April 2025

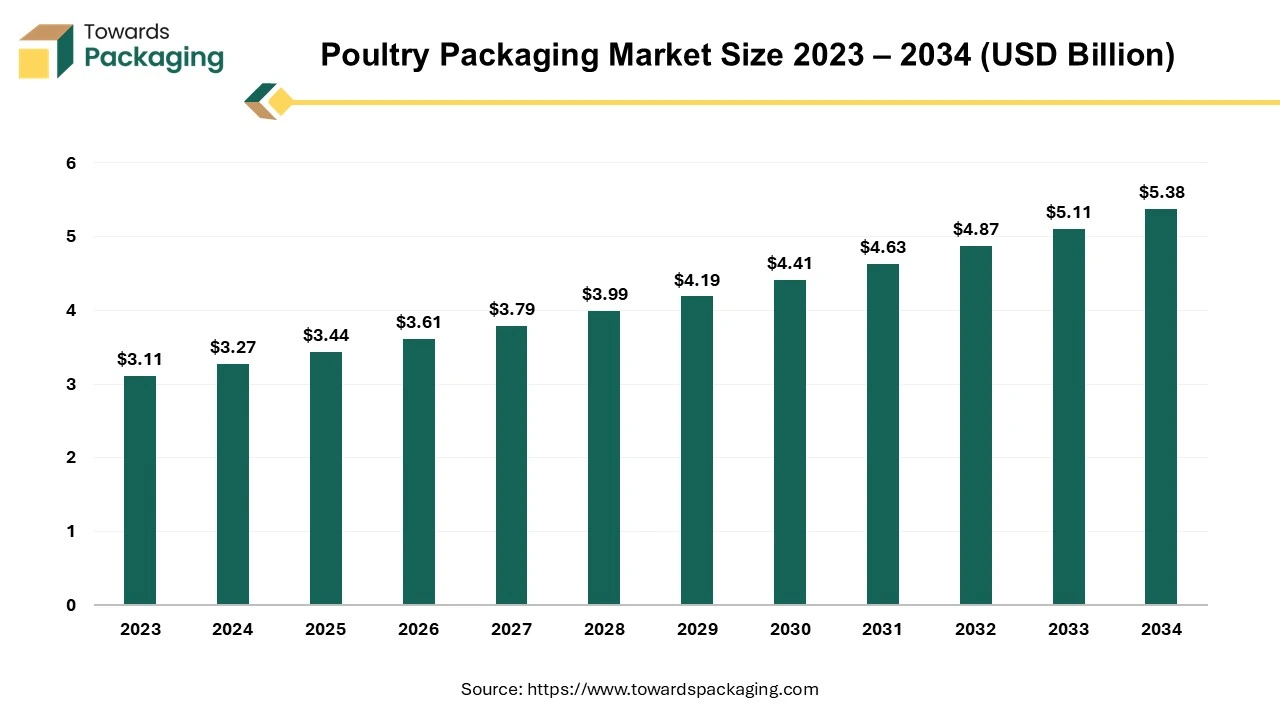

The poultry packaging market is set to grow from USD 3.44 billion in 2025 to USD 5.38 billion by 2034, with an expected CAGR of 5.1% over the forecast period from 2025 to 2034.

Poultry consists of any domesticated bird reared for egg or meat production, such as ducks, geese, chickens, guinea fowl, and turkeys. The packaging solutions for poultry are diverse and designed to protect the various components they contain. Identifying the best packaging alternatives can take a lot of work for producers. Materials, transportation, and shelf life must all be carefully considered.

Convenience, sustainability, creativity, and waste reduction are no longer merely desirable qualities. They are increasingly required by customers and investors seeking a modern culinary experience. There is a rising focus on developing processing and packaging solutions that benefit customers and the environment. The sustainability of packaging materials significantly impacts consumer purchase decisions and investment in innovation.

As environmentally responsible poultry packaging technologies are needed, convenience becomes essential, particularly among busy Millennials and Generation Z professionals. Over 54% of these customers are willing to spend more for affordable, portable, and resealable poultry packaging.

Globally, poultry meat is expected to account for 41% of total meat protein by 2030, up 2% from the baseline. Poultry prices are projected to track grain prices closely since feed costs account for many production expenses, and output responds quickly to rising worldwide demand. Although poultry meat production will continue to be the primary driver of meat production development, its expansion rate is expected to decline compared to the preceding decade. The rise in packaging demand is partly attributed to the production and consumption of poultry products.

The United States, Malaysia, Saudi Arabia, Brazil, and Australia consume more than 40 kilograms per person per year, whereas Thailand, Indonesia, and India consume tiny (9.6 kg, 7.3 kg, and 2.2 kg, respectively).

The low consumption of poultry meat in Indonesia is unexpected compared to many other Islamic nations, particularly Saudi Arabia. India's low per capita consumption is caused by both the population's poor purchasing power and the high percentage of vegetarians and vegans due to religious constraints.

