April 2025

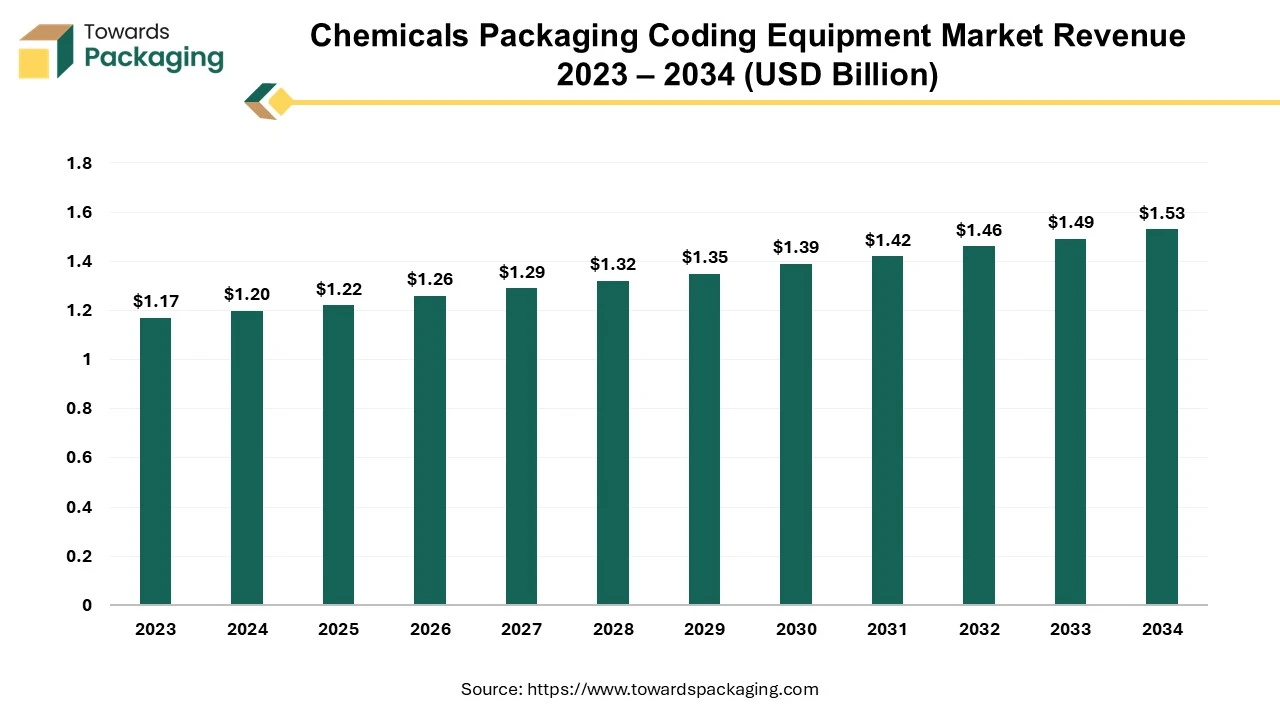

The chemicals packaging coding equipment market is forecast to grow from USD 1.22 billion in 2025 to USD 1.53 billion by 2034, driven by a CAGR of 2.5% from 2025 to 2034.

The chemicals packaging coding equipment market is likely to register impressive growth during the projected forecast period. Due to the wide range of substrates, severe conditions, high throughput needs, chemical resistance, date marking requirements, batch coding, variable information and interaction with the production lines; coding and marking in the chemicals sector presents special challenges. Choosing the right coding and marking technologies like laser marking, inkjet printing, hi-resolution coding printers and labeling systems is important for overcoming these obstacles. Continuous maintenance as well as the support is also necessary to guarantee peak performance and adherence to industry standards. Complete attention must be paid to every part of the production process, from guaranteeing regulatory compliance to upholding brand integrity.

The stringent regulatory requirements along with the increased demand for the chemical products across various industries are expected to augment the growth of the chemicals packaging coding equipment market during the forecast period. Furthermore, the growing concerns over product traceability and safety as well as the expansion of the specialty chemicals sector are also anticipated to augment the growth of the market. Additionally, the technological advancements in the coding equipment along with the surge in the e-commerce has amplified the need for clear and traceable product information on the chemical packages is also projected to contribute to the growth of the market in the near future.

The growing chemical sales are expected to fuel the growth of the chemicals packaging coding equipment market during the projected timeframe. According to the European Chemical Industry Council, the global sales of chemicals reached €5,434 billion in 2022. This is due to the rising demand for chemical products across various industries. Pharmaceuticals are important for the well-being and health of humans and represent a major end-use market for different chemicals. In the United States, childhood vaccinations can now prevent 16 diseases, which include polio and measles as well, as reported by PhRMA. People may now control and survive with conditions like diabetes, high blood pressure and various types of cancer because of advancements in the pharmaceuticals. Thousands of medications and vaccinations are constantly being developed in an effort to aid people who are afflicted by a wide range of illnesses.

Buildings are essential and chemistry-enabled materials are utilized in roofing, walls and floor coverings, insulation, countertops, and other parts of buildings. Chemicals are employed in almost every aspect of construction and upkeep, from caulks and silicone sealants to keep basements dry to roof coatings that reflect light to keep roofs cool. The building and design industry has benefited from innovations in chemical research and materials science by producing a wide range of high-performance products and materials that can help with a variety of issues, such as reducing the effects of climate change, improving human health and wellness, improving energy efficiency and making a building more resilient to natural disasters. As these industries expand and production volumes increase, the need for accurate labeling and traceability becomes important to guarantee safe handling, storage and usage of chemicals. Effective coding options are necessary to meet strict regulatory standards that mandate complete labeling for safety and environmental compliance.

