April 2025

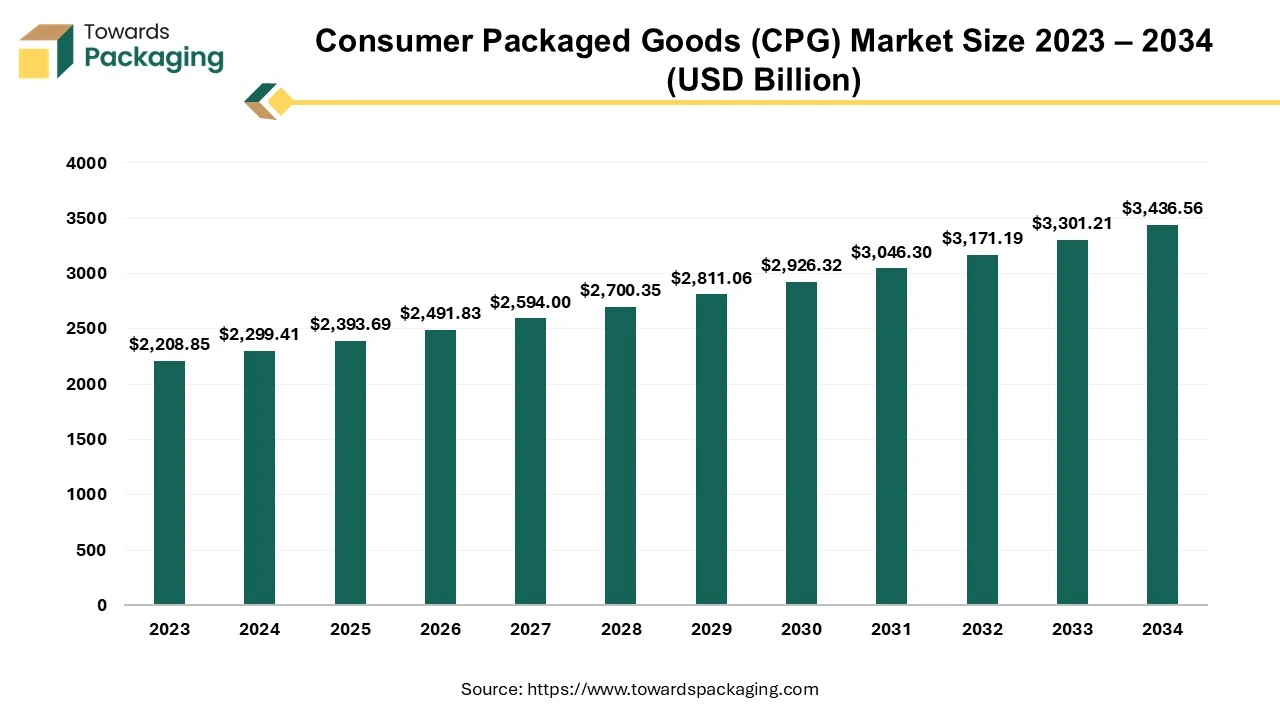

The global consumer packaged goods market size was evaluated at US$ 2208.85 billion in 2023 and is expected to attain around US$ 3436.56 billion by 2034, growing at a CAGR of 4.1% from 2024 to 2034.

Consumer packaged goods are goods that the typical consumer consumes daily, such as food, beverages, and household supplies. and makeup. Consumer packaged goods (CPG) play a pivotal role in the daily lives of individuals, encompassing a diverse range of products from food and beverages to apparel and cosmetics. These items are integral to households and necessitate consistent replenishment or replacement, fuelling an ongoing demand that fosters a fiercely competitive market for all brands. Underscores the robustness of the CPG sector, revealing an impressive 8% year-over-year growth and a projected annual sales figure of $1.62 trillion. This data signals a thriving market environment, prompting CPG firms to keenly observe shifting consumer patterns. A notable 40% of these firms actively respond to these changes by setting ambitious sustainability objectives.

In response to the imperative of sustainability, CPG companies are strategically incorporating comprehensive plans to align their operations with environmentally conscious practices. A prime example is the commitment to sustainable packaging for their product lines. By prioritizing eco-friendly materials and production processes, these firms aim to reduce their environmental footprint and contribute positively to global sustainability goals. Moreover, CPG companies are adopting holistic sustainability initiatives that extend beyond packaging. These initiatives encompass emission reduction strategies and other environmentally responsible objectives, collectively aimed at enhancing the overall eco-friendliness of their products. This strategic shift towards sustainability aligns with evolving consumer preferences and positions CPG firms as responsible contributors to a greener and more sustainable future.