For Instance,

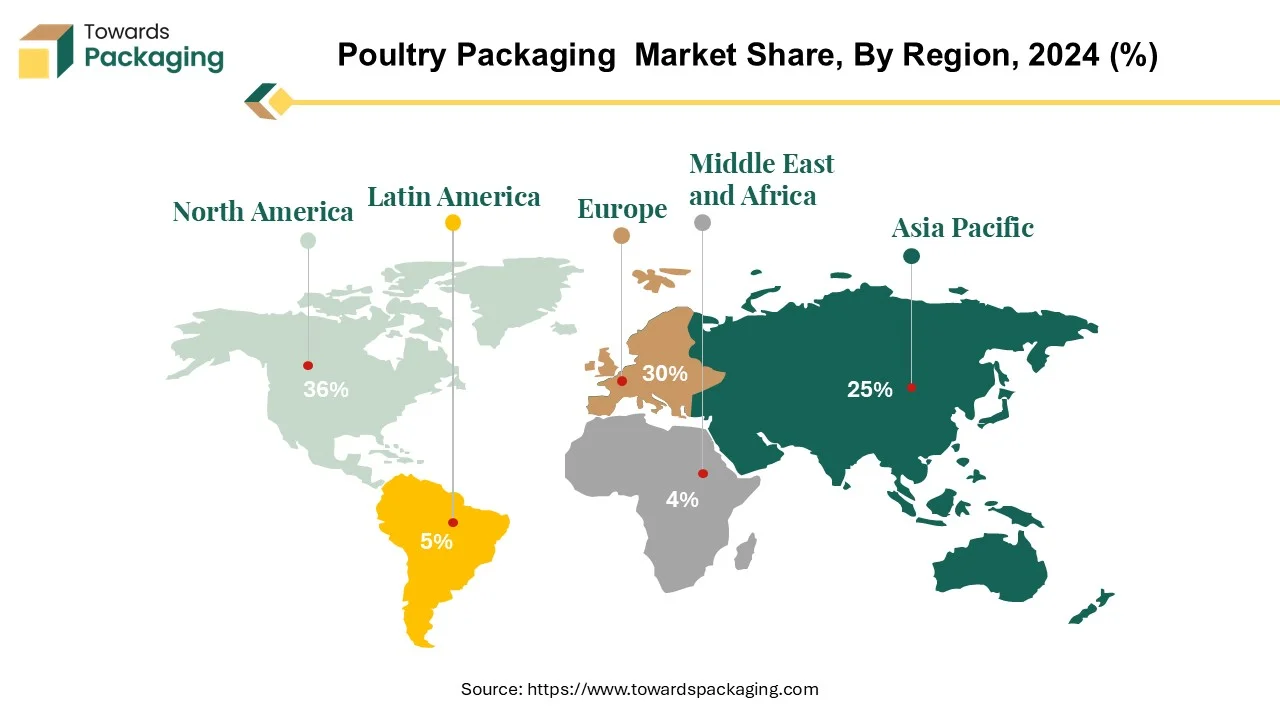

The poultry packaging market in North America is one of the largest and most dynamic segments of the overall packaging industry. Several vital variables contribute to this strong presence. North America, particularly the United States, consumes a significant amount of chicken, over 15,000 metric tons per year, considerably outpacing other regions. Chicken has become an integral part of American cuisine, from popular meals like chicken wings at sporting events to its use as an essential ingredient in soups and other cuisines. This extensive consumption creates a demand for economical and novel poultry packing options.

As poultry becomes the most consumed livestock commodity internationally, countries including Brazil, the United States, the European Union, and Thailand have increased domestic production to satisfy rising demand. Brazil is the world's leading poultry exporter, with the United States also playing an important role, but its market share is expected to fall significantly in the coming years.

For Instance,

Intense competition among packaging producers in the North American market fosters a culture of ongoing invention and improvement. These organizations aim to differentiate themselves through distinctive packaging designs, materials, and functionality. This competitive landscape motivates continual R&D efforts to improve product performance and fulfill changing consumer demands for convenience, sustainability, and food safety.

North America's poultry packaging market is thriving due to strong consumption rates, global trade dynamics, and a competitive environment fostering innovation and customer satisfaction.

Innovation in the poultry packaging market is driving substantial changes, particularly as European packers and retailers look for more sustainable and innovative ways to boost sales. This push for innovation is spurred by changing consumer habits and a growing awareness of environmental problems, particularly those related to food and packaging waste. As a result, there has been a considerable shift from old polypropylene (PP) packaging to more modern options such as polyethylene terephthalate (PET) packaging.

The poultry sector is not immune to the effects of geopolitical events, with global climatic changes influencing commercial dynamics. There was a brief period of optimism after the initial disruption caused by the pandemic. The ongoing crisis in Ukraine has caused commercial activity to slow down, especially in the European market, which has further impacted the industry's trajectory.

