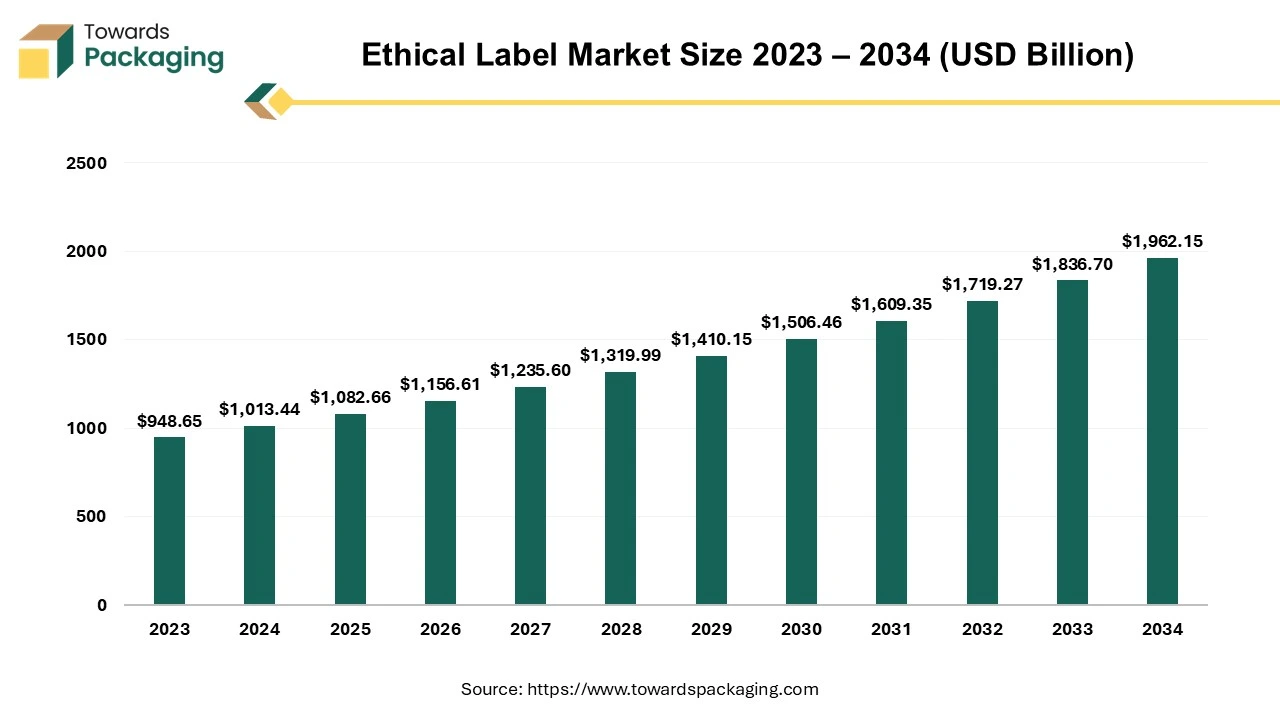

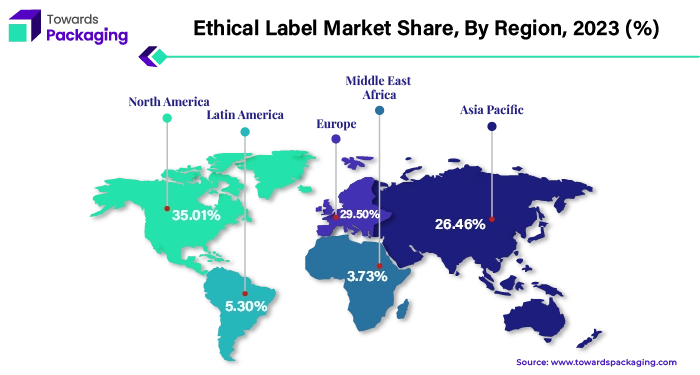

The ethical label market is forecasted to expand from USD 1,156.60 billion in 2026 to USD 2,096.16 billion by 2035, growing at a CAGR of 6.83% from 2026 to 2035. This report provides a detailed segmentation by label type, product type, and distribution channel while analyzing regional dynamics across North America (35.01% share in 2023), Europe, Asia Pacific (8.91% CAGR), Latin America, and the Middle East & Africa. It includes a thorough value chain assessment, competitive landscape of major players like Nestlé, Unilever, Danone, and PepsiCo, and trade data insights reflecting import–export trends for sustainable and Fairtrade-certified goods. The report also explores collaborations among NGOs, regulators, and companies, providing a 360° view of the industry’s evolution.