The preference for consumer packaged goods (CPG) varies across different generational cohorts, highlighting distinct consumer behaviours. Among Millennials (Gen Z), approximately 79% express preferences for CPG products, showcasing a significant affinity for these goods. Generation X closely follows, with 78% indicating a preference for CPG items. Boomers also exhibit a substantial inclination, with 70% expressing a preference for CPG. In contrast, the Silent Generation demonstrates a comparatively lower preference, with 57% indicating a favourable stance towards CPG products.

Consumer goods are popular worldwide and the demand for them keeps rising at a good pace. The packaging plays an important role in the branding and marketing of a product as it is major visual aspect of that product’s identity. With increased competition, marketing and branding has become a crucial component for organizations. This has created different designs, usage of materials, environmentally sustainable options etc., specific customizations on the products to set the product apart and increase visual appeal. The consumer packaged goods also clearly define what their product is, for example, ‘gluten free’ or ‘plant based’. This creates awareness about the nutrient value and ingredients accommodating consumers with specific tastes. It adds value to the brand as well as marketing efforts that will grow the consumer base.

Artificial Intelligence (AI) is slowly, but surely finding its place in the consumer packaged goods industry. Organizations of all sizes are looking for ways to implement AI into their operations as it could have an incredible impact. The CPG industry can utilize AI for operational efficiency, inventory, enhance demand forecast and modernize supply chain managements to name a few. AI can play a major role in understanding and decoding market dynamics that the current infrastructure finds complex like – volume of data, compliance requirements, consumer patterns, predictive analysis, increase optimization etc. There are a number of tools available that cater to specific services using AI technology, for example, in streamlining supply chain management. With AI, businesses can run operation more efficiently and positively affects the overall output. The CPG goods market is a competitive environment and integrating innovative technologies like Artificial Intelligence can offer a competitive edge to organizations.

| Trends | |

| Online Marketing and E-commerce Shift | The CPG industry is significantly transitioning towards online marketing and e-commerce platforms, reflecting changing consumer preferences for convenient and digital shopping experiences. |

| Embrace of Eco-friendly Practices | CPG companies increasingly adopt eco-friendly packaging, sustainable retail displays, and environmentally conscious business practices, responding to heightened consumer awareness and demand for products with reduced ecological impact. |

| Direct-to-Consumer Expansion | Traditional CPG firms are exploring new avenues with the rise of direct-to-consumer brands and purchasing options, recognizing the importance of establishing direct connections with consumers to enhance brand loyalty and adapt to evolving market dynamics. |

| Supply Chain Resilience | CPG companies prioritize developing more stable, diversified, and resilient supply chains, driven by the need to mitigate risks, ensure consistent product availability, and adapt to disruptions in the global market. |

