportation. In summary, collapsible rigid boxes combine the strength and protection of rigid packaging with the practical benefits of lower storage and shipping costs because of their ability to collapse flat.

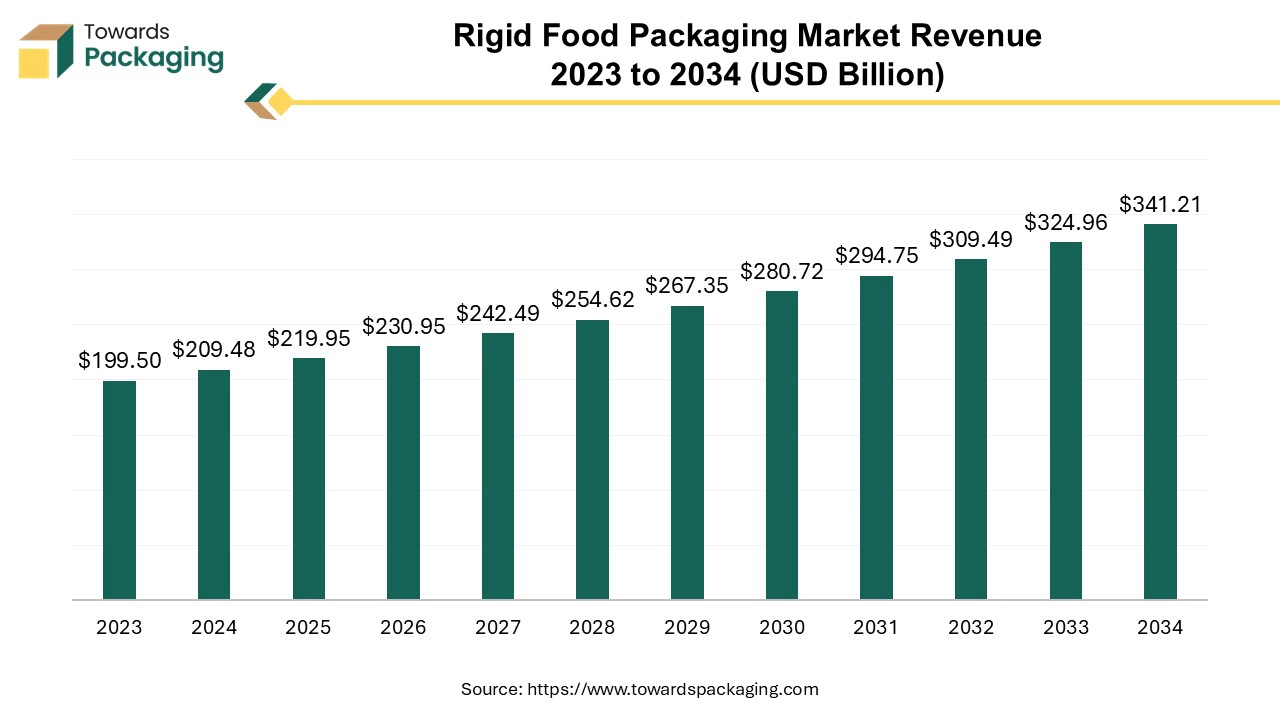

The global rigid food packaging market valued at US$ 199.50 billion in 2023, is projected to reach approximately US$ 341.21 billion by 2034, growing at a CAGR of 5% from 2024 to 2034. This growth is driven by the increasing demand for ready-to-eat food and evolving consumer food preferences.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing rigid food packaging which is estimated to drive the global rigid food packaging market over the forecast period.

Rigid food packaging is a category of packaging designed to offer a solid, inflexible structure to protect food products. Unlike flexible packaging, which can be bent or folded, rigid packaging maintains its shape and provides a stable barrier to external factors. Rigid packaging maintains its shape and does not collapse or bend. This rigidity assists in safeguarding the food from physical damage and contamination.

By Product

By Material

By End Use

By Region

January 2026

January 2026

January 2026

January 2026