April 2025

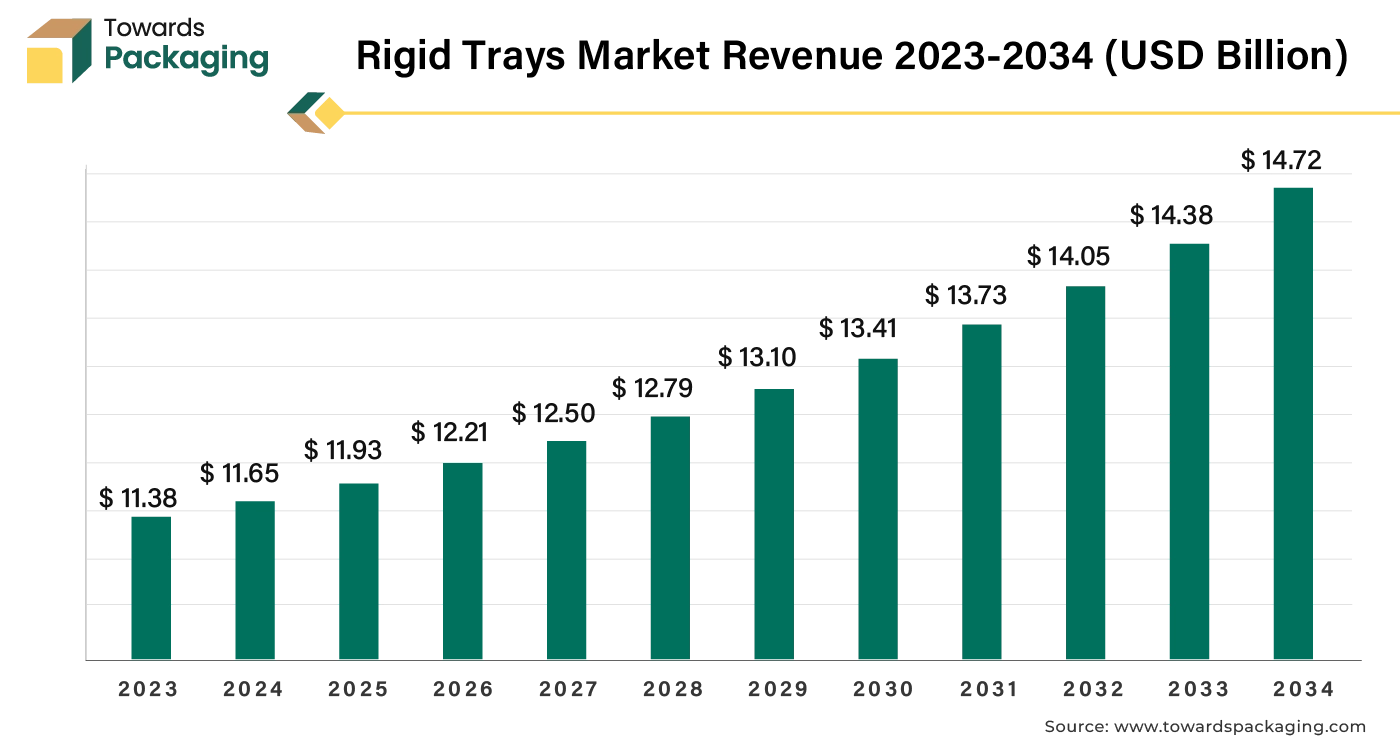

The rigid tray market size is predicted to expand from USD 11.93 billion in 2025 to USD 14.72 billion by 2034, growing at a CAGR of 2.37% during the forecast period from 2025 to 2034.

Rigid trays are extensively utilized in retail for products displays and in the consumer goods sector for organizing and shipping products. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing rigid tray which is estimated to drive the global rigid tray market over the forecast period.

One kind of packaging that is robust, unyielding, and holds its shape even when empty is called rigid tray packaging. For a variety of products, its structural strength and longevity offer strong protection and preservation throughout their existence. Materials that are naturally rigid, including glass, metal, and some plastics like polyethylene terephthalate (PET) and High-Density Polyethylene (HDPE), are used to make rigid packaging. This type of packaging is extensively employed in many different industries to present and safeguard a wide variety of products while maintaining structural integrity all the way through the supply chain. It works especially well for products that need extra protection, like electronics, high-end consumer goods, fragile goods, and medications.

Rigid packaging provides a more substantial and secure containment for products than flexible packaging, which consists of materials like bags and pouches. In general, rigid packing materials have the following qualities: Glass: It can maintain the purity of its contents and has inert properties. finds a market niche for unique goods and high-end beverages. Metal: its durability and impermeability make it perfect for a range of foods, guaranteeing an extended shelf life.