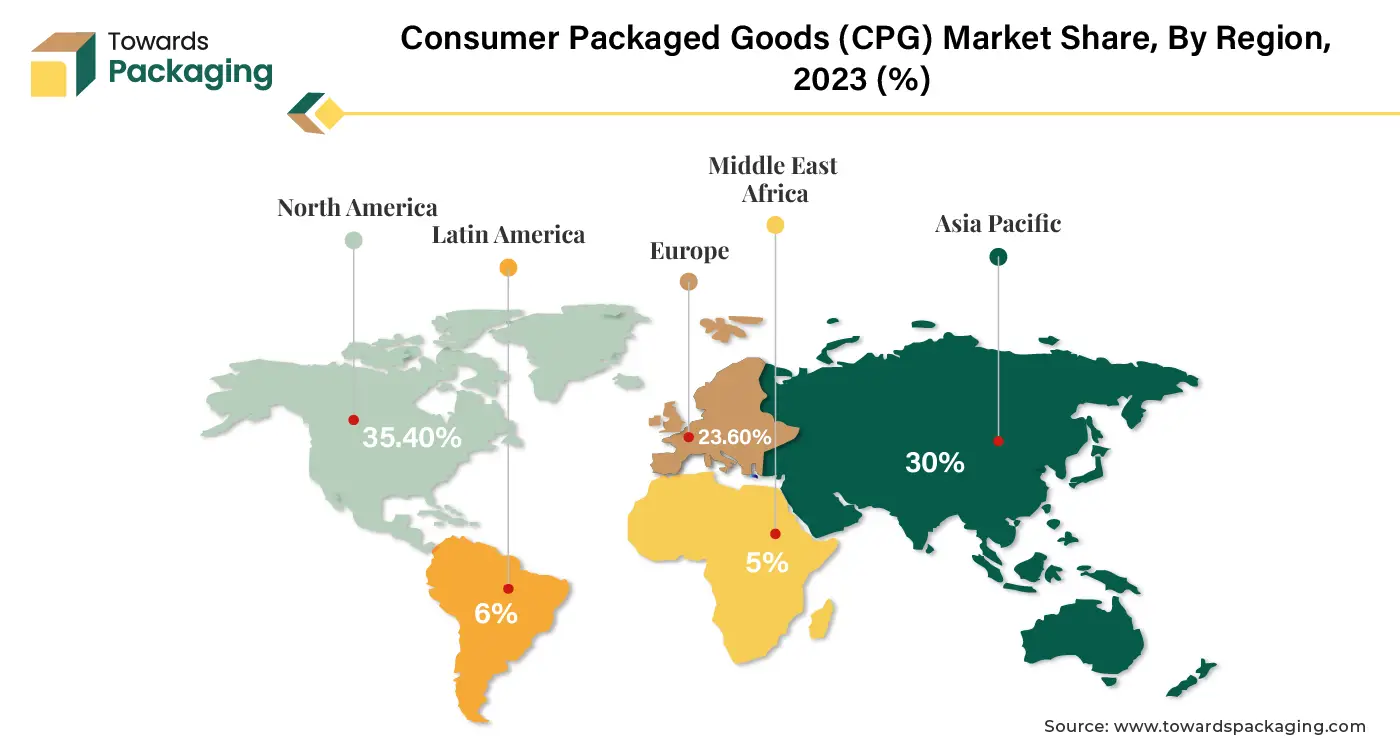

The consumer packaged goods (CPG) industry remains a cornerstone of North America's economic landscape, boasting an impressive valuation of around $2 trillion. Industry leaders, including renowned companies like Coca-Cola, Procter & Gamble, and L'Oréal, play pivotal roles in shaping this sector's trajectory. Despite healthy profit margins and robust financial standings, CPG manufacturers face perpetual challenges securing coveted shelf space within retail establishments. To maintain and expand market share, these companies consistently allocate substantial resources to advertising, aiming to enhance brand recognition and drive sales.

The CPG landscape has witnessed a notable trend of increased marketing expenditures across diverse sectors, sizes, and price tiers in the United States. According to a survey conducted among U.S. marketing professionals, 23 per cent of CPG companies' budgets were dedicated to marketing initiatives in early 2023. This proportion marked the highest share of advertising expenditures observed among various industries in the country during that period.

For Instance,

While established market leaders like PepsiCo and L'Oréal continue their annual investments of billions of dollars in expansive marketing campaigns, they find themselves at the forefront of adapting to significant shifts in consumer behaviour. Consumers evolving preferences and behaviours necessitate a strategic realignment of marketing approaches, prompting these industry giants to navigate and capitalize on the changing dynamics to maintain their competitive edge in the ever-dynamic CPG landscape.

For Instance,

Asia's rapidly expanding consuming class is a noteworthy trend poised to reshape the region's economic landscape. By 2030, it is projected that an astounding three billion individuals, constituting 70% of Asia's total population, will join the consuming class. This surge represents a billion more individuals than the present and a substantial increase of 2.5 billion from the turn of the millennium. Such a demographic shift is anticipated to significantly enlarge the consuming class in various economies.

Projections indicate a substantial increase in the consumption class in specific countries. By 2030, Indonesia may see up to 200 million individuals becoming part of the consuming class, a noteworthy increase from the current 120 million. Similarly, India could witness an expansion to as high as 825 million individuals in the consuming class by 2030, up from approximately 340 million.

Notably, the growth in the consuming class is not only about an influx of new members but also about internal mobility within the class itself. The upward income movement within the consuming class will drive consumption growth over the next decade. This upward shift in revenue is set to alter the centre of gravity in the income pyramid, influencing consumption habits.

Over the last two decades, a substantial 80% of Asia's consumption growth has been attributed to the lower-income segments of the consuming class as new members entered. It is anticipated that higher-income consumers will take the lead, contributing up to 80% of future consumption growth in the next decade. This shift in the composition of the consuming class and their income levels presents a significant opportunity for consumer packaged goods (CPG) companies to cater to an expanding and evolving consumer base in the dynamic Asian market.

For Instance,

The food and beverage sector has emerged as the predominant online consumer packaged goods (CPG) segment for the year, representing 44% of total sales. While the pandemic significantly boosted online sales, other market dynamics, such as adherence to hygiene standards and a growing consumer preference for personalized experiences, are expected to sustain the momentum of online shopping in this category. Projections indicate that the food and beverage segment is poised to generate a substantial $26,774 million in revenue.

In recent years, consumer packaged goods and food and beverage industries have faced persistent challenges, with ongoing disruptions extending beyond the initial impact of the global pandemic. Raw material shortages originating from Ukraine and Russia, along with delays in production and processing and surging oil and gas costs, have directly affected various aspects of food-related manufacturing, transportation, and agricultural supply chains. These challenges are not confined to a specific region, as CPG manufacturing, food distribution, and retail operations grapple with issues on a global scale.

