Gift Wrapping Paper Market Insights, Forecast and Competitive Strategies

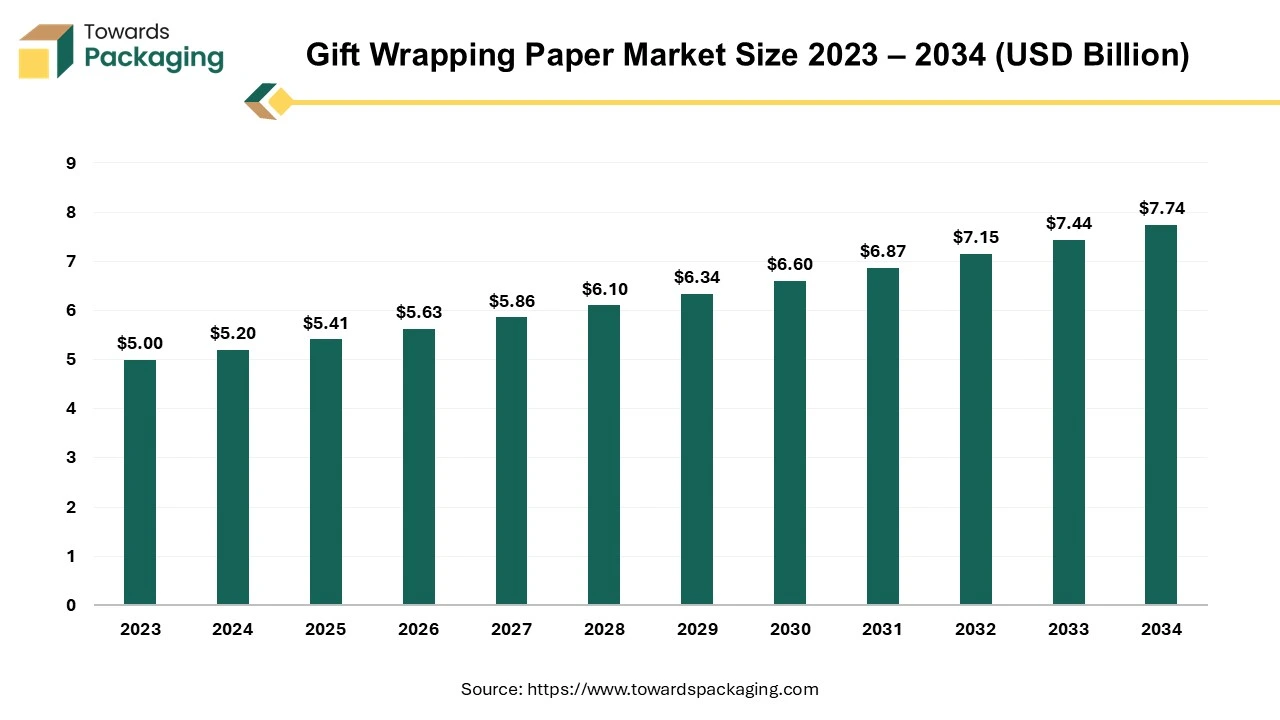

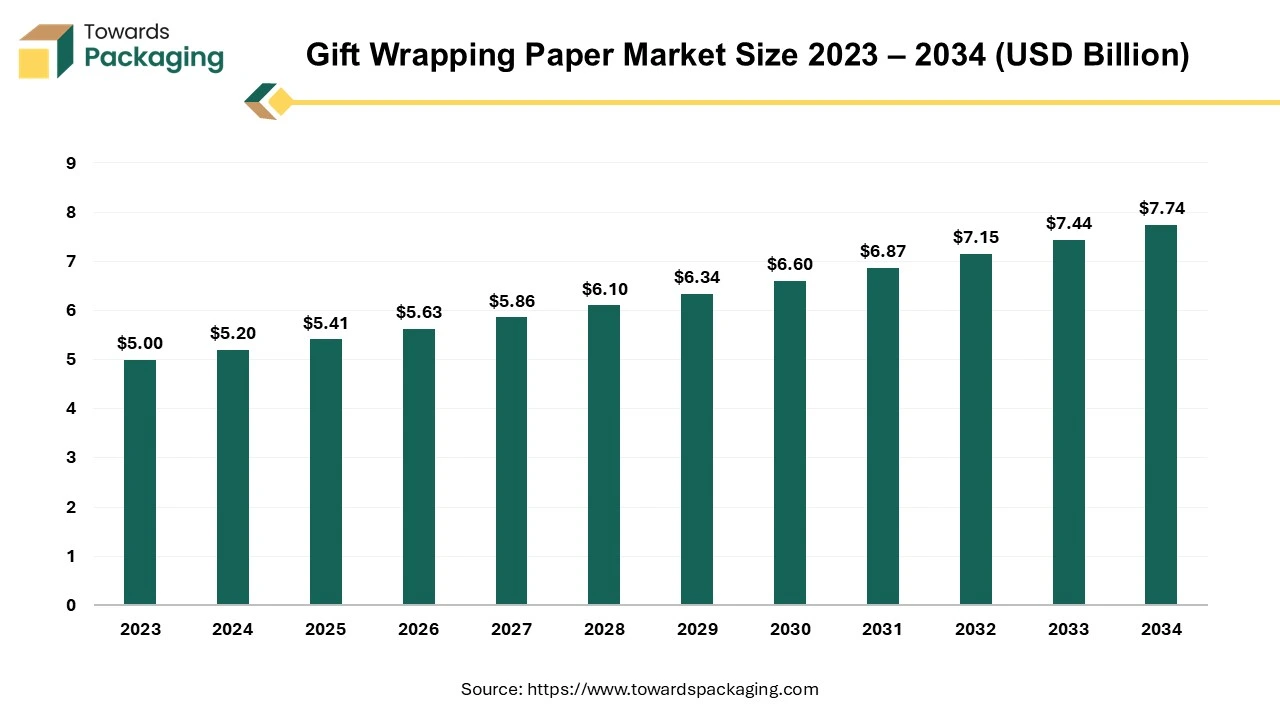

The gift wrapping paper market was valued at USD 5.63 billion in 2026 and is expected to reach USD 8.05 billion by 2035 at a CAGR of 4.05%. Our report covers product segments, material types, distribution channels, and end-user industries, alongside detailed regional data for NA, EU, APAC, LA, and MEA. It also includes profiles of leading companies, acquisition-driven strategies, value chain mapping, supply-side structures, trade statistics, and comprehensive manufacturer–supplier insights.

Major Key Insights of the Gift Wrapping Paper Market

- North America dominated the gift-wrapping paper market in 2024.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By material, the kraft paper segment dominated the market with the largest share in 2024.

- By packaging, the primary segment registered its dominance over the global gift wrapping paper market in 2024.

- By sales channel, the departmental/convenience/discount stores segment dominated the gift wrapping paper market in 2024.

Gift Wrapping Paper Market Overview

Gift wrapping paper plays a vital role in the art of gift-giving, adding an extra layer of excitement and thoughtfulness. It is used to conceal the contents of a present, building anticipation and creating a visually appealing presentation. Available in countless designs, colors, and materials, gift wrapping paper can elevate even the simplest gift into something extraordinary.

Gift wrapping paper isn't just for concealing gifts. It can be repurposed for creative projects like: scrapbooking, origami, decorative liners, glossy paper, etc. The gift wrapping paper offers a subdued, elegant look, suitable for formal events or understated gifts.

Market Trends

Rising Trend for Eco-Friendly and Sustainable Materials

Consumers are increasingly favoring wrapping papers manufactured from biodegradable or recycled materials, reflecting a broader commitment to environmental responsibility. This shift has prompted manufacturers to innovate and develop eco-friendly wrapping paper options to meet this demand.

Rising Customized Designs

There's a rising demand for unique and personalized wrapping solutions that enhance the gift-giving experience. Consumers seek custom designs that reflect the recipient's personality or the occasion, leading to an increase in offerings of bespoke wrapping papers and accessories.

Creative Alternatives to Traditional Wrapping Paper

Many are turning to unconventional materials for gift wrapping, such as fabric scraps, newspapers, or reusable gift bags, to add a personal touch and reduce waste. This trend aligns with the principles of green gifting, emphasizing sustainability and creativity.

