April 2025

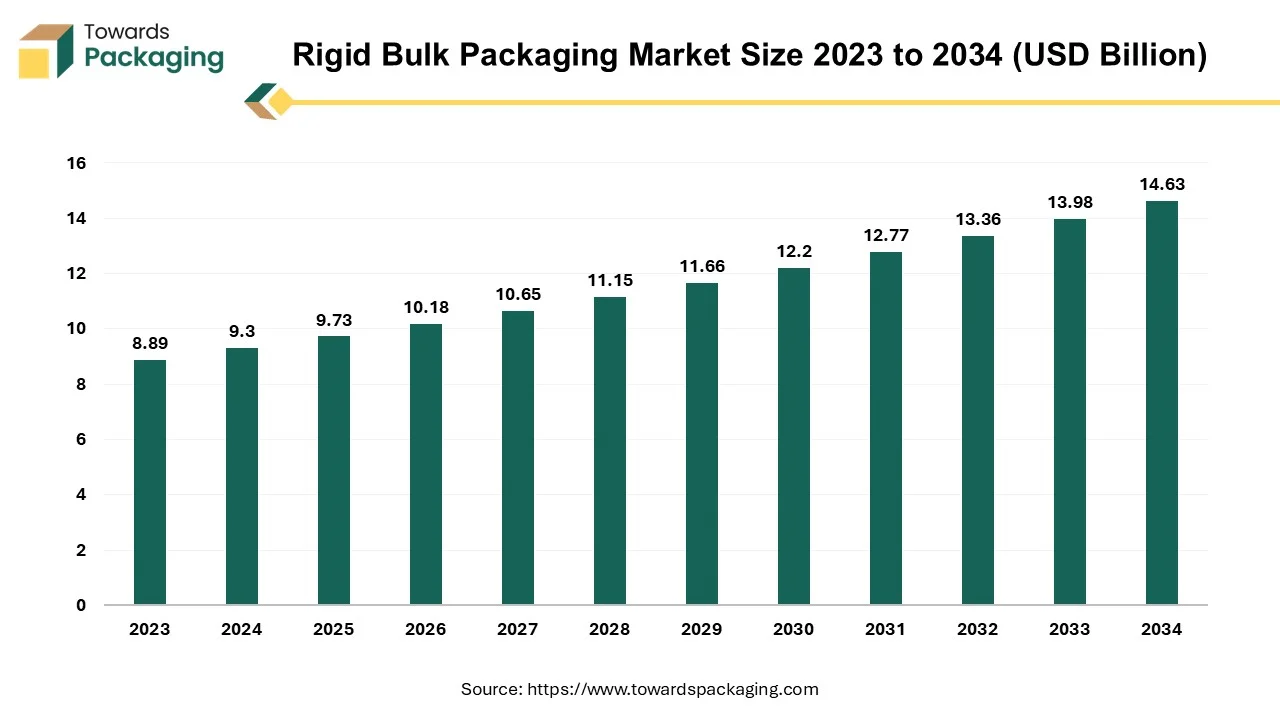

The global rigid bulk packaging market projected at USD 9.3 billion in 2024, is expected to reach USD 14.63 billion by 2034, growing at a CAGR of 4.63% over the forecast period. The sustained growth in the rigid bulk packaging market is a result of rising demand in the food and beverage and pharmaceutical industries across the globe.

Unlock Infinite Advantages: Subscribe to Annual Membership

Rigid bulk packaging refers to high-strength packaging containers that are mainly used to transport perishable, delicate, and volatile products. This type of packaging ensures the safe transportation of sensitive products. Heavy-duty materials such as high-strength plastics, metals, and wood are generally used to manufacture rigid bulk packaging.

Rigid bulk packaging is commonly used in the food and beverage, pharmaceutical, and industrial chemical transportation industries. These industries utilize rigid bulk packaging for the safe and efficient transportation of pharmaceutical drugs, perishables, and volatile chemicals. This type of packaging prevents leaks and contamination of products. The global push towards reusable forms of packaging is driving demand for bulk containers. These also have the added advantage of being highly cost-effective compared to smaller containers.

The industry has seen growth due to the rapid pace of industrialization and urbanization occurring in several countries in the Asia-Pacific region which has caused the demand for various products to rise rapidly. A rise in global import and export volumes coming from the region is driving growth in the market. The global packaging market size to grow at a 3.16% CAGR between 2025 and 2034.

Recent government regulations limiting the use of plastics and other raw materials used in rigid bulk packaging are challenging growth in the sector. The increasing popularity of flexible packaging that takes up less storage space and environmental concerns are also a restraint in the market.

Rapid urbanization has caused the demand for food and beverages, pharmaceutical, and manufacturing sectors to skyrocket, particularly in the emerging economies of Asia-Pacific. High demand in these sectors can be attributed to increasing disposable income and significant government investment in energy, industrial, healthcare, and transport infrastructure across the region. The growing oil and gas imports into the region have also spiked demand for rigid bulk packaging. Surging investment in healthcare infrastructure has also grown demand for durable, hygienic, and lightweight variations of rigid bulk packaging.

All these factors have significantly boosted the rigid bulk packaging market as there is now a high demand for reusable bulk containers to optimize cost-effectiveness in regional supply chains and ensure secure bulk transportation of goods. The region is also poised for sustained growth during the forecast period, making it likely that this demand will be maintained.

Strict environmental regulations are being widely adopted by several countries to reduce the impact of hard-to-recycle materials like certain plastics. Some countries have outright banned single-use plastics while others require mandatory plastic offsetting schemes for businesses. Some materials used in rigid bulk packaging have been declared hazardous in some countries while others impose limits on their recyclability. In some regions, the need for adequate recycling infrastructure and trash management systems poses challenges to the growth of the rigid bulk packaging industry.

The growing cost of renting and owning storage space has given way to the rising popularity of flexible packaging which offers greater versatility compared to their rigid bulk counterparts. Some businesses also choose to switch to flexible packaging options to bring down transportation costs.

Rigid bulk packaging manufacturers introduce tailored solutions to meet industry requirements by offering a variety of designs and capacities. Diversifying into manufacturing recycled plastic products, jars, and clamshells help businesses grow, especially in the fast-growing markets of the Asia-Pacific region. Businesses opt to adopt advanced packaging techniques to cater to the growing demand for produce and healthcare packaging solutions in the region.

The plastic segment held the largest share of the rigid bulk packaging market in 2024. The plastics segment includes bioplastics, polyethylene, polyethylene terephthalate, polystyrene, and others. The versatility, durability, and lightweight but rigid nature of plastic packaging allow businesses to meet a variety of packaging needs across industries. Manufacturing plastic for packaging is also a lot cheaper compared to other materials leading to its widespread adoption in the industry. Due to an increasing demand for sustainable and eco-friendly rigid packaging solutions, metal, wood, and glass alternatives are gaining popularity in the rigid bulk packaging sector.

The metal segment is the fastest-growing material type in the rigid bulk packaging market due to a global shift towards more eco-friendly packaging alternatives. Metal is also more recyclable than materials like plastic. Rigid metal packaging provides an airtight, temperature-controlled, and light-resistant environment for products, helping extend their shelf life. This is particularly useful for the food, beverages, and cosmetic industries. Wood rigid bulk packaging is gaining traction in the space thanks to a shift in consumer behavior and demand for sustainable packaging solutions, including wooden and plywood packaging. Wood is a natural and renewable resource. When wood is harvested and used for packaging, the carbon remains locked away from the atmosphere, reducing net CO2 emissions.

The intermediate bulk containers (IBC) segment led the rigid bulk packaging market. Intermediate bulk containers are the gold standard in rigid bulk packaging owing to their cost-effectiveness. They are especially useful for transporting liquids in bulk that can then be portioned out into smaller containers for end users. Businesses can save on costs by shipping out larger containers, compared to several smaller ones. IBCs are also durable and reusable, making them ideal for transporting hazardous materials due to features such as double valves. The incorporation of such features makes filling and draining them a lot simpler. The universal design of IBCs makes them stackable and easy to handle.

The bulk boxes is the fastest-growing product type in the rigid packaging space due to their durability and customization which contributes to brand recognition. Rigid bulk boxes offer an added layer of security against moisture and other environmental hazards. Pails are also gaining traction in the rigid bulk packaging space. Pails are widely utilized as shipping and transportation containers due to the expansion of manufacturing sectors in growing economies.

The market is divided into food, beverage, pharmaceutical and chemicals, industrial, and others. The food and beverages dominated the market in 2024. The food and beverage industry has grown dramatically in the past decade, especially in the Asia-Pacific region due to a large consumer base and rising disposable income which has shifted consumer tastes and preferences. The increasing demand for staple foods, carbonated soft drinks, caffeinated drinks, snacks, and baked goods is driving demand for proper transportation and storage solutions in the rigid bulk packaging space.

The pharmaceutical segment of the market is the fastest growing segment in the market. The overall rising demand for pharmaceutical products across the globe, is observed to supplement the market. The increasing investment in healthcare and the prevalence of chronic diseases are driving demand for the transportation of goods.

Asia Pacific had the largest share in the rigid bulk packaging market. The region is home to several of the largest emerging economies in the world with a high demand for manufacturing & construction. A high disposable income and a young demographic’s changing lifestyles have spurred demand for a variety of goods through the rise of e-commerce, leading to growing trade.

The Chinese government has implemented stricter environmental regulations to promote recycling and sustainable packaging solutions. This has led to increased demand for high-quality, durable, and reusable rigid bulk packaging.

The Make in India initiative aims to transform India into a global manufacturing hub. This has led to increased investments in manufacturing infrastructure, which in turn drives the demand for rigid bulk packaging to support various industries.

North America is the fastest growing region in the space, during the forecast period. The region is home to robust manufacturing industries and important market players in the chemicals, pharmaceuticals, food and beverages, and automotive sectors. The United States is the world's third-largest exporter and second-largest importer of goods. This is leading to high growth in the rigid bulk packaging space. Companies in the region are increasingly adopting smart packaging solutions that incorporate IoT, sensors, and RFID technology to improve supply chain efficiency and product tracking.

By Material

By Product Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025