April 2025

The global industrial packaging market was valued at USD 65.38 billion in 2023 and is projected to reach USD 111.82 billion by 2034, registering a CAGR of 5% from 2024 to 2034. The market growth is attributed to the rising emerging sustainability trends and rising technological advancements.

Industrial packaging is essential to companies that ship or deliver items to clients. Whether it's a retail shop, product manufacturer, distributor, wholesaler, or an e-commerce portal selling products around the globe, relying on industrial packaging solutions is essential for ensuring the protection and security of goods while in transit. Over the last few decades, the use of industrial packaging for direct delivery to customers' doorsteps has steadily grown. Distribution systems that involved multiple interactions and storage periods presented difficulties, significantly reducing a product's shelf life. The use of industrial packing has enabled for faster and less destructive transit, consequently abolishing these time restrictions. This benefit has reduced manufacturing cycles and improved possible amounts for companies.

Industrial packaging has enabled manufacturers and merchants save costs on inventories. Significantly the potential to transfer products more quickly and with less damage, firms are increasingly choosing for purchasing on a daily basis opposed to periodic or weekly purchases, significantly eliminating inventory holding expenses. An important part of industrial package design is ensuring that items be transported safely and with little damage from point A to point B. Palletization stacking patterns and pallet material choices are among the design factors. The global market for industrial packaging market is expanding rapidly due to the extensive usage of packaging to protect goods or materials during transit. This development indicates the vital role that industrial packaging plays in modern supply chains, allowing items to travel efficiently and securely across sectors.

The integration of Artificial Intelligence (AI) is transforming the Industrial Packaging Market by enhancing operational efficiency, product innovation, and supply chain management. AI technologies, such as machine learning and computer vision, are revolutionizing industrial packaging processes through advanced automation and data analytics.

AI-driven automation improves production efficiency by optimizing packaging lines and minimizing human error. Intelligent systems can adjust packaging parameters in real-time, ensuring consistent quality and reducing waste. Predictive maintenance powered by AI anticipates equipment failures, thereby reducing downtime and lowering maintenance costs. AI also plays a crucial role in supply chain optimization. Through data analysis and predictive analytics, AI systems forecast demand, manage inventory more effectively, and streamline logistics. This leads to reduced lead times, lower costs, and improved customer satisfaction.

Industrial packaging offers an essential part in supply chain management in the Asia-Pacific region, ensuring the secure and effective movement of goods across a range of sectors. The need for effective and dependable packaging solutions has increased dramatically due to the region's quick industrialization, increasing urbanisation, and growing trade networks.

The Asia-Pacific region's industrial packaging incorporates an extensive variety of materials and technologies that are customised to satisfy the unique requirements of different industries, such as manufacturing, electronics, automotive, food and beverage, pharmaceuticals, and retail. Packaging is essential to these sectors as it helps to protect goods during transportation, reduce damage, and meet legal requirements.

The Asia-Pacific region is the centre for packaging design and material innovation due to its extensive geographic scope and varied market dynamics. Manufacturers in Southeast Asian, Chinese, Japanese, Indian, South Korean, and other countries constantly invest in R&D to improve packaging's cost-effectiveness, sustainability, and efficiency. The expansion of online shopping and e-commerce has increased demand for package delivery-optimized packaging solutions, which contributed to the development of durable yet lightweight packaging materials and designs.

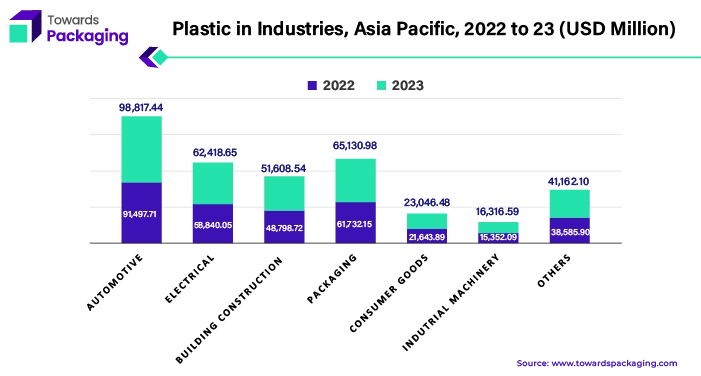

Asia Pacific region have largest share plastic applications in industrial packaging of various sectors such as automotive, electrical, building and constructions and others. In the Asia-Pacific region, industrial packaging has become more sustainable due to legislative restrictions and increasing environmental awareness. To mitigate the environmental impact of packaging processes, businesses are investigating circular economy concepts, introducing recycling programmes, and utilising eco-friendly materials. The Asia-Pacific region's industrial packaging is defined by its ingenuity flexibility, and commitment to resolving environmental issues while satisfying the changing demands of a changing market environment.

Perstorp declared its acquisition by PETRONAS Chemicals Group Berhad (PCG), a division of PETRONAS Group and the top integrated chemicals supplier in Malaysia.

