April 2025

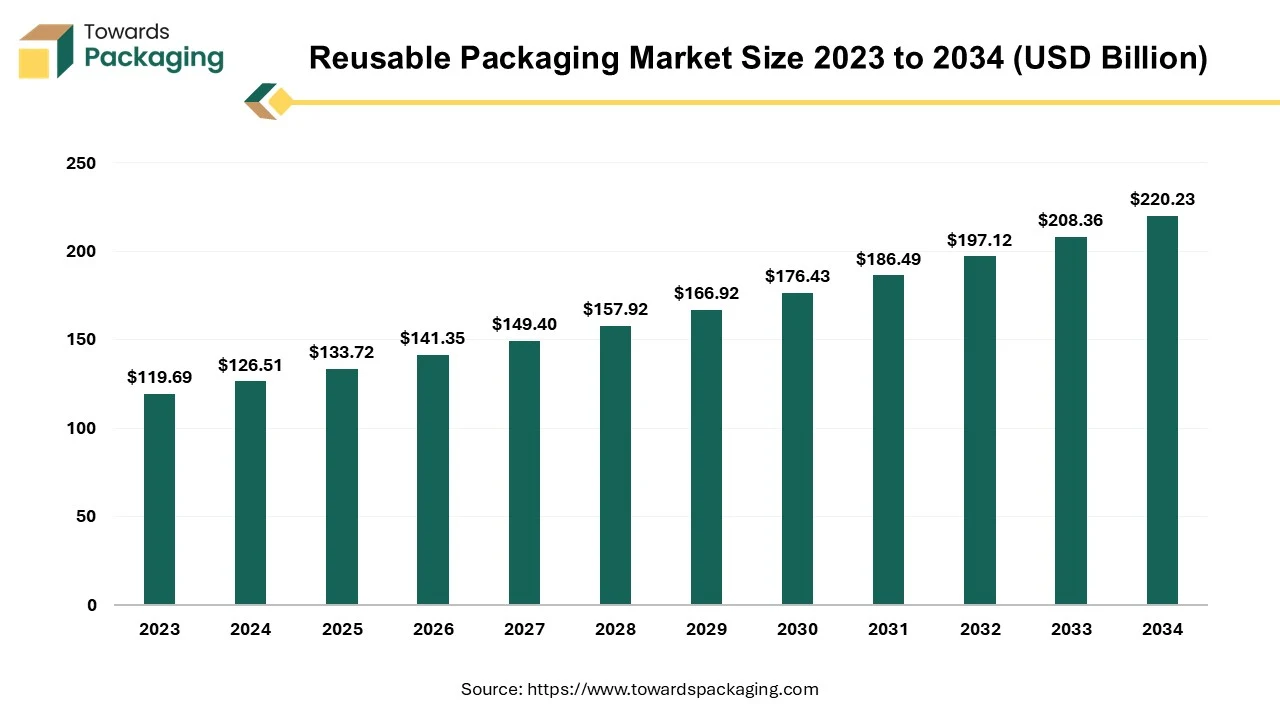

The reusable packaging market is expected to grow from USD 133.72 billion in 2025 to USD 220.23 billion by 2034, with a CAGR of 5.7% throughout the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing reusable packaging which is estimated to drive the global reusable packaging market over the forecast period.

In order to move goods through supply chains effectively and safely, reusable transport packaging typically consists of pallets, bins, tanks, intermediate bulk containers, reusable plastic containers, and other hand-held containers, as well as totes, trays, and dunnage. In order to assure their efficient recovery and return for ongoing usage, these packaging products are made to last. Transporting commodities, raw materials, ingredients, or parts to facilities for manufacturing or processing goods is a common usage. Next, completed goods are shipped to warehouses or distribution centers en route to commercial markets like wholesale or retail outlets. The majority of reusable transport packaging items are made for business-to-business use, but the rise of home delivery and e-commerce is creating new chances for reusable packing to be used effectively.