Themed and Novelty Wrapping Papers

There's an increasing popularity of themed wrapping papers, including food-themed designs, that add a unique and playful element to gift presentation. Such designs cater to specific interests and can make the gifting experience more memorable.

How Can AI Improve the Gift Wrapping Paper Industry?

AI integration can significantly enhance the global gift wrapping paper industry by enhancing customer experience, streamlining operations, and driving innovation. The AI integration can analyze market trends, cultural preferences, and seasonal data to predict popular designs and themes for wrapping paper. AI tools like generative models can develop unique and customizable wrapping paper patterns, catering to diverse customer preferences.

The AI can forecast demand, minimizing overproduction and minimizing waste. AI algorithms can optimize shipping routes and inventory distribution, ensuring timely delivery and cost effective. AI-powered chatbots can guide customers in selecting the best wrapping paper based on their needs and occasions. Augmented Reality (AR) applications can let customers visualize how a wrapping paper design looks on their gift before purchase.

Driver

Growing E-commerce Sector

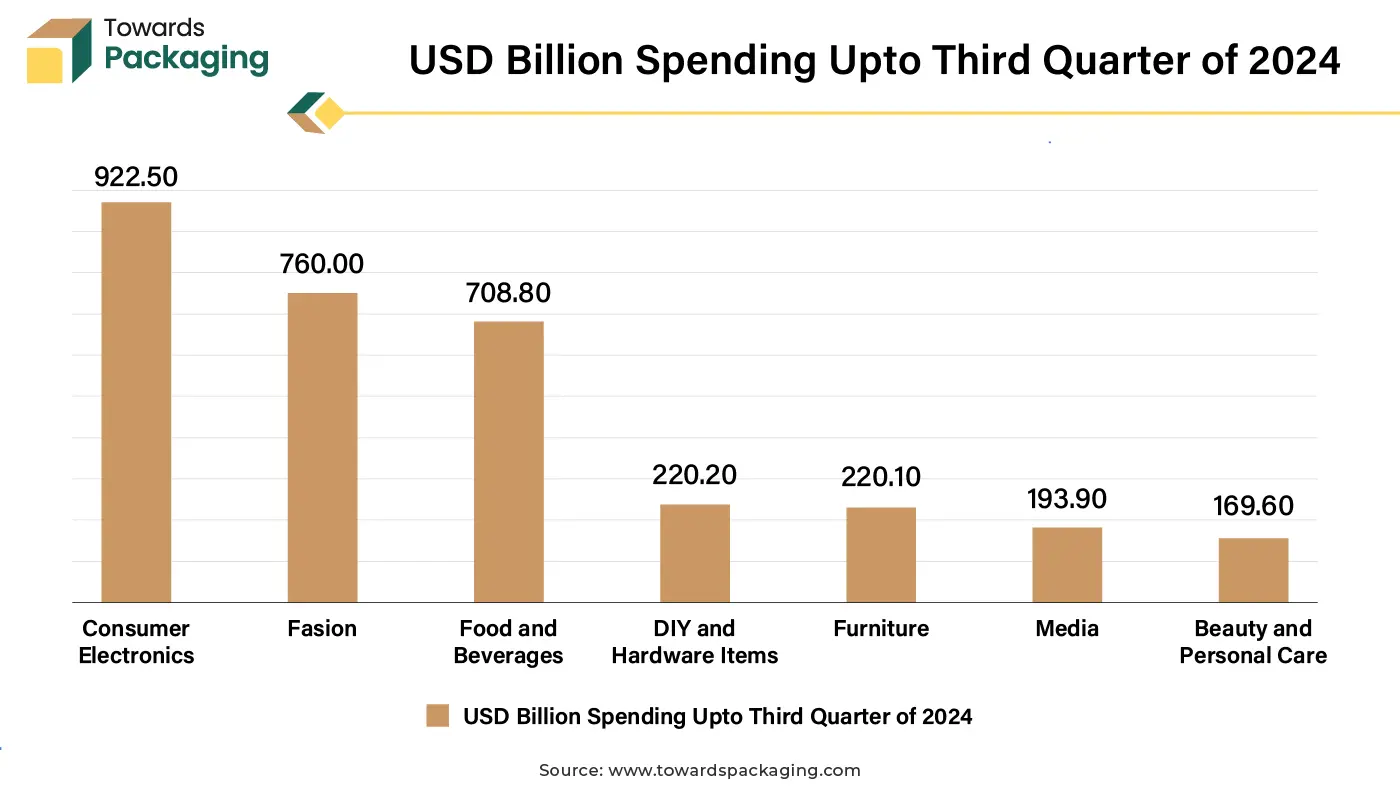

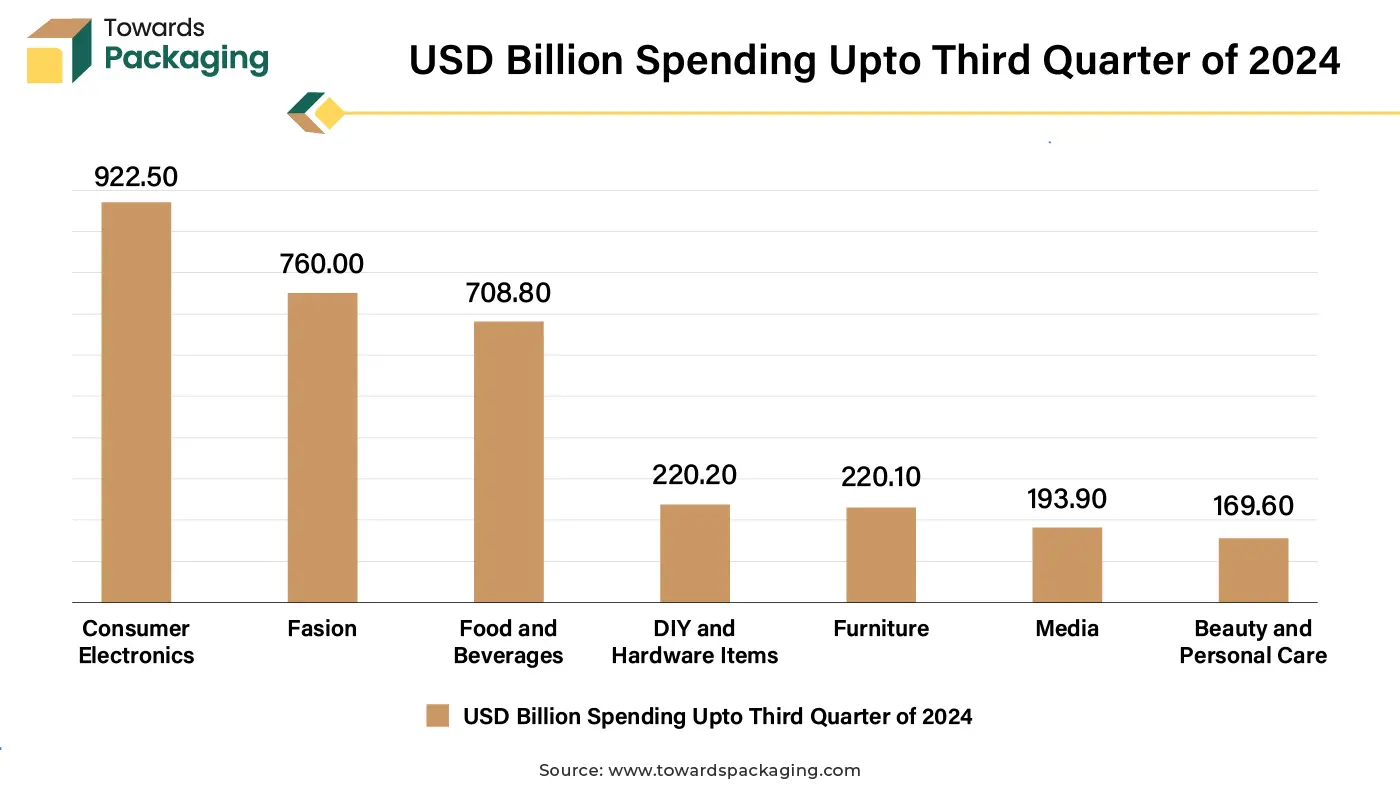

E-commerce platforms often enhance customer experience with attractive packaging, including gift-wrapped options. Subscription box services also contribute to increased usage of decorative wrapping materials. Hence, growing trend of purchasing goods from online platform has increased the demand for the gift wrapping paper and estimated to drive the growth of the global gift wrapping paper market over the forecast period.

