April 2025

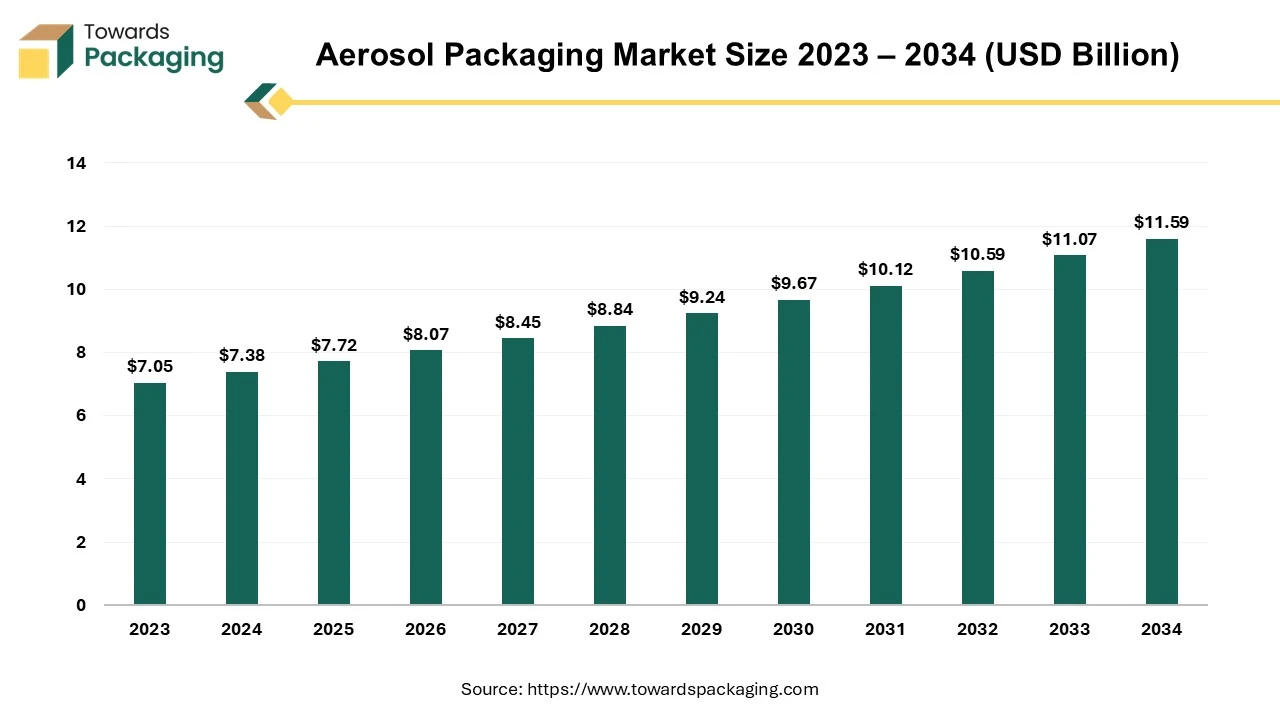

The aerosol packaging market is predicted to expand from USD 7.72 billion in 2025 to USD 11.59 billion by 2034, growing at a CAGR of 4.62% during the forecast period from 2025 to 2034.

Aerosol packing is a way of packaging products in containers that use fuel to discharge the contents in the form of a slight mist, foam, or spray. Aerosol packaging, invented by an American chemist in 1941, has become common in various industries, including food, medicines, cosmetics, and household cleaning. It provides consumers with quick answers for everyday chores, such as styling hair with hairspray and disinfecting surfaces with cleaning goods. These items are distributed from aluminium cylinders or cans, which function similarly to bottles but release contents as a mist or foam spray when a spray button or valve is pressed. The container's design incorporates a dip tube that extends to the product and mixes it with a vaporized fuel during release, ensuring that only the desired ingredient is disseminated.

The aerosol packaging market is a thriving sector of the packaging industry, enabling the manufacture and distribution of containers for a wide range of consumer and industrial products. Aerosol packaging uses propellants to efficiently spread liquid or particle substances, benefiting various industries such as personal care, home products, automotive, and healthcare.

This market is driven by aerosol delivery systems' ease and effectiveness and their ability to maintain product quality and extend shelf life. Packaging technology developments have brought eco-friendly propellants and sustainable materials, hence resolving environmental issues. Despite regulatory limits and ecological concerns, market expansion continues due to shifting consumer tastes and economic trends. Companies are innovating to suit consumer demands, influencing the aerosol packaging market, and promoting cross-industry cooperation for future progress.

For Instance,

North America dominates the aerosol packaging industry, accounting for most of the market share. Aerosol package deliveries have increased significantly across the area, with North America seeing an 11% increase and South America following closely with a 6% rise.

The aerosol packaging market includes manufacturing and selling containers designed to discharge aerosol goods such as sprays, foams, and mist. These containers are often made of aluminium or steel and are used in various industries, such as personal care, household products, automotive, and healthcare.

The region's strong customer base, technological improvements in packaging materials and design, and broad acceptance of aerosol-based products all contribute to the growth of the North American aerosol packaging industry. Growing urbanization and shifting lifestyles have increased the demand for easy and effective packaging solutions.

South America has substantial growth potential in the aerosol packaging industry, owing to similar factors such as increased disposable incomes, urbanization, and customer preferences for aerosol-based products. The Americas is an essential region in the worldwide aerosol packaging industry, with strong growth and ongoing innovation to satisfy the changing needs of consumers and enterprises.