Artificial Intelligence (AI) driven counterfeit tools can predict how different designs and materials will perform under various conditions, leading to more efficient and effective tray designs. AI algorithms has ability to generate incredibly and innovative designs based on specific parameters, optimizing for factors like strength, material usage, and weight. AI is able to monitor machinery and tell in advance potential failures before they occur, minimizing downtime and reducing maintenance costs. AI can utilize data-driven approaches to create optimized tray designs.

It can simulate various stress and load scenarios to refine tray structures for better performance, durability, and cost-effectiveness. AI-powered robotics and automation can streamline the manufacturing process, improving precision and reducing manual labor. This leads to higher production rates and lower error rates. AI systems can monitor equipment in real-time, predicting failures before they occur. This minimizes downtime and maintenance costs by addressing issues proactively.

AI-driven inspection systems can detect defects and inconsistencies during production more accurately than human inspectors. This ensures higher product quality and reduces waste. AI can forecast demand and optimize inventory levels, ensuring that production aligns with market needs. This helps in managing supply chain disruptions and reducing holding costs. AI can analyze customer data to provide insights for creating customized trays that meet specific needs, improving customer satisfaction and expanding market reach.

AI algorithms can analyze production data to identify inefficiencies and suggest improvements, leading to better resource utilization and cost savings. By integrating AI, the rigid tray industry can achieve improved operational efficiency, better quality control, and enhanced customer satisfaction.

There growing emphasis on sustainable packaging solutions. Many rigid trays recyclable or biodegradable materials to meet environmental regulations and consumer preferences. The key players operating in the market are focused on innovating and launching new sustainable rigid tray to meet the rising demand in the rigid tray market.

For instance,

The key players operating in the market are facing challenge due to high cost of raw material due to expensive aspects of procuring a raw material and expensive costs associated with shipping/transportation can significantly affect the cost of raw materials as well. The cost of producing rigid trays, especially those made from advanced or specialized materials, can be high, impacting their overall affordability and market competitiveness. This affects the rigid tray overall pricing and competitiveness in the market.

