Pressure Sensitive Labels Market Trends, Disruptors & Competitive Strategy

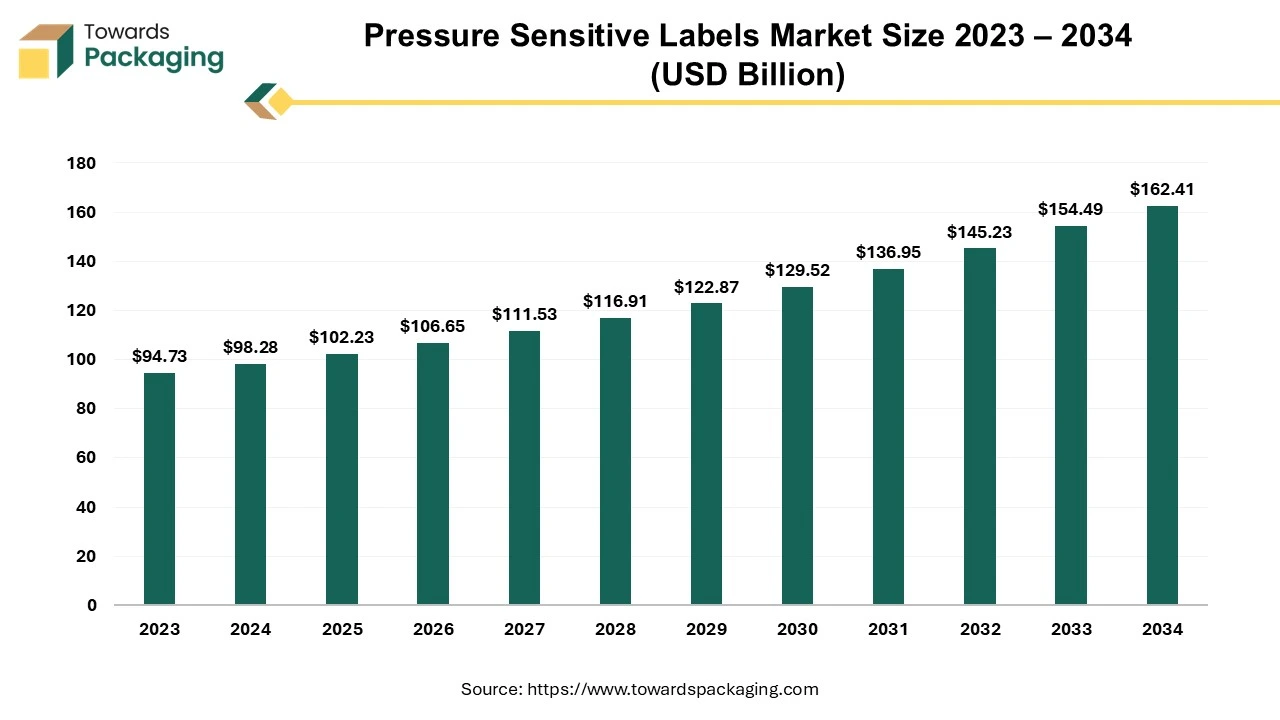

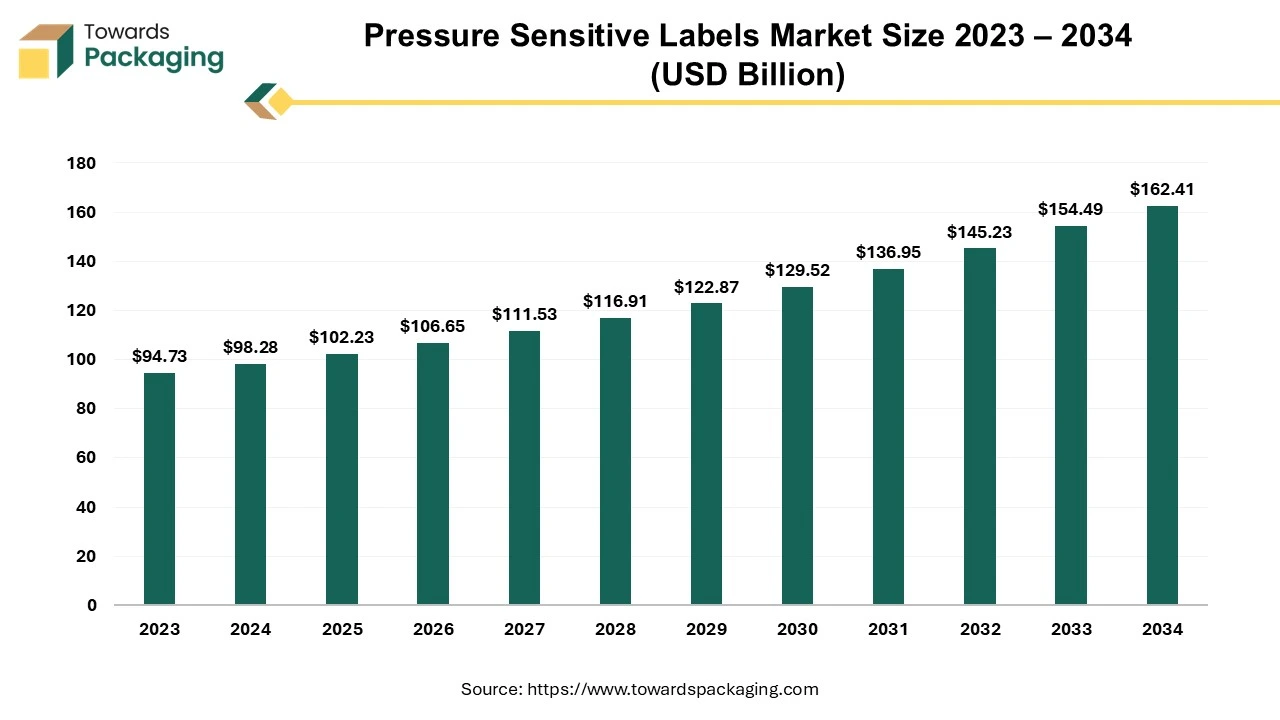

The pressure sensitive labels market is forecasted to expand from USD 108.66 billion in 2026 to USD 170.75 billion by 2035, growing at a CAGR of 5.15% from 2026 to 2035. Demand growth is supported by the fact that pressure-sensitive labels already account for over 80% of all labels used globally due to their versatility and compatibility across more than 10+ printing technologies including flexography and digital.

The competitive landscape includes top players such as Avery Dennison, CCL Industries, UPM Raflatac, 3M, LINTEC, each holding between 5-12% global share. The value chain spans raw materials (paper/film), adhesives, coating, converting, and distribution, with the film segment accounting for 55.42% share in 2024. Trade data shows rising import–export flows as global packaging usage grows by over 6% per year across emerging markets.