For Instance,

Europe emerges as the fastest-growing region in the aerosol packaging market. In 2022, the continent's overall unit production remained unchanged at 5.3 billion aerosol items. The United Kingdom, Germany, and France jointly account for over 55% of Europe's yearly aerosol output across all categories. Italy, the Netherlands, and Spain are scheduled to manufacture more than 4.0 billion aerosol dispensers in the same year.

The United Kingdom dominates aerosol manufacturing in Europe, with Germany coming in second. Several factors contribute to the growth of the European aerosol packaging market. First and foremost, there is a significant demand for aerosol products in various industries, including personal care, household goods, automotive, and healthcare. Second, technological developments in packaging materials and production methods have increased efficiency and sustainability, driving market growth. Changing customer preferences for convenient and innovative packaging options has increased regional demand.

The United Kingdom, Germany, France, Italy, the Netherlands, and Spain are all significant players in the European aerosol packaging business, using their manufacturing capabilities and strategic location to suit the changing demands of both domestic and international markets. The United Kingdom and Germany are the biggest contributors to aerosol production, accounting for the largest market share. Europe is a thriving hub for aerosol packaging innovation and production, propelling the sector ahead through its growth and vitality.

For Instance,

Aluminium is the dominant material in aerosol packaging, providing robust protection for various products. While Peli molded watertight cases and custom-built flight cases are famous for protective cases, aluminum containers also serve an important role, albeit less well-known. The industry remains committed to sustainability, as indicated by the growing demand for aluminum cans with high percentages of post-consumer recycled materials.

The supply of high-quality aluminum scrap, critical for complicated aerosol can production, must be improved worldwide. Furthermore, achieving a uniform recycling design is essential to facilitating the efficient and safe reintroducing of aluminum aerosol cans into the recycling process while reducing material input and packaging complexity.

Aluminum bottles are widely used in the premium beverage and spirits markets for packaging chemicals, fragrances, flavors, and essential oils. Despite this, 2.9 billion units, or 3.9% fewer, were shipped globally by member businesses, according to the International Organization of Aluminum Aerosol Container Manufacturers (AEROBAL). The most common materials used for aerosol containers are steel and aluminum, with glass and plastic containers coming in second. Interestingly, more than 75% of European manufacturing in the aerosol packaging sector is accounted for by cosmetics and home goods.

For Instance,

Aerosol cans are a rapidly growing component of the aerosol packaging business, with manufacturing topping five billion units annually in Europe alone. The aerosol cans sector is expected to grow by 3% worldwide between 2022 and 2026. These cans, made of aluminum or steel (tinplate), serve a wide range of purposes in a variety of industries, including beauty and personal care (e.g., hair sprays, deodorants, shaving creams), food (e.g., whipped cream, dairy products), household goods, and paints and coatings. The International Organisation of Aluminium Aerosol Container Manufacturers (AEROBAL) has reported a significant increase in global deliveries of aluminum aerosol cans, with a 6.6% increase in the first half of 2023. This increase totals over 3.2 billion units, demonstrating the strong demand and broad use of aluminum aerosol cans worldwide.

The dramatic increase in aerosol can production reflects the growing reliance on aerosol packaging solutions in various industries. Factors fueling this increase include aerosol cans' convenience, efficiency, and adaptability, as well as advances in production techniques and materials. As demand rises, particularly in emerging economies, the aerosol packaging sector is positioned for significant growth and innovation in the years ahead.

For Instance,

The aerosol packaging market's personal care section includes various goods tailored to meet individual grooming and hygiene demands. This industry makes substantial use of aerosol packaging for products such as deodorants, hairsprays, shaving creams, and body sprays. Aerosol containers make it easy to dispense these solutions, allowing for precise application and consistent coverage. The personal care industry is known for perpetual innovation, with manufacturers always offering new formulations, smells, and packaging designs to satisfy changing customer preferences and trends.

Aerosol containers are predominantly built of steel and aluminum, with glass and plastic containers remaining marginal. Cosmetics and household items account for more than three-quarters.

Sustainability initiatives are gaining traction in this category, boosting demand for environmentally friendly aerosol packaging solutions built from recyclable materials and using post-consumer recycled content. As consumers place a higher value on sustainability and product efficacy, personal care firms are experimenting with new packaging designs and materials to meet these demands while retaining product integrity and consumer pleasure. With the worldwide personal care market expanding steadily, backed by rising disposable incomes and increased awareness of personal hygiene, the aerosol packaging sector within this segment is primed for further growth and innovation.

The competitive landscape of the aerosol packaging market is dominated by established industry giants such Berry Global, Inc., Ball Corporation, Aptar Group Inc, Allied Cans Limited, Crown Holdings, Inc., SC Johnson & Son, Inc., Henkel AG & Co. KGaA., Beiersdorf AG. Exal Corporation, Euro Asia Packaging, and TUBEX GmbH.These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Pursuing sustainability is essential to assisting our clients in achieving their objectives and enabling Berry Global's product line management vice president, Jonathan Reitman, to state. "The spray through overlap stock option serves a variety of markets, including homecare, automotive, and industrial. It fits 211/65mm necked-in aerosol cans. This spray, through overlap's pre-inserted button function, makes it ready to use right out of the factory, giving Berry customers convenience benefits and streamlining the end-user experience.

For Instance,

Ball is a proponent of sustainable techniques, working with recyclable materials and assisting our partners in running their businesses effectively. They have shown their dedication by being the first and only impact-extruded aerosol and aluminum packaging provider to receive certification from the Aluminum Stewardship Initiative in January 2023.

For Instance,

By Material

By Product Type

By End Use

By Region

April 2025

April 2025

April 2025

April 2025