The ethical label market is anticipated to augment with a considerable CAGR during the forecast period. Ethical labels, like Fairtrade, came into existence to assist the customers in recognizing goods and businesses offering a diverse range of ethical assurances. And there are constantly new ones emerging. Products that fulfill specific requirements are acknowledged by them, such as providing fair compensation to the laborers or adhering to the animal welfare guidelines. However, there are significant differences between them in terms of the real level of ethical demands and the strength of their checks. Ethical labels are now widely used. Moreover, sustainable labels have become popular since they provide businesses with a means of handling ethical concerns and provide activists with an effective model for enacting change. The Ecolabel Index tracked 455 labels in 25 industry categories and 199 countries in 2022.

The rising consumer awareness and the demand for sustainable and ethically produced goods coupled with the growing importance of food safety is anticipated to augment the growth of the ethical label market within the estimated timeframe. The integration of Corporate Social Responsibility (CSR) into business strategies along with the supportive regulatory frameworks and government initiatives is also expected to support the market growth. Furthermore, the development of new certification standards and product innovations as well as the increasing number of collaborations between businesses, non-governmental organizations (NGOs), and regulatory bodies is also likely to contribute to the growth of the market in the years to come.

The increasing awareness about environmental and social issues and the growing demand for transparency and accountability to augment the growth of the ethical label market during the forecast period. Consumers are increasingly conscious of how their product choices affect both themselves and the globe. Clean labeling is becoming a customer demand instead of a trend, and the food packaging industry as a whole is reacting by emphasizing these features more and more.

In a worldwide poll conducted by the Fairtrade America of 11,150 customers, comprising 2,200 consumers of the United States and discovered that the 61% of the people identify the Fairtrade label, representing a 118% increase in familiarity since 2019. In general, 72 percent of the customers stated they trusted the label, with forty-eight percent stating they had some faith in it and 38% stating they had a great deal of faith in it. Additionally, Consumers are becoming more interested in Fairtrade items in stores and are ready to pay more for them. Sixty-seven percent of consumers believe, or strongly agree, that they would be willing to pay extra for these products in spite of inflation. The frequency with which consumers buy Fairtrade products has also increased; 91% of consumers who are aware of the Fairtrade label report are obtaining certified goods either occasionally or frequently.

Furthermore, concerns regarding the animal utilization in the production of the food are being expressed by consumers, interest organizations and the legislators, leading to a growing conversation about animal welfare. For instance, according to a study conducted by the American Society for the Prevention of Cruelty to Animals (ASPCA) in 2023, 79% of the participants were worried about how industrial animal husbandry would affect the welfare of animals. In the same way, almost half of the EU residents want clear information about the care and upbringing of animals (European Commission 2022). The labels make the animal welfare feature more noticeable, which helps the consumers distinguish between products that meet the highest and lowest criteria for animal care. Due to this, companies are using ethical labels in greater numbers to stand out in an increasingly competitive sector, draw in socially conscious customers as well as promote brand loyalty. It is anticipated that this pattern will hold true, further fueling the market growth for ethical labeling.

The main issues with the certifications are related to the customer awareness and corporate expenses. The expense of becoming verified or certified is the largest obstacle for firms. Furthermore, the certification procedure could be expensive, time-consuming, and uncertain. The original cost estimate for a firm will go up due to unanticipated expenditures, lab analyses, reviews, etc., as is the case with many custom evaluations. The majority of firms in various nations might not be able to afford the high cost of becoming accredited with certain labels. As per the U.S. Small Business Administration, small firms generate up to two-thirds of the net new jobs and account for over 44% of the economic activity in the country. This puts small enterprises at a disadvantage as even if they implement the sustainable and ethical policies, the cost barrier won't represent their good practices. Since small firms have minimal access to their intended audience or the niche of sustainable customers, larger companies with larger marketing costs will continue to beat them.

