April 2025

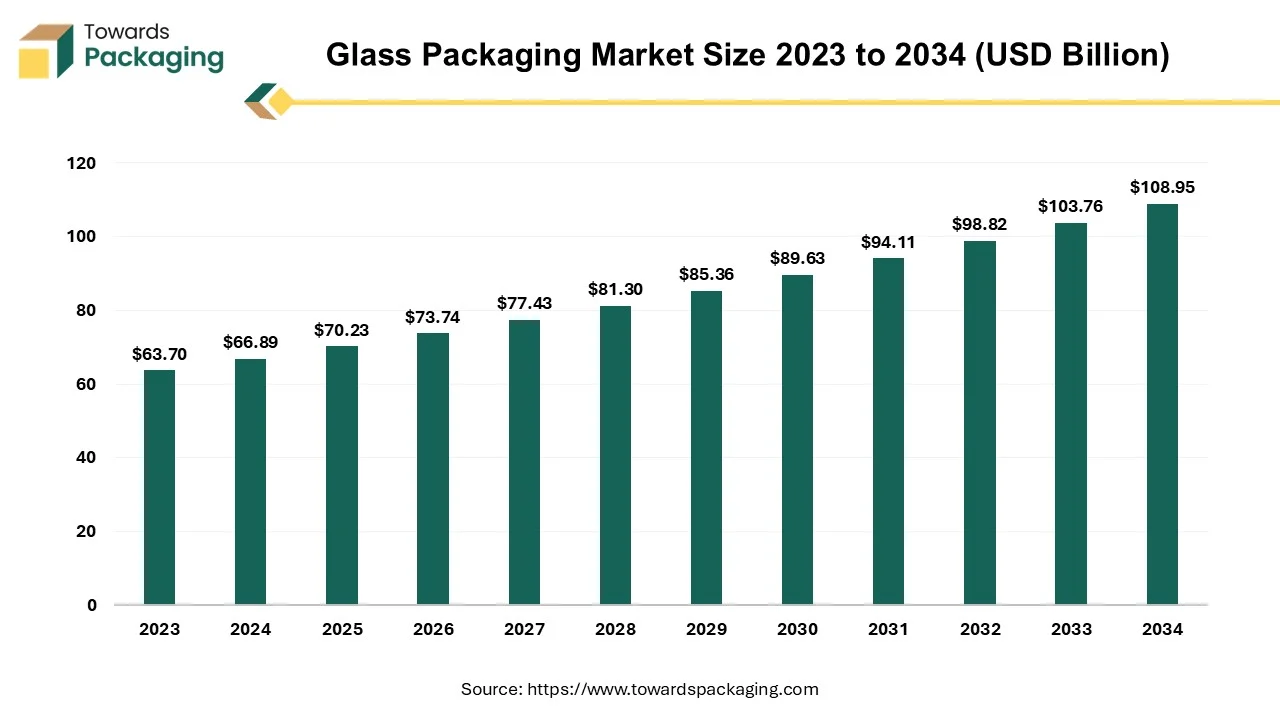

The glass packaging market is projected to reach USD 108.95 billion by 2034, growing from USD 70.23 billion in 2025, at a CAGR of 5% during the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing glass packaging which is estimated to drive the global glass packaging market over the forecast period.

Glass packaging has been used for centuries due to its durability, chemical stability, and premium appeal. It remains a popular choice for industries like food & beverages, pharmaceuticals, cosmetics, and premium seafood packaging. The glass packaging provides a 100% barrier against oxygen, moisture, and external contaminants, ensuring a longer shelf life. Protects sensitive contents like seafood, dairy, and medicines from spoilage. Often used for high-end products due to its luxurious look and feel. Glass packaging can be coloured, embossed, or customized for branding purposes.

