February 2025

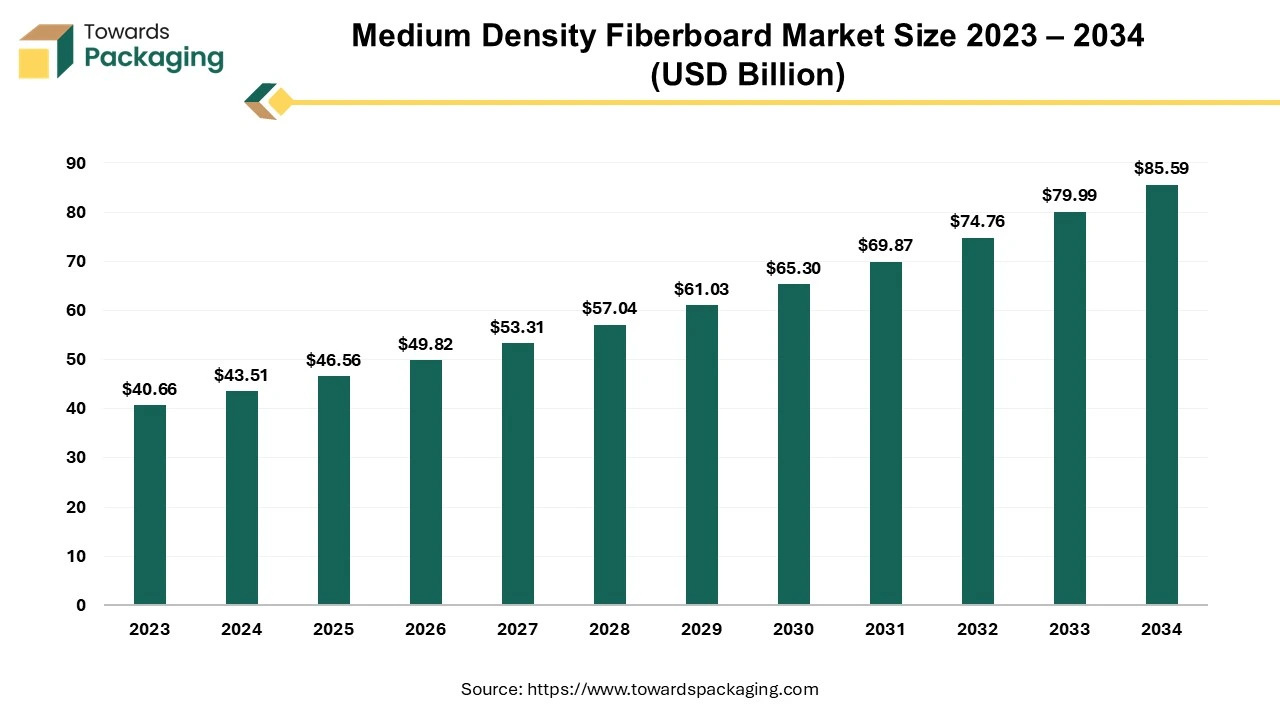

The global medium density fiberboard market size reached US$ 43.51 billion in 2024 and is projected to hit around US$ 85.59 billion by 2034, expanding at a CAGR of 7% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The medium density fiberboard market is playing a significant role in the packaging industry majorly in the building and construction industry due to rising trendy styles and low product costs. The rapidly rising population, tourism, and growing urbanisation have influenced the growth of the medium density fiberboard market. These factors raise the demand for flooring, interior designing, windows, and several other uses where MDF boards are utilized significantly. The furniture sector is observing a rise in demand for a growing number of dwellings, and residential as well as non-residential buildings.

A huge number of furniture are made from MDF board panels, growing demand for furniture is also influencing the development of the market. There are several major market players such as Arauco, CENTURY PLYBOARDS, Kastamonu Entegre, Swiss Krono Group, EGGER Group, Greenply, and many others are introducing innovation in this field which attracts a huge number of customers towards this market.

In the manufacturing of fiberboard, there is a huge impact of AI as it is used in the production procedure by analyzing the quality of the products. Artificial intelligence is used to inspect these panels and separate all the defective pieces which enhances the reliability of brands in this market. It controls the major parameters such as usage of resins, fibre density, and pressing conditions which is useful for reducing waste production, raising efficiency, and improving the quality of the fiberboard.

With the incorporation of advanced technology such as artificial intelligence and machine learning, it is easy to predict the maintenance of the product which enhances user experience and boosts the development of the market. It is widely used in optimization procedures such as pressing pressure, fibre size, and resin content to ensure high-quality dense fiberboard panels. Such technologies reduce the energy efficiency and time of production which increase the demand of this market.