The pressure sensitive labels industry is projected to achieve remarkable growth over the forecast period. A pressure-sensitive label has three layers face stock, adhesive, and release liner. To generate a label material which can be imprinted on, laminated, die-cut, and then peeled off and attached to the product, all of these elements are sandwiched together throughout the manufacturing process. Over 80% of the labels supplied in the current market are pressure-sensitive labels, making them one of the most frequently utilized options. This is mostly because of how versatile they are. They are utilized in a wide range of products such as food containers, durable goods, toys, medical equipment, corrugated boxes, beer cans and bottles, plastic pouches, and much more. Furthermore, this sort of label works with a large range of printing technologies.

The expanding consumer goods and retail sectors along with the surge in the online shopping are expected to augment the growth of the pressure sensitive labels market during the forecast period. Furthermore, the technological advancements in digital printing as well as the push toward sustainability, as brands are increasingly adopting recyclable and biodegradable materials is also anticipated to augment the growth of the market. Additionally, the rise of smart labeling technology, such as QR codes and NFC-enabled tags along with the improved adhesive technologies to provide more versatile options are also projected to contribute to the growth of the market in the near future.

Key Trends and Findings

- The increasing awareness of sustainability among consumers has led to a growing percentage of firms utilizing sustainable packaging options for their goods. PS labels frequently use recycled materials for their facestock. Due to the technological developments, organizations are now able to produce unique adhesives that do not hinder recycling. Additionally, PS Labels are designed to last and have a very attractive appearance. PS Labels that are resistant to harsh handling and harsh environments, including chemical drums, have become more common.

- When it comes to pressure sensitive labels, RFID is revolutionary. RFID, or radio-frequency identification, gathers and transmits data using radio waves. It is a data tracking, storing, and transmission chip that can be incorporated into products, labels, as well as anywhere on the packaging. Pressure sensitive labels can be integrated with RFID chips to provide "intelligent labeling" solutions. These labels are frequently utilized to track, authenticate, and prevent product counterfeiting.

- There is a growth in the use of detachable and repositionable films as facestock. These films make it simple to remove and reinstall specifically while marking beverages when high machine speeds are involved. Due to their precise application and limited surface area, they are also used in pharmaceutical labeling.

- Pressure sensitive labels are also aesthetically pleasing as items compete for customers' attention on store shelves. Rich textured specialty papers, vivid metallized foils; films with clear, matte, metalized and eye-catching holographic variants; textiles and even solid wood veneer goods are among the various pressure sensitive label materials that label printers can utilize. Converting decorations might involve holographic/metallic foil stamping, de-bossed or embossed pictures, die-cut forms, die-cut text and logos, coarse graining areas, and spot varnishing.