North America's strong manufacturing and distribution industries are built on the backs of industrial packaging. It includes a wide range of materials and solutions that meet the demanding needs of many industries, such as consumer goods, automotive, aerospace, medicines, and food & beverage. In North America, industrial packaging is essential to the safe and effective movement of commodities across long distances. Smart packaging techniques are used by businesses to reduce waste, safeguard goods from harm during transportation, and enhance handling and storage procedures. Packaging technologies are consistently advanced in the region due to the significant emphasis on quality control, regulatory compliance, and customer satisfaction.

Manufacturers and suppliers in the US, Canada, and Mexico conduct research and development investments to improve the strength, sustainability, and affordability of packaging materials. One of the world's top manufacturers of chemical goods is the United States. The Department of Transportation, the International Air Transport Association, and the Environmental Protection Agency monitor chemical exports within the United States. Chemicals are transported by any means of transportation under the control of the Pipeline and Hazardous Materials Safety Administration and the U.S. Department of Transportation. the products' transit while protected in premium packaging.

The growing e-commerce industry in North America has increased demand for specialised packaging solutions made for online retail fulfilment. Industrial packaging in the area is constantly developing to match the changing demands of contemporary supply chains and transportation networks, from corrugated boxes to protective cushioning materials. North American industrial packaging supports the secure transit of goods throughout the continent's vast production and distribution networks by demonstrating a dedication to innovation, efficiency, and sustainability.

Plastic's cost-effectiveness, durability, and adaptability contribute to it being a major player in the industrial packaging companies. For the transportation and protection of goods, industrial packaging composed of plastic materials including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polystyrene (PS) offers a number of advantages. Packaging made of plastic is essential to the safe and secure transportation of hazardous products. Plastics are an essential raw material used to make the packaging that is utilised to ship dangerous goods across international borders. Drums, jerricans, composite intermediate bulk containers (IBCs), non-bulk composite packaging, and some inner packaging’s used in combination packaging’s are all composed of plastic.

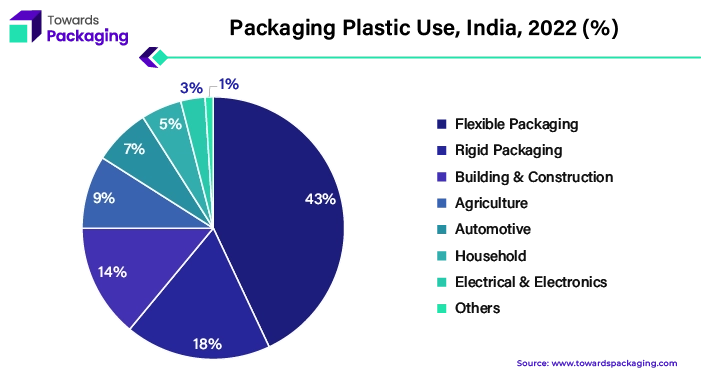

The Central Pollution Control Board estimates that India produces over 25,940 tonnes of plastic garbage every day, despite the fact that plastic is a common material in most Indian homes. Every year, over 9.46 million tonnes of plastic garbage are produced. Plastic packaging is extremely adaptable when it involves automated packaging procedures, which increases production and efficiency in manufacturing and distribution facilities. Plastic packaging can be recycled, and developments in recycling technology keep raising the sustainability level of plastic packaging solutions.

IBCs, or intermediate-capacity bulk containers, are industrial containers used for bulk and liquid product storage and transportation. Three frequently utilised forms of IBC are used today: flexible, foldable, and stiff. 600 litres and 1000 litres are the capacities of the two most popular rigid IBC tanks. Bulk items can be stored in medium-capacity containers for several uses. Containers can be reused after being cleaned and dried. This is dependent on multiple factors, such as whether the IBC will be recycled, if it has to be durable, and if there are any regulatory restrictions. Rigid containers in the shape of cubes are frequently composed of plastic, namely polyethylene or high-density polyethylene (HDPE). A strong external container, often in the form of a cage, constructed mostly of iron or galvanised tubular steel.

The foldable IBC is composed of extremely robust polyethylene that is empty inside and does not form a stiff outside cage. Various heavy materials, such as woven polypropylene or polyethylene, are used to make flexible IBC or wholesale bags.

IBCs are made to be portable and easy to handle. Their uniform measurements enable a smooth connection with current forklift and pallet systems. Pallet tanks, also called pallecons, allow IBCs to be safely and stacked during transit, reducing the possibility of damage. This effectiveness lowers expenses related to human handling and optimises logistics.

The Intermediate Bulk Container (IBC) industry leads the way in technical developments as the need for effective packaging and transportation solutions keeps rising. To improve IBC technology and make it even more efficient and flexible to the changing demands of global enterprises and industries, manufacturers are constantly investing in R&D.

The chemical industry is the most significant consumers of industrial packaging due to the extensive variety of chemicals it makes and distributes, many of which require specialised packaging solutions for safe handling, transportation, and storage. Chemical compounds differ widely in their qualities, ranging from caustic acids to delicate powders, necessitating packaging that can efficiently contain, preserve, and identify them.