In August 2024, United States Business Association of E-Commerce, as of the first half of 2024, retail commerce sales in the United States totalled US$579 billion. In the second quarter of 2024, US commerce sales totalled US$291.6 billion, up 6.8% from the same period the year before and 0.82% from the previous quarter. As of the first half of 2024, this amounts to US$579.45 billion in total e-commerce sales in the nation. Sales are expected to reach US$1.26 trillion by year's end and US$1.72 trillion by 2027, according to experts. About 22.6% of all US retail sales will occur online by that time.

Restraint

Economic Slowdowns & Seasonal Dependency

The key players operating in the gift wrapping paper market are facing challenges due to economic slowdowns and seasonal dependency. Economic recessions or financial crises can lead to reduced consumer spending on non-essential items, including gift wrapping materials. Rising costs of raw materials like paper, ink, and coatings can increase production costs, making wrapping paper less affordable for consumers. The industry heavily relies on festive seasons and special occasions, making sales cyclical and unpredictable. Low demand during off-seasons can impact profitability.

Opportunity

Seasonal and Festive Demand & Consumer Preferences for Aesthetic Appeal

Holidays such as Christmas, New Year, and Thanksgiving drive demand for gift wrapping products. Cultural festivals like Diwali, Eid, and Chinese New Year also play a significant role in increasing demand.

A growing preference for visually appealing and unique packaging drives demand for innovative wrapping paper designs. Customized and eco-friendly wrapping papers are gaining popularity. Due to high consumer demand of the gift wrapping paper in festive and seasonal programs, it has estimated to create lucrative opportunity for the growth of the global gift wrapping paper market in the near future.

For instance, in November 2024, KFC, the fast-food brand company has introduced lickable wrapping paper for the holiday season. This Christmas season, a lot of firms are already surprise their customers with new product launches and promotions. For instance, KFC has unveiled a new holiday product that tastes like chicken: lickable wrapping paper for the occasion. Fast food is a popular industry that many people adore but that some diners dispute. It serves millions of people globally because it's quick, easy, tasty, and inexpensive.

Sustainability Trends

The gift-wrapping paper market is increasingly embracing sustainability with a shift toward recycled, biodegradable, and compostable paper, including plantable seed options. Reusable substitutes like fabric or upcycled wraps are becoming more popular, but consumers now favor recyclable materials with certifications like FSC. Low-ink natural and minimalist designs are popular, and retailers are encouraging eco-friendly decisions with rewards. Sustainability is becoming a primary focus for growth and innovation as regulations prohibiting single-use plastics push the market towards greener solutions.

Regulatory Landscape of Gift-Wrapping Paper Market

Regulatory changes are increasingly shaping the gift-wrapping paper market, as non-recyclable materials and single-use plastics are restricted by governments all over the world. Stricter recycling and waste management regulations in places like the EU and UAE are pushing producers to use recyclable, biodegradable, and environmentally friendly paper. By guaranteeing that wrapping materials adhere to environmental standards and promote the objectives of the circular economy, these regulations are driving the industry toward sustainable production methods. Consequently, adherence to these regulations has emerged as a crucial catalyst for market expansion and innovation.

Future Demands

- Eco-friendly materials: Increasing demand for recycled, biodegradable, and compostable wrapping papers.

- Reusable and upcycled wraps: Growing interest in fabric wraps, newspapers, and other upcycled alternatives.

- Minimalist and natural designs: Consumers prefer low-ink, neutral, and nature-inspired aesthetics.

- Certified and transparent products: Higher demand for FSC-certified and fully recyclable options.

- Innovative solutions: Rising popularity of plantable seed papers and other zero-waste options.