The coding inaccuracies and equipment reliability issues are expected to hamper the market growth within the estimated timeframe. The majority of the products in organizations are printed with some kind of date code or identification. Date coding and marking for these products are governed by national and international laws and regulations. For the completion of this procedure, numerous companies and enterprises use various technologies, such as thermal inkjet, continuous inkjet, and laser coding. Any error in the labeling or date coding can cause serious problems. Common concerns with these systems include print triggers and product sensor failures. The printer is not correctly triggering to print in this situation; it prints either prior to or soon after the product packaging has gone through the print head. The worst aspect is that professionals rarely identify this issue immediately. Consequently, this results in large batches of products with incorrect or missing information and costly repackaging and re-coding efforts before products can reach the market.

Furthermore, due to many distinct uses for laser marking, it's likely that the laser marking fails to appear the way it should as the laser medium or settings are incorrect. For example, attempting to anneal with engraving settings will result in an incorrect design because annealing and engraving use distinct marking techniques. Material damage is another potential problem with a laser marking equipment. Many people are converting to laser marking machines because of the damage-less marking feature; however, when used properly, a laser marking machine shouldn't harm any materials. These technical restraints make the implementation and maintenance of the coding equipment complex and resource-intensive. As a result, they limit the efficiency of the coding operations, potentially affecting both compliance and brand reputation in the chemicals packaging industry.

The expansion in the emerging markets is projected to fuel the growth of the market in the near future. This is owing to the increasing urbanization, infrastructure development and a rising demand for the chemical products across various sectors. In Argentina, end-use goods like paints, pharmaceuticals, beauty products etc. account for almost half of the local chemical output. Argentina also presents an established agricultural sector and it is the biggest consumer of chemical industry products. Furthermore, as per the statistics by the DataMexico, in 2023, chemical product trade in the Mexico, consisting of sales as well as purchases abroad was valued at US$59.8 billion. In July 2024, chemical product sales abroad reached US$1.27 billion, with a total of US$3.85 billion in the foreign purchases. This high level of activity in Argentina and Mexico reflects the demand for chemical products and points to the growing need for the better packaging coding equipment.

India's chemical sector is very diverse and produces over 80,000 commercial goods. India is third in Asia and sixth globally in terms of the chemical production, which accounts for 7% of the country's GDP. Presently valued at US$220 billion, the Indian chemical sector is projected to climb to US$300 billion by 2030, according to the India Brand Equity Foundation. By 2040, the demand for chemicals and petrochemicals in India is predicted to almost triple, surpassing $1 trillion USD. This surge in the production and trade requires the utilization of dependable coding equipment. For coding equipment manufacturers, expanding chemical sector offers substantial growth opportunities to improve the operational efficiency and compliance with the international standards, driving the demand for state-of-the-art coding equipment.

The continuous inkjet segment held considerable market share in 2024. Continuous inkjet printers print directly onto a surface by discharging ink. This non-contact technique can print on any kind of target without causing blurring and printing errors. From packaging machines to conveyors, the small head size and omnidirectional printing capability guarantee simple installation in a variety of settings. Furthermore, these printers are known for their lower operational costs compared to the other technologies which are likely to support the growth of the segment within the forecast period. CIJ printers are among the most rapid industrial marking options available, compared to their other equivalents in terms of speed. They deliver coding applications a high degree of consistency and legibility and also a wide range of inks are accessible that cover a substantially broader range of materials that a CIJ printer could mark. These factors are expected to contribute to the segmental growth of the market.

The specialty chemicals segment is likely to grow at a considerable CAGR during the forecast period. This is due to the increasing demand for high-performance chemicals across various industry verticals such as electronics, pharmaceuticals, automotive and renewable energy, among others. The specialty chemical sector now generates a wide range of compounds that can be utilized to increase efficiency, decrease waste and save resources. The automobile, pulp and paper, and food and feed industries receive products such as polymers, additives, adhesives, flavors and surfactants, among others. Large quantities of specialty chemicals are created to satisfy the needs of different industries. Specialty chemical production relies heavily on economies of scale, which enable economical manufacturing procedures. Furthermore, many industries are actively seeking green alternatives and this has also spurred the demand for the specialty chemicals that offer lower emissions and reduce the environmental impact.

Asia Pacific is likely to grow at fastest CAGR during the forecast period. This is due to the rapid economic growth and industrial expansion in countries like China, India, and Southeast Asia countries. Also, the expanding chemical manufacturing base along with the increase in the export of chemicals and related products is likely to contribute to the regional growth of the market. As per the India Brand Equity Foundation, agrochemical exports reached USD 661.18 billion, dye exports reached USD 379.61 billion, and other dye intermediates reached USD 27.87 billion between April and May 2024. With an approximate 15% global market share, the Indian colorants sector has become a major player. Furthermore, the growing focus on anti-counterfeiting solutions and increasing pharmaceutical production is also expected to contribute to the regional growth of the market.

North America held a considerable market share in 2024. This is owing to the strong presence of the many large-scale chemical manufacturing companies such as Dow Inc., ExxonMobil Chemical Company, Eastman Chemical Company and DuPont, among others. Furthermore, chemical import and export activity in the United States has been increasing gradually over time, and the country continues to maintain its position as a net exporter. A rising trade surplus will result from the industry's stronger competitiveness, specifically for those sectors that gain most by the US shale gas revolution. According to the American Chemistry Council data, the total US exports were valued at USD 179 billion in 2022. The top chemicals export destinations were Mexico, Canada and China whereas the top exported products were bulk petrochemicals, plastic resins and other specialties. Additionally, the strict labeling and traceability standards by regulatory bodies like the FDA and EPA are also anticipated to promote the growth of the market in the region in the near future.

By Technology

By Type

By End-Use Industry

By Region

April 2025

April 2025

April 2025

April 2025