April 2025

.webp)

Principal Consultant

Reviewed By

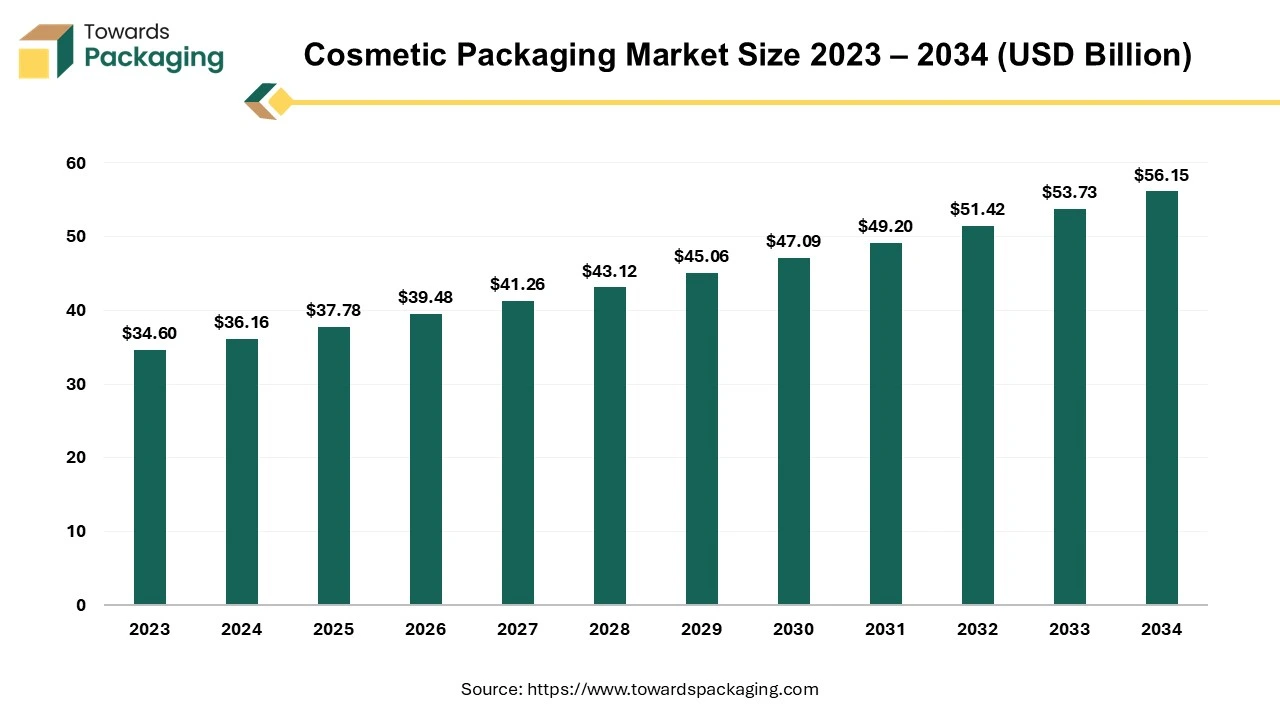

The global cosmetic packaging market size reached US$ 36.16 billion in 2024 and is projected to hit around US$ 56.15 billion by 2034, expanding at a CAGR of 4.5% during the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing cosmetic packaging which is estimated to drive the global cosmetic packaging market over the forecast period.

Cosmetic packaging refers to the containers, materials, and wrapping used to store, protect, and present beauty and personal care products. It includes primary, secondary, and tertiary packaging designed for functionality, branding, and product preservation. The cosmetic brands use sustainable packaging – brands are using glass, bamboo, refillable containers, and PCR (post-consumer recycled) plastics. The consumers prefer clean, simple packaging that showcases the product.

Environmental concerns are prompting brands to adopt sustainable packaging solutions. This includes the use of biodegradable materials, refillable containers, and designs that minimize waste. Such initiatives align with consumer demand for eco-conscious products.

There's a growing preference for minimalist packaging characterized by simple typography and ample white space. This "less is more" approach conveys sophistication and transparency, resonating with consumers seeking authenticity.

Technological integration into packaging is on the rise. Features like QR codes, augmented reality (AR), and near-field communication (NFC) enhance user engagement by providing product information, authenticity verification, and personalized experiences.

Brands are incorporating vintage and heritage elements into packaging to evoke nostalgia and connect with consumers on an emotional level. This trend adds a touch of classic elegance to modern products.