Furthermore, the largest barrier to customer communication is the consumer education as well as awareness. Majority of the customers, particularly people who do not actively seek out sustainable items, are unlikely to comprehend the relevance or the function of the certifications and labeling. Customers might not recognize the significance of a certification or sustainable label even after seeing it on several products for years. Eliminating the knowledge gap is essential for a business to get the benefits of obtaining the certification. A company's strategic plan should include selecting the most suitable or reputable certification as it is a means for demonstrating its dedication to better practices.

The increasing government initiatives and growing partnerships between non-governmental organizations (NGOs), governmental bodies and other businesses, companies is likely to create significant opportunity for the growth of the market in the years to come.

These collaborative efforts demonstrates how the partnerships help in overcoming the industry challenges such as green washing, certification challenges and inconsistent standards as well as promotes sustainable and ethical practices on a global scale, benefiting businesses, consumers and the environment.

The sustainability and Fairtrade labels segment captured significant market share in 2023. Fairtrade is a globally recognized and accepted sustainability label. Over 500 million small-scale communities of farmers rely on agriculture for their livelihoods, thus maintaining a sustainable environment is essential. Farmers provide the food, textiles and fuel that consumers, merchants, and retailers depend on to meet the basic demands of an expanding world population. By using a distinctive, two-pronged strategy, Fairtrade labels seek to encourage environmentally friendly practices and sustainable food production. Farmers that adhere to the Fairtrade standards and get recognized as Fairtrade producers are expected to enhance the water and soil effectiveness, manage the pests and the waste, refrain from applying dangerous pesticides, minimize the production of greenhouse gases and safeguard the biodiversity. In addition to supporting healthy plants and attracting wildlife that helps manage pests and illnesses, this enables farmers to improve their property and create nutrient-rich soils.

In terms of production, Fairtrade encourages and supports the application of agro-ecology concepts to move to stronger farming methods and to put measures in place for adapting to the changes in the environment. Fairtrade actively participates in the commercial sphere and promotes greater environmental equity in trade by examining laws that attempt to address the damaging effects of trade activities upon the environment. To enable farmers and workers around the world access carbon funding to help combat the consequences of climate change, Fairtrade also provides the opportunity to create Fairtrade Carbon Credits through the Fairtrade Climate Standard, which is in partnership with the Gold Standard.

The beverages segment held largest market share of 60.58% in 2023. Clean labels are a preferred choice in the production of the beverages and beverage compounds due to an increased knowledge of the origin of the products and regional nature as well as a need for near-natural and natural ingredients in drinks that ideally hold at least a "Free from" label. Consumers are demanding for more ethically sourced tea, cocoa and coffee as they attempt to become more sustainable. Consumers often expect businesses to source ethically, even in cases where inflation forces them to alter their shopping habits. Large companies and merchants still support the Fairtrade in spite of the Brexit's effects and continued difficulties associated with the cost of living. Their dedication to Fairtrade, as well as the farmers and laborers in their supply chains, is truly remarkable.

For instance,

Asia Pacific is expected to grow at a fastest CAGR of 8.91% during the forecast period. This is owing to the ongoing urbanization and higher levels of education across the region along with the greater awareness and concern about the environmental and social issues. Furthermore, the increasing production as well as the consumption of beverages such as soft drinks, tea and coffee in addition to a growing interest in premium juices is also likely to support the regional growth of the market. According to the report by the International Coffee Organization, in 2022, coffee consumption climbed to 15.4 million bags, up from 14.7 million bags the year before. Additionally, the growth of retail sectors the development of the food and beverage industry is also anticipated to augment the regional growth of the market during the forecast period.

North America held largest market share of 35.01% in 2023. Fair Trade certification is the most widely used Fair Trade label in the US and the studies show that Fair Trade knowledge and purchase behavior are becoming more popular in the region. Also, the younger generations are still more concerned about the condition of the environment and the manufacturing processes of the goods they purchase. The Generation Z and Millennials are more inclined as compared to the older generations to be aware of the Fair Trade Certified mark and to actively search for it; this increased awareness translates into purchasing. Furthermore, the rising demand for clean, organic, and non-GMO products as well as the growing consumer demand for transparency from brands regarding the sourcing and production of their products is also expected to support the regional growth of the market in the near future.

By Label Type

By Product Type

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026