Gift Wrapping Paper Market Segments Insights

Kraft Paper Segment Led the Market in 2024

The kraft paper segment held a dominant presence in the global gift wrapping paper market in 2024. Kraft paper is extensively used for gift wrapping due to its practical and aesthetic qualities, as well as its environmental benefits. Kraft paper is sturdy and resistant to tearing, making it ideal for wrapping gifts securely, especially for irregularly shaped items. Made from natural wood pulp, kraft paper is biodegradable, recyclable, and often made from recycled materials. This makes it a sustainable choice, appealing to environmentally conscious consumers. Its neutral, earthy tone provides a blank canvas that can be customized with ribbons, stamps, or other decorative elements, suiting various occasions and theme. Kraft paper is relatively inexpensive compared to specialized or glossy gift wrap.

Primary Segment Witnessed Significant Share in 2024

The primary segment registered its dominance over the global gift wrapping paper market in 2024. Gift wrapping transforms an ordinary item into something special and visually appealing, making it suitable for gifting occasions. The decorative nature of wrapping creates excitement and anticipation. Wrapping adds a personal and thoughtful touch to a gift, showing effort and care in the presentation, which can enhance the emotional value of the gesture. Although typically lightweight, gift wrapping provides a basic layer of protection against dust, scratches, and minor damage during handling. Wrapping conceals the contents of a gift, maintaining the element of surprise until the moment it is opened.

Gift wrapping allows for creativity and customization to suit the occasion, recipient, or theme. Various materials, colors, and designs can be chosen to align with specific preferences or celebrations. In many cultures, wrapping gifts is a traditional practice, symbolizing respect, thoughtfulness, and the importance of the occasion. While gift wrapping isn't always practical or eco-friendly, its widespread use reflects its ability to enhance the gift-giving experience

Departmental/Convenience/Discount Stores to Led the Market in 2024

The Departmental/Convenience/Discount stores segment to segment led the global gift wrapping paper market. Departmental stores often position gift items as premium products by enhancing their presentation (e.g., packaging, branding). This can justify higher prices, as customers perceive them as high-quality or luxurious. In many cases, customers shopping in these stores have fewer immediate alternatives, especially if they're already in the store for other purchases. This allows stores to charge higher prices. Departmental stores often stock branded or exclusive gift items not readily available elsewhere. This uniqueness can command a premium and high sale of the gift paper.

Regional Insights

North America’s Advanced Technology to Recycle Supports Dominance

North America region held the largest share of the global gift wrapping paper market in 2024. North America boasts a robust retail infrastructure with widespread availability of wrapping paper in department stores, specialty stores, and online platforms. Promotions and accessibility further enhance market dominance. Manufacturers in North America frequently introduce innovative and sustainable wrapping paper options, such as recyclable and biodegradable products, appealing to environmentally-conscious consumers. North America's dominance in the gift wrapping paper market is significantly influenced by several major players: Hallmark Cards, Inc., IG Design Group Americas, Seaman Paper Company, Greif, Inc., and Shamrock Retail Packaging among others.

In the United States, consumers are showing a strong preference for biodegradable, compostable, and FSC-certified wrapping papers. Eco-conscious consumers are becoming more interested in cutting-edge products like reusable cloth wraps and plantable seed papers. While corporate sustainability pledges and regulatory actions are hastening the adoption of eco-friendly gift wrap materials, retailers and e-commerce platforms are encouraging this trend with incentives.

Asia’s Growing Ecommerce Platform to Support Rapid Growth

Asia Pacific region is anticipated to grow at the fastest rate in the global gift wrapping paper market during the forecast period. Gift-giving is deeply rooted in cultural traditions across Asia-Pacific, such as during Chinese New Year, Diwali, and other festivals. This drives consistent demand for wrapping paper. Rapid growth in retail and e-commerce platforms makes gift-wrapping paper more accessible to consumers. Online retailers often bundle wrapping paper with gifts, further boosting sales.

India is growing in the gift-wrapping paper market, driving demand for eco-friendly and recyclable gift-wrapping papers. Reusable fabric wraps and upcycled paper are becoming more popular among urban consumers, and during holiday seasons, retailers are pushing eco-friendly options. Sustainability is a crucial component of the market expansion since government programs to cut back on single-use plastics are further promoting the transition to greener wrapping options.