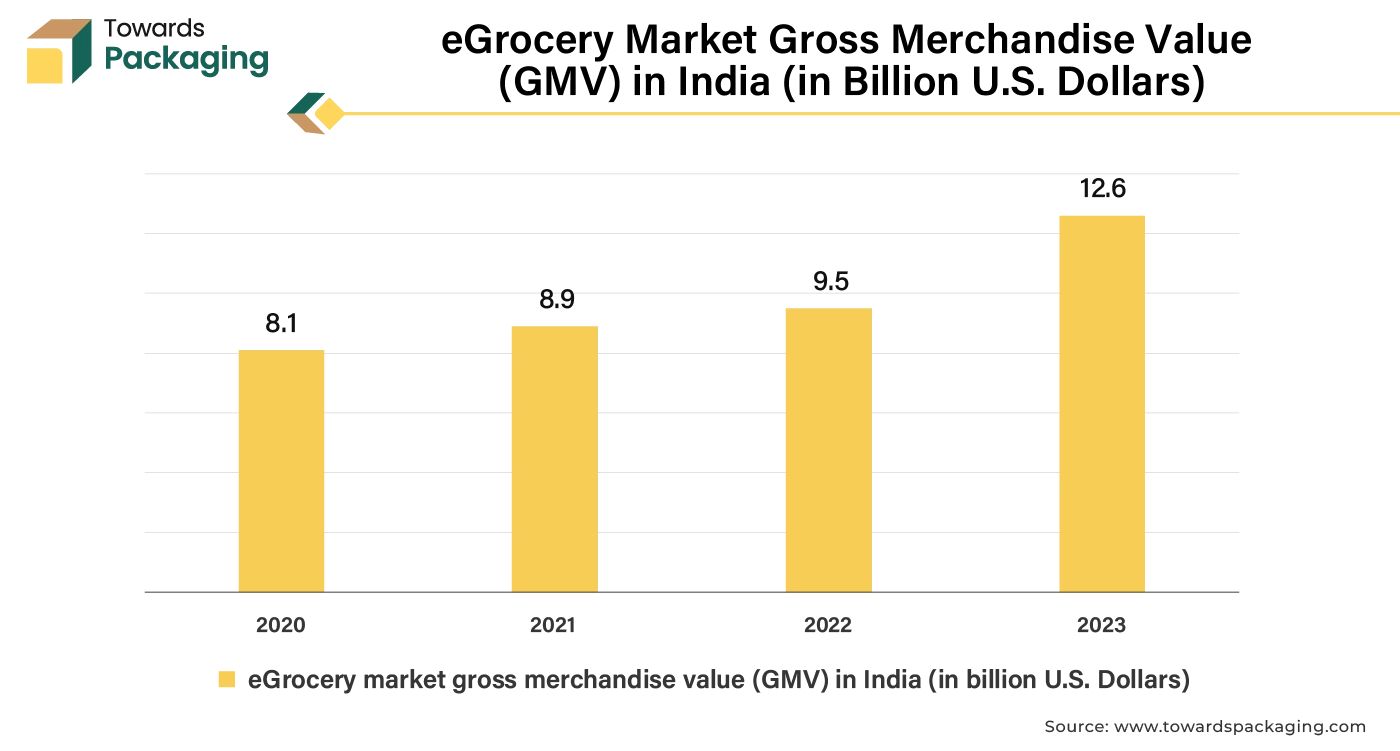

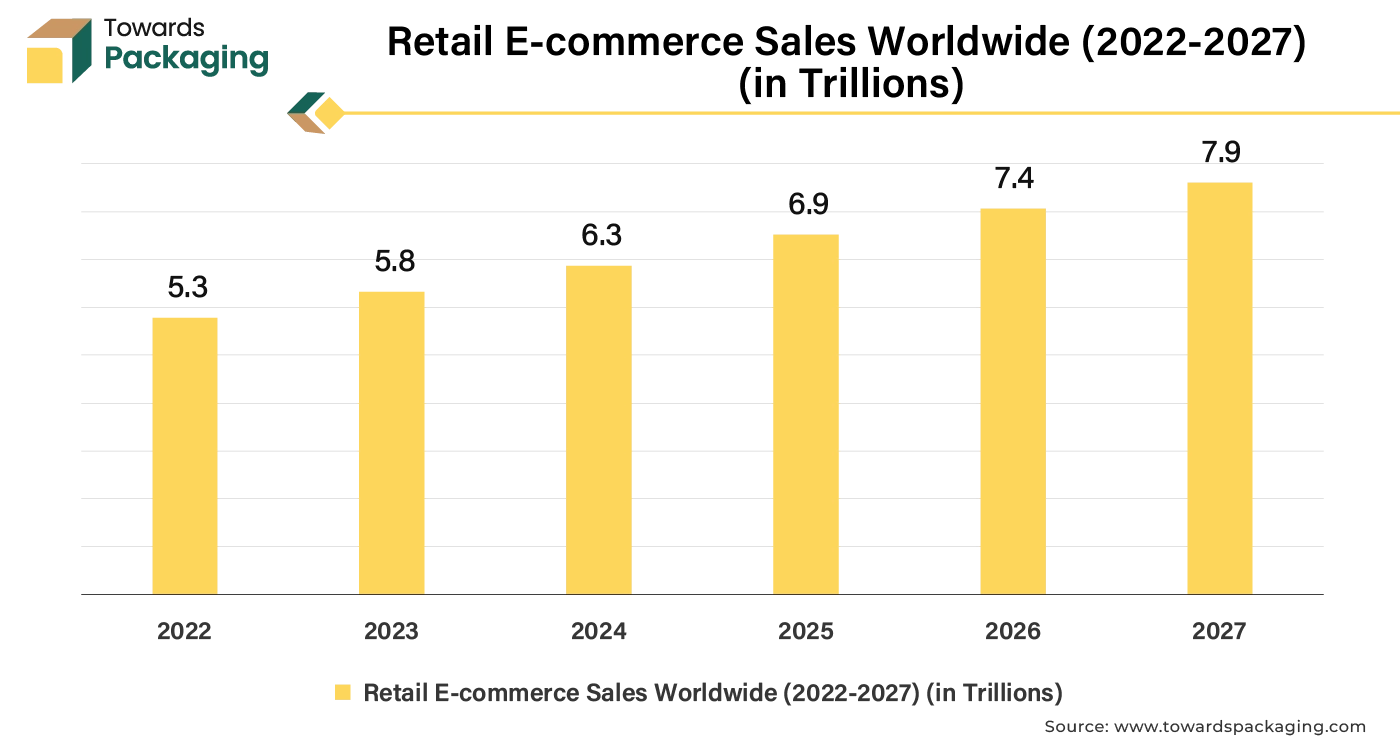

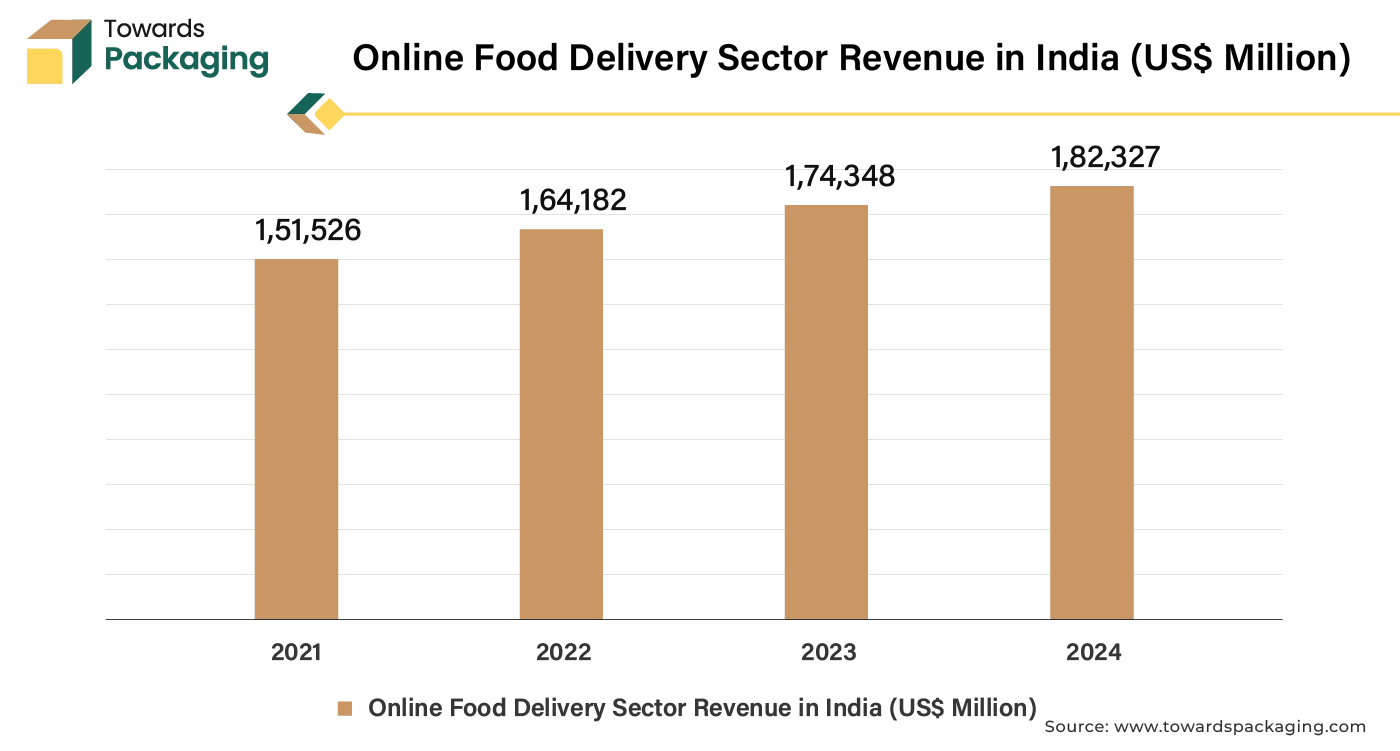

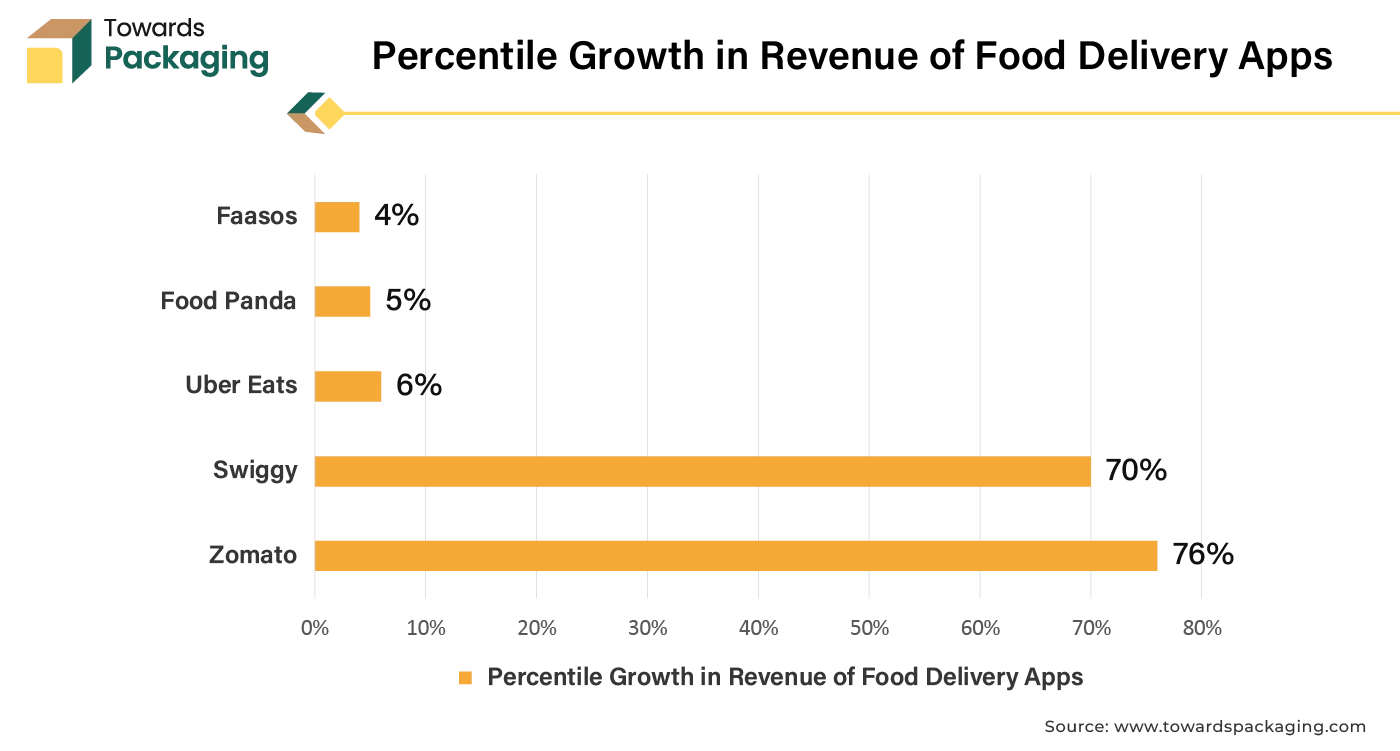

The E-commerce sector is flourishing and extending its sales worldwide. The online food ordering apps, shopping apps, grocery apps, etc. constantly have the demand of the rigid tray for packaging purpose. The online grocery apps are in high demand due to busy life style and requires rigid tray for premium and hygienic packaging of fruits and vegetables. Expanding economies and rising consumer markets in developing regions presents opportunities for expanding the use of rigid trays, particularly in sectors like food and beverages, pharmaceuticals, and electronics. The rise of e-commerce increases demand for robust and protective packaging solutions. Rigid trays that offer superior protection during transit can capture a significant share of this growing market.

The single-cavity rigid tray segment held the dominating share of the rigid tray market in 2024. The ease of use and variety of single-cavity rigid trays makes them ideal. Single-cavity rigid tray packaging is perfect for a variety of products because they are also simpler to make and provide an easy way to package individual items. In addition, there is an overwhelming demand for these trays since, in comparison to multiple cavity trays, they offer superior protection for larger or more fragile products.