The use of high-quality materials like heavy-wall recyclable PET that mimics glass offers a luxurious feel while ensuring durability and sustainability. These materials cater to consumers seeking premium experiences without compromising on environmental responsibility.

AI (Artificial Intelligence) is transforming the cosmetic packaging industry by enhancing design, manufacturing, sustainability, and customer engagement. AI-powered data analytics help brands create personalized packaging based on consumer preferences. QR codes, NFC tags, and Augmented Reality (AR) allow customers to scan packaging for product information, tutorials, and authenticity checks. AI can optimize customized labels and packaging designs for different target audiences. AI-driven material analysis helps develop biodegradable and recyclable packaging while maintaining durability. AI-powered waste reduction algorithms optimize the amount of material used in packaging, minimizing excess waste.

Increased global beauty awareness and self-care trends are driving demand for skincare, makeup, and personal care items. Growing disposable incomes, especially in emerging markets (India, China, Brazil, Southeast Asia), are boosting premium and mass-market cosmetics sales. The male grooming sector is expanding, increasing the need for specialized packaging for men’s products.

For instance, in January 2025, American Cosmetic Association, in the United States, consumers spend US$182.3 per year on beauty goods. The average American woman spends US$313 each month on cosmetics. The average American woman spends over US$3,756 a year on cosmetics and services. Spending on cosmetics exceeded $483 billion in 2020.

The average monthly expenditure of Americans on cosmetics is between US$244 and $313. Three out of four clients who purchase beauty products react favourably to tailored advice. As a result of the COVID-19 epidemic, 1 in 5 women altered their skincare regimen. 67% of consumers who buy cosmetic products say they look to influencers for product recommendations.

The key players operating in the market are facing issue due to environmental standards, supply chain disruption, and packaging frauds issues, which can restrict the growth of the cosmetic packaging market in the future. Fluctuations in the availability and pricing of raw materials (paperboard, glass, metal, bioplastics) create production delays. Global supply chain disruptions (e.g., shipping delays, raw material shortages) affect packaging availability and pricing.

Dependence on imported materials increases vulnerability to trade restrictions and geopolitical issues. Single-use plastic packaging is facing backlash, but alternatives like glass and aluminum come with higher carbon footprints due to energy-intensive production. Recycling infrastructure limitations make it hard for brands to achieve 100% sustainable packaging goals. Multi-layer and mixed-material packaging (plastic + metal + paper) is difficult to recycle, leading to environmental concerns.

The rise of online shopping (Amazon, Sephora, Nykaa, etc.) requires durable, lightweight, and attractive packaging. Subscription beauty boxes and influencer-driven brands are increasing demand for customized and aesthetically appealing packaging. AI-driven packaging innovations help brands design optimized e-commerce packaging to reduce waste and shipping costs. Online beauty sales require sturdy, protective packaging to prevent damage during shipping. Shock-resistant materials like corrugated boxes, padded mailers, and airless pumps ensure product integrity.

Leak-proof and break-resistant containers for fragile items (glass perfume bottles, liquid foundations, serums) are in high demand. Online shoppers prefer sustainable packaging, driving the shift to biodegradable, recyclable, and compostable materials. Subscription beauty boxes (Birchbox, Ipsy, BoxyCharm) require compact, visually appealing, and protective packaging. Hence, the expansion of E-commerce platform has raised the sales of cosmetic packaging, which has created lucrative opportunity for the growth of the cosmetic packaging market.

In January 2025, according to the data published by the national e-commerce associations, by 2023, the online share of the beauty business in the U.S. is expected to reach 48%, despite the fact that e-commerce penetration has only marginally expanded in recent years. Retailers of cosmetics report US$17.09 billion in sales online. 34.1% of the overall advertising budget in the beauty sector goes toward digital advertising. Influencers control 60% of the YouTube beauty content. 42% of consumers between the ages of 18 and 24 who purchase cosmetic products say social media is their source of inspiration. Advertisements on social media are how 37% of consumers learn about new cosmetic brands. Brands are found on social media by 66% of consumers due to blogger and celebrity endorsements.

The bottles segment held a dominant presence in the cosmetic packaging market in 2024. Bottles are suitable for a wide range of cosmetic products, including shampoos, lotions, perfumes, serums, and oils, making them a flexible packaging choice. Bottles protect cosmetic products from contamination, oxidation, and environmental factors like light, air, and moisture, preserving their quality and effectiveness. Bottles allow for controlled dispensing, whether through pumps, droppers, or squeeze mechanisms, minimizing waste and ensuring hygienic application. Bottles come in various materials (glass, plastic, metal) and finishes (frosted, glossy, matte), enhancing product presentation.