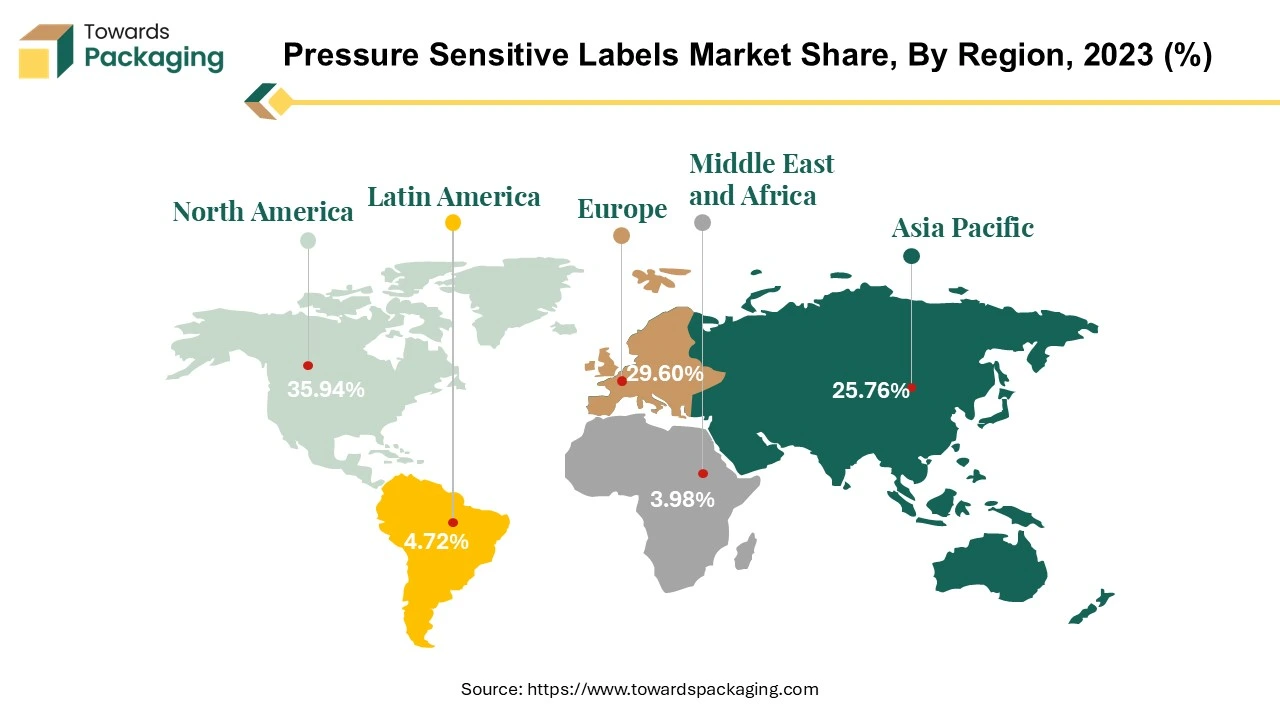

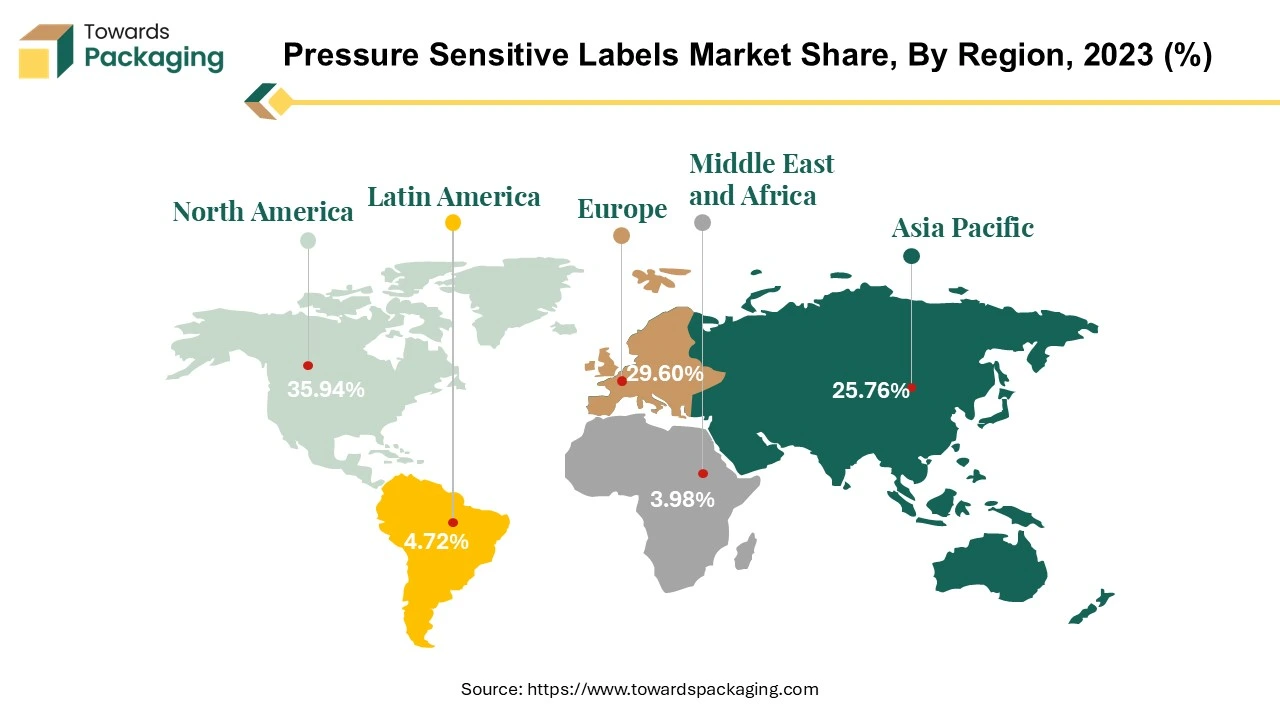

- North America held considerable market share of 35.94% in 2024. This is due to the high standards in food safety, healthcare labeling, and sustainable packaging, established regulatory frameworks and demand for premium packaging options.

- Asia-Pacific is expected to grow at a fastest CAGR of 7.25% during the forecast period owing to the rapid industrialization, urbanization and the growing e-commerce sector in countries like China, India and Japan.