Latin America, the demand for sustainable gift-wrapping papers

In Latin America, the demand for sustainable gift-wrapping papers is steadily increasing as customers start to care more about the environment. Recycled biodegradable and compostable materials are becoming increasingly popular, and eco-friendly products are being promoted by retailers. Limiting single-use plastics through regulations is also pushing manufacturers to use more environmentally friendly methods, which is spurring market expansion and innovation.

In Brazil, consumers are showing heightened interest in eco-friendly and recyclable wrapping paper, with upcycled and reusable wraps gaining popularity. Government regulations aimed at reducing environmental impact are driving the market toward greener alternatives, and retailers are increasingly providing sustainable packaging solutions, particularly during holiday seasons. In the Brazilian gift wrap market sustainability is starting to play a major role in product innovation and growth.

Paper, Paperboard and Woodpulp Statistics - Eastern Europe, Caucasus & Central Asia (EECCA) - 2022

| Category | 2022 Value (Million Tonnes) | Change vs 2021 (%) |

| Total Paper & Paperboard Production | 11.4 | -1.3 |

| Apparent Consumption (Total) | 10.1 | -2.2 |

| Sanitary & Household Paper Production | 0.9 | 1.5 |

| Sanitary & Household Paper Consumption | 0.88 | 2.2 |

| Packaging Material Production | 7.7 | -2 |

| Packaging Material Consumption | 7 | -1.9 |

| Case Material Production | 5.4 | -3.2 |

| Case Material Consumption | 4.5 | -4.2 |

| Cartonboard Production | 1.12 | -0.2 |

| Cartonboard Consumption | 1.82 | 3.5 |

| Woodpulp Production | 9.15 | 0.5 |

| Woodpulp Consumption | 6.75 | 0.5 |

| Woodpulp Exports | 2.72 | 0.7 |

| Woodpulp Imports | 0.32 | -4.8 |

In 2022, the EECCA region experienced a slight drop in overall paper and paperboard production and consumption. Packaging and case materials saw modest declines, while sanitary and household paper production and consumption grew slightly. Cartonboard consumption increased even though production remained almost flat. Woodpulp production and consumption were largely stable, with exports slightly up and imports slightly down. The data indicates a minor contraction in the paper sector with selective growth in niche segments.

Global Gift Wrapping Paper Market Key Players

- DS Smith Plc

- Oji Paper Co. Ltd.

- Smurfit Kappa Group Plc

- Stora Enso Oyj

- Nippon Paper Group Inc.

- HighPoint Packaging

- Twin Rivers Paper Company

- Kraft Wrap Inc.

- Madico Inc.

- The Paper Company India

Latest Announcements by Gift Wrapping Paper Industry Leaders

- In August 2024, Ceri Stirland, CEO of UK Greetings company, stated, the new paper tear strip represents a significant step forward in sustainable gift wrap solutions. The UK Greetings company is advancing goal to lessen environmental impact without sacrificing product functionality by removing plastic from this component. According to Ceri Stirland, CEO of UK Greetings company, the strip is the first of its sort available in the UK.

According to UK Greetings, it has invested "substantially" in "cutting-edge," cutting-edge gear to effectively produce and apply paper tear strips on a large scale. In an attempt to gradually replace plastic shrink wrap in gift wrap applications, UK Greetings launched a paper tear strip for roll wrap products. The solution is said to be plastic-free and 100% recyclable. It aims to be an environmentally friendly solution that blends in seamlessly with current roll wrap designs while also being user-friendly for customers.

New Advancements in Gift Wrapping Paper Industry

- In April 2024, Orlandi, a pioneer in packaging and sample solutions, announced the release of EcoPro Paper-Wrap, a new product. Because EcoPro doesn't contain plastic, film, or foil, it is a major development in recyclable packaging solutions and was created to satisfy the growing need for environmentally friendly packaging.

Global Gift Wrapping Paper Market Segments

By Material

- Kraft Paper

- Recycle Paper

- Bleached Paper

- Unbleached Paper

By Packaging

- Primary

- Secondary

By Sales Channel

- Departmental/Convenience/Discount Stores

- Hyper/Supermarket

- Online Sales

- Others (Independent/Specialty Stores)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (3)