Tools and component usage in the industrial world is being accelerated by the necessity for effective and safe packaging. As single-cavity has sturdy design, they are less likely to break or lose items when being transported and stored. The key players operating in the market are focused on developing and launching new single cavity rigid tray in the rigid tray market which is estimated to drive the growth of the segment over the forecast period.

For instance,

The plastic segment held the dominating share of the rigid tray market in 2024. Plastic rigid tray packaging is sturdy, non-flexible plastic trays has ability to hold and transport products. These trays are commonly manufactured from materials like Polystyrene (PS), polyethylene terephthalate (PET), or polypropylene(PP). Rigid plastic trays are strong and sturdy in nature as well as resistant to impact, making them ideal for protecting products during transportation and handling. Many rigid plastic trays can be cleaned and can be reused multiple times, making them a sustainable option compared to single-use packaging. They can be molded into various shapes and sizes to fit specific product requirements, offering a tailored packaging solutions.

Transparent or clear plastic trays allows for easy visibility of the products inside, enhancing presentation and helping with inventory management. Overall, rigid plastic trays offer the combination of strength, versatility, and cost-efficiency, making them a popular choice for various industries. The key players operating in the market are focused on innovating the new plastic rigid tray packaging to meet the rising demand from the consumers, which is estimated to drive the growth of the segment over the forecast period.

For instance,

Aluminium segment is estimated to grow at fastest rate in the rigid tray market. The aluminium rigid tray are widely utilized in food and ice-industry to store ice cream in refrigerator, which assists in preserving freshness and extending shelf life. Aluminium trays are durable, lightweight and recyclable, making them an attractive option for both convenience and environmental sustainability. The aluminium trays are commonly utilized for baking, roasting, and ready-to-eat meals. In these sectors, aluminium trays are utilized for packaging sterile products and samples.

They are also utilized for packaging non-food items like cosmetics and electronics. With increasing emphasis on reducing environmental impact, the recyclability of aluminum trays is a significant selling point. Many companies are investing in improving the recyclability of their products. The key players operating in the market are focused on launching innovative aluminium tray for medical use which is estimated to drive the segment over the forecast period.