Market Drivers

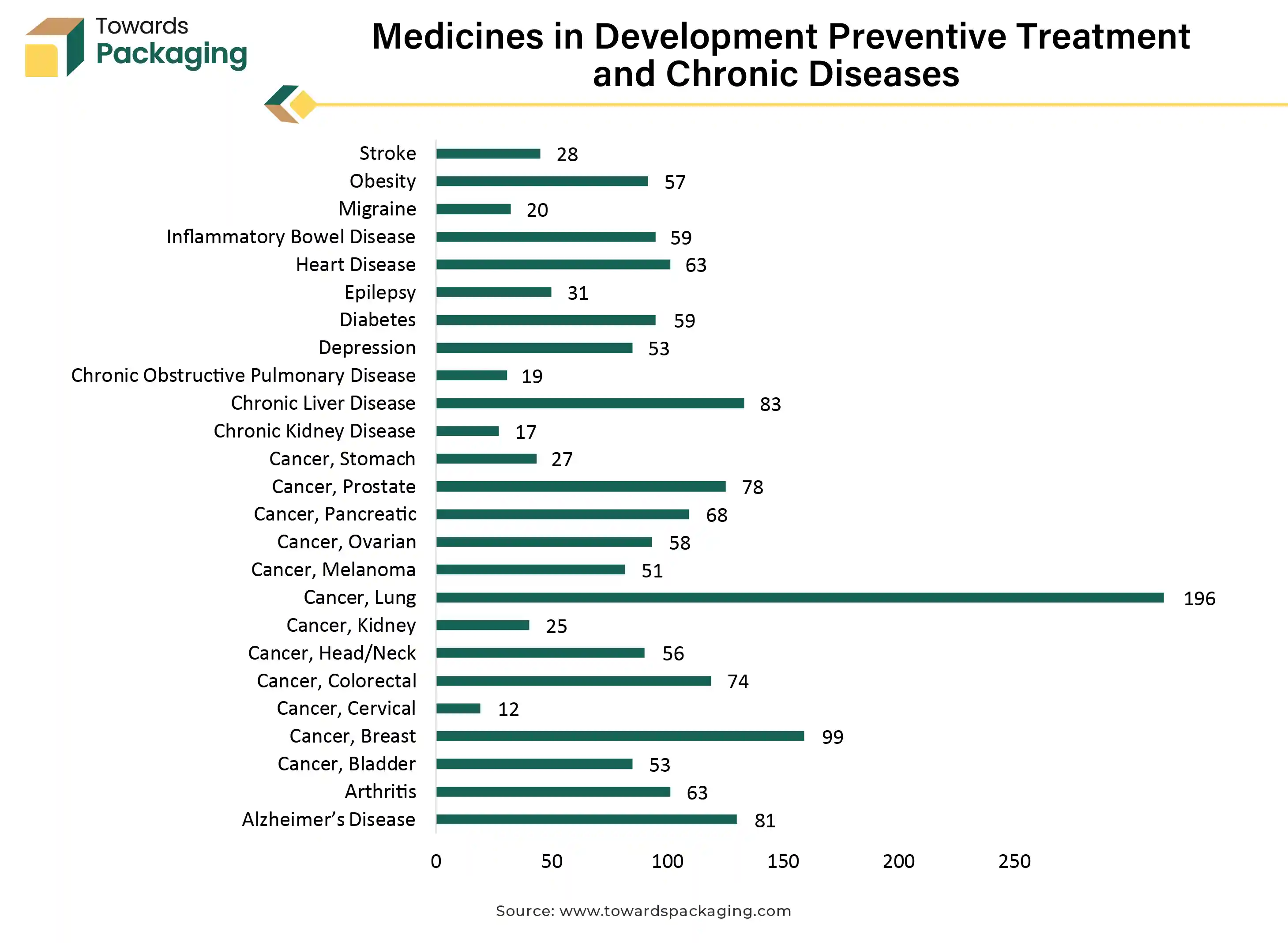

Growing Pharmaceutical and Healthcare Sectors

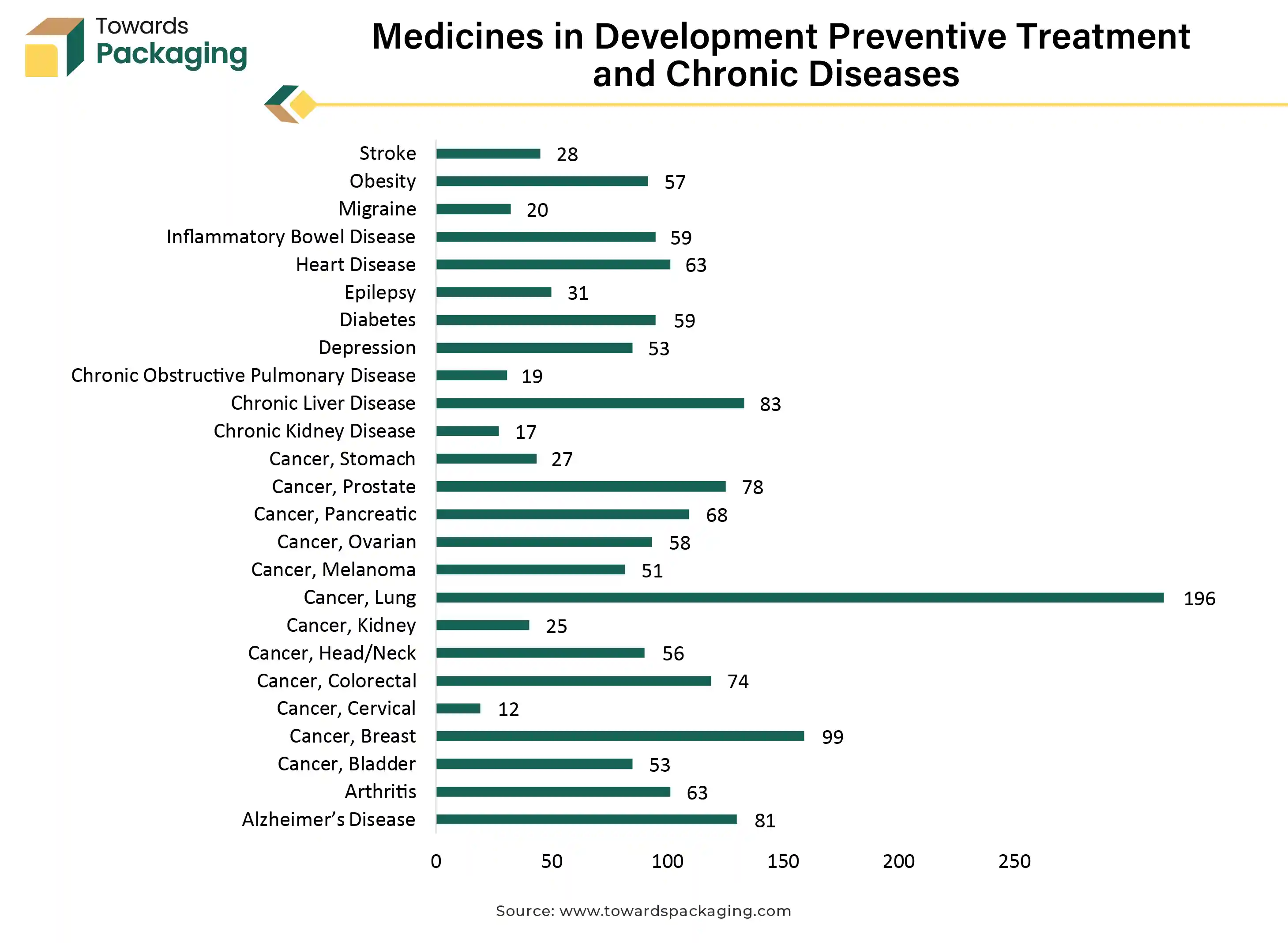

The growth in the pharmaceutical and healthcare sectors owing to the aging global population, rising prevalence of chronic diseases, and increased health awareness is anticipated to augment the growth of the pressure sensitive labels market during the forecast period. As per the Pharmaceutical Research and Manufacturers of America, in the United States, approximately 129 million individuals (i.e. 51.8%) suffer from at least one serious chronic medical condition. Furthermore, chronic diseases that may be prevented and treated are closely linked to seven of the most common reasons of death in the US.

In addition, a growing percentage of adult Americans suffer from numerous chronic illnesses; 42% suffer from two or more and 12% have five or more. Since chronic illnesses account for over 90% of the 4.5 trillion dollars spent on health services annually, they have a huge economic impact on the American healthcare system. By 2030, 83.4 million people are expected to have three or more chronic disorders, substantially increasing the financial burden that these illnesses place on society.

Nearly 1,181 medications are now being developed to prevent chronic illnesses. However, pharmaceutical and healthcare industries demand accurate, regulation-compliant labeling to guarantee patient safety, product authenticity as well as compliance with the stringent health regulations. Pharmaceutical products require labels that provide information such as dosage instructions, batch numbers, expiry dates and safety warnings making reliable labeling important. Since many pharmaceutical products have long storage lives or require special storage conditions, PSLs must be durable, resistant to moisture, chemicals, and temperature fluctuations, and able to withstand the environments in which these products are stored or transported.

Market Restraints

Availability of Substitute Products

The availability of alternatives such as shrink sleeves, wet glue labels and in-mold labels are likely to limit the growth of the market within the estimated timeframe. Wet adhesive labels are not just widely used in the beverage sector but they are also beneficial to the environment because they are simple to get off and don't leave any residue. They are also high-quality, water-resistant, flexible, and reasonably priced. Labels made with wet adhesive usually wrap a product bottle, can, or other container. It is a typical label material for plastic bottles, glass bottle and jars. Thus, for products like sauces, nutritional supplements, cannabis and CBD products, salad dressings, health and beauty items, beer bottles, wine, and spirits, among others, wet glue labels are ideal.

Furthermore, one more popular alternative is an in-mold label, which is melted on over the container during manufacturing, eliminating the need for lining or adhesive as needed in the case of pressure-sensitive labels. The ability to expose the label to various environmental conditions is the primary advantage of in-mold labeling. It is difficult to harm an in-mold label using physical handling, temperature, environment, or even the majority of chemicals. Another popular alternative is the shrink sleeves labels that are ideal for various shapes of containers, preserving the design integrity on the shelves. They also offer complete coverage, improving the visibility and brand recognition from every angle. These alternatives are appealing in the markets where specific functional or aesthetic requirements exceed the capabilities of the pressure-sensitive labels such as full-surface labeling, superior durability, or cost efficiencies for high-volume production.

Market Opportunities

Advancements in the Printing Technologies

The advancements in the printing technologies are projected to fuel the growth of the market in the near future. Innovations such as digital printing, flexography, and hybrid printing systems have revolutionized label production by offering improved precision, vibrant colors and cost-effective options. Digital printing is an innovative, adaptable, and growingly common technique for printing text and images on a variety of materials such as paper, plastic, and more. Digital printing transfers ink onto a substrate without the use of plates or screens, in contrast to conventional printing methods like offset printing for large quantities or screen printing. Rather, the printed text is sourced from digital data. New paper options have been made possible by the growth of digital printing. Now, there are many variations to choose from like matte, glossy, satin, and more, and the results are equivalent to offset printing.