Europe's prominence in the global poultry packaging scene was highlighted in 2023 when it emerged as the second-largest region in the market. In response to changing customer tastes and market circumstances, the area has aggressively implemented novel packaging options, as seen by this position.

For Instance,

Plastic continues to be the most widely used material in the poultry packaging industry, with PET overtaking PP in popularity because of its benefits. Although PET has been used in poultry packaging for a while, packers and retailers have only now understood its advantages.

PET has a higher gas barrier performance than PP and is more aesthetically pleasing because of its clarity and glitter. It also has better environmental credentials. PET also helps packaging lines operate more efficiently in terms of manufacturing. Trays composed of rPET laminated to PE, for example, require lower sealing temperatures than trays made of PP, which saves energy.

rPET trays frequently contain more than 95% post-consumer recycled material, which aligns with sustainability goals. Furthermore, PET's strong gas barrier qualities extend the shelf life of poultry items, reducing food waste at the retail and consumer levels, especially in the context of global supply chains.

The switch from polypropylene to polyethylene demonstrates the poultry packing industry's dedication to sustainability. Retailers focus on value-added packaging options that put convenience first, creative pack designs, and on-pack graphics to increase sales of poultry goods. This trend demonstrates how the poultry packaging industry changes as customer preferences, environmental concerns, and commercial demands for more utility and appeal come together.

For Instance,

Bags are essential in the poultry packing industry for the easy storage, transportation, and presentation of different poultry products. These bags are available in various materials, such as paper, plastic, and woven materials, each with unique advantages like affordability, breathability, and durability. Individual portions of poultry items are frequently packaged in plastic bags, especially polyethylene, because of their resistance to moisture and capacity to preserve product freshness.

On the other hand, paper bags are better suited for bulk packaging and are commonly used for whole poultry or larger slices. Woven bags made of jute or polypropylene are famous for packing frozen poultry items due to their incredible strength and insulating capabilities. Overall, the bag market in the poultry packaging industry is diverse, meeting various packaging requirements while assuring product quality and consumer convenience.

For Instance,

The global food and meat retail industry is undergoing substantial shifts as consumer preferences shift, socioeconomic breakthroughs occur, and technology advances. Forward-thinking food businesses are continuously creating new ways to attract and keep customers. There is a particular emphasis on food shopping in India, as new retail chains compete with tiny, non-meat-selling establishments.

Over 90% of meat sales in India are made through wet marketplaces, particularly in the raw fresh segment. Traditional meat stores, often small, use crude processes such as cutting meat on wooden logs and polishing bits with knives. Unlike the efficient operations of wealthy countries or established retail chains, Indian shoppers frequently choose to buy meat from freshly butchered corpses exposed openly. This preference arises from a conviction that meat purchased this way is of more excellent quality, as customers enjoy the transparency and confidence of seeing the meat's freshness firsthand.

This impression is widespread, highlighting the continued importance of wet markets in India's meat retail scene despite the rise of modern retail chains.

For Instance,

Chicken is a primary product of the poultry business, which includes chicken, turkey, duck, and goose. Poultry products are known for their low-fat content, affordability, and diversity in cooking methods. However, because food is highly perishable, careful care is required to avoid foodborne infections, making packaging critical for protection and preservation.

Chicken is well-known worldwide for its easy preparation, availability, and excellent flavor. It also appeals to consumers who want low-calorie, easily digestible meal options. While chicken is a regular ingredient on menus, turkey has grown in favor. Duck, goose, and other poultry kinds are less popular.

Apart from whole birds, the market offers a wide range of poultry parts, offal, and processed poultry products. To guarantee freshness and preserve product quality throughout the supply chain, there is an increasing need for premium, breathable packaging solutions due to the variety of uses for poultry products.

For Instance,

The competitive landscape of the poultry packaging market is dominated by established industry giants such as Amcor PLC, ProAmpac LLC, UFlex Limited, Berry Global, Inc., Winpak Limited, Sealed Air Corporation, Smurfit Kappa, ULMA GROUP, Glenroy, Inc., International Paper, Smart Packaging Solutions, Safepack and Huhtamaki. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Amcor PLC has the potential to service poultry growers and merchants globally. This allows the organization to provide consistent quality and service across multiple regions while remaining aware of regional tastes and restrictions.

For Instance,

ProAmpac employs many tactics in the poultry packaging industry to sustain its competitive advantage and cater to changing consumer needs. One noteworthy tactic is to concentrate on sustainability, whereby the business creates packaging solutions with a minimal negative impact on the environment by using recyclable materials and producing less packaging waste.

For Instance,

By Material

By Packaging

By Distribution

By Product Type

By Region

April 2025

April 2025

April 2025

April 2025