For instance,

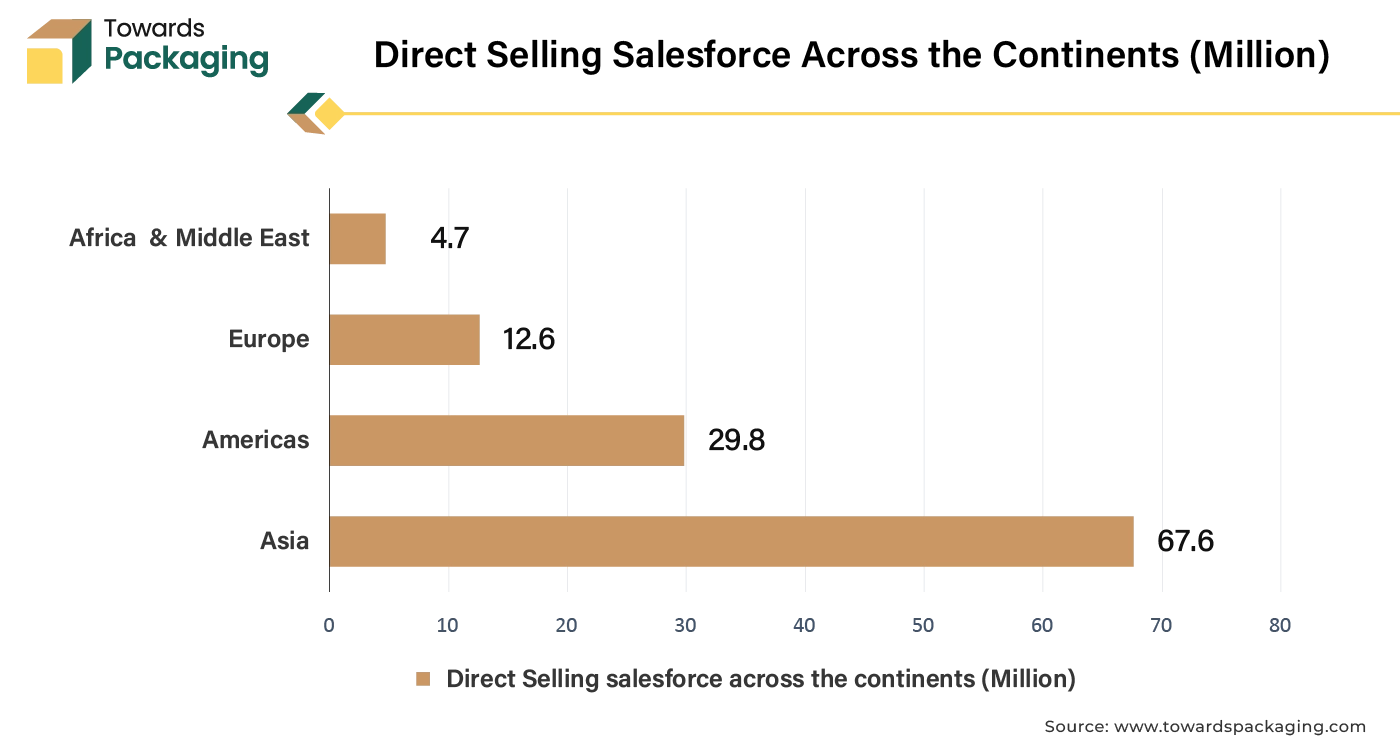

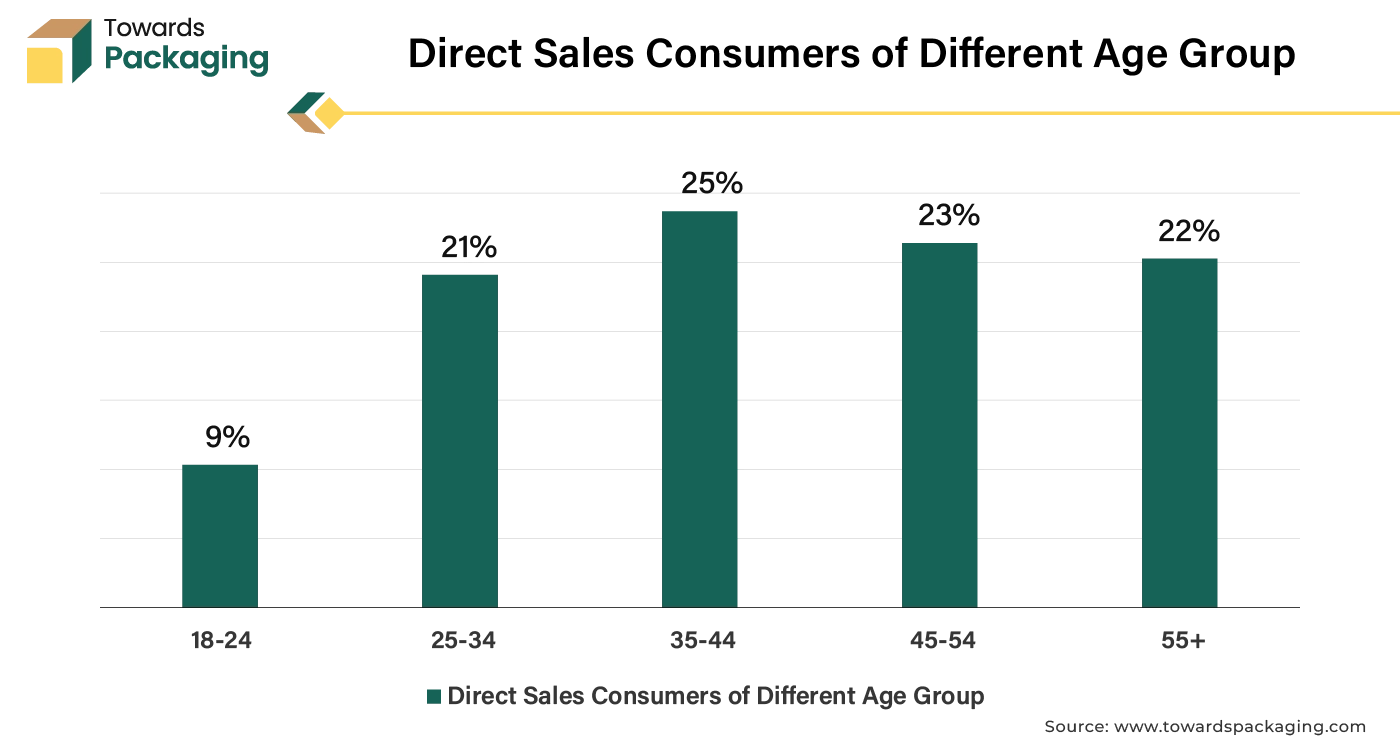

The direct sales segment held the dominating share of the rigid tray market in 2024. The direct sales channel allows the industries to provide tailored solutions and customized products to meet specific customer needs. Direct interaction with customers offer valuable insights into market trends and customer preferences. The customers are able to feel the material of product in person and can make the purchase easier.

The E-retail platforms segment is estimated to grow at fastest rate over the forecast period. The busy-life style and changing trend of the consumers is supporting the E-retail platform growth.

The commercial segment held the notable share of the rigid tray market in 2024. In the last several years, rigid trays have made a successful transition from their original use in the packaging and transportation of goods to their more beautiful and secure display in the commercial sector. Other major forces behind their acceptance include food packaging for prepared meals, pharmaceuticals for the safe transportation of medical devices, and electronics for the protection of devices during shipping. Since rigid trays are strong, protective, and adaptable, they are also being utilized more frequently in the business world. Strong packaging to minimize damage during shipping, strict safety regulations, and the development in online meal delivery are driving industries' demand. Increasing launch of new medical devices is estimated to drive the growth of the commercial segment in the rigid tray market.

For instance,

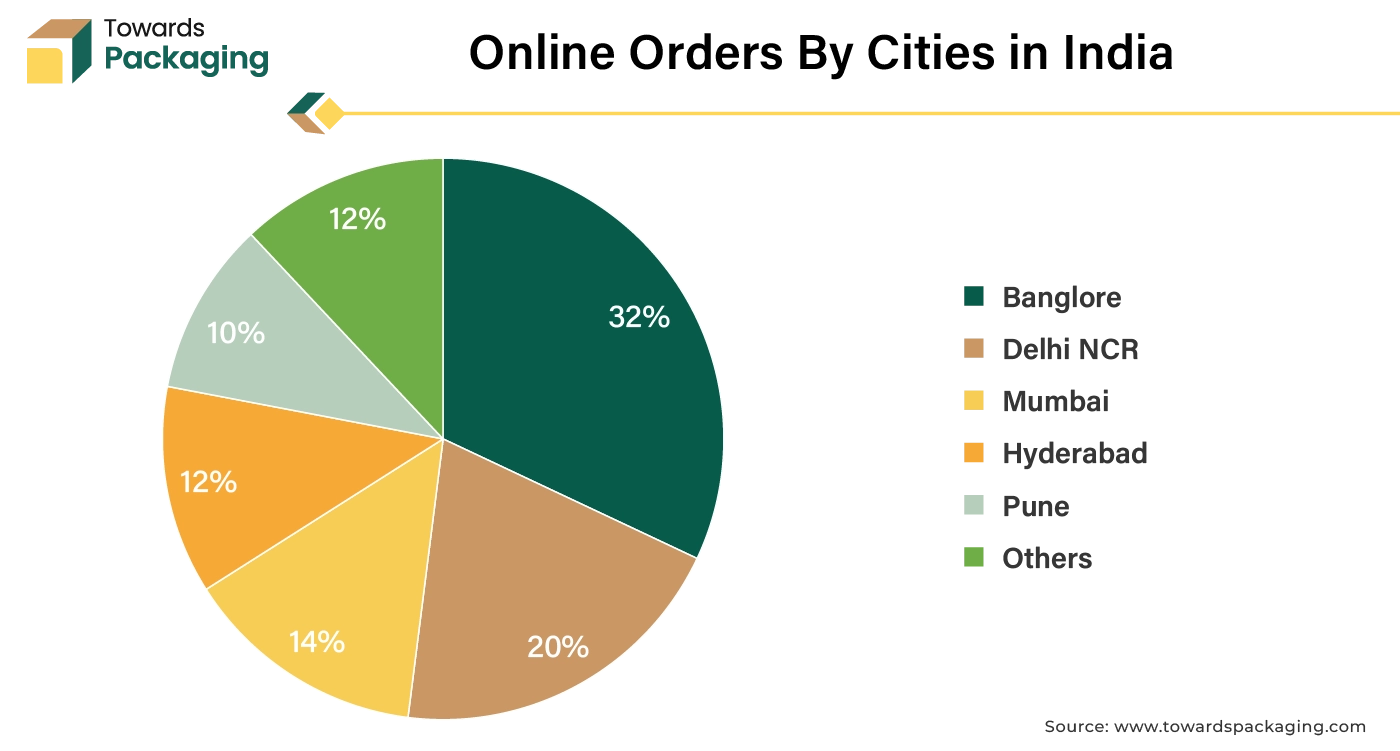

The Asia Pacific region witnessed the highest market share for the year 2024. Rapid economic development and industrialization in countries like China, India, and Southeast Asian nations are increasing the demand for various packaged goods, boosting the need for rigid trays. Rapid urbanization is leading to higher demand for packaged products in cities, driving the need for efficient and attractive packaging solutions. The growth of e-commerce in the region is driving demand for effective packaging solutions. Rigid trays provide durability and protection for products during shipping and handling. Due to the busy life style people in Asia Pacific are preferring ordering food online which has risen the demand for the rigid tray for packaging food.

The Europe region is estimated to grow at fastest rate over the forecast period. Europe has a well-established and advanced packaging industry, which drives the demand for high-quality rigid trays used across various sectors, including food and beverages, pharmaceuticals, and electronics. Strict European regulations on packaging safety and quality standards push companies to use reliable and compliant packaging solutions, such as rigid trays, to meet these requirements. There is a significant emphasis on sustainability in Europe, with many businesses and consumers favoring eco-friendly packaging solutions. The rigid tray market is responding with products made from recyclable or biodegradable materials.

European consumers increasingly value high-quality and aesthetically pleasing packaging. Rigid trays offer a premium look and feel, enhancing product presentation and brand appeal. Innovations in materials and manufacturing processes have led to the development of advanced rigid trays that offer better performance and functionality, attracting more users. The key players operating the market are focused on adopting inorganic growth strategies like collaboration to develop innovative sustainable rigid tray packaging solution for food industry, which is estimated to drive the growth of the rigid tray market in Europe in the near future.

Rigid Tray Market Projected CAGR for Key Countries from 2024 to 2034 |

|

| Countries | Value CAGR (2024 to 2034) |

| Canada | 0.45% |

| United States | 0.73% |

| Germany | 0.55% |

| India | 5.2% |

| Thailand | 4.5% |

| South Korea | 2.85% |

| China | 4.8% |

| United Kingdom | 0.95% |

For instance,

NEWERTM technology, developed in Versalis' research laboratories in Mantua and industrialized in Forever Plast's facilities in Lograto (Brescia) under a co-development agreement between Versalis and Forever Plast, is responsible for the production of REFENCETM. Purification of recovered polymers in accordance with EU Regulation 1616/2022 on recycling is made possible by NEWER technology. Additionally, the US Food and Drug Administration (FDA) Non-Objection Letter (NOL) was received by the technique.

Sonoco Products Company is going to be the world's top producer of aerosol packaging and rigid tray food packaging. The transaction makes it easier for Sonoco Products Company to collaborate with clients and take the lead in innovation and sustainability.

Both the metals division of Sonoco Products Company and Eviosys have significant commercial momentum. Producing food cans and ends, aerosol cans, metal closures, and promotional packaging to preserve the goods of hundreds of consumer brands, Eviosys is a top global supplier of metal packaging. With almost 6,300 workers spread across 44 manufacturing locations in 17 countries, Eviosys has the biggest footprint in the EMEA region for the production of metal food cans. Sonoco projects that Eviosys will generate roughly $2.5 billion in revenue and $430 million in adjusted EBITDA in 2024.

Eviosys has grown EBITDA by over 50% since 2021 and has significant operational and commercial momentum. Sonoco Products Company anticipates that the combination of Eviosys with Sonoco's complementary metal can business will result in synergies exceeding $100 million.

By Product

By Material

By Sales Channel

By End-user

By Region

April 2025

April 2025

March 2025

March 2025