Carbon balanced printing is another technology in the printing industry gaining traction created by a carbon balanced printer on the carbon balanced paper. With carbon balanced print, organizations may minimize (balance) the inevitable carbon footprint of their printed papers. It's an easy decision with big advantages. Since the printing sector contributes substantially to greenhouse gas emissions, carbon balanced printing helps minimize its carbon footprint, making it more sustainable. Additionally, carbon-balanced printing is more effective since it uses less energy during the printing process that eventually saves money. Also, innovations in the sustainable printing methods such as water-based inks and energy-efficient systems, corresponds with the growing demand for the eco-friendly options. These technological advancements collectively position the market for substantial growth by focusing on the efficiency, quality and sustainability.

Greif Inc. – Revenue by Source (2020–2024)

| Source |

2020 |

2021 |

2022 |

2023 |

2024 |

| Global Industrial Packaging |

— |

3.32 B |

3.65 B |

2.94 B |

3.12 B |

| Paper Packaging & Services |

1.92 B |

2.22 B |

2.68 B |

2.26 B |

2.30 B |

| Land Management |

26.30 M |

21.00 M |

22.00 M |

21.30 M |

20.30 M |

| Rigid Industrial Packaging & Services |

2.30 B |

— |

— |

— |

— |

| Flexible Products & Services |

272.90 M |

— |

— |

— |

— |

Greif Inc. – Revenue by Country (2020–2024)

| Country / Region |

2020 |

2021 |

2022 |

2023 |

2024 |

| United States |

2.76 B |

3.25 B |

3.94 B |

3.33 B |

3.41 B |

| Europe, Middle East & Africa |

1.29 B |

1.67 B |

1.70 B |

1.31 B |

1.39 B |

| Asia Pacific & Other Americas |

469.30 M |

634.70 M |

708.90 M |

575.40 M |

654.40 M |

| North America |

— |

— |

— |

— |

— |

| Other |

— |

— |

— |

— |

— |

| Europe |

— |

— |

— |

— |

— |

Key Segment Analysis

Material Segment Analysis Preview

The film/plastic segment held largest market share of 55.42% in 2024. The qualities and benefits of this material make it a popular choice to produce the pressure-sensitive labels. The material guarantees longevity and a neat, polished appearance while withstanding humidity, chemical substances, and temperature changes. The transparency and clarity of the labels created from this material are well-known. Due to their flexibility and resilience to tearing, they are perfect for applications that are subjected to harsh use. Polyester (PET), polypropylene (PP), and polyethylene (PE) are frequently utilized film materials. The increasing demand for flexible packaging options supports the growth of this segment, as these labels adhere seamlessly to irregularly shaped containers. Paper labels are likely to grow at a significant CAGR during the forecast period as there are numerous uses for these labels, and they the most economical.

End-User Industry Segment Analysis Preview

The food & beverages segment held largest market share of 38.16% in 2024. This is due to the rapid expansion of the beverage industry such as the bottled water, soft drinks and alcoholic beverages. Furthermore, the increasing consumer preference for processed foods predominantly in the urban areas as well as the rising popularity of the ready-to-eat meals, snacks, and single-serve beverages is also expected to contribute to the segmental growth of the market. Additionally, the surge in demand for organic, gluten-free, and plant-based products along with the growing online grocery shopping and expansion of the frozen and refrigerated food segments is expected to support the growth of the segment in the global market.

Regional Insights

Asia Pacific is likely to grow at fastest CAGR of 7.25% during the forecast period. This is due to expansion of industrial activities and urban centers. Also, the rapidly growing online retail market as well as the expanding food & beverage sector is likely to contribute to the regional growth of the market. As per the India Brand Equity Foundation, it is anticipated that the Indian food and beverage packaging market would rise significantly, from US$ 33.7 billion in 2023 to reach US$ 46.3 billion in 2028. Furthermore, the growing prominence of product information, safety and traceability by consumers coupled with the availability of low-cost raw materials and labor in the region is also expected to contribute to the regional growth of the market.

North America held considerable market share of 35.94% in 2024. This is owing to the presence of strong healthcare and pharmaceutical sector across the region. Furthermore, the growth of the e-commerce and retail as well as high consumer preference for aesthetically appealing and high-quality packaging is also expected to contribute to the regional growth of the market. Statistics Canada reports that in December 2020, e-commerce retail trade sales in Canada reached a new high of US$3.82 billion, surpassing the US$3.2 billion increase spurred during the coronavirus pandemic lockdown measures in May 2020. E-commerce sales reached over US$2.34 billion in March 2022. By 2025, retail e-commerce sales are expected to reach US$40.3 billion. Additionally, the adoption of smart labeling technologies along with the increased use in industrial applications is also anticipated to promote the growth of the market in the region in the near future.

Latin America

The pressure sensitive labels market in Latin America is growing as industries move toward packaging solutions that serve durability, flexibility, and branding advantages. Unlike traditional wet-glue labels, pressure-sensitive formats are becoming more popular due to their compatibility with a huge range of container materials, including glass, PET, and flexible pouches. Local converters are increasingly investing in advanced coating and die-cutting technologies to develop production efficiency and reduce waste, while multinational FMCG companies are encouraging acceptance by standardizing pressure-sensitive designs across global supply chains.

Suitability is also reshaping the landscape, with growing experimentation in linerless and recyclable adhesive systems personalised to regional recycling challenges. In parallel, the growth of digital printing in Latin America enables smaller brands to leverage pressure-sensitive labels for short runs and customization, signalling a move in manufacturing dynamics beyond just volume growth.

Middle East and Africa

The pressure sensitive labels market in the Middle East and Africa is constantly gaining momentum, specifically as it substitutes traditional glues and wraps across the food, beverage, and fast-moving consumer goods sectors. The UAE, driven by Indian-led converters, dominates the regional label landscape, acting as both a production center and export hub. While glue-applied labels still constitute the largest share, pressure-sensitive formats are the fastest-growing segment, assisted by their ease of application and adaptability across materials such as glass, PET, and flexible packaging.