The skin care segment accounted for a considerable share of the cosmetic packaging market in 2024. People are more educated about skincare benefits and ingredients, leading to increased interest in high-quality products. Social media, beauty influencers, and dermatologists play a role in spreading awareness. Consumers view skincare as part of overall self-care and wellness rather than just beauty. A shift toward preventive skincare to delay aging and skin damage is driving demand. Aging populations and younger consumers seeking preventative skincare boost sales of anti-aging creams, serums, and treatments.

The paper-based segment registered its dominance over the global cosmetic packaging market in 2024. Consumers and brands are shifting toward sustainable packaging due to environmental concerns. Paper-based materials are often biodegradable, recyclable, and sourced from renewable resources, cutting-down plastic waste. Advanced paper-based materials (e.g., laminated paper, coated paperboard) offer protection from moisture, air, and external damage. The advanced paper-based material can be combined with minimal plastic or biodegradable coatings to enhance functionality.

The 100 ml – 150 ml segment witnessed the largest share in 2024. Cosmetic packaging in the 100 ml – 150 ml range sells at a higher rate as this size is travel-friendly and meets airline carry-on liquid restrictions (usually under 100 ml). It’s easy to carry in handbags, making it ideal for daily use. It’s easy to carry in handbags, making it ideal for daily use. This size is widely available in physical stores and online, making it easy for consumers to repurchase. Many brands design limited editions and promotional offers in this size range. Many brands reduce excess packaging in favour of smaller, eco-friendly containers to cut costs and waste. Governments encourage less plastic usage, making medium-sized, recyclable packaging an attractive choice.

Asia Pacific region dominated the global cosmetics packaging market in 2024. The rising middle class and higher disposable incomes in countries like China, India, and South Korea are increasing demand for beauty products. As India has high level of pollution, the skin care products are sold in large amount in the India. South Korea and Japan set global beauty trends, leading to innovative packaging solutions like airless pumps, cushion compacts, and eco-friendly refillable containers.

China Cosmetic Packaging Market Trends:

China is the world’s second-largest beauty market, with increasing demand for skincare, cosmetics, and personal care products. The "Guochao" trend (preference for domestic brands) is boosting demand for unique and high-quality packaging. China is a global hub for packaging production, offering high-tech automation and lower costs, attracting both domestic and foreign beauty brands.

North America is projected to host the fastest-growing cosmetics packaging market in the coming years. Growth in online beauty sales (Amazon, Sephora, Ulta, DTC brands) requires durable and aesthetically appealing packaging for shipping. North America is home to major beauty brands (Estée Lauder, L’Oréal USA, P&G, Unilever) that invest heavily in high-quality and sustainable packaging. North American leading packaging firms (AptarGroup, Berry Global, WestRock) drive continuous innovation and automation in packaging production.

U.S. Cosmetic Packaging Market Trends

The U.S. is one of the largest beauty markets, with high spending on skincare, cosmetics, and personal care. Airless pumps, refillable systems, and mono-material designs enhance functionality and sustainability. U.S. leading beauty brands (Estée Lauder, L’Oréal USA, P&G, Unilever, Coty) invest heavily in packaging innovation. The rise of clean beauty and sustainable brands in U.S. (e.g., Ilia, Saie, Merit) fuels demand for minimalist and non-toxic packaging.

Europe is seen to grow at a notable rate in the foreseeable future. EU Green Deal & Circular Economy Action Plan drive demand for biodegradable, recyclable, and refillable packaging. Bans on single-use plastics and incentives for PCR (post-consumer recycled) plastic, glass, aluminum, and paper-based materials fuel innovation. France, Italy, and Germany dominate the luxury beauty sector, increasing demand for high-end, intricate packaging.

Europe is home to global cosmetic giants (L’Oréal, Unilever, Shiseido Europe, Beiersdorf) that invest in packaging R&D and sustainability. Adoption of airless dispensers, refillable systems, and smart packaging (QR codes, NFC tags for product authentication and traceability). Brands invest in 3D printing, digital printing, and AI-driven customization for personalized packaging solutions.

By Type

By Application

By Material

By Capacity

By Region

April 2025

April 2025

April 2025

March 2025