AI-driven automation can streamline glass production by optimizing temperature, pressure, and speed in molding, reducing energy consumption. Predictive maintenance uses AI to analyze equipment performance and anticipate failures, reducing downtime and repair costs. Computer vision and machine learning can detect defects (cracks, bubbles, irregularities) faster and more accurately than manual inspection. AI can improve consistency in production by automatically adjusting processes based on real-time quality assessments. AI-integrated QR codes and NFC technology provide consumers with real-time product information, sustainability details, and recycling instructions.

AI-powered computer vision can detect defects such as cracks, bubbles, or irregularities in glass bottles and containers with greater accuracy than human inspection. Machine learning algorithms can continuously improve defect detection by analyzing past data and predicting manufacturing issues. AI can analyze sensor data to predict equipment failures before they happen, reducing downtime. AI-driven systems can adjust temperature, pressure, and speed in glass molding to optimize quality while minimizing energy consumption. AI-driven demand forecasting can help manufacturers produce the right amount of glass packaging, reducing overproduction and waste. Automated logistics management can optimize delivery routes and warehouse stocking, cutting costs and emissions.

Glass is chemically inert, making it ideal for storing medicines, vaccines, and injectable drugs. The expansion of biotechnology and specialty drugs is increasing the demand for borosilicate glass vials and ampoules. The pharmaceutical industry relies heavily on glass vials, ampoules, and syringes for storing vaccines, injectable drugs, and biologics. The growth of biopharmaceuticals, gene therapies, and specialty drugs increases the need for high-quality borosilicate glass that resists chemical interactions. Biologics and biosimilars require packaging that prevents contamination, and glass is preferred due to its inert properties and ability to maintain drug stability.

As personalized medicine and advanced therapies grow, customized glass packaging solutions will be in higher demand. Rising healthcare spending in developing countries (India, China, Brazil) is increasing the production of pharmaceuticals, fueling demand for glass packaging. The aging population worldwide is driving demand for injectables, IV solutions, and ophthalmic products, all of which rely on glass packaging. The expansion of the pharmaceutical and healthcare industries is directly boosting the demand for glass packaging, especially for vials, ampoules, and high-quality containers used in medicine storage.

According to the data published by the Indian Pharmaceutical Association, in 2025, it has been estimated that according to an investigation by ETMutual Funds, mutual funds focused on pharmaceutical and healthcare have provided the highest average return in 2024 (January 1, 2024 to December 3, 2024), at about 38.05%.

The key players operating in the market are facing issue due to fragility of glass material and competition from alternative packaging materials which has estimated to restrict the growth of the glass packaging market. Glass production requires extremely high temperatures, leading to higher energy consumption and costs, especially with rising fuel prices. Some segments prefer plastic pouches, cartons, or metal cans due to cost-efficiency and convenience.

Glass is more fragile than plastic or metal, leading to higher breakage risks during transport and storage. Although glass is sustainable, its manufacturing process emits significant CO₂, making it less eco-friendly compared to some alternatives. Consumers often prefer lightweight and shatterproof packaging, making plastic or aluminum more appealing for on-the-go products. Advances in biodegradable plastics and compostable packaging present competition to glass.

Growing concerns about plastic waste and pollution are pushing brands to switch to glass, which is 100% recyclable and reusable. Government policies & regulations: Many countries are introducing plastic bans and recycling mandates, encouraging industries to adopt glass packaging. Circular economy initiatives: Glass can be recycled endlessly without losing quality, aligning with sustainability goals of major corporations.

Manufacturers are developing lightweight glass to reduce transportation costs and carbon emissions. Smart glass packaging (e.g., NFC-enabled bottles, QR codes) is gaining traction, offering enhanced customer engagement and traceability. For instance, in 2023, SGD Pharma, pharmaceutical company revealed the expansion of the beauty and cosmetics range with the launch of the Nova - a lightweight glass bottle.