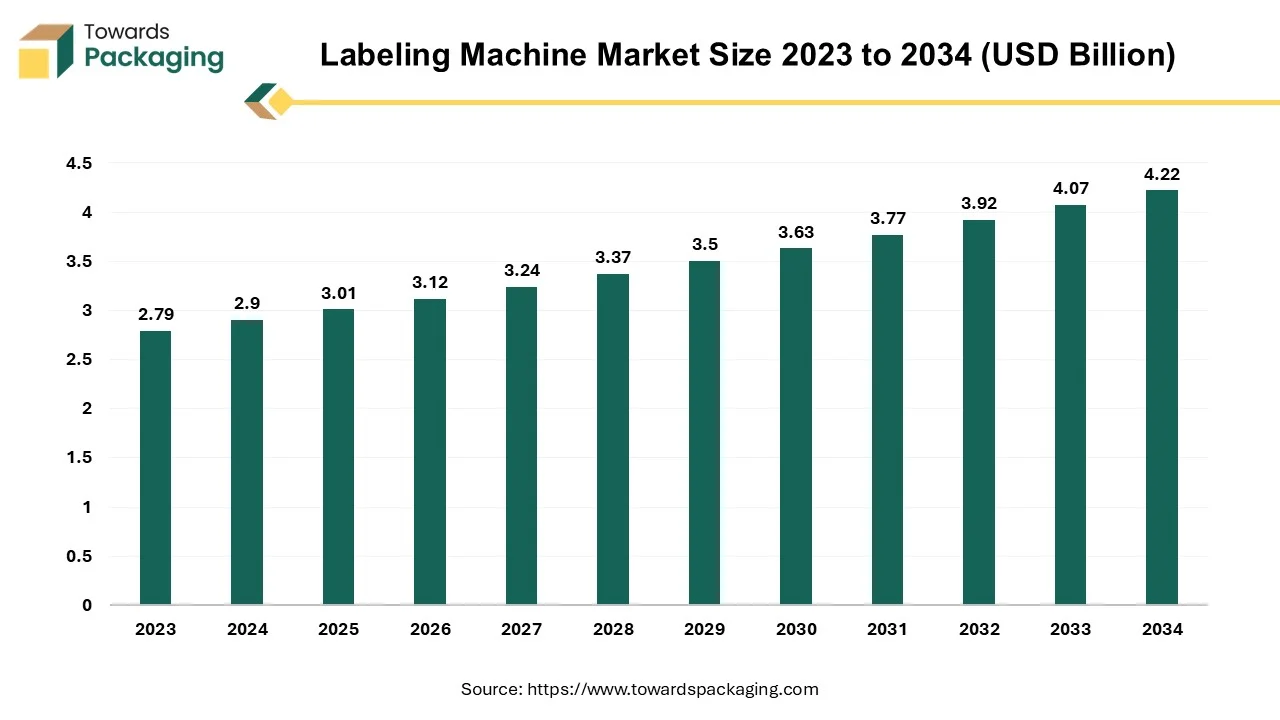

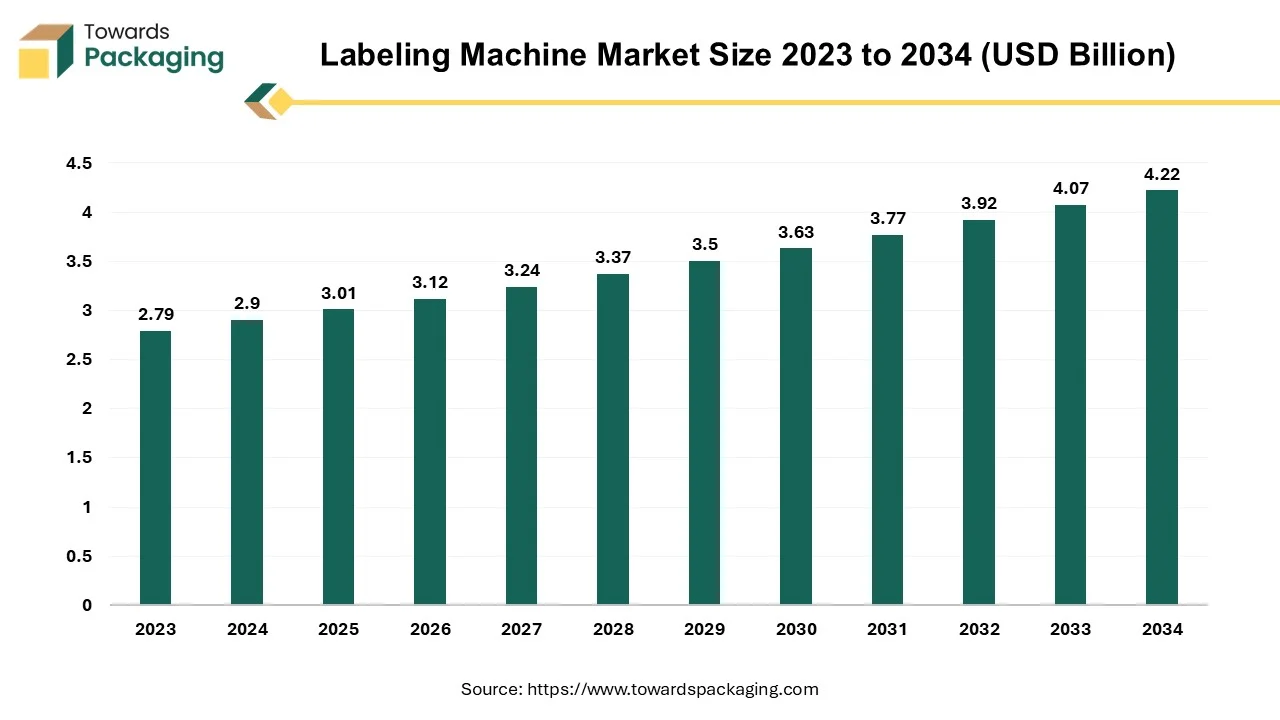

Labeling Machine Market

The labeling machine market is forecasted to expand from USD 3.01 billion in 2025 to USD 4.22 billion by 2034, growing at a CAGR of 3.84% from 2025 to 2034.

Labels are applied to products or packaging using a labeling machine. Some labeling machines can also produce labels in addition to applying them. The market is filled with a variety of labeling machines, from high-production machines that enable total automation to the manual tools that only allow for basic label dispensing. These machines are high in demand from various industry verticals.

