April 2025

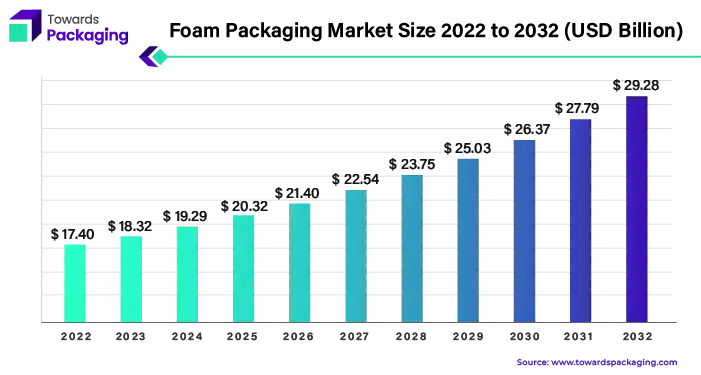

The global foam packaging market was valued at USD 18.32 billion in 2023 and is projected to reach USD 32.50 billion by 2034, registering a CAGR of 5.35% from 2024 to 2034. The market growth is attributed to the increase in the popularity of online shopping and rapid technological advancements.

The foam packaging is the process of encasing things in foam, such as expanded polystyrene (EPS) or polyethylene (PE), to keep them safe during handling and transportation. These materials were selected because they are very effective at absorbing shocks and are lightweight. 98% of foam packing is air. The development of foam packing has been characterised by an ongoing search for innovation to satisfy changing industry demands. The market has seen a radical shift from conventional Styrofoam blocks to custom-molded foam inserts, propelled by developments in material science and production technology. Foam packing was first only used for simple protective purposes. Customisation and sustainability, however, have been the industry's main growth pillars over time.

The importance of foam packing cannot be emphasised. It is a strong solution that guarantees the protection and safety of fragile items while they are in transit. Foam packing is essential for minimising damage and lowering returns for businesses because of its capacity to cushion delicate objects and absorb shocks. The adaptability of foam packing is one of its main benefits. Foam materials have several uses in a variety of sectors, from securing electronics to preserving perishable items. Foam packing has become an essential part of contemporary supply chains, whether it is used to protect food items or secure medical equipment during transit.

Enhancing the recyclability and biodegradability of foam packaging goods is another priority for producers in order to comply with environmental standards and meet consumer expectations. Manufacturers are investing resources on R&D to provide cutting-edge foam solutions that balance sustainability and performance. Foam packaging continues to be a vital component of effective and dependable product protection since it conforms to industry requirements and changes to accommodate new trends. It is crucial for businesses to select the appropriate packaging solutions as they handle the intricacies of the supply chain. The foam packaging market is characterised by a dynamic landscape where success is contingent upon achieving excellence in quality, sustainability, and innovation.

For Instance,

North America dominated the foam packaging market in 2024. The market growth in the region is attributed to the increasing number of online services, such as Amazon Fresh, Big Basket, blinkit, zepto, Jio Mart, and more. These applications allow users or consumers to purchase fresh vegetables without ever leaving their homes. In New York, the bulk of food and beverage processing facilities are also wineries, facilities for the slaughter and processing of animals, and establishments for the processing of food and beverages. Thus, these factors are expected to drive the market growth in the region. The U.S. and Canada are the major countries driving the market growth.

The foam packaging market growth in the region is attributed to the growing rapid population, increasing e-commerce industry, and increasing number of online services in the region. In addition, China, India, Japan, and South Korea are the major countries driving the market growth in the region. The market in China held the largest market share in 2024 and India has fastest growing market in the region.

Expanded polystyrene (EPS) foam is a flexible material with a wide range of uses in the foam packaging sector. EPS foam, which is recognised for its flexibility and low weight, is used in many different industries, including building, cushioning, thermal insulation, flotation, transportation, and packaging. Its composition, which consists of only 2% plastic and 98% trapped air, is one of the characteristics that set EPS foam apart. It's highly efficient as an insulating and packing material because of its special makeup. It’s entirely recyclable quality and minimal raw material utilisation make it an affordable option.

EPS foam has several appealing qualities that increase its popularity across a wide range of sectors. Its resilience assures endurance and dependability in a variety of applications, while its lightweight design makes handling and shipping easier. EPS foam is resistant to moisture, which means that it may be used in places where there is a lot of humidity or exposure to moisture. Another characteristic of EPS foam that makes it a great option for insulation is its thermal efficiency. Its efficient temperature regulation improves energy economy and lowers heating and cooling expenses. EPS foam also performs exceptionally well in absorbing shocks, protecting fragile goods from harm during handling or transportation.

Products made of EPS foam are in high demand, especially in the food and beverage, building, infrastructure, and industrial sectors. Due to its structural stability and capacity to withstand loads and backfill stresses, it is an essential tool in construction contexts where dependability and longevity are important.

For Instance,

The flexible foaming category is the leading force in the globally market for foam packaging. Flexible polyurethane foam is used in this market sector to provide cushioning for a wide range of consumer and commercial items. According to its adaptability, flexible foam finds significant use in a variety of applications, including furniture and bedding, automobile interiors, carpet underlay, and packaging.