The soda-lime glass segment held a dominant presence in the glass packaging market in 2024. Soda-lime glass is cheaper to manufacture compared to other types like borosilicate glass, making it the preferred choice for mass production. Transparent and color-customizable of soda-lime glass making it ideal for packaging and display. Soda-lime glass has low melting point (compared to borosilicate glass) makes it easier to mold and shape.

The vials segment accounted for a significant share of the glass packaging market in 2024. Glass is extensively used for manufacturing vials due to its unique properties that ensure the safety, stability, and effectiveness of stored substances. As glass has chemical inertness & non-reactivity. Glass does not react with drugs, vaccines, or chemicals preventing contamination. The glass material offers thermal resistance can withstand high-temperature sterilization processes (autoclaving). The glass material is suitable for cryogenic storage and transport of temperature-sensitive drugs.

The food & beverages segment registered its dominance over the global glass packaging market in 2024. As companies expand, they introduce more products requiring glass packaging (e.g., sauces, juices, dairy products, alcoholic drinks). Increasing consumer preference for premium and organic foods boosts glass usage due to its perceived purity and safety. The wine, beer, and spirits industry relies heavily on glass bottles for preserving taste and quality. Expanding breweries and distilleries increase the demand for customized and sustainable glass bottles.

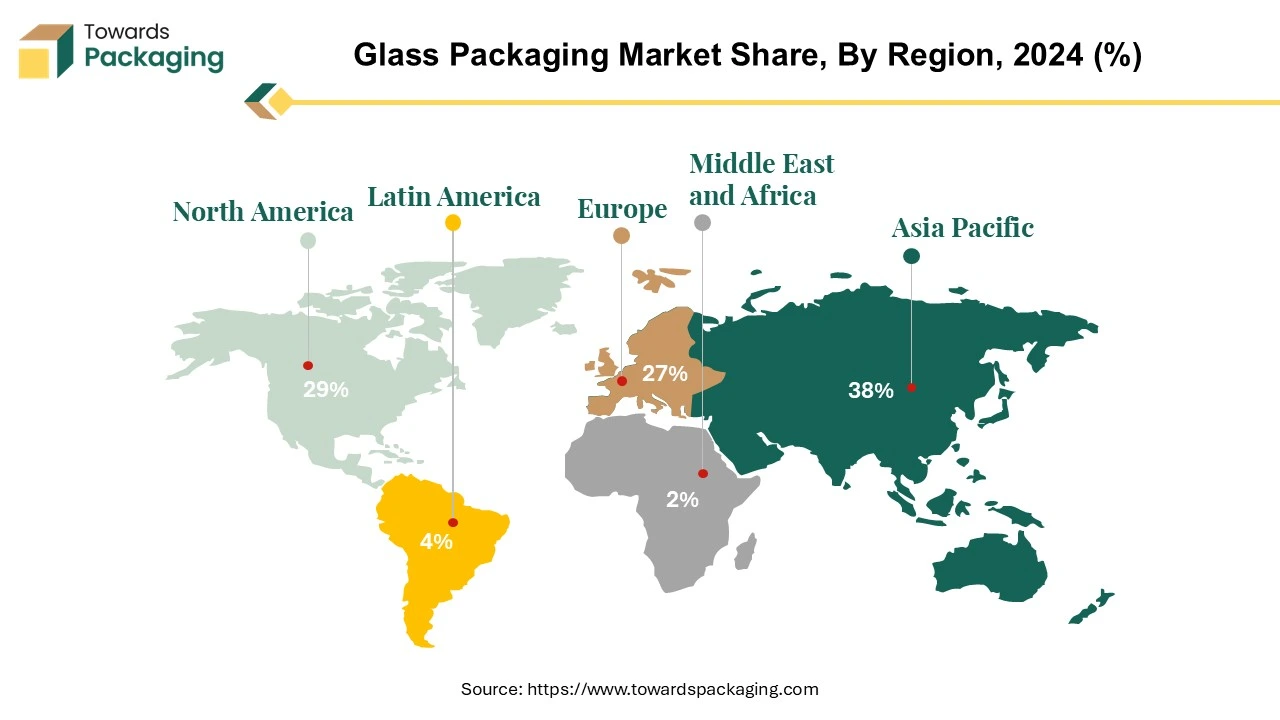

Asia Pacific region dominated the global glass packaging market in 2024. This increase is explained by the growing need for environmentally friendly and sustainable packaging options because glass is a 100% recyclable material that has a smaller environmental impact. Furthermore, the expansion of the food, beverage, and pharmaceutical sectors in the area is increasing demand for long-lasting, safe, and high-quality glass packaging. Further encouraging market expansion are cutting-edge technology and packaging designs that improve the visual attractiveness of glass items.

The demand for glass packaging in India has increased due to shifting lifestyles, increased disposable incomes, and growing westernization, especially in the food and beverage and alcoholic beverage sectors. Additionally, as glass is the ideal material for products like ampoules, dropper bottles, and high-end cosmetic containers, the expanding healthcare and cosmetics industries have helped to fuel the need for glass packaging.

North America region is anticipated to grow at the fastest rate in the glass packaging market during the forecast period. North America region has a high consumption of alcoholic beverages, especially beer, wine, and spirits, which are often packaged in glass bottles due to their premium appeal and ability to preserve taste. Increasing awareness about environmental sustainability has led to a preference for glass, as it is 100% recyclable and reusable without losing quality. The pharmaceutical and personal care industries in North America rely on glass packaging for its chemical resistance, safety, and aesthetic appeal.