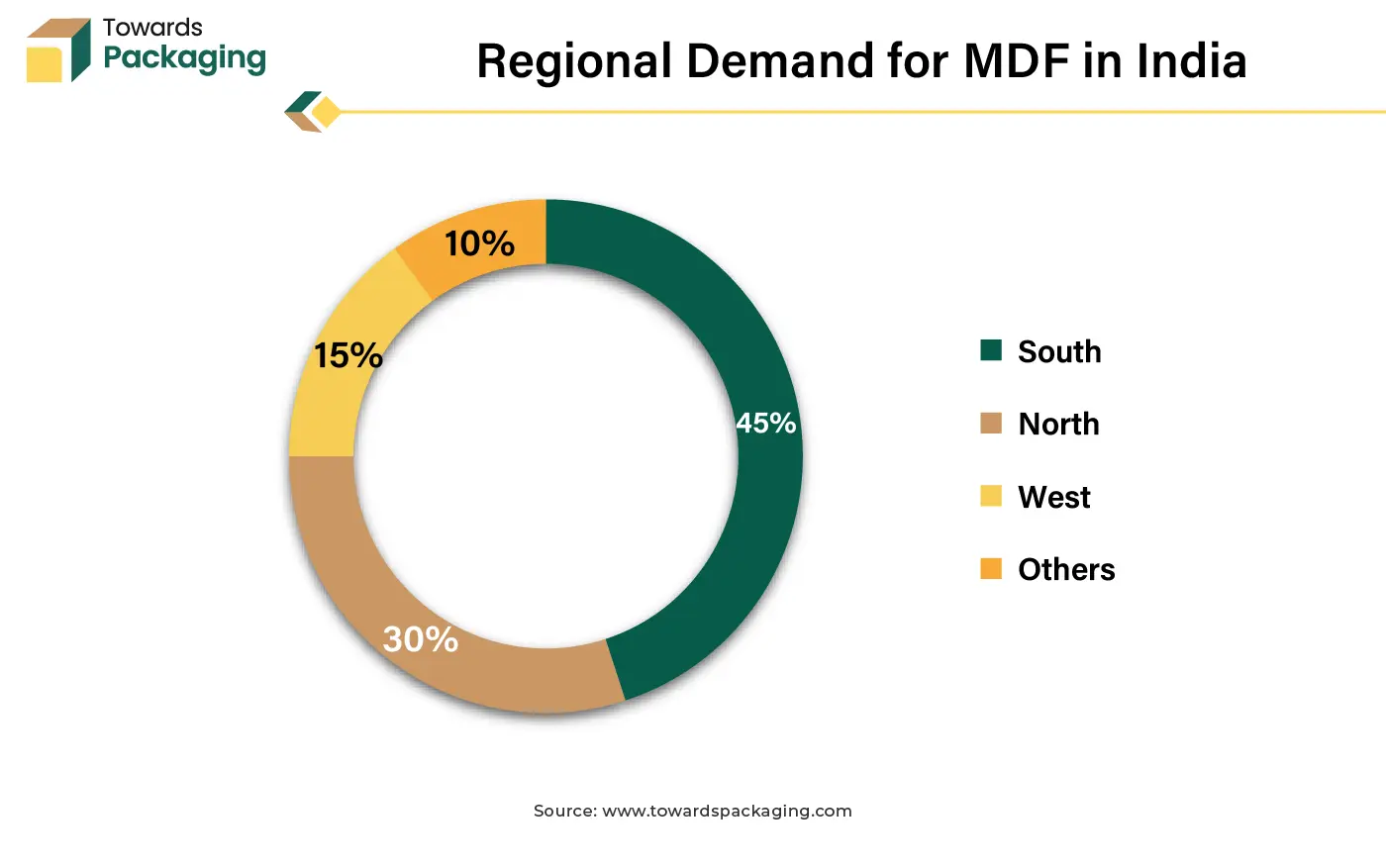

The medium density fiberboard market is growing rapidly due to the rising support of the government and growing demand for sustainable products. The request for wooden goods such as plywood, particle boards, and medium-density fiberboard has been amplified because of the support from several governments globally to expand the construction business's sustainability. The industry for these wooden products is predicted to increase because of such creativities. These are used as sustainable resources, and the usage of this category of medium-density fiberboard is growing. The demand for personal and commercial infrastructure has been enhanced by the rising populations in several countries such as India, Brazil, the U.S. and China, this is predicted to be beneficial for the MDF industry.