In December 2022,

Specifically, the availability of raw ingredients critical to the production of staple products such as cereal, flour, bread, beer, and other commodities has been constrained in the United States. Furthermore, disruptions in the shipping and container industries have led to delayed shipments and increased costs, exacerbating concerns about inflation. The cumulative impact of these factors underscores the intricate challenges faced by the food and beverage sector within the larger CPG landscape, necessitating strategic adaptation to navigate the complexities of the current market environment.

The forefront of the consumer packaged goods (CPG) market, demonstrating substantial dominance in both offline and online dimensions. This sector is impressive in offline transactions, amounting to $297, emphasizing the enduring significance of traditional brick-and-mortar retail channels. The offline basket size signifies the average amount spent on food and beverage products in physical stores, highlighting the substantial revenue generated through these conventional retail outlets.

In contrast, the online basket size for the food and beverage sector is $64, indicating the average expenditure on these products in the digital realm. Although the online dimension is a growing aspect of the market, it is noteworthy that the offline component retains its substantial share, underscoring the continued importance of physical retail channels for CPG companies.

For Instance,

| 2023 Rank | Company | 2022 Net Revenue | One Year Sales Growth |

| 1 | Nestlé SA | $99.32 Billion | 3.78% |

| 2 | PepsiCo | $86.392 Billion | 8.70% |

| 3 | LVMH Moët Hennessey Louis Vuitton* | $84.677 Billion | 23.28% |

| 4 | Procter & Gamble | $80.187 Billion | 5.35% |

| 5 | JBS S.A. | $72.609 Billion | 11.73% |

| 6 | Unilever N.V. | $63.293 Billion | 2.01% |

| 7 | Anheuser-Busch InBev | $55.786 Billion | 6.41% |

| 8 | Tyson Foods | $53.282 Billion | 13.25% |

| 9 | Nike, Inc. | $46.71 Billion | 4.88% |

| 10 | Coca-Cola Co. | $43.005 Billion | 11.25% |

CPG companies strategically prioritize large brick-and-mortar retailers as a focal point of their operations, recognizing that these outlets constitute most of their business. The emphasis on brick-and-mortar retail is particularly relevant for high-volume perishable items within the food and beverage sector. These products, widely available at retailers globally, are frequently purchased for immediate consumption, with consumers instinctively replenishing their preferred frozen meals. The chronic nature of these purchases, often made with minimal deliberation, contributes to the enduring strength of brick-and-mortar retail for CPG companies operating in the food and beverage sector.

Understanding and utilizing data is crucial for CPG brands aiming to enhance their marketing strategies. By collecting, analyzing, and leveraging data insights, brands can significantly improve their sales methods, inform product development, monitor competitors, and personalize marketing campaigns.

Analyzing CPG data allows for better decision-making regarding products and sales processes. It helps identify underperforming products, categories, or specific retail stores and locations. This critical insight enables brands to:

To improve sales, focus on successful areas and learn from them while addressing less successful areas with targeted marketing efforts.

Sales data analytics provide a clear picture of when to create new products or optimize existing ones. Insights into consumer preferences, historical data, and market trends help marketers collaborate with product development teams to meet evolving consumer needs. By making informed decisions about product creation and retirement, brands can drive growth and profitability.

CPG data insights are invaluable for assessing and monitoring competitor activity. By keeping an eye on the competitive landscape, brands can differentiate themselves effectively. Key areas to monitor include:

Understanding both competitive and consumer data allows brands to stand out with effective product recommendations and personalized customer experiences.

Data is essential for delivering targeted, personalized, and effective marketing campaigns in the CPG industry. Insights into consumer behavior, preferences, and interactions enable marketers to personalize strategies, ensuring that marketing efforts resonate with consumers and drive engagement and sales.

CPG brands can use data to:

Personalization is the next era of CPG marketing, allowing for 1:1 experiences at scale through smart targeting, segmentation, and activation across marketing channels.

By leveraging CPG data insights, brands can enhance their marketing strategies, ensuring they remain competitive and relevant in a rapidly evolving market.

The competitive landscape of the consumer packaged goods (CPG) market is characterized by established industry leaders such as PepsiCo, Unilever, Nestle, General Mills, Danone, Mondelez, JBS, AB InBev, Kraft Heinz and Diageo. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences. Additionally, the sector sees dynamic collaborations, acquisitions, and strategic partnerships as companies strive to capture market share in this highly competitive and evolving industry.

By Application

By Distribution Channel

By Region

April 2025

March 2025

February 2025

February 2025