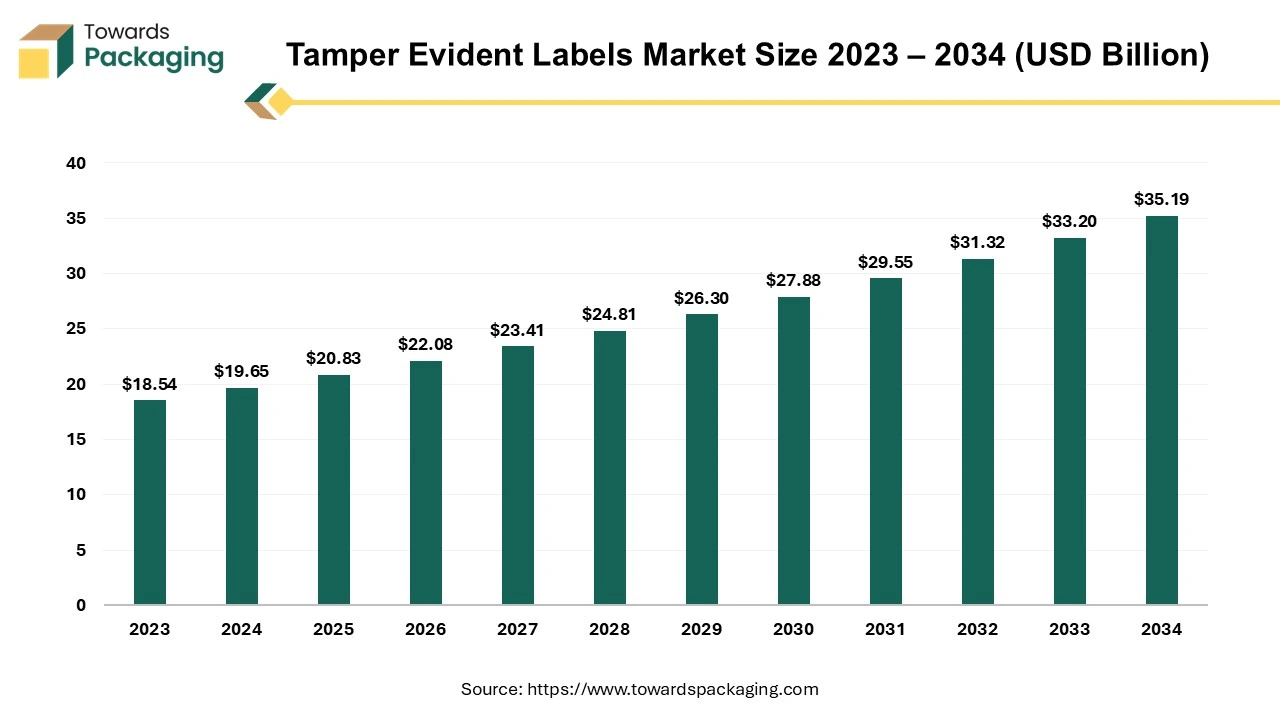

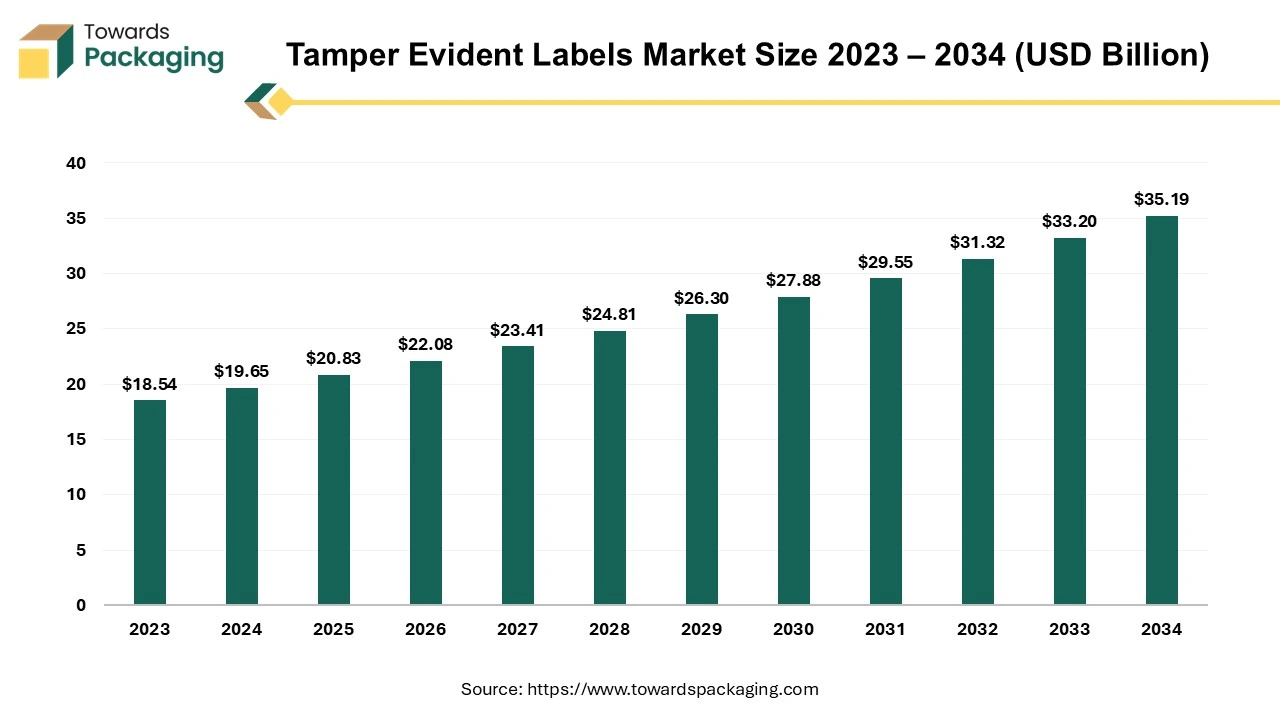

Tamper Evident Labels Market

The tamper evident labels market is anticipated to grow from USD 20.83 billion in 2025 to USD 35.19 billion by 2034, with a compound annual growth rate (CAGR) of 6.00% during the forecast period from 2025 to 2034.

The tamper evident labels market is likely to register considerable growth during the projected period. The purpose of the tamper-evident labels is to prevent tampering and to provide visible proof of tamper or attempted tampering, thus securing the product to which they are attached. From valuable goods to important documents, the tamper-evident products are utilized in the security as well as protection of a wide range of objects. Once a security label has been applied, it will show signs of tampering. Each label product has a different tamper-evident feature. Product tampering, theft, and counterfeiting are constant issues that numerous organizations in a wide range of industries deal with. Due to this, the market for tamper-evident products is growing substantially and will continue to grow as more companies seek to safeguard their items, packaging and warranties.