The most important factors are flexible foam's capacity to be shaped into a variety of forms and stiffness levels, offering customised protection for breakable objects including instruments, medical equipment, and electronics. Its supportive, long-lasting, and lightweight qualities provide ideal cushioning without adding undue weight. This aspect leads to substantial cost savings during shipping in place of improving product safety.

Flexible foam can be easily modified, making it possible for it to adapt smoothly to a variety of product forms and sizes, unlike its rivals made of stiff foam. This flexibility guarantees the best defence against shocks and vibrations, protecting products all while going through the supply chain. Using flexible polyurethane foam supports initiatives aimed at preserving the environment. The total environmental impact of packing materials is decreased by the recyclable nature of some flexible foam varieties. Furthermore, flexible foam's lightweight characteristics support environmentally friendly transportation methods by reducing carbon emissions.

Flexible polyurethane foam accounts for around 30% of the polyurethane market in North America, where it commands a sizable market share. The fact that it is widely used in industries like automobile, furniture, and bedding highlights how essential it is to many others. A flexible and lightweight packaging solution is essential in today's industry, as demonstrated by the growth of the flexible foaming category. Flexible polyurethane foam remains the material of choice for protective packaging applications because to its many advantages, including environmental sustainability, customisation, and durability.

For Instance,

The food companies overflowing with foamed polystyrene, frequently referred to as Styrofoam. It has been praised for its lightweight and insulating characteristics, which keep food warm or cold during travel and storage, prolonging shelf life and decreasing spoiling. Polystyrene has evolved into an indispensable tool for food service operators, ranging from steaming coffee cups to takeout containers.

There is a substantial environmental cost associated with this convenience. Oil and natural gas are two non-renewable resources that are used to make almost all Styrofoam packaging. The plastics sector, which depends largely on these resources, may use up to 20% of the world's oil supply by 2050. Polystyrene is disposed of in landfills after usage, where it takes generations for it to break down, releasing toxic compounds into the atmosphere and threatening animals.

The food industry is confronted with a decision. Even while polystyrene has many advantages, its effects on the environment cannot be overlooked. Going forward, there is an urgent need for sustainable options that preserve food quality without endangering the environment.

For Instance,

Styrene-based goods are produced by BASF's Styrenics subsidiary for the packaging and construction sectors. One of the biggest providers of styrene-based goods in Europe, BASF sets itself apart among other things by consistently expanding its product line. Styrenic foams such as polystyrene and styrene, extruded polystyrene (XPS) Styrodur®, and expanded polystyrene (EPS) Styropor® and Neopor®, BASF now provides product variations based on resource-saving production procedures, the mass balancing approach.

For Instance,

The competitive landscape of the foam packaging market is dominated by established industry giants such as Sealed Air Corporation, Sonoco Products Company, BASF SE (Germany), Dart Container Corporation, Pactiv LLC, WinCup, Genpak, Zotefoams Plc (U.K.), Arkema (France), Kaneka Corporation (Japan), Rogers Corporation (U.S.), Synthos SA (Poland), Armacell (Germany), JSP (Japan), and Foampartner Group (Switzerland) and Pregis LLC. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Sealed air company Businesses are able to protect their items during shipment with a customisable solution when they use foam for packaging. Superior cushioning offered by foam packing materials protects goods from compromise while reducing the total transportation footprint. Foam packing offers customisable options for density, size, and form, making it ideal for protecting a wide range of products, including fragile goods and electronics.

For Instant,

Products based on styrene are produced by BASF's Styrenics business for the packaging and construction sectors. One of the biggest providers of styrene-based goods in Europe, BASF sets itself apart among other things by consistently expanding its product line. Together with styrenic foams like polystyrene and styrene, extruded polystyrene (XPS) Styrodur®, and expandable polystyrenes (EPS) Styropor® and Neopor®, BASF now provides product variations based on resource-saving production techniques called the mass balance method.

Expandable polystyrene (EPS) granulates made of graphitic material is now part of BASF's product line. Ten percent of Neopor® F 5 McycledTM's material is recycled, making it ideal for a variety of architectural applications—especially façade insulation.

A survey revealed that the U.S. uses over 5.6 billion pieces of plastic foam foodware each year. Eleven states and Washington D.C. have already passed laws to limit its use. Maryland was the first state to ban plastic foam foodware. Since then, the amount of plastic foam collected during the International Coastal Cleanup in Maryland has dropped by 65%. Since 1986, volunteers from the International Coastal Cleanup have gathered over 8.7 million plastic foam cups, plates, and takeout containers from around the world.

A recent report shows that 70% of Americans, regardless of political beliefs, support a nationwide ban on plastic foam foodware. The survey also found that half of Americans mistakenly put plastic foam in their recycling bins, even though it can't be recycled through regular curbside programs. Many Americans are worried about the effects of plastic foam. About 76% are concerned it contains harmful chemicals, and over 50% are very worried about wildlife eating tiny pieces of plastic foam.

Foam packaging leading market players are Sealed Air Corporation, Sonoco Products Company, BASF SE (Germany), Dart Container Corporation, Pactiv LLC, WinCup, Genpak, Zotefoams Plc (U.K.), Arkema (France), Kaneka Corporation (Japan), Rogers Corporation (U.S.), Synthos SA (Poland), Armacell (Germany), JSP (Japan), and Foampartner Group (Switzerland) and Pregis LLC.

By Material

By Structure

By End Use

By Region

April 2025

April 2025

April 2025

April 2025