Global chemical companies are upgrading the industrial packaging for better environmental aspects and consumer preferences. Chemical industries rely on industrial packaging to maintain compliance with stringent safety rules and to reduce the dangers connected with dangerous products. Drums, intermediate bulk containers (IBCs), totes, and specialised containers are popular packaging materials for transporting chemicals in bulk. These containers are frequently made of strong materials like as high-density polyethylene (HDPE) or steel, which are designed to withstand the corrosive nature of many chemicals while also providing containment in the event of a spill or leakage.

For Instance,

The supply chain in the industrial packaging market involves a multifaceted network designed to efficiently manage the flow of packaging solutions across various industries. The process begins with raw material suppliers who provide essential inputs like plastics, metals, and paper products. These materials are transported to packaging manufacturers where they are converted into various packaging forms such as pallets, drums, containers, and stretch films.

Once produced, the packaging materials enter the distribution phase. Here, logistics companies play a crucial role in managing inventory, warehousing, and transportation. This stage ensures that packaging solutions are delivered promptly to end-users in sectors such as chemicals, pharmaceuticals, food and beverages, and industrial goods.

Quality control is integral throughout the supply chain, with rigorous testing to meet industry standards and regulations. Packaging must withstand the rigors of transportation and storage while protecting the contents.

The Industrial Packaging Market is essential for safeguarding a wide array of products across various sectors. Key components include primary packaging, which directly contains the product (e.g., cans, bottles, and drums), secondary packaging, which groups primary packages for handling (e.g., boxes and shrink wraps), and tertiary packaging, which aids in bulk handling and logistics (e.g., pallets and stretch film).

Major players contribute significantly to this market's ecosystem. Companies like Amcor and Mondi are renowned for their advanced flexible packaging solutions, offering durability and customization for diverse industrial needs. Sealed Air and Smurfit Kappa excel in providing innovative protective and sustainable packaging options that enhance product safety during transit and storage. WestRock and International Paper specialize in robust paper-based packaging solutions, catering to bulk handling and logistics efficiency.

Companies like Berry Global and Sonoco Products focus on delivering high-quality plastic and composite packaging, addressing specific requirements of industries such as chemicals, food and beverages, and pharmaceuticals. Collectively, these companies ensure that industrial products are well-protected, efficiently handled, and meet regulatory standards, highlighting the complexity and critical nature of the industrial packaging market.

The competitive landscape of the industrial packaging market is dominated by established industry giants such as DS Smith (U.K.), Mondi (U.K.), Sonoco Products Company (U.S.), Sealed Air (U.S.), Huhtamäki Oyj (Finland), Smurfit Kappa (Ireland), WestRock Company (U.S.), UFP Technologies, Inc. (U.S.), Stora Enso (Finland), Pregis LLC (U.S.), Shenzhen Hoichow Packing Manufacturing Ltd. (China), International Paper (U.S.), Dordan Manufacturing Company (U.S.), Hangzhou Xunda Packaging Co. (China), Mosburger GmbH (Austria), Universal Protective Packaging Inc. (U.S.), Parksons Packaging Ltd. (India), Neenah Paper and Packaging (U.S.), Plastic Ingenuity (U.S.), and JJX-Packaging (U.S.). These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Mondi produces lightweight, recyclable packaging that is simple to use and has several advantages over conventional non-paper-based packaging methods. Examine the advantages of our industrial solutions to get a new perspective on heavy-duty packaging like cartons and boxes.

For Instance,

The industrial markets have high standards. Durability, accuracy, adaptability, and ingenuity are all qualities that industrial goods must possess. Since Sonoco was founded to cater to the industrial sectors, we have a solid understanding of the challenges that our clients face and the resources they require to succeed. Using that information, a variety of solutions were created to assist them in achieving their objectives.

For Instance,

Sustainable packaging options from Smurfit Kappa are made to showcase and safeguard your goods, no matter how big or little. All of our packaging is made to guarantee that items reach their destination in the best possible shape because supply chains can be difficult.

For Instance,

UFP Packaging offers OEM components and packaging solutions to small and big organisations in a variety of sectors as a full-service supplier. From wood pallets and boxes to highly customised packing solutions with integrated tracking systems, we develop and produce the widest range of custom packaging solutions on the market.

For Instance,

Industrial packaging leading market players are DS Smith (U.K.), Mondi (U.K.), Sonoco Products Company (U.S.), Sealed Air (U.S.), Huhtamäki Oyj (Finland), Smurfit Kappa (Ireland), WestRock Company (U.S.), UFP Technologies, Inc. (U.S.), Stora Enso (Finland), Pregis LLC (U.S.), Shenzhen Hoichow Packing Manufacturing Ltd. (China), International Paper (U.S.), Dordan Manufacturing Company (U.S.), Hangzhou Xunda Packaging Co. (China), Mosburger GmbH (Austria), Universal Protective Packaging Inc. (U.S.), Parksons Packaging Ltd. (India), Neenah Paper and Packaging (U.S.), Plastic Ingenuity (U.S.), and JJX-Packaging (U.S.)

By Material

By Product Type

By End User

By Region

April 2025

April 2025

April 2025

April 2025