The U.S. glass packaging market is anticipated to increase significantly during the over the forecast years. The market is being driven in large part by the growing demand for eco-friendly and sustainable packaging options as a result of consumers' increased environmental consciousness. Due to glass's inert and non-reactive qualities, the pharmaceutical industry is seeing an increase in demand for glass packaging, which is fueling market expansion. It is anticipated that the need for glass packaging will be fueled by the aging of the American population and the concurrent growth of the pharmaceutical sector.

The market for glass packaging in Canada is anticipated to expand considerably as a result of rising beer consumption. Glass bottles are widely used to protect beer's contents from UV light exposure. Glass bottles and containers are also in high demand due to the growing popularity of cosmetics and fragrance goods, especially high-end and luxury brands. A competitive advantage for the expansion prospects of the sector is also provided by Canada's position as a major exporter of glass and glassware.

Europe region is seen to grow at a notable rate in the foreseeable future. The EU has implemented stringent policies to reduce plastic waste and promote circular economy practices, driving demand for glass as a sustainable packaging solution. Europe has one of the highest glass recycling rates globally, with countries like Germany, France, and the Netherlands leading in glass collection and reuse. This supports cost-effective and sustainable glass production. European consumers are highly conscious of sustainability, leading to a growing preference for glass over plastic, especially in food, beverages, and cosmetics.

The increasing consumption of wine, beer, and premium spirits, particularly in countries like Italy, France, and Spain, is driving the demand for glass bottles. European manufacturers are investing in advanced technologies to produce lightweight yet durable glass bottles, reducing costs and carbon emissions while maintaining strength and aesthetics. European governments and packaging companies are working together to enhance glass recycling infrastructure and encourage glass usage through incentives and funding programs.

Thaddeus Lubbers, Director, Sales-Beer and Beverage at Ardagh, presented alongside Glass Packaging Institute (GP) President Scott DeFife at CBC's "Sustainability Solutions in Glass Packaging for Brewers" panel session in April 2024. One of the top glass suppliers to the American beer market, Ardagh has been making inventive glass bottles in the United States for over 125 years. Two new Boston Round bottles were added to Ardagh's expanding line of American-made bottles. AGP-North America's BOBTM website (BuyOurBottles) offers the new 16 oz (473 ml) Boston Round glass beverage bottles in amber (brown) and flint (clear) glass.

By Material

By Product

By Application

By Region

April 2025

April 2025

April 2025

April 2025