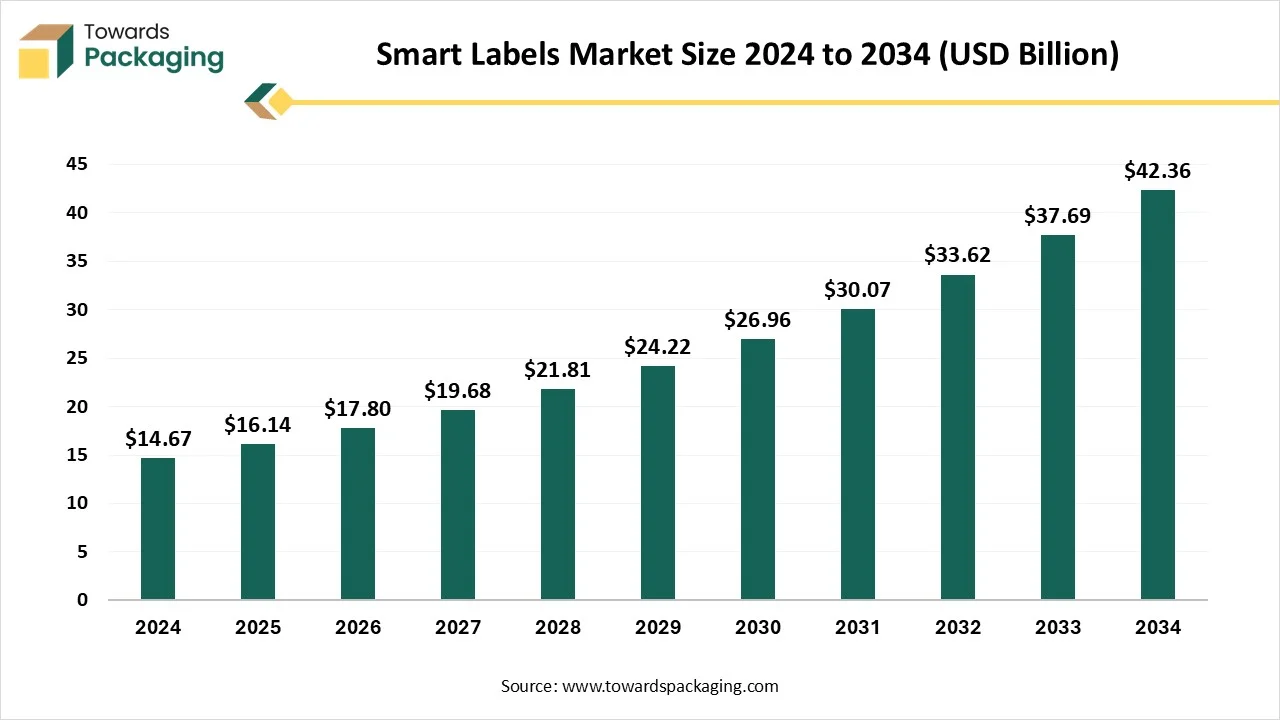

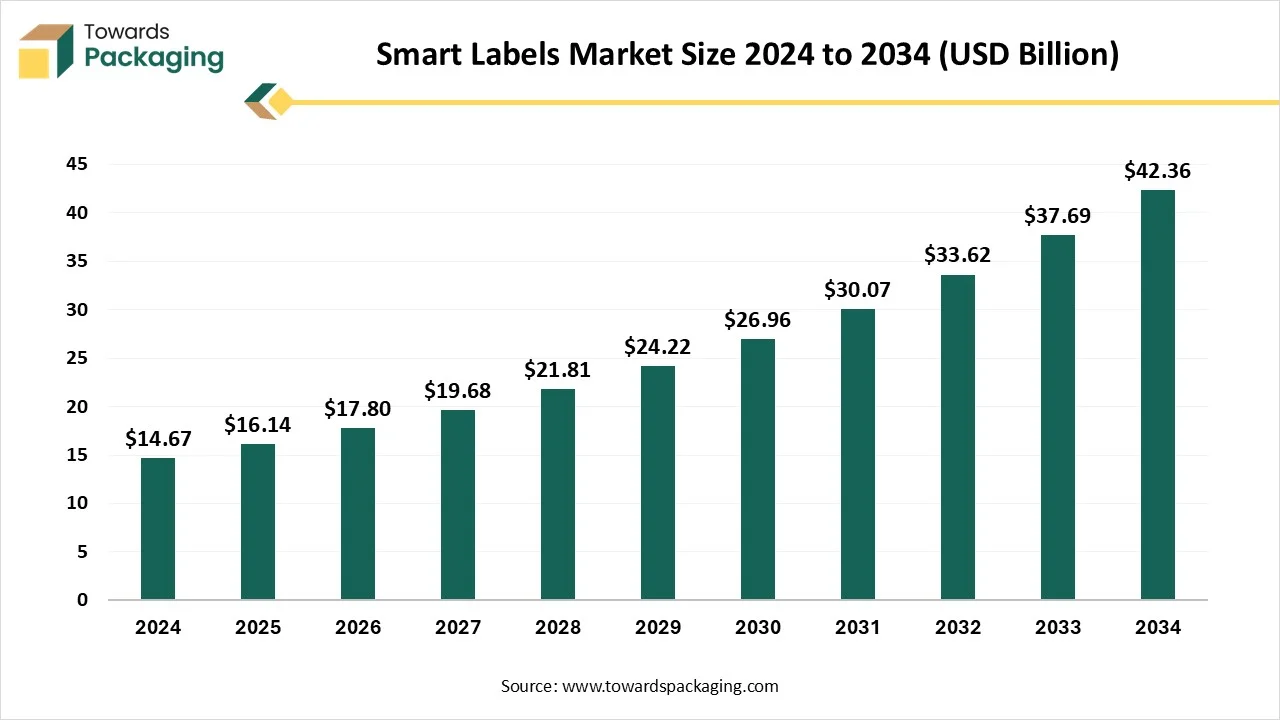

Smart Labels Market

The smart labels market is expected to increase from USD 16.14 billion in 2025 to USD 42.36 billion by 2034, growing at a CAGR of 11.32% throughout the forecast period from 2025 to 2034.

The smart labels market is experiencing steady growth within the estimated timeframe. A smart label is one which integrates technology to broaden the use and information on labels or packaging beyond what can be printed using conventional techniques. This can be in the form of near field communication (NFC), QR codes and RFID tags, among other types. To enable an interaction, these labels depend on a user's interaction through an end-user device such as a smartphone.

Recent Developments by Key Market Players

- In May 2025, Bio4Life, which is a supplier of sustainable materials, revealed a home-compostable pressure-sensitive adhesive, which is perfect for direct food contact. This latest adhesive assists in lowering waste and market environmental responsibility in the food packaging industry.

- In April 2023, Rayoface AQBSA, a novel printable coated cavitated white BOPP facestock film, was launched by Innovia Films specifically for pressure-sensitive labeling applications. The film has an adhesive receptive coated surface on the back side and a printable top coating. It is 58 microns thick. With 91 percent opaqueness, Rayoface AQBSA offers a white surface that can be used in a variety of industry sectors, including the food and beverage, personal care, and various other packaged goods for consumers industries.

- In August 2023, Avery Dennison introduced a groundbreaking generation of linerless decorative alternatives to minimize the packaging waste. These decorative linerless products, AD LinrSave and AD LinrConvert, are made possible by unique micro-perforation technology. They will guarantee the performance and consumer attractiveness of pressure-sensitive labels while significantly reducing label waste, CO2, and water footprint. This is the next phase of Avery Dennison's innovation journey, allowing the sector to move toward a future that is more connected and sustainable.

Pressure Sensitive Labels Market Top Players

Global Pressure Sensitive Labels Market is Segmented as Follows

By Material

- Paper

- Film/Plastic

- Others

By Adhesive Technology

- Water-Based

- Solvent-Based

- Hot-melt-Based

- Radiation-Based

By Printing Technology

- Flexography

- Lithography

- Letterpress

- Screen Printing

- Gravure

- Others

By End-User Industry

- Food & Beverages

- Pharmaceuticals

- Consumer Durables

- Home & Personal Care

- Retail Labels

- Others

By Region

- North America

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa