April 2025

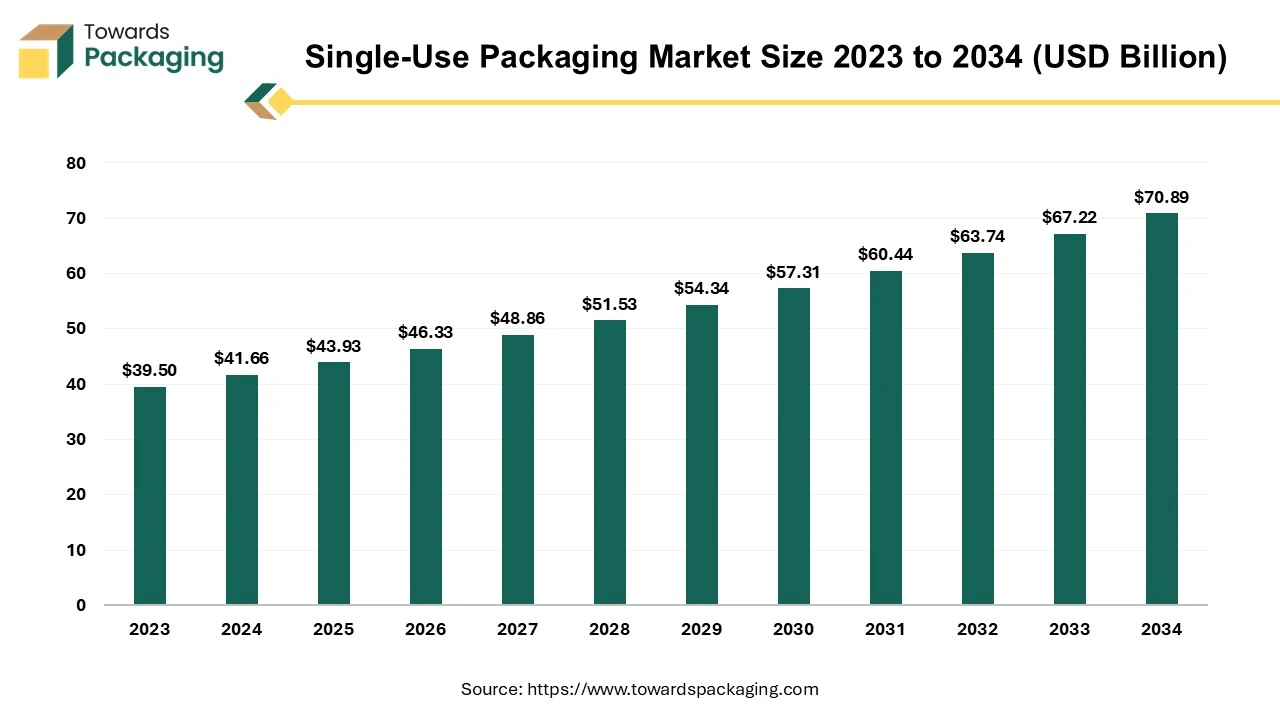

The single-use packaging market is projected to reach USD 70.89 billion by 2034, growing from USD 43.93 billion in 2025, at a CAGR of 5.46% during the forecast period from 2025 to 2034.

Single-use packaging refers to materials and products designed for one-time use. These packaging solutions are crafted to offer the enclosed products convenience, safety, and protection. They find common usage in industries where maintaining product hygiene, ensuring freshness, and implementing tamper-proof measures are critical.

Single-use packaging is crucial in healthcare because it ensures product sterility and prevents cross-contamination. Disposable syringes, vials, surgical gloves, and sterile bandages are packaged in single-use materials to maintain hygiene requirements and to avoid infection risk. The single-use packaging market is marked by continuous innovation and developments to improve functionality, sustainability, and cost-effectiveness. Manufacturers always explore novel materials, technologies, and designs to suit consumer demands for convenience, safety, and environmental responsibility.

The single-use packaging business offers a severe environmental concern due to the extensive use and poor recycling of disposable plastics. Alarming figures show that 90% of thrown plastic is not recycled, worsening environmental degradation. Even things labelled as recyclable may be considered single-use if they are intended to be discarded after only one usage. This category includes a wide range of plastic products designed for single use, such as plastic bags, coffee stirrers, straws, water bottles, soda bottles, and a significant amount of food packaging. While the simplicity of these things encourages widespread use, they also contribute significantly to the growing plastic waste crisis. Approximately half of global plastic consumption is made up of single-use plastics, which exacerbates the problems related to plastic pollution. Single-use plastics account for over 130 million tonnes of global plastic production, emitting over 225 million tonnes of greenhouse gases (GHGs) during extraction and processing.

The widespread use of single-use packaging has sparked worries about its environmental impact, notably plastic pollution and trash generation. As a result, there is an increasing interest in developing sustainable alternatives, such as biodegradable, compostable, and recyclable packaging materials, to address these issues and foster a circular economy.

Single-use packaging, a direct response to the fast-paced urban lifestyle, is experiencing a surge in demand. The rise of online food delivery services, specifically designed to cater to our convenience needs, has significantly amplified this demand. Celebrating its robustness, adaptability, affordability, and transparency, single-use packaging has become a popular choice across various industries. Shifting consumer purchasing habits and a preference for flexible, cost-effective, and user-friendly packaging are driving the single-use packaging market. Single-use food packaging plays a vital role in preventing foodborne diseases, effectively eliminating the risk of contamination and disease transmission. Single-use products are a common sight at fast-food restaurants, takeaway restaurants, and catering facilities, with items such as drinking cups, lids, straws, and bottles made of paper and plastic.

The growth of e-commerce in developing nations such as China and India is predicted to increase demand for throwaway packaging. The market for single-use packaging is influenced by lifestyle changes and the expansion of numerous industries, such as food and drinks, home care, healthcare, and personal care, which is driven by the growth of e-commerce.

The escalating usage of plastic materials has sparked severe environmental concerns, compelling governments and regulatory groups to take action. Some countries, like India, have taken a firm stand by banning the production, import, and use of single-use products with a high littering potential. This includes plastic cutlery, plates, cups, straws, and packaging films of a certain thickness. Some regions rely significantly on food and energy imports and are susceptible to economic shocks. The battle has resulted in higher raw material and energy prices, affecting the profitability of enterprises along the supply chain, including the packaging industry.

In April 2022, Diageo launched a new relationship with ecoSPIRITS, a technology business that creates circular packaging solutions for the luxury spirits and wine industries. Diageo aims to minimize its carbon footprint and waste from single-use spirits packages.

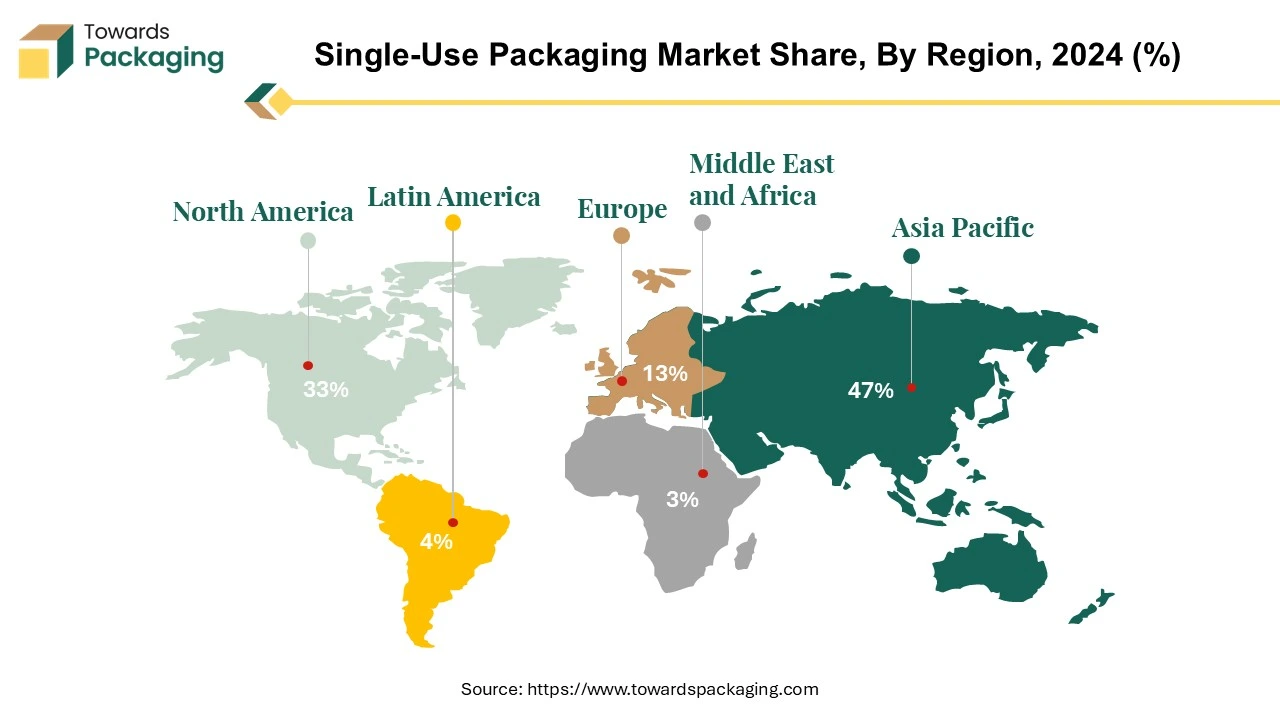

The North American single-use packaging firm is positioned for expansion, driven by the desire for smaller, more convenient packaging and eye-catching visual appeal. Bags, straws, trays, boxes, plates, coffee stirrers, bottles, and most food packaging are examples of single-use packaging intended for use just once before being discarded or recycled. The single-use packaging industry in the region, especially in the US and Canada, is growing steadily. Single-use packaging is prevalent in these countries because they are affordable and versatile and may be used in various end industries. The pharmaceutical industry in the US is mainly responsible for the rise in single-use packaging, especially in the case of medications and medical supplies, where plastic packaging lowers the possibility of contamination.

The beverage packaging market, especially for single-use formats, is expected to expand due to the growing demand for bottled beverages, soft drinks, alcoholic beverages, ready-to-drink beverages, and milk. Key drivers for market growth include the surge in e-commerce and online food delivery services, where disposable packaging offers convenience and efficiency. Despite environmental concerns, the lightweight and resilient properties of disposable packaging continue to make it a popular choice.

The conflict between Russia and Ukraine has complicated the supply chain by limiting food shipments from the area and increasing commodity prices. This has affected supply chain profit margins, especially with the growing cost of packing materials. Despite these obstacles, the single-use packaging market in North America is still dynamic and can adjust to changing customer demands and market conditions.

Single-use plastic bags are widely used around the globe. The environmental impact of single-use plastic bags, or SUPBs, has been a topic of discussion and consumption worldwide. While alternatives like cotton and paper bags are frequently seen as more ecologically friendly, they have their environmental impact. They might only sometimes be more environmentally friendly than plastic bags in all categories.

For plastic bags, the same climatic consequences as an SUPB require using thick, durable polypropylene (PP) bags roughly 10–20 times and slimmer, yet still reusable, polyethene (PE) bags 5–10 times. This emphasises the significance of the bags' longevity and the requirement that users deliberately reuse each bag several times.

Comparing single-use polyethene bags made from renewable resources to conventional SUPBs reveals that the former performs better environmentally regarding climate impact. They still provide problems with littering, though, and they'll make the environment more eutrophic and acidic. This analysis draws attention to the intricate trade-offs that must be made when weighing the environmental effects of different bag options. While reducing the usage of single-use plastic bags is essential, it's also important to consider the ecological impact of alternative materials and their whole life cycle. Reusable bag adoption and responsible consumer behaviour are two examples of sustainable activities that reduce shopping bags' adverse environmental effects.

Single-use packaging is standard in supermarkets and retail locations, offering a low-cost alternative that effectively performs critical functions in food packaging. Its primary function is to protect food goods by preventing damage and ensuring their safety before consumption. Beyond safety, packaging is essential for capturing consumer attention, transmitting information, and creating brand identity-notably, packaging accounts for 31% of overall plastic use.

Starbucks, originating with its first store outside North America, has evolved over the decades to become the largest coffee chain globally. As of 2023, Starbucks boasts a network of over 35,000 stores across approximately 80 countries worldwide. The following table shows the number of Starbucks locations globally:

| Number of Starbucks Stores by Continent 2023 | ||

| Continent | Number of Stores | Percentage (%) Share of Total Starbucks Stores Worldwide (35,711) |

| Asia | 12,728 | 35.64% |

| Africa | 130 | 0.36% |

| North America | 18,931 | 53.01% |

| South America | 436 | 1.22% |

| Europe | 2,554 | 7.15% |

| Antarctica | 0 | N/A |

| Oceania | 81 | 0.23% |

Bags play a significant role in the food and beverage industry, particularly with the increasing prevalence of on-the-go eating. Packaging is essential in facilitating the convenient consumption of food. The trends of home delivery and takeaway food have experienced rapid growth, making plastic bags a crucial element for restaurants, cafes, and food service chains. These bags are instrumental in providing customers with the convenience of receiving their food orders.

Most plastic packaging is single-use, making up 40% of worldwide plastic waste. The reliance on single-use plastic formats in food packing and the persistence of plastics in the environment highlights plastic pollution's far-reaching and little-understood effects on ecosystems and human health.

The environmental repercussions of plastic pollution highlight the importance of finding alternatives to single-use packaging. As people become more aware of the negative consequences of single-use packaging, there is a growing demand for sustainable and eco-friendly options to help the environment. The continual search for feasible alternatives reflects a more significant commitment to transforming the food industry's packaging into something more sustainable and responsible.

| Country | More concerned (2020) | Same level of concern (2020) | Less concerned (2020) | More concerned (2023) | Same level of concern (2023) | Less concerned (2023) | Change in respondents (percentage points) |

| US | 71 | 22 | 7 | 37 | 42 | 21 | -34 |

| UK | 61 | 36 | 3 | 33 | 50 | 20 | -31 |

| Germany | 37 | 50 | 14 | 28 | 57 | 15 | -9 |

| France | 54 | 39 | 7 | 43 | 41 | 16 | -12 |

| Italy | 67 | 29 | 4 | 31 | 41 | 28 | -35 |

| Brazil | 90 | 9 | 1 | 60 | 29 | 11 | -30 |

| India | 94 | 4 | 2 | 56 | 24 | 20 | -38 |

| China | 62 | 20 | 17 | 26 | 40 | 34 | -36 |

| Japan | 54 | 44 | 2 | 33 | 51 | 16 | -21 |

The chart displays the results of a survey or study on consumers' perceptions of hygiene and food safety in packaging compared to before the COVID-19 pandemic. The table shows the responses of consumers from various countries, including the US, UK, Germany, France, Italy, Brazil, India, China, and Japan.

The table suggests that in most countries, the percentage of respondents who were more concerned about hygiene and food safety in packaging decreased between 2020 and 2023, while the percentage of respondents who were less concerned increased. This could indicate that consumers' perceptions of hygiene and food safety in packaging have changed over time, possibly due to the COVID-19 pandemic.

The competitive landscape of the single-use packaging market is characterized by established industry leaders such as Pactiv LLC, Sealed Air Corporation, Coveris S.A, Winpak Limited, Bemis Company Inc., Novolex, Hotpack Packaging Industries LLC, Ukrplastic, Ampac Holding and Transcontinental Inc. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences. Additionally, the sector sees dynamic collaborations, acquisitions, and strategic partnerships as companies strive to capture market share in this highly competitive and evolving industry.

Sealed Air develops packaging solutions for various industries, including food and beverage, healthcare, e-commerce, and industrial applications. One of its significant achievements is the development of materials and technology targeted at improving the sustainability and environmental impact of single-use packaging.

Winpak's experience with flexible packaging is exciting in the context of single-use packaging. Flexible packaging, such as pouches, bags, and films, is famous for single-use applications due to its lightweight design, convenience, and cost-effectiveness.

Bemis focuses on innovation and collaboration to solve developing trends and issues in the single-use packaging industry. Through collaborations with customers, suppliers, and industry stakeholders, the firm strives to improve the performance, functionality, and sustainability of its packaging solutions.

By Material

By Type

By Region

April 2025

April 2025

April 2025

April 2025