The continuous growth in purchasing power due to the rising economy will enhance the demand for products that improve the look of the living areas. The medium-density fiberboard and plyboard have been extensively utilized in the manufacturing of furniture such as beds, library shelves, tables, and sofas since both are similar. In comparison to plywood, these medium-density fiberboard panels are significantly low-cost and have a flatter exterior. These features make these fiberboard panels a great addition to plyboard in utilization where humidity and heat resistance are not the major necessities.

The support from several governments across the world to raise the sustainability of the building sector has driven the growing demand for wooden products such as MDF, particle boards, and plywood. Both medium-density fiberboard and plyboard have the same nature, both of them have been mostly used in the production of furniture such as beds, tables, library shelves, and sofas. The medium-density fiberboard panels charge suggestively less than the plyboard while being empty of element grain and knots in its building. Due to these characteristics, this fiberboard is an exceptional substitute for plyboard for application in places wherein moisture and impact resistance are not the prime necessities.

The medium density fiberboard has been demonstrated to be an outstanding resource for the establishment of dividers in commercial spaces to confirm confidentiality and social distancing between the workforces this has been a major aim. Several market players have projects to renew the workplaces to offer an attractive ambience to the employees.

Due to numerous aspects, the growing demand for MDF panels from the packaging sector is influencing its market development. The product delivers a balance of durability, sturdiness, and affordability which makes it an attractive option for packaging purposes. Its even density and smooth exterior permit shaping, easy cutting, and finishing, provided that adaptability in packaging pattern.

Moreover, medium-density fiberboard is favoured over old-style resources such as plyboard or solid wood because of its low charges and more reliable quality. As the packaging sector is expanding continuously on a global level, influenced by e-commerce development and growing customer demand for packaged products, the request for medium-density fiberboard panels in the packaging industry is anticipated to upsurge, influencing its market development.

The medium-density fiberboard panels are utilized in a variation of manufacturing procedures in the construction industry, comprising windows, siding, flooring, door panels, and flooring. In the aforesaid applications, this plywood could take the place of unadventurous construction resources like plywood, cement, plastic, and glass. The demand for medium-density fiberboard panels is consequently anticipated to upsurge through the estimated period accompanied by the extension of the construction sector.

The increasing demand for furniture is predicted to upsurge as a consequence of remodelling and reformation projects carried on by refining living values. The expansion of workplace spaces and commercial constructions in developing nations has impacted the request for wooden furniture as a consequence of the development of the service area.

The production of these fibreboards consists of formaldehyde as an essential material and exposure to them in huge quantities causes cancer in human beings. These harmful effects hinder the growth of the market as the leading companies are working significantly to reduce such negative effects.

The standard segment dominated the market in 2024 due to rising construction work and furniture industries. There is a high demand for dense fiberboard for manufacturing cabinets, furniture, and floors in the building both residential and non-residential. These are highly in demand due to the growing construction of buildings for personal and commercial usage which require high-density fiberboard for creating trending designs. It is mainly used in places where moisture and fireworks occur as it is highly durable. It has wide usage due to the easy availability of these dense fiberboards and enhances the market demand.

The E1 medium density fiberboard segment dominated the market in 2024 due to strong regulatory support across the world. These boards are manufactured by a combination of phenol-formaldehyde resin which is mainly used as a binding agent. The demand for E1 MDF is influenced by enhancing air quality and decreasing revelation to dangerous matters. As consciousness towards health and ecological apprehensions increases, customers and businesses are progressively selecting products completed from E1 medium-density fiberboard which is supposed to be harmless and more environment-friendly than other choices.

The furniture segment dominated the market in 2024. This segment is dominating due to several benefits associated with this segment such as durability, lightweight, and low-charges. The major market players manufacturing furniture are giving major priority to medium-density fiberboard which is easy to handle, work, and transport to longer distances. The lightweight properties of these fiberboard panels have influenced the market demand as they decrease the shipping cost of the furniture.

Asia Pacific held the largest share of the market in 2024. This is due to the rapidly growing demand for sustainable furniture. The governmental guidelines started implementing RFID sensors in wooden packaged products and rising economic conditions in countries such as India, Japan, China, Thailand, and South Korea have enhanced the demand for medium-density fiberboard panels. The growing economy significantly contributes to the development of the market.

North America is seen to grow at the fastest rate during the forecast period. There is a huge demand for medium-density fiberboard panels due to growing construction work in countries such as the U.S. and Canada. These regions have high-standard and advancement in technology has influenced the growth of these fiberboard panels. With the expansion of the e-commerce sector, there is a huge preference for lightweight furniture for transportation to longer distances at low charges. The growing trend for sustainable resources for construction work has increased the demand for this market.

Product Outlook

Type Outlook

By Region Covered

February 2025