| Metric | Details |

| Market Size in 2024 | USD 126.51 Billion |

| Projected Market Size in 2034 | USD 220.23 Billion |

| CAGR (2025 - 2034) | 5.7% |

| Leading Region | North America |

| Market Segmentation | By Material, By Product Type, By End-Use and By Region |

| Top Key Players | Smart Crates, Schoeller Arca Systems, Reusable Packaging Group, Polymer Logistics, Reusable Transit Packaging, Mauser Packaging Solutions, ORBIS Corp, Smurfit Kappa |

The packaging industry is only one of several that artificial intelligence (Al) is transforming. Al has evolved into a strategic pillar for reimagining packaging for the future in 2023, not just a technical instrument. Al is ushering in a new era of packaging through resource optimization, customisation, and environmental impact reduction. Al is a major contributor to the development of more ecologically friendly and sustainable packaging. Algorithms assist in determining the most environmentally friendly products and maximizing their utilization to cut down on waste. Al makes it possible to develop packaging that is lighter and less clunky without sacrificing product protection by examining real needs.

Increase in e-commerce drives need for reusable, durable shipping containers. Last-mile delivery services in urban areas are adopting reusable systems for sustainability and branding. Growth in online shopping and expansion of E-commerce platforms has driven the growth of the reusable packaging market in near future. In January 2025, according to the data published by the National e-commerce associations, in 2024, the leaders in the e-commerce sector spent $3.5 billion on advertising overall, with individual expenditures ranging from US$41.3 million to US$1.7 billion. With a staggering US$1.7 billion, more than four times Walmart's expenditure, Amazon took the lead. In contrast, Aliexpress spent the least amount at US$322,000, which is 5,000 times less than Amazon. This is mostly because Aliexpress is utilized more frequently outside of the U.S. than it is in the U.S. Despite this low investment, Aliexpress.com's website traffic has increased significantly in the US.

The key players operating in the market are facing issue due to complex logistics & reverse supply chains, high initial investment costs and limited infrastructure, which has estimated to restrict the growth of the reusable packaging market in the near future. Upfront costs for durable materials, cleaning infrastructure, design, and tracking systems are significant. Many small and mid-sized businesses see this as a barrier compared to cheap single-use alternatives. Managing the cleaning, return, and redistribution of reusable packaging is complex. Inefficiencies in reverse logistics increase costs and carbon footprint if not optimized. In many regions, there is a lack of cleaning, repair, and storage facilities to support reusable systems. Lack of universal standards for packaging design complicates pooling and reusing across companies. Regulations on reuse systems vary widely across regions, causing complexity for multinational companies.

Strong global momentum towards circular economy adoption. The key players operating in the market are redesigning supply chains around reuse, developing long-term opportunities for reusable packaging providers. Hence, the rise of circular economy models has estimated to create lucrative opportunity for the growth of the reusable packaging market in the near future. Development of lightweight, durable, and sustainable materials enhances packaging lifespan and appeal. Increasing launch of the design solutions for modularity, stackability, and aesthetics, has created lucrative opportunity for the growth of the reusable packaging market in the near future.

The plastic segment held a dominant presence in the reusable packaging market in 2024. The plastic material is durable has longevity and withstand multiple use cycles. Resistant to impact, weather, moisture, and chemicals suitable for tough handling in logistics. Compared to metal or glass, plastic is much lighter, minimizing shipment cost and carbon footprint per shipment. Plastics can be easily molded into various shapes and sizes for different applications. Plastic packaging withstands harsh environments: UV exposure, moisture, chemicals, and temperature changes. Plastics integrate well with RFID tags, QR codes, and sensors for asset tracking and inventory management.

The containers segment accounted for a considerable share of the reusable packaging market in 2024. As the reusable containers are reusable and lower long-term costs they are being sold more in number. The key players operating in the market are under pressure to meet zero-waste goals and carbon reduction targets. Reusable containers assist in reducing landfill waste and environmental impact. Reusable solutions are future-proof way to stay compliant. Reusable containers are stackable, nestable, and easy to handle, improving space utilization and reducing handling time. Strong materials mean reusable containers provide better protection against damage, minimizing losses and returns.

The food & beverage segment registered its dominance over the global reusable packaging market in 2024. Food and beverage products move through supply chains rapidly and in large quantities, making reusable systems economically attractive. Frequent shipments mean more opportunities to reuse packaging efficiently. Reusable plastic crates, bins, and containers are easy to sanitize, clean, and sterilize, meeting strict food safety regulations. Reusable packaging solutions like crates and totes double as display units in retail (direct-to-shelf). Reusable packaging assists brands showcase their commitment to sustainability, especially in fresh produce and beverages. Major retailers (like Carrefour, Walmart, Tesco) prefer reusable packaging for faster restocking and reduced waste. As online grocery shopping expands, reusable packaging is ideal for last-mile delivery and return logistics. Shared pooling systems (like IFCO or CHEP) make reusable packaging more accessible to food producers without high upfront costs. Eco-conscious packaging becomes part of the brand story, especially for premium, organic, or ethical food brands.

North America region held the largest share of the reusable packaging market in 2024, owing to expansion of the food and beverages industry in the region. North America region has a highly developed logistics network (rail, air, road). Efficient supply chains in North America region benefits greatly from reusable packaging solutions like totes, pallets and crates for better inventory management and transportation. Major industries like food & beverage, automotive, pharmaceuticals and retail rely heavily on reusable packaging. Growing state-and federal-level regulations push companies to minimizes single-use plastics and embrace circular economy models. North American consumers are increasingly conscious of sustainability.

U.S. Reusable Packaging Market Trends

U.S. reusable packaging market is U.S. corporations are under growing pressure to meet environmental, governance (ESG) targets, and social targets. Initiatives such as the U.S. Plastics Pact and local zero-waste goals accelerate adoption. U.S. corporations are under growing pressure to meet Environmental, Social, and Governance (ESG) targets. The U.S. has a well-developed network of reusable packaging pool operators (e.g., CHEP USA, IFCO Systems, Tosca). Companies in the U.S. are heavily focused on operational efficiency and cost reduction. The U.S. has a vibrant ecosystem of startups innovating in reusable packaging systems.

Asia Pacific region is anticipated to grow at the fastest rate in the reusable packaging market during the forecast period. Countries like China, India, Vietnam, and Indonesia are manufacturing powerhouses. Massive growth of online shopping in India (Flipkart, Amazon India), China (Alibaba, JD.com), and Southeast Asia. Asia Pacific has lower manufacturing costs for producing reusable packaging materials and components. Policies in countries like China (plastic ban & circular economy targets) and India (single-use plastic ban) strongly promote reusable packaging adoption. Regional frameworks like ASEAN sustainability initiatives also play a role. Asia Pacific is home to major automotive (China, Japan, South Korea) and electronics (China, Taiwan, South Korea) industries. Cities like Singapore, Shanghai, and Tokyo are piloting reusable packaging solutions in public and private sectors. Multinational corporations operating in Asia Pacific region (Unilever, Nestlé, Coca-Cola) are implementing global sustainability goals locally.

India Reusable Packaging Market Trends

India reusable packaging market is growing due to government pressure to reduce plastic usage. Nationwide ban on single-use plastics (phased out from 2022 onwards) is a big catalyst. The Swachh Bharat (Clean India) Mission promotes sustainable waste management. Shift towards Extended Producer Responsibility (EPR) regulations, making companies responsible for the lifecycle of packaging. Massive surge in e-commerce players like Amazon India, Flipkart, Reliance Retail. India is becoming a manufacturing hub for electronics, automobiles, and pharmaceuticals.

Europe region is seen to grow at a notable rate in the foreseeable future. European Green Deal and Circular Economy Action Plan aggressively promote reuse and recycling. Strict regulations on single-use plastics — banned across EU since 2021. European consumers are highly eco-conscious and willing to pay a premium for sustainable packaging. Established companies like IFCO, CHEP Europe, Euro Pool System enable efficient pooling and circulation of reusable pallets, crates, and containers. Big European retailers (Tesco, Carrefour, Aldi) and food distributors utilize reusable packaging extensively. Many European countries offer financial incentives for businesses adopting reusable packaging systems.

By Material

By Product Type

By End-Use

By Region

April 2025

April 2025

April 2025

April 2025